What is the Coaxial Cable and Tools and Equipment Market Size?

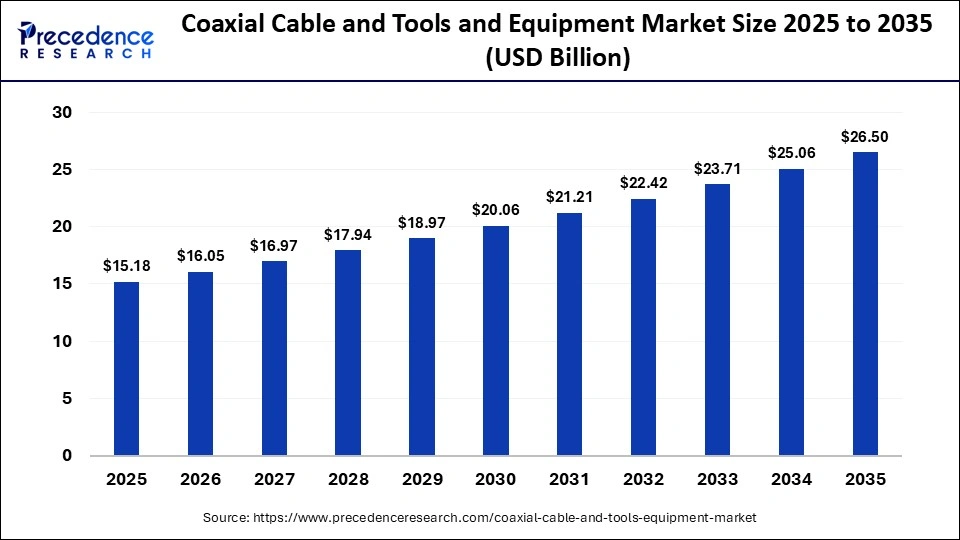

The global coaxial cable and tools and equipment market size is calculated at USD 15.18 billion in 2025 and is predicted to increase from USD 16.05 billion in 2026 to approximately USD 26.50 billion by 2035, expanding at a CAGR of 5.73% from 2026 to 2035. The coaxial cable and tools & equipment industry is experiencing unprecedented growth, driven by the growing need for high-speed broadband and internet connectivity.

Market Highlights

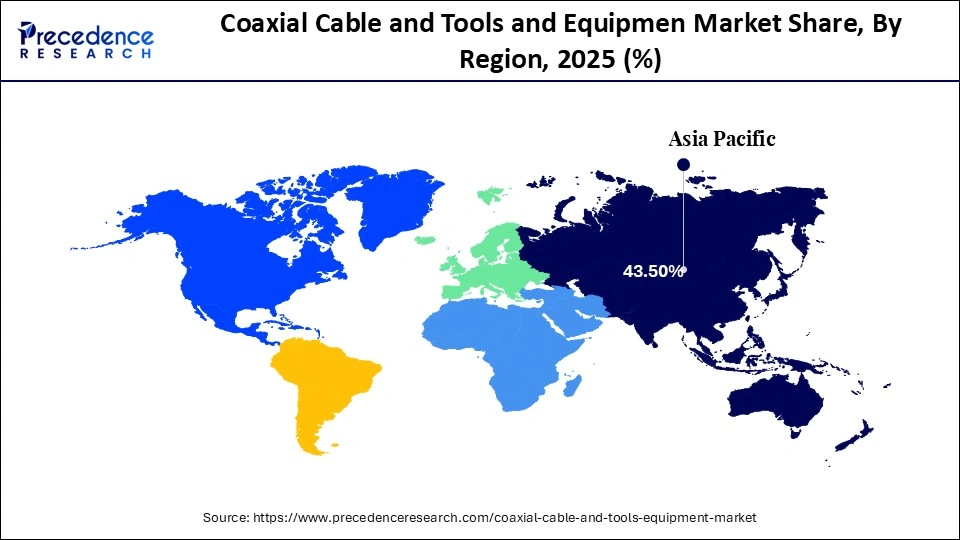

- North America dominated the market, holding the largest market share of 43.5% in 2025.

- The Asia Pacific is expected to grow at a solid CAGR of 7.0% between 2026 and 2035.

- By cable type, the flexible coaxial cable segment held the major market share of 38.6% in 2025.

- By cable type, the hardline coaxial cable segment is expected to grow at a remarkable CAGR of 6% between 2026 and 2035.

- By material, the copper segment captured the biggest market share in 2025, at 43.8%.

- By material, the copper-clad aluminum segment is growing at a significant CAGR of 6.4% between 2026 and 2035.

- By application, the cable TV (CATV) segment accounted for the highest market share of 28.6% in 2025

- By application, the internet/broadband segment is expected to grow at a strong 6.2% between 2026 and 2035.

- By end-user, the commercial segment held the largest share of 48.6% in 2025.

- By end-user, the industrial segment is projected to grow at a notable 6.2% CAGR between 2026 and 2035.

Coaxial Cable and Tools & Equipment Market Overview

The coaxial cable and tools and equipment market encompasses the production, distribution, and deployment of coaxial cables along with the specialized tools required for their installation, testing, and maintenance. Coaxial cables are widely used across broadband networks, telecommunications infrastructure, television distribution systems, military and defense communications, surveillance networks, and industrial signal transmission. Their continued relevance is driven by reliable signal shielding, stable bandwidth performance, and suitability for both legacy and hybrid network architectures.

The tools and equipment segment includes cable cutters, crimping tools, stripping tools, continuity and signal testers, compression connectors, grounding kits, and complete installation toolkits used by network installers, telecom operators, and maintenance teams. Demand for these tools is closely tied to infrastructure expansion, including fiber-coax hybrid network upgrades, cable television modernization, 5G backhaul support, and security system deployment. For example, broadband expansion programs and cable network upgrades require precise termination and testing of coaxial lines to maintain signal integrity and compliance with performance standards.

This segmentation enables stakeholders to analyze demand patterns across residential, commercial, and defense applications. Telecom upgrades and broadcast deployments drive large-volume demand for standardized cables and connectors, while military, surveillance, and industrial environments require high-performance coaxial solutions with enhanced durability and shielding.

How Are AI-Driven Innovations Reshaping the Coaxial Cable and Tools & Equipment Market?

As technology continues to evolve, the integration of Artificial Intelligence (AI) is significantly accelerating the growth of the coaxial cable and tools & equipment market. AI integration improves network management, fault detection, and high-speed data transmission. AI is widely being applied to optimize and maintain networks that use coaxial cable infrastructure, such as cable TV and broadband systems. AI algorithms efficiently analyze network performance trends and identify potential warning signs of cable degradation, enabling proactive maintenance and reducing service downtime. Integration of AI with coaxial cable networks primarily involves using adapters, such as MoCA adapters, to convert the signal for use with standard IP-based AI systems.

This integration is particularly evident in hybrid fiber-coaxial broadband architectures governed by the Data Over Cable Service Interface Specification standards maintained by CableLabs. According to CableLabs' 2022 technical publications, AI-enabled network analytics are increasingly embedded in DOCSIS 3.1 and DOCSIS 4.0 operational environments to process telemetry data, including signal-to-noise ratios, upstream ingress noise, packet loss, and latency variation across coaxial segments. Machine learning models use these datasets to predict localized cable impairment, connector corrosion, shielding failures, and impedance mismatches before customer-facing service degradation occurs.

In cable television and broadband access networks, operators deploy AI-driven assurance platforms that ingest data from coaxial line testers, spectrum analyzers, and remote PHY devices installed at the network edge. According to the U.S. Federal Communications Commission's 2023 broadband technical filings, such platforms support automated fault classification and root-cause analysis in last-mile coaxial infrastructure, reducing manual truck rolls and accelerating fault isolation.

Coaxial Cable and Tools & Equipment Industry Outlook

- Industry Growth Overview: Between 2026 and 2035, the industry is expected to experience accelerated growth, driven by rapid urbanization, rising demand for high-speed data & internet, a surge in 5G network rollouts, growing demand for digital entertainment, and expanding broadband penetration.

- Global Expansion: Several leading players in the coaxial cable and tools & equipment markets are implementing strategies to broaden their geographic reach, including acquisitions, collaborations, and new product launches. For instance, in January 2024, Telstra and Prysmian announced an expansion of Prysmian's optical cable manufacturing plant in Australia to build the industry-leading fibre-optic cable required for Telstra's intercity fibre network, using advanced technology to reduce the project's environmental impact. Telstra InfraCo is building the intercity fibre network to meet ongoing demand for fast, reliable digital networks.

- Major Investors: Several major investors and companies actively engaged in the coaxial cable and tools & equipment industry include large, global manufacturers and specialized tool providers, such as Belden Inc., CommScope, Amphenol Corporation, Prysmian Group, and TE Connectivity. Their investment significantly accelerates the market growth through network upgrades, product innovation, and strategic partnerships. For instance, Optimum, a leading provider of fiber internet, mobile, and TV services, announced a network upgrade plan to deliver multi-gigabit internet speeds across 65% of its service footprint by 2028. This will double the availability of multi-gigabit speeds over the next three years.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.18 Billion |

| Market Size in 2026 | USD 16.05 Billion |

| Market Size by 2035 | USD 26.50 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.73% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Cable Type, Material, Application, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Cable Type Insights

What Causes the Flexible Coaxial Cable Segment to Dominate the Coaxial Cable and Tools Equipment Market?

Flexible Coaxial Cable: The segment held the largest market share in 2025, at 38.6%. The segment's growth is driven by rising demand for high-speed internet and the global expansion of 5G networks. Flexible cables can support higher data transmission rates. Flexible coaxial cables are widely utilized in consumer electronics, smart home systems, aerospace, automotive, and industrial automation. In broadband and in-building network deployments, flexible coaxial cables are preferred for their ease of installation, tight bend-radius tolerance, and compatibility with existing conduit layouts. Their ability to support frequent reconfiguration and maintenance makes them well-suited for dense urban housing, data distribution within commercial buildings, and retrofitting legacy communication infrastructure.

Hardline Coaxial Cable: The segment is expected to grow at a remarkable CAGR of 6% between 2026 and 2035. Hardline coaxial cable is a thick, rigid type, often featuring a solid copper or aluminum center conductor. Hardline coaxial cable ensures high-power signal transmission with minimal signal loss and offers high resistance to electromagnetic interference (EMI) over extended distances. This segment is primarily deployed in cable television trunk lines, broadband backhaul, radio-frequency transmission towers, and large-scale outdoor communication networks, where durability and signal stability are critical. Growth is further supported by rising investments in network densification, including 5G macro cell sites and cable network upgrades that require long-distance, low-attenuation signal transmission.

Material Insights

Which Segment Is Dominated by the Material in the Coaxial Cable and Tools & Equipment Industry?

Copper: The segment dominates the coaxial cable and tools & equipment industry, holding a 43.8% share in 2025. The segment's growth is primarily driven by the material's superior electrical conductivity, durability, mechanical strength, and cost-effectiveness compared with alternatives. Copper is often the preferred standard choice for reliable high-speed data transmission and power distribution. Copper is 100% recyclable without loss of quality, a fact increasingly emphasized amid sustainability goals and environmental regulations.

Copper-Clad Aluminum: On the other hand, the segment is the fastest-growing with a CAGR of 6.4% in the coaxial cable and tools & equipment sector. Copper-clad aluminum (CCA) has a lower cost compared to pure copper, which significantly increases its adoption in budget-conscious projects, particularly in residential and commercial building markets. CCA cables are much lighter than solid copper cables of the same length, which reduces transportation costs and speeds installation, particularly in large infrastructure projects. Moreover, copper-clad aluminum is widely used in aerospace and automotive applications, where weight reduction improves fuel efficiency.

Application Insights

What Causes the Cable TV (CATV) Segment to Dominate the Coaxial Cable and Tools & Equipment Market?

Cable TV (CATV): The segment dominates the coaxial cable and tools & equipment market, with a 28.6% share in 2025. The segment's growth is driven mainly by rising consumer demand for high-definition (HD), 4K, and 8K streaming and video services. The ongoing demand for high-definition content increases the need for high-quality coaxial cables to handle the high-frequency signals and increased bandwidth requirements.

Internet/Broadband: On the other hand, this segment is expected to be the fastest-growing in the coaxial cable and tools & equipment industry, with a 6.2% growth rate during the forecast period. The segment's growth is driven by rising demand for high-speed internet and the global rollout of 5G networks. Government-led digitalization initiatives across developed and developing countries are substantially fueling large-scale broadband expansion.

End-user Insights

What Has Led the Commercial Segment to Dominate the Coaxial Cable and Tools & Equipment Market?

Commercial: The segment dominates the coaxial cable and tools & equipment markets with a 48.6% share, driven by the rising demand for high-speed internet and network infrastructure. The commercial segment is a major end-user in the coaxial cable and tools & equipment sector. Several commercial buildings, including office buildings, retail spaces, and hospitality venues, are increasingly adopting Building Automation Systems (BAS) to manage HVAC, lighting, security, and access controls, driving the demand for coaxial cables.

Industrial: On the other hand, the segment is a significant, rapidly growing application area with an expected CAGR of 6.2% for the coaxial cable and tools & equipment industry. The segment's growth is primarily driven by the increasing adoption of Industry 4.0 initiatives and Industrial IoT (IIoT) technologies. In addition, the rising use of automated systems and robotics across sectors such as manufacturing, automotive, and electronics is expected to spur demand for highly durable, high-performance cabling to withstand harsh operating environments.

Regional Insights

How Big is the North America Coaxial Cable and Tools & Equipment Market Size?

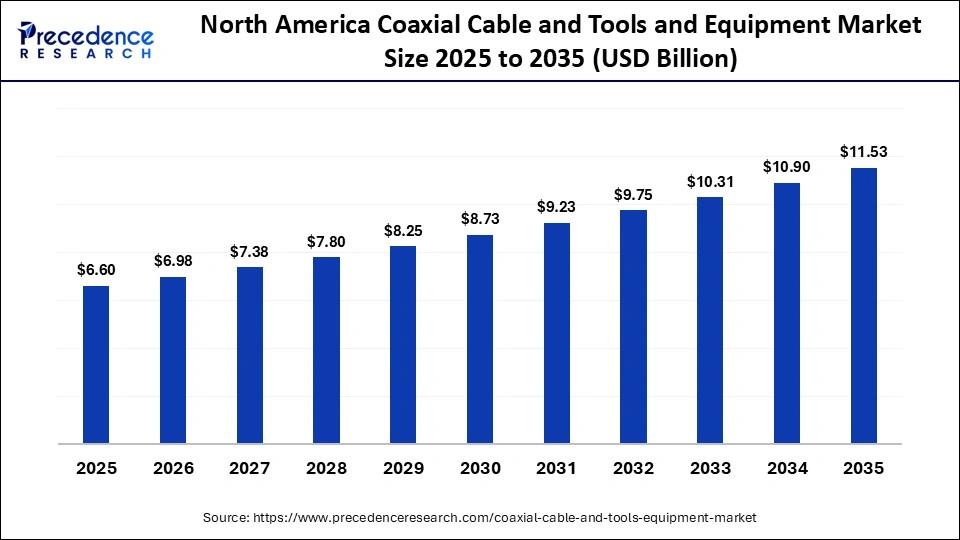

The North America coaxial cable and tools & equipment market size is estimated at USD 6.60 billion in 2025 and is projected to reach approximately USD 11.53 billion by 2035, with a 5.74% CAGR from 2026 to 2035.

What Has Led the North America Region to Dominate the Coaxial Cable and Tools & Equipment Market?

North America dominated the industrial burners market, holding the largest market share of 43.5% in 2025. This leadership position is attributed to the well-established and widespread hybrid fiber-coaxial (HFC) network infrastructure. The North America region is home to prominent players such as Belden Inc., CommScope, TE Connectivity, Harmonic, and others. These companies have strong brand recognition and drive innovation through strategic initiatives, contributing to the region's market growth. In addition, high demand for high-speed internet and data services, along with supportive government initiatives to modernize network infrastructure, are expected to drive the region's growth during the forecast period.

- In September 2025, Harmonic and Comcast announced their partnership to expand fiber broadband access as the Internet provider continues to expand its network into new markets. In 2024, Comcast expanded its network to more than 1 million new locations, with more than 1.2 million planned by the end of 2025.

What is the Size of the U.S. Coaxial Cable and Tools & Equipment Market?

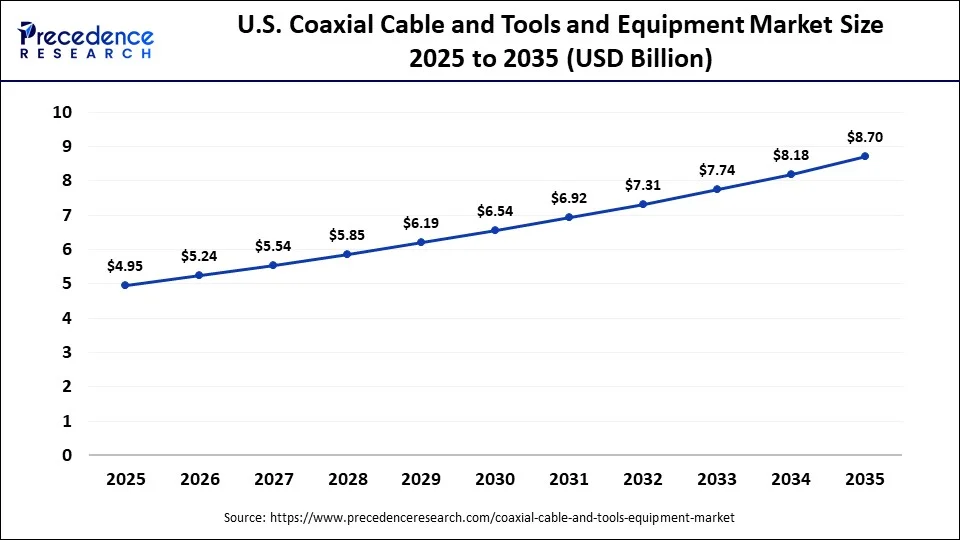

The U.S. coaxial cable and tools & equipment market size is calculated at USD 4.95 billion in 2025 and is expected to reach nearly USD 8.70 billion in 2035, accelerating at a strong CAGR of 5.80% between 2026 and 2035.

United States Coaxial Cable and Tools & Equipment Market Analysis

The United States is transforming the coaxial cable and tools & equipment market. The United States is a major contributor to the coaxial cable and tools & equipment market in North America. The country has a high internet usage rate and an increasing dependence on data-intensive applications such as online gaming, 4K/8K video streaming, and cloud services, which necessitate a robust communication infrastructure that, in turn, accelerates the demand for coaxial cables. The country's growth is also largely driven by increasing investments in network upgrades to support multi-gigabit internet speeds.

In February 2025, CommScope, a global leader in network connectivity, announced a collaboration with the National Content & Technology Cooperative (NCTC) to provide enhanced access to CommScope's end-to-end network solutions for NCTC members. NCTC supports independent broadband and pay-TV communications service providers serving small and midsized communities in all 50 United States and territories. Together, NCTC members reach about one-third of U.S. households. CommScope and NCTC reinforce their ongoing commitment to bringing broadband to rural and underserved areas.

What Causes the Asia Pacific Coaxial Cable and Tools & Equipment Market to Grow at the Fastest-Growing CAGR?

The Asia Pacific region is the fastest-growing in the coaxial cable and tools & equipment market, with a CAGR of 7%. The growth of the Asia Pacific region is mainly driven by rapid urbanization & industrialization, increasing demand from specialized sectors, growing demand for high-speed internet & broadband expansion, a surge in 5G network rollouts, and rising technological shifts such as 5G and IoT. Several companies are investing heavily in new product development and strategic partnerships to meet the ongoing demand for high-speed internet connectivity. Additionally, the region has the presence of mature telecommunications and cable TV infrastructure in countries like Japan, China, and India is expected to fuel the expansion of the Asia Pacific region.

India's Coaxial Cable and Tools & Equipment Market Analysis

India's coaxial cable and tools & equipment market is experiencing significant growth, driven by the combination of factors such as the expansion of telecommunication infrastructure, rapid urbanization, increasing demand for high-speed internet & services, the rising expansion of large-scale high-speed broadband, growing demand from the cable television industry, and rapid technological innovation. Moreover, government-led digitalization initiatives and increased investment in network infrastructure expansion are expected to drive market growth in the coming years.

Which Factors Are Responsible for the Growth of the Coaxial Cable and Tools & Equipment Sector in the European Region?

The European region holds a substantial market share in the coaxial cable and tools & equipment sector. The growth of the region is attributed to the deployment of 5G networks, increasing adoption of high-speed internet, the increasing use of HFC networks, and the proliferation of Internet of Things (IoT) solutions in offices, smart homes, and industries. Several telecom operators in the region are increasingly leveraging coaxial infrastructure by upgrading their hybrid fiber-coaxial (HFC) networks to technologies such as DOCSIS 3.1 and 4.0, which provide multi-gigabit speeds and higher bandwidth. The region is experiencing demand from various end users, including internet service providers (ISPs), telecommunications operators, the cable television industry, the military & aerospace sector, the data centers & IT sector, and the automotive sector.

Germany Coaxial Cable and Tools & Equipment Market Trends

The country is experiencing significant growth. The robust presence of digital networks supports the coaxial cable and tools & equipment market, the growing need for hybrid fiber-coaxial (HFC) networks, the increasing demand for high-speed internet, rising innovation in materials and tools that improve performance, and surging investment in network upgrades. The country is experiencing demand from several industries, including telecommunications, aerospace, defense, automotive, media, and manufacturing, as they rely heavily on high-performance coaxial cables for secure, stable communication systems.

Additionally, favorable government initiatives aimed at expanding high-speed broadband access and integrating smart technologies, such as IoT and industrial automation, are driving growth in the coaxial cable and tools & equipment industry during the forecast period.

Key Players in the Coaxial Cable and Tools & Equipment Market

- Belden Inc.

- CommScope

- Amphenol Corporation

- Prysmian Group

- Nexans

- Tripp Lite

- TE Connectivity

- HUBER+SUHNER

- Times Microwave Systems

- Corning

- RF Industries

- Legrand

- Infinite Electronics

- Radiall

- Pasternack

Recent Developments

- In May 2024, Qorvo, a leading global provider of connectivity and power solutions, announced the industry's first single-chip variable inverse cable equalizer. This groundbreaking IC is designed specifically for CATV application developers seeking to upgrade their networks to the advanced DOCSIS 4.0 standard.

(Source: https://www.qorvo.com) - In August 2025, Amphenol Corporation announced a definitive agreement to acquire CommScope's Connectivity and Cable Solutions (CCS) business for USD 10.5 billion. The transaction expands Amphenol's interconnect product capabilities in the fast-growing IT datacom market, particularly by adding fiber-optic interconnect products for artificial intelligence and other data center applications.(Source: https://investors.amphenol.com)

Segments Covered in the Report

By Cable Type

- Hardline Coaxial Cable

- Triaxial Cable

- Twinaxial Cable

- Semi-Rigid Coaxial Cable

- Helical Coaxial Cable

- Flexible Coaxial Cable

By Material

- Copper

- Copper-Clad Steel (CCS)

- Copper-Clad Aluminum (CCA)

- Silver-Plated Copper

By Application

- Internet/Broadband

- Cable TV (CATV)

- Satellite TV

- Telecom

- Military & Aerospace

- CCTV/Surveillance

- Industrial Automation

By End-user

- Residential

- Commercial

- Industrial

- Government & Defense

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting