Cables for Endoscopes Market Size and Forecast 2025 to 2034

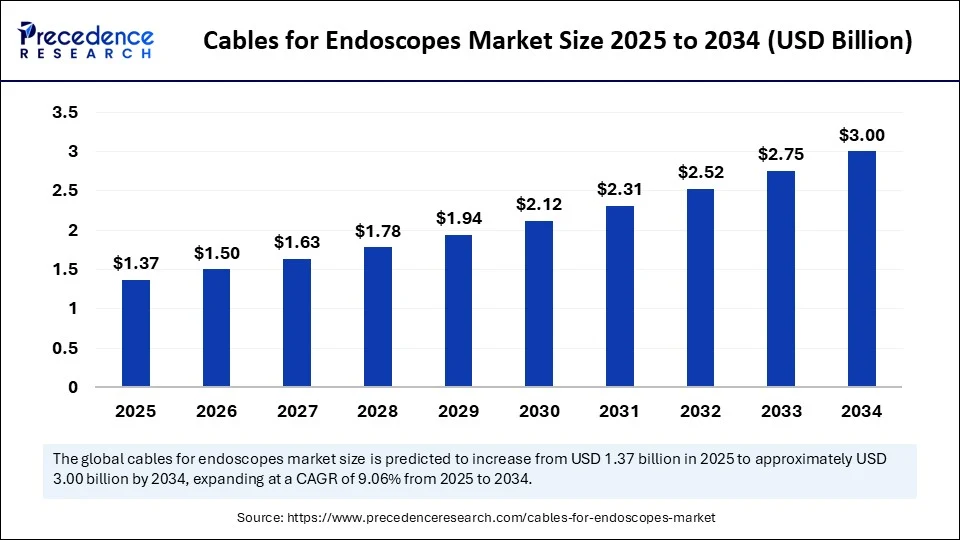

The global cables for endoscopes market size accounted for USD 1.26 billion in 2024 and is predicted to increase from USD 1.37 billion in 2025 to approximately USD 3.00 billion by 2034, expanding at a CAGR of 9.06% from 2025 to 2034. The market is showing steady growth with the developments in imaging technology used in the medical field, growing demand for minimally invasive surgery, and spending growth in healthcare and healthcare infrastructure, indicating an overall positive prognosis for the market.

Cables for Endoscopes MarketKey Takeaways

- In terms of revenue, the global cables for endoscopes market was valued at USD 1.26 billion in 2024.

- It is projected to reach USD 3.00 billion by 2034.

- The market is expected to grow at a CAGR of 9.06% from 2025 to 2034.

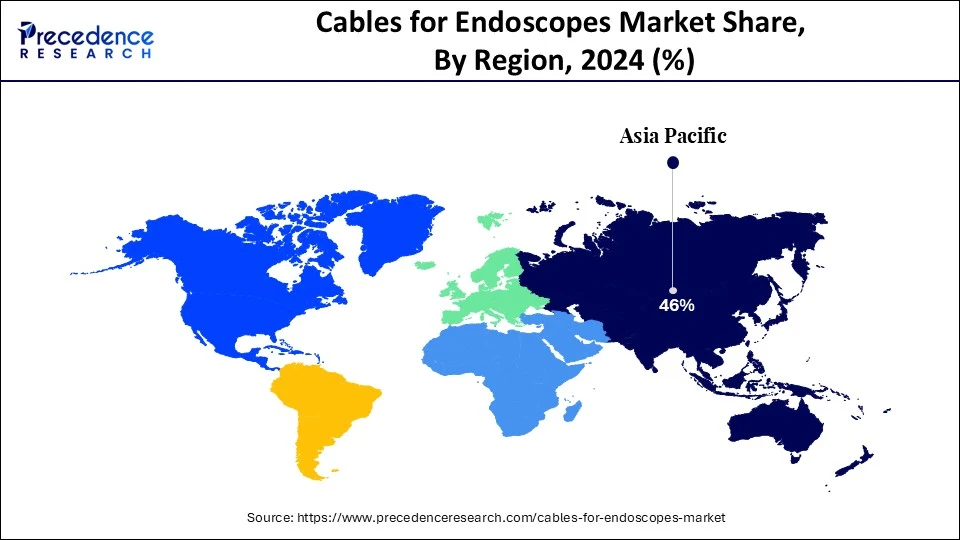

- Asia Pacific dominated the cables for endoscopes market with the highest revenue share of 46% in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the signal cables segment held the led market share in 2024.

- By type, the control cables segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By endoscope type, the flexible endoscopes segment captured the biggest market share in 2024 and is also expected to witness the fastest CAGR during the foreseeable period.

- By application, the diagnostic segment held the largest market share of 45% in 2024.

- By application, the therapeutic/surgical segment is expected to expand at a notable CAGR over the projected period.

- By material, the silicone segment captured the highest market share of 38% in 2024.

- By material, the TPE (thermoplastic elastomer) segment is expected to expand at a notable CAGR over the projected period.

- By connector type, the standard connectors segment generated the major market share of 50% in 2024.

- By connector type, the custom connectors segment is expected to expand at a notable CAGR over the projected period.

- By end user, the hospitals and clinics segment accounted for the significant market share of 50% in 2024.

- By end user, the OEMs segment is expected to expand at a notable CAGR over the projected period.

How are Technology Developments Impacting the Future of Cables for Endoscopes?

The cables for endoscopes market is evolving rapidly as manufacturers are continuously developing new technologies to meet the growing demand for greater precision and durability in less invasive procedures. Innovations such as fiber optical integration, advanced shielding, and more flexible and lighter-weight materials are all leading to improvements in both signal transmission and control during operation, thus improving patient outcomes by reducing interference.

Recently, some manufacturers have developed heat-resistant, sterilization-friendly coatings, and cable manufacturers are integrating 'smart' embedded sensors into their cable designs that will allow real-time diagnostics. In addition, many leading technology manufacturers are investigating Artificial Intelligence-enabled monitoring of cable integrity, thereby maximizing operational life and reliability.

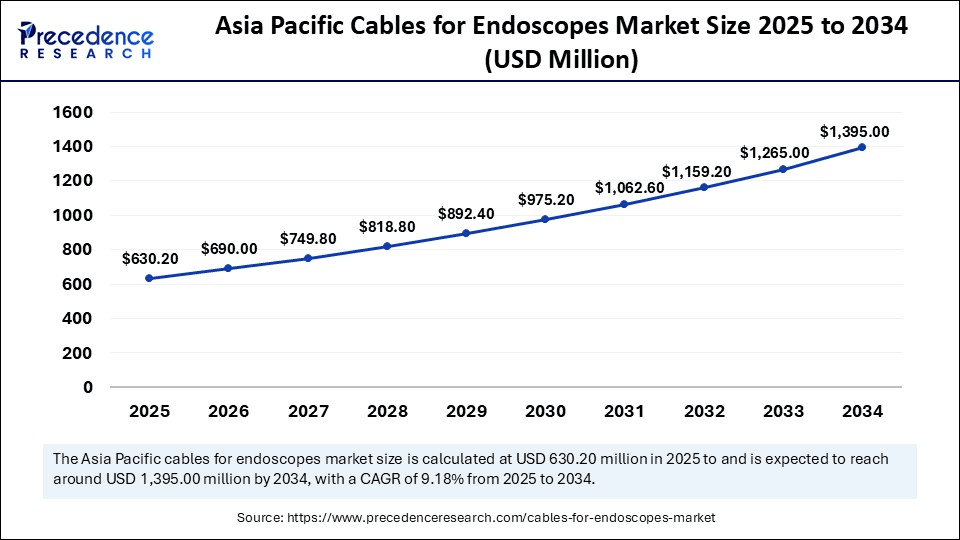

Asia Pacific Cables for Endoscopes Market Size and Growth 2025 to 2034

The Asia Pacific cables for endoscopes market size was exhibited at USD 579.6 million in 2024 and is projected to be worth around USD 1,395.00 million by 2034, growing at a CAGR of 9.18% from 2025 to 2034.

Why is Asia Pacific the most important region in 2024?

Asia Pacific is at the forefront of procedure demand, density of OEMs (original equipment manufacturers), and supply of localized components. The super-aged demographics in Japan and a strong culture of screening have kept volumes for GI (gastrointestinal) endoscopy and ENT high, while China and India add scale via further expansion of screening programs and new capacity. Policy tailwinds—including India's Production Linked Incentive (PLI) for medical devices are fast-tracking the onshoring of cable/interconnect manufacturing, accelerating lead times and enabling cost-competitive, high-flexibility and sterilization-resistant build cables for scopes, like Gi and ENT. Collectively, these dynamics equal more pull-through for camera/ light and control cables with OEMs and repair/refurb channels.

The aging demographics in Japan (~30% aged 65+) and sophisticated screening guidelines continue to support some of the highest estimated utilization rates in the world for upper GI and colonoscopies, directly increasing demand for durable, miniaturized cable sets in flexible endoscopes. The latest generation of data has identified very high new endoscopy incidence rates for older cohorts and new trials to optimize population colonoscopy screening, which is further evidence of consistent throughput that eats cables and accessories. Major OEMs are innovating and partnering with local manufacturers, which has also added to the engineering loop being tightened between scopes and interconnect design. This allows for accelerated premium cable specification.

Why is North America projected to be the fastest-growing region during the forecast period?

North America is projected to be the fastest-growing region, driven by policy and site-of-care changes that broaden access to procedures and refresh capital fleets. The U.S. went from covering the middle-aged CRC screening age to 45, expanding the eligible population; Medicare and commercial payers continue to define and clarify coverage to maintain colonoscopy volumes. At the same time, endoscopy procedures continue to migrate to ASCs (ambulatory surgery centers). This growth segment of the market is adding Medicare-certified ASCs and growing procedure volumes that necessitate the purchase of durable, quick bounce-back cables and connectors for high-volume reprocessing. Frequent FDA clearances for next-gen endoscopes also spur cable upgrades.

Market Overview

The cables for endoscopes market is the global market involved in the design, manufacture, and supply of specialty cables that provide efficient power, image, and command signal transmission in endoscopic systems. Endoscope cables are instrumental in high-definition imaging, device control and are driven by stringent performance and reliability requirements for minimally invasive, diagnostic, and surgical procedures.

Market demand for endoscope cables stems from market growth for minimally invasive surgical procedures, continual advancements in technology for imaging systems, and the adoption of flexible and video endoscopes. Endoscope cables are also driven by strict regulations and a need for cable designs that are durable, biocompatible, and can be sterilized and reused. These complexities promote innovation and competitiveness in the cables for endoscopes market.

Cables for Endoscopes Market Growth Factors

- Increasing demand for minimally invasive procedures- Growing preference for minimally invasive surgery, which offers the possibility of 24-hour recovery and lower risk of complications while enhancing patient outcomes, leads to the adoption of endoscopes, which increases the need for advanced and reliable endoscope cables.

- New endoscopic imaging technology- New advancements in high-definition, 3D, and AI-signal imaging increase the need for cables with high-integrity signals and durability, which allows manufacturers of endoscopes to offer equipment with fully advanced cable solutions.

- Growing healthcare infrastructure - a growing number of hospitals, diagnostic centers, and specialty surgical facilities, particularly in emerging economies, increases demand for endoscope equipment and accessories, and increases the need for high-performance endoscopes

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.00 Billion |

| Market Size in 2025 | USD 1.37 Billion |

| Market Size in 2024 | USD 1.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.06% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Endoscope Type, Material, Application, Connector Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is the demand for cables in endoscopes benefiting from the boom in minimally invasive surgery?

The expanding adoption of minimally invasive surgery around the world is a key driver in the growing demand for advanced endoscope cables. Minimally invasive surgical techniques offer patients shorter recovery times, less risk of infection, and fewer days in the hospital. Both patients and health care providers have preferred MIS over open surgery formats. This shift necessitates the development of highly reliable cables that transmit and deliver uninterrupted signals, provide greater flexibility, and offer durability to withstand highly complex procedures.

As informed by the World Health Organization, over 230 million major surgical procedures are performed each year. Increased investments in surgical infrastructure are driving a more direct increase in the demand for better-designed endoscope cables and ultimately helping to drive revenues for these new procedures, which are more precision-driven and image-intensive. (Source: https://cdn.who.int)

Restraint

Is cost sensitivity in healthcare procurement impeding endoscope cable uptake?

From a business analytics perspective, a major limiting factor in the cables for endoscopes market is cost sensitivity on the part of healthcare providers. Hospitals and diagnostic centers typically operate under rigorous budget allocations, and purchasing decisions are made primarily on cost-effectiveness rather than technological advancement. More than 60% of respondents to a 2024 survey of hospitals in the U.S. indicated that they delayed upgrading their endoscopic systems, despite some limitations, and gave priority to bedroom devices based specifically on capital budget restrictions, and often do not purchase the cables.

Particularly in emerging economies, the divide is even more distinct, where procurement committees aggressively negotiate prices and select downgraded alternatives, thus clearly imposing a limitation on the adoption of premium cables. Furthermore, reimbursement systems in many countries simply do not provide adequate coverage for advanced endoscopy accessories, imposing yet another financial disincentive, reducing the ROI for healthcare providers. Within a cost-driven evaluation of phenomenological relevance, a financial augmentation is therefore limiting the velocity of renewal innovation in the marketplace.

Opportunity

Will next-generation wireless and capsule endoscope cables transform minimally invasive procedures?

One key opportunity for the cables for endoscopes industry is consolidating new wireless and capsule endoscope technologies. Capsule endoscopy, which uses swallowable devices to capture internal images, is indeed creating some traction as a less invasive alternative to traditional methods. Recent reports are beginning to show that adoption of capsule endoscopy will increase substantially in hospitals in the Asia-Pacific region due to rising incidences of gastrointestinal disorders and a shift towards painless diagnostics.

For example, multiple med-tech companies announced developments in wireless image transmission and miniaturized fiber-optic cables to capture better images and allow better navigation. This is creating a growing market opportunity for companies that can create light, biocompatible, and easy-to-sterilize, high-bandwidth cables and systems for next-generation devices. As minimally invasive surgery and patient-friendly diagnostic tools continue to emerge, companies that continue to innovate in this space can create a key competitive advantage in the evolving endoscopy ecosystem.

Type insights

Which cable type dominates the cables for endoscopes market?

The signal cables segment dominated the market in 2024, with the fiber optic cables sub-segment holding 35% revenue share. The demand for signal cables is strong, as it is integral for transmitting imaging and lighting information during endoscopy procedures. The Fiber Optic subsegment is projected to be the largest in 2024 due to its superior image quality and ability to transfer light effectively. There are more uses for fiber optic cables in endoscopes than any other type. These cables are used for gastrointestinal endoscopes to help with diagnostics and are also a mainstay in routine screens and procedures like minimally invasive treatments.

The flexible control cables sub-segment of the control cables segment is anticipated to have the fastest growth, as these cables are critical in moving and controlling endoscopes. The Flexible Control subsegment is predicted to have the fastest growth as it is increasingly used in robotic-assisted and next-generation flexible endoscopes. Flexible Control cables provide flexibility, durability, and smooth movement that can aid in navigating anatomical pathways, making them an appealing option for hospitals and OEMs developing more advanced endoscopy systems.

Endoscope type insights

Which endoscope type dominates the cables for endoscopes market in 2024?

The flexible endoscopes segment dominated the market in 2024, with the gastrointestinal sub-segment holding 40% revenue share, due to its versatility across multiple diagnostic and therapeutic procedures. The Gastrointestinal subsegment was the largest share of flexible endoscopes in 2024, as gastrointestinal endoscopy is one of the most frequently performed procedures worldwide to support early detection of colorectal cancer and ulcers, and diagnosis of digestive disorders. Flexible endoscopes offer a broad scope of application opportunities in preventive screening and advanced interventional care, and this range of usage provides a reliable demand for cables for use with flexible endoscopes for the foreseeable future.

The bronchoscopes sub-segment of the flexible endoscopes segment is anticipated to have the fastest growth. These devices allow for minimally invasive visualization of airways and are increasingly being adopted for interventional and therapeutic pulmonology applications. Flexible endoscopes and bronchoscope cables are opening new markets as healthcare systems push for early detection and advanced care in respiratory services.

Application Insights

Which applications leads the cables for endoscopes market?

The diagnostic application was the dominant segment in the cables for endoscopes market in 2024, as the demand for endoscopes for early disease detection using minimally invasive procedures is increasing, hospitals and diagnostic centres now rely on endoscopes to examine gastrointestinal, pulmonary, and urological concerns. The demand for early disease detection is also supported by increasing awareness of preventive healthcare and rising cases of chronic disorders.

The therapeutic and surgical application segment is projected to be the fastest-growing segment with increasing usage of endoscopic techniques in minimally invasive surgical procedures (e.g., laparoscopic, arthroscopic, and robotic-assisted). Specialised cables are designed for these techniques to ensure performance, precision, and reliability, while maintaining the durability required for surgical applications. The cables continue to evolve with new, flexible, and higher-performance designs, allowing safety and expanding versatility for the advanced instruments used in operating room procedures.

Material insights

Which material segment is dominating the cables for endoscopes market?

In 2024, the silicone segment led the market due to its excellent biocompatibility, flexibility, and resistance to heat and sterilization. These properties make them very suitable for medical purposes, particularly in reusable endoscopes that are reused with multiple cleaning cycles. The Silicone will keep its performance under the demanding clinical conditions and has more reasonably predictable safety and efficacy of direct patient contact, thereby giving rise to its universal adoption amongst hospitals and purpose-built endoscopy centres.

The TPE (Thermoplastic Elastomer) segment is expected to have the fastest growth in the upcoming years. The growth in TPE use relates as it is seen to offer a better compromise balance than silicone with its flexibility, relatively cheap cost, and easier processing. TPE cables are now widely used in disposable and single-use endoscopes, which is in line with healthcare's priorities for infection control and cost containment. The transition to disposable devices in outpatient and emergency care is expanding the use and growth rate of the TPE Segment.

Connector type insights

Which connector type segment dominates the cables for endoscopes market in 2024?

The standard connectors segment dominated the cables for endoscopes market in 2024, which is based on extensive compatibility and reliability at cost-effectiveness, dominated the market. These connectors are routinely found in hospitals and clinics, as they integrate seamlessly with the existing endoscopic equipment and systems. Their established design and demonstrably safe track record have made them a favourite for diagnostic and therapeutic procedures, and there will no doubt be continued demand for standard connectors in both developed and emerging healthcare markets.

The custom connectors segment is anticipated to grow at the highest rate throughout the forecasted timeframe. The demand for specialty and high-performance endoscopic systems, especially advanced surgical and robotic-assisted procedures, is driving this growth. OEMs, based on unique specifications such as increased data transfer speed, miniaturization, and durability, are increasingly designing custom connectors.

End user insights

Why are hospitals and clinics dominates the cables for endoscopes market?

The hospitals and clinics segment accounted for the largest share of the market due to the high number of patients being admitted for diagnostic and surgical procedures that involve endoscopy. Hospitals and clinics are reliant on advanced endoscopic systems that allow for imaging, power, and control operations with a reliable cable assembly. The sources of volume of patients requiring minimally invasive procedures and the need for a high rate of usage of the equipment show that hospitals and clinics will still have the greatest market share, allowing it to remain steady.

The OEMs segment is expected to grow at the highest rate over the forecast period, based on their increased collaborations with medical device firms to develop customized and advanced cable solutions. The OEMs are looking to incorporate lightweight, high-performance, durable yet cost-effective cables into next-generation endoscopes, which would include single-use and robotic-assisted devices. Given their role in promoting and supporting advanced innovation and their ability to customize solutions for identified clinical needs, the OEMs segment will enjoy rapid growth.

Value Chain Analysis

- Raw Material Sourcing

Top-tier manufacturers procure the best medical-grade polymers, copper, and fiber-optic materials. All of the material selected for the assembly of medical cables revolves around signal integrity and flexibility, biocompatibility, and stringent healthcare capabilities for precision diagnostics.

- Engineering Components

The electrical components within the cable assembly (i.e., insulation layers, shielding, and connectors) are all employed and engineered for electrical performance, durability, and compatibility with multiple endoscope systems.

- Assembling, Testing, and Certifications

Cable assembly involves detailed assembling and thorough testing for electrical continuity, flexibility, sterilization resistance, and regulatory compliance testing (ISO 13485, medical device quality management system).

- Distribution and Support

Products can be received via hospital purchasing systems and specialty distributors, all knowledgeable technicians, trainers, and support staff to assist in fortifying product lifespan and deliver uninterrupted clinical functionality.

Cables for Endoscopes Market Companies

- Olympus Corporation

- Karl Storz SE and Co. KG

- Stryker Corporation

- Medtronic plc

- Richard Wolf GmbH

- Fujifilm Holdings Corporation

- ConMed Corporation

- Boston Scientific Corporation

- Cook Medical

- Ambu A/S

- Pentax Medical

- Micro-Tech Endoscopy Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Hangzhou Shunxiang Medical Equipment Co., Ltd.

- Medline Industries, Inc.

- Merit Medical Systems, Inc.

- Steris plc

- Smith and Nephew plc

- Zhejiang Wanli Medical Technology Co., Ltd.

- Applied Medical Resources Corporation

Segments Covered in the Report

By Type

- Power Cables

- Standard Power Cables

- High-Flex Power Cables

- Signal Cables

- Fiber Optic Cables

- Coaxial Cables

- HDMI/USB Cables

- Control Cables

- Flexible Control Cables

- Reinforced Control Cables

- Others

By Endoscope Type

- Flexible Endoscopes

- Gastrointestinal

- Bronchoscopes

- Urological

- ENT

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Hysteroscopes

- Others

By Application

- Diagnostic

- Therapeutic/Surgical

- Research and Laboratory

- Others

By Material

- PVC

- Silicone

- TPE (Thermoplastic Elastomer)

- Others

By Connector Type

- Standard Connectors

- Custom Connectors

- Others

By End User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Research and Diagnostic Labs

- OEMs

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting