What is the Cardiac Mapping Market Size?

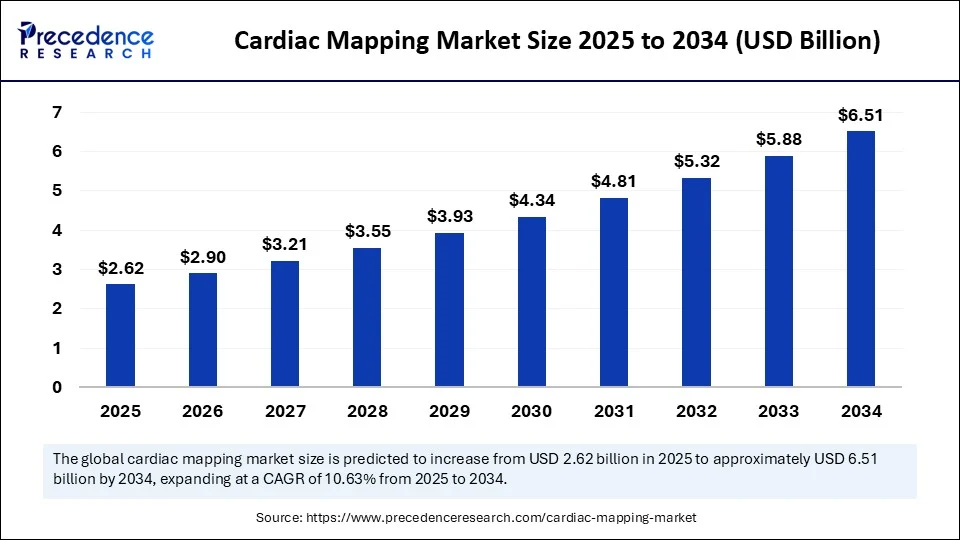

The global cardiac mapping market size is calculated at USD 2.62 billion in 2025 and is predicted to increase from USD 2.90 billion in 2026 to approximately USD 7.09 billion by 2035, expanding at a CAGR of 10.47% from 2026 to 2035.

Cardiac Mapping MarketKey Takeaways

- In terms of revenue, the global cardiac mapping market was valued at USD 2.62 billion in 2025.

- It is projected to reach USD 7.09 billion by 2035.

- The market is expected to grow at a CAGR of 10.47% from 2026 to 2035.

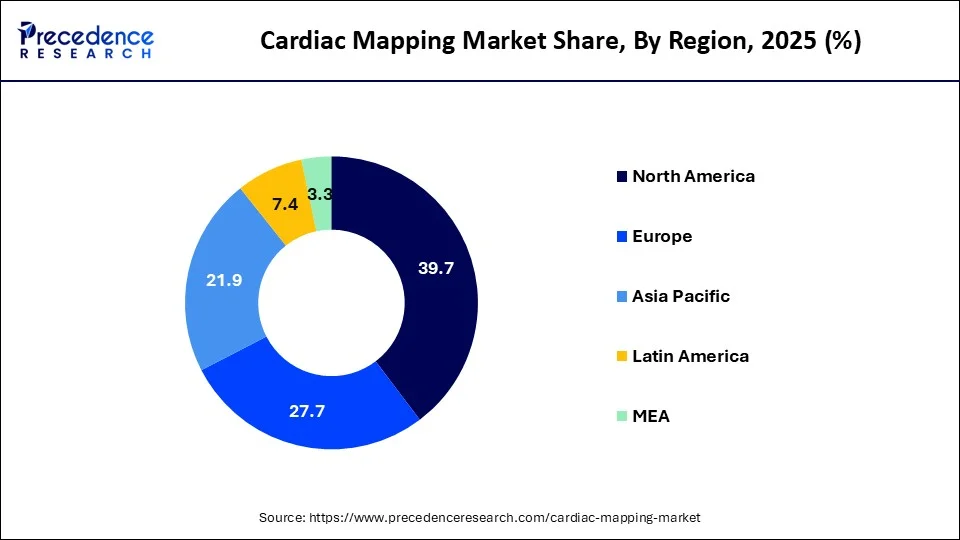

- North America dominated the market with the largest market share of 39.7% in 2025.

- Asia Pacific is expected to grow at a notable rate in the upcoming period.

- By product type, the electroanatomical mapping systems segment held the biggest market share of 31.4% in 2025.

- By product type, the contact mapping systems segment is expected to grow at the fastest rate during the forecast period.

- By indication, the atrial fibrillation (AF) segment captured the highest market share of 42.6% in 2025.

- By indication, the ventricular tachycardia segment is expected to grow at the fastest rate in the coming years.

- By technology, the contact mapping segment generated the major market share of 48.1% in 2025.

- By technology, the non-contact mapping segment is emerging as the fastest growing during the forecast period.

- By end user, the hospitals segment held the largest share of 52.7% in 2025.

- By end user, the electrophysiology labs segment is expected to grow at the fastest CAGR during the forecast period.

Market Overview

The cardiac mapping market encompasses the technologies, products, and services used to create detailed maps of the heart's electrical activity. Cardiac mapping is primarily used in the diagnosis and treatment of complex cardiac arrhythmias such as atrial fibrillation, atrial flutter, and ventricular tachycardia. It provides real-time visualization of the origin and propagation of electrical impulses in the myocardium, aiding in precise catheter ablation therapy and guiding electrophysiologists in interventional procedures. This market includes various mapping systems (electro anatomical, contact, non-contact), catheters, software, and associated consumables and services.

The demand for cardiac mapping technologies has been increasing dramatically due to the increased incidence of arrhythmias. The need for accurate real-time diagnostic tools is growing as conditions like ventricular tachycardia, atrial fibrillation, and other rhythm disorders become more prevalent, especially in older populations. Effective ablation therapies rely on cardiac mapping systems, which enable physicians to identify and evaluate aberrant electrical pathways in the heart precisely. Hospitals and clinics have been compelled to implement sophisticated mapping systems due to the rising global disease burden, which has led to increased procedure volumes and device sales in the electrophysiology sector.

Cardiac Mapping MarketGrowth Factors

- Rising prevalence of cardiac arrhythmias: Conditions like atrial fibrillation are becoming more common, increasing the need for precise mapping techniques.

- Advancements in mapping technologies: Innovation, such as 3D electro-anatomical mapping and high-density mapping systems, improves diagnostic accuracy.

- Growing aging population: Older adults are more prone to heart rhythm disorders, fueling demand for mapping procedures.

- Increased adoption of minimally invasive procedures: Cardiac mapping supports catheter ablation for mapping procedures.

- Expanding healthcare infrastructure in emerging markets: Improved access to advanced cardiac care is driving market growth in countries such as India and Brazil.

- Rising awareness and screening programs: Early detection initiatives and increased patient awareness are leading to more frequent use of mapping systems.

How is artificial intelligence transforming cardiac mapping procedures?

Artificial intelligence is transforming cardiac mapping by improving the speed, accuracy, and precision of diagnosing arrhythmias. AI analyzes complex heat signals in real time, enabling high-resolution 3D maps and guiding more effective ablation procedures. It streamlines workflows, reduces procedure time, and supports personalized, data-driven care for cardiac patients.

AI-driven Platforms assist in automatically detecting anomalous electrical pathways, lowering human error and boosting diagnostic confidence. By continuously learning from large datasets, these systems improve over time and provide predictive insights into the risks of arrhythmias that are unique to each patient. Additionally, increased consistency during mapping and ablation is ensured by integration with robotic-assisted systems. Additionally, AI is enabling telehealth-based analysis and remote consultations, thereby increasing access to professional cardiac care in underprivileged areas.

Market Scope

| Report Coverage | Details |

| Market Size by 2036 | USD 7.09 Billion |

| Market Size in 2025 | USD 2.62 Billion |

| Market Size in 2026 | USD 2.90 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.47% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Indication, Technology, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing prevalence of cardiac arrhythmias

One of the primary factors driving the market's expansion is the global rise in cardiac arrhythmias, particularly atrial fibrillation. The annual diagnosis of rhythm disorders affects millions of people, resulting in a constant demand for cutting-edge diagnostic tools. Effective ablation treatments can be guided by the accurate identification of arrhythmogenic regions made possible by cardiac mapping systems. Maps that enable early and precise detection greatly lower the risk of heart failure and stroke.

Advancements in cardiac mapping technologies

Newer mapping systems with improved temporal and spatial resolution are the result of continuous R&D. Methods such as non-contact mapping and 3D electro-anatomical mapping provide a thorough visual representation of the electrical activity within the heart. Patients and physicians are exposed to less radiation due to these advancements, resulting in a reduction in the need for fluoroscopy. In complex situations, such as persistent atrial fibrillation, high-density mapping also enhances accuracy.

Restraints

Lack of skilled electrophysiologists and trained professionals

Proficiency in intricate mapping software and specialized electrophysiology training are essential for the effective operation of cardiac mapping systems. Nonetheless, there is a global shortage of qualified experts who can accurately interpret and perform such procedures. This increases reliance on a small pool of specialists and results in the underutilization of available equipment. A lack of formal training programs and low employee retention rates also hampers growth in emerging economies.

Complexity and longer learning curve of new technologies

Newer mapping systems with improved precision, but they come with complex user interfaces and a steep learning curve. Clinicians often need extensive hands-on experience and workshops to use these systems in real-time procedures confidently. The transition from conventional 2D mapping to advanced 3D or AI-integrated platforms can disrupt existing workflows. Delayed adoption due to hesitance or lack of familiarity can slow market expansion, especially in institutions with limited technological adaptability.

Opportunities

Growing demand for outpatient and ambulatory procedures

The trend in cardiac care is shifting toward ambulatory surgical centers (ASCs) and outpatient settings, where there is a need for time- and cost-efficient technologies. Systems designed for small, portable cardiac mapping in these environments offer a significant opportunity. By creating systems with quick setup times, compact footprints, and intuitive user interfaces, manufacturers can capitalize on this trend. Demand will continue to be driven by the growth of same-day cardiac procedures around the world.

Personalized and precision medicine approaches

The move toward personalized treatment is opening new avenues in cardiac mapping, particularly for patient-specific ablation strategies. Mapping systems that can integrate patient data, anatomy, and electrophysiological patterns into tailored treatment plans are gaining traction. This trend encourages the development of software platforms that can support adaptive procedures. Companies that offer customizable solutions tailored to individual arrhythmia profiles are more likely to experience higher clinical adoption.

Segment Insights

Product Type Insights

The electroanatomical mapping systems segment dominated the cardiac mapping market in 2025. The dominance of electroanatomical systems stems from their ability to create incredibly detailed 3D maps of the heart's chambers, which aid doctors in accurately locating the causes of arrhythmias. These tools greatly increase the success rate of ablation procedures by providing real-time visualization of complex arrhythmias. They are also recommended for adoption in clinical settings due to their capacity to shorten fluoroscopy times and reduce radiation exposure. Continuous advancements in software algorithms and mapping accuracy have made these systems indispensable in high-volume electrophysiology centres. Moreover, the availability of remote support and compatibility with robotic ablation systems is supporting widespread utilization.

The contact mapping systems segment is expected to grow at the fastest rate, under which the high-density contact mapping systems sub-segment is leading the charge. This is due to their ability to gather thousands of data points every second, which makes it possible to map electrical activity at extremely high resolution. Especially in cases of persistent AF and ventricular tachycardia, this enhanced resolution aids in the precise identification of micro-re-entrant circuits and intricate arrhythmogenic substrates. Their increasing use in research and academic hospitals is driving the market's explosive expansion. Technological advancements in catheter design and multi-electrode arrays are making them more user-friendly. Collaborations between medical device companies and hospitals for training and development are also boosting the adoption rate of these devices.

Indication Insights

The atrial fibrillation (AF) segment dominated the cardiac mapping market in 2025 due to its widespread occurrence worldwide and the rising rates of diagnosis among the elderly. The most common arrhythmia that is treated with catheter ablation is AF, and treatment planning for this condition depends heavily on mapping. Additionally, the need for mapping systems has increased due to a rise in early interventions brought on by increased awareness of the risks of stroke associated with AF. Multiple clinical studies have demonstrated the benefit of mapping-guided ablation over empirical approaches. The introduction of minimally invasive AF treatment in outpatient settings further reinforces the need for reliable and rapid mapping technologies.

The ventricular tachycardia segment is likely to grow at the fastest rate in the upcoming period. VY procedures are now safer and more successful thanks to the growing use of high-resolution mapping technologies, particularly in patients who have had a myocardial infarction. Electrophysiologists are adopting substrate-based mapping systems for VT ablation at a faster rate due to growing clinical evidence in favor of this approach. Recurrence rates have been considerably decreased in VT due to the increasing use of 3D and high-density electron atomical mapping systems. Scar tissue can now be identified more quickly and precisely thanks to new mapping algorithms. Furthermore, demand is being fueled by screening programs and growing awareness of sudden cardiac death in high-risk groups.

Technology Insights

The contact mapping segment dominated the market in 2025, as physical contact with the endocardial surface allows for the precise and direct acquisition of intracardiac signals. Most electrophysiology procedures utilize it because it is dependable in capturing real-time electrograms and is compatible with a wide variety of catheters. Hospitals' extensive use and cost-effectiveness have further cemented their dominance. Due to their ease of interpretation and compatibility with standard ablation tools, contact-based systems are frequently chosen. When compared to non-contact alternatives, electrophysiologists also have a shorter learning curve. By enhancing catheter ergonomics and signal fidelity, manufacturers are solidifying their market position.

The non-contact mapping segment is expected to experience rapid growth, as it enables the mapping of entire cardiac chambers and the reconstruction of anatomy more quickly without physical contact. This shortens the process and improves safety, particularly in cases of unstable or complex arrhythmias. Non-contact systems are becoming increasingly popular in sophisticated EP labs as innovation leads to better algorithms and more precise visualization. When catheter stability is a problem, they are especially helpful in pediatric cases or arrhythmias. Advances such as real-time lesion assessment and panoramic 3D visualization are increasing the clinical utility of non-contact mapping. Its demand is also being fueled by more physician familiarity and supportive clinical guidelines.

End User Insights

The hospitals segment dominated the cardiac mapping market in 2025, as these settings are seeing a large number of catheter ablation procedures and arrhythmia treatments. Hospitals are preferred for complex cardiac interventions because they have integrated imaging systems and fully functional electrophysiology labs. Large private, institutional, and government-funded hospitals also make significant investments in cutting-edge mapping technologies, which contribute to the market's dominance. Hospitals also gain from partnerships with leading medical device manufacturers and reimbursement benefits. They frequently act as hubs for early adoption of next-generation mapping technologies and clinical trials. They are the preferred locations for cardiac mapping because they have skilled electrophysiologists on staff and post-procedural care facilities.

The electrophysiology labs segment is expected to grow at the fastest CAGR over the projection period, as they are increasingly specialized standalone centers focusing solely on diagnosing and treating arrhythmias. Due to the increased prevalence of cardiovascular disease, the growing availability of qualified EP specialists, and investments in cutting-edge cardiac mapping technologies that enable accurate and effective treatment planning, these labs are expanding. EP labs are a popular option for elective procedures because they provide more individualized care and shorter wait times. Particularly in urban areas, the trend of outpatient ablation procedures is speeding up the expansion of these facilities.

Regional Insights

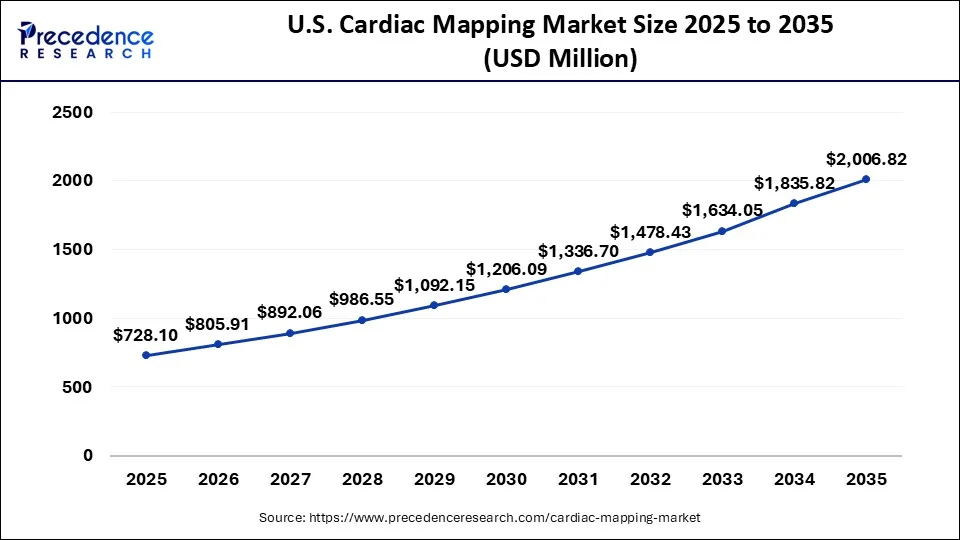

The U.S. cardiac mapping market size is exhibited at USD 728.10 million in 2025 and is projected to be worth around USD 2,006.82 million by 2035, growing at a CAGR of 10.67% from 2026 to 2035.

What North America the dominant region in the market?

North America dominated the cardiac mapping market due to its early adoption of cutting-edge cardiac technologies, high healthcare spending, and sophisticated healthcare infrastructure. The region's leadership has been further reinforced by the presence of significant players, a high incidence of arrhythmias, and favorable reimbursement policies for electrophysiology procedures. Demand for mapping-guided ablation is also being driven by government initiatives aimed at improving heart health and reducing the burden of stroke. In this area, clinical trials for next-generation mapping devices are regularly carried out. Further factors supporting ongoing dominance include an aging population, an advantageous regulatory pathway, and the extensive use of robotic catheter navigation systems.

Europe is expected to witness a significant amount of growth throughout the forecast period. This growth can be attributed to the increasing number of cardiac surgery patients and arrhythmia cases in the region. The region also has a strong presence of key market players, a rising number of cardiac surgery patients, and an advanced healthcare infrastructure. The rise in cardiovascular disease-related deaths and the increasing geriatric population in the region also highlight the need for continued innovation and advancements in healthcare technology to effectively reduce treat this situation.

Asia Pacific is the fastest-growing region, driven by the increasing use of sophisticated mapping systems, rising healthcare spending, and growing awareness of cardiac health. Regional market growth is also being driven by government initiatives aimed at reducing cardiovascular disease, the expansion of private healthcare facilities, and an aging population. Advanced electrophysiology treatments are becoming increasingly accessible in major metropolitan areas, thanks to medical tourism and cross-border partnerships. Local producers are bringing cutting-edge, reasonably priced mapping tools to the market. Additionally, the region's adoption is being accelerated by increased investment in hospital infrastructure, expansion of EP labs, and rising research.

The cardiac mapping devices market in Latin America is growing due to several factors. The reasons behind this growth can be attributed to the growing awareness regarding cardiovascular-related mortality and strong regulatory frameworks that support the market's growth. The Brazil cardiac mapping devices market is expanding the most, due to rising healthcare expenditure and government initiatives which are aimed at improving cardiac care infrastructure. The region is also witnessing a rise in collaborations and partnerships with research centers, academic institutions and key companies to advance cardiovascular disease research and medical education. These efforts continue to push the Latin America market forward.

Middle East and Africa are seen picking up the pace when it comes to the cardiac mapping market. This substantial growth is driven by the rising prevalence of CVDs and the increasing adoption of advanced medical technologies in the region. Increasing arrhythmia cases, rising healthcare expenditures, and the increasing number of hospitals in the region led to market expansion. Moreover, the region is also witnessing strategic collaborations between international medical device manufacturers and local healthcare providers, with aims to enhance treatment outcomes and expand access to advanced cardiac care solutions.

Value Chain Analysis

- Input and Raw material sourcing

Cardiac mapping systems depend on specialized materials such as mapping catheters, high precision wiring, sterile disposables and signal processing electronics. These are core components of these systems and are mandated to meet stringent regulatory standards. Suppliers increasingly prioritize biocompatible plastics, miniaturized electrodes and sensor modules that are compatible with 3D or advanced mapping systems.

Key Players: TE Connectivity, Molex, Nordson Medical - Manufacturing Process

Manufacturing includes the building of cardiac mapping systems and assembling the machines used in hospitals. Companies shape the catheters, attach the electrodes, install wirings and sensors and make sure that each unit is sterile and safe to use. They also assemble the main mapping system, which includes screens, wires and software. Larger companies are seen producing both, reusable machines as well as disposable catheters.

Key Players: Biosense, Abbott, Medtronic - Product Design and Innovation

In this stage, companies focus on improving how these cardiac mapping systems work. Their goal is to make these systems more accurate, faster to use and is easy for doctors during surgical procedures. Companies are seen working on clearer visual displays of the heart, more flexible catheters and better, advanced software that can enable healthcare professionals to detect heart abnormalities much faster. Innovations in this stage also help on reducing errors, enabling safer treatment of patients.

Key Players: Abbott, Boston Scientific, Medtronic

Top Vendors and their Offerings

- Johnson & Johnson: Biosense Webster leads the market with its CARTO 3 System, offering high-resolution 3D electroanatomical mapping and advanced integration with ablation catheters. Its strong clinical evidence, widespread adoption, and continuous innovation in navigation technologies position it as the gold standard in complex arrhythmia procedures.

- Abbott Laboratories: Abbott stands out with its EnSite X EP System, featuring sensor-enabled mapping catheters that deliver flexible, high-density mapping with real-time anatomical and electrical insights. The platform's compatibility with robotic navigation (via its collaboration with Stereotaxis) enhances procedural precision and physician control.

- Boston Scientific: Boston Scientific distinguishes itself with the Rhythmia HDx Mapping System, which offers ultra-high-density mapping with rapid acquisition of detailed electroanatomical data. Its ability to generate over 100,000 data points automatically in a single procedure enables exceptional precision in identifying arrhythmogenic substrates, especially in complex or repeat ablations.

Cardiac Mapping MarketCompanies

- Biosense Webster (Johnson & Johnson)

- Abbott Laboratories

- Boston Scientific Corporation

- Medtronic plc

- MicroPort Scientific Corporation

- EP Solutions SA

- Acutus Medical

- Philips Healthcare

- GE HealthCare

- Siemens Healthineers

- BIOTRONIK SE & Co. KG

- CathRx Ltd

- Lepu Medical Technology

- CardioFocus Inc.

- Stereotaxis Inc.

- APN Health, LLC

- CARTO (part of Biosense Webster)

- Imricor Medical Systems

- Topera (Acquired by Abbott)

- Bardy Diagnostics

Recent Developments

- In December 2025, vTitan Corporation, a MedTech company focused on innovative healthcare solutions, announced the launch of vCardio, a single-lead, wearable point-of-care cardiac monitor. The device is entirely designed and manufactured in India, making vTitan one of the first companies in the country to deliver an end-to-end solution from hardware to cloud-based AI analytics in the health-tech space. This vCardio has been engineered to provide smart, continuous monitoring for early detection of cardiac events and vigilant post-surgery care. With this launch, the company aims to make point-of-care services more accessible for patients and clinics.

(Source: www.expresshealthcare.in ) - On 21 May 2025, Johnson & Johnson MedTech announced the U.S. launch of the SOUNDSTAR CRYSTAL intracardiac ultrasound catheter, offering enhanced 2D imaging quality and full integration with the CARTO 3 mapping system through AI-powered anatomy generation.

(Source: www.jnjmedtech.com) - On 17 February 2025, Boston Scientific received CE mark approval for the navigation-enabled FARAWAVE NAV ablation catheter and FARAVIEW software, enhancing mapping capabilities for its FARAPULSE pulsed field ablation system used in atrial fibrillation treatment.

(Source:www.hmpgloballearningnetwork.com) - On 21 April 2025, Vektor Medical showcased vMap, its non?invasive AI-powered arrhythmia mapping system, at Heart Rhythm 2025 in San Diego. The FDA-cleared solution, using standard ECGs, has been used in over 2,000 procedures and will support the IMPRoVED?AF clinical study.

(Source:www.businesswire.com)

Segments Covered in the Report

By Product Type

- Contact Mapping Systems

- Traditional Contact Mapping Systems

- High-Density (HD) Contact Mapping Systems

- Non-Contact Mapping Systems

- Electroanatomical Mapping Systems

- Cardiac Mapping Catheters

- Linear Mapping Catheters

- Circular Mapping Catheters

- Multipolar Mapping Catheters

- Software & Algorithms

- 3D Visualization & AI-integrated Platforms

- Activation Mapping Software

- Voltage Mapping Tools

- Supportive Accessories & Consumables

- Sheaths

- Connectors

- Calibration Devices

- Others

By Indication

- Atrial Fibrillation (AF)

- Atrial Flutter

- AV Nodal Reentrant Tachycardia (AVNRT)

- Ventricular Tachycardia (VT)

- Supraventricular Tachycardia (SVT)

- Others (e.g., Atrial Tachycardia, WPW Syndrome)

By Technology

- Contact Mapping

- Non-Contact Mapping

- Electromagnetic Mapping

- ECG Imaging

- Others

By End User

- Hospitals

- Electrophysiology (EP) Labs

- Ambulatory Surgical Centers (ASCs)

- Research & Academic Institutes

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting