Automotive Seat Belts Market Size and Forecast 2025 to 2034

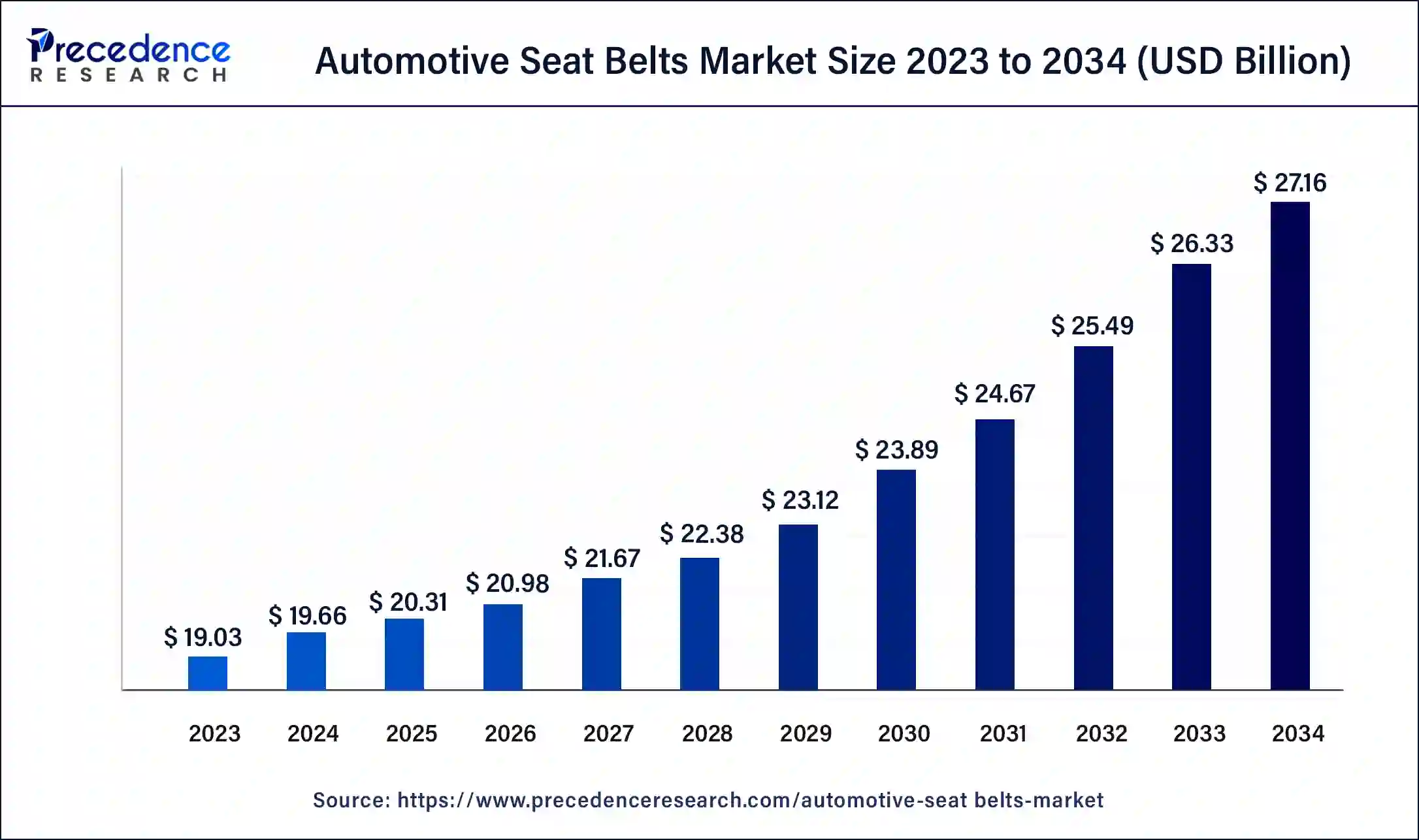

The global automotive seat belts market size accounted for USD 19.66 billion in 2024, and is anticipated to hit around USD 20.31 billion by 2025, and is predicted to reach around USD 27.16 billion by 2034, growing at a CAGR of 3.28% from 2025 to 2034.

Automotive Seat Belts Market Key Takeaways

- In terms of revenue, the market is valued at $20.31 billion in 2025.

- It is projected to reach $27.16 billion by 2034.

- The market is expected to grow at a CAGR of 3.28% from 2025 to 2034.

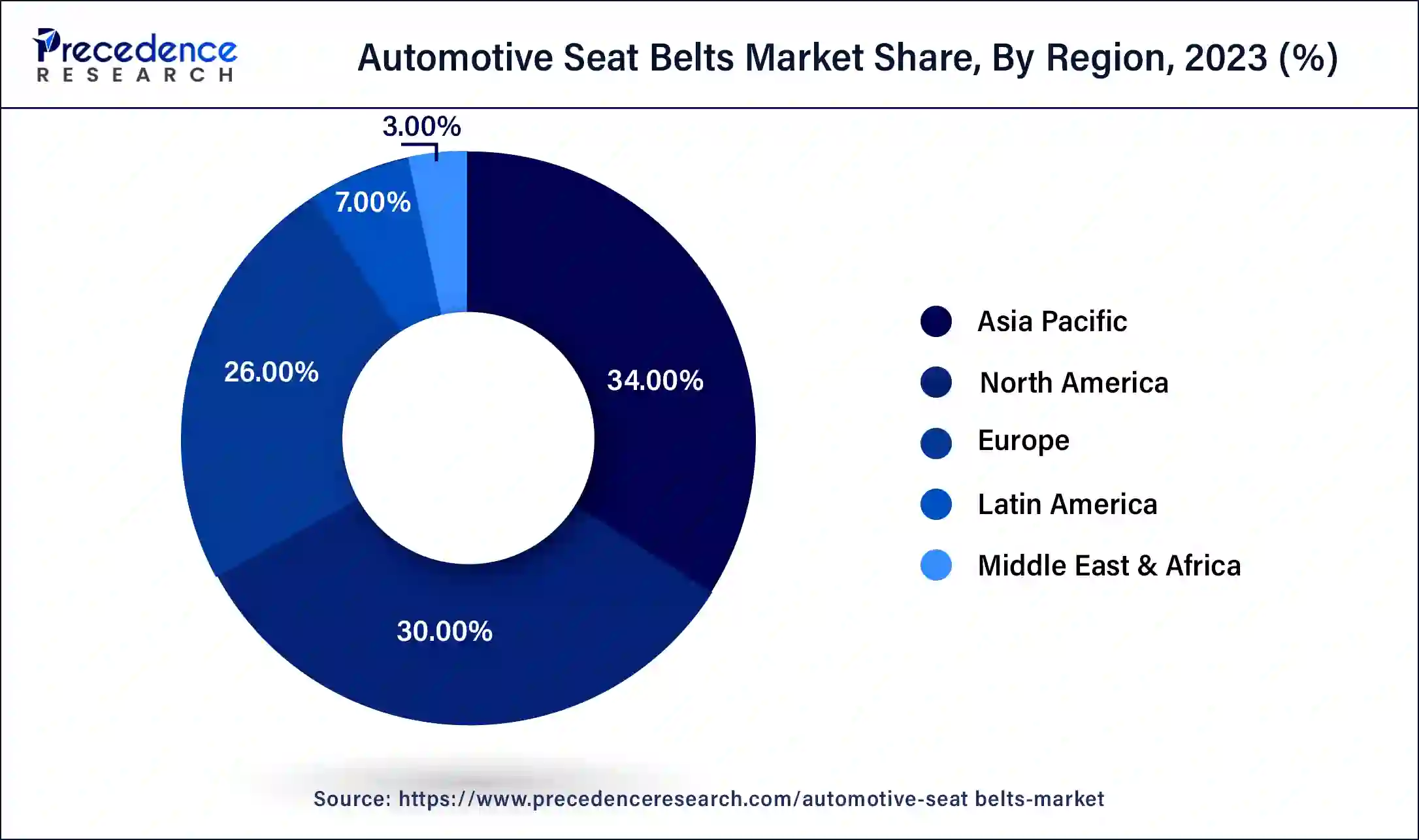

- Asia-Pacific contributed more than 34% of revenue share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

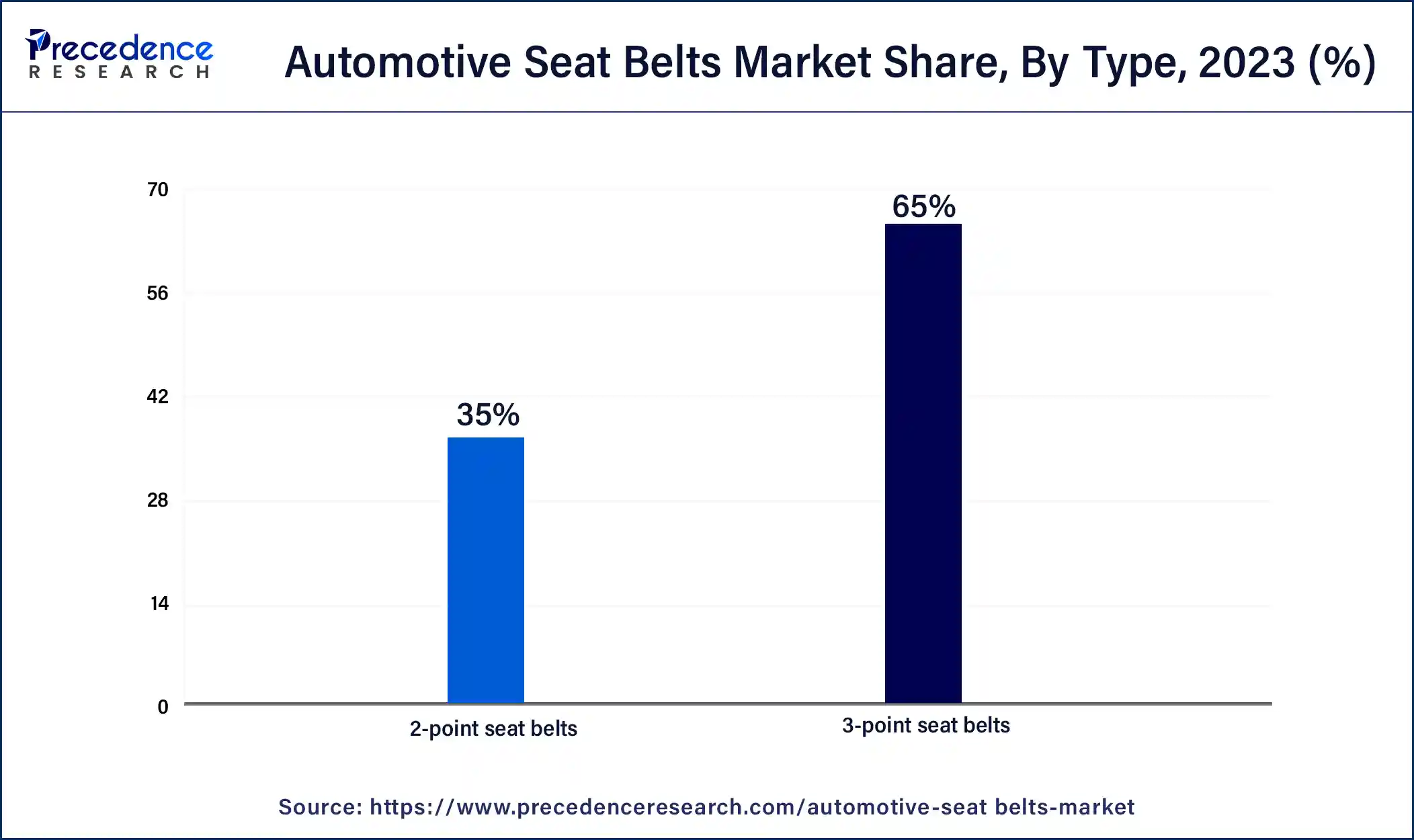

- By type, the 3-point seat belts segment has held the largest market share of 65% in 2024.

- By type, the 2-point seat belts segment is anticipated to grow at a remarkable CAGR of 4.3% between 2025 and 2034.

- By vehicle, the passenger cars segment generated over 47% of revenue share in 2025.

- By vehicle, the HCV segment is expected to expand at the fastest CAGR over the projected period.

- By component, the retractor segment has held the largest market share of 25% in 2024.

- By component, the pillar loops segment is expected to expand at the fastest CAGR over the projected period.

- By distribution channel, the OEM segment generated over 62% of revenue share in 2024.

- By distribution channel, the aftermarket segment is expected to expand at the fastest CAGR over the projected period.

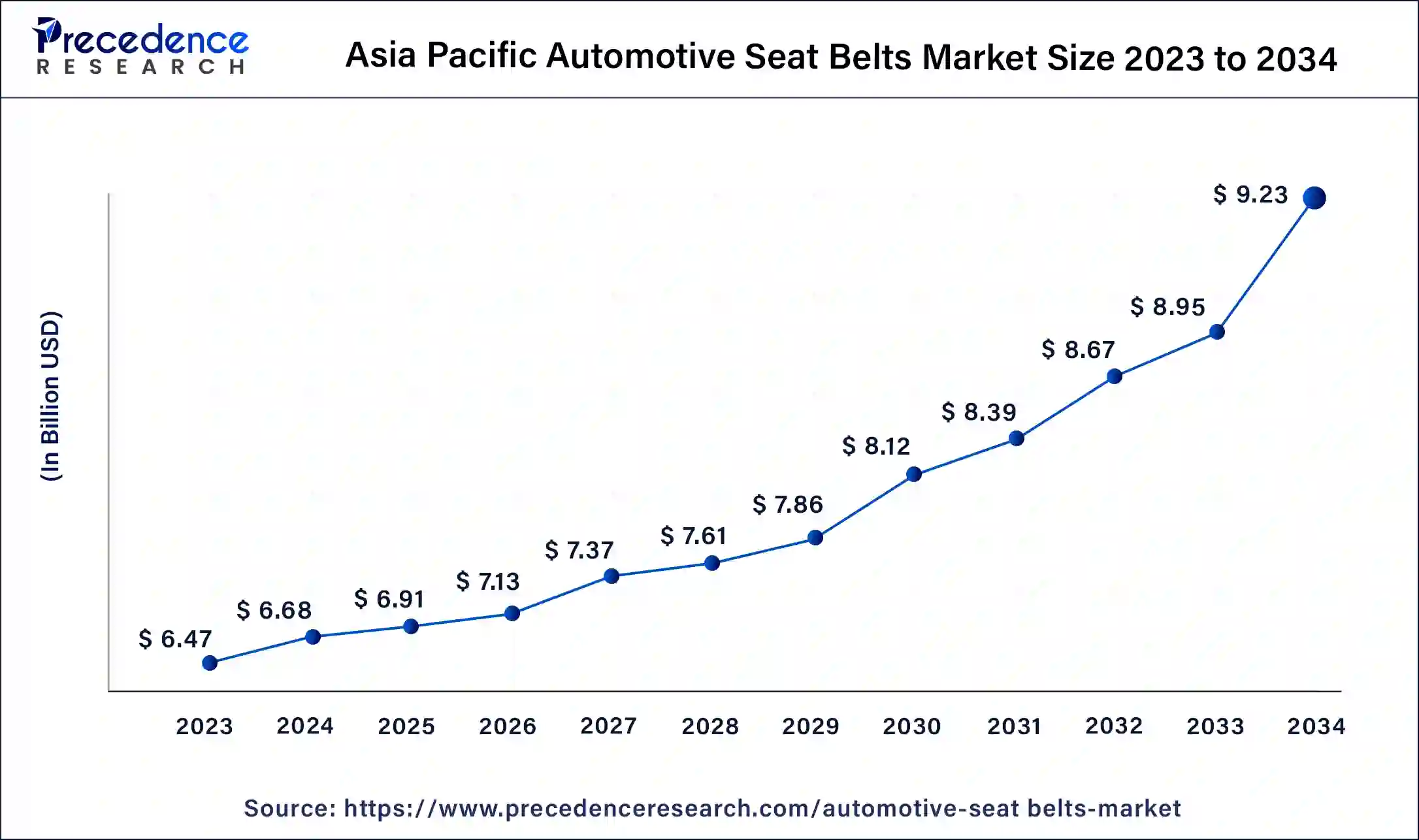

Asia Pacific Automotive Seat Belts Market Size and Growth 2025 To 2034

The Asia Pacific automotive seat belts market size is calculated at USD 6.91 billion in 2025 and is expected to be worth around USD 9.23 billion by 2034, rising at a CAGR of 4% from 2025 to 2034.

Asia-Pacific has held the largest revenue share of 34% in 2024. Asia-Pacific dominates the automotive seat belts market due to robust vehicle production, increasing awareness of road safety, and stringent government regulations mandating seat belt usage. Rapid urbanization, a rise in disposable incomes, and a growth in middle-class population contribute to higher vehicle ownership in the region. Additionally, collaborations between automotive manufacturers and seat belt suppliers for advanced safety technologies further propel market growth. The burgeoning automotive industry, coupled with a focus on enhancing safety features, positions Asia-Pacific as a major contributor to the global automotive seat belts market.

North America is estimated to observe the fastest expansion. North America commands significant growth in the automotive seat belts market due to stringent safety regulations and a high level of consumer awareness regarding road safety. The region's well-established automotive industry emphasizes safety features, propelling the demand for advanced seat belt technologies. Additionally, a robust aftermarket sector contributes to market growth as consumers prioritize retrofitting vehicles with upgraded safety systems. The presence of major automotive manufacturers and a proactive approach toward implementing safety standards position North America as a key player in driving innovations and market dominance for automotive seat belts.

Europe is observed to grow at a considerable growth rate in the upcoming period, largely driven by strict safety regulations and heightened consumer awareness. The European Union requires seat belt reminders for every seating position, thereby promoting compliance. Innovations in technology, such as smart seat belts featuring built-in sensors, are emerging. The advent of electric and autonomous vehicles is accelerating the creation of specialized restraint systems. Furthermore, partnerships between automobile manufacturers and safety equipment suppliers are spurring innovation. Nations like Germany and France are leading in R&D, concentrating on improving passenger safety and incorporating advanced features into seat belt technologies.

Germany is crucial to the European automotive seat belts market because of its strong automotive sector and focus on safety innovations. Leading German manufacturers are pioneering the development of sophisticated seat belt technologies, including heated belts and multi-stage load limiters. The nation's dedication to research and development, along with rigorous safety regulations, guarantees the ongoing advancement and acceptance of state-of-the-art seat belt systems in vehicles.

Market Overview

Automotive seat belts are pivotal safety components designed to safeguard vehicle occupants during unforeseen events such as accidents or abrupt stops. Comprising a secure buckle and a webbed strap, these devices are fastened across the lap and chest of passengers. The fundamental role of seat belts is to confine individuals, preventing them from being ejected during a collision and thereby minimizing the likelihood of severe injuries or fatalities.

Modern seat belts incorporate advanced technologies, including pretensioners that automatically tighten the belt upon impact and force limiters that manage slack to reduce occupant impact. Working in tandem with other safety features like airbags, seat belts provide comprehensive protection. Adherence to seat belt usage is mandated in numerous countries due to their established effectiveness in saving lives and reducing injuries, solidifying their status as indispensable components of global vehicle safety systems.

Automotive Seat Belts Market Growth Factors

- Regulatory Mandates: Stringent regulations mandating seat belt use globally drive market growth as manufacturers comply with safety standards.

- Increasing Vehicle Production: The growing automotive industry results in higher demand for seat belts as standard safety equipment in newly manufactured vehicles.

- Rising Awareness of Road Safety: Growing awareness among consumers regarding the importance of road safety boosts the adoption of seat belts.

- Technological Advancements: Integration of advanced technologies, such as smart seat belts and sensor-based systems, contributes to market expansion.

- Innovation in Material Sciences: Ongoing research in materials used for seat belts enhances durability and safety, attracting more consumers.

- Global Urbanization: Urbanization trends increase the need for safer transportation, driving the demand for reliable seat belt systems.

- Increasing Stringency of Crash Test Standards: Continuous improvements in crash test standards necessitate the development of more robust and effective seat belt solutions.

- Rising Disposable Income: Higher disposable income levels enable consumers to prioritize safety features, positively impacting the seat belt market.

- Focus on Occupant Protection: Growing emphasis on occupant safety, spurred by rising accident rates, fuels the demand for advanced seat belt technologies.

- Collaborations with Automotive Manufacturers: Strategic partnerships between seat belt manufacturers and automobile companies foster market growth through joint innovations.

- Emerging Electric Vehicle Market: The surge in electric vehicle adoption propels the demand for specialized seat belts designed for these vehicles.

- Increasing Demand for Autonomous Vehicles: The rise of autonomous vehicles creates new opportunities for seat belt manufacturers to develop innovative restraint systems.

- Expansion of Automotive Aftermarket: The aftermarket sector sees growth as consumers upgrade and replace seat belts for improved safety and comfort.

- Advancements in Belt Buckle Technology: Innovations in buckle design contribute to user convenience and safety, driving market expansion.

- Growth in E-commerce Channels: The online availability of automotive components facilitates easier access to a variety of seat belt options, stimulating market growth.

- Collapsible Seat Belt Designs: Development of collapsible seat belt designs enhances ease of use and storage, appealing to consumers.

- Adoption of Seat Belt Pretensioners: Increasing integration of pretensioners in seat belt systems improves overall safety, driving market demand.

- Rise in Fleet Management Services: Expanding fleet management services contributes to increased seat belt installations in commercial vehicles.

- Government Initiatives for Road Safety: Supportive government initiatives and campaigns for road safety create a favorable environment for seat belt adoption.

- Global Tourism Growth: The rise in international tourism increases the need for stringent safety measures, positively impacting the automotive seat belt market.

Major Key Trends in Automotive Seat Belts Market

- Integration of Smart Technologies: Seat belts are transforming with embedded sensors and connectivity features, allowing for real-time tracking of occupant behavior and improving synergy with other vehicle safety systems for enhanced protection.

- Focus on Sustainability: Manufacturers are investigating eco-friendly materials and sustainable manufacturing processes for seat belts, aligning with global environmental goals and meeting the rising demand for green automotive parts.

- Adaptation to Electric and Autonomous Vehicles: The transition to electric and autonomous vehicles is fostering the development of tailored seat belt systems that accommodate new vehicle designs and safety needs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 27.16 Billion |

| Market Size in 2025 | USD 20.31 Billion |

| Market Size in 2024 | USD 19.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.28% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Vehicle, Component, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Vehicle production growth and occupant protection focus

Vehicle production growth and a heightened focus on occupant protection are dual catalysts propelling the demand for automotive seat belts. As global vehicle production continues to surge, with an increasing number of automobiles being manufactured, the need for mandatory safety features becomes more pronounced. Governments and regulatory bodies worldwide enforce stringent safety standards, making seat belts a fundamental requirement in new vehicles. This surge in production not only mandates the inclusion of seat belts but also fuels the overall demand for these safety devices.

Simultaneously, the automotive industry's intensified focus on occupant protection amplifies the significance of advanced seat belt systems. Manufacturers are investing in research and development to enhance seat belt designs, incorporating features like pretensioners and force limiters. Consumers, now more than ever, prioritize vehicles equipped with comprehensive safety measures. This dual momentum, driven by both production growth and occupant protection emphasis, synergistically contributes to the rising demand for advanced and technologically superior automotive seat belts in the market.

Restraint

Global economic Fluctuations and limited retrofitting options

Global economic fluctuations pose significant challenges for the automotive seat belts market as they directly impact vehicle production and consumer purchasing power. During economic downturns, reduced consumer spending on automobiles can lead to a decline in the overall demand for seat belts. Additionally, automotive manufacturers may cut back on production, affecting the incorporation of seat belts in new vehicles. The cyclical nature of the economy thus presents a restraint on the market's growth, making it susceptible to economic uncertainties. Limited retrofitting options also constrain the market demand for automotive seat belts.

Retrofitting advanced seat belt systems into existing vehicles can be technically complex and expensive, dissuading vehicle owners from upgrading their seat belt systems. This limitation is particularly relevant in regions with a significant number of older vehicles on the road. The challenge of retrofitting hinders the market's potential growth, as it restricts the adoption of advanced seat belt technologies in the existing vehicle fleet, which is a considerable portion of the automotive market.

Opportunity

Advanced technologies integration and focus on lightweight materials

Advanced technologies integration and a focus on lightweight materials are pivotal in creating significant opportunities within the automotive seat belts market. The incorporation of cutting-edge technologies, such as sensors and artificial intelligence, enables the development of intelligent seat belt systems that can respond dynamically to driving conditions. This innovation enhances overall safety, providing opportunities for manufacturers to differentiate their products in a competitive market. Simultaneously, a focus on lightweight materials addresses broader industry trends towards fuel efficiency and sustainability. Lightweight seat belt materials not only contribute to vehicle weight reduction but also align with environmental goals.

Opportunities arise for seat belt manufacturers to leverage these advancements, meeting consumer demands for both enhanced safety features and eco-friendly solutions. As automotive manufacturers seek ways to optimize vehicle performance and efficiency, seat belts crafted from lightweight materials with advanced technologies become integral components, opening avenues for growth and market expansion.

Type Insights

In 2024, the 3-point seat belts segment had the highest market share of 65% based on the type. The 3-point seat belt segment in the automotive seat belt market refers to safety restraints with three attachment points – one over the occupant's lap and two across the chest. This design provides enhanced protection compared to older belt configurations. Trends in the 3-point seat belts segment involve continuous improvements in design and materials, ensuring better comfort and safety. The adoption of pretensioners and load limiters in 3-point seat belts further enhances their effectiveness, reflecting a commitment to advancing occupant protection in vehicles.

The 2-point seat belts segment is anticipated to expand at a significant CAGR of 4.3% during the projected period. The 2-point seat belts segment in the automotive seat belts market refers to the traditional seat belt design with two anchorage points, typically securing the lap area. This segment, while historically prevalent, is experiencing a shift in trends as automotive safety standards evolve. Modern safety regulations and consumer preferences are driving a transition towards more advanced seat belt systems with additional anchorage points, such as 3-point or multi-point seat belts. Despite this shift, 2-point seat belts remain relevant, especially in certain vehicle types, contributing to a diverse seat belt market.

Vehicle Insights

According to the vehicle, the passenger cars segment has held 47% revenue share in 2024. The passenger cars segment in the automotive seat belts market refers to seat belt systems designed specifically for vehicles intended for personal transportation. Trends in this segment include a heightened focus on smart seat belt technologies, integrating sensors for improved occupant safety. Additionally, customization options and aesthetic considerations are gaining prominence as consumers seek personalized features. The passenger cars segment is witnessing innovations that align with the broader market trends of advanced safety features and a seamless integration of technology for a more secure and comfortable driving experience.

The HCV segment is anticipated to expand fastest over the projected period. In the automotive seat belts market, the heavy commercial vehicle (HCV) segment refers to large trucks and buses designed for transporting goods or passengers. In recent trends, the HCV sector has witnessed a growing emphasis on safety, with increasing regulations mandating robust seat belt systems. Manufacturers are responding by integrating advanced technologies like pretensioners and adaptive restraint systems to enhance occupant protection. The demand for durable and effective seat belts in HCVs aligns with the broader industry focus on improving safety standards for both drivers and passengers in heavy-duty vehicles.

Component Insights

According to the component, the retractor segment has held a 25% revenue share in 2024. The retractor segment in the automotive seat belts market refers to the component responsible for controlling the length of the seat belt strap, ensuring proper restraint during vehicle movement or sudden stops. A key trend in retractors involves the integration of advanced technologies such as pretensioners and load limiters. Pretensioners automatically tighten the seat belt upon impact, while load limiters release controlled slack, optimizing occupant safety. This trend reflects an industry-wide commitment to enhancing seat belt effectiveness through technological innovations for improved crash protection and overall vehicle safety.

The pillar loops segment is anticipated to expand fastest over the projected period. The pillar loop is a crucial component of automotive seat belts, serving as the attachment point for the upper portion of the belt. This segment encompasses the anchor point on the vehicle's structure, typically located on the vehicle's B-pillar. Trends in pillar loop design focus on enhancing durability, ease of use, and compatibility with advanced restraint systems. Manufacturers are incorporating materials and engineering innovations to make pillar loops more robust and adaptable, aligning with the broader trend of integrating sophisticated technologies for improved safety and user experience in the automotive seat belts market.

Distribution Channel Insights

According to the distribution channel, the OEM segment has held a 62% revenue share in 2024 The Original Equipment Manufacturer (OEM) segment in the automotive seat belts market refers to the direct supply of seat belts to vehicle manufacturers for installation in newly manufactured vehicles.

A key trend in this segment involves collaborative partnerships between seat belt manufacturers and OEMs to develop and integrate advanced safety features seamlessly. As safety regulations evolve, OEMs are increasingly prioritizing innovative seat belt technologies, creating opportunities for manufacturers to align their offerings with the evolving demands of vehicle producers and regulatory standards.

The aftermarket segment is anticipated to expand fastest over the projected period. In the automotive seat belts market, the aftermarket segment refers to the distribution channel involved in the sale of seat belts after the initial vehicle purchase. This includes replacement and upgrade options for existing seat belt systems. A current trend in the aftermarket segment involves a rising demand for advanced safety features, prompting consumers to retrofit vehicles with technologically enhanced seat belts. As safety-conscious consumers seek to improve their existing vehicles, the aftermarket presents an evolving landscape with a focus on innovative seat belt solutions and customization options.

Automotive Seat Belts Market Companies

- Key Safety Systems (now part of Joyson Safety Systems)

- Joyson Safety Systems

- Autoliv Inc.

- ZF Friedrichshafen AG

- Takata Corporation (now part of Joyson Safety Systems)

- Continental AG

- Robert Bosch GmbH

- Delphi Automotive (Aptiv PLC)

- Denso Corporation

- Toyoda Gosei Co., Ltd.

- Hyundai Mobis

- Goradia Industries (Beam's Seatbelts)

- Far Europe Inc.

- Ashimori Industry Co., Ltd.

- Seatbelt Solutions LLC.

Recent Developments

- In January 2023, ZF Friedrichshafen launched the "Heat Belt," a groundbreaking heated seat belt intended for electric vehicles. This innovation boosts occupant comfort in cold weather and minimizes the need for cabin heating, potentially increasing the vehicle's range by as much as 15%. The heating components are seamlessly incorporated into the seat belt design, maintaining typical functionality.

- In June 2024, E-Smart introduced a novel seat belt system that modifies restraining force according to occupant size and posture. This adaptive innovation aims to enhance protection during collisions by tailoring the belt's performance to individual requirements, marking a notable progress in vehicle safety and compliance.

- In May 2023, Maruti Suzuki upgraded its Baleno model to feature a three-point seat belt for the middle rear passenger, alongside an adjustable headrest and seat belt reminder system. This improvement addresses the growing demand for comprehensive safety features for rear occupants and adheres to evolving safety standards.

Segments Covered in the Report

By Type

- 2-Point Seat Belts

- 3-Point Seat Belts

By Vehicle

- Passenger Cars

- LCV

- HCV

By Component

- Webbing Strap

- Retractors

- Buckles

- Tongues

- Pillar Loops

By Distribution Channel

- OEM

- Aftermarket

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content