Cell Therapy Manufacturing Market Size and Forecast 2025 to 2034

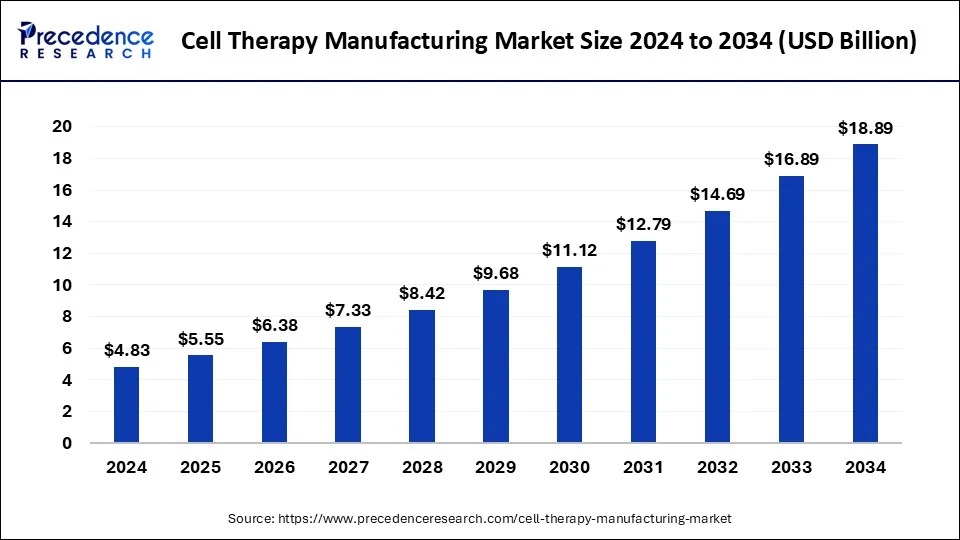

The global cell therapy manufacturing market size was estimated at USD 4.83 billion in 2024 and is predicted to increase from USD 5.55 billion in 2025 to approximately USD 18.89 billion by 2034, expanding at a CAGR of 14.61% from 2025 to 2034. The rising incidence of chronic diseases such as cancer, autoimmune disorders, and degenerative conditions are key factors driving the market growth.

Cell Therapy Manufacturing Market Key Takeaways

- The global cell therapy manufacturing market was valued at USD 4.83 billion in 2024.

- It is projected to reach USD 18.89 billion by 2034.

- The market is expected to grow at a CAGR of 14.61% from 2025 to 2034.

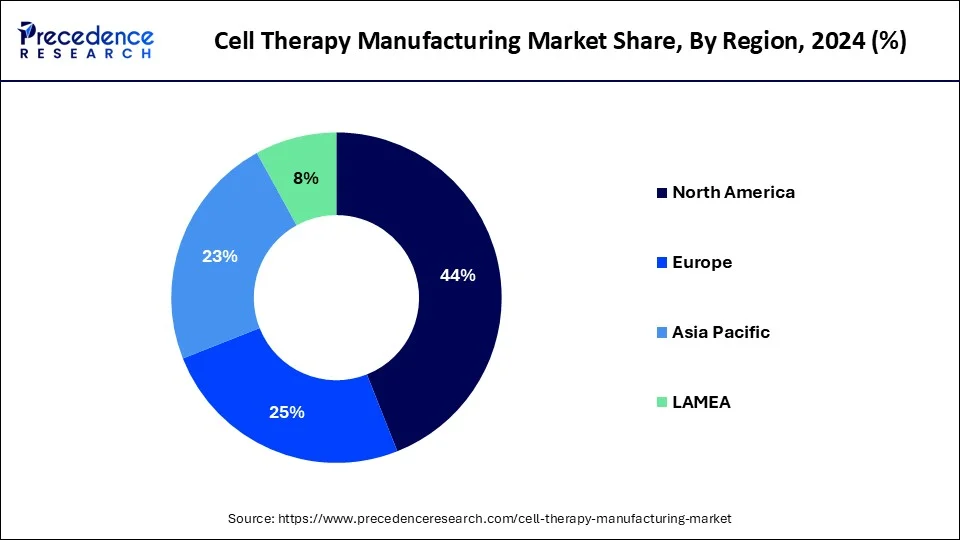

- North America led the market with a major revenue share of 44% in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

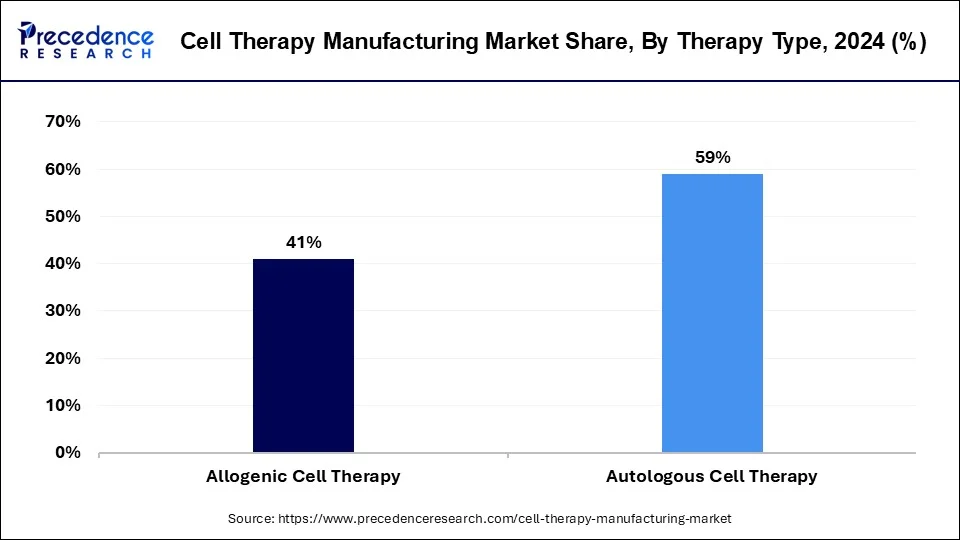

- By therapy type, the autologous cell therapy segment has held the biggest revenue share of 59% in 2024.

- By therapy type, the allogenic cell therapy segment is projected to be the fastest-growing segment over the forecast period.

- By technology type, the somatic cell technology segment held the largest share of the market in 2024.

- By technology type, the 3D technology segment is expected to grow at the fastest rate during the projected period.

- By source, the IPSC (induced pluripotent stem cell) segment dominated the market in 2024.

- By source, the bone marrow segment is the second largest segment in the global market.

- By application, the oncology segment has contributed the largest revenue share of 35% in 2024.

- By application, the neurological segment is projected to show the fastest growth during the forecast period.

- By end user, pharmaceutical and biotechnology companies held the dominant position in the cell therapy manufacturing market in 2024.

- By end user, academic and research institutes are expected to be the fastest-growing segment in the market going forward.

