What is Automotive Starter Motor Market Size?

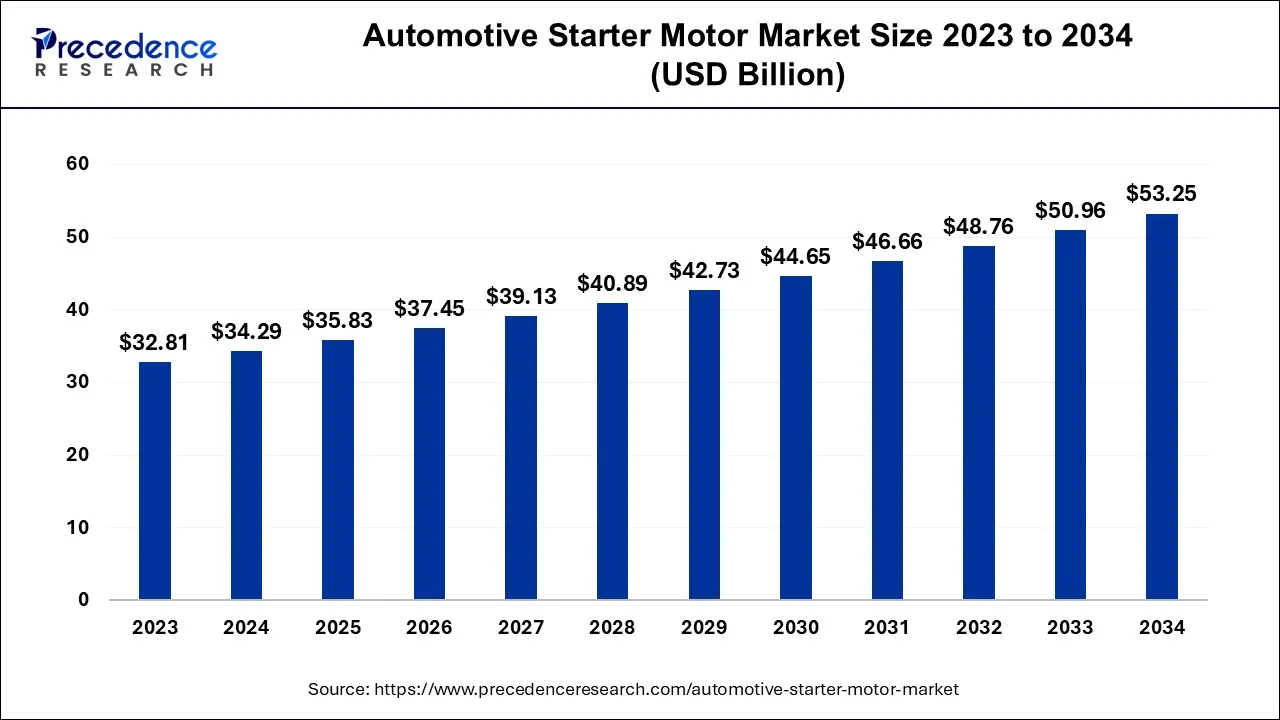

The global automotive starter motor market size is valued at USD 35.83 billion in 2025 and is anticipated to reach around USD 53.25 billion by 2034, expanding at a CAGR of 4.50% over the forecast period from 2025 to 2034.

Market Highlights

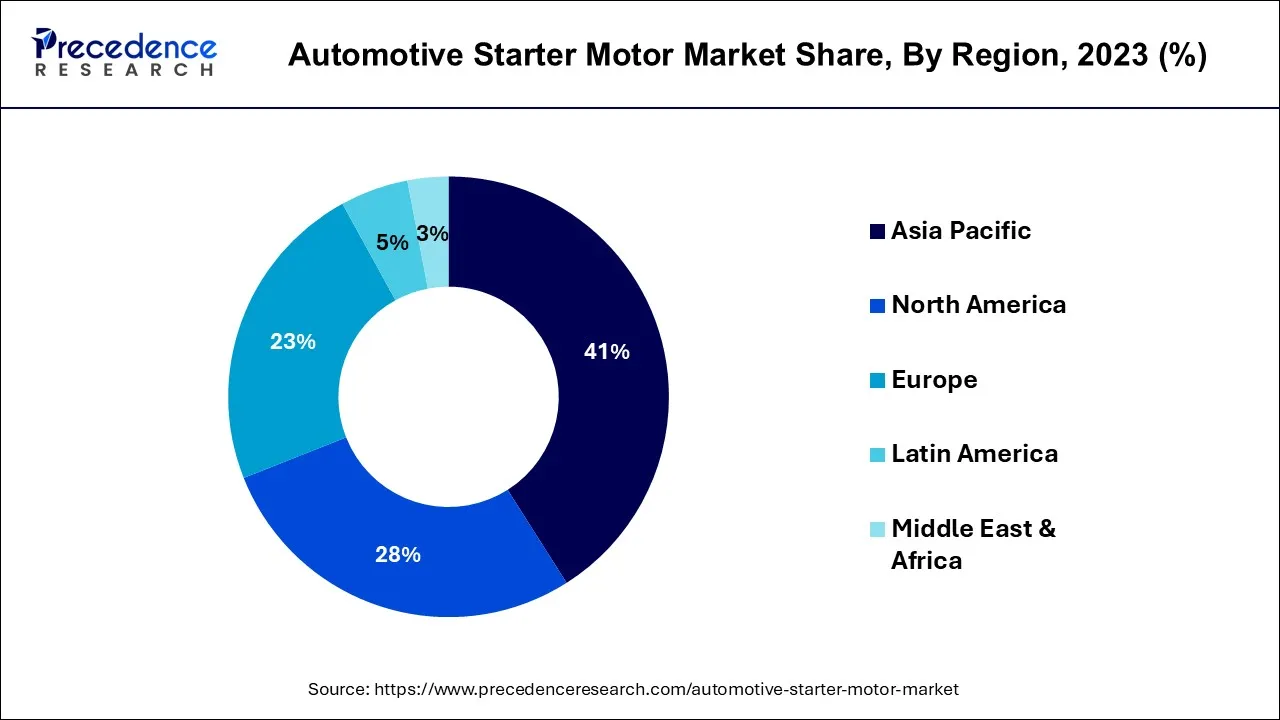

- By region, Asia-Pacific contributed more than 41% of revenue share in the automotive starter motor market in 2024. North America region is estimated to expand the fastest CAGR between 2025 and 2034.

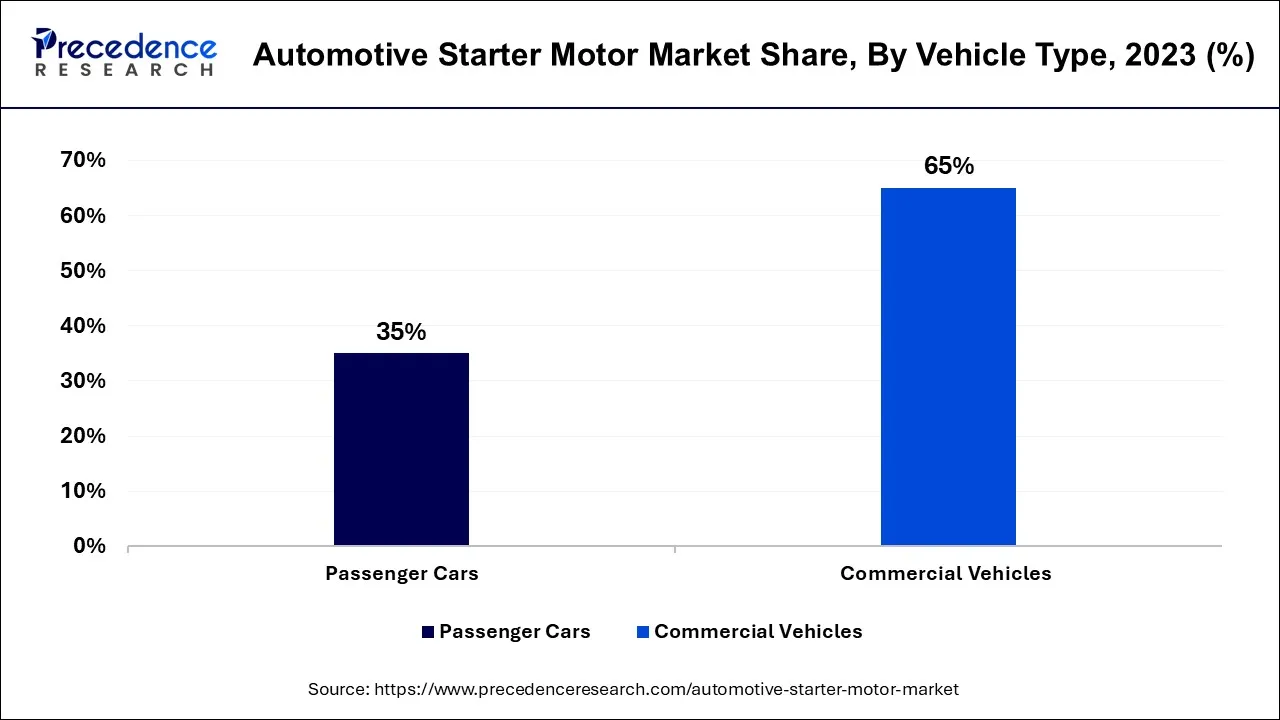

- By vehicle type, the commercial vehicles segment has held the largest market share of 65% in 2024. On the other hand, the passenger cars segment is anticipated to grow at a remarkable CAGR of 5.8% between 2025 and 2034.

- By application type, the internal combustion engine (IC engine) segment had the largest market share of 60% in 2024. Whereas the hybrid/micro-hybrid powertrain segment is expected to expand at the fastest CAGR over the projected period.

- By type, the electric segment had the largest market share of 32% in 2024. On the other hand, the hydraulic segment is expected to expand at the fastest CAGR over the projected period.

- By sales channel, the OEM segment had the largest market share of 55% in 2024. Meanwhile, the replacement/aftermarket segment is expected to expand at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 35.83 Billion

- Market Size in 2026: USD 37.45 Billion

- Forecasted Market Size by 2034: USD 53.25 Billion

- CAGR (2025-2034): 4.50%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Strategic Overview of the Global Automotive Starter Motor Industry

The automotive starter motor market represents the domain dedicated to the production and distribution of initiation mechanisms for internal combustion engines in vehicles. These crucial components kickstart the rotational action of the engine, enabling the vehicle's ignition. This realm encompasses a diverse array of starter motor varieties, ranging from conventional electric starters to cutting-edge, eco-conscious designs. Its dynamics are shaped by factors such as evolving trends in automotive production, technological innovations, and consumer preferences for eco-friendly, energy-efficient options. This arena is characterized by fierce competition, as numerous manufacturers and suppliers vie to offer dependable and cost-effective starter motor solutions to the automotive sector.

Automotive Starter Motor Market Growth Factors

- A foundational catalyst for the automotive starter motor market revolves around the ceaseless surge in global automobile production. As the world's populace swells and urbanization maintains its momentum, the unrelenting need for personal and commercial vehicles propels the demand for starter motors across the automotive spectrum, from passenger cars to heavy-duty commercial rigs. Furthermore, emerging economies in developing nations exhibit remarkable increase in vehicle production, providing an added impetus.

- Unceasing progress in the realm of starter motor technology wields significant influence. Perpetual innovation yields more efficient and dependable starter motor systems. These transformative innovations encompass the integration of intelligent and energy-frugal starter motors, enhancing not only reliability but also fuel efficiency and environmental impact reduction. Often, stringent emissions directives necessitate these advancements, intensifying their contribution to market expansion.

- The burgeoning adoption of electric vehicles (EVs) casts another profound influence on the automotive starter motor market. EVs depend on starter motors for auxiliary functionalities, such as climate control and power-assisted steering. As the EV sector flourishes, the demand for starter motors tailored to the distinctive demands of electric mobility experiences upward trajectory.

- Environmental apprehensions and strict emission regulations compel automakers to conceive more fuel-sparing vehicles. Starter motors play a pivotal role in ameliorating a vehicle's fuel efficiency by curtailing idling periods and enabling start-stop systems. With regulations escalating globally, the call for sophisticated starter motor systems that align with these mandates burgeons.

- Emerging markets, particularly in Asia, Latin America, and Africa, witness a remarkable surge in vehicle ownership. With a growing middle class in these regions, vehicle ownership rises, resulting in augmented demand for starter motors in new vehicles and as replacements in older ones. The growth trajectory of the automotive starter motor market remains intricately linked to the economic advancement of these areas.

- The global trend towards urbanization kindles the desire for compact vehicles tailored for urban landscapes. These vehicles often encompass start-stop systems to diminish fuel consumption amidst urban traffic conditions. This accentuates the demand for sophisticated starter motor systems proficient in handling frequent engine restarts, amplifying market expansion.

- The amalgamation of starter motor systems with other vehicle components, such as hybrid mechanisms and regenerative braking systems, is increasingly prevalent. This not only enhances overall vehicle performance but also augments the automotive starter motor market, as these systems grow more intricate and integral to modern vehicles.

Major Key Trends in Automotive Starter Motor Market

- Electrification of Powertrains: The increasing popularity of hybrid and electric vehicles is spurring demand for high-performance starter motors that can accommodate both internal combustion and electric drive systems.

- Start-Stop System Integration:Automakers are more frequently integrating start-stop technology to enhance emissions reduction and fuel efficiency, which requires robust and quick-response starter motors capable of repeated engine restarts.

- Lightweight and Compact Designs: Manufacturers are focusing on creating lighter and more compact starter motors to address space limitations while enhancing overall vehicle efficiency without sacrificing performance or durability.

Market Outlook

- Market Growth Overview: The Automotive Starter Motor market is expected to grow significantly between 2025 and 2034, driven by the widespread adoption of start-stop systems, increasing growth in hybrid electric vehicles, and the large and ageing global vehicle fleet ensures a steady and consistent demand for replacement and remanufactured starter motors.

- Sustainability Trends: Sustainability trends involve light weighting and material efficiency, the adoption of remanufacturing parts (circular economy), and energy efficiency in manufacturing. Reducing dependence on traditional ICE technology, responsible sourcing and compliance.

- Major Investors:Major investors in the Bosch, Denso Corporation, Valeo SA, and Zhengzhou Coal Mining Machinery Group Co (ZMJ) and CRCI.

- Startup Economy: The startup economy in the market is focused on EV components and Propulsion, AI-driven maintenance and diagnostics, and specialized hybrid system integration.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 35.83 Billion |

| Market Size in 2026 | USD 37.45 Billion |

| Market Size by 2034 | USD 53.25 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.50% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Vehicle Type, By Type, and By Sales Channel, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing vehicle production

The inexorable upswing in vehicle production serves as a pivotal catalyst propelling the growth of the automotive starter motor market. The incessant global population expansion coupled with the pervasive wave of urbanization fuels an unyielding appetite for a diverse array of vehicles. This escalating demand transcends the automotive spectrum, encompassing passenger cars, heavy-duty trucks, and various modes of transportation, all of which rely on starter motors as the crucial ignition enabler.

Furthermore, the emergence of burgeoning economies, especially in the likes of India, China, and Brazil, where a burgeoning middle class craves personal and commercial vehicles, intensifies the clamor for starter motors. These dynamic economies emerge as epicenters of automotive manufacturing, magnifying the market's reach and influence. Additionally, the aftermarket segment for starter motors, driven by the surge in vehicle production, takes on a profound significance.

With a mounting population of vehicles on the road, the inevitable wear and tear on incumbent starter motors spark a perpetual demand for replacements and enhancements, thereby ensuring the market's continuous expansion. In essence, the automotive starter motor market derives its vital impetus from the relentless escalation in vehicle production, solidifying its enduring growth and relevance.

Restraint

Shift to electric vehicles (EVs)

The shift to electric vehicles (EVs) is serving as a prominent restraint on the growth of the automotive starter motor market. As EVs gain traction and market share, they pose a significant challenge to the traditional automotive starter motor industry. Unlike internal combustion engine (ICE) vehicles, electric vehicles do not rely on conventional starter motors for engine ignition. This fundamental difference in propulsion systems reduces the demand for traditional starter motors, particularly in the segment of the automotive market that transitions to electric mobility.

As governments worldwide emphasize sustainability and offer incentives for EV adoption, consumers are increasingly drawn to electric vehicles. This transition away from ICE vehicles limits the growth prospects of starter motor manufacturers, as they face a shrinking market for their products. Consequently, the automotive starter motor industry must adapt by diversifying its product offerings, exploring alternative markets, and innovating in response to the changing landscape of the automotive industry to mitigate the impact of the EV shift.

Opportunity

Innovation in start-stop systems

The innovation in start-stop systems unfolds a substantial canvas of opportunities within the automotive starter motor market. The advent of start-stop technology, a design aimed at augmenting fuel efficiency and curbing emissions, has taken center stage in contemporary vehicles. This system orchestrates the automatic halting of the engine when the vehicle idles, only to reignite it seamlessly upon the driver's acceleration. This recurrent cycle of engine stoppage and reactivation places distinct demands on the starter motor, necessitating the development of sturdier and more resilient solutions.

Hence, a burgeoning requirement arises for advanced starter motor systems, adept at efficiently managing the increased frequency of engine starts. Manufacturers are positioned to embark on the creation of starter motors featuring heightened durability, expedited response times, and optimized thermal regulation. These innovations not only bolster the efficacy of start-stop systems but also contribute to the overarching goal of vehicle efficiency and environmental sustainability. As the automotive sector persistently champions fuel economy and emissions mitigation, the crafting of starter motors tailored to these technological strides unfolds as a significant avenue for expansion for manufacturers.

Vehicle Type Insights

According to the vehicle type, the commercial vehicles segment has held a 65% revenue share in 2024. The commercial vehicles segment commands a significant share in the automotive starter motor market due to the distinctive demands of heavy-duty applications. Commercial vehicles, such as trucks and buses, require robust and durable starter motors capable of handling larger engines and frequent starts. They operate under demanding conditions, often in harsh environments and with higher load capacities, necessitating dependable starter motor systems. As a result, manufacturers have developed specialized starter motors for commercial vehicles, making this segment a major contributor to the market's overall revenue, driven by the substantial global presence of commercial fleets and logistics operations.

The passenger cars segment is anticipated to expand at a significant CAGR of 5.8% during the projected period. The passenger car segment is expected to witness significant growth in the automotive starter motor market due to their sheer volume and broad consumer base. Passenger cars are the most commonly owned and driven vehicles, making them a dominant force in the market. Additionally, modern passenger cars often feature advanced starter motor technology, including start-stop systems, which require reliable and efficient starter motors. As fuel efficiency and emission standards continue to shape the automotive industry, the development of starter motors tailored to passenger cars is essential. This segment's substantial market growth is further reinforced by urbanization trends and increasing global car ownership.

Application Type Insights

Based on the application type, the Internal Combustion Engine (IC Engine) segment is anticipated to hold the largest market share of 60% in 2024. The Internal combustion engine (IC Engine) segment retains a major share in the automotive starter motor market due to the prevalence of traditional combustion engine vehicles. Despite the rise of electric vehicles, IC engine vehicles still dominate global roads. These vehicles require starter motors for engine ignition, ensuring a continuous demand for these components. Furthermore, the extensive existing IC engine vehicle fleet in mature markets and the ongoing production of such vehicles in emerging economies sustain the prominence of this segment in the starter motor market.

On the other hand, the hybrid/micro-hybrid powertrain segment is projected to grow at the fastest rate over the projected period. The dominant growth of the hybrid/micro-hybrid powertrain segment within the automotive starter motor market is primarily attributed to the burgeoning acceptance of hybrid and micro-hybrid vehicles. These innovative transportation solutions rely on cutting-edge starter motor technology to adeptly manage the frequent cycles of engine start and stop.

The surging global demand for environmentally conscious and fuel-efficient modes of transportation serves as a potent catalyst propelling this segment to the forefront. Additionally, the rigorous emissions regulations imposed by governing bodies have further thrust this sector into the spotlight, as hybrid and micro-hybrid powertrains emerge as a compelling strategy for curbing carbon emissions. As the automotive industry steadfastly advances in the pursuit of sustainable technologies, the hybrid/micro-hybrid powertrain segment maintains its commanding growth within the starter motor market.

Type Insights

Based on the type, the electric segment is anticipated to hold the largest market share of 32% in2024. The electric segment holds a major share in the automotive starter motor market primarily due to the rising adoption of electric vehicles (EVs). Unlike traditional internal combustion engine (ICE) vehicles, EVs require starter motors for auxiliary systems, such as power steering and air conditioning, thereby contributing significantly to the demand. The growing global emphasis on environmental sustainability and stringent emissions regulations is driving the shift towards electric mobility, further boosting the electric starter motor segment. As EVs continue to gain popularity, this segment is expected to maintain and potentially expand its substantial market share in the automotive starter motor industry.

On the other hand, the hydraulic segment is projected to grow at the fastest rate over the projected period. The hydraulic segment holds a significant share in the automotive starter motor market due to its reliability and robust performance. Hydraulic starter motors are widely used in heavy-duty applications, such as commercial trucks and industrial machinery, where consistent and powerful engine ignition is crucial. Their ability to generate high torque even in harsh conditions makes them the preferred choice. Additionally, hydraulic starter motors require less maintenance and have a longer lifespan, reducing operational costs. As industries continue to rely on heavy machinery, the demand for reliable and durable hydraulic starter motors remains strong, sustaining their major market share.

Sales Channel Insights

Based on the sales channel, the OEM segment is anticipated to hold the largest market share of 55% in2024. The OEM (Original Equipment Manufacturer) segment holds a major share in the automotive starter motor market primarily due to its direct integration into the manufacturing process of new vehicles. OEMs are the initial suppliers of starter motors to automakers, ensuring that each vehicle is equipped with a compatible and high-quality starter motor system. This strategic positioning grants them a significant share as they establish long-term partnerships with automotive manufacturers, benefiting from the consistent demand generated by the production of new vehicles. Additionally, OEMs are often at the forefront of innovation, offering advanced starter motor solutions tailored to modern vehicle requirements.

On the other hand, the replacement/aftermarket metal segment is projected to grow at the fastest rate over the projected period. The replacement/aftermarket segment commands a significant share in the automotive starter motor market due to several factors. As vehicles age and require maintenance, there's a sustained demand for starter motor replacements. Additionally, consumer preferences for vehicle upgrades, enhanced performance, and customization contribute to this segment's prominence.

The availability of advanced and high-quality aftermarket starter motor options, often at competitive prices, offers consumers a cost-effective alternative to purchasing brand-new vehicles. Moreover, the increasing average age of vehicles on the road in mature markets further bolsters the Replacement/Aftermarket segment's importance, making it a substantial and enduring component of the automotive starter motor market.

Regional Insights

Asia Pacific Automotive Starter Motor Market Size and Growth 2024 to 2034

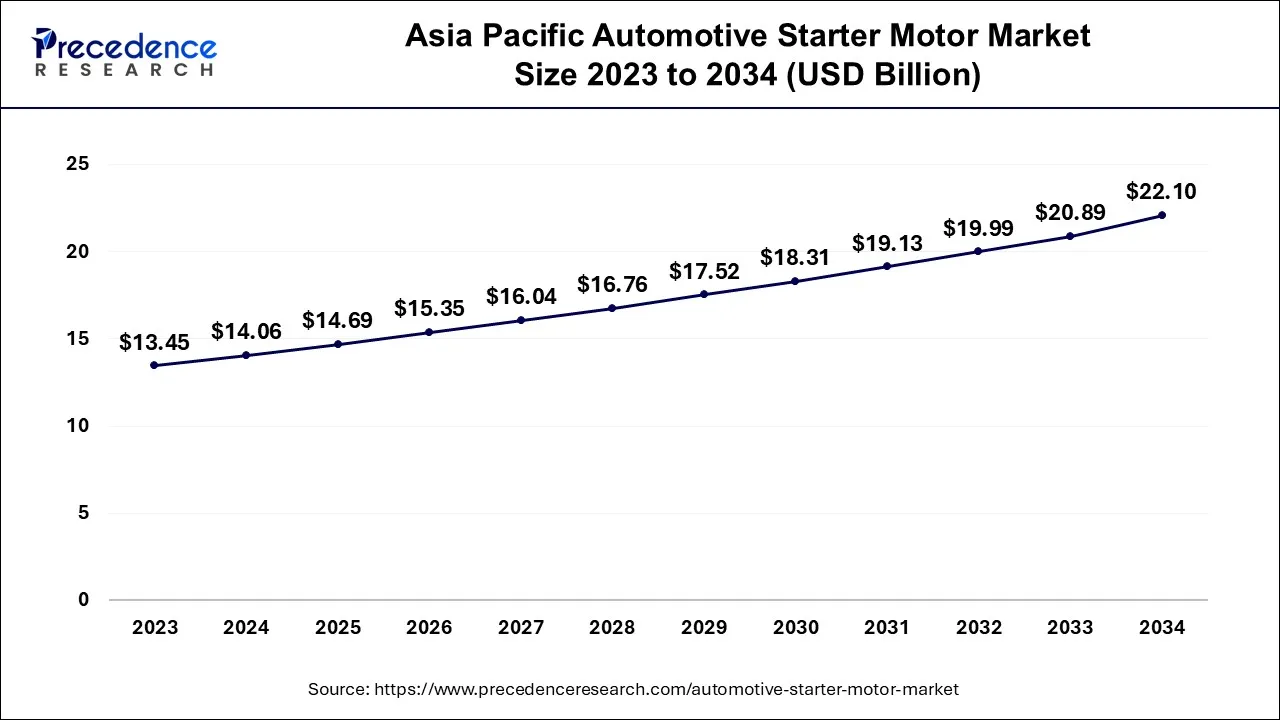

The Asia Pacific automotive starter motor market size is accounted at USD 14.69 billion in 2025 and is projected to be worth around USD 22.10 billion by 2034, poised to grow at a CAGR of 4.63% from 2025 to 2034.

Asia-Pacific held the largest revenue share 41% in 2024. The preeminence of the region in the automotive starter motor market can be attributed to a constellation of distinctive factors. This geographical domain encompasses some of the globe's most expansive and swiftly advancing automotive markets, with China and India serving as prime examples. The burgeoning middle-class population and ongoing urbanization in this territory have engendered an escalating appetite for vehicles, thereby propelling the demand for starter motors. Furthermore, the Asia-Pacific region boasts major automotive manufacturing centers and exhibits a notable inclination towards electric mobility, both of which converge to bolster its dominance in the automotive starter motor market. In essence, it stands as an automotive epicenter, wielding considerable influence in the industry.

North America is estimated to observe the fastest expansion. North America maintains significant growth in the automotive starter motor market due to several key factors. The region boasts a well-established automotive industry with a substantial number of vehicles on the road, creating a continuous demand for starter motor replacements. Stringent environmental regulations have prompted automakers to adopt advanced starter motor technologies. Moreover, a higher consumer preference for larger vehicles like trucks and SUVs in North America contributes to greater starter motor usage. The presence of prominent automotive manufacturers, coupled with a growing market for electric vehicles, further solidifies North America's prominent growth in the automotive starter motor market.

How is Europe Rising in the Automotive Starter Motor Market?

Europe is observed to grow at a considerable growth rate in the upcoming?period, driven by stringent emission regulations, a rising demand for fuel-efficient vehicles, and the increasing adoption of start-stop systems. Manufacturers in the region are implementing advanced starter motors to adhere to Euro 6/7 standards and to promote electrification trends. Innovations in lightweight and compact starter motors are boosting demand among OEMs and in the aftermarket. The rise in sales of hybrid and plug-in hybrid vehicles is also contributing to market growth. Additionally, robust automotive infrastructure in Germany, France, and Italy, coupled with investments in sustainable mobility solutions, continues to enhance adoption throughout the continent.

China Automotive Starter Motor Market Trends

China's rising adoption of start-stop technology, technological innovation focuses on enhancing performance and efficiency, increasing compact gear reduction starter motors, and offering superior torque and cold-start reliability. The shift towards electrified and hybrid powertrains and smart diagnostics, and IoT integration.

U.S. Automotive Starter Motor Trends

The U.S. continued demand for internal combustion and hybrid vehicles, despite the long-term threat from Battery Electric Vehicles. The widespread adoption of robust start-stop systems and the integration of Integrated Starter-Generator (iBSG) technology in mild hybrids. Strong aftermarket demand and a focus on durability and performance, especially in the commercial vehicle segment, further support the market.

Germany Automotive Starter Motor Trends

Germany is a key player in the automotive starter motor market in Europe due to its strong automotive manufacturing sector and research and development capabilities. Major OEMs and Tier 1 suppliers are concentrating on innovating fuel-efficient technologies, including start-stop systems and high-efficiency starter motors. As the adoption of electric and hybrid vehicles grows alongside stringent emission regulations, Germany remains a central hub for the production of advanced automotive components, significantly contributing to the market's regional growth.

Automotive Starter Motor Market Value Chain Analysis

- R&D and Product Design This foundational stage involves designing and engineering starter motors, focusing on improving performance, durability, and efficiency.

Key Players: Robert Bosch GmbH, DENSO CORPORATION, Valeo SA, BorgWarner Inc., and Continental AG. - Raw Material Sourcing (Tier 3 Suppliers)This initial stage involves procuring the fundamental raw materials, such as steel, copper, aluminum, and plastics, necessary for manufacturing starter motors.

Key Players: Raw material suppliers specializing in metals and plastics, serving Tier 2 and Tier 1 suppliers. - Distribution and Aftermarket ServicesThe market splits into two channels: finished vehicles are distributed to dealerships for sale, while replacement and remanufactured starter motors are sold to the aftermarket through parts distributors and retailers. Aftermarket services include maintenance, repair, and the provision of replacement parts throughout the vehicle's lifespan.

Key Players: BBB Industries (aftermarket), Prestolite Electric (aftermarket), Cummins Inc. (heavy-duty), and various auto parts distributors and retailers.

Automotive Starter Motor Market Companies

- Bosch Bosch is a major global manufacturer of starters, including advanced start-stop systems. Bosch also provides extensive aftermarket support for its starters and alternators through a wide network of workshops.

- Denso CorporationDenso is a global powerhouse known for its innovation in electrical systems, including starters for both conventional and advanced start-stop applications. It supplies a wide range of high-quality, lightweight, and efficient starters to major automakers worldwide.

- ValeoValeo is a key player with a long history in rotating machines, offering both advanced original equipment (OE) starters and a strong remanufacturing program for the aftermarket.

- Hitachi Automotive SystemsAs part of the broader Hitachi group, Hitachi Automotive Systems (now Hitachi Astemo) produces a range of high-performance and durable starters for various automotive and heavy-duty applications.

- Mitsubishi ElectricMitsubishi Electric is a major OE supplier of compact, lightweight, and high-efficiency starters for both passenger and commercial vehicles.

- Mitsuba CorporationMitsuba is an independent auto parts firm that contributes specialized and efficient motors to the automotive industry, including starter motors for both four-wheelers and motorcycles.

- Hella KGaA Hueck & Co.Hella is primarily known for its lighting and electronics, and their focus on efficiency and electrification overlaps with the broader starter motor market. They supply components and systems that support the overall electrical system of the vehicle and have a large aftermarket organization for auto parts.

- BorgWarner Inc.BorgWarner is a global leader in providing solutions for hybrid and electric vehicles and also supplies products for combustion engines, including advanced starting technologies.

- Mahle GmbHMahle is a major automotive supplier with a focus on electrification and mechatronics, and they produce electric drives and related products that compete with or integrate with traditional starting systems.

- Prestolite ElectricPrestolite is a key supplier of heavy-duty starters for transportation, construction, and agricultural applications, focusing on robust and reliable electrical equipment for demanding industrial use.

- Lucas ElectricalLucas provides a wide range of high-quality replacement starters and alternators for the aftermarket, serving both newer and older vehicle models.

- ASIMCOASIMCO is a Chinese supplier of automotive components, though its primary focus appears to be on brake systems and other parts rather than starter motors directly.

- Remy International, Inc.Acquired by BorgWarner, Remy International was a leading manufacturer, remanufacturer, and distributor of starters and alternators for light- and heavy-duty applications.

Recent Developments

- In January 2024, SEG Automotive revealed plans to expand its starter motor manufacturing facility in Hungary to satisfy the rising demand throughout Europe. The new line will concentrate on energy-efficient starter motors designed for vehicles equipped with start-stop systems, thus supporting emissions reduction efforts.

- In October 2024, Valeo announced a renewed partnership with Renault aimed at electric and hybrid components, including advanced starter motors. This collaboration is designed to create integrated solutions for the next generation of vehicles.

- In June 2023, Renault unveiled its Rafale SUV, featuring a 1.2L turbo engine paired with a starter-generator system. This hybrid configuration underscores the growing use of starter-based electrification technologies in European passenger vehicles.

- In 2021, SEG Automotive introduced an upgraded version of its SC60 and S78 starter motors, setting new benchmarks in the industry. The SC60, touted as one of the most compact in its class, is tailored to snugly fit into smaller vehicles, particularly compact cars. It impressively delivers up to 1.2kW of starting power, ensuring reliable ignition. In parallel, the S78 platform for start-stop motors offers a substantial power output of up to 2.2kW. This technology not only enhances the efficiency of start-stop systems but also caters to more demanding applications, particularly in larger and more power-hungry vehicles.

Segments Covered in the Report

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Application Type

- Internal Combustion Engine (IC Engine)

- Hybrid/Micro-Hybrid Powertrain

By Type

- Electric

- Pneumatic

- Hydraulic

- Starter Motor Generator

By Sales Channel

- OEM

- Replacement/Aftermarket

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting