What is the Chemical Recycling Feedstock Market Size?

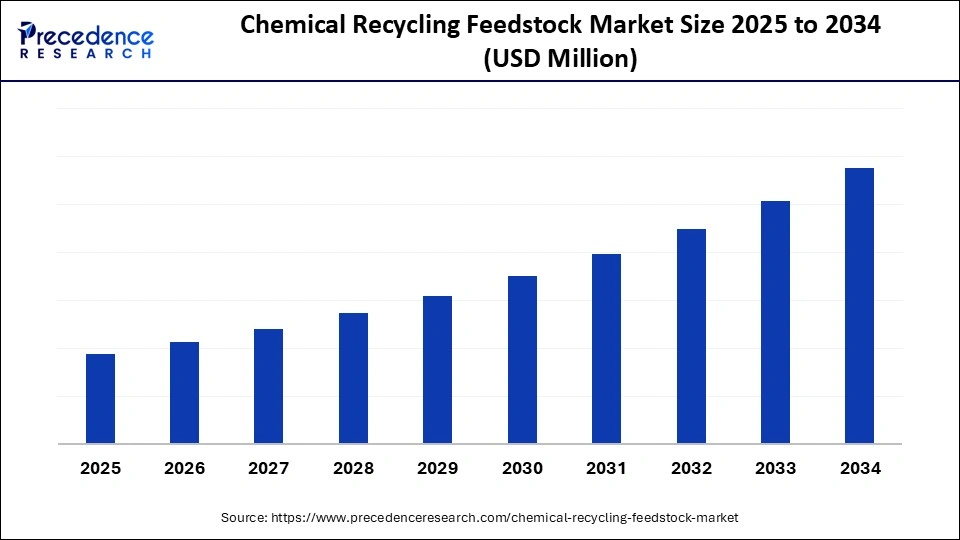

The global chemical recycling feedstock market is witnessing rapid growth as companies transform plastic waste into valuable raw materials for polymer and fuel production.The market growth is attributed to expanding technological advancements in chemical recycling and increasing corporate commitments to circular economy goals.

Chemical Recycling Feedstock Market Key Takeaways

- North America segment held a dominant presence in the market in 2024, accounting for an estimated 35% market share.

- The Asia Pacific segment is expected to grow at the fastest rate in the chemical recycling feedstock market during the forecast period of 2025 to 2034.

- By feedstock type, the polyethene (PE) segment accounted for a considerable share of the market in 2024 that holding a market share of about 30%.

By feedstock type, the polypropylene (PP) segment is projected to experience the highest growth rate in the market between 2025 and 2034. - By recycling technology, the pyrolysis segment led the market, accounting for an estimated 40% market share.

- By recycling technology, the depolymerization segment is set to experience the fastest rate of market growth from 2025 to 2034.

- By end-use application, the packaging segment registered its dominance over the chemical recycling feedstock market in 2024, which held a market share of about 37.2%.

- By end-use application, the textiles segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By scale of operation, the large-scale segment dominated the market, accounting for an estimated 60% market share.

- By scale of operation, the medium-scale segment is projected to expand rapidly in the market in the coming years.

What is the Chemical Recycling Feedstock Market?

The plastic waste crisis, which is increasing worldwide, is a major driver of the chemical recycling feedstock market. By 2024, the United Nations Environment Programme (UNEP) had reported that the amount of material used globally. They had increased three times over the last 50 years, with the majority of materials entering the economy being virgin materials.

This linear form of economy has contributed to significant waste and an environmental footprint, necessitating a shift to solutions for the circular economy. One of the most promising technologies is chemical recycling, where plastic waste can be transformed into useful chemicals and fuels by the use of pyrolysis. The 2024 report published by the U.S. Department of Energy highlighted the potential of chemical recycling to address the plastic waste issue. Further development of recycling facilities and refurbishment of infrastructure would help attract more investors, speed up plant commissioning timeframes, and thus fuel the market.(Source: https://www.unep.org)

Important Technological Change in Chemical Recycling Feedstock Market

The chemical recycling feedstock market is undergoing a period of radical technological transformation driven by the need for sustainability, resource efficiency, and alignment with the goals of the global circular economy. The development of pyrolysis and depolymerization operations can be described as one of the biggest changes. These are beneficial for improving the recovery of high-quality feedstocks from mixed plastic waste streams.

In 2024, Carbios, Loop Industries, and Plastic Energy, among others, made breakthroughs related to enzymatic recycling and solvent-based depolymerisation, and high-purity recovery of polyethene terephthalate (PET) and polypropylene (PP) became scalable. The other significant development is the introduction of AI-based sorting and automated material recognition technology, which optimizes feedstock segregation and reduces the rate of contamination, thereby enhancing conversion efficiency. Furthermore, chemical recycling technologies are expected to play a critical role in facilitating sustainable production and achieving ambitious carbon neutrality goals.

Impact of Artificial Intelligence on the Chemical Recycling Feedstock Market

The chemical recycling feedstock market is being transformed by the use of artificial intelligence (AI) to improve efficiency, lower costs, and open new avenues to scalability. AI-based computer vision systems assist companies in recognising, sorting, and isolating mixed plastic waste more precisely than is possible by manual or traditional mechanical methods. This has a direct effect on the quality and consistency of feedstock streams. Furthermore, the companies also use AI-powered digital twins to model real-time chemical reactions and feedstock conversion operations, optimizing parameters to achieve maximum output.

Trade Statistics & Trends for Chemical Recycling Feedstocks

- Singapore as Asia's Recycling Gateway: ASEAN trade in chemically recycled polymers increased by 21% in 2024, with Singapore serving as the central distribution hub for HDPE, LDPE, and PP feedstock across Southeast Asia.

- Middle East Green Corridor: Saudi Arabia and the UAE expanded chemical recycling feedstock exports by 14% in 2024, enabled by investments from SABIC and ADNOC into solvent-based recycling infrastructure.

- China–Japan Circular Economy Partnership: 2024 trade flows of depolymerized PET feedstock increased 18% following a bilateral recycling innovation agreement and joint investment in sorting technologies.

- Germany's Chemical Recycling Export Expansion: In 2024, Germany exported ~EUR 12 billion worth of chemically recycled feedstocks, largely to the EU and North America, driven by advances in pyrolysis and depolymerisation scaling.

- Latin America's Recycling Export Leap: Brazil, Chile, and Argentina collectively increased chemical recycling feedstock exports in 2024, with Braskem and other majors investing in local depolymerisation facilities.

- Circular Trade Alliance Formation: In 2024, the Global Recycling Foundation reported the creation of a Circular Feedstock Alliance between 15 nations to harmonise cross-border recycling trade standards.

- Trans-Pacific Recycling Pact: The U.S., Japan, South Korea, and Australia signed a trade pact in 2024 to promote the exchange of depolymerised and solvent-based feedstocks, projecting a growth in bilateral trade by 2026.

(Source: https://blog.itpweb.com)

(Source: https://www.researchgate.net)

(Source: https://www.eea.europa.eu)

(Source: https://www.hul.co.in)

(Source: https://www.reuters.com)

Regulatory Landscape Table Of Chemical Recycling Feedstock Market

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. EPA (Environmental Protection Agency) | National Recycling Strategy (2021) - Resource Conservation and Recovery Act (RCRA) - Sustainable Chemistry Challenge | Advanced recycling standards - Feedstock quality requirements - Environmental impact reporting | In 2024, the EPA introduced guidelines for chemical recycling feedstocks under the National Recycling Strategy, emphasizing the traceability and safety of feedstocks. Several pilot projects are underway to align pyrolysis outputs with food-contact regulations. |

| European Union | European Commission Directorate-General for Environment & ECHA | Circular Economy Action Plan - EU Waste Framework Directive - End-of-Life Plastics Regulation | Waste hierarchy compliance - Recycled content targets - Traceability of recycled polymers | The EU is implementing the SUP Directive and is advancing legislation to ensure chemical recycling meets the same safety requirements as virgin materials. In 2024, ECHA released a guidance document for chemical recycling facilities on the qualification of feedstock. |

| China | Ministry of Ecology and Environment (MEE) | Circular Economy Promotion Law - Technical Guidelines for Plastic Waste Recycling - GB Standards | Feedstock purity and classification - Industrial recycling infrastructure development | China's 2024 Five-Year Plan emphasizes the development of a circular economy, with chemical recycling identified as a key priority. MEE mandates feedstock certification and limits on hazardous content for recovered plastics. |

| India | MoEFCC + Central Pollution Control Board (CPCB) | Plastic Waste Management Rules, 2021 - Hazardous Waste (Management, Handling and Transboundary Movement) Rules | egregation and recovery standards - Licensing for recycling facilities - Compliance audits | India's 2024 draft amendments to the Plastic Waste Management Rules propose specific standards for chemical recycling feedstocks. The CPCB is establishing national guidelines for feedstock certification to encourage investment in advanced recycling. |

| Japan | METI + Ministry of the Environment (MOE) | Basic Environment Law - Recycling Promotion Law - Industrial Waste Management Law | Feedstock traceability - Safety and quality control - Resource efficiency | In 2024, Japan expanded its Industrial Waste Management Law to incorporate chemical recycling feedstocks. The government promotes pilot projects for enzymatic and depolymerization recycling routes as part of its Circular Economy Strategy. |

| South Korea | Ministry of Environment (MOE) | Framework Act on Resource Circulation - Act on Promotion of Saving and Recycling of Resources | Quality verification of recycled feedstocks - Certification programs - Green product incentives | In 2024, South Korea introduced a national certification system for chemical recycling facilities to ensure the quality of feedstock, thereby facilitating trade in recycled polymers and aligning with its Green New Deal initiatives. |

| Australia | Department of Climate Change, Energy, the Environment, and Water | National Waste Policy Action Plan - Product Stewardship Act - Recycling Modernisation Fund | Feedstock quality standards - Investment in recycling infrastructure - Public–private partnerships | In 2024, Australia increased funding for advanced chemical recycling projects, emphasizing transparent quality verification and alignment with circular economy objectives. Industry guidelines for pyrolysis and depolymerization feedstocks are under development. |

Chemical Recycling Feedstock Market Growth Factors

- Rising Global Plastic Waste Management Policies: Strengthening regulations and national strategies are propelling investments in advanced chemical recycling infrastructure, growing feedstock recovery capacity.

- Driving Circular Economy Commitments: Increasing corporate pledges to use recycled content are boosting demand for chemically reclaimed feedstock in manufacturing and packaging industries.

- Growing Technological Innovations in Polymer Conversion: Advances in catalytic depolymerization and pyrolysis technologies are fuelling higher efficiency and quality in feedstock recovery.

- Boosting Public–Private Recycling Initiatives: Collaborative programs between governments, NGOs, and industry players are driving scalable chemical recycling projects globally.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Feedstock Type, Recycling Technology, End-Use Applications, Scale of Operation, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is Increasing Demand for Sustainable Plastic Solutions Driving Growth in the Chemical Recycling Feedstock Market?

Increasing demand for sustainable plastic solutions is expected to drive the chemical recycling feedstock market in the coming years. Increased consumer and regulatory pressure on brand owners to use recycled content in packaging is pushing companies. They find an alternative to mechanical recycling, which is frequently hampered by contaminated or mixed streams.

The leaders in the consumer goods sector worldwide invest heavily in ensuring a steady supply of feedstock to minimize reliance on fossil-based feedstock, which directly underlies the market's growth. The 2024 progress report on the Global Commitment by the Ellen MacArthur Foundation reported that signatories achieved a 14% PCR share of their plastic packaging in 2023. With a target of 26% by 2025, it creates commercial pressure to ensure reliable streams of feedstock. Furthermore, the growing regulatory frameworks supporting circular economy initiatives are anticipated to accelerate market development.(Source: https://www.ellenmacarthurfoundation.org)

Restraint

Insufficient Feedstock Availability

A lack of suitable feedstock is expected to hinder the chemical recycling feedstock market. A limited supply is likely to impede the development of chemical recycling technologies, as the availability of quality feedstock is crucial to the successful recycling process. Additionally, chemical recycling technologies often involve complex processes that require significant energy inputs, resulting in high operating costs.

Opportunity

How Are Surging Investments from Petrochemical and Energy Majors Fuelling the Chemical Recycling Feedstock Market?

Surging investments from petrochemical and energy majors are projected to boost the market's opportunities for the market. Cooperation with such innovators as Agilyx, Carbios, and Plastic Energy develops new technology platforms that optimise the feedstock conversion efficiency and scalability. Such collaborations promote quicker commercialisation and geographic expansion, increasing the availability of varied sources of feedstock.

Increasing capital inflows also enhances the resilience of the supply chains, decreases the bottlenecks in operations, and speeds up competitive differentiation in the industry. In 2024, the Ellen MacArthur Foundation found that corporate investments in recycling innovation increased more than 22% over 2023, as the need to access high-quality feedstock streams became more urgent. Additionally, the high demand for advanced waste management solutions is likely to support the availability of feedstock.(Source: https://www.ellenmacarthurfoundation.org)

Segment Insights

Feedstock Type Insights

Why Is Polyethylene (PE) the Leading Feedstock in the Market for Chemical Recycling Feedstock?

The polyethylene (PE) segment dominated the chemical recycling feedstock market in 2024, accounting for an estimated 30% market share, primarily due to its use in film, rigid containers, and single-use packaging, which produce large volumes and relatively homogeneous waste streams. HDPE and LDPE streams are the focus, as pyrolysis and steam-cracking integration return intermediates.

These are equal to the current petrochemical cracker feedstocks, enhancing commercial offtake and making converters less prone to compatibility issues. Furthermore, the use of polymer-specific sorting upgrades and digital traceability pilots to document provenance and composition provided buyers with a boost in sourcing recycled PE and strengthened PE's competitive advantage.

The Polypropylene (PP) segment is expected to grow at the fastest rate in the coming years, as players in the industry seek to meet the engineering-grade polymer requirements for automotive, durable goods, and technical packaging products. Moreover, the technical specifications and industry alliances and brand procurement pilots signed resulted in capacity additions and made PP the fastest-growing sub-segment in the coming years.

Recycling Technology Insights

How Has Pyrolysis Emerged as the Dominant Recycling Technology in the Chemical Recycling Feedstock Sector?

The pyrolysis segment held the largest revenue share in the chemical recycling feedstock market in 2024, accounting for 40% of the market, due to its established route to creating oil-grade intermediates that feed into existing petrochemical crackers. Furthermore, the use of pyrolysis-derived oil as a co-processing material in steam crackers or upgrading olefins enhances the commercial offtake contracts, further fuelling the segment.

The depolymerization segment is expected to grow at the fastest CAGR in the coming years, as industry players seek superior-quality monomers and polymer-based recycled products that meet very high technical and regulatory standards.

To achieve virtually virgin PET, polyesters and some polyamides are recovered by chemical engineers using catalytic and enzymatic depolymerisation pathways. They are useful in food-contact, automotive, and engineering-grade applications. Additionally, the capital investments into depolymerisation capacity in priority regions are expedited to facilitate the recycling technology market.

End-Use Application Insights

Why Does Packaging Account for the Largest Share of the Chemical Recycling Feedstock Market?

The packaging segment dominated the chemical recycling feedstock industry in 2024, holding a market share of approximately 50%, due to the large number of single-use PET and polyolefin packages in use in the food, beverage, and consumer products sectors. Brand procurement teams started buying more chemically reclaimed PET and PE to fulfil corporate commitments and changing regulations on recycled content in purchases, providing predictable offtake pipelines to recyclers.

The Packaging and Packaging Waste Regulation was adopted by the European Council on 16 December 2024. Binding reuse and minimum recycled-content thresholds were established, which had a direct impact on sourcing strategies and supplier specifications throughout the EU. Furthermore, the significant consumer goods companies increased technical certification of chemically recycled products, further facilitating the chemical recycling technology.(Source: https://environment.ec.europa.eu)

The textiles segment is expected to grow at the fastest CAGR in the coming years, as clothing brands seek circular polyester-based fibres and design textiles. Recycling policies, including the Sustainable and Circular Textiles agenda of the EU, and local plans under the UNESCAP, have raised the recycled-content standards. Further fuelling the investment case in depolymerisation plants and specific collection systems of textile feedstocks.

Scale of Operation Insights

How Have Large-Scale Facilities Secured the Majority Share in the Chemical Recycling Feedstock Market?

Large-scale segment held the largest revenue share in the chemical recycling feedstock market in 2024, accounting for an estimated 60% market share, as it can offer economies of scale and per-unit conversion costs lower than those of smaller plants, and receive offtake contract benefits in large-scale operations where major petrochemical and consumer-goods purchasers are involved. Moreover, large facility locations in industrial complexes, where joint utilities, a trained labor force, and supplier networks are available, are favored by strategic investors.

The medium-scale segment is expected to grow at the fastest rate in the coming years, owing to higher-speed, lower-risk scale-ups that align with regional feedstock supply and niche product demand. Additionally, technology licensors and engineering companies are citing quicker pacing in process enhancements at medium scale, which equates to incremental capacity builds in numerous geographies and resistance to single-site operational breaches.

Regional Insights

Why Did North America Dominate the Chemical Recycling Feedstock Market?

North America led the chemical recycling feedstock market, capturing the largest revenue share in 2024, which accounted for approximately 35%. This dominance was driven by intensive investment in the industry and early commercial pilots that successfully connected chemically reclaimed feeds with the downstream offtake. In November 2024, the U.S. Environmental Protection Agency released its National Strategy to Prevent Plastic Pollution, which sent decisive regulatory signals and may have steered capitals into high-tech recycling yard shows. (Source:https://www.dlapiper.com)

- In 2024, the American Chemistry Council and PlasticsEurope affiliates in North America continued to advocate, reinforce awareness campaigns, and report corporate sustainability information in accordance with the GRI and CDP guidelines. Furthermore, the combination of these processes made North America the most developed regional centre of recycling chemical feedstock during the mentioned year.(Source:https://www.americanchemistry.com)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, as governments and industries stepped up national structures and capital programs towards recycling. In 2024, China announced its intention to establish a national resources-recycling group, enhance domestic infrastructure, improve logistics, and standardize industrial recovery practices. (Source: https://www.reuters.com)

- In October 2024, South Korea also minimised administrative hurdles by exempting the registration of recycled chemicals. This promotes the adoption of advanced technologies, such as depolymerization and solvent-based recovery. Additionally, domestic market giants such as Reliance Industries, SK Geo Centric, and Mitsubishi Chemical have developed large-scale demonstration facilities, further boosting the market in the coming years.(Source: https://gpcgateway.com)

Top Vendors in Chemical Recycling Feedstock Market & Their Offerings

- Loop Industries (Canada / USA): A leader in sustainable plastics, Loop Industries focuses on advanced depolymerization technology to convert PET waste into high-purity feedstock for packaging and textiles, enabling closed-loop recycling.

- Plastic Energy (UK/Spain): Plastic Energy operates advanced pyrolysis facilities that produce TACOIL, a feedstock for producing virgin-quality plastics.

- Agilyx Corporation (USA): Agilyx develops chemical recycling solutions for polystyrene and mixed plastic waste streams, converting them into styrene monomer and other chemical feedstocks.

- Brightmark (USA): Brightmark specializes in large-scale pyrolysis facilities that transform post-use plastics into synthetic oils and waxes.

- Carbios (France): Carbios pioneers enzymatic depolymerization technology for the recycling of PET.

- Quantafuel (Norway): Quantafuel operates chemical recycling plants that utilize pyrolysis to convert mixed plastic waste into high-value chemical feedstocks for fuel production and virgin polymer manufacture.

- Recycling Technologies Ltd. (UK): Recycling Technologies deploys the RT7000 chemical recycling machine that converts mixed plastic waste into Plaxx, a feedstock compatible with petrochemical processes.

Chemical Recycling Feedstock Market Companies

- Agilyx Corporation

- BASF ChemCycling

- Brightmark

- Carbios

- Covestro

- Dow Chemical Company

- ExxonMobil Chemical

- INEOS Styrolution

- Ioniqa Technologies

- LG Chem

- Loop Industries

- LyondellBasell Industries

- Mitsubishi Chemical Corporation

- Plastic Energy

- Reliance Industries

- Renewlogy

- SABIC

- Shell Chemicals

- TotalEnergies

- Versalis (Eni)

Recent Developments

- In September 2025, BASF SE, Porsche AG, and technology partner BEST – Bioenergy and Sustainable Technologies GmbH – announced the successful completion of a landmark pilot project that validates the viability of chemical recycling for automotive shredder residues (ASR). This challenging waste stream, typically composed of plastics, foams, paints, and films, has long been destined for thermal recycling. By applying advanced gasification processes, the consortium has demonstrated a method to convert ASR into high-quality raw materials. These can be reintegrated into automotive manufacturing, including the production of steering wheels, marking a significant step forward in circular economy practices for the automotive sector. (Source: https://www.chemanalyst.com)

- In February 2025, PolyCycl, an emerging circular economy technology startup headquartered in Chandigarh, India, introduced its next-generation Contiflow Cracker Generation VI pyrolysis technology. This patented system is designed to address India's growing plastic waste challenge by converting hard-to-recycle materials such as single-use grocery bags and food-contaminated packaging into food-grade polymers, renewable chemicals, and sustainable fuels. The indigenous innovation positions PolyCycl as a key enabler of sustainable material transitions in one of the world's most waste-burdened markets, reinforcing its role as a domestic leader in advanced chemical recycling solutions. (Source: https://www.indianchemicalnews.com)

- In October 2025, Syensqo S.A., based in Brussels, unveiled a proprietary depolymerization technology for sulfone polymers, establishing a new benchmark in polymer circularity. The technology efficiently breaks down post-industrial scrap (PIR) and post-consumer parts (PCR) made from formulated polyarylethersulfone (PAES) into purified raw material monomers. These monomers can be infinitely reincorporated into products such as Udel PSU, Radel PPSU, and Veradel PESU, as well as other thermoplastics and epoxy resin formulations, without any degradation in performance. Building on its sustainable ECHO sulfone polymers portfolio, Syensqo has reinforced its position as an innovation leader in high-performance sustainable materials.(Source: https://www.chemengonline.com)

Segments Covered in the Report

By Feedstock Type

- Polyethylene (PE)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polypropylene (PP)

- Homopolymer PP

- Copolymer PP

- Polyethylene Terephthalate (PET)

- Bottles

- Films

- Fibers

- Polystyrene (PS)

- General Purpose PS

- High Impact PS

- Polyvinyl Chloride (PVC)

- Rigid PVC

- Flexible PVC

- Others

- Polycarbonate (PC)

- Polyurethane (PU)

- Others

By Recycling Technology

- Pyrolysis

- Thermal Pyrolysis

- Catalytic Pyrolysis

- Gasification

- Plasma Gasification

- Conventional Gasification

- Depolymerization

- Hydrolytic Depolymerization

- Methanolysis

- Glycolysis

- Solvolysis

- Alcoholysis

- Acidolysis

- Aminolysis

- Dissolution

- Selective Polymer Dissolution

- Solvent-Based Separation

- Others

By End-Use Applications

- Packaging

- Automotive

- Construction

- Electronics

- Textiles

- Others

By Scale of Operation

- Small-Scale

- Medium-Scale

- Large-Scale

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting