Cloud Computing in Chemical Market Size and Forecast 2025 to 2034

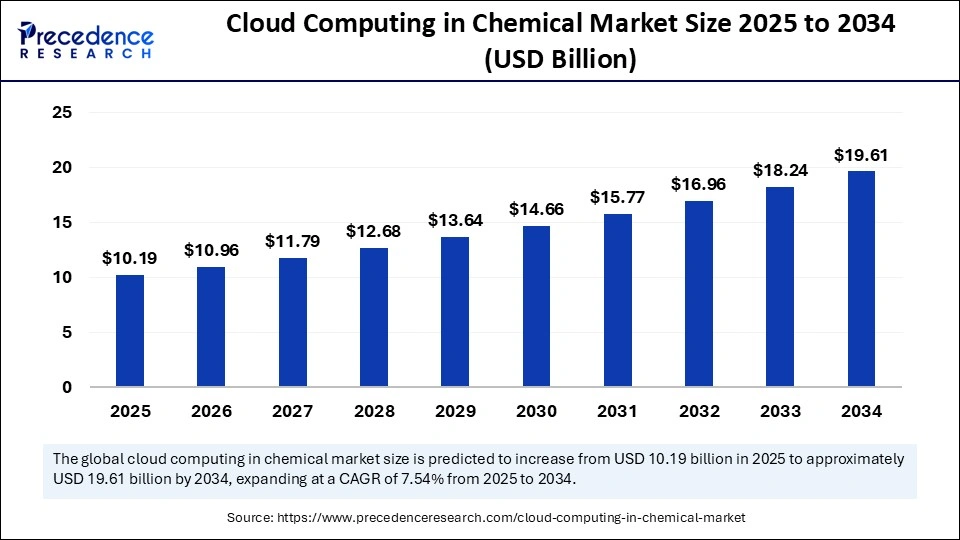

The global cloud computing in chemical market size was calculated at USD 9.48 billion in 2024 and is predicted to increase from USD 10.19 billion in 2025 to approximately USD 19.61 billion by 2034, expanding at a CAGR of 7.54% from 2025 to 2034.The cloud computing in chemical market expansion is driven by the increased adoption of cloud computing platforms by researchers and rising collaborations between chemical companies and technology providers.

Cloud Computing in Chemical Market Key Takeaway

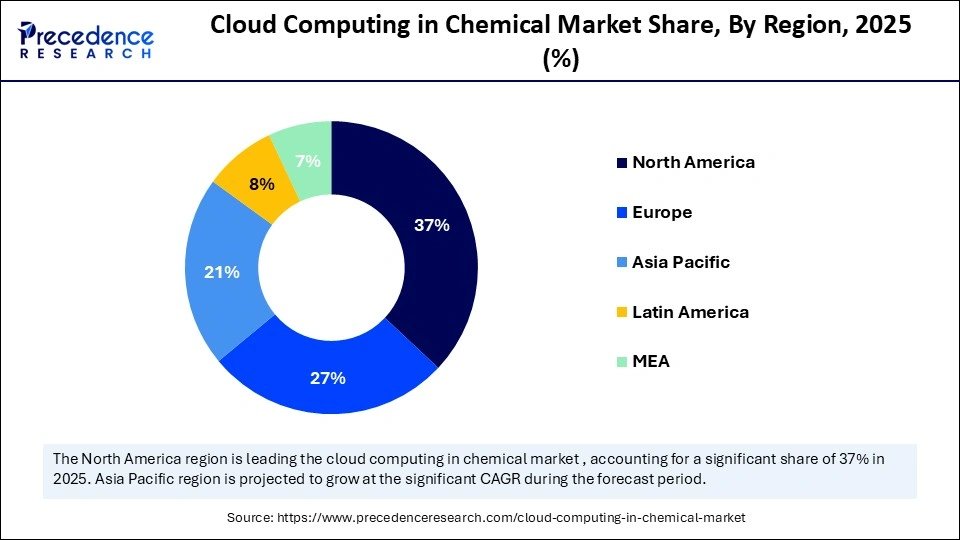

- North America dominated the global market with the highest share around 37% 2024.

- Asia Pacific is estimated to expand at the fastest CAGR between 2025 and 2034.

- By deployment, the public cloud segment contributed the biggest market share in 2024.

- By deployment, the hybrid cloud segment is expected to grow at the fastest CAGR during the forecast period.

- By service, the infrastructure as a service segment accounted for the largest market share in 2024.

- By service, the software as a service segment is anticipated to witness the fastest growth over the forecast period.

- By application, the research and development segment captured the largest market share in 2024.

- By application, the supply chain management segment is anticipated to show the fastest growth during the predicted timeframe.

- By end-user, the pharmaceutical segment led the market in 2024.

- By end-user, the specialty chemicals segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

Role of AI in Cloud Computing in Chemical Market

Integrating Artificial Intelligence in cloud computing for the chemical industry boosts processes with reduced downtimes, improved efficiency, and accelerated research and development. Cloud computing services provide companies with the necessary infrastructure required for AI and machine learning methodologies, significantly reducing the investments associated with hardware and software, ultimately mitigating the environmental impact and improving the safety of chemical plants. AI-powered tools can be used for analyzing historical data and large datasets for various applications, such as predictive analytics and maintenance, virtual screening of chemical compounds, molecular modeling, optimizing chemical processes, and accelerating drug and materials discovery.

U.S. Cloud Computing in Chemical Market Size and Growth 2025 to 2034

The U.S. cloud computing in chemical market size was evaluated at USD 2.46 billion in 2024 and is projected to be worth around USD 5.18 billion by 2034, growing at a CAGR of 7.73% from 2025 to 2034.

North America dominated the global cloud computing in chemical market with the largest share in 2024. The region's market dominance is driven by ongoing advancements in technologies, increased market competition fostering the digital transformation of the chemical industry, growing use of cloud-based platforms, increased access to internet connectivity, active government participation, strong supply chain networks, and increased demand for cloud solutions. The U.S. is a major contributor to the North American cloud computing in chemical market. This is mainly due to the increasing usage of digital technologies, robust research infrastructure, and well-established supply chain networks. The presence of major market players like Amazon and Microsoft, supportive regulatory frameworks, and the rising development of subscription-based models are boosting market growth.

Asia Pacific is anticipated to witness the fastest growth over the forecast period. The rising government initiatives and policies for promoting digital transformation and increasing implementation of smart manufacturing technologies with automated systems are expected to drive market growth in the region. There is a high focus on enhancing the efficiency of supply chains and supporting market growth. The rising adoption of digital technologies and cloud computing contributes to regional market growth.

China is expected to have a stronghold on the Asia Pacific cloud computing in chemical market during the forecast period. This is mainly due to factors such as supportive government initiatives, like Made in China 2025 and Internet Plus, widespread adoption of cloud computing technologies, presence of major players like Tencent and Huawei, remote working culture, and implementation of cloud-based solutions in developing innovative infrastructure plans.

Europe is expected to witness considerable growth in the market during the predicted timeframe. The market growth is driven by factors such as growing demand for digital transformation, enhanced regulatory compliance, initiatives for sustainability, increased access to advanced technologies like AI and machine learning, and robust security measures improving risk management. Furthermore, the European Alliance on Industrial Data and Cloud for addressing concerns regarding data security and sovereignty, as well as the European Cloud Strategy emphasizing the importance of edge computing, are fostering market expansion.

Market Overview

Cloud computing is transforming the chemical industry by providing scalable computational power tools and resources linked to chemical research and engineering with improved data storage and management, as well as enhanced potential for facilitating collaboration, analysis, and scientific discovery. In the chemical industry, cloud computing is applied for diverse applications, such as in spectroscopic techniques, computational chemistry for molecular dynamic simulations and DFT calculations, chemical engineering for the simulation of chemical reactions and analysis of industrial processes, material sciences for designing new materials, and in analysis of material characterization data.

The shift toward digitalization for improving business operations and integration of cloud platforms into chemical research facilities contribute to market growth. Moreover, widespread accessibility to on-demand high-performance computing (HPC) resources, the rising development of virtual laboratories for conducting chemical experiments and simulations, and the need for automated workflows are key factors driving the growth of cloud computing in the chemical market.

Cloud Computing in Chemical Market Growth Factors

- Subscription-based models: One of the most commonly used models in the cloud computing industry is the pay-as-you-go pricing model, enabling chemical companies to adjust their subscription levels based on their specific needs and use them only when needed. This, in turn, enhances the affordability and accessibility of services while reducing costs and waste with their simplified management models.

- Regulatory compliance: The adoption of cloud computing technologies enhances the regulatory compliance of various processes in the chemical industry, from drug discovery to supply chain management, with the implementation of standardized tools and stringent regulations, further mitigating errors and enhancing safety and transparency.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 19.61 Billion |

| Market Size in 2025 | USD 10.19 Billion |

| Market Size in 2024 | USD 9.48 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.54% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Application, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increased Emphasis on Digitalization

The growing demand for advanced technological solutions, the need for enhancing operational efficiency, real-time visibility to improve supply chain management, and the capability to comply with the changing regulatory landscapes are driving the adoption of digitalization in the cloud computing chemical market. Chemical industries are leveraging cloud-based solutions, such as big data analytics, the Internet of Things (IoT), artificial intelligence, machine learning, and smart manufacturing processes, which are ultimately streamlining workflows with automated processes while reducing costs and improving flexibility and security. Additionally, emerging markets from developing countries foster the expansion of cloud computing in chemical market with the increased demands for new advanced tools and resources, which outweighs the need for huge capital investment for developing IT infrastructure for these companies.

Restraint

High Costs and Security Issues

The adoption of cloud computing involves huge initial investments in infrastructure, such as networking hardware, storage, and servers for installing a private cloud. Furthermore, recurring maintenance, upgrades, and skilled professional costs increase the expenditure. These high-cost investments with continuous operating expenses are not affordable to companies with a limited budget, which can potentially hinder the growth of cloud computing in chemical market.

Security concerns like data breaches and data loss are major problems due to the sensitive data of chemical processes. Complexities associated with regulatory compliance, like HIPPA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation), create challenges in the market. Inadequate security practices due to a lack of awareness, as well as insecure application programming interfaces (APIs) and insufficiency in identity access management (IAM), can lead to compromised data security, limiting the growth of the market.

Opportunity

Development of New Business Models

The growing development of innovative business models by cloud-based solutions providers for enhancing data analytics, optimized decision-making, and streamlining operations create immense opportunities in the cloud computing in chemical market. Deployment of new models for various applications, such as the operational expenditure (OPEX) model for shifting capital expenditure (CAPEX) to reduce costs, agile cloud-based ERP (Enterprise Resource Planning) systems for enhancing visibility and data integration across all departments, and hybrid cloud models that benefit private and public cloud environments for evolving business needs support market expansion. These models improve sustainability by leveraging circular economy principles. Implementation of Industrial Internet of Things (IIoT) devices and sensors enabling smart manufacturing, as well as integration of blockchain technology for enhancing security and transparency in supply chains, are expected to fuel the market growth in the coming years.

Deployment Insights

The public cloud segment dominated the cloud computing in chemical market with the largest share in 2024. The segment's dominance is mainly attributed to the increased adoption of public cloud among chemical companies due to its cost-effectiveness and enhanced scalability. These companies are heavily adopting digital technologies and modernizing their infrastructure to automate several processes. Public cloud reduces the risk of over-provisioning, allowing maximum utilization of resources. The public cloud offers a platform for the storage, processing, and analysis of huge volumes of data created by chemical processes, which can be used for gaining better insights about performance in production and identifying areas for optimization for developing proactive maintenance strategies.

The hybrid cloud segment is expected to grow at the fastest rate during the forecast period. The rising demand for scalable and flexible processes with optimal performance of IT resources is driving the adoption of a hybrid cloud. The hybrid cloud approach decreases the infrastructure and maintenance costs for companies and also offers the benefits of the pay-as-you-go model. Furthermore, the focus of chemical companies on gaining a competitive edge by integrating their aging infrastructure with new and advanced cloud-based solutions for streamlining their operations with data-driven decision-making processes while maintaining adherence to regulatory compliance with stringent data security and privacy directives is boosting the growth of the hybrid cloud segment.

Service Insights

The infrastructure as a service segment held the largest share of the cloud computing in chemical market in 2024. Implementation of infrastructure as a service (IaaS) provides chemical companies with virtualized computer network approach for delivering resources like networks, virtual computers, and storage on rent through cloud platforms. The increased focus of chemical companies on utilizing AI-powered automation, hybrid and multi-cloud strategies, and incorporating innovative emerging technologies like 5G and serverless computing are improving the efficiency of processes with enhanced security and reduced costs, further enabling rapid decision-making. Additionally, IaaS provides strong solutions for business continuity and disaster recovery with efficient management and security tools, which helps companies to ensure availability and access to sensitive data and information in case of unexpected events.

The software as a service segment is expected to grow at the fastest rate over the forecast period. Software as a service (SaaS) solutions are a crucial part of the cloud computing infrastructure, offering easy-to-deploy, cost-effective, and feasible cloud-based applications for several purposes like R&D, manufacturing, and supply chain management, further modernizing operations with reduced overhead costs for chemical companies. Moreover, the increasing focus of cloud technology providers on developing innovative business models that swiftly adapt to market trends. The rising focus on optimizing manufacturing operations, increasing use of operational expenditure (OPEX) models, and a strong emphasis on sustainable circular economy for improving regulatory compliance and enhancing carbon footprint tracking are fostering the segment's growth.

Application Insights

The research and development segment dominated the cloud computing in chemical market with the largest share in 2024. The heightened adoption of advanced digital technologies for research purposes and increased access to AI and machine learning algorithms enabling automation and intelligent decision-making in chemical reactions bolstered segment growth. Generative chemistry and quantum computing accelerate the development of innovative products and methods as well as enhance scalability and flexibility in modern chemical research with cloud infrastructure. Moreover, enhanced collaboration activities among researchers further support the growth of this segment.

The supply chain management segment is anticipated to show the fastest growth during the predicted timeframe. The growing need for transparency in supply chains with the surging demand for agile and flexible solutions, as well as the ability of data-driven decision-making for optimizing processes of production and logistics, is driving the adoption of cloud computing technologies. These technologies offer enhanced scalability, security, and cost-effective solutions for the management of complex supply chains for the chemical industry.

End-User Insights

The pharmaceuticals segment held a significant share of the cloud computing in chemical market in 2024. Cloud computing technologies help in drug discovery processes, facilitating the analysis of huge datasets such as molecular structure, genetic profiles, and clinical trials. This leads to better identification of potential drug candidates. Furthermore, enhanced data management and security offered by cloud platforms make them suitable for pharmaceutical companies. Increased collaborations among researchers and pharmaceutical companies and the need to reduce costs linked to data storage and IT infrastructure bolstered segmental growth. The improved resilience of supply chains with real-time monitoring and the growing need to navigate the complex regulatory landscape of the pharmaceutical industry are driving the growth of this segment.

The specialty chemicals segment is predicted to show the fastest growth during the forecast period. The growing demand for specialty chemicals in various fields like agrochemicals, consumer products, and industrial applications is driving the adoption of advanced cloud computing technologies among companies involved in developing specialty chemicals. The rising R&D activities in drug discovery and development of innovative materials, as well as solutions, further support the segment's growth. Cloud computing technologies are being applied for conducting metabolomics analysis, assessing chemical properties, as well as for simulation and optimization of chemical processes, which fuels the segment growth.

Cloud Computing in Chemical Market Companies

- Amazon Web Services

- Alibaba Cloud

- DigitalOcean

- IBM

- Google Cloud

- Microsoft

- Cisco

- Linode

- Huawei

- VMware

- Red Hats

- Oracle

- SAP

- Salesforce

- Rackspace

Industry Leader's Announcement

- In July 2024, Quantistry, a Berlin-based start-up providing the world's most insightful cloud-native chemical simulation platform, signed a Memorandum of Understanding (MoU) with IQM Quantum Computers (IQM). Dr. Peter Eder, Head of Strategic Partnerships at IQM Quantum Computers, said, “We are demonstrating our ongoing commitment to accelerating quantum computing innovation and exploring use cases of industrial relevance by extending our relationship with Quantistry. With our strong technical expertise and unique technology, this partnership gives us the opportunity to expand innovation leadership in the quantum ecosystem and show how quantum computing can benefit the chemical and material industries.”

Recent Development

- In July 2024, Microsoft collaborated with Quantinuum to create 12 highly dependable logical qubits by leveraging Azure's Quantum qubit-virtualization system applied to Quantinuum's H2 trapped-ion quantum computer, which demonstrates a hybrid, end-to-end chemistry simulation.

Segments Covered in the Report

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Service

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

By Application

- Research and Development

- Supply Chain Management

- Data Management

By End-User

- Pharmaceutical

- Agricultural Chemicals

- Specialty Chemicals

- Petrochemical

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting