What is Automotive Plastics Market Size?

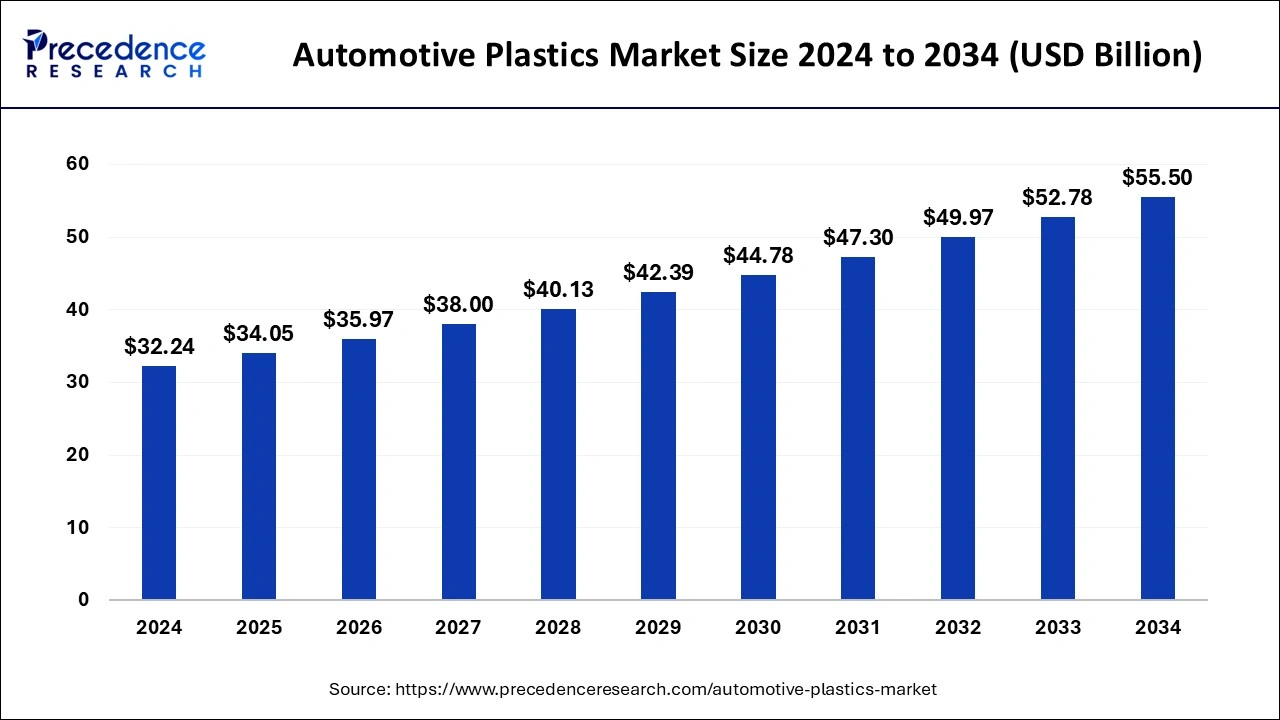

The global automotive plastics market size is estimated at USD 34.05 billion in 2025 and is predicted to increase from USD 35.97 billion in 2026 to approximately USD 58.28 billion by 2035, expanding at a CAGR of 5.52% from 2026 to 2035. Automotive plastics can withstand high weather conditions like extreme dry and wet conditions, rapid temperature swings, and intense sunlight and UV rays. They also have excellent chemical and heat resistance and more energy efficiency, which helps the market's growth.

Market Highlights

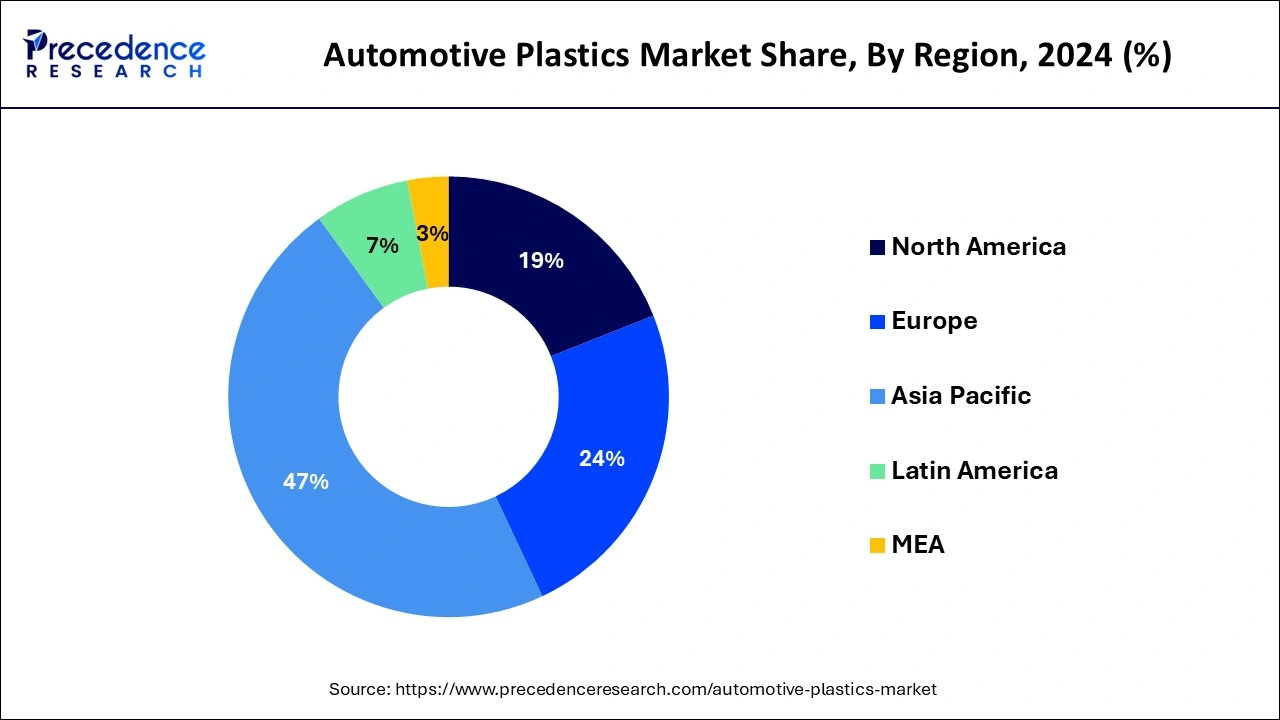

- Asia Pacific dominated the market with the largest revenue share of 47% in 2025.

- Europe is projected to host the fastest-growing market during the forecast period of 2026 to 2035.

- By product, the polypropylene (PP) segment has held a major revenue share of 33% in 2025.

- By product, the polyvinyl chloride (PVC) segment is projected to grow at the fastest CAGR of 18.02% during the forecast period.

- By process, the injection molding segment has contributed more than 57% of revenue share in 2025.

- By application, the interior furnishing segment has held a largest revenue share of 45% in 2025.

- By application, the electrical components segment will grow at the fastest rate in the market during the forecast period.

- By application, the exterior furnishing segment will grow significantly during the forecast period.

- By vehicle, the passenger cars segment dominated the market in 2024.

Market Overview

The automotive plastics market refers to a wide range of polymer materials used in the automotive industry for various vehicle components and parts. These materials offer many advantages over traditional materials like glass and metal, including lighter weight, improved efficiency, improved design flexibility, and corrosion resistance. The benefits of automotive plastics include delivering more design flexibility for circularity and durability, support for reliable and safe vehicle operation, offering greater styling, improving fuel efficiency, meeting performance goals, cost savings, enhancing design freedom, and reducing weight. These benefits help to the growth of the market.

Artificial Intelligence: The Next Growth Catalyst in Automotive Plastics

AI is transforming the automotive plastics industry by enabling smart manufacturing, particularly through real-time monitoring of injection molding processes, which reduces defects and waste. It facilitates the development of advanced lightweight polymers by analyzing material science data to optimize performance for electric vehicles. AI-driven computer vision systems are revolutionizing quality control by inspecting plastic parts for micro-defects at high speeds, often surpassing the capabilities of human inspection.

Automotive Plastics Market Growth Factors

- Automotive plastics offer many benefits over traditional materials such as glass and metals, including corrosion resistance, improved design flexibility, improved fuel efficiency, and lighter weight.

- These automotive plastics are used in the automotive industry for many vehicle components and parts.

- Automotive plastics help deliver more design flexibility for circularity and durability, supporting reliable and safe vehicle operation, improving fuel efficiency, and helping to provide cost savings.

- The application of automotive plastics includes chassis, under the hood, exterior furnishing, interior furnishing, electrical components, and powertrains. These benefits and applications help to grow the automotive plastics market.

Automotive Plastics MarketTrends

- Growing demand for lightweight plastics in electric vehicles to improve battery range and fuel efficiency.

- Increasing use of recycled and bio-based plastics to meet sustainability goals.

- Plastics are being used in structural and safety-critical components, not just interiors or trims.

- Focus on the circular economy with closed-loop recycling of automotive plastics.

- Development of high-temperature and flame-retardant polymers for EV powertrains and electronics.

- Advancements in lightweight material design to reduce vehicle weight without compromising strength.

- Rising plastic content per vehicle, especially in electric and hybrid models.

- Collaborations between automakers and chemical companies to scale recycled plastic use and improve material innovation.

Market Outlook

- Industry Growth Overview: The market for automotive plastics is expanding because of increased use in interior the hood components, and structural elements, as well as the desire for lighter vehicles, particularly electric vehicles particulalry electric vehicles. To scale effectively, manufacturers are investing in cutting-edge production and recycling technologies. The demand for automotive plastics is increasing due to the world's growing vehicle production.

- Sustainability Trends:Recycled and bio-based plastics are becoming more popular due to sustainability. End-of-life vehicle plastics are being transformed into materials with the aid of sophisticated recycling and closed-loop systems, lessening their negative effects on the environment. More automakers are establishing goals to incorporate environmentally friendly materials into their next models.

- Startup Economy:To promote innovation and more environmentally friendly production, startups are recycling old plastics into automotive-grade materials and developing sustainable polymers and bioinspired designs. Numerous startups are working with OEMs to incorporate their solutions into the production of mainstream automobiles.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 34.05 Billion |

| Market Size in 2026 | USD 35.97 Billion |

| Market Size By 2035 | USD 58.28Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.52% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Process, Application, Vehicle and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising use in the automotive industries

The use of automotive plastics is high in the automotive industry. These are used in the automotive industry because they help to reduce emissions in vehicles, they help to improve fuel efficiency, and have more design flexibility for improving recyclability and durability; automotive plastics are lightweight materials that replace metals and help to reduce vehicle weight. These qualities make automotive plastics ideal for the automotive industry. Expensive metal materials are gradually replaced by automotive plastics in the industry because of their mechanical properties and machinability. These factors help the growth of the automotive plastics market.

Restraint

Disadvantages of automotive plastics

The disadvantages of automotive plastics include recyclability, waste management, and environmental impact. Automotive plastics and composites are used in the automotive industries in heterogeneous ways, and these are difficult to release for recycling. The disposal, production, and consumption of the components of automotive plastics can affect the economic costs. Automotive plastics may affect the economy and the environment. The regulatory, technical, and economic challenges can hamper the growth of the market. Automotive plastics can lead to environmental and health problems. These disadvantages can restrict the growth of the automotive plastics market.

Opportunity

Research and development

Investment in research and development for the various innovative applications of automotive plastics helps the growth of the market. High demand for lightweight and electric vehicles helps to reduce environmental problems and contributes to the growth of the market. In modern cars, automotive plastics are the main component, and when it comes to the disposal of ELVs (end-of-life vehicles), capturing these automotive plastics for recycling and reuse will be an opportunity for the growth of the market. The government should be involved in government regulations to reduce emissions that help the growth of the automotive plastics market.

Segment Insights

Product Insights

The polypropylene (PP) segment dominated the automotive plastics market in 2025. Polypropylene (PP) is used as automotive plastics in various industries, such as the automotive industry for many components and parts. These include tires, suspension insulators, soundproof and air filtering systems, headrests, seats, engine covers,battery cases, dashboard components, door panels, interior trims, and bumpers. Automotive plastics like polypropylene (PP) are widely used for cars or other vehicles because of their ability to adopt several plastic fabrication methods and their heat and chemical resistance. Polypropylene (PP) has crystal clearer transparency than polyethylene. It has outstanding mechanical properties and high resistance to freezing, heat, impact, and fatigue. Polypropylene (PP) is hard and may be used for structural and mechanical applications that help the growth of the segment. These factors help the growth of the polypropylene (PP) product type segment and contribute to the growth of the market.

The polyvinyl chloride (PVC) segment is projected to grow at the fastest rate in the automotive plastics market during the forecast period. Polyvinyl chloride (PVC) is also called vinyl, and it is a versatile and economical thermoplastic polymer that is highly used in the construction and building industry. Polyvinyl chloride (PVC) is used in the automobile industry and plays the main role in helping to make modern automobiles of high quality, safe, and cost-effective. It helps to reduce their effect on the environment. Polyvinyl chlorides (PVC) are also used for a high range of auto parts, including blow molding, compression molding, injection molding, and extrusion processes that help the growth of the polyvinyl chloride (PVC) product type segment and contribute to the growth of the automotive plastics market.

Process Insights

The injection molding segment dominated the automotive plastics automotive plastics market in 2025. Automotive plastics are commonly used in injection molding. In the automotive industry, the most common type of injection molding is thermoplastic injection molding, which makes use of materials like ABS (acrylonitrile butadiene styrene), nylon, and polypropylene for the manufacturing of automobile parts. Other injection molding materials are used in automotive parts, includingpolyurethane (PE), polymethyl methacrylate (PMMA), polyamide (PA), etc. The injection molding process is beneficial for automotive plastic parts production because of their repeatability, material availability, high surface finish quality, color options, fast prototype with rapid tooling, etc., properties. These factors help to the growth of the injection molding process type segment and contribute to the growth of the market.

Application Insights

The interior furnishing segment dominated the automotive plastics market in 2025. Automotive plastics are used for interior furnishing. In the car interiors, different types of plastics are used, including polyurethane (PU),polycarbonate (PC), polyethylene (PE), polystyrene (PS), acrylonitrile butadiene styrene (ABS), and polyvinyl chloride (PVC). These automotive plastics are used in car interior furnishings like instrumental panels, trims, and bumpers. Automotive plastics are commonly used for steering wheels, armrests, headrests, and car seats because of their cost-effectiveness, lightweight, and durability properties. These factors help the growth of the interior furnishing application type segment and contribute to the growth of the market.

The electrical components segment will grow at the fastest rate in the automotive plastics market during the forecast period. Automotive plastics may be insulators or electric conductors. It plays a unique role as an alternative to driving trains and batteries. Increasing demand for reduction in greenhouse gas (GHG) emissions. These automotive plastics may reduce weight and help electric vehicles to deliver with greater driving ranges. Electric vehicles emit less heat than internal combustion engine cars. Due to the lighter weight of the components, automotive plastics are used in electrical component applications. These factors help the growth of the electrical components application type segment and contribute to the growth of the automotive plastics market.

The exterior furnishing segment will grow significantly during the forecast period. For exterior furnishing applications, automotive plastics are helpful due to their longevity and durability properties. These automotive plastics have design flexibility, greater styling, and lighter properties. As compared to traditional automotive materials like glass and metals, automotive plastics offer major advantages. For the vehicle exteriors like trims, liftgates, hoods, bumpers, and lights, there are automotive plastics used. These types of automotive plastics are used for the automotive body parts of vehicles. These automotive plastics help to improve safety and to reduce emissions. These benefits help the growth of the exterior furnishing application type segment and contribute to the growth of the growth of the automotive plastics market.

Vehicle Insights

The passenger cars segment dominated the automotive plastics market in 2025. In the passenger cars vehicle type automotive plastics are used. The passenger cars' vehicles include internal combustion engine (ICE) vehicles andelectric vehicles. Electric vehicles include battery electric vehicles (BEV), plug-in hybrid electric vehicles (PHEV), and fuel cell electric vehicles (FCEV). Automotive plastics are used in vehicles because of their performance, fuel efficiency, increased safety, low cost, high chemical resistance, and lightweight properties. These automotive plastics help to replace metals and provide more design flexibility to improve recyclability and durability. These factors help to the growth of the passenger cars vehicle type segment and contribute to the growth of the market.

Regional Insights

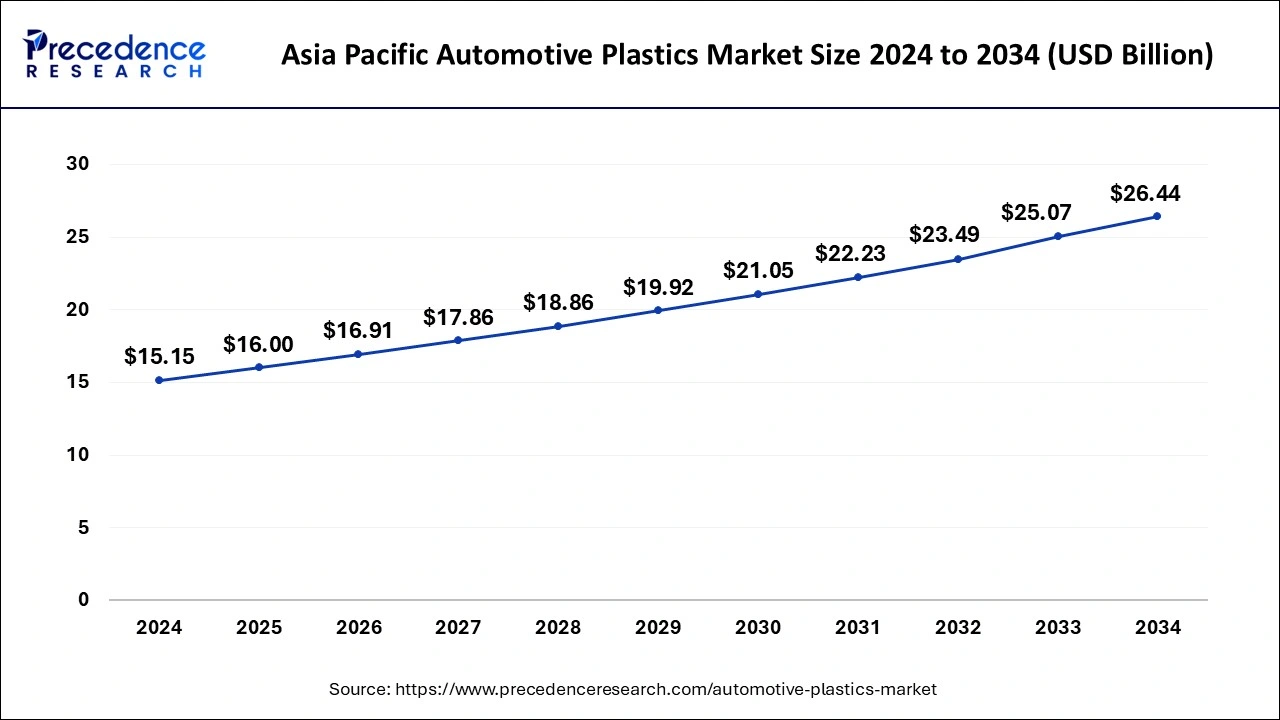

What is the Asia Pacific Automotive Plastics Market Size?

The Asia Pacific automotive plastics market size is valued at USD 16.00 billion in 2025 and is projected to reach around USD 27.95 billion by 2035 with a CAGR of 5.72% from 2026 to 2035.

Asia Pacific dominated the automotive plastics market in 2025. The increased demand for lightweight vehicles helps to the growth of the market in the region. In passenger car applications, automotive plastics are in high demand due to their lightweight properties. In India, China, and Japan, automotive production is high, and the use of automotive plastics is increasing, which leads to the growth of the market in this region. In India, there is a high demand for polypropylene (PP) types of automotive plastics. These factors help to the growth of the market in Asia Pacific.

- In November 2023, Ayodhya, the temple town in India, partnered with a private company to use and convert plastic waste into automotive fuel.

- In May 2024, China launched anti-dumping probes, a polyacetal resin, a type of plastic used for automobile parts and other items.

China Automotive Plastics Market Trends

China's strategic shift towards high-performance materials that support the national leadership in electric vehicle production. The integration of advanced polymers is essential for achieving the light-weighting goals required to extend EV range and meet stringent carbon neutrality targets.

Europe is projected to host the fastest-growing automotive plastics market during the forecast period of 2026 to 2035. The European automotive industries are moving towards the use of automotive plastics-based vehicles. In Europe, polypropylene (PP) type of automotive plastics is highly used. These factors help the region's growth.

Germany Automotive Plastics Market Trends

Germany's rapid adoption of electric vehicles mandates lightweight engineering to extend battery life. Stricter environmental regulations, particularly the EU's proposed 25% minimum recycled-plastic content mandate for new cars, are accelerating the shift toward sustainable and recycled polymer solutions.

How Did North America Experience A Notable Growth in the Automotive Plasticss Market?

North America's strict CAFÉ standards mandate metal-to-plastic substitution to achieve critical fuel efficiency gains. The ongoing EV transition further accelerates this demand, as manufacturers utilize specialized polymers for battery housings and cooling modules to optimize driving range. Growing adoption of recycled and bio-based plastics to support sustainability goals is further shaping market trends, with the US leading regional growth followed by Canada and Mexico.

U.S. Automotive Plastics Market Trends

U.S.'s aggressive light-weighting strategies that replace metal with high-performance polymers to meet stringent fuel efficiency and emission targets. The EV revolution is a major catalyst, driving specialized demand for heat-resistant and insulating plastics critical for battery housings and electrical systems. Sustainable innovation is peaking, with manufacturers rapidly integrating bioplastics and recycled composites to align with eco-friendly mandates and consumer preferences.

Value Chain Analysis

- Feedstock Procurement: Automakers and plastic manufacturers focus on securing high-quality polymer feedstocks, including virgin and recycled plastics, to ensure consistent performance in automotive parts. Supply chain reliability is critical to meet growing production demands.

Key Players: Companies leading feedstock procurement include BASF, Dow Inc., and ExxonMobil, which supply high-performance polymers and advanced materials to the automotive sector. - Waste Management & Recycling:Recycling and waste management are key to sustainability, with automakers adopting mechanical and chemical recycling to convert end-of-life vehicle plastics into usable materials. Reducing waste and implementing closed-loop systems are priorities.

Key Players: Leading companies include MBA Polymers, UBQ Materials, and SABIC, which specialize in recycling automotive plastics and supplying recycled polymers back to manufacturers. - Regulatory Compliance & Safety Monitoring: Automotive plastics manufacturers comply with environmental, safety, and quality regulations to ensure parts are safe, non-toxic, and meet global standards. Continuous monitoring helps prevent defects and maintain compliance.

Key Players: Key players ensuring regulatory compliance include Covestro, Lanxess, and Celanese, offering materials that meet global automotive safety and environmental standards.

Automotive Plastics Market Companies

- AkzoNobel N.V.: AkzoNobel provides high-performance automotive coatings and specialty paint solutions that protect and enhance both plastic exterior and interior components. They are focusing on sustainability by developing low-VOC products, bio-based coatings, and specialized, durable coatings for recycled plastic materials.

- Adient plc: As a global leader in automotive seating, Adient utilizes advanced plastic foams, structural components, and trim covers to improve passenger comfort, safety, and vehicle lightweighting.

- Borealis AG: Borealis supplies advanced polyolefin compounds (Daplen™ and Fibremod™) that enable lightweight construction for automotive parts like bumpers, body panels, and dashboards.

- BASF SE: BASF offers a comprehensive portfolio of engineering plastics, particularly polyamide (Ultramid) and polyurethane, to replace metal components, reduce weight, and improve EV battery efficiency.

- Dow Inc: Dow provides a wide range of plastic materials, including high-performance polyolefins and polyurethanes, that are essential for improving vehicle interiors and exterior durability.

- Covestro AG: Covestro develops high-purity polycarbonates and specialized polyurethanes used in automotive applications, ranging from headlamps and radiator grilles to interior cabin parts.

Other Major Key Players

- TEIJIN Limited

- Royal DSM N.V.

- Quadrant AG

- Owens Corning

- Lear Corporation

- Grupo Antolin

- Hanwha Azdel Inc

- SABIC

- Momentive Performance Materials, Inc.

- Evonik Industries AG

- Magna International, Inc

- Saudi Basic Industries Corporation (SABIC)

Recent Developments

- In April 2025, Covestro launched a new range of post-consumer recycled (PCR) polycarbonates made from end-of-life automotive headlamps. The products have been developed as part of a consortium created by GIZ (Deutsche Gesellschaft für Internationale Zusammenarbeit), with partners Volkswagen and NIO. The new, TÜV Rheinland-certified grades contain 50 percent recycled content; they are now commercially available for new automotive applications.

- In March 2025, the Global Impact Coalition (GIC, a CEO-led initiative launched a circularity pilot for automotive plastics with seven global companies active in the chemical and recycling industries—BASF, Covestro, LyondellBasell, Mitsubishi Chemical Group, SABIC, SUEZ, and Syensqo. The pilot aims to address the problem of recycling plastics from end-of-life vehicles (ELVs).

- In January 2024, Sonichem launched a project to transform the automotive industry with bio-based plastics. These are used in the production of composites, resins, and plastics.

- In February 2024, a new multi-substrate primer for the plastic automotive exterior was launched by the AkzoNobel. A new 2k solvent-borne primer in conductive and dark grey for automotive OEM exterior plastic parts was developed by AkzoNobel.

- In February 2024, a new range of recycling content thermoplastic elastomer (TPE) products was launched by the KRAIBURG TPE for the automotive series.

- In December 2023, a new recycled ocean plastic or resin made from recovered maritime plastics for automotive applications was launched by LyondellBesell.

Segments Covered in the Report

By Product

- Acrylonitrile Butadiene Styrene (ABS)

- Polypropylene (PP)

- PP LGF 20

- PP LGF 30

- PP LGF 40

- Others

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Rigid PVC

- Flexible PVC

- Polyethylene (PE)

- High-density Polyethylene (HDPE)

- Other PE Grades

- Polybutylene Terephthalate (PBT)

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Polyamide (Nylon 6, Nylon 66)

- Others

By Process

- Injection Molding

- Blow Molding

- Thermoforming

- Others

By Application

- Powertrains

- Electrical Components

- Interior Furnishing

- IMD or IML

- Others

- Exterior Furnishing

- Under the Hood

- Chassis

By Vehicle

- Passenger Cars

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Fuel cell Electric Vehicles (FCEV)

- Light Commercial Vehicles

- Medium & heavy Commercial Vehicles

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content