List of Contents

What Bronchial Biopsy Devices Market Size?

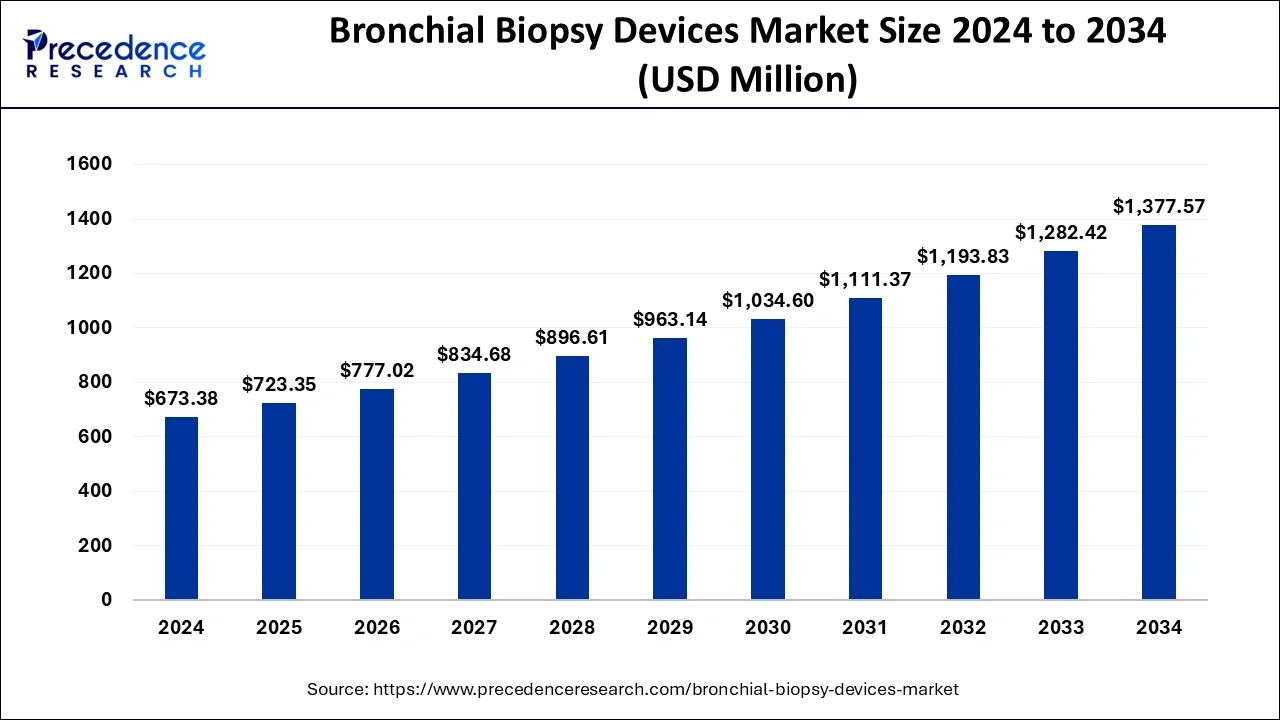

The global bronchial biopsy devices market size is calculated at USD 723.35 million in 2025 and is predicted to increase from USD 777.02 million in 2026 to approximately USD 1,468.35 million by 2035, expanding at a CAGR of 7.34% from 2026 to 2035.The bronchial biopsy devices market is growing because of the rising incidence of respiratory illnesses and lung cancer, as well as improved technologies, an increasing number of elderly, and growing awareness of people towards health, which also contributes to growth in demand.

Bronchial Biopsy Devices Market Key Takeaways

- In terms of revenue, the global bronchial biopsy devices market was valued at USD 723.35 million in 2025.

- It is projected to reach USD 1,468.35 million by 2035.

- The market is expected to grow at a CAGR of 7.34% from 2026 to 2035.

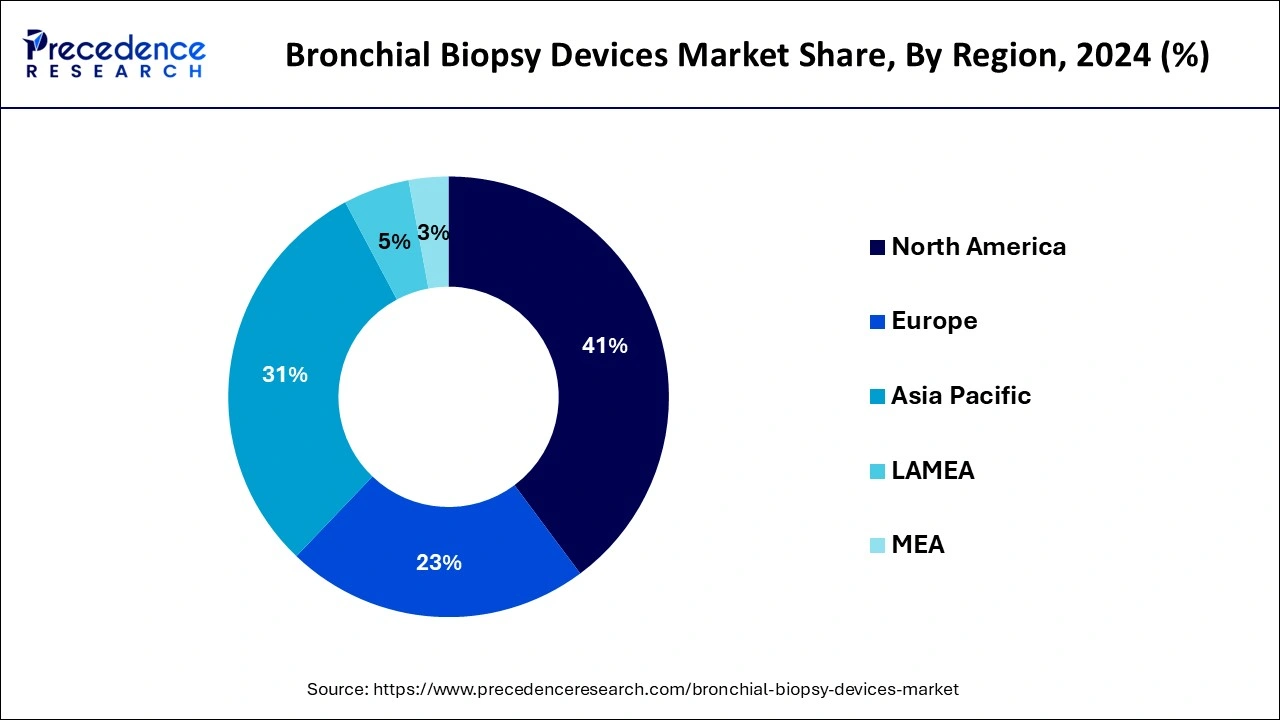

- North America dominated the global market with the largest market share of 41% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By product, the transbronchial needle aspiration (TBNA) needles segment contributed the highest market share of 63% in 2025.

- By product, the biopsy forceps product segment is expected to grow at a notable CAGR during the forecast period.

Market Overview

A biopsy is defined as a medical operation carried out to remove tissues from an organ to determine the existence of a disease, specifically inflammatory and neoplastic diseases. Lung Biopsy is the extraction of the lung tissues to diagnose any lung disease, infection, or cancer. Increased incidence of cancer, especially the breast, prostate, and lung, coupled with increased technological development in biopsy, has propelled the bronchial biopsy devices market. This surgical procedure is mandatory for detecting some diseases, including coeliac disease, malignancies, etc, and is mainly carried out by radiologists, surgeons, and interventional cardiologists.

The constantly rising incidence of lung diseases requires new diagnostic tools. The cases of respiratory diseases such as lung cancer and interstitial lung disease are on the rise worldwide, and there is a need for prompt and accurate lung biopsies. This diagnostic procedure is necessary for determining the presence, extent, and nature of lung diseases, posing insights that are crucial for effective treatment planning.

How is AI Impacting the Bronchial Biopsy Devices Market?

The increasing accuracy and reducing tissue trauma in the bronchial biopsy devices market when AI-powered systems were used. Compared to other surgical methods, the robotic system allows precise control, which is essential, especially when the lesion is hard to locate. In addition to enhancing the physician diagnostic capabilities, the ability of patient treatment and management is also impacted positively by AI integration in the robotic system to add further value to these biopsies. They use AI algorithms for target identification, image processing, calculation of the optimal path for needle placement, and operation feedback. Robotic technology and AI can be potential implementations to overcome human mistakes.

- In April 2022, the MicroPort Trans-bronchial Surgical Robot, a robotic-assisted bronchoscopy navigation system jointly developed by Shanghai MicroPort MedBot (Group) Co., Ltd., was used in a robot-assisted trans-bronchial biopsy for lung nodules. It offers a system to perform lung disease treatment because it integrates all the intelligent support for the operation, including preoperative planning, respiratory compensation, and intraoperative surgery.

Bronchial Biopsy Devices Market Growth Factor

- Rising incidence of respiratory diseases: COPD, asthma, and lung cancer are becoming more prevalent, and bronchial biopsy is needed to confirm these diseases more often.

- Aging population: The average global population is aging, and as people age, they are more likely to have respiratory diseases that require diagnostic or therapeutic procedures that require biopsy devices.

- Improved healthcare infrastructure: Rising healthcare infrastructure and the development of technologies in developing nations are aiding in the availability of various complicated medical devices, such as bronchial biopsy tools, that are helping the growth of the bronchial biopsy devices market.

- Government and insurance coverage: As more governments and insurance companies recognize the importance of covering respiratory diseases with treatment and diagnostic procedures, bronchial biopsy devices are becoming available to a new population base.

Market Outlook

The bronchial biopsy devices market is expanding rapidly due to rising prevalence of respiratory diseases, increasing demand for minimally invasive diagnostic procedures, and technological advancements in biopsy tools. The growing adoption of flexible, precise devices for early detection of lung disease is driving global market growth.

The market is growing worldwide because of increasing cases of lung cancer, chronic obstructive pulmonary disease (COPD), and other respiratory disorders, along with rising awareness about early diagnosis. Emerging regions offer significant opportunities as healthcare infrastructure improves, awareness increases, and adoption of advanced diagnostic technologies accelerates.

Major investors include medical device manufacturers, healthcare technology firms, and private equity investors who fund R&D, clinical trials, and the commercialization of advanced bronchial biopsy tools. Their investments enhance device accuracy, expand product availability, and accelerate adoption in hospitals, diagnostic centers, and specialty clinics globally.

Market Scope

| Report Coverage | Details |

| Market Size by 2026 | USD 777.02 Million |

| Market Size in 2025 | USD 723.35 Million |

| Market Size in 2035 | USD 1,468.35 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.34% |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising incidence of respiratory diseases

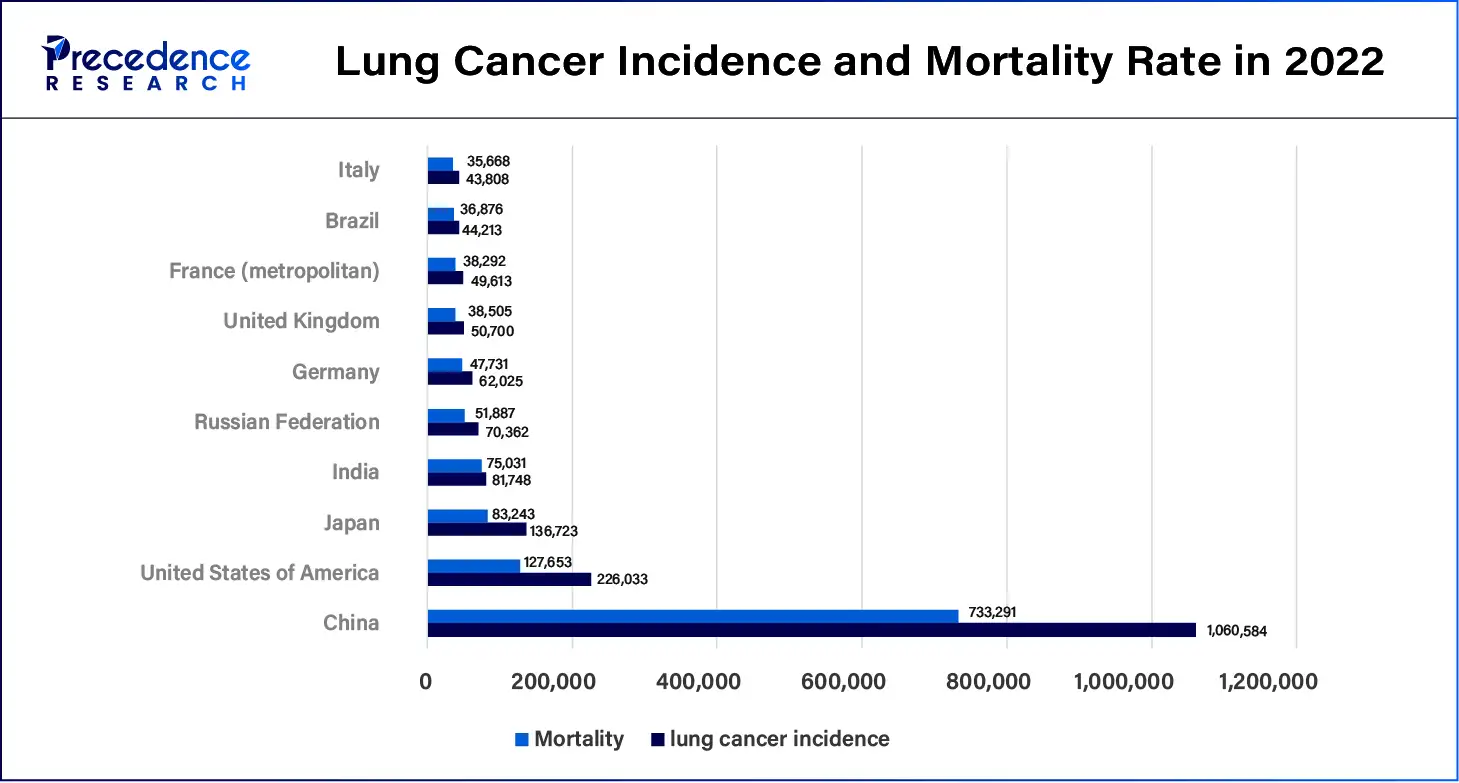

Lung cancer continues to become one of the most prevalent types of cancer, and the incidence rate is still rising. Long-term respiratory diseases include chronic obstructive pulmonary disease (COPD), lung cancer, asthma, and interstitial lung disease. Such an increase in respiratory diseases has put more demand for higher and more accurate methods of diagnosis. The leading factors that may have resulted in this rise include increased environmental pollution, smoking, working conditions, and demographic factors. Bronchial biopsy devices facilitate accurate diagnosis early enough for intervention. Lung ailments, including COPD, asthma, and lung malignancy, are progressively being realized in the global populace. The growing operation of bronchial biopsies for diagnosing lung cancer and related conditions.

- The GLOBOCAN 2022 database reveals that lung cancer was the most common cancer identified in 2022, with almost 2.5 million people diagnosed, or one in eight cancers identified globally (12.4% of all cancers globally).

Restraints

Cost constraints

The growth of the bronchial biopsy devices market is limited by high production and purchasing costs, especially for devices that are equipped with the latest technologies. These advanced devices are expensive to develop. The maintenance, training, and other operational costs of these advanced biopsy devices also augment the overall medical care expenses. Many of these devices are costly, putting a financial burden on both healthcare centers and patients to acquire the diagnostic tools that are needed to improve the generation and application of diagnostic procedures.

Opportunity

Rising demand for minimally invasive device

This shift towards minimally invasive techniques is contributing to the expansion of the bronchial biopsy devices market. The biopsy devices are tissue-sparing, which means that the recovery is quicker, skin closures are better with less scar tissue, and the chances of complications are much less than with an open biopsy. As a result, there is a rising preference for these devices among both patients and healthcare providers.

Innovations in bronchial biopsy devices are making processes less invasive, which aids both patients and healthcare providers. Further specific instruments and techniques lessen patient discomfort and recovery times. The trend towards minimally invasive procedures will continue to gain traction. The bronchial biopsy devices market is estimated to develop significantly over the period due to the rising inclination for minimally invasive diagnostic procedures.

Segment Insights

Product Insights

In the bronchial biopsy devices market, the transbronchial needle aspiration (TBNA) needles segment held the dominating share in 2025. Transbronchial needle aspiration is the method of taking tissue through a needle, which passes through the bronchial wall. It is used to obtain tissue from lung or hilar/mediastinal lesions that are near the endobronchial tree. The development of this segment can be attributed to the advantages of EBUS-TBNA over conventional TBNA and other biopsy methods like mediastinoscopy. Transbronchial needle aspiration (EBUS-TBNA) is a technique that integrates bronchoscopy with ultrasonography, where biopsy is done using a thin needle in real-time visualization of the airway, mediastinum, and lungs.

- In September 2023, Broncus Medical released the new BioStar Transbronchial Aspiration Needle (TBNA), suitable for minimally invasive diagnostics. Medical experts can use the new needle to take accurate tissue samples and quality specimens essential for diagnosing and staging lung cancer. The needle can seamlessly incorporate with endobronchial ultrasound bronchoscopy (EBUS) procedures, improving clinical outcomes and patient care.

The biopsy forceps product segment is expected to grow at a notable rate in the bronchial biopsy devices market during the forecast period. The Biopsy Forceps consists of the manufacturing and sales of tools that are used to biopsy tissues and remove them for diagnosis, especially in instances of cancer as well as other diseases. These are crucial in an ailment diagnosis, as they ensure accuracy and efficiency in sampling. The market comprises various types of forceps, jaws, and needles depending on the diseases/health conditions and procedural requirements. The developments in the biopsy forceps, including accuracy and the ability to perform less invasive biopsies, continue to increase the use of biopsies among healthcare providers.

- In July 2024, Boston Scientific Corporation introduced the United States launching of a new model of its Radial Jaw Single Use Biopsy Forceps with more jaw volume and an enhanced jaw design related to the market-leading Radial Jaw 3 Forceps. Radial Jaw 4 Forceps are intended to allow the collection of large-high-quality tissue specimens without the necessity to use large channel therapeutic endoscopes.

Region Insights

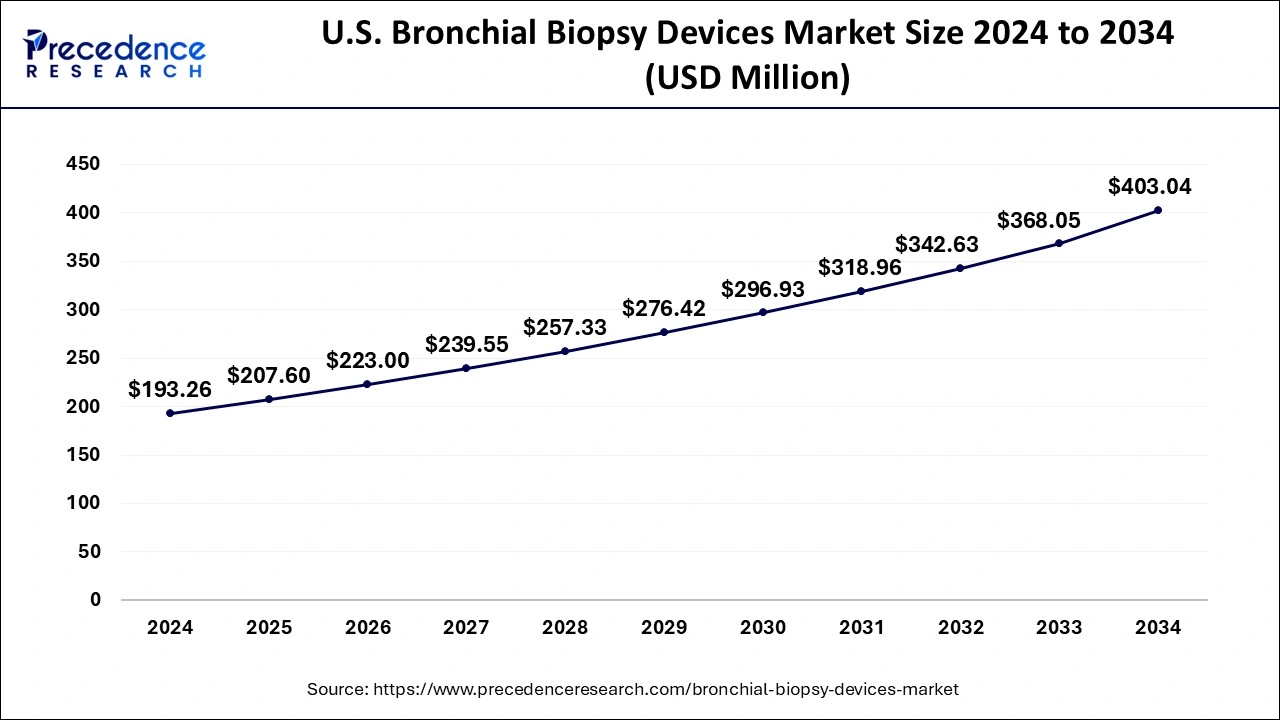

The U.S. bronchial biopsy devices market size is exhibited at USD 207.6 million in 2025 and is projected to be worth around USD 431.65 million by 2035, growing at a CAGR of 7.59% from 2026 to 2035.

North America dominated the bronchial biopsy devices market with the largest market share in 2024. The market is driven by technological advancements, an effectively developed healthcare system, a high prevalence of chronic diseases, and a growing population of geriatrics. North America has enough financial resources for progressive medical equipment, and well-developed regulations and research collaborations are contributing to its dominance. Diagnostic insurance reimbursement in the region and the competitive insurance markets in the region also enhance the suitability of biopsy technologies. Also, several product launches and funding are prevalent in the region.

- According to the American Cancer Society's estimates for lung cancer in the U.S. for 2024, It is estimated that there will be about 234,580 new incidents of lung cancer (116,310 among men and 118,270 among women); about 125,070 deaths from lung cancer (65,790 among men and 59,280 among women).

Europe is a notably growing region in the market due to the high prevalence of respiratory diseases, including lung cancer and chronic obstructive pulmonary disease (COPD), which drives demand for advanced diagnostic tools. Strong healthcare infrastructure, widespread availability of skilled pulmonologists, and supportive regulatory frameworks facilitate the adoption of minimally invasive biopsy technologies. Additionally, ongoing investments in research and development by leading medical device companies are accelerating innovation and expanding the market across hospitals and specialty clinics in the region.

Germany is a major contributor to the market in Europe, driven by growing interest in advanced diagnostic techniques such as transbronchial lung cryobiopsy. The country's strong medical research infrastructure and active clinician involvement support the adoption of innovative biopsy tools for diagnosing complex lung conditions. This combination of expertise and technology creates significant opportunities for market growth.

Asia Pacific is expected to grow at the fastest rate in the bronchial biopsy devices market during the forecast period. A prominent upsurge in respiratory conditions, including asthma, COPD, and lung cancer. Moreover, there is an increasing prominence on health campaigns intended to grow awareness of respiratory diseases and the importance of regular health check-ups. These initiatives are expected to increase the usage of bronchial biopsy procedures for early diagnosis and treatment of respiratory diseases. This increasing prevalence of the diseases is anticipated to drive the need for better diagnosis techniques, including bronchial biopsy equipment.

Value Chain Analysis

High-quality metals, polymers, and biocompatible materials are sourced to manufacture safe and reliable biopsy devices.

Key Players: Medtronic, Olympus Corporation, Boston Scientific

Raw materials are processed and assembled into bronchial biopsy tools, including forceps, brushes, needles, and cryoprobes, ensuring precision and safety.

Key Players: Boston Scientific, Olympus Corporation, Medtronic

Finished devices are distributed through medical distributors, hospitals, and healthcare networks to reach clinics, diagnostic centers, and hospitals worldwide.

Key Players: Cardinal Health, McKesson Corporation, Medline Industries

Hospitals, pulmonology clinics, and diagnostic centers utilize these devices for early detection and diagnosis of lung diseases like cancer and COPD.

Key Players: Mayo Clinic, Cleveland Clinic, Charite

Bronchial Biopsy Devices Market Companies

Provides advanced bronchial biopsy devices such as the FlexiForce biopsy forceps and CryoPlasma cryobiopsy system for minimally invasive lung diagnostics.

Offers a range of bronchial biopsy devices, including Acro-Cut biopsy forceps and CryoBalloon devices for improved lung tissue sampling and cancer diagnosis.

Specializes in the SnowStorm cryobiopsy system and Broncho-Bio biopsy forceps, which enable precise tissue sampling in bronchial diagnostics and respiratory treatments.

Other Major Key Players

- Olympus Corporation

- Becton, Dickinson and Company (BD)

- Cook Medical

- Telemed Systems, Inc.

- HOBBS MEDICAL INC

- Argon Medical Devices (WEIGAO GROUP)

- Horizons International Corp.

- Erbe Elektromedizin GmbH

Latest Announcement by Industry Leader

- In October 2024, Cook County Health invited hosted Cook County Board President Toni Preckwinkle to celebrate the launch of the Intuitive Surgical ION Navigational Bronchoscopy platform in John H. Stroger, Jr. Hospital in Chicago.

- The technique of robotic navigational bronchoscopy is a cutting-edge tool that makes diagnosing lung cancer safer, quicker, and more accurate. The technology permits less invasive biopsies, which means less pain and risk of complications for patients, as well as a faster time to treatment and recovery.

Recent Developments

- In October 2025, Invenio Imaging received the FDA's Breakthrough Device Designation for NIO Lung Cancer Reveal, an AI module designed to assist doctors in evaluating bronchoscopic lung forceps biopsies during surgery.

(Source: respiratory-therapy.com) - In October 2025, Intuitive Surgical received FDA clearance for new software upgrades for its Ion robotic bronchoscopy system, improving minimally invasive lung biopsies with accurate location and shape information through fiber optic technology.

(Source: massdevice.com ) - In April 2024, Single Pass declared that its Class II Kronos biopsy closure device had received clearance from the U.S. Food and Drug Administration (FDA). The FDA has determined that devices are significantly equivalent to predicted devices in terms of their safety and effectiveness.

- In May 2023, Argon Medical Devices, Interventional solutions for Radiology, surgery intervention, cardiology, and oncology, announced the release of the SuperCore Advantage Semi-Autocused biopsy device as the latest addition to their soft tissue biopsy devices in the United States market.

- In September 2022, Serpex Medical received a U.S. FDA 510(k) clearance on Compass Steerable Needles, steerable biopsy needles that enable precise access to lung nodules in the intrapulmonary region. Serpex Medical aims to use the advantage of steerable instruments to allow enhanced accuracy and reach to facilitate the detection and management of lung cancer. The clearance of the Compass Steerable Needles follows the recent clearance of Serpex's Recon Steerable Sheath.

Segments Covered in the Report

By Product

- Biopsy Forceps

- Durability

- Disposable

- Reusable

- Transbronchial Needle Aspiration (TBNA) Needles

- Conventional

- EBUS-TBNA

- Cytology Brushes

- Cryobiopsy Devices (Cryoprobes)

- Durability

- Disposable

- Reusable

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client