U.S. Cell Therapy Manufacturing Market Size and Growth 2025 to 2034

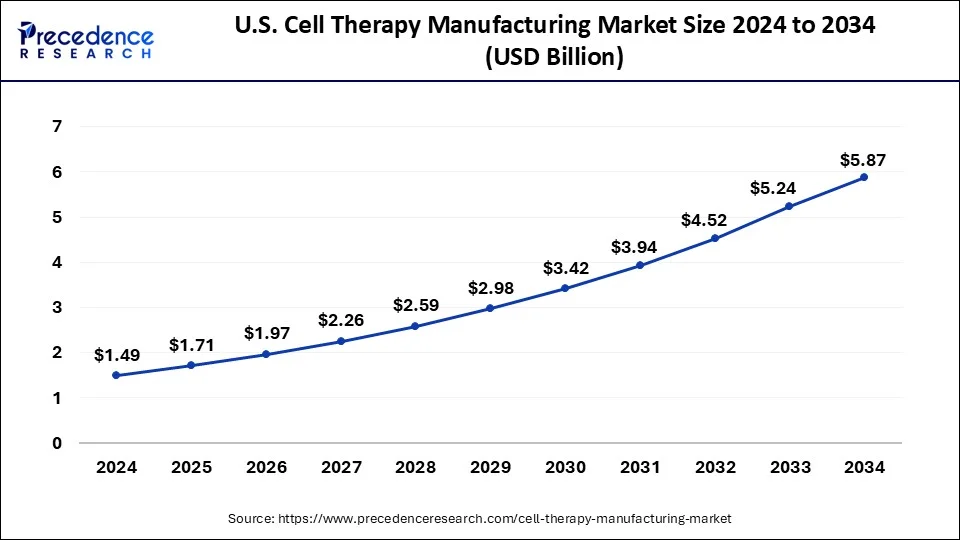

The U.S. cell therapy manufacturing market size was estimated at USD 1.49 billion in 2024 and is predicted to be worth around USD 5.87 billion by 2034, at a CAGR of 14.70% from 2025 to 2034.

North America dominated the global cell therapy manufacturing market. The United States led in North America in 2023 and is expected to maintain this position in the forecast period. Factors such as the rising prevalence of sickle cell disease and the presence of numerous developers of gene, cell, and tissue-based therapeutics are driving growth. Moreover, the region benefits from many contract development organizations, and local companies are expanding their manufacturing facilities.

- In May 2023, Thermo Fisher Scientific and the University of California, San Francisco (UCSF) announced a partnership to establish a new cell therapy cGMP manufacturing site. This facility will be adjacent to UCSF Medical Center's Mission Bay Campus.

Asia Pacific is expected to witness the fastest growth during the forecast period. Countries such as China, Japan, and South Korea are investing heavily in research and development and constructing state-of-the-art manufacturing facilities. The region benefits from a sizable patient population, rising healthcare spending, and government support to foster the growth and acceptance of cell therapies. Additionally, Asia Pacific is becoming a center for contract manufacturing organizations (CMOs) providing cell therapy manufacturing services.

- In April 2024, President Draupadi Murmu launched India's first indigenously developed CAR T-cell therapy for the treatment of cancer, hailing it as a "breakthrough" that provides a "new hope for humankind" in the battle against the disease.

How AI has been affected to the market?

Artificial intelligence has brought significant benefits to the cell therapy manufacturing market by enhancing precision, efficiency, and scalability across the production process. Machine learning algorithms can analyse vast datasets from cell cultures to identify optimal growth conditions, detect subtle quality deviations, and predict yields more accurately. This proactive monitoring reduces the risk of batch failures and ensures consistent therapeutic potency. AI also support automation in complex workflows, minimizing human error and contamination risks while freeing skilled personnel for higher value tasks. In addition, predictive analytics helps forecast raw material needs and manufacturing timelines, improving supply chain reliability. These capabilities not only streamline operations but also accelerate the path from research to commercialization, ultimately making cell therapies more accessible to patients.

Market Overview

The cell therapy manufacturing market comprises industries that produce therapeutic products using isolated tissue to treat disorders or wounds. Cell therapy manufacturing is essential for developing and commercializing cell-based treatments, such as CAR-T cell and stem cell therapies. It is critical to have efficient and scalable manufacturing processes to meet the increasing demand for these innovative treatments and make them available to patients around the world.

The process of cell therapy includes harvesting cells from a patient or donor, modifying or growing them in a lab, and then reintroducing them into the patient's body to improve biological functions. Manufacturing includes steps like isolating cells, expanding them, performing genetic modifications if needed, conducting quality control tests, and preparing the final product. These steps are carried out in highly controlled environments to ensure the safety, purity, and effectiveness of therapeutic cells.

Cell Therapy Manufacturing Market Growth Factors

- Ongoing research and development activities can lead to the findings of new cell therapy pathways that can drive market growth.

- Rising investment from the public and private sectors into the cell therapy market can fuel the market growth in upcoming years.

- The expansion of clinical trials across the globe can also contribute to the market expansion.

- Regulatory agencies like EMA and FDA are providing support and guidance for the development and approval of cell therapies which can boost market growth further.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 14.61% |

| Market Size in 2024 | USD 4.83 Billion |

| Market Size in 2025 | USD 5.55 Billion |

| Market Size by 2034 | USD 18.89 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy Type, Technology Type, Source, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

One major driver in the cell therapy manufacturing market is the groping clinical success and expanding pipeline of cell based therapies. Over the past decade, several cell therapies. Over the past decade, several cell therapies have achieved regulatory approval and demonstrated transformative outcomes for patient with conditions that previously had limited or no effective treatments. These breakthroughs have validated the therapeutic potential of cell based interventions, fuelling investment from both public and private sectors. As more therapies advance through late stage clinical trials, demand for scalable, high quality manufacturing solutions is rising. Pharmaceutical companies, biotech firms, and contract manufacturing organizations are expanding capabilities to meet this demand, while research institutions are pushing the boundaries of what cell therapies can target, ranging from oncology and autoimmune diseases to regenerative medicine applications. This momentum creates a feedback loop, where clinical success spurs more research, which in turn increases the need for robust manufacturing capacity.

Another significant driver is the advancement of manufacturing technologies and automation. The cell therapy industry has traditionally relied on lobar intensive, manual processes that were difficulty to scale. However, recent innovations such as closed system production while improving consistency and reduced contamination risks. These technologies allow manufacturers to achieve higher yields, shorten production cycles, and reduce human error. Moreover, automation enables better process control and data tracking, which is essential for meeting stringent regulatory requirements. As these tools become more widely adopted, they lower barriers to entry for new market participants and help established player scale up meet growing global demand. This technological progress is not only enhancing operational efficiency but also paving the way for more affordable and accessible cell therapies in the long term.

Restraint

One of the major restraints in the cell therapy manufacturing market is the complexity of production and scalability challenges. Cell therapies require an intricate manufacturing process that involve highly specialized equipment, strict environmental controls, and a deep understanding of cell biology. Each therapy often demands a tailored approach to culturing, expanding, and modifying cells, which is a persistent challenge. Even minor variations in temperature, nutrient composition, or handling techniques can affect cell viability and therapeutic efficacy. This complexity not only prolongs development timelines but also limits the capacity of manufacturers to meet growing global demand. Companies must invest heavily in training, process optimization, and quality control measures, which can slow market expansion and strain resources.

Another significant restraint is the regulatory and compliance burden associated with cell therapy manufacturing. Because these therapies involve living cells and have the potential to directly impact patient health, they are subject to some of the most rigorous oversight detailed documentation of manufacturing processes, and robust traceability of raw specially for smaller companies and research institutions that may lack dedicated compliance teams. Additionally, regulations can vary widely between regions, meaning that manufacturers aiming for global distribution must adapt processes and documentation to multiple standards. Delays in approvals or the need for repeated audits can slow the pace of innovation, deter investment, and limit the speed at which new therapies reach the market. These stringent requirements, while essential for patient safety, create substantial operational and financial hurdles for players in the industry.

Opportunities

One major opportunity in the cell therapy manufacturing market lies in the expansion of allogeneic, “off-the-shelf” therapies. Unlike autologous therapies, which require cells to be collected from each individual patient, allogenic therapies use donor cells that can be manufactured red in bulk, stored, and administrated to multiple patients. This approach has the potential to dramatically reduce treatment costs, shorten production timelines, and increase accessibility. As research in cell engineering, cryopreservation, and immune compatibility advances, more companies are expected to invest in scalable allogeneic manufacturing platforms. This shift could unlock large patient populations previously underserved by highly individualized, labor- intensive autologous approaches, creating new commercial and therapeutic opportunities.

Another merging opportunity is the integration of AI and digital twin technologies into manufacturing workfloes. AI driven analytics can optimize cell growth conditions, predict potential quality deviations, and enhance process consistency, while digital twin models allow manufactuerers to simulate production scenarios before implementing them in real facilities. These tools not only improve efficiency and product quality buut also support faster regulatory approval by providing richer, more consistent process data. As these digital capabilities mature, they will enable a new level of precision and scalability in cell therapy manufacturing, helping companies reduce costs, accelerate time to market, and expand into new geographies more confidently.

Therapy Type Insights

The autologous cell therapy segment was the leading therapy type in the cell therapy manufacturing market in 2024. Autologous therapy is a novel treatment approach that involves using a person's own cells or tissues. These cells or tissues are treated outside the body before being re-inserted into the donor. This method is widely used in various fields of medicine, including orthopedics and dermatology, for both therapeutic and cosmetic purposes.

According to market projections, the allogenic cell therapy segment is expected to experience the highest growth rate in the cell therapy manufacturing market over the forecast period. Allogenic cell therapies involve using cells from healthy donors of the same species, as opposed to xenogeneic therapies, which use cells from different species. In this type of therapy, cells are expanded and potentially modified to treat multiple patients.

Technology Type Insights

The somatic cell technology segment held the largest share of the cell therapy manufacturing market in 2023. These benefits stem from this type of therapy. Besides advancing stem cell research and therapies, somatic cell nuclear transfer (SCNT) has the special ability to produce cells tailored to individual patients for regenerative medicine. Also, it can be used to breed transgenic animals for biomedical purposes. These factors can drive the segment growth further.

The 3D technology segment is expected to grow at the fastest rate during the projected period. This is attributed to the three-dimensional (3D) technologies, like biomaterial scaffolds, that serve various purposes. They support cell survival, prompt cell specialization, provide a surface for cell growth, aid tissue regeneration, determine tissue shape and size, deliver growth factors, and shield cell transplants from the immune system to prevent rejection. These are some important functions of 3D technologies in medical applications.

- In January 2024, Pluri, an Israel-based biotech company, launched a new business division named PluriCDMO that will offer cell therapy manufacturing services as a contract development and manufacturing organization (CDMO). The new division includes a 47,000-ft2 good manufacturing practice (GMP) cell therapy production facility.

Global Cell Therapy Manufacturing Market Revenue, By Technology Type, 2022-2024 (USD Million)

| By Technology Type | 2022 | 2023 | 2024 |

| Somatic Cell Technology | 823.2 | 925.9 | 1,045.3 |

| Cell Immortalization Technology | 461.2 | 515.2 | 577.6 |

| Viral Vector Technology | 736.8 | 844.3 | 971.5 |

| Genome Editing Technology | 692.2 | 786.1 | 896.3 |

| Cell Plasticity Technology | 418.3 | 461.8 | 511.4 |

| 3D Technology | 623.6 | 730.3 | 858.1 |

Source Insights

The IPSC (induced pluripotent stem cell) segment dominated the cell therapy manufacturing market in 2023. Induced pluripotent stem cells (iPSCs) are viewed as an excellent option for creating ready-made allogeneic cell therapies. They can multiply indefinitely, are easily modified genetically, allow for the selection of specific clones after modification, and eliminate the need for individual cell collection.

The bone marrow segment is the second largest segment in the global cell therapy manufacturing market. A bone marrow transplant (BMT) is a specialized treatment for individuals with specific cancers or other medical conditions. It entails extracting stem cells from the bone marrow, filtering them, and reintroducing them into either the same individual (donor) or another recipient.

Global Cell Therapy Manufacturing Market Revenue, By Source, 2022-2024 (USD Million)

| Source | 2022 | 2023 | 2024 |

| IPSC's (Induced pluripotent stem cell) | 1,092.5 | 1,268.1 | 1,478.9 |

| Bone marrow | 801.3 | 914.6 | 1,048.3 |

| Umbilical cord | 648.2 | 723.2 | 809.6 |

| Adipose tissue | 721.2 | 812.6 | 919.0 |

| Neural stem | 492.3 | 545.1 | 604.5 |

Application Insights

The oncology segment dominated the cell therapy manufacturing market in 2024. An oncologist is a doctor who specializes in identifying, diagnosing, and treating cancer in patients. They are trained to address various types of cancer affecting different parts of the body. The advancement of biotechnology, personalized medicine, and innovative treatment methods has elevated oncology's significance in the market.

The neurological segment is projected to show the fastest growth during the forecast period. This is because, in recent years, there has been an increasing focus on using cell transplantation or cell therapy to treat nerve injuries. This approach has gained attention for its potential in treating neurological diseases by giving new treatment options. Cell therapy in neurological diseases aims to mimic the natural process of cell repair and development in the nervous system. This can help address the root causes of the disease, improve dysfunction, and facilitate tissue repair.

- In April 2024, Aspen Neuroscience, Inc. announced that the first patient had been dosed in the ASPIRO trial, a Phase 1/2a open-label clinical trial to assess the safety and tolerability of ANPD001, an autologous, dopaminergic neuron cell replacement therapy for participants with moderate to severe Parkinson's disease. Aspen Neuroscience is a private biotechnology company developing personalized regenerative therapies.

End-user Insights

End-user, pharmaceutical and biotechnology companies dominated the cell therapy manufacturing market in 2024. These organizations are at the forefront of translating scientific breakthroughs into commercially viable treatments, particularly in areas such as regenerative medicine, oncology, and rare disease. Their dominance is supported by string in house expertise, robust funding capabilities, and access to advanced manufacturing technologies. These companies often operate dedicated facilities or collaborate with specialized contract manufacturers to assure scalable, compliant, and high-quality production of cell-based products. Strategic partnerships, global distribution networks, and regulatory experience further strengthen their ability to lead in bringing innovative therapies from clinical trials to the marketplace.

In contrast, academic and research institutions are projected to be the fastest-growing end-user segment in the coming years. These institutions play a critical role in the discovery and preclinical development of novel cell therapies, often acting as incubators for ground-breaking innovations. Increasing public, and private research funding, along with enhanced access to advanced laboratory infrastructure, is enabling these institutes to progress projects from the bench to early stage clinical studies. Many are also entering collaborative agreements with industry players to accelerate technology transfer and commercialization. Their focus on exploring new therapeutic areas, coupled with the flexibility to experiment with unconventional approaches, positions them as a dynamic growth driver in the market.

Cell Therapy Manufacturing Market Companies

- Merck KGaA

- Thermo Fisher Scientific

- Catalent, Inc

- Bio-Techne

- Cytiva

- Lonza

- The Discovery Labs

- Novartis AG

- Bristol-Myers Squibb Company

- Gilead Sciences, Inc.

Recent Developments

- In March 2024, Cellars announced the completion of the first Cell Shuttle, an automated, cGMP-compliant cell therapy manufacturing platform to support the global demand for cell therapies while reducing the cost of manufacturing and process failure rates.

- In March 2023, Cell One Partners and the Center for Breakthrough Medicines (CBM) entered into a strategic collaboration aimed at accelerating the development and commercialization of cell and gene therapies. This collaboration brings together the expertise and resources of both organizations to drive innovation and advance the field of regenerative medicine.

- In September 2022, the Cell Therapy Manufacturing Center (CTMC) and Ori Bio collaborated to expedite the process development, commercialization, and clinical integration of cell therapies. This partnership aimed to enhance the advancement of cell-based treatments and bring them to patients more efficiently.

Segments Covered in the Report

By Therapy Type

- Allogenic Cell Therapy

- Autologous Cell Therapy

By Technology Type

- Somatic Cell Technology

- Cell Immortalization Technology

- Viral Vector Technology

- Genome Editing Technology

- Cell Plasticity Technology

- 3D Technology

By Source

- IPSC (Induced Pluripotent Stem Cell)

- Bone Marrow

- Umbilical Cord

- Adipose Tissues

- Neural Stem

By Application

- Musculoskeletal

- Cardiovascular

- Gastrointestinal

- Neurological

- Oncology

- Dermatology

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting