Cardiotoxicity Screening Market Size and Forecast 2025 to 2034

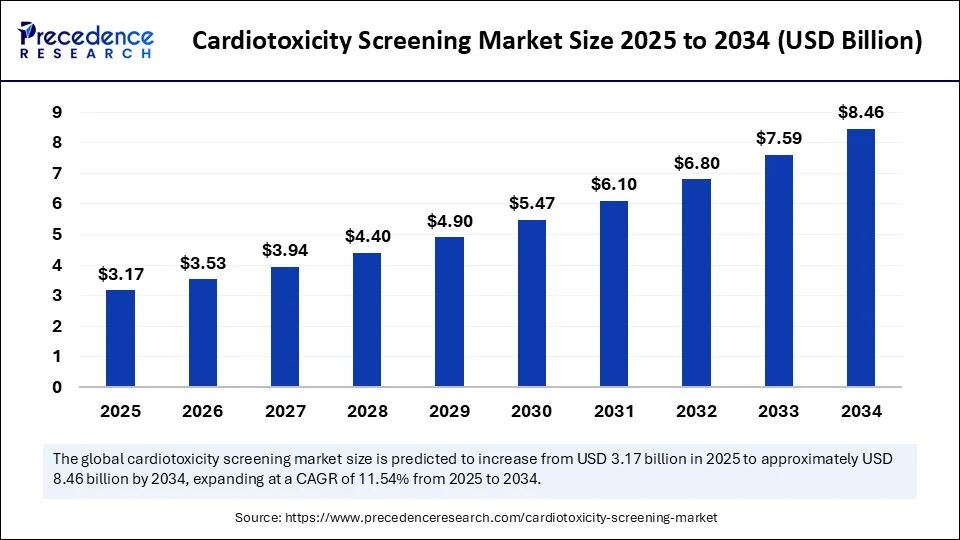

The global cardiotoxicity screening market size accounted for USD 2.84 billion in 2024 and is predicted to increase from USD 3.17 billion in 2025 to approximately USD 8.46 billion by 2034, expanding at a CAGR of 11.54% from 2025 to 2034. The increased demand for effective and precise cardiotoxicity screening methods is driving the global market. The growing awareness about drug safety is further contributing to this demand.

Cardiotoxicity Screening MarketKey Takeaways

- In terms of revenue, the global cardiotoxicity screening market was valued at USD 2.84 billion in 2024.

- It is projected to reach USD 8.46 billion by 2034.

- The market is expected to grow at a CAGR of 11.54% from 2025 to 2034.

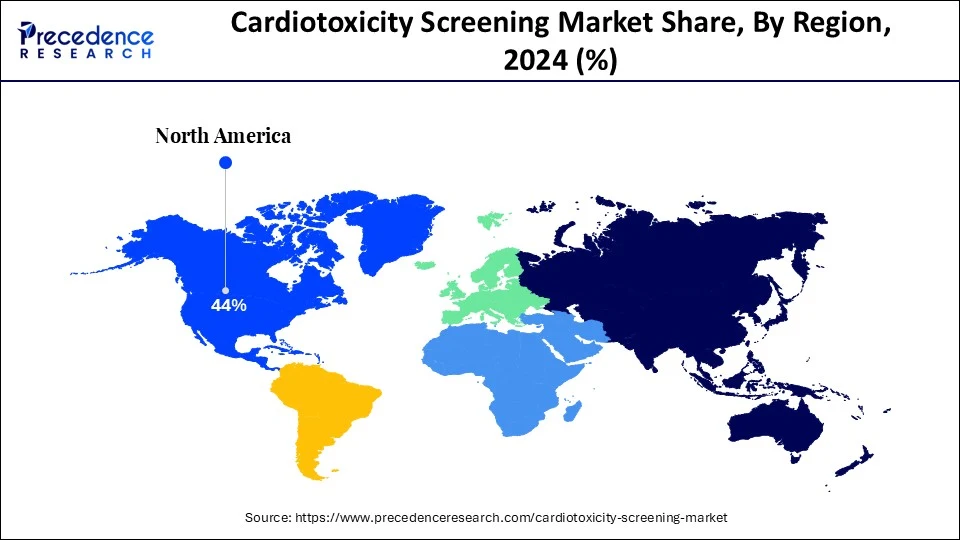

- North America dominated the global cardiotoxicity screening market with the largest share of 44% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By assay/test type, the hERG (Kv11.1) binding and patch-clamp assays segment contributed the biggest market share of 30% in 2024.

- By assay/test type, the multi-electrode array (MEA) with iPSC-cardiomyocytes segment is expected to grow at a notable CAGR between 2025 and 2034.

- By modality/approach, the in vitro (cell and tissue-based) segment captured the highest market share of 60% in 2024.

- By modality/approach, the in silico/computational (simulation, PBPK-QT models) segment will grow at a CAGR between 2025 and 2034.

- By product and service type, the assay kits, reagents and ready-to-use cells (iPSC-cardiomyocytes, dyes, media) segment held the largest market share of 40% in 2024.

- By product and service type, the contract testing services/CRO screening programs segment will grow at a notable CAGR between 2025 and 2034.

- By end-user, the pharmaceutical and biotechnology companies (in-house screening) segment generated the major market share of 55% in 2024.

- By end-user, the CROs/safety and toxicology service providers segment will grow at a CAGR between 2025 and 2034.

AI to Improve Cardiotoxicity Screening

The use of Artificial Intelligence in both research and clinical practices is becoming a transformative approach to enhance cardiotoxicity screening methods. The growing prevalence of heart disease and advancements in cardiotoxicity screening have boosted the shift toward AI adoption in ECG analysis, enabling early detection of structural heart diseases, like cardiomyopathy, pulmonary hypertension, and valve disease. AI-powered prediction of drug-induced cardiotoxicity makes them essential in new drug developments. The growing adoption of AI-enabled tools for specific heart conditions and the integration of AI for pro-arrhythmia predictions are transforming cardiotoxicity screening approaches. Additionally, the ongoing use of AI in cardio-oncology helps to reduce the risk of developing cardiotoxicity.

U.S. Cardiotoxicity Screening Market Size and Growth 2025 to 2034

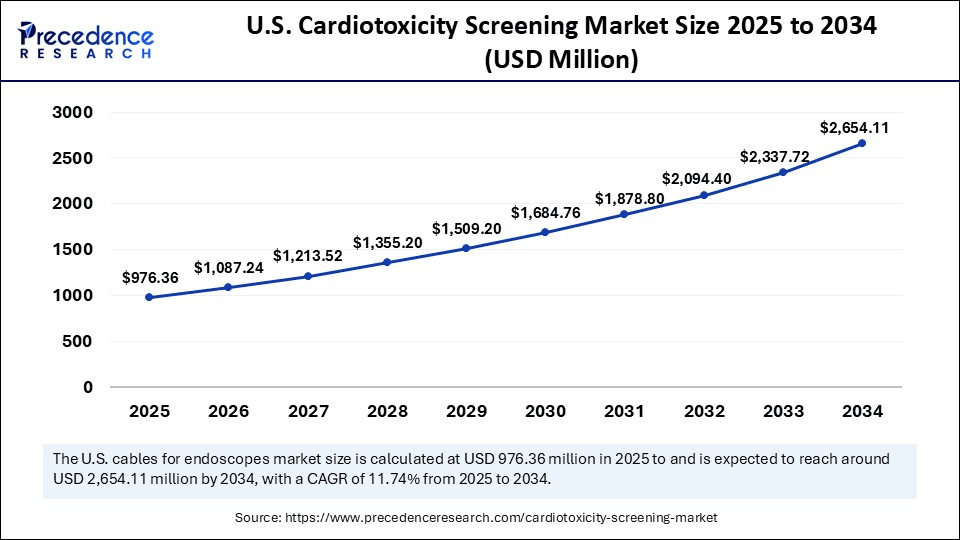

The U.S. cardiotoxicity screening market size was exhibited at USD 874.72 million in 2024 and is projected to be worth around USD 2,654.113 million by 2034, growing at a CAGR of 11.74% from 2025 to 2034.

North America Cardiotoxicity Screening Market

North America dominates the global market due to the region's advanced healthcare infrastructure, strict regulatory guidelines, and strong presence of major pharmaceutical companies. The awareness about drug safety and early detection of chronic disease is contributing to the increased need for comprehensive cardiotoxicity screening methods. Additionally, the large emphasis on technological advancements, driven by expanding applications across personalized medicine and drug developments, is fostering innovations in cardiotoxicity screening.

The U.S. Key Market Trends

The U.S. is a major player in the regional market, contributing to growth due to the increased prevalence of cardiovascular diseases and increased awareness of heart disease, and technological advancements. The expanding cardio-oncology field and growing focus on novel drug developments are fostering the adoption of cardiotoxicity screening technologies in countries' research. Additionally, the strong presence of stringent regulations, strict guidelines for drug safety, and initiatives in approving novel innovations are further adding to the market expansion. The FDA Modernization Act empowers the use of non-animal models and AI for drug development, expecting to bring innovative regulatory approvals for novel cardiotoxicity testing efforts.

- In March 2025, researchers at the University of California, San Diego, and Stanford University developed an AI model to reconstruct the electrical signals inside heart cells based on recordings taken from outside the cells. This model can help to open the possibility of chip and high-yielding cardiotoxicity testing by using commercially available microelectrode arrays. (Source: https://www.bio-itworld.com)

Asia Pacific Cardiotoxicity Screening Market

Asia Pacific is the fastest-growing region of the global market, growth driven by the region's increasing healthcare expenditure, rising prevalence of cardiovascular disease, and growing awareness about drug safety. The increased investments in the R&D sector, government initiatives, and strict regulations for early toxicity testing of novel drugs are driving the need for comprehensive cardiotoxicity screening in the region. Asia Pacific has experienced rapid innovations in screening technologies such as 3D model cells, microfluidics, and AI-powered data analysis to improve the efficiency and accuracy of cardiotoxicity screening technologies, contributing to the growing adoption rate.

China's Innovative Approaches in Cardiotoxicity Screening Developments

China is leading the regional market due to countries' rapid innovations in the development of cardiotoxicity screening technologies. The increased cardiovascular disease prevalence, strict regulatory standards, and rising R&D investments are driving the shift toward technological advancements. Major innovations, including in vitro and in vivo modeling, AI-enabled analytics, and high-throughput screening, are leveraging market growth.

Indian Market Trends

India is the second-largest country, leading the regional market, due to countries' expanding healthcare expenditure and pharmaceutical R&D growth. The growing cardiovascular disease, advancements in screening technologies, and increasing drug development activities are fostering the market growth. Additionally, government investments and support for local pharmaceutical companies are contributing to drug development activities, driving the need for advanced cardiotoxicity screening technologies.

Cardiotoxicity Screening Market: Overview and Outlook

The cardiotoxicity screening market comprises assays, instruments, software, and outsourced services used to detect, quantify, and predict adverse effects of chemical and biological drug candidates on cardiac function. The market spans in vitro platforms (hERG/Kv11.1 assays, automated patch clamp, multi-electrode arrays (MEA) with human iPSC-cardiomyocytes, calcium-flux assays), in vivo telemetry/ECG studies, and silico/computational models (QT/QTc prediction, integrated CiPA-style workflows). Growing regulatory emphasis on pro-arrhythmia risk, expansion of oncology and CNS therapeutics with cardiac liabilities, and advances in human-relevant models (iPSC cardiomyocytes, MEA, APC + modeling) drive market expansion.

The market is experiencing rapid expansion, driven by emerging trends such as human-relevant models, including iPSC-cardiomyocytes and MEA, the rising integration of silico modeling, and advancements in APC throughput. Pharmaceutical companies are focusing on investing in platforms and outsourced services to reduce late-stage attritions, making silico and in vitro CiPA modeling attractive solutions. Additionally, the growing complexity of biologics and oncology innovations is driving demand for conventional cardiac safety assays and long-term monitoring, thereby increasing the need for cardiotoxicity screening.

The cardiotoxicity screening market is experiencing spectacular challenges, including translational gaps from animals to humans, variability in iPSC cell lots and protocols, high CAPEX for instrumentation, data standardization and regulatory harmonization, and the need for validated predictive algorithms. However, with growing innovations in areas like standardized human-cell panels, validated CiPA-aligned test batteries, integrated CRO + platform partnerships, and services for chronic cardiotoxicity (long-term culture/3D models), it is expected to bring significant innovative growth in the emerging market.

What are the Key Trends of the Cardiotoxicity Screening Market?

- Increased Cardiovascular Disease Prevalence: The rising incidence of chronic diseases like heart diseases and cancer, as well as a growing aging population, is driving the need for early detection and prevention of cardiotoxic effects, which has increased demand for advanced cardiotoxicity screening methods.

- Drug Safety Awareness: The growing advancement center of development and awareness of drug safety among healthcare professionals and patients has boosted demand for cardiotoxic screening services to prevent cardiotoxic effects of medications.

- Demand for Effective Screening Methods:The demand for sophisticated cardiotoxicity screening technologies has increased, particularly in personalized medications.

- Expanding Pharmaceutical Industry: The growth of the pharmaceutical industry has boosted drug development and therapeutic approaches, driving demand for advanced cardiotoxicity screening technologies.

- Regulatory Requirements: Strict regulations for drug safety, like the FDA and EMA, have mandated cardiotoxicity assignment for novel drugs before their approval, driving the need for precise cardiotoxicity screening technologies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.46 Billion |

| Market Size in 2025 | USD 3.17 Billion |

| Market Size in 2024 | USD 2.84 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Assay/Test Type, Modality/Approach, Product and Service Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Chemotherapy and Oncology Therapeutics

The rising innovations in cancer treatments, including chemotherapy and oncology therapeutics, drive the need for cardiotoxicity screening technologies. Chemotherapy and oncology therapeutics have a high risk of cardiotoxic effects, which can create cardiovascular complications in patients. Cardiotoxicity screening technology monitors and mitigates these risks of effects. The increased use of chemotherapy and oncology therapeutics is driving demand for effective cardiotoxicity screening methods for enhancing patient safety and reducing the risk of long-term cardiovascular damage. The growing innovations in personalized medicines for cancer are further driving demand for comprehensive cardiotoxicity screening technologies.

Restraint

High Cost

The cardiotoxicity screening technologies are expensive, especially the advanced technologies and comprehensive testing strategies, which can be a major barrier to market growth. Small budget-conscious pharmaceutical companies and limited healthcare budget regions can face high challenges in affording these technologies. The highest cost of cardiotoxicity screening technologies can hamper upfront investments in specialized equipment and personnel, leading to hindrance of novel innovations and advancements.

Opportunity

Advancements in Screening Technologies

The technological advancements in screening, such as in silico modeling, cell-based assays, and high-throughput screening, are transforming the cardiotoxicity screening market. These advanced technologies enable more accuracy, efficiency, and early detection of cardiotoxic effects. The growing advancements in computer models and simulations predict cardiotoxic effects, making technology more cost-effective and highly accurate. High-throughput screening enables testing of compounds and streamlines the screening process to enhance efficiency. The ability of cell-based assays to offer relevant biological data and mimic human cardiac tissues makes them ideal for screening newly developed drugs more efficiently and accurately.

Assay/Test Type Insights

Which Assay/Test Type Segment Leads the Cardiotoxicity Screening Market?

The hERG (Kv11.1) binding and patch-clamp assays segment led the cardiotoxicity screening market in 2024, due to its wide use in cardiotoxicity screening to identify components that have the potential of causing fatal heart rhythm abnormalities. The hERG (Kv11.1) binding and patch-clamp assays allow automated patch-clamp and high-throughput screening of drugs. This assay is ideal for the identification and mitigation of cardiotoxic risk factors during drug development. The use of patch-clamp in multi-well plates and automated liquid handling helps to screen a large number of components.

The multi-electrode array (MEA) with iPSC-cardiomyocytes segment is expected to grow fastest over the forecast period, due to increasing demand for non-invasive cardiotoxicity screening methods. The multi-electrode array (MEA) with iPSC-cardiomyocytes offers high-throughput screening and human-related data for drug safety assessments. Multi-electrode array (MEA) assays used for monitoring the electrical activity of cardiomyocytes derived from iPSC (human-induced pluripotent stem cells) help to identify potential cardiotoxicity effects in drugs.

Modality/Approach Insights

What made the In Vitro Segment Dominate the Cardiotoxicity Screening Market in 2024?

In 2024, the in vitro (cell and tissue-based) segment dominated the market, due to the need for human-relevant models in the screening of cardiotoxicity in developed drugs for human use. The limitation of animal models in human response prediction drives the adoption of the in vitro (cell and tissue-based) models. Cardiotoxicity screening offers more accurate and human-induced data than conventional animal models by screening using in vitro (cell and tissue-based) modality. The growing adoption of cutting-edge in vitro technologies like human-induced pluripotent stem cell-derived cardiomyocytes (hiPSC-CMs) and 3D cell cultures is driving demand for cardiotoxicity screening methods.

The in silico/computational (simulation, PBPK-QT models) segment is the second-largest segment, with a market share of approximately 15% in 2024, due to its ability to enhance the accuracy and efficiency of drug development. The in silico/computational (simulation, PBPK-QT models) plays a crucial role in process acceleration, helping to reduce dependency on traditional, costly, and time-consuming in vivo animal studies. The use of in silico/computational (simulation, PBPK-QT models) is high for pro-arrhythmia risk and the mechanism of ion channel-blocking drugs. The need for fast drug developments, reducing animal testing needs, and enhancing screening accuracy, the use of in silico/computational (simulation, PBPK-QT models) is rapidly growing in research and development activities.

Product and Service Type Insights

Why Assay Kites, Reagents, and Ready-to-Use Cells Dominated the Cardiotoxicity Screening Market in 2024?

The assay kits, reagents, and ready-to-use cells (iPSC-cardiomyocytes, dyes, media) segment dominated the cardiotoxicity screening market in 2024, due to their essential role in drug development and safety testing. The need for effective screening methods to ensure drug safety is driving the adoption of assay kits, reagents, and ready-to-use cells, especially the iPSC-cardiomyocytes, dyes, and media. Assays are widely used in the detection and measurement of cardiotoxic effects of drugs. Reagents help to improve screening reliability and effectiveness. The ready-to-use cells (iPSC-cardiomyocytes, dyes, media) are widely used in cardiotoxicity screening due to their ready-to-use culture.

The contract testing services/CRO screening programs segment is expected to grow fastest over the forecast period, due to its significant role in offering specialized expertise and efficient testing capabilities. Pharmaceutical and biotechnology companies are rapidly outsourcing cardiotoxicity screening services to CROs to reduce cost burden and expand their drug development process. The offering of specialized services such as cardiotoxicity assessments by contract testing services/CRO screening programs drives their need in the pharmaceutical companies.

End-User Insights

Which End-User Dominates the Cardiotoxicity Screening Market?

In 2024, the pharmaceutical and biotechnology companies (in-house screening) segment dominated the market, due to increased demand for advanced technologies in in-house drug developments of pharmaceutical and biotechnology companies. These companies are investing heavily in research and development, driving the need for advanced cardiotoxicity screening technologies and services. The growing emphasis of these companies to invest in advanced technologies such as high-throughput screening, cell-based assays, and in silico modeling is contributing to the segment's growth. Additionally, the strong resource and specialized expertise for assessing cardiac safety products in pharmaceutical and biotechnology companies drives the adoption of cardiotoxicity screening technologies.

The CROs/safety and toxicology service providers segment is expected to grow fastest over the forecast period, due to specialized expertise provided in assessing cardiotoxicity by CROs. Pharmaceutical companies are investing in strong cardiac safety testing and monitoring to meet regulatory requirements for patient safety, driving the need for CROs/safety and toxicology service providers. These providers provide testing platforms and infrastructures, helping to offer cardiotoxicity screening more efficiently and cost-effectively to pharmaceutical and biotechnology companies.

Value Chain Analysis

- R&D

There are several R&D efforts in cardiotoxicity screening technologies, including advanced imaging techniques, biomarker identification and utilization, cell-based screening, early detection and prevention, and advanced assessment and monitoring.

Key Players: Molecular Devices, Creative Bioarray, Miltenyi Biotech, and Axol Bioscience.

- Distribution to Hospitals

Cardiotoxicity screening distribution in hospitals conducts regular cardiac function assessment for patients, particularly patients who are undergoing chemotherapy. Common methods such as radionuclide ventriculography, biomarker testing, and echocardiography are widely used in hospitals.

Key Players: Cyprotex, Eurofins Discovery, Stemina Biomarker Discovery, and Charles River Laboratories.

- Patient Support and Services

HIPAA regulations are the major assets for patient support and services, including privacy and security guidelines regarding cardiotoxicity screening. This activity encourages education of healthcare professionals about their legal and ethical responsibilities to ensure patient support and privacy while performing cardiotoxicity screening.

Key Players: IQVIA, Indigital Technologies, Eurofins Scientific, and Labcorp Drug Development.

Cardiotoxicity Screening Market Companies

- Charles River Laboratories

- Labcorp/Covance

- Eurofins Scientific

- WuXi AppTec

- Evotec

- ICON plc

- Certara

- Simulations Plus

- Axion BioSystems

- Multi-Channel Systems (MCS)

- Nanion Technologies

- Sophion Bioscience

- Molecular Devices/Danaher group

- Fujifilm-CDI (Cellular Dynamics International)

- Ncardia (formerly Axiogenesis)

- Axol Bioscience

- Thermo Fisher Scientific

- PerkinElmer

- Charles River/HESI/CiPA collaborators

Recent Developments

- In June 2025, the U.S. Geological Survey published in the journal Environmental Science and Technology, identifying Biosphenol P (BPP) as a potent cardiotoxic compound through high-throughput screening. Researchers have highlighted BPP's ability to induce cardiotoxicity by apoptosis and the NF-kB pathway. (Source: https://pubs.acs.org)

- In April 2025, the industry-leading solutions to streamline high-throughput screening while maintaining physiological relevance were launched by the Ncardia in a “Advancing high-throughput cardiac screening with physiologically relevant 3D iPSC-based models,” focused webinar.(Source: https://www.ddw-online.com)

Segment Covered in the Report

By Assay/Test Type

- hERG (Kv11.1) Binding and Patch-Clamp Assays

- Automated Patch Clamp (APC)

- Multi-Electrode Array (MEA) with iPSC-Cardiomyocytes

- Calcium-Flux and Optical Electrophysiology Assays

- In vivo Telemetry/Conscious ECG Studies (rodent, dog, non-rodent)

- In Silico Predictive Modeling and QSAR/CiPA Workflows

By Modality/Approach

- In Vitro (cell and tissue-based)

- In Vivo (animal telemetry, ECG)

- In Silico/Computational (simulation, PBPK-QT models)

By Product and Service Type

- Assay Kits, Reagents and Ready-to-use Cells (iPSC-cardiomyocytes, dyes, media)

- Instrumentation and Platforms (MEA systems, APC rigs, patch amplifiers)

- Contract Testing Services/CRO Screening Programs

- Software and Predictive Analytics (QTc algorithms, pro-arrhythmia AI)

- Consulting, Validation, and Regulatory Support

By End User

- Pharmaceutical and Biotechnology Companies (in-house screening)

- CROs/Safety and Toxicology Service Providers

- Academic and Research Institutes

- Regulatory Bodies and Translational Consortia

- Instrument and Reagent Suppliers (internal R&D use)

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting