Automotive Glass Market Size and Forecast 2025 to 2034

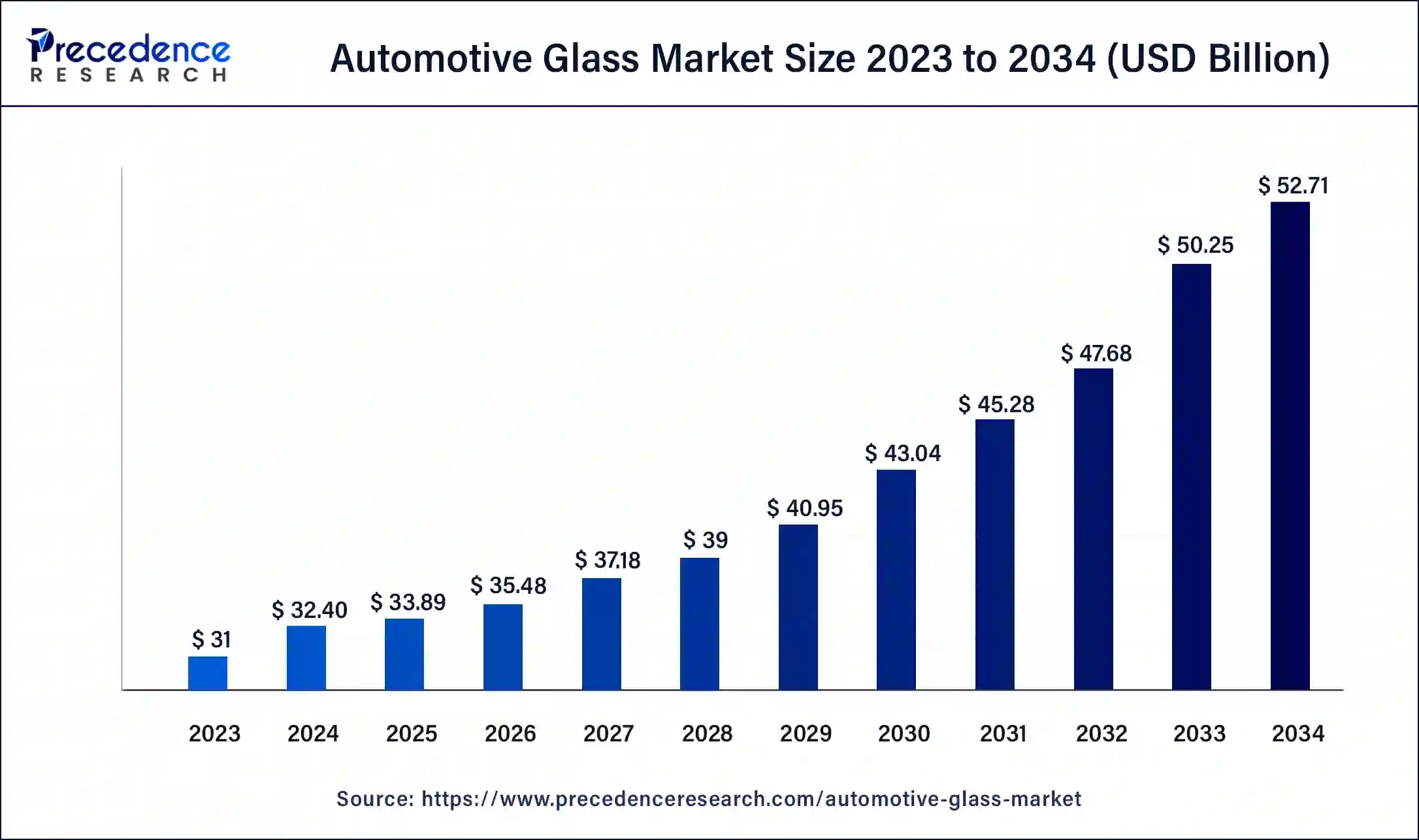

The global automotive glass market size was valued at USD 32.40 billion in 2024 and is expected to reach around USD 52.71 billion by 2034, expanding at a CAGR of 4.99% from 2025 to 2034.

Automotive Glass Market Key Takeaways

- Asia-Pacific contributed 55% of market share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2033.

- By product, the tempered glass segment held the largest market share of 60% in 2024.

- By product, the laminated glass segment is anticipated to grow at a remarkable CAGR of 7.3% between 2025 and 2034.

- By vehicle type, the passenger cars segment generated over 59% of the market share in 2024.

- By vehicle type, the light commercial vehicles segment is expected to expand at the fastest CAGR over the projected period.

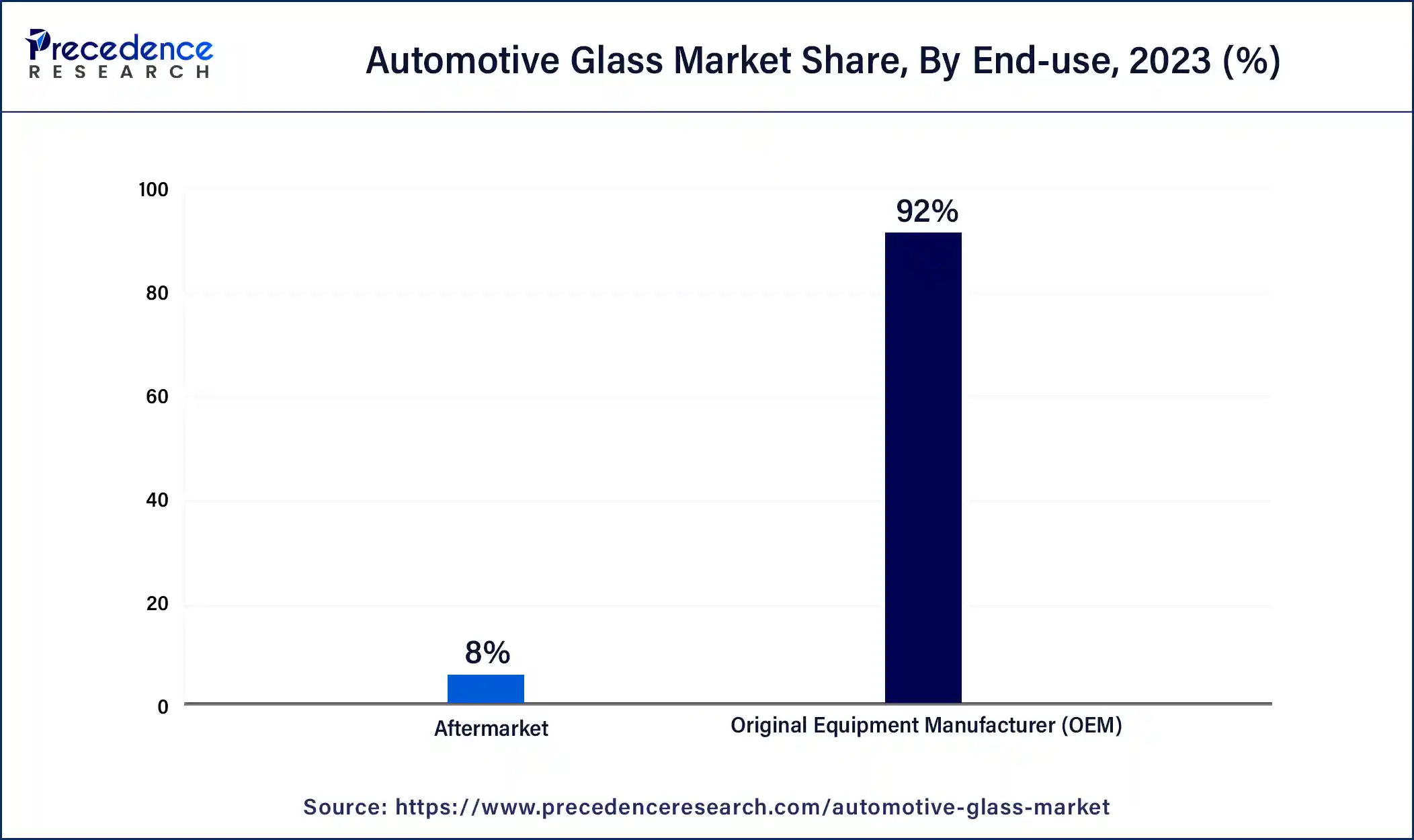

- By end-use, the original equipment manufacturer (OEM) segment generated over 92% of the market share in 2024.

- By end-use, the aftermarket segment is expected to expand at the fastest CAGR over the projected period.

Asia Pacific Automotive Glass Market Size and Growth 2025 to 2034

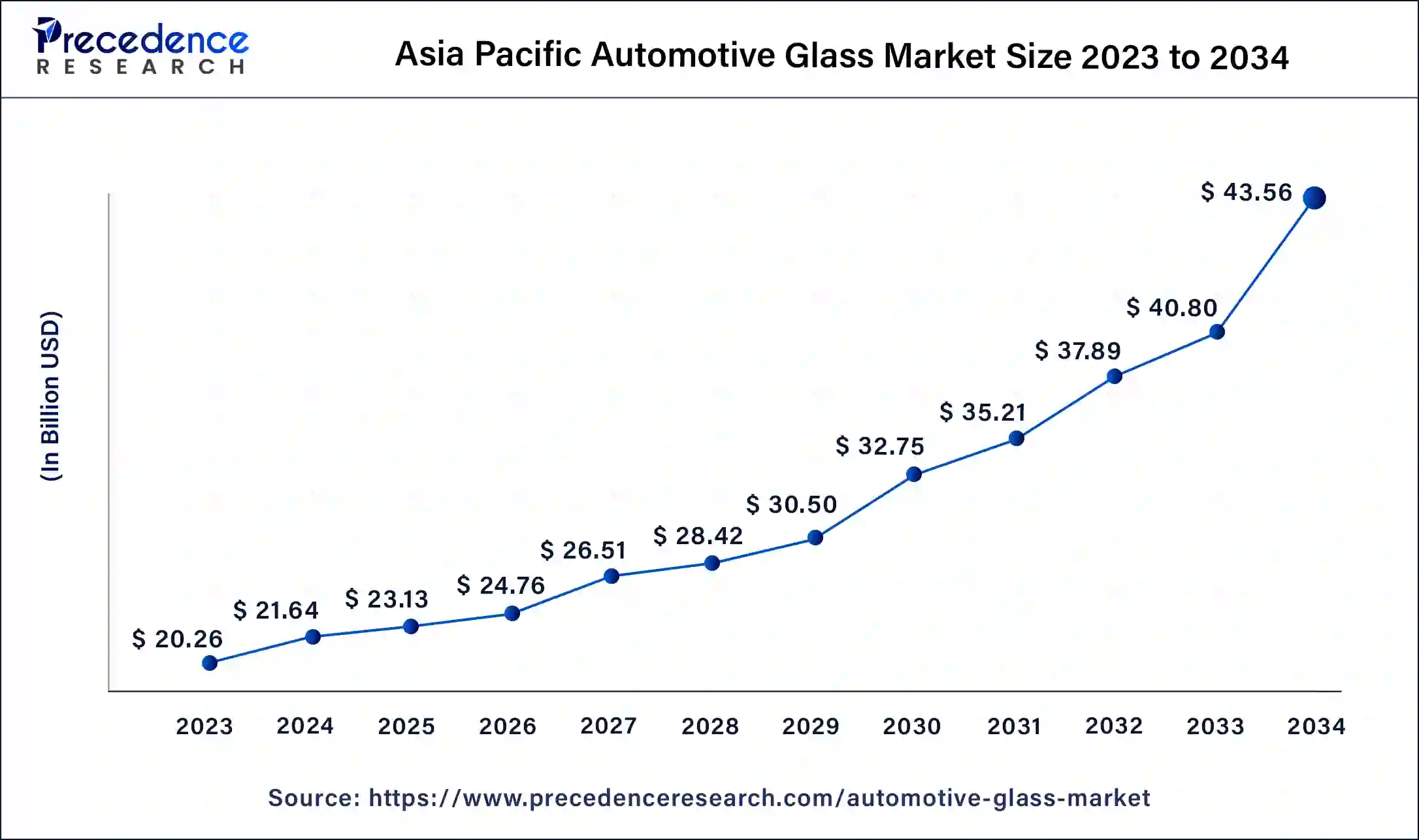

The Asia Pacific automotive glass market size was valued at USD 21.64 billion in 2024 and is expected to reach around USD 43.56 billion by 2034, growing at a CAGR of 5.20% from 2025 to 2034.

Asia-Pacific held the largest share of 55% in 2024 due to several factors. The region experiences robust growth in the automotive industry, with a high demand for vehicles across various segments. Rapid urbanization, increasing disposable income, and a growing population contribute to the rising demand for automobiles. Additionally, the emphasis on technological advancements and the adoption of electric vehicles in countries like China further boost the automotive glass market in the Asia-Pacific region, making it a key player in the global automotive glass industry.

China Automotive Glass Market Trends

China's need for Automotive Glass has surged rapidly over the last few years. Over the next ten years, production and demand will keep expanding. The Chinese economy continues to experience rapid growth, fueled by ongoing rises in industrial output, trade, consumer spending, and capital investments for more than twenty years. This recent research analyzes China's economic trends, investment climate, industrial growth, supply and demand, industry capacity, structure, marketing channels, and key industry players.

As drivers and passengers demand greater safety and comfort, along with advanced uses of optical, mechanical, and other technologies in glass products, specialty function glass is gaining increasing popularity in the market. As a key component of advanced automotive technology, smart glass in vehicles is progressively transforming the riding experience for individuals.

- The conclusion of the 33rd China Glass 2024 trade show in Shanghai marked a significant triumph for IOCCO's technologies in automotive glass manufacturing. The company garnered significant positive responses from attendees and was able to showcase its cutting-edge and market-leading solutions.

North America is poised for rapid growth in the automotive glass market due to several factors. The region is experiencing a surge in electric vehicle adoption, driving demand for specialized glass. Stringent safety regulations also contribute to the growing market, necessitating advanced glass technologies. Moreover, the region's focus on lightweight materials to enhance fuel efficiency provides opportunities for innovative glass solutions. With a robust automotive industry and increasing emphasis on vehicle aesthetics and safety, North America is positioned for substantial growth in the automotive glass market.

U.S. Automotive Glass Market Trends

The United States automotive glass industry involves the manufacturing and sale of glass used in vehicles, including windshields, windows, and sunroofs. It features laminated, tempered, and smart glass technologies for security, durability, and UV shielding. Advancements in ADAS integration, thermal insulation, and enhanced visibility are driving market growth. Currently, top manufacturers in the United States are launching colored coatings to prevent smash-and-dash theft, shield against glare, enhance acoustic comfort, and protect passengers from being ejected during a collision.

The rising trend of incorporating automotive aerodynamic designs is one of the key elements driving market expansion. Automotive producers have utilized nanotechnology and coatings to create their own self-cleaning and anti-glare glasses that offer exceptional durability and optical clarity. Moreover, substantial growth will be noted in after-market sales influenced by a rising trend in road accidents and ensuing glass replacements, creating a lucrative opportunity for manufacturers and service providers in the United States.

Meanwhile, Europe is experiencing notable growth in the automotive glass market due to several factors. The region's commitment to stringent safety standards drives demand for advanced automotive glass technologies. Additionally, the emphasis on sustainability and the growing adoption of electric vehicles contribute to the need for specialized glass solutions. With a focus on lightweight materials for fuel efficiency and increasing consumer preferences for advanced safety features, Europe has become a thriving market for automotive glass, presenting opportunities for innovation and market expansion.

Market Overview

Automotive glass, commonly known as car windows, is a crucial component of vehicles designed to provide visibility, protection, and structural support. It serves as a barrier between the occupants and external elements, such as wind, rain, and debris, ensuring a safe and comfortable driving experience. Typically made of laminated or tempered glass, automotive glass undergoes specific manufacturing processes to enhance durability and safety.

In addition to windshields, automotive glass includes side windows, rear windows, and sometimes glass elements in side mirrors. Modern automotive glass often incorporates advanced technologies like UV coatings for sun protection and defrosting capabilities. Beyond its functional role, automotive glass can also contribute to the aesthetics of a vehicle, making it an integral part of both safety and design considerations in the automotive industry.

Automotive Glass Market Data and Statistics

- As reported by the International Organization of Motor Vehicle Manufacturers (OICA), the worldwide production of automobiles reached 85.02 million vehicles in 2022.

- In 2020, global auto production, as per the OICA, experienced a 16% decline, falling to less than 78 million vehicles. This level was comparable to sales figures recorded in 2010.

- According to the International Energy Agency (IEA), electric car sales globally witnessed a remarkable surge of over 40%, reaching 3 million in 2020 compared to 2.1 million in 2019. Notably, China experienced a 12% increase in electric car sales over the same period.

- The IEA also reported that the proportion of SUVs in total vehicle sales exceeded 50% in the U.S. and registered an approximately 3% rise in both China and Europe, with the combined share reaching 39%.

Automotive Glass Market Growth Factors

- The continuous growth in global vehicle sales is a significant driver for the automotive glass market. As more vehicles are manufactured and sold globally, there is a parallel increase in the demand for automotive glass, including windshields, side windows, and rear windows.

- The automotive industry's emphasis on fuel efficiency and environmental sustainability has led to a demand for lightweight materials, including glass. Advanced glass technologies, such as thin and lightweight glazing solutions, are becoming popular to meet fuel efficiency standards, contributing to market growth.

- Stringent safety regulations and an increased focus on occupant safety have driven advancements in automotive glass technologies. The incorporation of laminated glass for windshields, which enhances shatter resistance and protects occupants during accidents, has become a key growth factor.

- The integration of advanced technologies in automotive glass, such as heads-up displays, augmented reality features, and smart glass solutions, has attracted consumer interest. These technological innovations not only enhance driving experiences but also drive the demand for sophisticated automotive glass products.

- The growing adoption of electric vehicles, which often incorporate special glass features for thermal insulation and reduced energy consumption, contributes to the expansion of the automotive glass market. The shift towards electric mobility is influencing the types and functionalities of glass used in vehicles.

- Consumer preferences for aesthetically pleasing vehicles have led to the incorporation of larger sunroofs, panoramic windows, and other design elements. This trend drives the demand for specialized and visually appealing automotive glass, influencing market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 52.71 Billion |

| Market Size in 2025 | USD 33.89 Billion |

| Market Size in 2024 | USD 32.40 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.99% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Vehicle Type, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising global vehicle production

- In 2022, the International Organization of Motor Vehicle Manufacturers (OICA) reported a production of 85.02 million vehicles, indicating a growing demand for automotive glass.

The surge in global vehicle production has a significant impact on the demand for automotive glass, driving market growth. As more cars are manufactured worldwide, the need for various types of automotive glass, including windshields, side windows, and rear windows, increases proportionately. The automotive glass market is closely linked to the overall expansion of the automotive industry, as these glass components are essential for providing visibility, safety, and structural support in vehicles. With rising global vehicle production, original equipment manufacturers (OEMs) and automotive glass suppliers experience a heightened demand for their products.

This increased demand is not only driven by the sheer volume of vehicles being produced but also by the need for advanced technologies and materials in automotive glass to meet evolving safety standards and consumer preferences. As the automotive sector continues to grow, the automotive glass market is poised to thrive, playing a crucial role in ensuring the safety, aesthetics, and functionality of vehicles on a global scale.

Restraint

Complex manufacturing processes

The complexity of manufacturing processes in the automotive glass industry poses a restraint on market demand. The intricate methods involved in producing specialized automotive glass, such as laminated and tempered glass, contribute to challenges in terms of time and cost. The detailed procedures require precision and expertise, leading to longer production times and increased manufacturing expenses. This complexity can potentially slow down the overall production capacity of automotive glass, impacting the timely supply to meet market demands.

Moreover, the sophisticated manufacturing processes also necessitate a higher level of technical know-how and investment in advanced machinery. Smaller manufacturers or those with limited resources may face barriers to entry, limiting their ability to compete effectively in the market. As a result, the intricacies of manufacturing pose a significant hurdle for some players, affecting the overall growth and dynamics of the automotive glass market.

Opportunity

Focus on lightweight materials

The automotive industry's heightened focus on lightweight materials is creating significant opportunities in the automotive glass market. As manufacturers strive to improve fuel efficiency and reduce emissions, there is a growing demand for innovative glass solutions that contribute to overall vehicle weight reduction. This emphasis on lightweight materials presents an opportunity for automotive glass manufacturers to explore and develop advanced glass technologies that meet both safety standards and the industry's weight-saving objectives.

In response to this trend, manufacturers can invest in research and development to create thinner and lighter glass options without compromising on strength or safety. These innovations not only align with the industry's sustainability goals but also position automotive glass as a crucial element in achieving overall vehicle weight reduction. As automakers increasingly seek ways to enhance fuel efficiency, the development of lightweight glass solutions represents a strategic opportunity for growth and differentiation in the automotive glass market.

Product Insights

The tempered glass segment held the highest market share of 60% in 2024. Tempered glass is a type of automotive glass that undergoes a controlled thermal treatment to enhance its strength. In the automotive glass market, the tempered glass segment involves the production of durable and shatter-resistant glass, primarily used for side windows and rear windows. A significant trend in this segment is the increasing preference for tempered glass due to its safety features. Automakers and consumers alike favor tempered glass for its ability to crumble into small, blunt pieces upon impact, minimizing the risk of injuries during accidents, and contributing to overall safety trends in the automotive industry.

The laminated glass segment is anticipated to witness rapid growth at a significant CAGR of 7.3% during the projected period. Laminated glass is a key segment in the automotive glass market, known for its safety features. Comprising two layers of glass bonded with a layer of polyvinyl butyral (PVB) or similar material, it remains intact upon impact, reducing the risk of shattering. A notable trend in this segment is the increasing adoption of laminated glass for windshields, driven by stringent safety regulations. Manufacturers are continually innovating, enhancing laminated glass to provide improved protection, UV filtering, and acoustic insulation, contributing to its rising prominence in the automotive industry.

Vehicle Type Insights

The passenger cars segment has held 59% market share in 2024. The passenger cars segment in the automotive glass market refers to glass products designed specifically for use in cars meant for personal transportation. This includes windshields, side windows, and rear windows for traditional sedans, hatchbacks, and SUVs. A key trend in this segment involves the integration of advanced technologies, such as heads-up displays and smart glass, to enhance the driving experience. Additionally, there's a growing demand for lightweight glass solutions to contribute to fuel efficiency and comply with the automotive industry's focus on sustainability.

The light commercial vehicles segment is anticipated to witness rapid growth over the projected period. The light commercial vehicles (LCV) segment in the automotive glass market encompasses vehicles designed for commercial purposes, such as vans and pickup trucks. A notable trend in this segment involves a growing demand for durable and impact-resistant automotive glass to ensure safety and longevity. Manufacturers are increasingly focusing on developing specialized glass solutions for LCVs, emphasizing both safety features and cost-effectiveness. This trend aligns with the rising use of light commercial vehicles across various industries, driving the need for reliable and high-quality automotive glass products.

End-use Insights

The original equipment manufacturer (OEM) segment held a 92% market share in 2024. The original equipment manufacturer (OEM) segment in the automotive glass market refers to the production and supply of glass directly to vehicle manufacturers for original installations. In this segment, manufacturers collaborate with automakers to provide customized glass solutions tailored to specific vehicle models. A notable trend in the OEM segment involves an increasing demand for advanced technologies, such as heads-up displays and smart glass, as automakers seek to incorporate innovative features that enhance safety, aesthetics, and overall driving experiences in newly manufactured vehicles.

The aftermarket segment is anticipated to witness rapid growth over the projected period. The aftermarket segment in the automotive glass market refers to the replacement and customization of glass components in vehicles that have already been sold. It includes services such as windshield replacements and upgrades for aesthetics or improved features. A notable trend in this segment is the increasing demand for replacement glass due to wear, accidents, or evolving safety standards. As vehicles age, there is a consistent need for automotive aftermarket glass services, creating a steady market for manufacturers and service providers to offer replacement solutions and cater to consumer preferences.

Automotive Glass Market Companies

- Asahi Glass Co., Ltd.

- Saint-Gobain S.A.

- Fuyao Glass Industry Group Co., Ltd.

- Nippon Sheet Glass Co., Ltd. (NSG Group)

- Guardian Industries

- AGC Inc.

- Vitro S.A.B. de C.V.

- Xinyi Glass Holdings Limited

- Central Glass Co., Ltd.

- Shenzhen Benson Automobile Glass Co., Ltd.

- Pittsburgh Glass Works (PGW)

- Webasto SE

- Corning Incorporated

- SYP Kangqiao Autoglass Co., Ltd.

- Pilkington Group Limited

Recent Developments

- In May 2022, NSG Group revealed plans to integrate its automotive glass business in China with SYP Kangqiao Autoglass Co., Ltd., a leading Chinese automotive glass manufacturer. This strategic partnership with SYP Automotive is designed to bolster NSG Group's capacity to meet the growing demands of car manufacturers in the Chinese market.

- In March 2022, LKQ Corporation finalized an agreement to divest PGW Auto Glass to One Equity Partners (OEP), a private equity firm. According to its website, PGW boasts an extensive network with over 100 distribution branches and a customer base exceeding 27,000 in both Canada and the United States.

- In February 2019, Vitro, a North American automotive glass manufacturer, committed a significant investment of USD 60 million toward the development and implementation of cutting-edge technologies. These investments were strategically directed at the North American market, with the goal of reinforcing Vitro's prominent position in the automotive glass sector. The company aimed to strengthen its role as a premier supplier to original equipment manufacturers (OEMs) and aftermarket customers in the region.

Segments Covered in the Report

By Product

- Tempered Glass

- Laminated Glass

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By End-use

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting