What is Aseptic Fill-Finish Manufacturing Market Size?

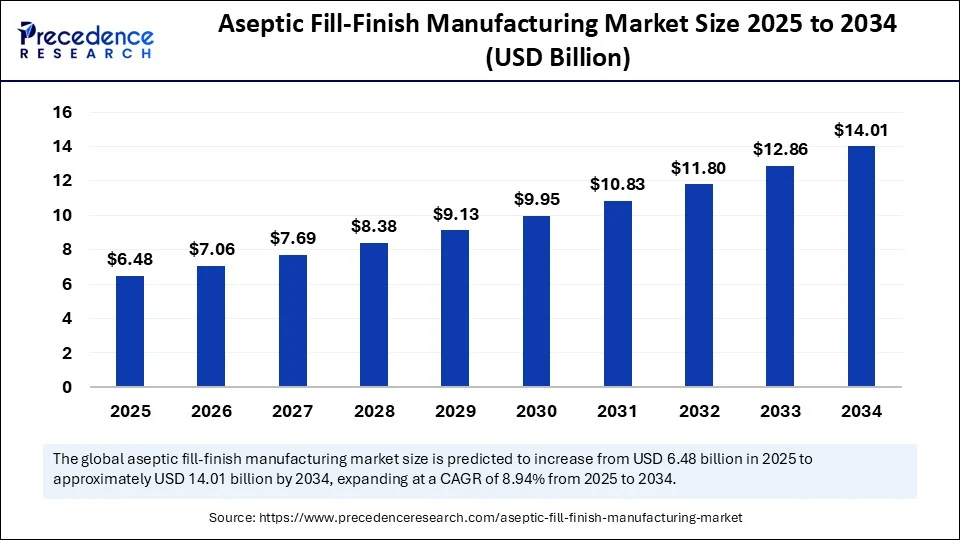

The global aseptic fill-finish manufacturing market size accounted for USD 6.48 billion in 2025 and is predicted to increase from USD 7.06 billion in 2026 to approximately USD 14.01 billion by 2034, expanding at a CAGR of 8.94% from 2025 to 2034.

Market Highlights

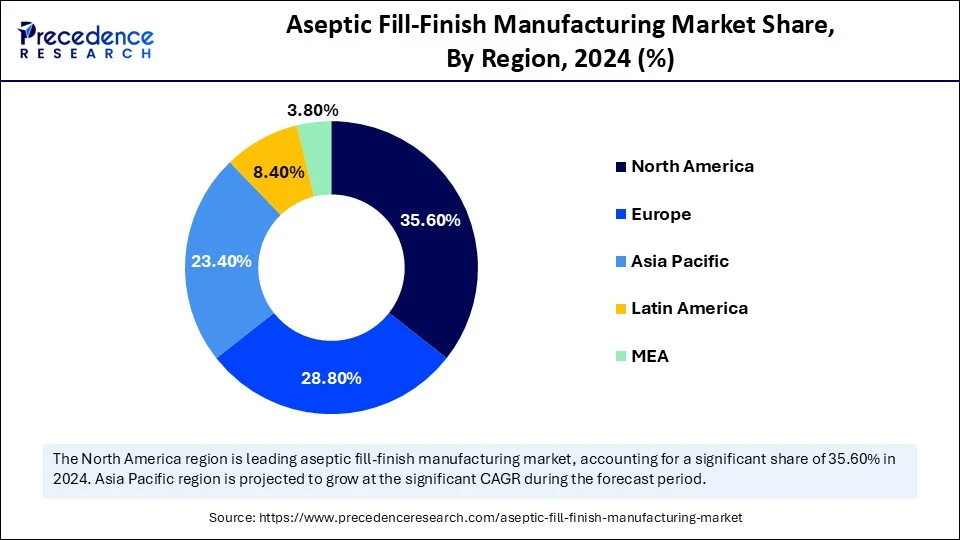

- North America dominated the aseptic fill-finish manufacturing market with the largest market share of 35.6% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 8.8% during the forecast period.

- By packaging format, the vials segment held the largest share captured the biggest market share of 36.4% in 2024.

- By packaging format, the prefilled syringes (PFS) segment is expected to grow at a CAGR of 9.2% during the forecast period.

- By molecule/product type, the large molecules/biologics segment contributed the highest market share of 33.7% in 2024.

- By molecule/product type, the radiopharmaceuticals segment is projected to grow at the fastest CAGR of 10.8% during the forecast period.

- By drug classification, the branded drugs segment held the largest market share of 51.2% in 2024.

- By drug classification, the biosimilars segment is the fastest-growing segment during the forecast period.

- By end user, the biopharmaceutical companies segment generated the major market share of 38.9% in 2024.

- By end user, the biotech startups segment is projected to grow at the fastest CAGR of 10.1% during the forecast period.

Market Overview

The global aseptic fill-finish manufacturing market is being shaped by technological advancements such as automation and robotics, which minimize human intervention and reduce contamination risks, along with the adoption of single-use technologies that offer flexibility and cost effectiveness in sterile drug production. Furthermore, process efficiency and reliability are being increased by innovations like artificial intelligence (AI) driven quality control, real-time monitoring, and sophisticated isolator systems. Pharmaceutical and biotech firms can now increase production, guarantee adherence to stringent regulatory requirements, and satisfy the growing demand for biologic vaccines and injectable treatments thanks to these developments.

- On 10 July 2024, PCI Pharma Services announced the installation of a sterile fill finish and lyophilization line as part of its US$100 million capital expansion at its Bedford, New Hampshire, facility.

How is Artificial Intelligence Transforming the Global Aseptic Fill-Finish Manufacturing Market?

Artificial Intelligence (AI) is transforming the global aseptic fill-finish manufacturing market by enabling real-time monitoring, predictive analytics, and automation to minimize human error and contamination risks. AI-powered systems maximize fill volumes, quickly identify deviations, and improve equipment efficiency in general. AI also facilitates predictive maintenance for equipment, increasing uptime and decreasing expensive downtime. AI is increasingly playing a key role in aseptic fill-finish operations innovation by enhancing process accuracy, regulatory compliance, and production scalability.

Aseptic Fill-Finish Manufacturing MarketGrowth Factors

- Rising demand for biologics, biosimilars, and vaccines.

- Increasing prevalence of chronic disease is driving injectable drug use.

- Expanding pipeline of monoclonal antibodies and advanced therapies.

- Growing outsourcing to CMOs/CDMOs for scalability and compliance

- Technological advancements in automation, robotics, and single-use systems.

- Strict regulatory standards ensuring adoption of aseptic processes.

- Increasing investment in sterile manufacturing facilities worldwide.

- Growing adoption of prefilled syringes and ready-to-use vials.

- Rising focus on patient safety and contamination-free packaging

- Strong government and private sector funding for biopharmaceutical R&D.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.48 Billion |

| Market Size in 2026 | USD 7.06 Billion |

| Market Size by 2034 | USD 14.01 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.94% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Packaging Format, Molecule Type/Product Type, Drug Classification, Operational Stage, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for sterile injectables

Sterile injectables are becoming the foundation of contemporary therapies. The global market is expanding rapidly. Environments free of contamination are necessary for the safety and effectiveness of biologics, biosimilars, and vaccines. Aseptic fill finish procedures are becoming more and more important as injectable formulations are chosen over oral routes due to their quicker onset of action. The expansion of biologic therapies, which rely significantly on sterile packaging formats, is another factor contributing to this surge.

Increased use of prefilled syringes and RTU formats

Patient-friendly drug delivery formats like prefilled syringes, cartridges, and ready-to-use (RTU) vials are rapidly becoming more popular in the pharmaceutical industry. In-home care setting, these formats increase convenience, lower dosage errors, and boost compliance. This trend is a powerful growth driver since aseptic fill finish manufacturing is essential to creating these packaging formats because they must maintain drug stability while remaining sterile.

Restraints

High capital investment requirements

Establishing aseptic fill finish facilities necessitates large upfront expenditures for sophisticated automation systems, cleanrooms, isolators, and specialized equipment. Small and mid-sized pharmaceutical companies frequently find these costs prohibitive, which hinders their ability to enter the market. Capacity expansion is slowed by the high-cost barrier, especially in developing nations with scarce resources.

Stringent regulatory requirements

Although regulations promote safety and quality, compliance is made more difficult by the continuously changing rules issued by organizations like the FDA, EMA, and WHO to meet these standards. Businesses must make significant investments in documentation validation and monitoring, which raises operating expenses. Complying with these regulations may limit the ability of smaller manufacturers to participate in the market.

Opportunities

Rising demand for biologics and biosimilars

The need for aseptic fill finish solutions is anticipated to rise as biologics take over pharmaceutical pipelines and biosimilars become more widely accepted, because biologics are extremely susceptible to contamination. Advanced sterile manufacturing is crucial for manufacturers who invest in high-capacity contamination-free technologies. This trend offers substantial growth prospects.

Increasing adoption of prefilled syringes and RTU formats

They are safe and convenient patient-friendly drug delivery formats, like ready-to-use vials, auto injectors, and prefilled syringes, that are becoming more and more popular. For aseptic fill finish producers who can create these specialized packaging solutions while preserving sterility and scalability, this trend is creating new growth opportunities.

Segment Insights

Packaging Format Insights

Why did the vials segment dominate the global aseptic fill-finish manufacturing market in 2024?

The vials segment holds the largest share in the global aseptic fill-finish manufacturing market, due to its extensive application in injectable medications, biologics, and vaccines. Their cost effectiveness, flexibility, and string compatibility with current fill finish lines are all advantages. Their long history of use in both branded and generic injectables, along with their established regulatory acceptance, further solidifies their dominance. In large-scale manufacturing, vials continue to be the recommended option for government procurement programs, clinics, and hospitals.

The prefilled syringes (PFS) segment is the fastest-growing packaging format as they enhance patient convenience, reduce medication errors, and improve dosing accuracy. Rising adoption in biologics and specialty drugs, coupled with increasing demand for self-administration among chronic disease patients, fuels growth. Pharmaceutical companies are also investing heavily in PFS-compatible fill-finish lines, supported by growing preference from healthcare providers for ready-to-use formats that optimize safety and reduce contamination risks.

Molecule/Product Type Insights

Why did the large molecules/biologics segment dominate the market in 2024?

The large molecules/biologics segment dominates the aseptic fill-finish market since they are responsible for a sizable percentage of newly approved medications, especially in the fields of immunology, oncology, and rare diseases. The demand for sophisticated fill finish systems is fueled by their intricate structures and sensitivity to contamination, which call for extremely controlled aseptic processing. Their market leadership is further cemented by rising R&D investment in cell and gene therapies, vaccines, and monoclonal antibodies.

The radiopharmaceuticals segment is emerging as the fastest-growing product type, encouraged by increased use in targeted treatments and cancer diagnosis. These medications' short half-lives and sensitivity to radiation necessitate exacting and sterile manufacturing procedures. Growth in this market is being accelerated by the growing use of nuclear imaging agents and PET in developed markets, as well as an increase in the approvals of new radiopharmaceutical treatments.

Drug Classification Insights

Why did the branded drugs segment dominate the global aseptic fill-finish manufacturing market in 2024?

The branded drugs segment dominates the aseptic fill-finish manufacturing market, driven by premium pricing strategies, robust regulatory approvals, and ongoing innovation. With the introduction of patented biologics and innovative treatments, big pharmaceutical companies continue to dominate the market, guaranteeing a steady demand for aseptic manufacturing capacity. Extensive worldwide distribution networks and steady demand in both developed and emerging markets are additional advantages for branded pharmaceuticals.

The biosimilars segment is the fastest-growing category, driven by the expiration of patents for popular biologics and regionally supportive regulatory frameworks. Demand is being fueled by cost benefits and growing adoption by healthcare systems to streamline spending. The production of biosimilars is being facilitated by manufacturers' expansion of aseptic fill being accelerated by rising patient acceptance of biosimilars in oncology, autoimmune, and metabolic disorders.

End User Insights

Why did biopharmaceutical companies dominate the aseptic fill-finish manufacturing market in 2024?

The biopharmaceutical companies segment dominates the global market, as the majority of the aseptic fill-finish capacities on a commercial scale are owned by them. A dominant position is guaranteed by their well-established infrastructure, robust R&D pipelines, and capacity to scale production for international markets. These businesses are solidifying their dominance in the industry by investing in cutting-edge facilities and implementing automation to maintain quality compliance and production efficiency.

The biotech startups segment is the fastest-growing segment, backed by government funding for novel treatments as well as venture capital investments. Rapid clinical trials and quicker commercialization are made possible by startups increasingly contracting with CDMOs to handle aseptic fill-finish services. Their quick ascent in the global fill finish ecosystem is being fueled by their agility, concentration on specialty biologics, and solid partnerships with well-established pharmaceutical companies.

Regional Insights

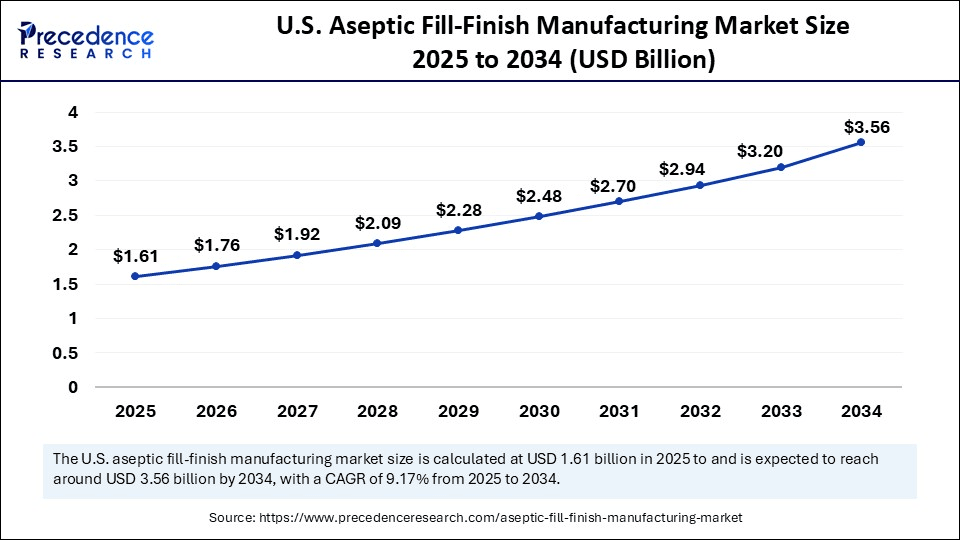

U.S. Aseptic Fill-Finish Manufacturing Market Size and Growth 2025 to 2034

The U.S. aseptic fill-finish manufacturing market size is exhibited at USD 1.61 billion in 2025 and is projected to be worth around USD 3.56 billion by 2034, growing at a CAGR of 9.17% from 2025 to 2034.

Why did North America Dominate the Aseptic Fill-Finish Manufacturing Market in 2024?

North America dominates the global aseptic fill-finish manufacturing market, supported by a sophisticated healthcare system, a large number of top pharmaceutical companies, and strict FDA regulations. Large-scale immunization campaigns, high biologics consumption, and quick adoption of innovative drug delivery technologies all serve to strengthen regional leadership. Long-term dominance is ensured by consistent investments in modernizing aseptic processing facilities.

Asia Pacific

Asia Pacific is the fastest-growing region, driven by growing centers for pharmaceutical production. Lower production costs, supportive government regulations, and the quick expansion of domestic biopharmaceutical manufacturing are important factors. Growing clinical research activities, increased healthcare spending, and a growing number of aseptic fill finish operations being outsourced to Asia CDMOs are all contributing to the region's strong market expansion.

Aseptic Fill-Finish Manufacturing Market Companies

- AbbVie

- Adragos Pharma

- Argonaut Manufacturing Services

- Baccinex

- GBI Biomanufacturing

- Grand River Aseptic Manufacturing

- Nipro PharmaPackaging

- Novo Nordisk

- Recipharm

- Sharp Services

- Symbiosis Pharmaceutical Services

Recent Developments

- On 30 June 2025, Sever Pharma Solutions announced the commercialization of a new state-of-the-art aseptic fill and finish line for prefilled syringes at its Malmö, Sweden, facility. The newly launched aseptic filling line incorporates automated visual inspection for enhanced quality control, and the state-of-the-art line complies with the highest standards for guaranteeing product quality and safety. (Source: https://www.pharmasalmanac.com)

- On 1 May 2025, Symbiosis Pharmaceutical Services announced MHRA approval for its new 20,000 sq ft GMP aseptic fill finish facility, part of a 26 million expansion. The regulatory inspection focused on the company's Bruce Building, a 20,000 sq ft facility equipped with automated fill/finish systems for the sterile manufacture of injectable drugs, including both small molecules and biologics. (Source: https://pharmasource.global)

Segments Covered in the Report

By Packaging Format

- Vials

- Glass Vials

- Plastic Vials

- Pre-filled Syringes (PFS)

- Ampoules

- Cartridges

- Pen Cartridges

- Pump Cartridges

- Bottles

- IV Bags

- Others (e.g., dual-chamber systems, microtubes)

By Molecule Type/Product Type

- Small Molecules

- Large Molecules/Biologics

- Monoclonal Antibodies (mAbs)

- Hormones

- Cytokines

- Cell and Gene Therapies

- Vaccines

- Biosimilars

- Ophthalmics

- Specialty Injectables

- Radiopharmaceuticals

- Lyophilized Products (requiring freeze-drying)

By Drug Classification

- Branded Drugs

- Generics

- Biosimilars

By Operational Stage

- Pre-clinical

- Clinical

- Phase I

- Phase II

- Phase III

- Commercial Production

By End User

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Biotech Startups

- Contract Research Organizations (CROs)

- Academic and Research Institutes

- Government and Public Health Agencies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting