What is Bioengineering Market Size?

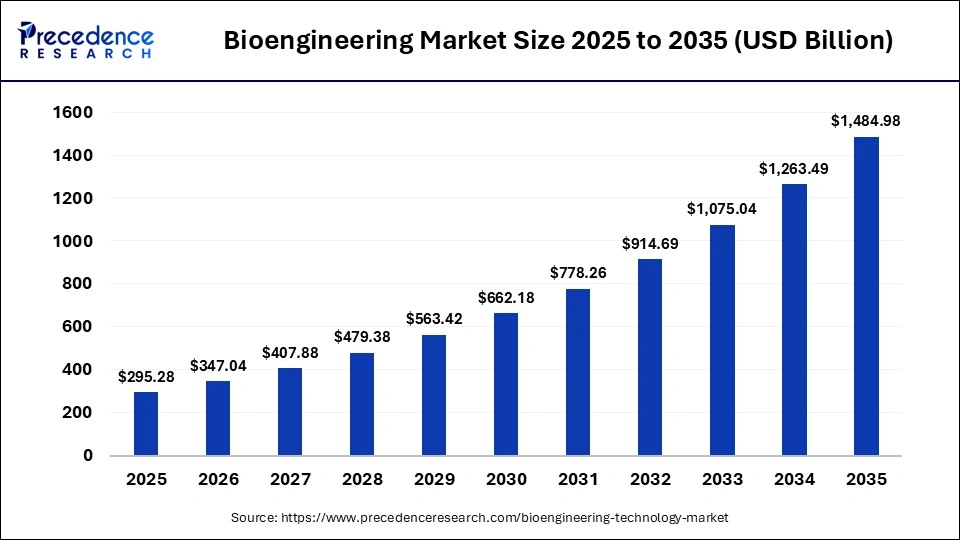

The global bioengineering market size accounted for USD 295.28 billion in 2025 and is predicted to increase from USD 347.04 billion in 2026 to approximately USD 1,484.98 billion by 2035, expanding at a CAGR of 17.53% from 2026 to 2035. The growth of the bioengineering market is driven by advances in synthetic biology, AI integration, precision medicine demand, sustainable bioprocessing, and strong government-backed research and innovation initiatives.

Market Highlights

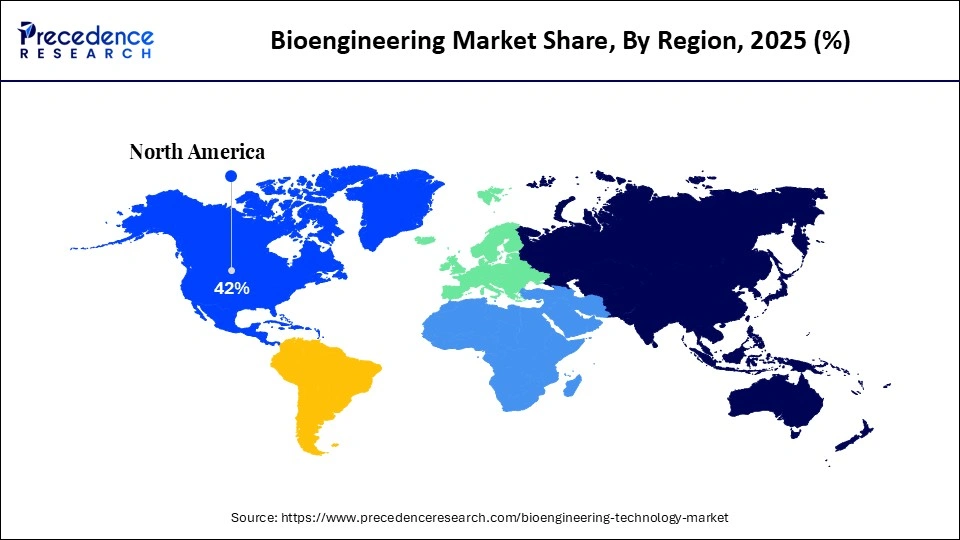

- North America led the bioengineering market with a 42% share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 18% between 2026 and 2035.

- By-product/sub-sector, the biomedical engineering segment captured approximately 30% market share in 2025.

- By-product/sub-sector, the synthetic biology & nano-biotechnology segment is expected to expand at the highest CAGR between 18% from 2025 to 2035.

- By technology, the DNA & genome sequencing technologies segment led the market and held a market share of 25% in 2025.

- By technology, the gene editing & AI-driven platforms segment is growing at a solid CAGR of 22% from 2026 to 2035.

- By application, the healthcare & medical devices segment captured around 45% market share in 2025.

- By application, the industrial & environmental bioengineering segment is poised to grow at a healthy CAGR of 17% from 2025 to 2035.

- By end-user, the pharmaceutical & biotechnology companies segment held around 40% market share in 2025.

- By end-user, the industrial biotechnology firms' segment is expected to expand at the fastest CAGR from 2025 to 2035.

How is the Future of Life Sciences Altered by Bioengineering?

The bioengineering market applies engineering concepts and develops solutions from the integration of biology and engineering. The Bioengineering market is experiencing an explosion of growth. The need for personalized medicines, regenerative medicine, and sustainable manufacturing of bio-based products is increasing the demand for bioengineering products and services. These advancements are leading to faster innovation cycles as a result of the combination of advancements in synthetic biology, tissue engineering, bioprocess optimization, and gene editing platforms, as well as increased use of automation, artificial intelligence, and computer modelling, thereby increasing the precision and scalability of biological research and development.

Increased collaborations between academia and industry, an increase in funding from private investment sources for the biotech industry, and increased emphasis on cost-effectiveness in drug development are only a few of the factors contributing to the growth of the bioengineering industry. Lastly, bioengineering's role in addressing global issues will further enhance its commercial and strategic relevance.

Bioengineering Market Outlook

- Market Overview: Bioengineering combines biology with engineering and provides the basis for medical advancements, agricultural advancements, and sustainability through gene editing, bioprinting, AI assisted design, and bio-based solutions.

- Technology and Innovation Impact: New advancements in CRISPR, artificial intelligence, and synthetic biology have improved the development of personalized medicine and increased the efficiency of bioengineering both through increased research and productivity.

- Workforce and Employment Trends: The US Federal Government's Bureau of Labor Statistics (BLS), in its 2020-2030 projections, has stated that employment for bioengineers will grow approximately 5% by 2034, which is better than average for other occupations due to the continued strong demand for medical devices and therapeutics.

- Government Policy and Growth of the Bioeconomy: The Indian government's initiative with its BioE3 policy to increase the size of India's bioeconomy by almost double by the year 2030 will assist bioengineering through attracting new innovation and job creation and strengthening India's Bio Manufacturing Infrastructure.

- Drivers of Healthcare and Chronic Disease Growth: The increase in chronic disease across the world is increasing the demand for the production, development, and deployment of novel bioengineered diagnostics, therapeutics, and regenerative therapies across all healthcare systems in the world.

AI Transforming Bioengineering: New Discoveries and Trends

Bioengineering is experiencing an unprecedented change due to the application of artificial intelligence (AI). Recent advances in drug discovery, genomic analysis, and smart bioprocessing through AI have created new avenues for researchers to use artificial intelligence as a tool in designing new proteins and speeding up the workflow of synthetic biology while also making it more sustainable, accurate, and efficient within both healthcare and agriculture. In response to the rapid growth of the field, academic institutions have been creating programs that utilize AI in bioengineering, which are preparing the next generation of biologists, engineers, and computer programmers.

In December 2025, HotHouse Therapeutics raised £2.9 M in pre-seed funding to launch an AI-driven plant bioengineering platform for sustainable drug discovery, targeting scalable production of vaccine adjuvants to ease supply constraints.

These projects, funded by innovation grants, include applications such as the combination of AI, materials science, and biomedical engineering. The utilization of AI in the development of diagnostic tools for disease subtype identification is a novel approach to improving disease management, as the use of AI to identify disease subtypes allows for the identification of safer and more effective therapies for patients. The synergy of bioengineering and artificial intelligence is speeding up the research life cycle and will ultimately lead to an environment where intelligent systems are able to create better solutions for biological problems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 295.28 Billion |

| Market Size in 2026 | USD 347.04 Billion |

| Market Size by 2035 | USD 1,484.98 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 17.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product,Technology,Application,End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product/Sub-Sector Insights

Why Does Biomedical engineering Dominated the Market?

Biomedical engineering is the leading segment of the bioengineering market with a 30% share because it is so closely linked with nearly every aspect of patient care through the design and development of medical equipment, diagnosing and therapeutic technologies, imaging devices, and implantable devices. Global hospitals and healthcare facilities have seen continued demand for these products, accelerated by an increasing number of resources committed to the development of advanced patient monitoring systems and minimally invasive technology. The existence of robust regulatory pathways and ongoing payment schedules has also enabled these products to be fully developed, launched into the marketplace, and commercially adopted over the long term across developed and emerging nations' healthcare channels.

Synthetic biology/nanobiotechnology has emerged as the fastest-growing segment with a 18% CAGR within the bioengineering sector, mainly as a result of synthetic biology's exponential growth as a Precision medicine platform, its incorporation into advanced therapeutic modalities, and its use within the development of sustainable bio-manufactured products. these fields allow for the creation of programmable biological systems (synthetic cells and tissue), novel mechanisms for drug delivery, and nano-sized diagnostic devices. In addition, increased funding has been directed to develop engineered microbial systems, biosensors, and nano-enabled therapeutics, driving R&D efforts to develop new pharmaceutical, industrial biotech, and environmental products from these advanced technologies.

Technology Insights

How Will DNA & Genome Sequencing Technology Adoption Drive Growth?

The DNA & genome sequencing technologies dominated the market with an approximately 25% share in 2025 because of their reliability, scalability, and decreased operational complexity. DNA sequencing and genome sequencing rely heavily on the adoption of these technologies as foundational tools throughout all bioengineering workflows, diagnostics, drug development, agricultural research, and beyond. This extensive application allows researchers to characterize genetic variation, disease progression, and biological function, thus driving the adoption of DNA and genome sequencing technologies across the many sub-disciplines of bioengineering.

The gene editing technologies/AI-driven platforms segment is set to grow at an approximately 18% CAGR since the rapid expansion of gene editing technologies and AI-based bio-management systems has become a significant driver for rapidly increasing speed and precision and for creating accurate predictions for faster drug development. CRISPR technologies and AI-based modeling and machine learning provide a means of accurately making genetic changes and developing the most optimized biological design. The increased use of these technologies for drug development and synthetic biology is providing previously unknown innovation cycles and shortening time-to-market.

Application Insights

Why Did Direct sales has Dominated the Bioengineering Market?

The healthcare & medical devices segment led the market with a 45% share in 2025. Bioengineering applications are largely focused on the production of medical devices and products, such as prosthetics, diagnostic tools, and therapeutics, due to the ongoing market demand for these types of products. As populations continue to age, the prevalence of chronic diseases continues to rise, and more attention is focused on developing a patient-centric approach to healthcare delivery, it is evident that there is a sustained need for the use of bioengineered devices and products. As new devices and products come onto the market through the collaboration of bioengineering professionals, the clinical profession, and the medical device industry, there will be ongoing innovation, regulatory alignment, and ultimately commercialization on a global scale.

The industrial and environmental bioengineering applications segment is set to be the fastest-growing with a 17% CAGR in the upcoming period, as industries are looking for environmentally sustainable options to replace traditional manufacturing and pollution control methods. Bio-based production systems, engineered enzymes, and microbial products are becoming more popular in the areas of waste management, renewable materials, and clean energy production. With the regulatory environment changing as well as increasing pressure from consumers and businesses to adopt more environmentally sustainable practices, the use of these methods is expanding rapidly in many industries across the globe.

End User Insights

Which End-User Dominates the Bioengineering Market in 2025?

Pharmaceutical and biotechnology companies led the end-user segment in 2025 with an approximately 40% share, as same scientific principles of bioengineering that support drug development and manufacturing, through biologics, also apply to developing advanced therapeutics; therefore, it makes sense that the largest group of end-users will be pharmaceutical/biotech companies, as they invest heavily in the development of bioprocesses, developing bioengineered organisms, and developing/using biomaterial products to improve product performance and scalability. Because of their R&D investment, regulatory expertise, and commercialization capabilities, the pharmaceutical/biotechnology industry will have an advantage in using and adopting advanced bioengineering solutions to develop new therapies and produce them on a large scale.

The industrial biotechnology firms segment is set to be the fastest-growing with a 18% CAGR, as it represents the fastest-growing segment of end-users within this sector. Industrial biotechnology companies are driven by the increasing use of bio-based materials, fuels, and chemicals. Bioprocessing technologies, engineering of bioengineered organisms (e.g., bacteria, yeast), and the use of synthetic biology platforms to replace petrochemical processes have also driven the growth of the industrial biotechnology business. These companies are also moving towards expanding their use of circular economy models and green manufacturing processes within their global supply chain.

Regional Insights

How Big is the North America BioengineeringMarket Size?

The North America bioengineering market size is estimated at USD 124.02 billion in 2025 and is projected to reach approximately USD 631.12 billion by 2035, with a 17.67% CAGR from 2026 to 2035.

Why is North America the top region for Bioengineering Market?

North America was the top region with a 42% share as the bioengineering hub of the world due to the following reasons: a strong innovation ecosystem, extensive healthcare infrastructure, and high utilization rate of advanced technologies are the main factors contributing to its leadership position in this industry. In addition, as a result of strong collaboration between universities, research institutions, and industry, advancements are being made in areas of medical devices, synthetic biology, and regenerative medicine at an unprecedented rate. Furthermore, through a comprehensive system of regulatory frameworks that support safe innovation, investment is made in translational research, leading to rapid commercialization of new solutions.

With a well-established venture capital landscape, North America fosters start-up and scale-up companies, sustaining the region's depth of technological knowledge. Finally, having world-class hospitals and clinical trial networks supporting cutting-edge bioengineering solutions enhances the demand for bioengineering solutions produced by the United States. This leadership is reinforced by sustained federal research funding that supports early-stage bioengineering breakthroughs. Large-scale clinical trial infrastructure enables faster validation and deployment of bioengineered products. Strong intellectual property protection further incentivizes private investment and long-term innovation.

What is the Size of the U.S. BioengineeringMarket?

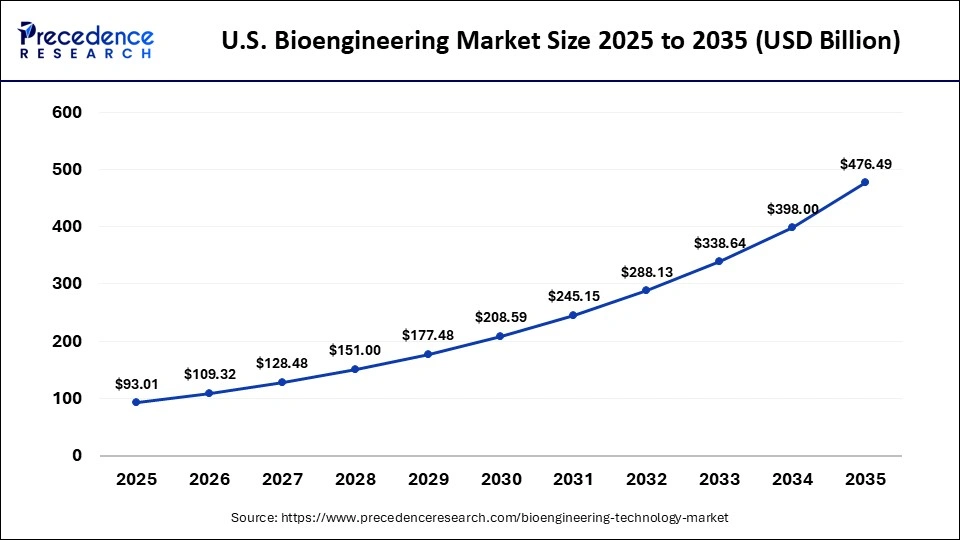

The U.S. bioengineering market size is calculated at USD 93.01 billion in 2025 and is expected to reach nearly USD 476.49 billion in 2035, accelerating at a strong CAGR of 17.75% between 2026 to 2035.

U.S. Bioengineering Market Trends

The U.S. leads the bioengineering market with an unmatched intensity and diversity of research and development. Major research universities and national research laboratories create the foundation for basic scientific understanding through research activities, while an established biotechnology industry enables the translation of scientific innovation into practical use. The comprehensive bioengineering ecosystem of the United States continues to attract top global talent and enhances interdisciplinary collaborative research and development, maintaining the momentum of innovation in the regenerative therapies, biomedical devices, and bioinformatics platforms.

Why is Asia Pacific experiencing the fastest growth of Bioengineering Market?

Asia Pacific is the fastest-growing region in bioengineering with a 18% CAGR, propelled by expanding healthcare access, rising scientific expertise, and supportive governmental initiatives. Emerging innovation hubs in major cities are rapidly adopting technologies that improve diagnostics, personalized medicine, and agricultural biotechnology. Growing investments in education and research infrastructure are empowering a new generation of scientists and entrepreneurs. Diverse markets within the region present opportunities for tailored solutions addressing local health challenges and demographic shifts. A competitive manufacturing base enhances production of bioengineering tools and biologics, strengthening integration into global value chains.

This momentum is reinforced by national funding programs that prioritize genomics, regenerative medicine, and biomanufacturing scale-up. Contract development and manufacturing organizations are expanding capacity to support regional clinical pipelines. Public–private partnerships are accelerating translational research from lab to pilot production. Improved regulatory pathways are shortening approval timelines for novel biologics and devices. Together, these dynamics are converting scientific capacity into sustained commercial growth across Asia Pacific.

China Bioengineering Market Trends

China's bioengineering landscape is marked by strong institutional support for innovation, expanding research capabilities, and a growing base of skilled professionals. Major cities host dynamic biotech clusters where academic excellence meets industrial ambition, accelerating developments across cell therapies, biomanufacturing, and biomedical instruments.

This growth is strongly supported by sustained public funding programs targeting life sciences and advanced manufacturing. Large-scale investments in biopharmaceutical parks and pilot biomanufacturing facilities are improving translation from research to commercialization. Domestic companies are scaling capabilities in cell and gene therapy production to meet both local and global demand. Regulatory reforms aimed at faster clinical approvals are further strengthening China's position in the global bioengineering value chain.

How Europe is Entering a New Era of the Bioengineering Market?

Bioengineering is experiencing significant growth across Europe through the combination of a strong scientific foundation, cross-border collaboration, and harmonized regulatory frameworks that facilitate research and innovation between countries. Governments, universities, and private enterprises across the region are jointly funding research in areas such as tissue engineering, precision medicine, and sustainable bioproducts. Strong emphasis on ethical development standards and patient safety is reinforcing public trust in emerging bioengineering technologies. A well-developed network of specialized research facilities enables efficient knowledge sharing and coordinated innovation across national boundaries.

Existing manufacturing capacity, combined with a highly skilled workforce, supports effective translation of research discoveries into deployable healthcare and industrial solutions. This ecosystem is further strengthened by EU-level funding programs that support multi-country research consortia. Standardized regulatory pathways are reducing duplication and accelerating clinical and industrial validation. Close integration between academia and industry is shortening commercialization timelines. Together, these factors are sustaining Europe's position as a collaborative and innovation-driven bioengineering market.

Germany Bioengineering Market Trends

Germany is the largest center of restriction enzyme use within Europe, supported by numerous world-class research institutions, a strong industrial biotechnology manufacturing base, and extensive academic–industry partnerships. The ongoing expansion of molecular biology and genetic research projects is sustaining continuous demand for restriction enzymes, alongside widespread application in diagnostic testing, basic research, and therapeutic development across Germany's industrial biotechnology sector.

This demand is further reinforced by high-throughput genomics and sequencing workflows that rely on precise enzymatic DNA manipulation. Biopharmaceutical companies are increasing enzyme consumption for cloning, vector construction, and cell line development. Strong public funding for life sciences research is sustaining long-term procurement by academic laboratories. Together, these factors position Germany as a core European hub for restriction enzyme utilization and innovation.

Why Is the Middle East & Africa Region Accelerating the Use of the Bioengineering Market?

Bioengineering adoption is accelerating across the Middle East and Africa as countries strengthen foundational capabilities while prioritizing healthcare modernization, food security, and environmental resilience. Governments are increasingly viewing bioengineered solutions as strategic tools to address chronic disease burden, improve diagnostics, enhance water management, and support sustainable agriculture. Expansion of local research institutions, innovation hubs, and specialized training programs is steadily building domestic scientific talent and technical capacity. These structural shifts are creating a favorable environment for long-term bioengineering integration across public health and industrial applications.

This momentum is further supported by national development strategies that emphasize biotechnology and life sciences diversification. International collaborations are transferring expertise in genomics, bioprocessing, and medical biotechnology. Pilot-scale biomanufacturing facilities are improving local translation of research into practical solutions. Together, these developments are accelerating bioengineering adoption across the Middle East and Africa region.

UAE Bioengineering Market Trends

The United Arab Emirates currently leads the Middle East and Africa region in bioengineering development by actively supporting scientific innovation and large-scale healthcare system transformation. Expansion of advanced research facilities, establishment of international partnerships, and a strong focus on biotechnology, genomics, and biomedical engineering are positioning the UAE as a regional hub for knowledge and innovation.

This leadership is reinforced by government-backed national strategies that prioritize life sciences and advanced manufacturing. Dedicated genomics and precision medicine programs are accelerating applied bioengineering research. Collaboration with global universities and technology firms is strengthening translational research capabilities. Investments in bioengineering talent development are ensuring long-term ecosystem sustainability.

Who are the Major Players in the Bioengineering Market?

Thermo Fisher Scientific Inc., Roche Holding AG, Pfizer Inc., Illumina, Inc., Agilent Technologies, Inc., AstraZeneca plc, Lonza Group Ltd., Moderna Inc., Johnson & Johnson, and Abbott Laboratories

Recent Developments

- In July 2025, IIT Indore and the Mehta Family Foundation announced two new academic schools in Sustainability and Biosciences & Biomedical Engineering to train leaders in climate, health tech, AI, and bio-manufacturing.

Source: https://www.biospectrumindia.com/news/16/26418/iit-indore-mehta-family-foundation-to-launch-academic-schools-in-sustainability-and-biomedical-engineering.html - In February 2025, Bioengineering firm Phitons launched sustainable alternatives to plastic using biodegradable PBAT-based polymers for carry bags, water bottles, and agricultural mulch, supporting eco-friendly packaging and compliance with plastic bans.

Source: https://www.etvbharat.com/en/!bharat/bioengineering-firm-phitons-launches-sustainable-alternatives-to-plastic-enn25021304560 - In February 2025, the Himachal Pradesh government launched a bioengineering initiative, planting deep-rooting vetiver grass to stabilize soil and reduce landslide risk as a low-cost, sustainable slope protection measure.

Source: https://timesofindia.indiatimes.com/city/chandigarh/himachal-govt-launches-bio-engineering-initiative-to-combat-landslides-with-vetiver-grass/articleshow/118223243.cms

Segments Covered in the Report

By-Product/Sub-Sector

- Biomedical Engineering

- Genetic Engineering

- Biotechnology

- Tissue & Regenerative Engineering

- Biomechanics Engineering

- Biomaterials

- Nano-Biotechnology

- Bioinformatics

- Biochemical Engineering

- Synthetic Biology & Bioprocessing

By Technology

- Nanobiotechnology

- Tissue Engineering & Regenerative Technologies

- DNA & Genome Sequencing

- Cell-Based Assay Technologies

- Fermentation & Bioprocessing Technologies

- Gene Editing Technologies

- Computational / AI-Driven Bioengineering Platforms

By Application

- Healthcare & Medical Devices

- Pharmaceuticals & Biotherapeutics

- Agriculture & Crop Engineering

- Food & Nutritional Biotechnology

- Environmental & Bioremediation Applications

- Industrial Biotechnology & Bio-Manufacturing

- Research & Academic Applications

By End-User

- Pharmaceutical & Biotechnology Companies

- Hospitals & Clinical Centers

- Agricultural & Food Processing Companies

- Research Institutes & Academic Laboratories

- Government & Public Health Organizations

- Industrial Biotechnology Firms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting