What is Biomarker Discovery Outsourcing Services Market?

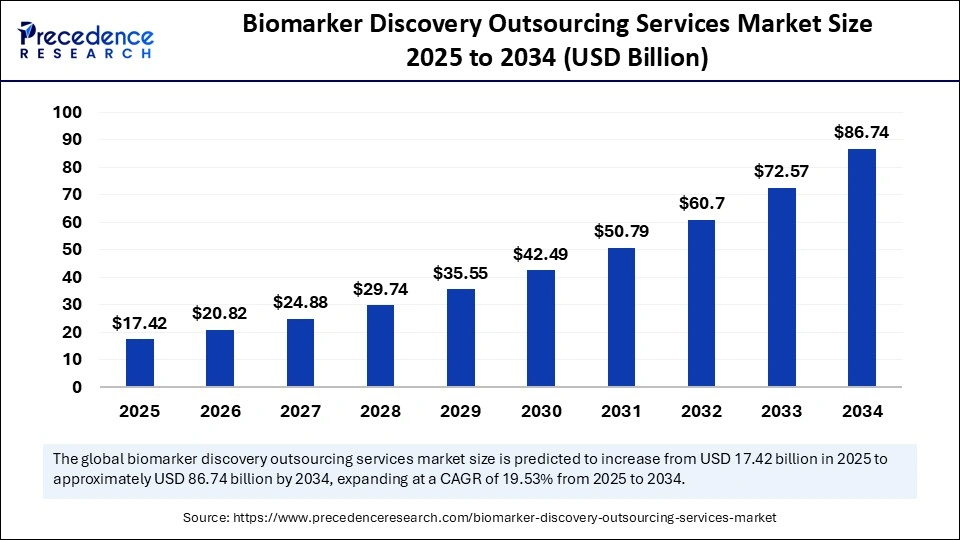

The global biomarker discovery outsourcing services market size accounted for USD 17.42 billion in 2025 and is predicted to increase from USD 20.82 billion in 2026 to approximately USD 86.74 billion by 2034, expanding at a CAGR of 19.53% from 2025 to 2034. The market is experiencing steady growth, driven by rising precision medicine demand and advanced diagnostic innovations.

Market Highlights

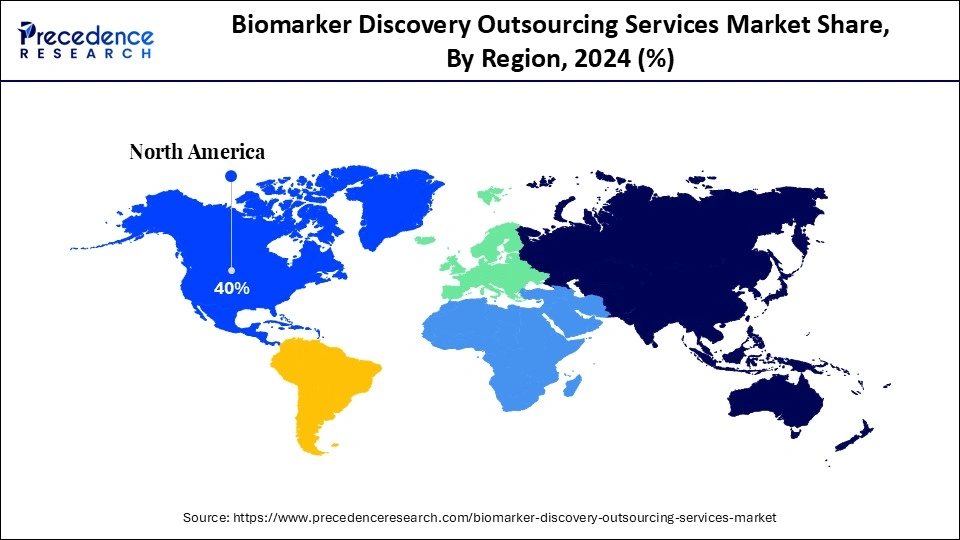

- North America dominated the biomarker discovery outsourcing services market with the largest market share of 40% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By service type, the biomarker identification segment held the biggest market share of 30% in 2024.

- By service type, the companion diagnostics development segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By technology, the genomics segment led the market in 2024.

- By technology, the multi-omics approaches segment is expected to expand at a notable CAGR over the projected period.

- By biomarker type, the diagnostic biomarkers segment captured the highest market share of 40% in 2024.

- By biomarker type, the predictive biomarkers segment is expected to expand at a notable CAGR over the projected period.

- By therapeutic area, the oncology segment dominated the market in 2024.

- By therapeutic area, the neurology segment is expected to expand at a notable CAGR over the projected period.

- By end user, the pharmaceutical companies segment generated the major market share of 45% in 2024.

- By end user, the biotechnology companies segment is expected to expand at a notable CAGR over the projected period.

Market Overview

The biomarker discovery outsourcing services market encompasses research and analytical solutions offered by contract research organizations (CROs), academic institutions, and biotech firms to identify and validate biomarkers for drug development, diagnostics, and precision medicine. Biomarkers, measurable biological indicators, play a pivotal role in predicting disease progression, monitoring treatment efficacy, and developing companion diagnostics.

Outsourcing these services allows pharmaceutical and biotechnology companies to reduce in-house R&D burden, accelerate timelines, and gain access to advanced platforms such as genomics, proteomics, transcriptomics, and metabolomics. The rise of AI-driven bioinformatics, the integration of a multi-omics approach, and increased focus on oncology and neurological research drive demand.

How Artificial Intelligence is Revolutionizing the Future of Biomarker Discovery Outsourcing Services?

Artificial intelligence is shaping the way we think about outsourcing biomarker discovery by providing fast, exact interpretation of complex biological data. In November 2024, PathAI made a significant step forward by launching PathExplore Fibrosis, an AI-enabled tool that estimates fibrosis, collagen, and fiber structures using standard H&E-stained whole-slide images. This impressive tool, which forgoes complicated workflows, ancillary stains, skips multiplexing, and provides reproducible and scalable insights into the tumor microenvironment, will help oncology researchers understand patterns of fibrosis that may inform the therapeutic response or impact their disease progression. AI tools such as this, especially with vendors like PathAI pushing the envelope, are quickly becoming a mainstay in our thinking around outsourced biomarker services and translating products into accurate solutions at lower costs, so we can get new drugs to patients and improve personalized medicine. (Source: https://www.drugdiscoverytrends.com)

Biomarker Discovery Outsourcing Services Market Growth Factors

- Expanding Need for Precision Medicine: Increasing attention to personalized treatment strategies has accelerated the demand for biomarker outsourcing as pharmaceutical and biotech companies seek to utilize an external knowledge base for the identification of patient-specific therapeutic targets.

- Rising R&D Budgets in Drug Development: Pharmaceutical companies are increasing R&D budgets to expedite drug discovery. In the face of these pressures, outsourcing biomarker services to external partners is a way of controlling costs, reducing timelines, and increasing success rates, making it a driver for market growth.

- Technology Advancements in Genomics and Proteomics: Next-generation sequencing, bioinformatics, and proteomic platforms are drastically expediting and increasing the accuracy of biomarker identification. Outsourcing providers that utilize next-generation technologies are seeing an increase in demand from drug developers and diagnostic companies.

- Regulatory Support:Regulatory authorities have been increasingly supportive of biomarker-guided clinical trials as a means of increasing the speed of drug approvals and improving the safety of using new drugs. This has spurred collaborations with outsourcing partners who specialize in biomarker discovery that provide compliance-ready work.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.42 Billion |

| Market Size in 2026 | USD 20.82 Billion |

| Market Size by 2034 | USD 86.74 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Technology Platform, Biomarker Type, Therapeutic Area, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is the growth in R&D investment in biopharmaceuticals driving biomarker discovery outsourcing?

The biomarker discovery outsourcing services market is triply impacted by the increase in R&D investment in biopharmaceuticals. As innovative therapies are needed to keep pace with the high demand in the marketplace, the global pharma and biotech companies are increasing drug development budgets and precision medicine initiatives. The way biomarkers are integrated into clinical trials can enhance clinical trials by improving patient stratification and limiting the number of failures in drug development pipelines.

The ability to outsource these R&D services gives firms access to value-added services and labor skills, leading to molecular laboratories and the latest technology, along with enabling the firm to optimize costs. Because globally, biopharma R&D spending exceeded $940 billion in 2023, with firms like Pfizer, Novartis, and others expanding their biopharma R&D projects relating to biomarkers, this is increasingly accelerating firms' reliance on their outsourcing partners to foster innovation and maintain their competitive advantage. (Source: https://ncses.nsf.gov)

Restraint

Are advanced biomarker technologies expensive enough to limit outsourcing again?

The service industry in biomarker discovery is encountering a major impediment in the form of growing costs associated with advanced technologies. Next-generation sequencing (NGS), high-throughput proteomics, and multi-omics seem fundamental and mainstream to precision medicine, but these technologies require a significant commit per project. In 2024, several different pharma companies pointed out that the outsourcing costs for complex biomarker panels were 2x higher than traditional assays, and there are implications for budget allowances by mid-tier firms.

Smaller biotech likely would not have the opportunity to even utilize services at their current pricing levels; this is an impediment for early-stage research. Moreover, outsourcing providers leverage private investment funding in the industry, as high costs are passed on from capital costs of specialized instruments and highly trained personnel.

Opportunity

Are the rising cancer cases and precision therapies providing a greenlight to outsource biomarkers?

The growing cancer burden seen worldwide, coupled with the industry's apparent shift to personalized medicine, shows an enormous opportunity for outsourcing services for oncology biomarker discovery. Cancer treatment today relies heavily on biomarkers for early diagnosis, prognostic risk, and mapping patients to targeted therapy options. Development of these biomarkers requires expensive infrastructure, technology, bioinformatics skills, and funding, prompting companies in pharmaceuticals and biotech to partner and discover through specialized outsourcing service providers.

New data by WHO (2024) indicating over 35 million new cases of cancer by 2050, accentuates the importance of biomarker-based value creation in our search for innovative drug discovery solutions. Outsourcing oncology biomarker discovery gives firms the ability to advance their oncology drug pipelines while increasing their operating efficiencies and scientific accuracy, and allows biomarker development, presenting an important opportunity.

Segment Insights

Service Type Insights

Why does Biomarker Identification Have the Largest Biomarker Discovery Outsourcing Services Market Share?

In the biomarker discovery outsourcing services market, the biomarker identification segment led the market in 2024. Pharmaceutical and biotech firms rely heavily on outsourced partners to identify new biomarkers associated with disease progression and therapeutic response. The increasing focus on precision medicine and early-stage research support is underway, and increasing demand for biomarker identification services, allowing for continued dominance in the landscape.

The companion diagnostics development segment is projected to be the service type accelerating the most rapidly, driven by the integration of targeted therapies into practice and regulator requirements for a diagnostic test when a drug is introduced. The outsourcing providers will again play a key role in co-developing these solutions. With advancements in genomic sequencing and biomarker validation, this segment will grow quickly and represent strong opportunities for innovation and partnerships in the coming years.

Technology Insights

Which Genomics (NGS) Dominates the Biomarker Discovery Outsourcing Services Market in 2024?

The genomics segment dominated the market in 2024, with the next-generation sequencing (NGS) sub-segment accounting for around 35% revenue share, as it enables the comprehensive profiling of genetic variation associated with disease mechanisms. Outsourcing providers are heavily involved in offering genomics-based biomarker discovery solutions because of their accuracy, scalability, and ability to provide high-throughput data. The increasing use of NGS in oncology, rare disease, and pharmacogenomics keeps genomics at the forefront of biomarker discovery.

The multi-omics approaches segment is likely to be the next fastest growing technology segment, as they utilize genomics, proteomics, metabolomics, and transcriptomics to greater examine biological systems and relationships. Outsourcing partners who have fully developed multi-omics methods provide advanced analytical frameworks to facilitate precision medicine initiatives for both the pharmaceutical as well as biotechnology pipeline development, and will continue to assure significant growth across both pipelines.

Biomarker Type Insights

Which Biomarker Type Dominated the Biomarker Discovery Outsourcing Services Market in 2024?

The diagnostic biomarkers segment was the leading segment in the biomarker discovery outsourcing services market, as they help identify disease, monitor patients, and drive treatment decisions. Pharmaceutical and biotech companies hire third-party organizations for the discovery and validation of diagnostic biomarkers to increase precision and minimize timelines. The increased role of diagnostic biomarkers in oncology, infectious diseases, and cardiovascular indications is helping to increase demand, making them the most common type of biomarker used in outsourced research.

The predictive biomarkers segment will have the quickest growth in the near future as they play a critical role in measuring a patient's response to our therapy; predictive biomarkers are increasingly being used in the drug development process as part of the global shift to precision medicine, since they can help with more optimal clinical outcomes. Furthermore, third-party or outsourced partners can provide important input into the evaluation of predictive biomarkers and help with regulatory compliance, helping drive quicker adoption for adjuvant use in both targeted drug development and companion diagnostic development.

Therapeutic Area Insights

Which Therapeutic Area is the Most Dominant in the Biomarker Discovery Outsourcing Services Market?

The oncology segment dominated the market in 2024, with the solid tumors sub-segment holding around 50% revenue share. This is because of the global burden of cancer and the need for effective and rapid solutions utilizing biomarker-driven approaches. Pharmaceutical companies are increasingly relying on outsourced discovery of oncology-focused biomarkers, which often improves the efficacy of drug candidates, expedites clinical trials, and enables patient stratification. By investing heavily in immuno-oncology and targeted therapy development, it further consolidates the segmented area of outsourced research and related services in oncology.

The neurology segment is likely to expand quickly, particularly the neurodegenerative sub-segment. The increasing prevalence of conditions like Alzheimer's and Parkinson's has led to the customization of novel biomarkers that improve early detection and monitoring of trials. Providers are increasingly looking to new capabilities such as incorporating proteomics and neuroimaging into biomarker development to help fulfill unmet needs, resulting in rapid growth of the neurology-based biomarker outsourcing sector.

End User Insights

Which End-User Segment Dominated the Biomarker Discovery Outsourcing Services Market in 2024?

The pharmaceutical companies segment dominated the end user in the biomarker discovery outsourcing services market in 2024 due to their high-level investments in biomarker discovery to support drug development pipelines, as well as for regulatory approval. Pharmaceutical companies have always heavily depended on outsourcing. Their prioritization of oncology, precision medicine, and companion diagnostics will certainly keep them as the most important customer base going forward.the biotechnology companies segment is expected to be the fastest-growing end-user segment. Biotechs tend to be very nimble and innovative in the targeted therapy and niche diagnostics space. We see biotechnology firms beginning to increasingly partnering with their outsourcing providers to accelerate the biomarker discovery process, especially in early-stage research and multi-omics research. The biotechnology industry is acquiring more funding, and collaborations are expanding the role of biotech firms, mainly in the space. Biotech is driving fast outsourcing growth in the biomarker discovery segment.

Regional Insights

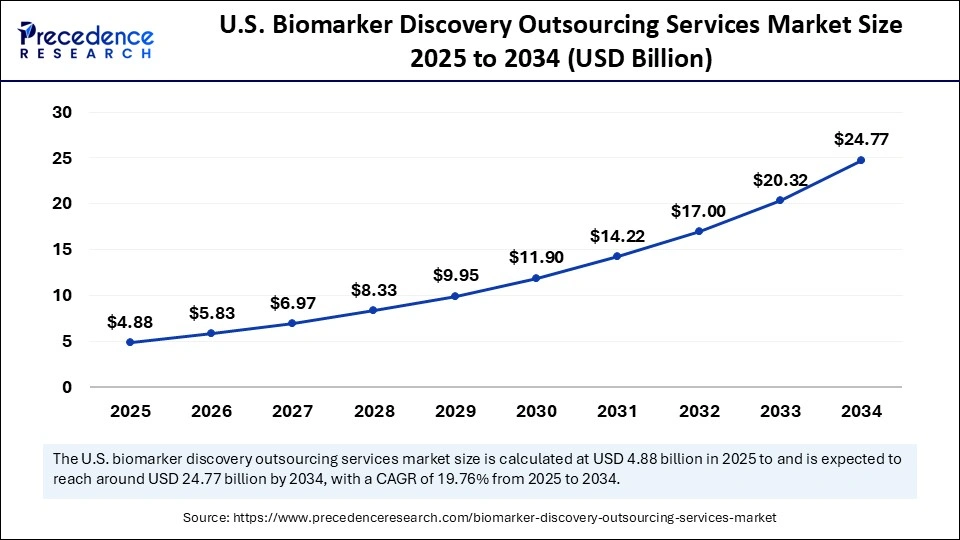

U.S. Biomarker Discovery Outsourcing Services Market Size and Growth 2025 to 2034

The U.S. biomarker discovery outsourcing services market size is exhibited at USD 4.88 billion in 2025 and is projected to be worth around USD 24.77 billion by 2034, growing at a CAGR of 19.76% from 2025 to 2034.

Is North America Leading the Biomarker Discovery Outsourcing Services Market?

North America is dominating the biomarker discovery outsourcing services market, supported by its strong innovation ecosystem and research infrastructure. North America has approximately 50% of the global biotech start-up companies, making it a market leader, and continues to lead the world in the number of biomarker-related patents filed. As. Modern omics platforms, AI-driven automation, and a robust regulatory framework enable pharmaceutical and biotech companies to outsource biomarker discovery to specialized CROs geographically dispersed throughout North America.

- In August 2025, SmartLabs and Sonrai Analytics announced a global strategic partnershipSmartLabs will provide its member companies access to Sonrai's AI-powered analytics platform, Sonrai Discovery, and together they'll develop exclusive AI-driven informatics tools to accelerate biomarker discovery and scientific outcomes within SmartLabs' managed research centers. (Source: https://www.finanznachrichten.de)

The United States continues to be the dominant driver of growth for North America's biomarker outsourcing market due to high R&D intensity and the vast number of elite CROs. The United States hosts the largest number of biomarker-related clinical trials. Further, the U.S. government expedited biomarker adoption with major initiatives such as the Cancer Moonshot program and funding for precision medicine to be more widely implemented. With strong academic partnerships, level of AI capabilities, and a clear regulatory path from the FDA, the U.S. continues to influence outsourced biomarker discovery practices and emerging global trends.

Why Is Asia Pacific the Fastest-Growing Region in the Biomarker Discovery Outsourcing Services Market?

Asia-Pacific emerged as fastest fastest-growing region in 2024, with it being a cost-benefit area for the outsourcing marketplace and rapidly growing biotech clusters and government investment for life sciences. The maximum global clinical trials were conducted in Asia-Pacific, with China, India, Australia, Japan, South Korea, and Singapore accounting for nearly 40,000 trials (39,843* in total) from 2020 to mid-2025. This also shows that the Asia-Pacific is a growing factor for biomarker-driven studies with plans to expand even more. AI-powered biomarker analytics are also being utilized more regularly. The trusted availability of large and different patient populations leads to better and more accurate tests, bolstering Asia-Pacific as a preferred area for global biomarker discovery, outsourcing partnerships.

China is firmly in the lead, since it's become the largest base for CROs and biotech collaborations in Asia-Pacific, growing also with the national Precision Medicine plans. There is a greater trend locally; companies are engaging with multinational pharma companies to pursue predictive and companion diagnostic biomarker projects faster. All of these trends, combined with the rapid expansions of AI-enabled omics research and recent regulatory reforms, China is extending its lead for biomarker outsourcing, while providing all of the scale and innovation for drug developers globally.

What Opportunities Exist in Europe for the Biomarker Discovery Outsourcing Services Market?

Europe offers significant opportunities in the market thanks to increasing demand from precision medicine and oncology research, where pharma and biotech firms require advanced multi‑omics and spatial biomarker expertise. European biopharma stakeholders are increasingly adopting AI to analyze complex health data, enabling more precise insights into patient populations and disease mechanisms. This trend is fueled by the rising demand for personalized medicine, as pharmaceutical companies seek to develop targeted therapies efficiently. Additionally, the expansion of outsourcing services allows firms to streamline drug development, leveraging specialized expertise and advanced technologies without expanding in-house capabilities.

Germany is a major contributor to the European biomarker discovery outsourcing services market. The market benefits from the country's robust healthcare and pharmaceutical sector, which is at the forefront of precision medicine and oncology research. As German biopharma companies increasingly invest in personalized therapies, there is growing demand for specialized biomarker discovery services, particularly in the areas of genomics, proteomics, and metabolomics. Additionally, Germany's strong academic research institutions and public-private partnerships, such as those under the German Cancer Research Center (DKFZ), create opportunities for collaboration with CROs.

In July 2024, the Health Committee of the Bundestag in Germany amended and approved the Federal government's Medical Research Act. It aims to streamline clinical trials and approval processes for drugs and medical devices by affecting national laws.

How is the Opportunistic Rise of Latin America in the Biomarker Discovery Outsourcing Services Market?

Latin America is expected to experience notable growth in the market during the forecast period. The regional market's growth is fueled by advancements in omics technologies, personalized medicine, and AI. This area is emerging as a key center for clinical research, particularly in biomarkers. Brazil leads the market, driven by a combination of advanced research infrastructure, a growing focus on precision medicine, and increased government investment in healthcare and biotechnology. The Brazilian government's initiatives aim to strengthen the pharmaceutical and clinical research sectors, which influence biomarker discovery.

What Potentiates the Growth of the Market Within the Middle East and Africa?

The growth of the biomarker discovery outsourcing services market in the Middle East and Africa (MEA) is potentiated by several key factors, including increased government investments in healthcare infrastructure and biotechnology across the region. Countries like the UAE, Saudi Arabia, and South Africa are rapidly adopting precision medicine and personalized therapies, which has fueled demand for advanced biomarker discovery services. The increasing demand for personalized medicine, along with the expansion of the life sciences ecosystem, is driving market growth across the Middle East and Africa.

Saudi Arabia is a major player in the market in the MEA, driven by the country's ambitious Vision 2030 initiative, which includes significant investments in healthcare innovation, biotechnology, and precision medicine. In June 2025, Saudi Arabia participated in the BIO International Convention to promote biotechnology investments and innovations. During the same month, the Ministry of Health of the Kingdom of Saudi Arabia unveiled a strategic healthcare vision and established global partnerships at BIO 2025.

Value Chain Analysis

- Research & Biomarker Discovery

The early stage of discovery often incorporates high-throughput methods in conjunction with genomic and proteomic analyses to harvest biomarkers. Many drug companies and biotechs utilize service providers with proven specialized methods, thus saving on costs and timelines.

- Biomarker Validation & Assay Development

The biomarkers discovered will undergo robust validation and assay development to verify that an accessible biomarker is reliable. Service providers will maximize the use of advanced bioinformatics, assuring accuracy and reproducibility, while remaining compliant with increasingly stringent regulatory and clinical trial standards.

- Partners and Clinical Integration

Working with pharmaceutical companies, contract research organizations (CROs), and academic partners increases expertise, enhances drug development times, and provides access to amazing biomarker innovations in diagnostics and personalized medicine.

- Commercialization & Regulatory Compliance

Validated biomarkers are developed into diagnostic products, or companion diagnostics. The commercialization strategy focuses on healthcare providers, but it becomes increasingly regulated, with more frameworks and protocols globally.

Biomarker Discovery Outsourcing Services Market Companies

- Eurofins Scientific

- Charles River Laboratories

- ICON plc

- Labcorp Drug Development

- Thermo Fisher Scientific

- WuXi AppTec

- Syneos Health

- Q� Solutions (IQVIA & Quest Diagnostics JV)

- Bio-Rad Laboratories

- PPD Inc. (Thermo Fisher Scientific)

- SGS SA

- Evotec SE

- Creative Biolabs

- GenScript Biotech Corporation

- DiscoverX (Eurofins Discovery)

- Proteome Sciences plc

- Medpace Holdings, Inc.

- Precision for Medicine

- Sino Biological Inc.

- Biomarker Technologies, Inc.

LatestStatements and Investments by Major Players

- In July 2025, TrilliumBiO and T-NeuroDx signed a strategic collaboration agreement to co-develop and commercialize blood-based, non-invasive biomarkers to facilitate earlier diagnosis of Alzheimer's disease. Clinical studies will be conducted on diverse populations.(Source: https://trilliumbio.com)

- In September 2025, Aptamer Group launched a new biomarker discovery service that combines the Optimer libraries with proteomic analysis to expedite the identification and validation of disease markers with functional binding for diagnostics and drug discovery.(Source: https://pharmaceuticalmanufacturer.media)

Segments Covered in the Report

By Service Type

- Biomarker Identification

- Target Discovery

- Candidate Biomarker Screening

- Biomarker Validation & Qualification

- Analytical Validation

- Clinical Validation

- Biomarker Assay Development

- Assay Design

- Assay Optimization

- Multiplex Assays

- Clinical Biomarker Discovery

- Patient Stratification

- Clinical Sample Testing

- Companion Diagnostics Development

- Bioinformatics & Data Analysis

- Data Mining & Integration

- AI-Driven Predictive Modeling

- Others

By Technology Platform

- Genomics

- Next-Generation Sequencing (NGS)

- qPCR & Microarrays

- Proteomics

- Mass Spectrometry

- Protein Microarrays

- Transcriptomics

- RNA Sequencing

- Microarray-Based Expression

- Metabolomics

- NMR Spectroscopy

- LC-MS/GC-MS

- Epigenomics

- DNA Methylation Analysis

- Histone Modification Analysis

- Lipidomics

- Multi-omics Approaches

By Biomarker Type

- Prognostic Biomarkers

- Diagnostic Biomarkers

- Surrogate Biomarkers

By Therapeutic Area

- Oncology

- Solid Tumors

- Hematological Malignancies

- Neurology

- Neurodegenerative Disorders

- Psychiatric Disorders

- Cardiovascular Diseases

- Immunology & Inflammatory Diseases

- Infectious Diseases

- Metabolic Disorders

- Others

By End User

- Pharmaceutical Companies

- Biotechnology Companies

- Academic & Research Institutes

- Diagnostic Laboratories

- CROs & Research Networks

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content