What is Automotive Steel Wheels Market Size?

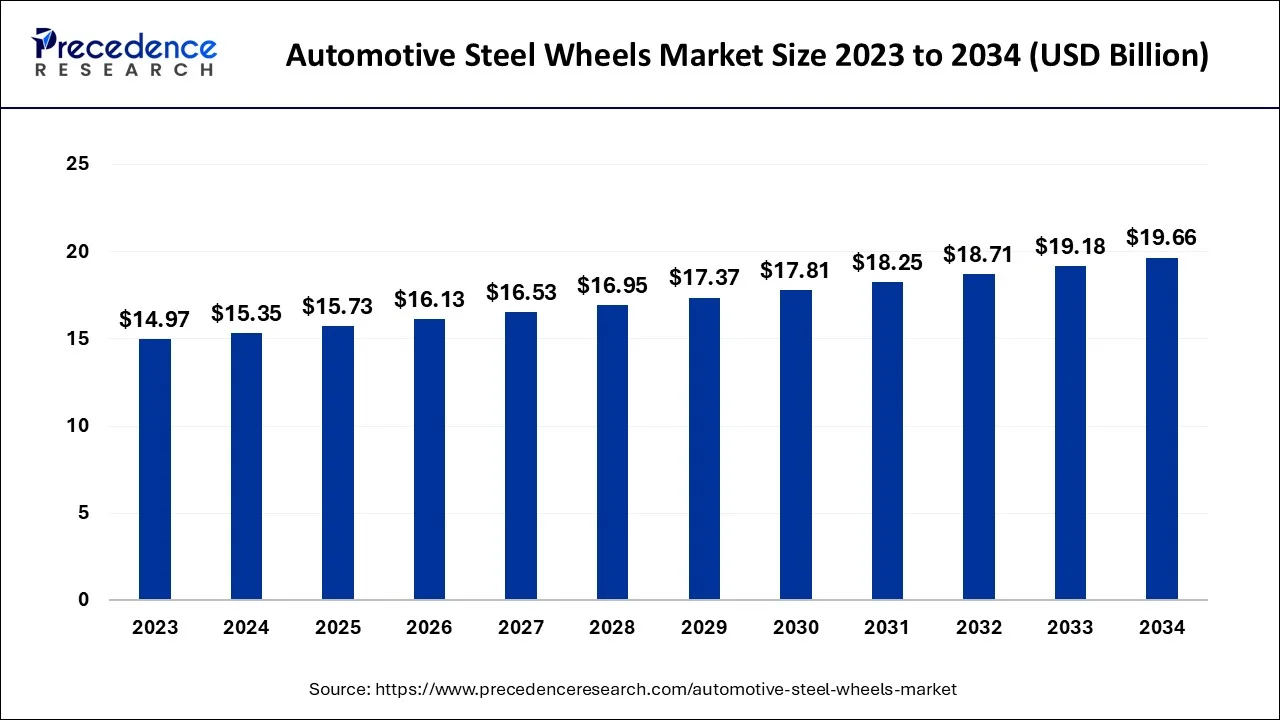

The global automotive steel wheels market size is calculated at USD 15.73 billion in 2025 and is projected to surpass around USD 20.13 billion by 2035, expanding at a CAGR of 2.5% from 2026 to 2035. The cost-effectiveness of steel wheels is the primary factor driving the growth of the market. Also, the growth in automotive industry along with the increasing demand for steel vehicles in emerging markets are expected to fuel market growth shortly.

Market Highlights

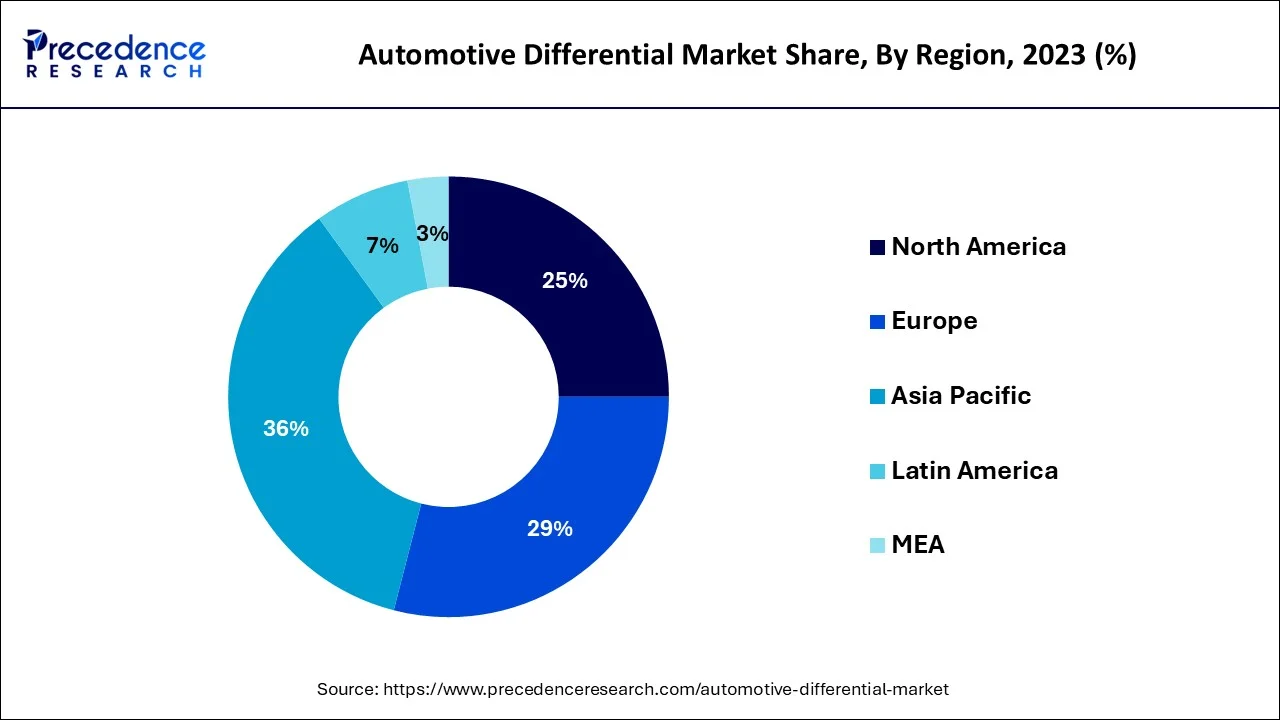

- Asia Pacific dominated the market in 2025 by holding the largest market share of 48%.

- North America is expected to grow at the fastest rate over the projected period.

- By vehicle type, the passenger vehicles segment generated the highest market share of 46% in 2025.

- By vehicle type, the light commercial vehicle segment is expected to grow at the fastest rate during the studied period.

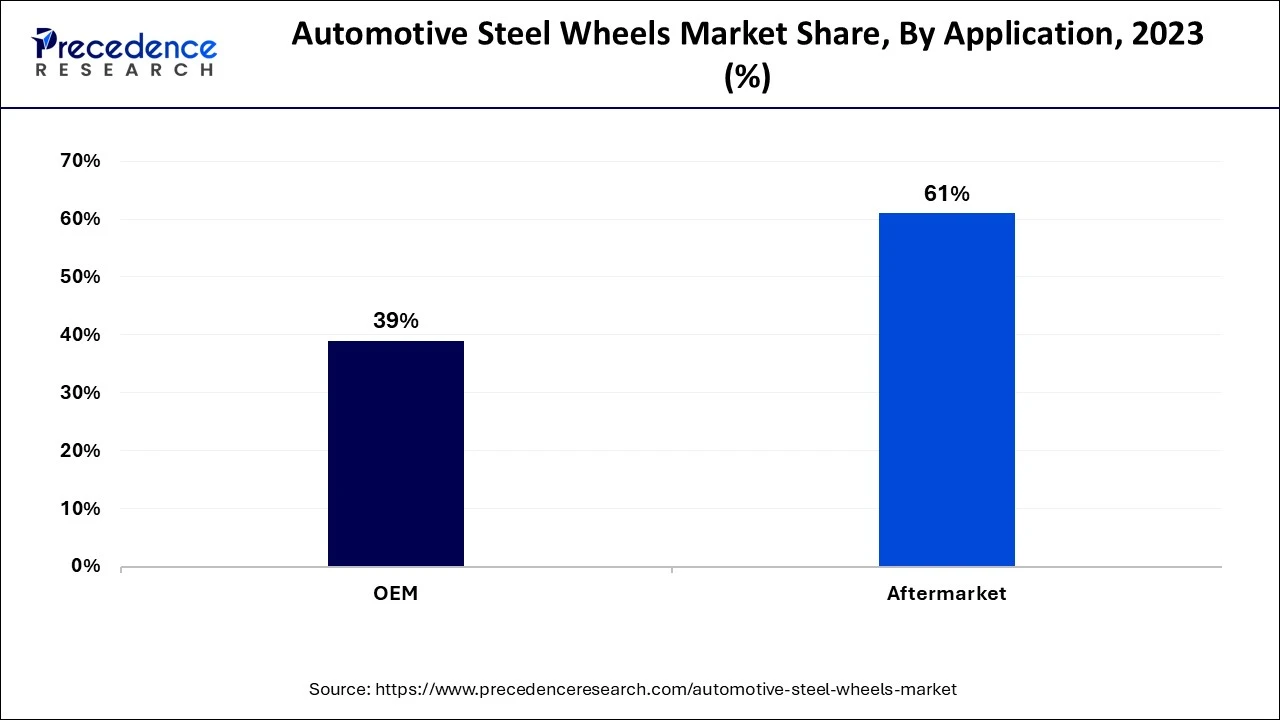

- By application, the aftermarket segment contributed the biggest market share of 61% in 2025.

- By application, the OEM segment is expected to grow at the fastest rate over the forecast period.

Market Overview

Automotive steel wheels are cylindrical shapes of rims on which the tires are fixed. These rims are both cheaper and stronger compared to the alloy wheel. Steel wheels help with easy movement and the vehicle's overall weight. The automotive sector across the globe has been obligated to modernize and find new methods. To reduce carbon discharge and develop energy efficiency. which in turn increases the application of stainless steel in the automotive industry.

Impact of AI on the Automotive Steel Wheel Market

Artificial Intelligence (AI) is playing a transformative role in the market. AI enhances production and design processes by enabling more accurate optimizations and simulations, which improve wheel performance and safety. Furthermore, the utilization of AI-driven analytics also helps in predictive maintenance and quality control by decreasing downtime and enhancing overall product reliability. These technological advancements can stimulate innovation within the automotive steel wheels market.

- In March 2024, by incorporating artificial intelligence (AI), machine learning (ML), and virtual reality (VR) technology, Hyundai Motor India was transforming its worldwide center for the production of passenger vehicles into an advanced manufacturing facility.

Commercial Vehicles and Car Production Global Statistics 2023

| Country/Region | Cars | Commercial Vehicles |

| ARGENTINA | 3,04,783 | 30,594 |

| AUSTRIA | 1,02,291 | 11,900 |

| BELGIUM | 2,85,159 | 46,944 |

| BRAZIL | 17,81,612 | 5,43,226 |

| CANADA | 37,68,881 | 1,76,138 |

| INDIA | 47,83,628 | 10,67,879 |

Automotive Steel Wheels Market Growth Factors

- The high acceptance of steel wheels in the automotive industry is expected to boost the demand and growth of the steel wheels market.

- Increasing demand for lightweight steel wheels can propel the market growth further.

- The increasing adoption of strategies by key market players will likely help in the automotive steel wheels market expansion shortly.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.73 Billion |

| Market Size in 2026 | USD 16.13 Billion |

| Market Size by 2035 | USD 20.13 Billion |

| Market Growth Rate | CAGR of 2.5% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Low development costs and advantages of steel wheels

Compared to aluminum alloy wheels, the cost required to manufacture steel wheels is very low. This is the key advantage of steel wheels. Steel wheels are more durable and rarely bend or crack. Furthermore, in the last few years, the time required to manufacture steel wheels has significantly reduced, and the quality has increased. Hence, the whole process becomes cost-effective. Which in turn lowers manufacturing costs and leads to market growth.

- In March 2024, the biggest producer of commercial vehicles in India, Tata Motors, presented Tata Steel with its next-generation, green fuel-powered commercial vehicles. The Ultra EV bus, which runs on battery electricity and liquefied natural gas (LNG), is among the fleet's vehicles, along with Prima tractors and tippers.

Restraint

Increasing geopolitical tensions

Escalating geopolitical conflicts is impacting the automotive steel wheels market significantly by impelling disruptions in the supply chain international trade and soaring raw material costs. Moreover, the volatile geopolitical scenario is affecting consumer confidence and industry investments, creating a substantial threat to the stability and growth of the market. Stakeholders should navigate these hurdles with strategic agility and resilience.

Opportunity

Rising demand for fuel-efficient vehicles

The growing requirement for fuel-efficient vehicles is considered the key factor that fuels the market expansion of the automotive steel wheels market. The implementation of stringent regulations by the government across the globe has impelled automakers to construct lighter vehicles. Additionally, steel wheels weigh much less than aluminum wheels, which aids in raising fuel efficiency and reduction of emissions. The high rigidity and damage resilience of steel can further drive the demand for steel vehicles.

- In September 2024, the unveiling of the new Swift S-CNG by Maruti Suzuki India Ltd. represents an improvement in the hatchback's fuel efficiency and adaptability. In an exchange filing, the business stated that the Epic New Swift S-CNG had the highest fuel economy in its class, at 32.85 km per kilogram. This model's launch is also consistent with Maruti Suzuki's dedication to environmental responsibility and eco-friendly transportation.

- In June 2023, for the Indian market, Michelin introduced X Multi Energy Z+, their most fuel-efficient truck and bus tire. This newest range of tires from Made-in-India is specifically designed for Indian road and load conditions, taking into consideration the increasing demand from Indian fleet owners for tires that use less gasoline.

Segment Insights

Vehicle Type Insights

The passenger vehicles segment dominated the automotive steel wheels market in 2025. The dominance of the segment can be attributed to the increasing demand for passenger vehicles across the globe along with the growing urbanization, especially in developing countries like China and India, where more people have higher disposable incomes. Additionally, these vehicles are generally equipped with steel wheels as a standard feature because of their reliability and lower production cost. This trend can sustain the growth of the automotive wheels market in developing regions.

- In May 2024, Leaders in the passenger vehicle (PV) industry, such as Tata Motors, Hyundai Motor India (HMIL), and Maruti Suzuki India (MSIL), reported flat or slightly higher sales in April. This is in comparison to the same month the previous year due to a large base effect and potential demand dampening from the current elections.

The light commercial vehicle segment is expected to grow at the fastest rate in the automotive steel wheels market during the studied period. This is due to the rising demand for light commercial vehicles from emerging markets along with the increasing e-commerce industry and logistics industry. Light commercial vehicles such as pickups and vans are anticipated to contribute to a larger portion of the commercial vehicles segment. The vehicle's multi-purpose abilities and affordability are driving the higher sales for this segment.

- In September 2024, With the introduction of its first four-wheeler EV, electric vehicle (EV) company Euler Motors gained entry into the light commercial vehicle (LCV) market. Two Storm EV trims have been released by the New Delhi-based electric vehicle company, which specializes in selling three-wheelers. These trims were created to meet the needs of both intra- and intercity travel.

Application Insights

In 2025, the aftermarket segment led the automotive steel wheels market by holding the largest market share. The dominance of the segment can be driven by the increasing need for wheel replacement due to wear and tear. Also, Steel wheels are generally used in vehicles that work under challenging environments such as rough roads or harsh atmospheres where they face a great amount of stress. This demand is particularly strong in nations with poor road infrastructure or where vehicles are utilized for heavy-duty purposes that ensure a steady flow of aftermarket sales.

- In August 2024, Ki Mobility's myTVS introduced a diagnostics platform driven by artificial intelligence (AI). This will serve the aftermarket market by enabling customers to keep an eye on the condition of their vehicles and providing technicians at repair facilities with a number of tools, such as the ability to locate dents and scratches on an automobile by simply snapping a photo of it and estimating the cost to have it fixed.

- In April 2024, Mastercraft, an aftermarket brand of vehicle body and paint repair services, is introduced by Nippon Paint in India. The Gurugram Center can fix over 2,500 automobiles a year and will offer cutting-edge, modern technology along with environmentally friendly solutions.

The OEM segment is expected to show the fastest growth in the automotive steel wheels market over the forecast period. The growth of the segment can be credited to the increasing number of steel wheels supplied directly to vehicle producers coupled with the original installations in new vehicles. Moreover, the OEM segment is associated with new vehicle production and production partnerships with automotive companies globally. OEMs prefer steel wheels because of their strength, durability, and cost-effectiveness.

Regional Insights

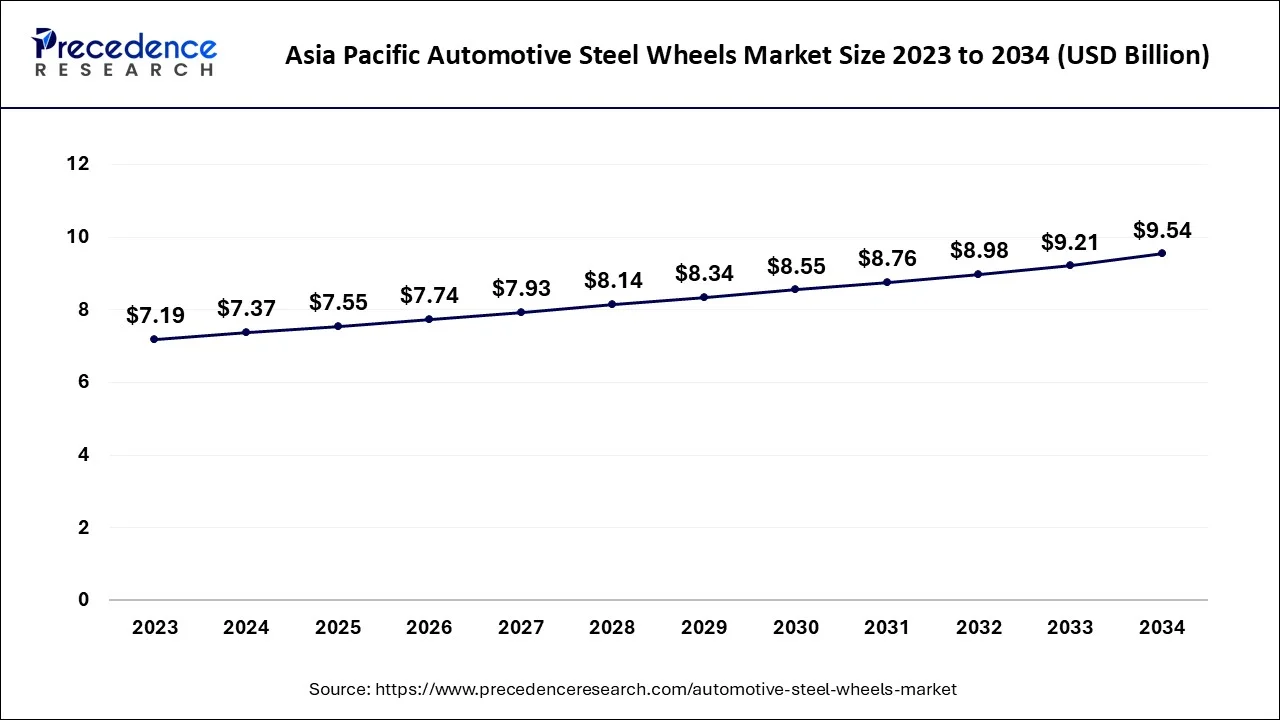

Asia Pacific Automotive Steel Wheels Market Size and Growth 2026 to 2035

The Asia Pacific automotive steel wheels market size is evaluated at USD 7.55 billion in 2025 and is projected to be worth around USD 9.80 billion by 2035, growing at a CAGR of 2.64% from 2026 to 2035

Asia Pacific led the automotive steel wheels market with the largest market share of 48% in 2025. The dominance of the region can be attributed to the increasing urbanization and economic expansion in developing countries such as China and India, which are seeing substantial economic growth, leading to the growth of a larger middle class with rising disposable income. Furthermore, this economic shift is fueling higher vehicle sales, especially in the budget and economy segments.

- In June 2024, Wagon axles for railroad wagons are the newest product offering from Hilton Metal Forging Ltd., a maker of forged items for a range of sectors. This occurs at a time when India's demands for wagon axles are met by imports. Hilton Metal's foray into this industry is in line with the government's "Make in India" and "Atmanirbhar Bharat" programs, which are designed to increase domestic production and lessen dependency on imports.

North America is anticipated to show the fastest growth over the projected period. The growth of the automotive steel wheels market in the region can be linked to the presence of major automotive manufacturing players and a huge consumer base. However, North America's focus on sustainability and recycling relates to the utilization of steel wheels because they are fully recyclable. This environmental consideration further propels the ongoing demand for steel wheels in the North American market.

- In September 2023, from its exhibit at IAA, Maxion Wheels, the largest wheel manufacturer in the world, unveiled Maxion BIONIC, the company's newest light vehicle wheel innovation. The growing need from OEMs for reasonably priced, fashionable, and environmentally friendly wheel solutions—particularly for light vehicle projects where wheel load is increasing—is met by Maxion BIONIC, a product of teams in Brazil, Mexico, the United States, and Germany.

What are the Advancements for Automotive Steel Wheels in Europe?

Europe is witnessing significant growth in the market. This growth is fueled by the region's stringent environmental regulations and its strong emphasis on sustainability. The region is home to various policies and initiatives that help in reducing carbon emissions and promoting recycling. These initiatives are encouraging manufacturers to adopt eco-friendly practices, thus increasing the demand for high-quality steel wheels.

Germany Automotive Steel Wheels Market Trends

The country is home to a robust automotive industry, which supports the demand for high-quality steel wheels, ensuring steady growth. Increasing electric vehicle production, demand for customized alloy wheels, and regulatory pressure to reduce carbon emissions are fueling innovation.

What are the Advancements for Automotive Steel Wheels in Latin America?

The Latin American market is experiencing substantial growth in the market. This growth is driven by various factors such as evolving consumer preferences, technological advancements, and regional economic factors. The region is also witnessing a rising consumer demand for personalized and aesthetic vehicle modifications, which is further expanding the value pool. Enthusiasts and aftermarket providers are seen investing more and more in high-quality steel wheels that have customized finishes, sizes, and designs, thus fostering innovation.

Brazil Automotive Steel Wheels Market Trends

The Brazilian automotive wheel bearing market is witnessing robust demand, driven by increased vehicle production and aftermarket growth, especially in compact and commercial vehicle segments. Growth in commercial vehicles and logistics fleets is reinforcing demand for robust wheels suited to challenging road conditions.

What are the Advancements in the Automotive Steel Wheels Industry in the Middle East and Africa?

The Middle East and Africa region is witnessing a gradual yet steady growth in the market. This growth is driven by rising vehicle ownership and infrastructure development in several countries. Government initiatives that are aimed at enhancing manufacturing processes and reducing import dependency are underway, thus driving the regional market's expansion. South Africa and the UAE are the leading players in this region as they have a growing number of local and international players.

Saudi Arabia Automotive Steel Wheels Market Trends:

The country's market is driven by rising vehicle purchasing, increasing vehicle age, and government initiatives to modernize transportation infrastructure. Furthermore, the government's push towards localization and industrial development offers opportunities for investments and partnerships.

Value Chain Analysis of the Automotive Steel Wheels Market

- Material Selection: OEM steel wheels are typically made from high-quality steel alloys that offer strength and durability. The specific alloy composition may vary depending on the intended application and performance requirements of the vehicle.

Key Players: POSCO, Nippon, Tata Steel - Manufacturing Process:This stage deals with the casting, forging, machining, and finishing of steel wheels. These processes involve removing any excess material, smoothing the surface, and adding any necessary features such as bolt holes or valve stems.

Key Players: Accuride Corporation, Maxion, Meister - Quality Check:This stage includes strict quality control measures that are implemented to ensure that the wheels meet the required standards. This includes conducting thorough inspections, performing dimensional checks, and conducting various tests to assess the strength, durability, and performance of the wheels.

Key Players: Tata, Zhejiang, Kronprinz

Automotive Steel Wheels Market Companies

- THE CARLSTAR GROUP, LLC.

- Automotive Wheels Ltd

- Central Motor Wheel of America, Inc.

- ALCAR WHEELS GMBH

- TOPY AMERICA, INC.

- CLN Coils Lamiere Nastri SpA

- Klassic Wheels Limited Accuride Corporation

- Steel Strips Group

- MAXION Wheels

- Thyssenkrupp AG

- U.S. WHEEL CORP.

Recent Developments

- In November 2025, Maxion Wheels announced the opening of a new manufacturing facility in Brazil, aimed at increasing production capacity and enhancing its ability to serve local automotive manufacturers. This strategic move is likely to strengthen Maxion's foothold in the South American market, allowing for more efficient supply chain operations and reduced transportation costs, which could enhance its competitive edge. (Source: https://www.bing.com)

- In July 2022, due to operational difficulties, Alcoa Corporation announced intentions to begin the closure of one of its three active smelting lines at the Warrick Operations plant in Indiana.

- In August 2022, Maxion Wheels joined the steel and aluminum industries' initiatives to show its support for the automotive industry's transition to carbon-free automobiles.

- In January 2022, German car components manufacturer Continental declared that it would be restructuring its company with an emphasis on services, software, and electric mobility. To establish a new business specializing in electric vehicle systems and components, the corporation intends to split off its powertrain division and merge it with an already-existing joint venture with China's CITC.

Segments Covered in the Report

By Vehicle Type

- Heavy Commercial Vehicle

- Light Commercial Vehicle

- Passenger Vehicle

By Application

- OEM

- Aftermarket

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content