What is the Carbon Footprint Assessment Services Market Size?

The global carbon footprint assessment services market is growing as businesses adopt emission-tracking tools and sustainability analytics to meet global climate targets and regulatory norms.The market for carbon footprint assessment services is growing as organizations and governments increasingly prioritize sustainability, environmental accountability, and compliance with climate-related regulations, driving higher adoption of assessment and reporting services.

Market Highlights

- Europe accounted for the largest market share of 33% in 2024.

- The Asia Pacific is expected to expand at a CAGR of 13 between 2025 and 2034.

- By service type, the baseline carbon footprint assessment segment captured more than 35% of market share in 2024.

- By service type, the scope 3 supply-chain emissions mapping & assessment segment is expanding at a strong CAGR of 11% over the projected period.

- By end-use industry, the manufacturing & heavy industry segment held the biggest market share 30% in 2024.

- By end-use industry, the retail & consumer goods segment is growing at a healthy CAGR of 11% between 2025 and 2034.

- By client size, the large enterprises segment contributed more than 55% of the market share in 2024.

- By client size, the medium-sized enterprises segment is growing at a strong CAGR of 12% between 2025 and 2034.

- By delivery mode, the on-site engagements segment captured approximately 48% of market share in 2024.

- By delivery mode, the remote / digital services segment is expected to expand at 13% CAGR from 2025 to 2034.

Sustainability Goals are Fueling Growth in The Carbon Footprint Assessment Services Market

With increased focus on corporate sustainability and more stringent environmental regulations, demand for carbon footprint assessment services is on the rise. These services focus on measuring, monitoring, and calculating greenhouse gas emissions across a supply chain. They help organizations understand how to reduce their emissions while adhering to global reporting standards. The market includes carbon accounting consulting services, data analytics services, and auditing verification services that assess emissions resulting from energy consumption, production, and logistics.

The rise in acceptance of net-zero goals and environmental, social, and governance reporting has increased the priority of carbon accounting for businesses. In addition, new digital platforms leveraging AI and IoT are increasing the accuracy of emissions monitoring, enabling real-time measurement and enhancing transparency in public disclosure of emissions accountability. As a whole, carbon accounting services are leading the way in enabling a market to grow as a key enabler of transformation toward sustainable business practices and climate accountability across the globe.

Innovation on Track: AI in Carbon Footprint Services

As the carbon footprint service area continues to grow, artificial intelligence is quickly becoming disruptive. For example, ClimateSeeds GEMS software now uses AI to classify large purchase datasets into emission factors, covering all categories without lag (in place of previous manual efforts), thereby facilitating greater granularity and accuracy. Simultaneously, Deloitte UK is providing an AI Carbon Footprint Calculator to estimate the AI projects footprint based on location, infrastructure, model, and use case, indicating that even AI endeavors require carbon accounting.

- On the product side, in July 2024, CO2 AI launched a generative AI-based solution that will calculate the emissions of thousands of products in a matter of minutes. This course addresses the fact that only about 38% of companies receive adequate product-level data from their suppliers.

- Overall, these recent advancements clearly indicate that AI-enabled assessment services may go from a niche to a necessity and become essential tools to help corporate decarbonisation strategies move forward.

Carbon Footprint Assessment Services Market Outlook

Because of standards such as the Greenhouse Gas Protocol, an increasing number of organizations are implementing formal emissions accounting systems, enabling consistent measurement of corporate carbon footprints across Scope 1, 2, and 3. These frameworks help companies compare performance across facilities, identify major emission sources, and plan reduction strategies. As more firms commit to climate targets and net zero pathways, demand for structured measurement services continues to rise.

Regulatory frameworks such as Indias Long-Term Low-Emissions Development Strategy (LT LEDS) indicate a national commitment to economy-wide decarbonisation and may drive demand for a service that measures emissions across sectors globally. Similar long-term climate strategies in Europe, Southeast Asia, and the Middle East also encourage organizations to adopt verified carbon accounting methods. This broader policy alignment strengthens the global market appeal for specialized assessment services.

A company will need to dedicate financial resources to invest in improved tools and methods to enable more granular emissions tracking (especially in the downstream or upstream value chain), opening the potential for dedicated assessment services that leverage advanced data analytics. These tools can include automated data capture, machine learning models for estimating Scope 3 emissions, and improved supplier reporting systems. Such investments help companies improve accuracy and reduce manual work in sustainability reporting.

With mandatory ESG disclosures widening, for example, in India the Business Responsibility and Sustainability Reporting (BRSR), which includes GHG emissions disclosures, many firms view carbon footprint assessments as a strategic differentiator rather than purely compliance. Companies increasingly use carbon data to show environmental leadership, attract investors, and strengthen brand value. This trend supports continuous demand for robust, verified emissions assessment services.

Mandated disclosure schemes, investor or stakeholder expectations for greater transparency, and the potential link between emissions data and risk management are creating a pathway for firms to procure dedicated assessment services. These services help companies identify operational risks, evaluate supply chain exposure, and prepare climate transition plans that meet investor expectations.

Accurately measuring indirect emissions (Scope 3) across global supply chains remains a complex, resource-intensive process, which is a real barrier to uptake, especially for smaller firms without sophisticated internal data systems. Limited supplier reporting, inconsistent data quality, and fragmented digital infrastructure make it more difficult to build complete emissions inventories. These challenges slow adoption among companies with fewer technical resources.

Market Scope

| Report Coverage | Details |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

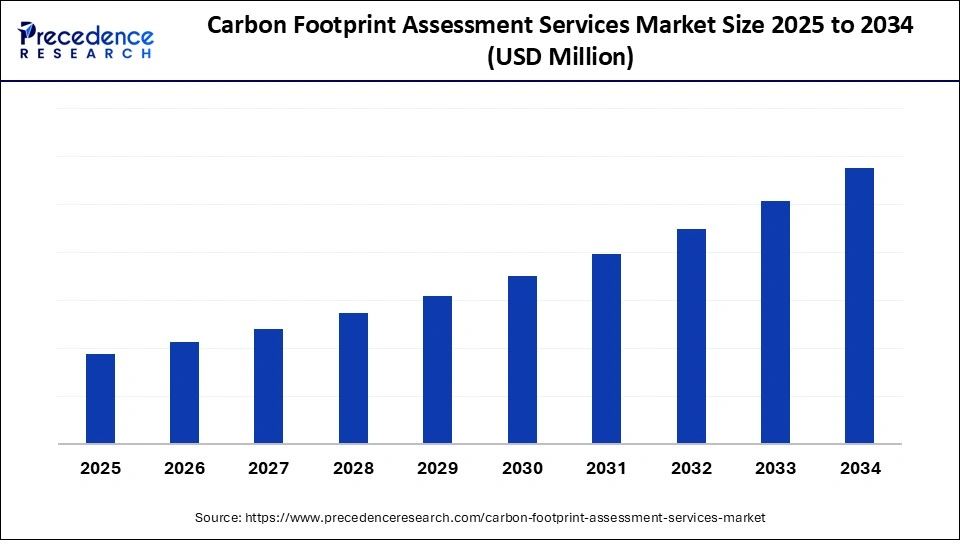

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, End-Use Industry, Client Size, Delivery Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Carbon Footprint Assessment Services Market Segment Insights

Service Type Insights

Baseline Carbon Footprint Assessment dominates the service type segment, accounting for about 35% of the market. Baseline carbon footprint assessments quantify an organization direct and indirect emissions from operations and provide the basis for sustainability planning. Carbon footprint assessments are used to set reduction targets and comply with international reporting standards. Second, Product or Service-Level Carbon Footprint Assessment is gaining traction as organizations aim to measure emissions associated with a specific product, which is relevant for eco-labelling and sustainable product development.

The Scope 3 supply-chain emissions mapping and assessment is the fastest-growing segment, with an expected CAGR of 11% in the carbon footprint assessment services market, as organizations become more focused on emissions across the full value chain. They are looking to expand their carbon accountability beyond their organizations internal operations to suppliers, procurement, logistics, and product life cycles. Growing frameworks for global reporting and disclosure of accounting emissions, including the GHG Protocol and CDP, are accelerating demand for tracking Scope 3 emissions.

The Lifecycle Assessment (LCA) Services segment and Verification, Certification & Audit Services segments are also expected to grow at notable rates in the carbon footprint assessment services market as organizations advance carbon accounting and reporting in support of long-term sustainability commitments to reductions and disclosure. LCA services are used to evaluate environmental impacts, from raw materials through product disposal, and to support critical, informed decision-making during design and production. Verification and certification services can provide credibility for emission reporting against international standards, such as ISO 14064, through certification systems and compliance audits.

End-Use Industry Insights

The manufacturing and heavy industry segment led the carbon footprint assessment services market with almost 30% market share during 2024. These industries are among the largest emitters of carbon due to the energy-intensive nature of production, the use of fossil fuels in machinery, and raw material extraction. Companies in this area are making greater investments in reducing the carbon footprint of their manufacturing processes to meet emission caps, improve energy efficiency, or mitigate costs associated with a carbon price.

The retail and consumer products segment is the fastest-growing in the carbon footprint assessment services market, with an 11% CAGR, as global brands focus on increasing transparency in their supply chains and sourcing sustainably. Because of rising consumer awareness and government regulations favouring eco-friendly labels, wholesale retailers are looking into their direct and indirect emissions from manufacturing, logistics, and packaging. The rapid adoption of digital carbon-tracking tools to enable carbon assessments, paired with enhanced engagement with suppliers, has enabled companies to bring their ESG commitments into line and improve brand reputation through verified climate actions.

Transportation and logistics, as well as the commercial and service sectors, are seeing notable growth and have also rapidly embraced participation in carbon footprint initiatives. Logistics providers have begun evaluating the nature of emissions in their operations as they prepare to offer route optimization or alternative fuels to mitigate them. The commercial and service sectors have prioritized the efficiency of buildings of the future and the adoption of renewable energy. Both the Agriculture and Forestry sectors are also beginning to participate, or are further engaged in tracking emissions, focusing on carbon sequestration and sustainable land management practices.

Client Size Insights

Large Enterprises are the largest client size segment in terms of overall market share at nearly 55%. These organizations span multiple geographies and are subject to rigorous emissions reporting and sustainability disclosure requirements. Due to their scale, large enterprises will require extensive carbon accounting to satisfy investor expectations, comply with international frameworks, and meet their own corporate sustainability objectives.

The medium-sized enterprises segment is the fastest-growing, with an approximately 12% CAGR in this market, driven by increased regulatory pressure and pressure from larger upstream supply-chain partners to provide carbon disclosures. Many mid-scale companies are beginning to address sustainability as part of their core corporate strategy to create competitive advantage, capture partnerships, and attract green financing. The availability of inexpensive digital platforms and consultant-driven carbon-tracking products has made emissions assessments more feasible, leading to rapidly growing adoption across a variety of sectors among medium-scale organizations.

The small and micro enterprise segment is emerging as a player in the movement as sustainability becomes a mainstream business priority. Because most do not have the budgeting or expertise, small and micro enterprises have now found simplified digital tools for collaborative reporting platforms. Their growing participation also helps extend carbon accountability through supply chains and enables larger corporations to address full emissions reporting. Their participation extends reach towards carbon reduction goals, whether national or global, by bringing businesses to the table at all operational levels.

Delivery Mode Insights

The on-site engagements segment is the market leader in the carbon footprint assessment services market, with approximately 48% market share. On-site services provided by evaluators involve the inspector traveling to the facility for audits, inspections, and on-site data collection, including measurements, photographs, and paperwork. Industries, particularly manufacturing and energy, favour on-site engagement because the services provide more accurate, verifiable compliance. On-site assessments also enable efficiency opportunities to be flagged.

The remote or digital services segment is emerging as the fastest-growing delivery mode with an approximately 13% CAGR, driven by the emerging popularity of cloud-based digital tools, IoT devices, and virtual audits. Organizations are also adopting digital dashboards that help companies track real-time emissions, automate reporting, or analyze emissions data with AI. The transition to digital, which reduces audit costs, is part of a broader sustainability trend across enterprises toward automated, transparent, and efficient assessments.

The hybrid models segment, which combines on-site assessment with remote data and remote verification of compliance, is emerging as the best option for enterprises seeking to create value through direct verification and audits. Hybrid models allow enterprises to complete the initial assessment remotely, with an on-site assessment following for compliance verification. The flexibility and efficiency of hybrid models, while also enabling a more comprehensive consideration of carbon accounting, make them relevant for global enterprises managing value chains that lead to renewable energy.

Carbon Footprint Assessment Services Market Regional Insights

Europe leads the market for carbon footprint assessment services with a 33% share, driven by strong climate policy, mandatory sustainability reporting standards, and the EU Green Deals goal of carbon neutrality. The region industrial sectors, namely manufacturing, automotive, and energy, have already begun utilizing advanced carbon auditing and lifecycle assessment solutions. High levels of awareness among enterprises and increasing investment in renewable projects also support demand for footprint evaluations in the region. Additionally, digital platforms and AI-based analytics tools are driving greater accuracy and efficiency in assessing emissions volumes and formulating reductions.

Germany Carbon Footprint Assessment Services Market Trend

Germany ranks as the market leader in Europe for carbon footprint assessment services, aided by its strong regulatory environment and early adoption of carbon management systems. The nation has set a goal to achieve net-zero emissions by 2045, while implementing a Supply Chain Due Diligence Act to provide companies with transparency to monitor and disclose their environmental impact. Additionally, strong collaboration among government, technology providers, and sustainability consultants makes Germany a leader in systematic carbon reporting and sustainable transformation across all industries.

Asia Pacific has the highest growth in the carbon footprint assessment services industry, with an approximate CAGR of 13%, driven by industrial growth, the energy transition, and increasing awareness of sustainability measures. There are strict environmental compliance regulations issued by governments in the region to support companies in their emissions monitoring and reduction efforts and to comply with the Paris Agreement. The adoption of carbon footprint assessment services is growing in emerging economies due to rapid digitization, green finance initiatives, and increased support for carbon accounting start-ups.

China

The main driver of market growth in the Asia Pacific is China, where strong momentum is driven by a national carbon trading system and the push to achieve carbon neutrality by 2060. China energy-intensive sectors, including manufacturing, are adopting data-driven carbon-tracking platforms and seeking additional third-party verification services. The governments policies to support low-carbon technologies and corporate sustainability reporting are creating a healthy ecosystem for carbon management in China. China is also experiencing increasing demand for verified carbon disclosures related to international trade, which controls how Chinese enterprises integrate footprint assessment services into business planning.

North America is seeing gradual growth in carbon footprint measurement services, bolstered by growing corporate sustainability commitments and stronger emission regulations. Organizations in the U.S. and Canada are turning to carbon accounting at an accelerating pace in order to comply with ESG reporting obligations and stakeholder requirements. There is growing use of AI and blockchain technology to monitor and authenticate emissions, increasing transparency and data trustworthiness. A stronger social conscience around environmental accountability, along with investors greater emphasis on decarbonization strategies, is driving the regional market momentum.

North America is led by the United States in market growth, driven by its proactive climate policy, corporate sustainability mandates, and technological infrastructure. Commitments by the federal government to reduce greenhouse gas emissions and the SECs increasing emphasis on climate risk disclosure are pushing organizations to adopt better carbon footprint solutions. The U.S. ecosystem of environmental consultancies, software providers, and industry coalitions drives faster adoption of accurate, scalable carbon measurement frameworks in the energy, construction, and logistics sectors, in particular.

The Middle East & Africa region is emerging as a viable hub for the carbon footprint assessment services market, driven both by goals for economic diversification and investments in renewable energy sources. Gulf countries are increasingly embedding carbon management frameworks into their Vision 2030 plans as they transition to sustainable economies. In Africa, countries are adopting carbon footprint assessment frameworks to support climate resilience and attract international financial support for green projects.

UAE Carbon Footprint Assessment Services Market Trend

The United Arab Emirates is emerging as a leading country in the Middle East & Africa region for the carbon footprint assessment services market, driven in part by its Net Zero by 2050 strategic initiative. Its hosting and participation in global climate conferences, such as COP28, accelerate the awareness and adoption of sustainability assessment frameworks. Importantly, collaboration among government agencies, corporations, and environmental consultants positions the UAE as a leader in the low-carbon transition and sustainability reporting.

Carbon Footprint Assessment Services Market Companies

Provides carbon footprint assessment services through its CCH Tagetik and Enablon software solutions, which enable companies to measure, analyze, and report their Scope 1, 2, and 3 emissions.

Provides software and consulting services related to carbon footprint assessment and management, primarily through its IBM Envizi ESG Suite and IBM Consulting services.

Help organizations measure, report, and reduce their environmental impact across all three scopes of greenhouse gas (GHG) emissions.

Provides tools for carbon footprint assessment as part of its broader Environmental, Health, and Safety (EHS) and Sustainability software solutions.

Ellipse carbon intelligence platform, to manage vast amounts of carbon-related data and track progress toward net-zero goals.

Enables companies to calculate, track, report, and manage their own greenhouse gas (GHG) emissions internally, rather than offering external assessment services performed by IsoMetrix consultants.

Provides Environmental, Health, and Safety (EHS) and Sustainability software that includes tools for tracking environmental emissions, which aids in carbon footprint management and assessment.

Provides ERP-centric carbon footprint software to measure, manage, and reduce emissions.

The EcoVadis platform helps manage ESG risk and compliance, meet corporate sustainability goals, and drive impact at scale.

Recent Developments

- In April 2024, Databricks launched its Data Intelligence Platform for Energy to enable energy companies to utilise generative AI on large-scale streams of asset, operations, and customer data, helping optimise grid reliability and reduce transmission losses.(Source: https://www.databricks.com)

- In October 2024, IBM acquired Prescinto, an Indian SaaS firm for renewable-energy asset performance management, to bolster its Maximo Application Suite with AI-enabled diagnostics for wind, solar, and storage assets, supporting its energy and utility market ambitions.(Source: https://www.business-standard.com)

Exclusive Insights

Our expert observed that carbon footprint assessment services are poised for stable growth as disclosure mandates and investor activism compel companies to measure Scope 1 to 3 emissions and improve supply-chain transparency. The convergence of standards surrounding ISO 14064 and the GHG Protocol is increasing technical consistency and the demand for accredited verification and automated data platforms. Primary risks include regulatory uncertainty and implementation delays, which may limit engagement from smaller organizations.

Commercial opportunities exist in comprehensive carbon-accounting software, third-party verification, and consulting services that convert carbon-footprint data into cost-saving decarbonization pathways. In the next two to three years, anticipate enhanced integration with financial reporting and increasing demand for traceable Scope 3 data.

Carbon Footprint Assessment Services MarketSegments Covered in the Report

By Service Type

- Baseline Carbon Footprint Assessment (Organisational)

- Product/Service Level Carbon Footprint Assessment

- Scope 3 Supply-Chain Emissions Mapping & Assessment

- Lifecycle Assessment (LCA) Services

- Verification, Certification & Audit Services

By End-Use Industry

- Energy & Utilities

- Manufacturing & Heavy Industry

- Transportation & Logistics

- Commercial & Services Sector

- Retail & Consumer Goods

- Agriculture, Forestry & Other Sectors

By Client Size

- Large Enterprises (Global/Multi-national)

- Medium-Sized Enterprises

- Small & Micro Enterprises

By Delivery Mode

- On-Site Engagements (onsite auditing, data collection)

- Remote / Digital Services (cloud platforms, virtual audits)

- Hybrid Models (mix of on-site + remote)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting