Aseptic Connectors and Welders Market Size and Forecast 2025 to 2034

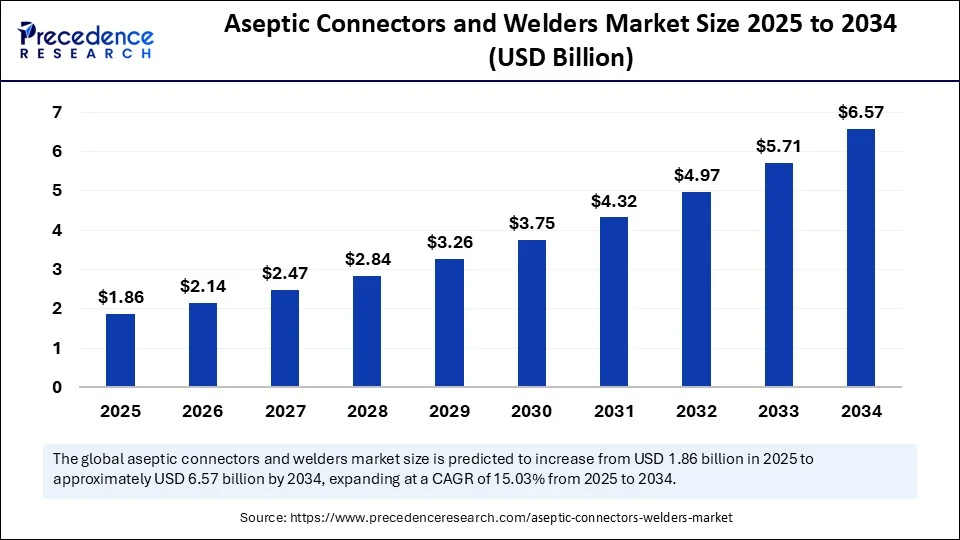

The global aseptic connectors and welders market size accounted for USD 1.62 billion in 2024 and is predicted to increase from USD 1.86 billion in 2025 to approximately USD 6.57 billion by 2034, expanding at a CAGR of 15.03% from 2025 to 2034. The market is witnessing substantial growth because of the increasing emphasis on sterile and contamination-free manufacturing in the biopharmaceutical and pharmaceutical industries. Therefore, to address the growing adoption of single-use technologies and the rising demand for advanced solutions in vaccine and biologics production, this market shift toward automatic and efficient processes is projected to drive market expansion in the coming years.

Aseptic Connectors and Welders MarketKey Takeaways

- In terms of revenue, the aseptic connectors and welders market was valued at USD 1.62 billion in 2024.

- It is projected to reach USD 6.57 billion by 2034.

- The market is expected to grow at a CAGR of 15.03% from 2025 to 2034.

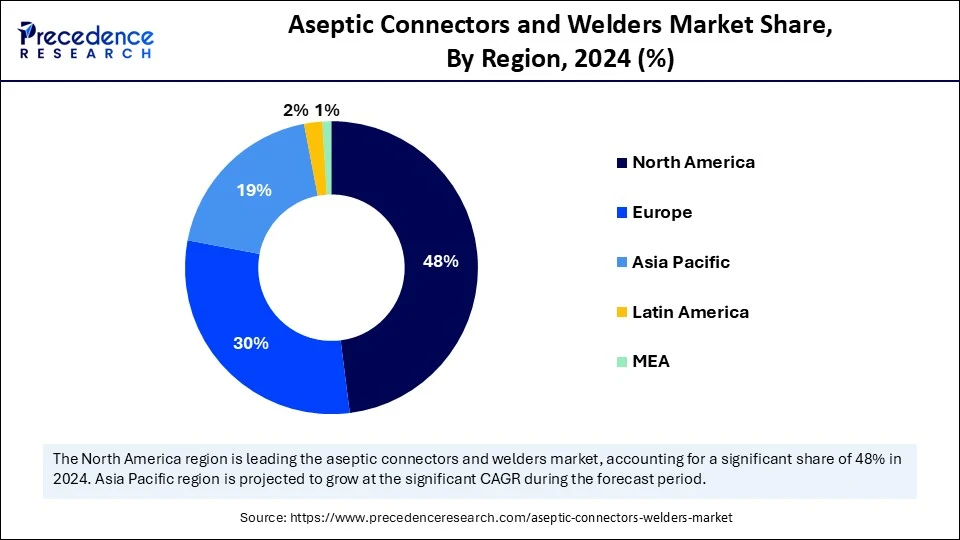

- North America dominated the global aseptic connectors and welders market with the largest revenue share of 40% in 2024.

- Asia Pacific is expected to grow at the highest CAGR of 15.4% from 2025 to 2034.

- By product, the aseptic connectors segment contributed the biggest market share in 2024.

- By product, the aseptic welders segment is expected to grow at the CAGR during the forecast period.

- By application, the upstream bioprocessing segment held the biggest revenue of 46% in 2024.

- By application, the downstream bioprocessing segment is expanding at a significant CAGR from 2025 to 2034.

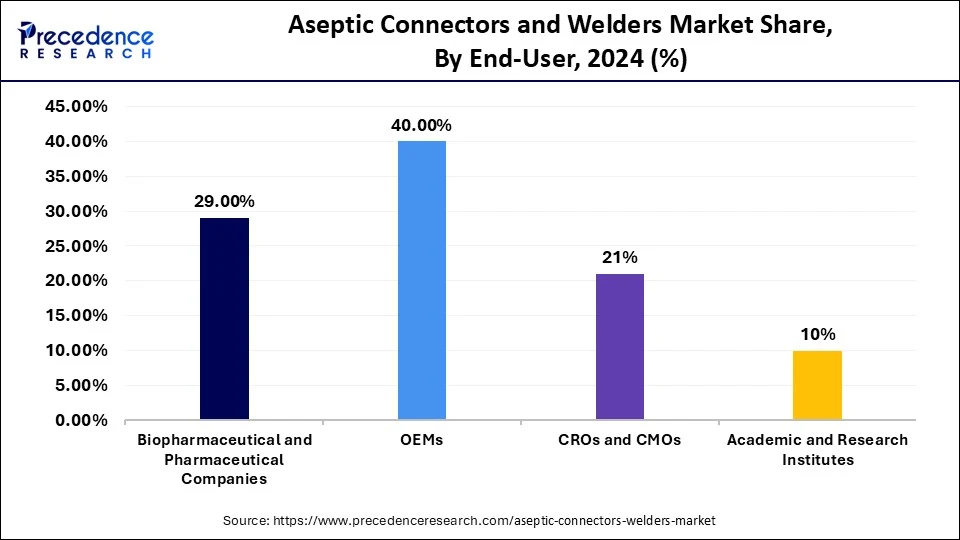

- By end-user, the OEMs segment contributed the biggest revenue share of 40% in 2024.

- By end-user, the CROs & CMOs segment is expected to grow at a significant CAGR over the projected period.

Impact of AI on the Aseptic Connectors and Welders Market

Artificial intelligence is profoundly impacting the aseptic connectors and welders market by enhancing precision, automation, and predictive maintenance. AI-driven systems can analyze data from sensors and cameras to control welding parameters in real time, ensuring consistent and high-quality welds, which is particularly pivotal in sterile environments. This leads to improved quality control with reduced downtime and optimized production cycles in industries such as pharmaceuticals and biotechnology. Additionally, AI automation can perform several tasks with greater precision and consistency than human operators, minimizing the risk of contamination and errors and improving overall efficiency by ensuring that only high-quality products are produced, reducing waste and enhancing product safety.

U.S. Aseptic Connectors and Welders Market Size and Growth 2025 to 2034

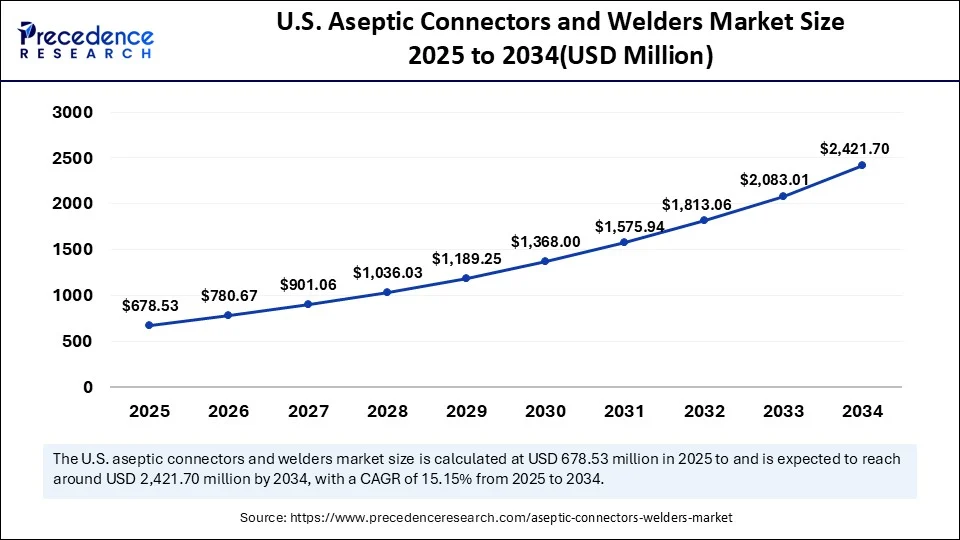

The U.S. aseptic connectors and welders market size was exhibited at USD 5,90.976 million in 2024 and is projected to be worth around USD 2,421.702 million by 2034, growing at a CAGR of 15.15% from 2025 to 2034.

How Does North America Dominate the Aseptic Connectors and Welders Market in 2024?

North America dominated the aseptic connectors and welders market by holding a major revenue share of 40% in 2024. This is due to its well-established biopharmaceutical industry, strong emphasis on single-use technologies, and a supportive regulatory environment. Furthermore, aseptic connectors are crucial for maintaining sterility in single-use systems across numerous companies engaged in the research & development and manufacturing of biologics, vaccines, and other therapies. North America boasts a robust research and development ecosystem, with universities, research institutions, and companies actively working on developing new and improved aseptic technologies. The FDA and other regulatory bodies in the region have emphasized the importance of contamination control and quality assurance in bioprocessing, further driving demand for aseptic connectors.

In April 2023, Colder Products Company (CPC), a U.S.-based company, announced the launch of its AseptiQuik W Series, the largest genderless aseptic connectors. The new 1-1/2-inch flow path solution easily transfers hundreds of liters per minute, significantly reducing fluid transfer times across bioprocesses and meeting challenging application requirements with higher-efficiency filtration devices.

(Source: https://investors.dovercorporation.com)

U.S. Aseptic Connectors and Welders Market Trends

The U.S. plays a significant role in the market due to its well-established biopharmaceutical and pharmaceutical industries. The U.S. is a major hub for vaccine innovation and manufacturing, with prominent companies like Pfizer, Moderna, and Johnson & Johnson investing heavily in aseptic processing. There is a high demand for sterile, closed-system solutions in biopharmaceutical manufacturing due to stringent quality regulations. The rising development of biologics, vaccines, and cell and gene therapies further contributes to market expansion.

What Factors Contribute to Aseptic Connectors and Welders Market Within Asia Pacific?

Asia Pacific is expected to grow at a double-digit CAGR of 15.4% in the coming years due to rapid industrialization, a vast population base, and increasing investments in the healthcare and biopharmaceutical industries. A large population base, along with a growing middle class with increased disposable income, translates to higher consumption of processed foods and beverages, fostering the necessity for aseptic packaging. Governments in countries like China and India are actively promoting technological advancements and infrastructure development in key sectors like healthcare and biopharmaceuticals, resulting in increased adoption of aseptic technologies, which drives the demand for aseptic connectors and welders for various applications, including drug manufacturing and research.

- In October 2024, Thermo Fisher Scientific signed a Memorandum of Understanding with the Government of Telangana to establish a Bioprocess Design Centre in Genome Valley, Hyderabad. This facility will enhance the development and production of biotherapeutics for India and the Asia-Pacific region by providing laboratories and training hubs to drive scientific research and innovation.

(Source: https://theindianpractitioner.com)

China Aseptic Connectors and Welders Market Trends

China plays a vital role in the market due to its status as a major manufacturing hub and key consumer of these products, driven by its expanding pharmaceutical and biotechnology sectors, along with increasing investments in healthcare modernization. China is a significant adopter of single-use bioprocessing technologies, including aseptic connectors, which are critical for flexible and efficient biopharmaceutical manufacturing.

What Opportunities Exist in the Aseptic Connectors and Welders Market?

Europe is expected to grow at a significant rate in the near future, driven by its well-established biopharmaceutical industry, stringent quality regulations, and emphasis on advanced technologies. As Europe is recognized as a hub for innovation, several government initiatives and collaborations across the region are further highlighting this market, emphasizing innovation and sustainability in manufacturing processes. European regulatory bodies such as the European Medicines Agency impose strict guidelines for quality control and sterile manufacturing, which further propels the adoption of advanced aseptic technologies.

Latin America Aseptic Connectors and Welders Market Trends

Latin America plays a distinctive role in the global market, primarily due to its rising infrastructure projects, urban expansion, and growing demand for affordable solutions, particularly in Brazil and Mexico. Governments in Brazil and Mexico actively promote foreign investment in various sectors, including healthcare and manufacturing, which can boost the demand for advanced technologies like aseptic connectors. Consequently, Brazil and Mexico are significant contributors to this growth, benefiting from increased government investments in healthcare and pharmaceutical sectors and the influx of multinational corporations that contribute to this expansion.

Middle East and Africa Aseptic Connectors and Welders Market Trends

The Middle East and Africa are emerging in the market due to the rising demand for aseptic connectors and welders, primarily driven by infrastructure development, industrialization, and increasing investments in healthcare and biotechnology. Rapid infrastructure development in countries like the UAE and Saudi Arabia is propelling the demand for aseptic technology in various industrial applications. Stringent regulations regarding the quality and safety of pharmaceuticals further support regional market growth.

Market Overview

Aseptic connectors and welders are specialized components used in various industries, including pharmaceuticals, biotechnology, and food and beverage, to create sterile connections during fluid transfer. These devices are engineered to provide sterile, leak-proof connections within a fluid transfer system and establish permanent, sterile welds in single-use systems for biopharmaceutical manufacturing. They help maintain a closed and sterile environment during various processes while offering a reliable and automated method for joining tubing without compromising sterility. These devices ensure the integrity of the fluid path, preventing contamination and preserving product sterility. The market is experiencing significant growth due to the increasing demand for sterile processing, advancements in technology, and the rise in biopharmaceutical production. Moreover, stringent regulations regarding biopharmaceutical sterility support market growth.

What are the Key Trends in the Aseptic Connectors and Welders Market?

- Growth of Biopharmaceuticals and Vaccines: The expanding biopharmaceutical industry, along with the rising development of biologics, vaccines, and cell and gene therapies, creates the need for robust aseptic processing solutions, which further boosts the demand for aseptic connectors and welders to ensure product safety and efficacy.

- Rising Demand for Sterile Processing: The rising emphasis on maintaining high hygiene standards in various industries, specifically in biopharmaceutical research and production, is driving the market for aseptic connectors and welders.

- Adoption of Single-Use Technologies:The adoption of single-use systems in bioprocessing is increasing, and aseptic connectors and welders are integral components of these systems, leading to market expansion as they reduce the risk of cross-contamination and simplify manufacturing processes by increasing the demand for reliable aseptic connection solutions.

- Stringent Regulatory Requirements: Regulatory bodies like the FDA and EMA require strict adherence to aseptic processing in biopharmaceutical research and manufacturing by fostering the adoption of advanced aseptic connectors and welders.

- Technological Advancements: Innovations in materials, designs, automation, and connection methods are leading to more efficient, reliable, and user-friendly aseptic connectors and welders, further propelling the market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.57 Billion |

| Market Size in 2025 | USD 1.86 Billion |

| Market Size in 2024 | USD 1.62 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.03% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Single-Use Systems

The primary factor driving the growth of the aseptic connectors and welders market is the growing demand for single-use systems in biopharmaceutical manufacturing. The expanding biopharmaceutical industry, focused on the development of biologics, vaccines, and advanced therapies, requires sterile and efficient production processes, fueling the need for single-use aseptic connectors and welders. This demand is attributed to the necessity for contamination-free fluid transfer, reduced cleaning and validation requirements, and faster changeovers, which ultimately enhance efficiency and affordability. The adoption of single-use systems eliminates the need for cleaning and sterilization, ensuring high-quality standards.

Restraint

Raw Material Volatility and High Costs

The main restraint in the aseptic connectors and welders market is the volatility of raw materials. This includes fluctuations in material prices influenced by various factors such as geopolitical tensions, supply chain disruptions, and global demand changes. These price fluctuations can significantly impact manufacturing costs and the overall profitability of companies in this market. Abrupt shifts in raw material prices can lead to increased production costs, potentially forcing companies to cut profits and hindering market growth.

Opportunity

Technological Advancements

Ongoing technological advancements create immense opportunities in the aseptic connectors and welders market. Innovations in materials and designs are improving the performance, efficiency, durability, and biocompatibility of aseptic connectors and welders with various processes. Technological innovations are leading to the development of automated aseptic connectors and welders, reducing human errors and ensuring compliance with strict safety and hygiene standards.

For instance, Biowelder S, automated aseptic welding, was developed to support cell andgene therapy (CGT) product development along with good manufacturing practice requirements. It enables rapid, sterile connection of small polyvinyl chloride and thermoplastic elastomer tubing in a non-classified environment, resulting in one welded tube and the disposal of the two leftover ends.

(Source: https://www.sartorius.com)

Product Insights

How Does the Aseptic Connectors Segment Dominate the Market in 2024?

The aseptic connectors segment dominated the aseptic connectors and welders market with the biggest revenue share in 2024. This is primarily due to their superior ability to maintain sterility, ease of use, and scalability in biopharmaceutical manufacturing, particularly in single-use systems. Aseptic connectors provide a closed, sterile fluid path, reducing contamination risks, which is crucial in biopharmaceutical production. They are well-suited for single-use systems, allowing flexibility and scalability in manufacturing processes, especially in the production of vaccines and other biopharmaceuticals. Improvements in connector design are enhancing their performance and reliability, further solidifying their market position.

The aseptic welders segment is expected to grow at the CAGR during the forecast period. This is mainly due to their essential role in biopharmaceutical manufacturing to maintain a sterile environment and improve efficiency. They are essential for creating sterile connections within single-use systems, minimizing contamination risks during fluid transfer. The segment growth if further attributed to the increasing adoption of single-use systems in the pharmaceutical and biopharmaceutical industries, driven by advantages such as lower contamination risk, reduced upfront costs, and quicker changeovers.

Application Insights

Why Did the Upstream Bioprocessing Segment Dominate the Aseptic Connectors and Welders Market in 2024?

The upstream bioprocessing segment dominated the market with a major revenue share of 46% in 2024, primarily due to its critical role in maintaining sterility during the initial stages of biologics production, where contamination can severely impact product quality and yield. This segment includes media preparation, cell culture, and fermentation processes, relying heavily on aseptic connectors and welders to ensure contamination-free fluid transfer and system integrity. The increased demand for mRNA therapies, monoclonal antibodies, and advanced therapies further bolstered the segment as their quality heavily depends on the level of sterility in upstream processes.

The downstream bioprocessing segment is expanding at a significant CAGR in the coming years, driven by the increasing demand for efficient purification, filtration, and formulation processes in biological manufacturing. The rising production of biopharmaceuticals, including monoclonal antibodies and biosimilars, necessitates more efficient and scalable downstream processing methods. Moreover, innovations in high-resolution membrane systems with continuous processing, as well as new classes of monoliths and membrane adsorbers, are optimizing downstream purification.

End-User Insights

What Made OEMs the Dominant Segment in the Aseptic Connectors and Welders Market in 2024?

The OEMs (Original Equipment Manufacturers) segment dominated the market with the largest revenue share of 40% in 2024 owing to their vital role in integrating these components into bioprocessing systems and single-use assemblies, particularly within the biopharmaceutical industry. OEMs are essential for providing validated, ready-to-use solutions to drug developers and contract manufacturers by incorporating these components into their equipment and systems. The strong demand from OEMs stems from the desire to integrate these components into bioprocessing systems and single-use assemblies, as the industry shifts toward offering modular and scalable solutions, solidifying their position.

The CROs & CMOs segment is expected to grow at the fastest CAGR over the projected period. This is mainly due to the increasing trend of outsourcing manufacturing processes. Biopharmaceutical and pharmaceutical companies are outsourcing their manufacturing processes to third parties. By outsourcing, these companies can focus on their core competencies, like drug discovery and marketing. As the volume of outsourced manufacturing processes rises, so does the need for aseptic connectors and welders among CROs and CMOs. The increasing demand for biologics and other specialized drugs necessitates aseptic manufacturing processes, supporting segmental growth.

Aseptic Connectors and Welders Market Companies

- Sartorius AG

- Merck KGaA

- Danaher(Cytiva)

- Saint-Gobain

- Dover Corporation (Colder Products Company)

- Liquidyne Process Technologies, Inc.

- MGA Technologies

- Watson-Marlow Fluid Technology Solutions

- Terumo BCT, Inc.

- LePure Biotech LLC

Recent Developments

- In January 2025, CPC launched the MicroCNX Nano Series aseptic connectors, an innovative solution for cell and gene therapy (CGT) sterile processing. This industry-first product simplifies the connection process by allowing users to click connector halves together to create sterile flow paths, replacing traditional methods such as biosafety cabinets and tube welding. A key feature is their ability to be frozen to -190°C, supporting cell preservation during storage and transport.

(Source: https://investors.dovercorporation.com) - In September 2024, CPC unveiled a new aseptic micro-connector that fits directly into the freeze cassettes used in CGT processing. The new MicroCNX ULT Series is the first to conveniently support sterility throughout CGT development processes by withstanding temperatures as low as -190°C and being compact enough to fit conveniently into a CGT freeze cassette, helping to minimize material loss of function during product shipment and storage.

(Source: https://investors.dovercorporation.com) - In April 2023, Qosina introduced Colder Products Company's new AseptiQuik W Series connectors to its extensive line of aseptic genderless connectors. This series enables quick and easy sterile connections in large-volume, high-flow production and process intensification environments at higher flow rates, thereby reducing the risk of flow restrictions and pressure drops.

(Source: https://www.businesswire.com)

Segments Covered in the Report

By Product

- Aseptic Connectors

- Connection type

- Barbed fittings

- Luer locks

- Genderless

- Others

- Tubing Size

- 1/16 Inch

- 1/4 Inch

- 3/8 Inch

- Others

- Connection type

- Aseptic Welders

By Application

- Upstream Bioprocessing

- Media Preparation

- Cell Inoculation

- Cell Expansion

- Sampling

- Other Applications

- Downstream Bioprocessing

- Purification

- Filtration

- Sampling

- Fluid Transfer

- Other Applications

- Harvest & Fill-finish Operations

- Product Collection

- Filtration

- Product Filling

- Sampling

- QC Testing

By End-User

- Biopharmaceutical & Pharmaceutical Companies

- OEMs

- CROs & CMOs

- Academic & Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting