What is Beauty Supplements Market Size?

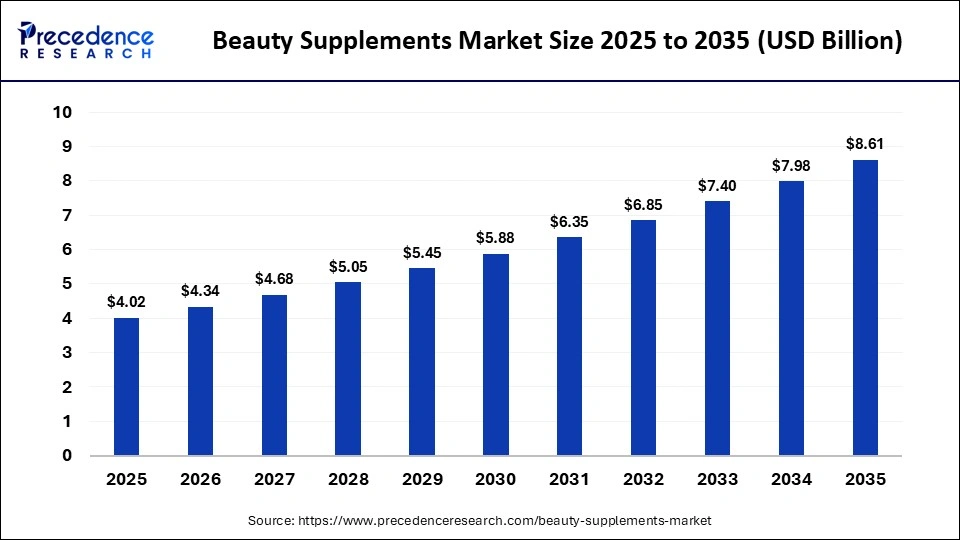

The global beauty supplements market size was calculated at USD 4.02 billion in 2025 and is predicted to increase from USD 4.34 billion in 2026 to approximately USD 8.61 billion by 2035, expanding at a CAGR of 7.92% from 2026 to 2035. The market is witnessing substantial growth driven by demand for ingestible, collagen-infused, and bioavailable formulations that enhance skin health and quality of life through innovative, science-backed solutions.

Market Highlights

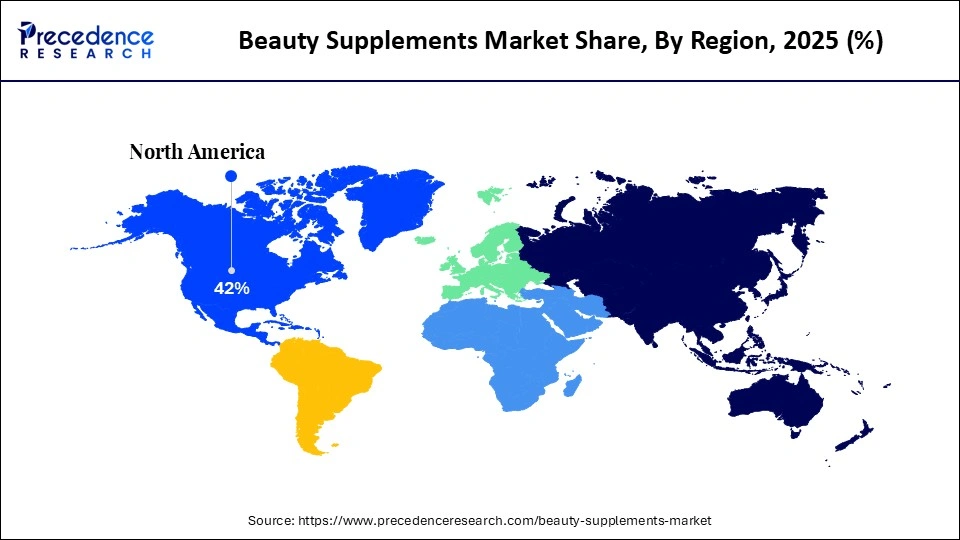

- North America dominated the market with a major market share of around 42% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

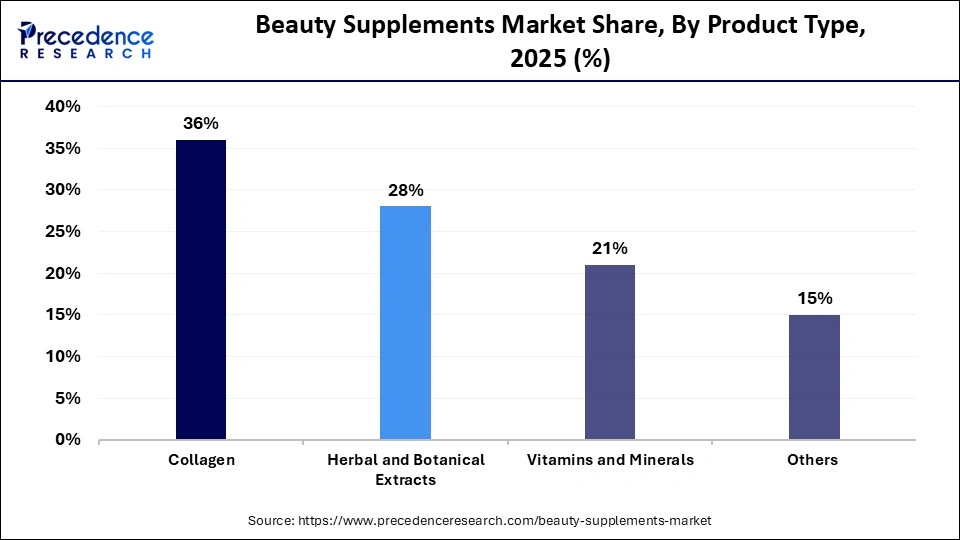

- By product type, the collagen segment contributed the highest market share of around 36% in 2025.

- By product type, the herbal and botanical extracts segment is expected to grow at the fastest CAGR between 2026 and 2035.

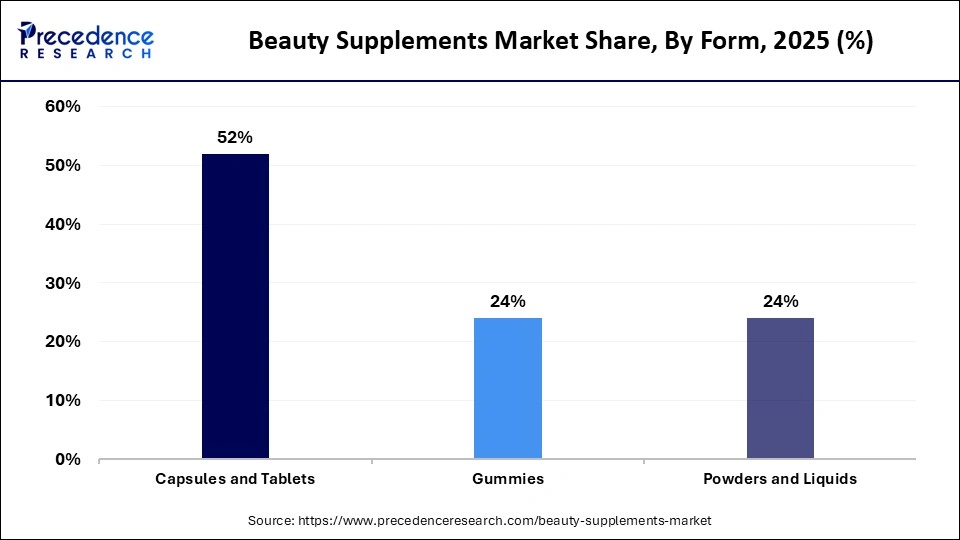

- By form, the capsules & tablets segment held a major market share of around 52% in 2025.

- By form, the gummies segment is expected to expand at the highest CAGR from 2026 to 2035.

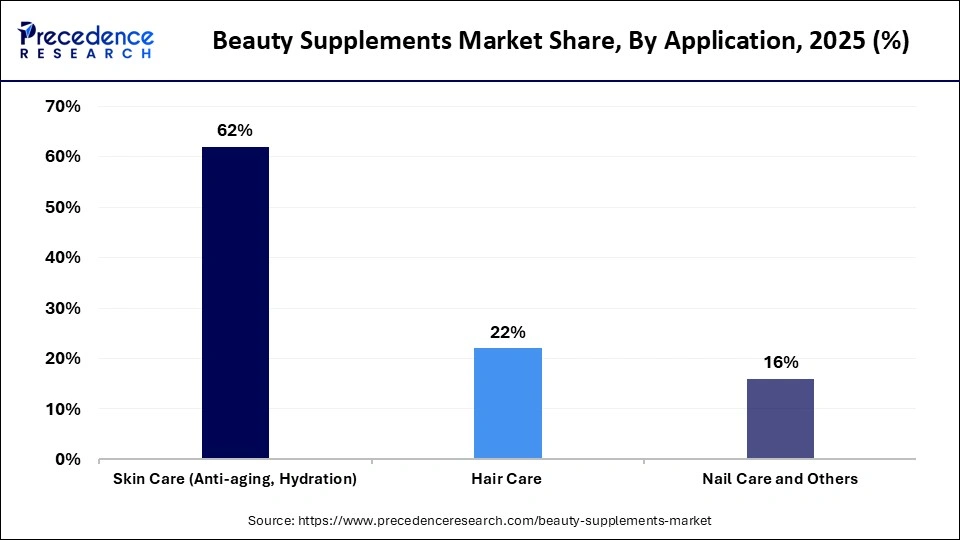

- By application, the skincare segment generated the biggest market share of around 62% in 2025.

- By application, the hair care segment is expected to expand at the fastest CAGR between 2026 and 2035.

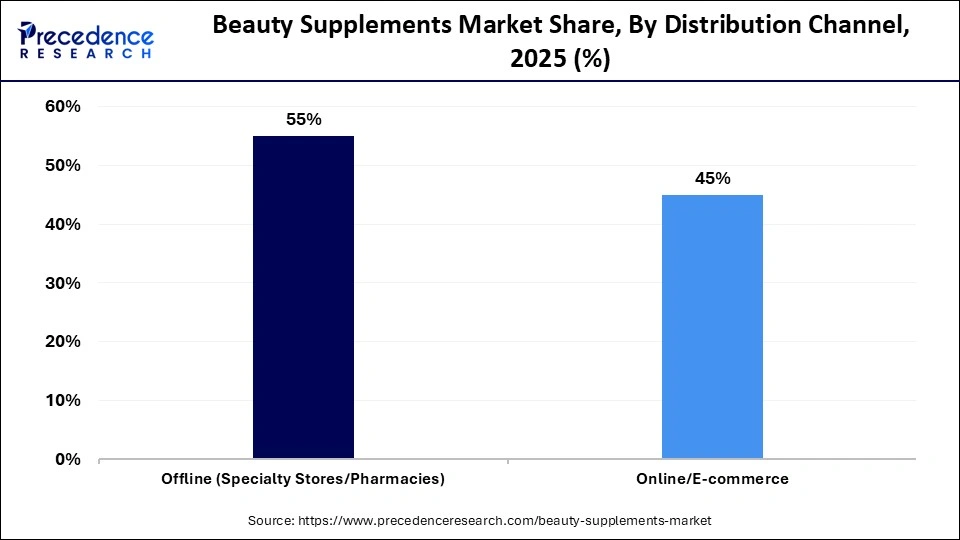

- By distribution channel, the offline segment accounted for the largest market share of about 55% in 2025.

- By distribution channel, the online/e-commerce segment is expected to grow at a solid CAGR between 2026 and 2035.

What is the Beauty Supplements Market?

The global beauty supplements market focuses on ingestible products such as capsules, tablets, gummies, and powders formulated with vitamins, minerals, antioxidants, and botanical extracts. These products are designed to improve aesthetic outcomes, including skin hydration and elasticity, hair growth, and nail strength, often bridging food and cosmetics and referred to as nutricosmetics or beauty-from-within products. This market is driven by holistic wellness trends, clean-label demands, and strong social media influence.

Major Trends in the Beauty Supplements Market

- Demand for Collagen and Specialized Ingredients: Collagen remains the top ingredient for skin elasticity and anti-aging, with high consumer demand for hyaluronic acid, biotin, and antioxidants.

- Shift towards Beauty-from-Within and Holistic Wellness: Consumers are increasingly adopting a holistic approach, using supplements to address skin health, gut health, and immunity simultaneously, bridging the gap between wellness and beauty.

- Growing Personalized and Tech-Enabled Solutions: AI-driven tools, DNA testing, and customized subscription packs are rising, allowing consumers to receive tailored supplements based on specific skin types, hormonal needs, and lifestyles.

- Clean-Label, Vegan, and Sustainable Formulations: There is a surge in demand for organic, non-GMO, and plant-based alternatives to traditional marine collagen, driven by sustainability concerns among Millennials and Gen Z.

How is AI Transforming the Beauty Supplements Market?

Artificial intelligence is transforming the market for beauty supplements by analyzing skin, microbiome, and lifestyle data to recommend tailored nutrient combinations, improving consumer retention and reducing product dissatisfaction. AI algorithms analyze user-provided data to create customized supplement regimens. Additionally, AI speeds up R&D by simulating ingredient interactions and predicting formulation stability, reducing development times. AI-powered chatbots also provide real-time advice and supplement recommendations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.02 Billion |

| Market Size in 2026 | USD 4.34 Billion |

| Market Size by 2035 | USD 8.61 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component,Application, Deployment,Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Outlook

Product Type Insights

What Made Collagen the Dominant Segment in the Beauty Supplements Market?

The collagen segment dominated the market with approximately 36% share in 2025. This is primarily due to its effectiveness in reducing wrinkles, enhancing skin elasticity, and improving hydration. Collagen, as a key structural protein for the health of skin, hair, and nails, is the preferred choice for consumers seeking beauty solutions that work from the inside out. Additionally, the growing demand for natural beauty products, alongside an aging population and increased endorsements from beauty influencers, has reinforced the segment's dominant position in the market.

The herbal & botanical extracts segment is expected to grow at the fastest CAGR in the foreseeable future. This growth is largely driven by a global shift toward natural wellness and clean-label products. The integration of traditional knowledge, such as Ayurveda and Traditional Chinese Medicine, is spurring innovation aimed at promoting skin radiance, hair strength, and overall vitality. There is increasing demand for products that are free from synthetic chemicals, which consumers perceive as safer and more sustainable to achieve enduring aesthetic results, contributing to segmental growth.

Form Insights

How Did the Capsules & Tablets Segment Lead the Beauty Supplements Market?

The capsules & tablets segment led the market with the largest share of 52% in 2025. The segment's dominance is driven by their convenience, precise dosing, and stability. Capsules and tablets provide accurate and standardized amounts of active ingredients such as biotin, hyaluronic acid, and collagen, which are essential for their efficacy. Moreover, these formats are easy to carry and consume, making them a preferred choice for busy, on-the-go consumers compared to powders or liquids. Their longer shelf life and higher stability also make them ideal for transportation and storage.

The gummies segment is expected to grow at the fastest rate during the forecast period, largely due to high consumer compliance, a shift toward beauty routines, and rapid innovation in functional, clean-label formulations. Gummies are highly photogenic and popular on social media, making them a favored choice among millennials and Gen Z as a key part of their beauty and wellness routines. They often contain advanced functional ingredients like marine peptides, collagen, biotin, and hyaluronic acid, designed to support skin elasticity, hair growth, and nail strength.

Application Insights

Why Did the Skincare Segment Dominate the Beauty Supplements Market?

The skincare segment dominated the market with the highest share of approximately 62% in 2025. The segment's dominance stems from rising consumer demand for holistic beauty, anti-aging, and hydration solutions. Consumers are increasingly incorporating collagen, vitamins, and hyaluronic acid into their routines to combat aging, dryness, and skin discoloration before these issues worsen. The transition from relying solely on topical creams to using ingestible, science-backed nutrients for sustained skin health is driving high adoption. Furthermore, convenience-driven, daily-use formats such as powders, capsules, and drinks are fueling market growth.

The hair care segment is expected to expand at the fastest CAGR during the forecast period, primarily due to heightened demand for solutions addressing hair loss and thinning. Increased consumer awareness of ingredient-led hair health. The availability of convenient formats like gummies and capsules, along with the rapid expansion of e-commerce, has made targeted products easily accessible. Furthermore, the increasing prevalence of premature and stress-related hair issues, particularly among younger consumers and the aging population, spurred demand for specialized, effective, and convenient ingestible hair growth products.

Distribution Channel Insights

What Made Offline the Leading Segment in the Beauty Supplements Market?

The offline segment led the market with around 55% share in 2025. This is primarily driven by the immediate trust, expert consultations, and the opportunity to physically examine products available at pharmacies, specialty stores, and supermarkets. Consumers tend to prefer purchasing beauty supplements from trusted sources where knowledgeable staff can provide personalized, in-person consultations, which is crucial for high-efficacy, premium products. Offline channels like specialty beauty retailers and supermarkets allow consumers to verify product quality and reduce the risk of counterfeits.

The online/e-commerce segment is expected to expand at the fastest CAGR during the forecast period. This growth is mainly driven by consumers' preference for online platforms to easily compare prices, read reviews, and access a wider variety of products with an easily searchable product range. Online platforms provide user-generated reviews, which build consumer trust in product efficacy, particularly for specialized skin or hair care supplements. Increased internet penetration and the growth of e-commerce giants have made it the fastest-growing sales channel.

Regional Insights

How Big is the North America Beauty Supplements Market Size?

The North America beauty supplements market size is estimated at USD 1.69 billion in 2025 and is projected to reach approximately USD 3.66 billion by 2035, with a 8.03% CAGR from 2026 to 2035.

How Did North America Dominate the Beauty Supplements Market?

North America dominated the market with about 42% share in 2025. The dominance of this region in the market is mainly driven by high consumer awareness of beauty-from-within concepts, significant disposable income, and a strong, established retail and e-commerce infrastructure. Consumers in the U.S. and Canada increasingly equate inner health with outer beauty, driving demand for supplements targeting skin, hair, and nails. A high average disposable income allows consumers to spend on premium, functional, and specialized beauty products. Additionally, a shift toward preventive health is making ingestible beauty products a staple in daily routines.

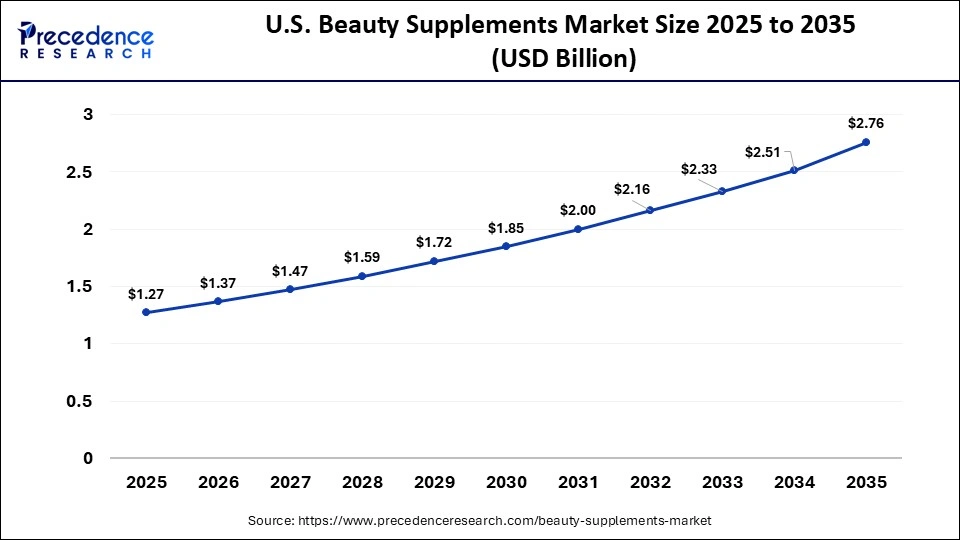

What is the Size of the U.S. Beauty Supplements Market?

The U.S. beauty supplements market size is calculated at USD 1.27 billion in 2025 and is expected to reach nearly USD 2.76 billion in 2035, accelerating at a strong CAGR of 8.07% between 2026 to 2035.

U.S. Beauty Supplements Market Trends

The U.S. plays a dominant role within the region by focusing on clinically backed, premium products like collagen, hyaluronic acid, and peptide-rich formulations, along with hybrid products that combine beauty benefits with overall wellness. High consumer awareness and increasing nutrient, mineral, and supplement consumption post-pandemic. Many brands, like Nutrafol and Unilever, with e-commerce, subscription models, and tele-health services, are driving growth.

Why is Asia Pacific Considered the Fastest-Growing Region in the Beauty Supplements Market?

Asia Pacific is expected to grow at the fastest rate during the forecast period. This growth is mainly driven by countries like Japan, South Korea, and China, where consuming functional foods, collagen-rich broths, and herbs for skin health is deeply rooted in daily life, reducing the need for consumer education and accelerating adoption. Increasing middle-class spending power in China and India allows consumers to treat these products as essential, premium personal care products. Additionally, Japan and South Korea have rapidly aging populations, driving demand for beauty supplements.

India Beauty Supplements Market Trends

India represents high potential for international brands due to its young population and expanding middle class. The booming beauty and personal care industry is driving demand for specialized supplements, along with high demand for skin, hair, and nail health products, and a culturally driven inclination towards traditional, natural, and herbal remedies. Also, it is home to international brands, and local and accessible options are favored, with brands like Herbalife, Amway, and others gaining traction

Value Chain Analysis

- Research & Development (R&D)

This stage focuses on bioavailability, identifying active ingredients, clinical validation, and creating personalized, data-driven, or genetically-based supplements.

Key Players: DSM-Firmenich AG, BASF SE, Kerry Group, GNC Holdings, and Nutrafol. - Ingredient Sourcing and Regulatory Compliance

This stage involves securing high-quality raw materials and navigating strict, yet varied, global regulations for sustainability and clean-label traceability.

Key Players: Gelita and Rousselot. - Manufacturing and Quality Control

This stage involves complex processing of actives into diverse, user-friendly formats: gummies, liquids, capsules, tablets, and powders.

Key Players: Catalent, Lonza, Akums Drugs & Pharmaceuticals, Fermentis Life Sciences, and Vital Proteins. - Logistics and Distribution Channel Management

This stage involves distributing to diverse channels, including e-commerce, specialty retailers, pharmacies, and supermarkets for premium products.

Key Players: Amazon, specialized beauty retailers (e.g., Sephora, Ulta), pharmacies (e.g., CVS, Boots), and courier services. - Marketing and Consumer Engagement

This stage focuses on educating consumers about the connection between lifestyle and diet and aesthetic outcomes.

Key Players: Amway, Nestlé Health Science, Unilever, L'Oréal, Shiseido, and Vital Proteins.

Who are the major players in the global Beauty Supplements Market?

The major players in the beauty supplements market include Amway Corporation, Nestlé Health Science, Unilever PLC, L'Oréal S.A., Shiseido Company, Limited, Meiji Holdings Co., Ltd., Herbalife International of America, Inc., Nu Skin Enterprises, Inc., GNC Holdings, LLC, HUM Nutrition Inc., Otsuka Holdings Co., Ltd., Blackmores Limited, Ritual, Haleon Group, and The Beauty Chef

Recent Developments

- In June 2025, Finzelberg launched Agilirose Beauty, a beauty-from-within ingredient combining rosehip berry and collagen. Introduced at Vitafoods Europe, it's clinically proven to support skin barrier, hydration, and elasticity. Using a blend of enzymatic degradation and selective membrane filtration, it extracts potent anti-inflammatory polyphenols that boost skin firmness and barrier integrity. (Source:https://nutraceuticalbusinessreview.com)

- In January 2025, GNC launched its luxury beauty supplement line featuring Premier Collagen, designed for youthful skin from within. Utilizing Naticol™ hydrolyzed marine collagen for superior absorption, this line combines marine and bovine collagen to offer effective hydration and smoothness. Rachel Jones emphasized GNC's commitment to science-backed solutions. (Source:https://www.gnc.com)

- In May 2024, VITALBEAUTIE introduced Super Retinol C, an edible retinol developed with dermatologists based on Amorepacific's research. This vegan product combines retinol with vitamins C, D, E, and more to enhance skin brightness. It offers a refreshing taste and is suitable for those sensitive to traditional retinol. A representative stated it's cost-effective and appealing to consumers. (Source: https://www.barchart.com)

Segments Covered in the Report

By Product Type

- Collagen

- Herbal & Botanical Extracts

- Vitamins & Minerals

- Others (Hyaluronic Acid, Probiotics

By Form

- Capsules & Tablets

- Gummies

- Powders & Liquids

By Application

- Skin Care (Anti-aging, Hydration)

- Hair Care

- Nail Care & Others

By Distribution Channel

- Offline (Specialty Stores/Pharmacies)

- Online/E-commerce

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting