Blood Cancer Diagnostics Market Size and Forecast 2025 to 2034

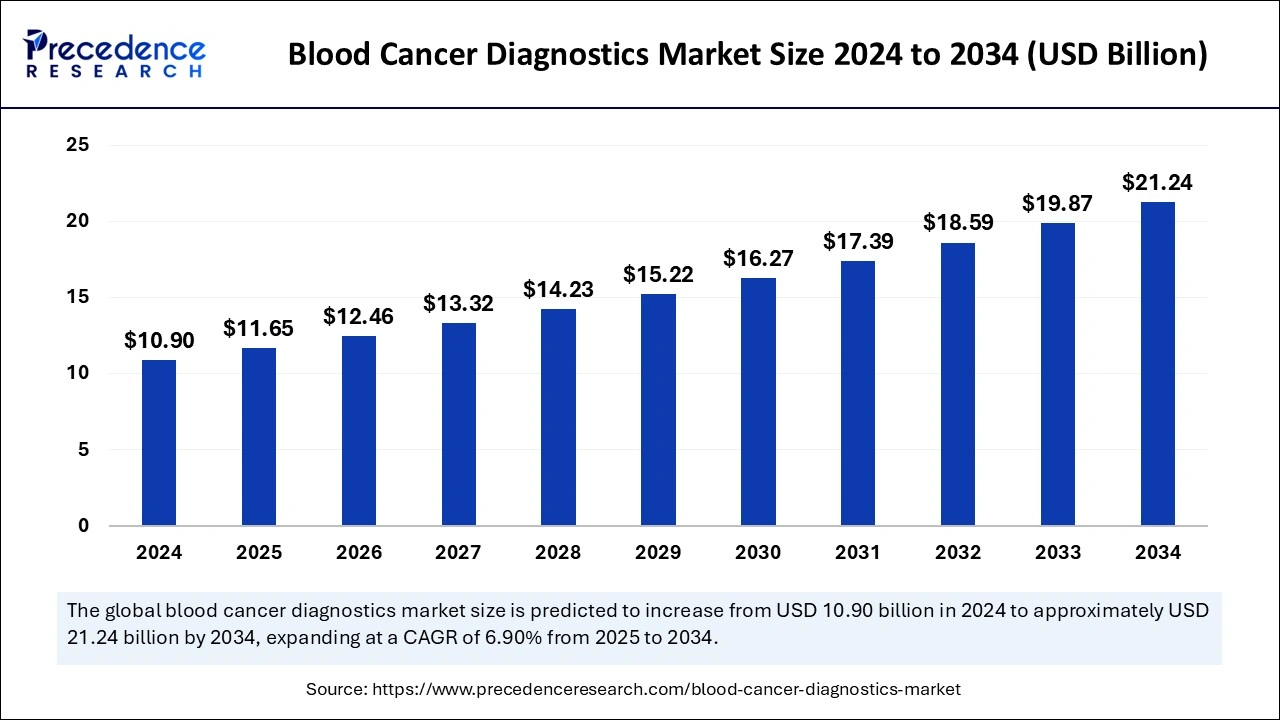

The global blood cancer diagnostics market size was estimated at USD 10.90 billion in 2024 and is predicted to increase from USD 11.65 billion in 2025 to approximately USD 21.24 billion by 2034, expanding at a CAGR of 6.90% from 2025 to 2034. The increasing incidence of blood cancer, the rising elderly population, growing awareness regarding the early screening of relevant symptoms, and rapid technological advancements in diagnostic techniques are among several factors expected to drive the growth of the global blood cancer diagnostics market throughout the projected period.

Blood Cancer Diagnostics Market Key Takeaways

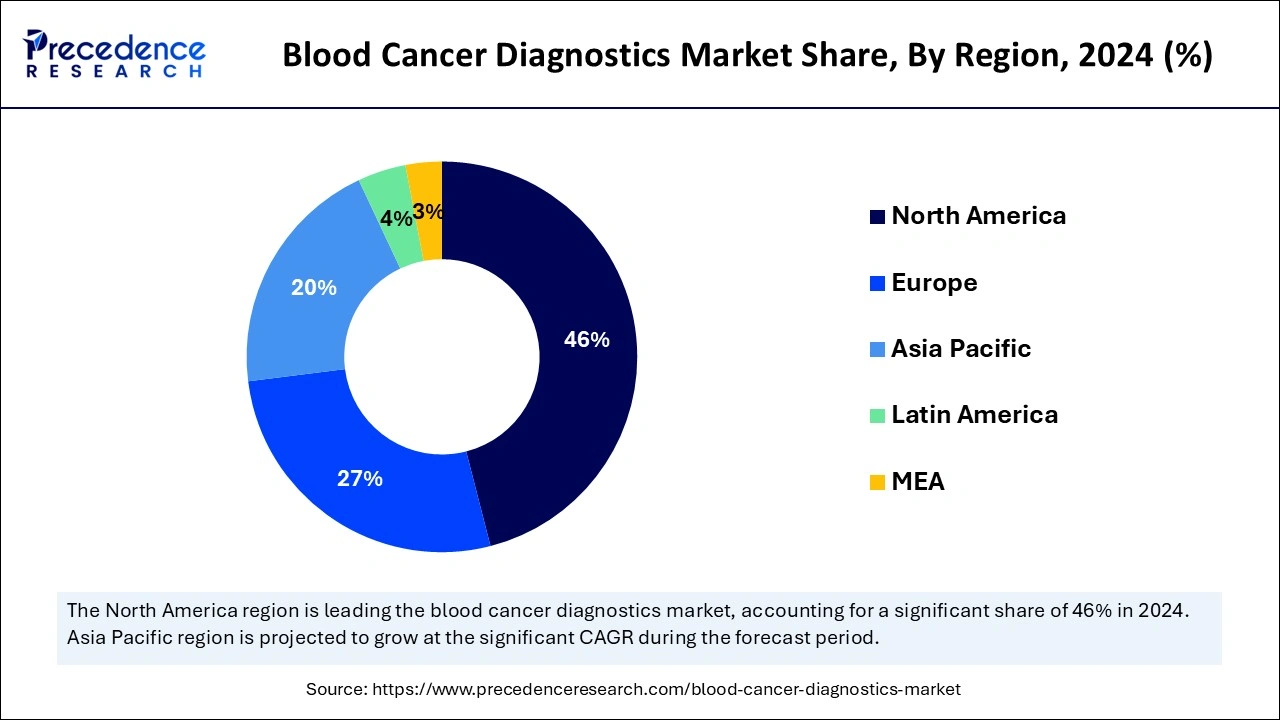

- North America led the blood cancer diagnostics market with the largest share of 46% in 2024.

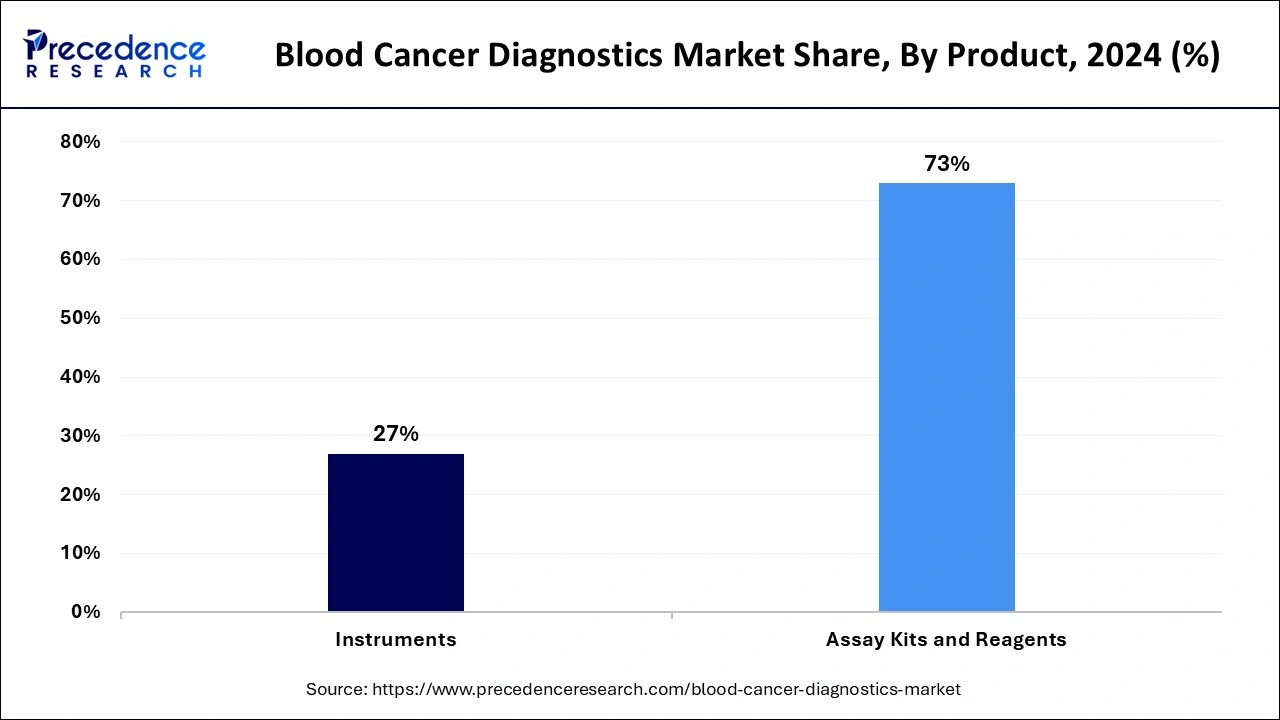

- By product, the assay kits and reagents segment accounted for the highest market share of 73% in 2024.

- By product, the instruments segment is expected to witness significant growth during the forecast period.

- By test, the blood tests segment contributed the biggest market share of 38% in 2024.

- By test, the molecular test segment will witness considerable growth over the forecast period.

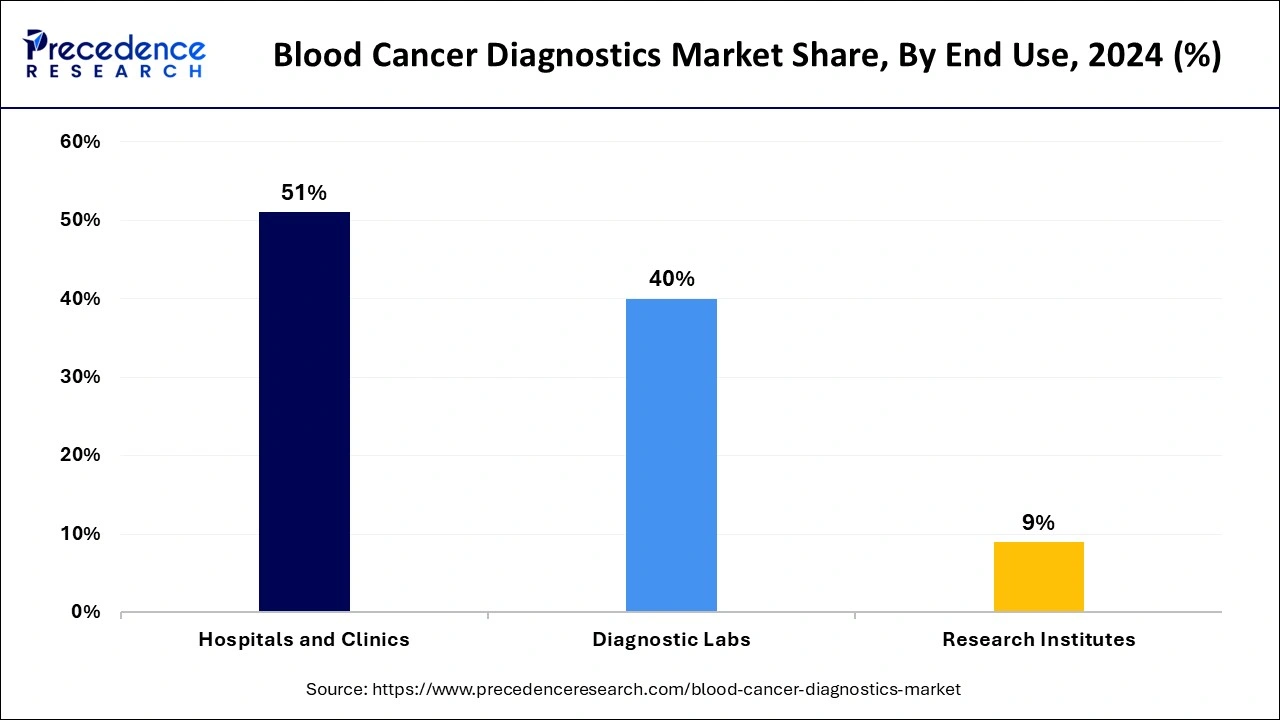

- By end use, the hospitals and clinics segment has held a major market share of 51% in 2024.

- By end use, the diagnostic labs segment is expected to grow significantly during the forecast period.

Integration of Artificial Intelligence (AI) in the Oncology Diagnostics

In recent years, the rapid evolution of health digitalization through Artificial Intelligence has brought a transformative impact in the field of cancer diagnostics and has shown promising results in the diagnosis of several different types of human cancers. The use of AI integration in the blood cancer diagnostics market presents an immense opportunity for better cancer detection and improved patient outcomes. In its initial stages, early detection can improve cancer outcomes by identifying the disease.

AI plays a vital role in medical imaging for early cancer detection, utilizing deep learning algorithms for image recognition and feature extraction. Harnessing the power of AI, particularly in tools like computer-aided diagnosis, has great potential to revolutionize early cancer detection. This technology provides improved accuracy, speed, precision, and sensitivity, which brings significant progress in accurate cancer diagnosis, treatment, and management. Therefore, the application of AI in cancer diagnostics can improve patient outcomes and reduce cancer mortality rates.

U.S. Blood Cancer Diagnostics Market Size and Growth 2025 to 2034

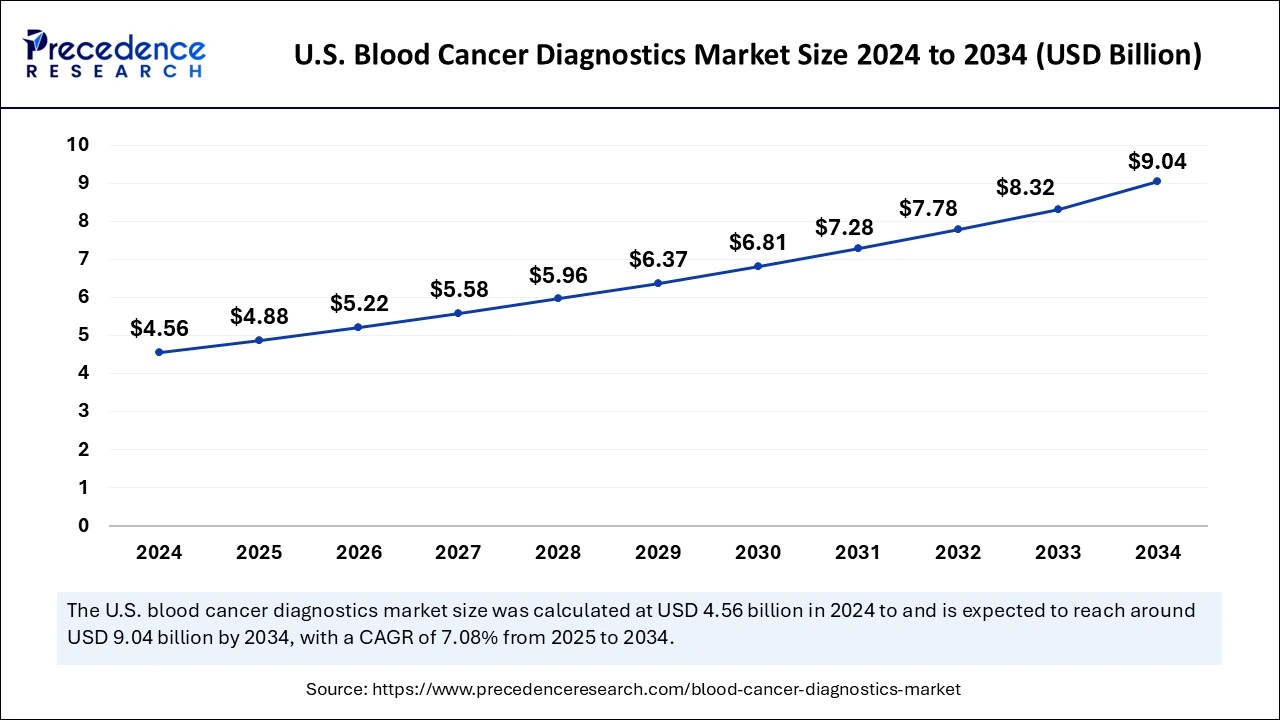

The U.S. global blood cancer diagnostics market size was exhibited at USD 4.56 billion in 2024 and is projected to be worth around USD 9.04 billion by 2034, growing at a CAGR of 7.08% from 2025 to 2034.

North America held the dominant share of the blood cancer diagnostics market in 2024. The growth of the region is attributed to the presence of sophisticated healthcare facilities, rising incidence of blood cancers such as leukemia, lymphoma, and multiple myeloma, rising private and public investments to enhance the infrastructure to support blood cancer diagnosis, rising R&D studies and trials, and rising awareness regarding early screening programs. In addition, technological advancements in diagnostic tools and techniques such as positron emission tomography (PET), NGS testing solutions, molecular testing, liquid biopsy, flow cytometry, and others are anticipated to promote regional growth during the forecast period.

- According to NIH in the United States, the estimated number of new cases in 2024 was 62,770, and the percentage of all new cancer cases was 3.1%. The estimated deaths in 2024 were 23,670, and the percentage of all cancer deaths was 3.9%.

- In November 2023, Universal DX, a biotech company on a mission to transform cancer into a curable disease, announced a strategic collaboration with Quest Diagnostics, the nation's leading provider of diagnostic information services, designed to improve colorectal cancer screening in the United States – for which more than 110 million people may be eligible.

On the other hand, Europe is observed to expand at a rapid pace in the blood cancer diagnostics market during the forecast period owing to the rising prevalence of blood cancers, rising awareness of early diagnosis of symptoms for better treatment outcomes, rapid technological advancement in diagnostic methods, and government entities advocating for routine screenings and early diagnoses. The region's extensive range of advanced diagnostic facilities, along with skilled professionals and treatment options, allows the development of personalized treatment plans that cater to each patient's unique needs.

- In October 2024, The two new clinical trials aim to improve the early detection of cancer due to the nearly £4m of funding from the National Institute for Health and Care Research (NIHR) and Office for Life Sciences (OLS). The MODERNISED and miONCO-Dx trials will use advanced techniques to see if certain cancers can be diagnosed in their earliest stages when treatment is much more likely to be successful.

Market Overview

The blood cancer diagnostics market includes several advanced diagnostic tests and techniques to diagnose and detect various human blood cancers. These tests may include blood tests, imaging tests, biopsy, and molecular tests. There are three major types of blood cancers: leukemia, lymphoma, and multiple myeloma. Each type begins in the bone marrow or blood when these cells fail to grow normally. Accurate and efficient diagnostic testing is widely utilized to confirm the presence of diseases and monitor the disease's progression.

Blood Cancer Diagnostics Market Growth Factors

- The increase in R&D activities coupled with rising investment in advanced healthcare facilities in developing nations creates significant growth opportunities for market players.

- The supportive government framework is expected to boost the growth of the market. Several government agencies aim to strengthen the healthcare infrastructure by providing adequate funding.

- The rising elderly population is anticipated to accelerate the expansion of the blood cancer diagnostics market in the coming years. The aging population is more susceptible to chronic diseases, including blood cancer, such as leukemia, lymphoma, and myeloma.

- The rising awareness regarding the early screening of the disease will drive the market growth expansion in the coming years. Early and accurate diagnosis is crucial for determining the stage and the most appropriate treatment method to reduce the potential mortality and improve the survival rate of these patients

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 21.24 Billion |

| Market Size in 2025 | USD 11.65 Billion |

| Market Size in 2024 | USD 10.90 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.90% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Test, End Use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for blood cancer diagnostic tests

The growing demand for blood cancer diagnostic tests is expected to drive the growth of the blood cancer diagnostics market during the forecast period. The surge in blood cancer diagnostic tests is majorly driven by the increasing prevalence of leukemia, lymphoma, and multiple myeloma across the globe. Blood cancer has become a major health concern, often resulting from aging, genetic and environmental factors. Leukemia is one of the most common types of blood cancer worldwide. The diagnostic techniques for blood cancer include imaging tests such as X-rays, CT scans, Magnetic Resonance Imaging (MRI), biopsies such as bone marrow biopsies, lymph node biopsies, and blood tests.

According to the data released by the World Health Organization (WHO) cancer agency, the International Agency for Research on Cancer (IARC), in February 2024:

- There were around 20 million new cases of cancer and approximately 9.7 million deaths in 2022. It is reported that about one in five people will develop cancer during 970,000 their lifetime.

- Lung cancer was the most commonly occurring cancer worldwide, with 2.5 million new cases accounting for 12.4% of the total new cases. Female breast cancer ranked second (2.3 million cases, 11.6%), followed by colorectal cancer (1.9 million cases, 9.6%), prostate cancer (1.5 million cases, 7.3%), and stomach cancer (970,000 cases, 4.9%).

- Over 35 million new cancer cases are predicted in 2050, a 77% increase from the estimated 20 million cases in 2022. The rapidly growing global cancer burden reflects both population aging and growth, as well as changes to people's exposure to risk factors, several of which are associated with socioeconomic development. Tobacco, alcohol, and obesity are key factors behind the increasing incidence of cancer, with air pollution still a key driver of environmental risk factors.

Restraint

High cost

The high cost associated with blood cancer diagnostic tests is anticipated to hamper the market's growth. In addition, the absence of skilled professionals and inadequate healthcare facilities in middle and lower-income countries may restrict the expansion of the global blood cancer diagnostics market.

Opportunities

Rapid technological advancement

The rapid technological advancement is projected to offer lucrative opportunities to the blood cancer diagnostics market during the forecast period. Several market leaders are developing new and innovative diagnostic techniques and tests to improve the speed, precision, and accuracy of blood cancer diagnosis. The advanced diagnostics of blood cancer encompasses a wide range of tests and procedures designed to diagnose, detect, and monitor the disease affecting the blood, bone marrow, and lymphatic system. The early detection of cancer becomes essential to ensure that the rate of treatment success is up and mortality is reduced. Technological advancements, including NGS and other molecular diagnostic techniques, are improving the efficiency and accuracy of blood cancer diagnosis.

- In July 2024, To help accelerate research into new treatments for Acute Myeloid Leukemia (AML) and Myelodysplastic Syndrome (MDS), Thermo Fisher Scientific Inc., the world leader in serving science, is partnering with the National Cancer Institute (NCI) – part of the National Institutes of Health – on the myeloMATCH (Molecular Analysis for Therapy Choice) precision medicine umbrella trial.

Product Insights

The assay kits and reagents segment accounted for the dominating share of the blood cancer diagnostics market in 2024, owing to the rising demand for accurate and rapid diagnostic tests. Assay kits & reagents are widely used to detect specific biomarkers, genetic mutations, and other indicators, assisting healthcare specialists in more effectively diagnosing and treating the disease. In addition, the rapid technological advancements and several strategic initiatives by the several manufacturers, such as expansion, product approvals, and collaboration, to develop these kits & reagents provide a wide range of products that serve the diverse diagnostic needs of patients.

On the other hand, the instruments segment is expected to witness significant growth during the forecast period. Instruments play a vital role in the accurate detection and monitoring of blood cancers, including lymphoma, leukemia, and multiple myeloma. In addition, molecular diagnostic instruments, including PCR machines and NGS systems, serve as important resources for identifying genetic abnormalities associated with blood cancers, which also accelerates the development of personalized treatment strategies.

Test Insights

The blood tests segment dominated the blood cancer diagnostics market in 2024 and is projected to continue its dominance over the forecast period. The growth of the segment is majorly driven by the rising incidence of blood cancers, which increases the demand for early and accurate diagnosis of blood tests. CBC tests can detect abnormalities in blood cell counts and indicate the presence of blood cancer. Moreover, the improvement of specialized blood tests, including multicancer detection, has significantly transformed the diagnosis and monitoring of blood cancers.

On the other hand, the molecular test segment will witness considerable growth over the forecast period. Molecular tests have substantially revolutionized the diagnosis of blood cancers. Molecular tests analyze blood samples to detect genetic abnormalities, proteins, or other molecules. These tests can help diagnose cancer, plan treatment, and monitor treatment response. In addition, techniques including Fluorescence in Situ Hybridization (FISH), PCR, and NGS are extensively used to identify gene mutations, chromosomal translocations, & gene rearrangements characteristic of certain blood cancers. Thus, molecular tests assist in the diagnosis and management of blood cancers and empower researchers and clinicians to effectively diagnose blood cancer, prepare plans for treatment, and monitor treatment response.

End Use Insights

The hospitals and clinics segment held the largest share of the blood cancer diagnostics market in 2024, and this segment is expected to sustain its position throughout the forecast period. The rapid growth of the segment is majorly driven by the rising acceptance and value of advanced cancer diagnostics in hospitals. The increasing developments in the laboratories of cancer care hospitals play a vital role in meeting the evolving needs of patients, and hospitals aim to provide a wide range of advanced diagnostic services in their settings. The major benefit offered by hospitals is the ability to perform cancer diagnoses and offer tests and results even in emergencies. Hospitals are incorporating advanced diagnostic technologies to enhance the precision and accuracy of blood cancer detection. This surge in the investment in groundbreaking diagnostic equipment and rising focus on early detection and personalized treatment plans for better treatment outcomes.

On the other hand, the diagnostic labs segment is expected to grow significantly during the forecast period owing to the rising testing and the presence of cutting-edge technologies for conducting tests. Moreover, the increasing volume of diagnostic tests conducted in diagnostic labs, coupled with the rising demand for testing instruments, is expected to propel the market demand during the forecast period.

Blood Cancer Diagnostics Market Companies

- Illumina

- InVivoScribe

- Ipsogen (Qiagen)

- Asuragen(Bio-Techne)

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Abbott

- Sequenta (Adaptive Biotechnologies)

- SkylineDx,

- Bio-Rad Laboratories

- Alercell, Sophia Genetics

Latest Announcements by Industry Leaders

- In August 2024, Accenture Ventures made a strategic investment in Earli Inc., a biotechnology company that has developed an innovative approach to early cancer detection. Earli's technology features a synthetic targeting platform that selectively reprograms cancer cells, prompting them to reveal and ultimately destroy themselves. This investment will help expand collaborations with global health and pharmaceutical companies, enabling them to utilize Earli's technology for faster and more accurate cancer detection and treatment.

Recent Developments

- In January 2025, Adaptive Biotechnologies Corporation, a commercial-stage biotechnology company that aims to translate the genetics of the adaptive immune system into clinical products to diagnose and treat disease, and NeoGenomics, Inc., a leading oncology testing services company, announced a multi-year exclusive strategic commercial collaboration that will advance minimal residual disease (MRD) monitoring options for patients with select blood cancers.

- In January 2025, the projects were awarded funding as part of a first-of-its-kind Small Business Research Initiative (SBRI) Cancer Challenge, funded by the Welsh Government and Northern Ireland Department for the Economy. Five innovative projects across Wales and Northern Ireland have been awarded a share of £1 million to develop technology to reduce waiting times and improve outcomes for cancer patients.

Segments Covered in the Report

By Product

- Instruments

- Assay Kits and Reagents

By Test

- Blood Tests

- Imaging Tests

- Biopsy

- Molecular Test

By End Use

- Hospitals and Clinics

- Diagnostic Labs

- Research Institutes

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content