What is the Braiding Machine Market Size?

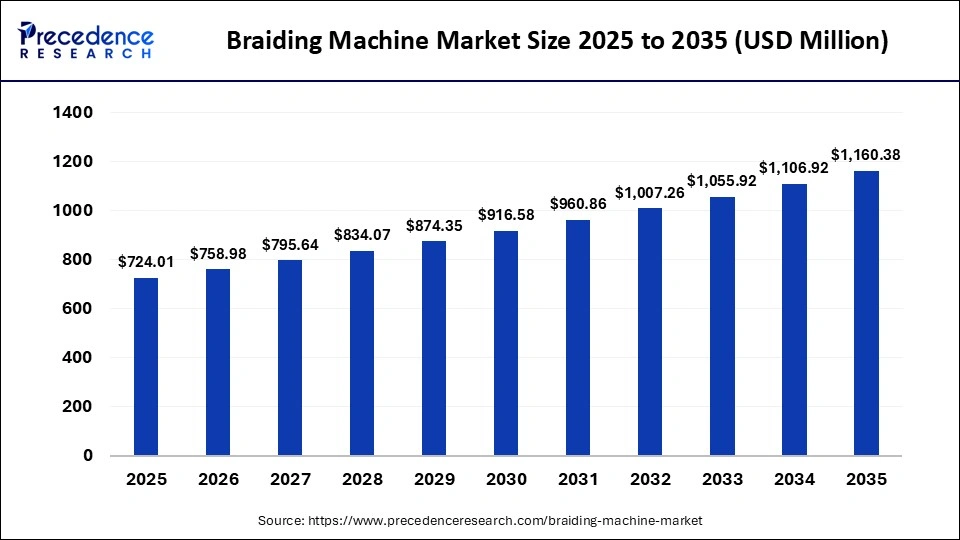

The global braiding machine market size was calculated at USD 724.01 million in 2025 and is predicted to increase from USD 758.98 million in 2026 to approximately USD 1160.38 million by 2035, expanding at a CAGR of 4.83% from 2026 to 2035.The market is driven by growing demand for high-strength braided products in automotive, aerospace, medical, and industrial applications.

Market Highlights

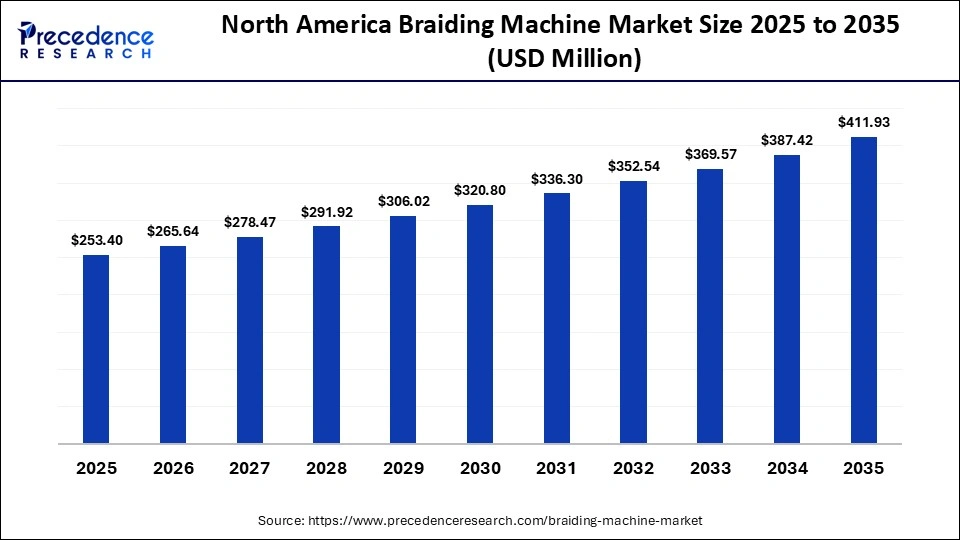

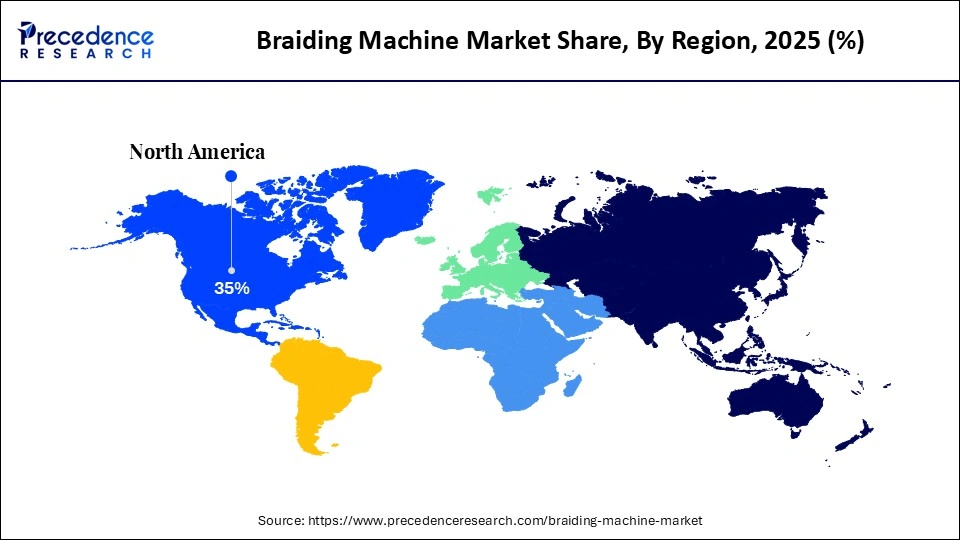

- North America accounted for the largest share of 35% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By product type, the horn gear braider segment registered dominance in the market in 2025.

- By product type, the Wardwell rapid braider segment is expected to grow at a rapid pace in the coming years.

- By end user industry, the textile segment dominated the market in 2025.

- By end user industry, the electrical segment is expected to grow at a significant rate during the forecast period.

- By distribution channel, the direct sales (OEM) segment led the market in 2025.

- By distribution channel, the indirect sales segment is expected to grow at the fastest rate in the upcoming years.

Market Overview

The braiding machine market encompasses machinery used to interlace yarns, wires, or fibers to produce braided products for industries such as automotive, aerospace, medical, and construction. These machines offer benefits like enhanced product strength, flexibility, durability, and precision in manufacturing complex shapes and high-performance materials. Ongoing production of automobiles and aircraft is raising the need for high-performance braided products, such as shielded cables, wire harnesses, & composite materials. Another key catalyst is the rapid shift toward lightweight and durable materials in manufacturing, especially carbon fiber and special yarns, which fosters the adoption of advanced 3D braiding technologies.

Major Components and Functions of Braiding Machine

Braiding machine mainly encompasses carriers, such as bobbin holders to transport yarn, bobbins for material storage, horn gears to propel carriers, and a track plate, i.e., braider head to clear movement paths. Moreover, these machines offer weaving of several strands, like yarns, wires, fibers, in a diagonal or circular pattern to develop a cohesive, braided structure. Also, the market explores the use of metallic wires, like tinned copper, in cables for Electromagnetic Compatibility (EMC) and mechanical protection.

How is AI Influencing the Braiding Machine Market?

AI supports improvement in 3D braiding, mainly for complex, non-axisymmetric shapes. Alongside, AI-powered systems help in calculating exact speed profiles, lowering angle errors to as low as 0.7°-1.0°. Moreover, the adoption of machine learning is fostering the detection of yarn defects and inconsistencies in real-time. Researchers are leveraging modified U-shaped networks (U-Net) to track surface parameters, such as pitch length, during mass production.

Major Trends in the Braiding Machine Market

- Automation and CNC Integration: There is increasing adoption of CNC‑controlled braiding machines that offer greater precision, reduced labor dependency, and improved production efficiency for complex braided structures.

- Pushing Sustainability & Energy Efficiency: Currently, numerous manufacturers are preferring eco-friendly designs to reduce material waste & enhance energy usage.

- Spurring 3D Braiding Technology Breakthrough: Day by day, extensive research activities are emphasizing the development of 3D braiding machines quicker and more capable of producing complex, near-net-shape preforms, like T-profile, bifurcated pipes.

- Progression of Collision Avoidance & Control: The market is designing algorithms and software for real-time collision testing of carriers, primarily for complex, multi-state, or lace-type braiding patterns.

- Smart Manufacturing & IoT Connectivity: Integration of IoT sensors and real-time monitoring systems allows predictive maintenance, remote diagnostics, and better-quality control, supporting Industry 4.0 adoption.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 724.01 Million |

| Market Size in 2026 | USD 758.98 Million |

| Market Size by 2035 | USD 1160.38 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.83% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | End User Industry, Distribution channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

Which Product Type Led the Braiding Machine Market in 2025?

The horn gear braider segment led the market by capturing the largest share in 2025. This is because of its superior flexibility in developing complex 2D & 3D shapes, high-speed, and consistent, high-quality output for industrial textiles, cords, & hoses. Also, it enables independent carrier movement to evolve intricate patterns. Its proven performance, versatility in handling various materials, and widespread adoption across industries made it the preferred choice for manufacturers seeking efficiency and durability in braiding operations.

On the other hand, the Wardwell rapid braider segment is expected to expand at a rapid pace in the upcoming period. This is because of its enhanced durability from specialized lubricants like Wardwell Red Oil, which extend machine life and reduce downtime. Recent innovations, such as an advanced lubrication system for 16- and 24-carrier Rapid Braider/Speedmaster models, allow direct oil flow to cams and driver bars, further improving performance and reliability. This combination of longevity, efficiency, and low maintenance is driving increased adoption across industries.

End User Industry Insights

Why Did the Textile Segment Dominate the Market in 2025?

The textile segment dominated the braiding machine market while capturing a major revenue share in 2025. This is mainly due to the increased demand for ready-made clothing, fashion apparel, and home textiles in emerging nations, especially China, India, Bangladesh, & Thailand, which significantly propelled the need for increased production capacities. Many leading firms employ Maypole (horn gear), Cartesian, and Wardwell braiders for items, including laces, ropes, technical composites, & apparel components. Additionally, the growing focus on advanced and high-performance fabrics for protective gear and industrial uses further reinforced the segment's market leadership.

However, the electrical segment is expected to grow at a significant rate over the forecast period, driven by the increasing demand for braided wires, cables, and shielding components used in power transmission, electronics, and renewable energy systems. Braided products provide enhanced conductivity, flexibility, and durability, making them ideal for electrical applications. Rising electrification across industries, including automotive, aerospace, and consumer electronics, is further accelerating the adoption of braiding machines in this sector.

Distribution Channel Insights

Why Did the Direct Sales (OEM) Segment Lead the Market in 2025?

In 2025, the direct sales (OEM) segment led the braiding machine market by holding the dominant share. This is because manufacturers prefer purchasing directly from original equipment manufacturers to ensure product quality, customization, and after-sales support. Direct OEM sales also allow for tailored solutions, faster delivery, and integration of advanced features like CNC controls and automation. Companies like Susmatex Machinery, Jayson Engineering, & Geesons Engineering are facilitating direct sales of high-speed braiding machines for textiles and wire.

The indirect sales segment is expected to expand at the fastest rate in the coming years due to the expanding network of distributors, dealers, and resellers that make machines more accessible to small and mid-sized manufacturers. This channel offers flexible purchasing options, localized support, and faster availability, especially in emerging markets. Increasing demand for turnkey solutions and regional after-sales services is further driving the growth of indirect sales.

Regional Insights

How Big is the North America Braiding Machine Market Size?

The North America braiding machine market size is estimated at USD 253.50 million in 2025 and is projected to reach approximately USD 411.93 million by 2035, with a 4.98% CAGR from 2026 to 2035.

Why Did North America Dominate the Braiding Machine Market?

North America dominated the braiding machine market by capturing the largest share in 2025. The region's leadership in the market is driven by strong demand for advanced, automated, and IoT-enabled machinery across aerospace, automotive, defense, and medical device industries. Innovations such as the hexagonal braider, developed by institutions like the University of British Columbia (Canada) and ITA (Germany), enable the production of structural components with high delamination resistance, further supporting the region's leadership in high-performance braided applications.

What is the Size of the U.S. Braiding Machine Market?

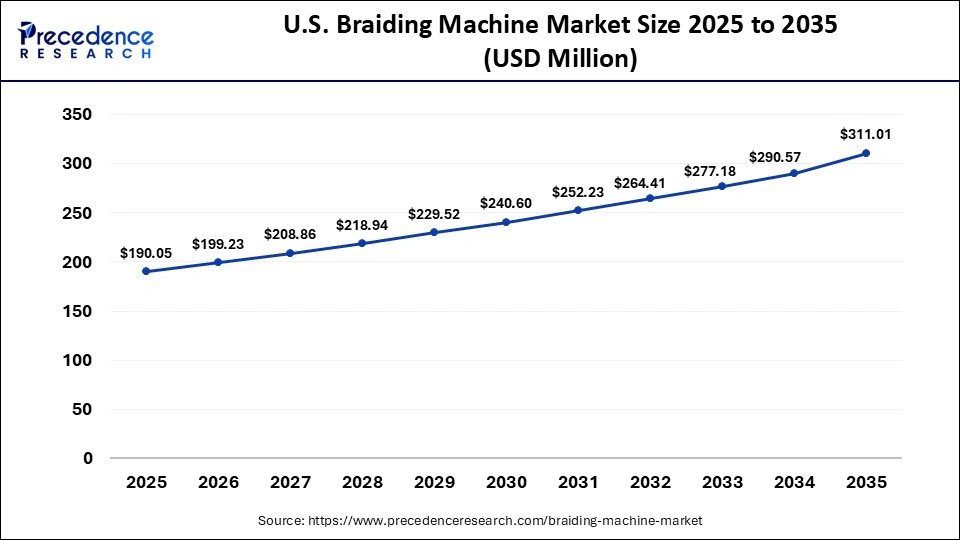

The U.S. braiding machine market size is calculated at USD 190.05 million in 2025 and is expected to reach nearly USD 311.01 million in 2035, accelerating at a strong CAGR of 5.05% between 2026 and 2035.

U.S. Braiding Machine Market Analysis

The U.S. is a major contributor to the North American market due to increasing demand for high-performance braided products in automotive, aerospace, defense, and medical industries. Manufacturers in the country have been putting efforts into novel designs, like a "chain and sprocket" mechanism, to allow robust vertical braiding, as it is important for braiding over mandrels & inline integration with pultrusion processes.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to witness the fastest growth in the braiding machine market. This is because of the rapid industrialization, urbanization, and increasing textile production in China and India. There is a strong emphasis on developing smart braiding machines using IoT sensors for real-time monitoring of yarn tension and performance, enabling predictive maintenance and minimal downtime. Although Wuxi Longterm Machinery Technologies Co., Ltd is encouraging the progression of specialized wire braiding machines for high-pressure hose production.

Japan is a key player in the Asia Pacific braiding machine market, driven by advanced R&D in four-step 3D braiding techniques for carbon fiber to create integrated structures with high electromagnetic interference (EMI) shielding. Japanese researchers have also developed innovative rotary 3D braider models using parametric programming to arrange cut-circles, allowing more carriers and the production of more intricate shapes than previous designs. These technological advancements strengthen Japan's position in high-performance and precision braiding applications.

Braiding Machine Market Value Chain Analysis

- Raw Material & Component Supply

This stage involves sourcing essential materials such as steel wires, high-performance fibers, mechanical parts, and electronic components, which form the foundation for machine production.

- Manufacturing & Assembly

Braiding machine manufacturers design, engineer, and assemble the equipment, integrating mechanical, electrical, and control systems.

- Technology Integration & Automation

Specialized technology providers and OEMs integrate CNC controls, IoT connectivity, and advanced automation features into the machines, enhancing precision, monitoring, and efficiency for modern industrial applications.

- Distribution & Sales

Distributors, regional dealers, and direct OEM sales teams deliver machines to end-users across industries such as automotive, aerospace, textiles, and medical, often providing installation and initial training to ensure smooth deployment.

- After-Sales Service & Support

Manufacturers and service providers offer maintenance, spare parts, software updates, and technical support to optimize machine performance and lifespan.

Who are the Major Players in the Global Braiding Machine Market?

The major players in the braiding machine market include Mayer & Cie. GmbH & Co. KG, Wardwell Braiding Co., The Steeger USA, Braidwell Machines Co., Cobra Braiding Machinery Ltd., TapeFormers Ltd, Alfa Flexitubes Pvt. Ltd., Kyang Yhe Delicate Machine Co., Ltd,. Talleres Ratera, S.A., HERZOG GmbH

Recent Developments

- In July 2025, Mayer & Cie celebrated its 120th anniversary and introduced its fourth generation of family ownership, which specializes in the production and sale of circular knitting & braiding machines.

- In July 2025, Mayer & Cie. delivered its first MR-15 braiding machine with 48 carriers, following the earlier shipment of an MR-11 system with 48 coil carriers in late 2024.

- In March 2025, Greenland (Xiamen) Technology Co., Ltd. launched the BFB-200L Series Vertical CNC Braiding Machines, designed for efficient production of high-pressure hoses, corrugated tubes, and large-diameter cables, supporting materials from stainless steel wire to advanced composites like aramid fiber.

Segments Covered in the Report

By Product Type

- Horn gear braider

- Maypole braider

- Square braider

- Wardwell Rapid Braider

- 4Track and column braider

- Wire braiding machines

By End User Industry

- Textile

- Sporting

- Automotive

- Medical

- Aerospace

- Electrical

- Marine Sector

- Others

By Distribution channel

- Direct sales (OEM)

- Indirect sales

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting