Coenzyme Q10 Market Size and Forecast 2025 to 2034

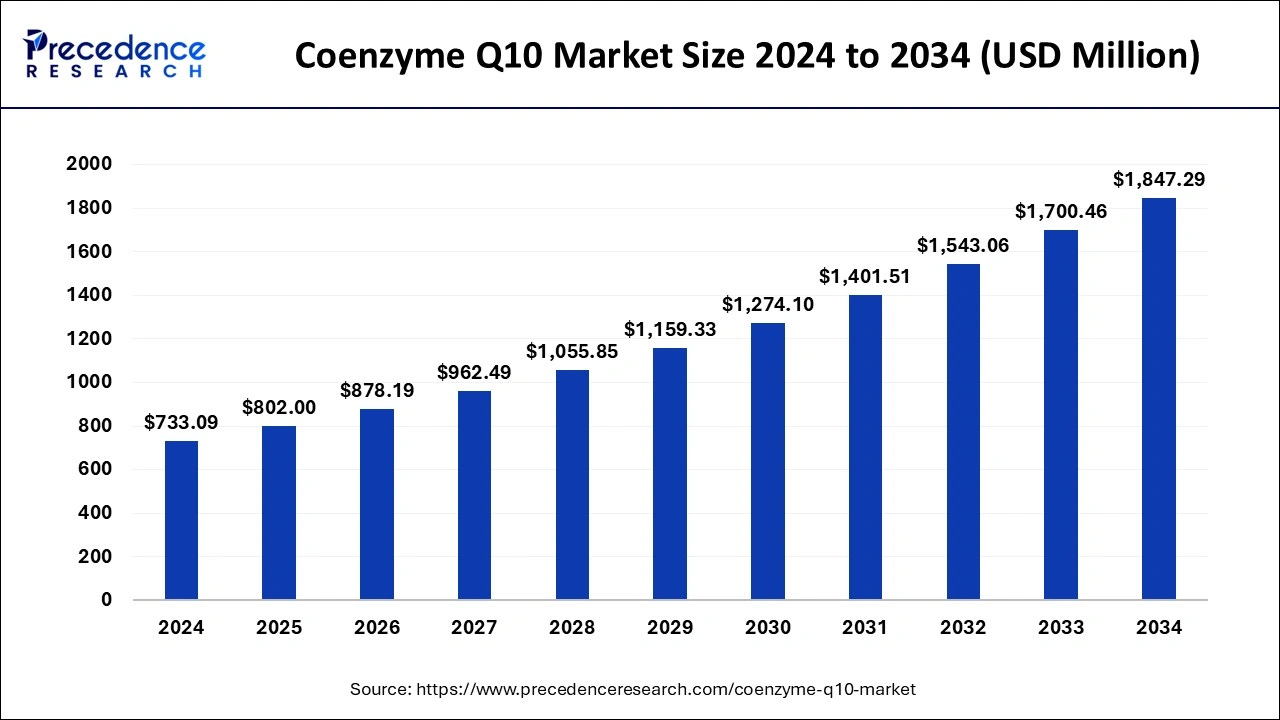

The global coenzyme Q10 market size accounted for USD 733.09 billion in 2024 and is predicted to increase from USD 802.00 billion in 2025 to approximately USD 1,847.29 billion by 2034, expanding at a CAGR of 9.68% from 2025 to 2034. The coenzyme Q10 market is driven by increasing rates of chronic illnesses, especially heart-related disorders.

Coenzyme Q10 MarketKey Takeaways

- The global coenzyme Q10 market was valued at USD 733.09 billion in 2024.

- It is projected to reach USD 1,847.29 billion by 2034.

- The market is expected to grow at a CAGR of 9.68% from 2025 to 2034.

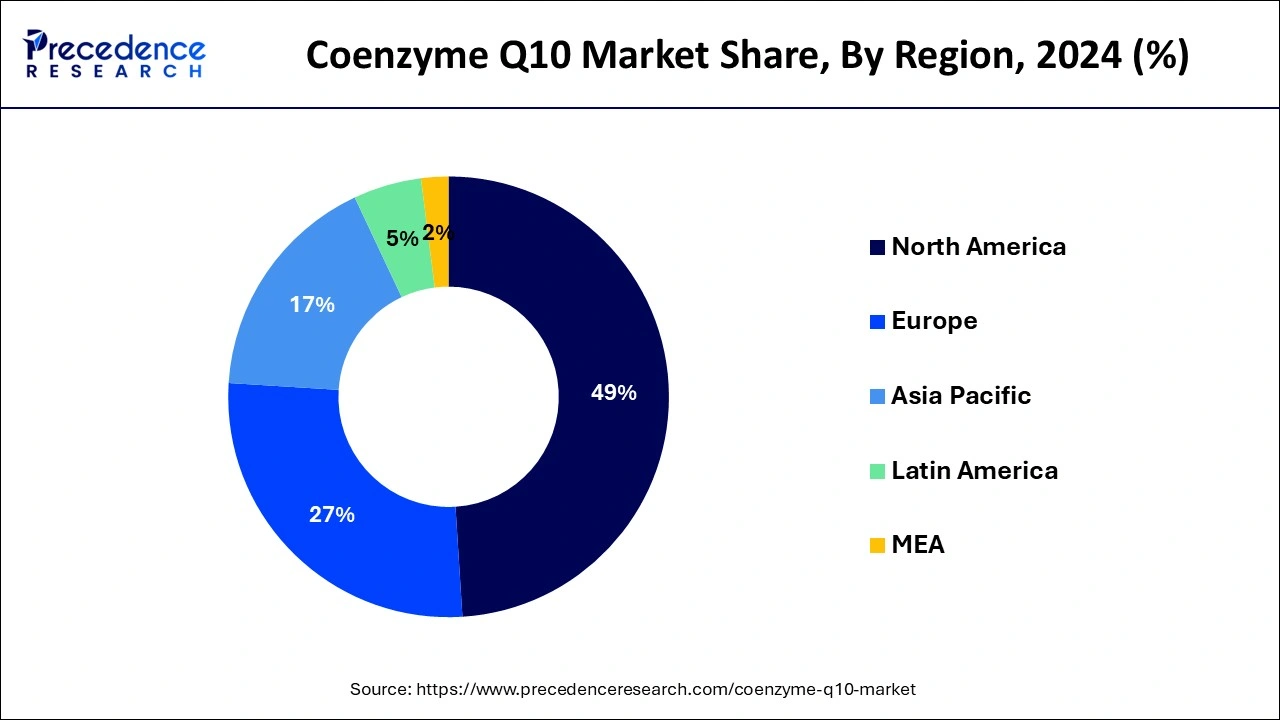

- North America held the largest market share of 49% in 2024.

- Asia Pacific is expected to grow at a CAGR of 17% during the forecast period.

- By application, the dietary supplements segment held the largest market share of 61% in 2024.

- By application, the cosmetics segment is expected to grow at a CAGR of 10.8% during the forecast period.

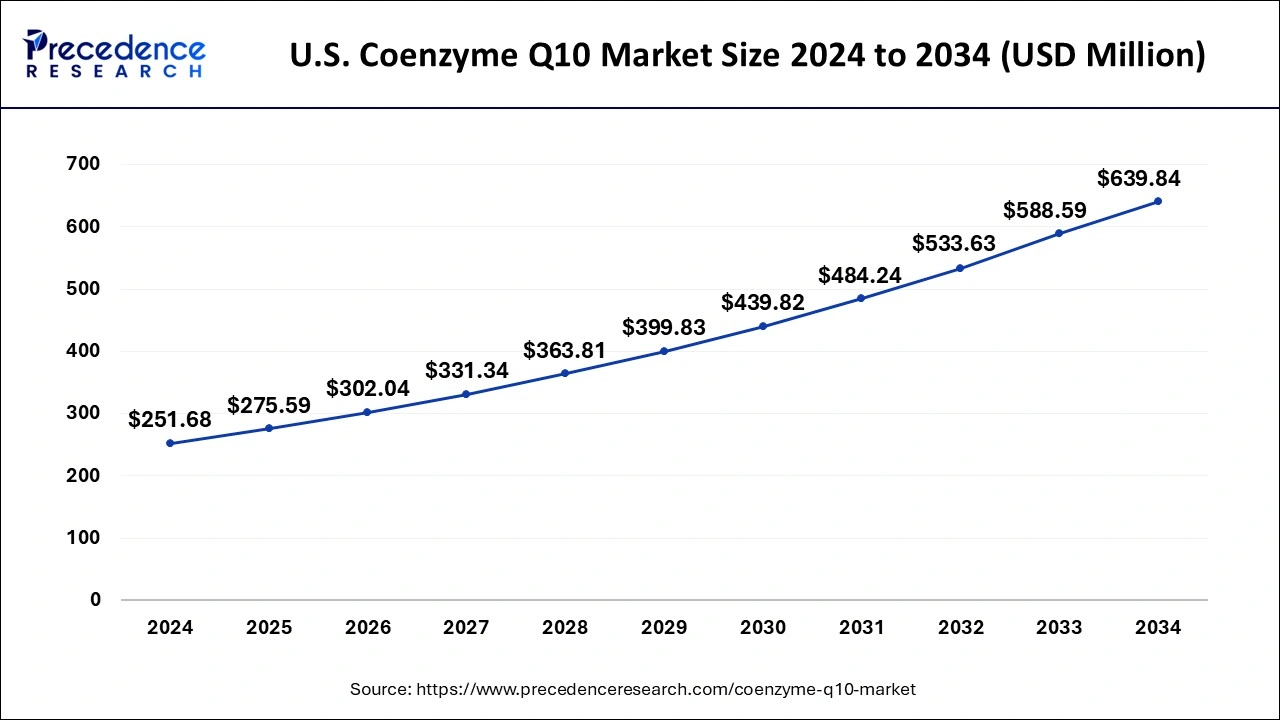

U.S.Coenzyme Q10 Market Size and Growth 2025 to 2034

The U.S. coenzyme Q10 market size was exhibited at USD 251.68 billion in 2024 and is projected to be worth around USD 639.84 billion by 2034, growing at a CAGR of 9.78% from 2025 to 2034.

North America held the largest market share of 49% in 2024 throughout the predicted timeframe. 90 million elderly adults will live in the United States by 2050. Given that the country's aging population is more likely to experience chronic health issues, there will likely be a greater need for long-term care, social services, and adequate healthcare. This covers heart disease, diabetes, arthritis, and depression.

An increasing number of older people are turning to dietary supplements to improve their health and well-being in their golden years. Research indicates that approximately 54% of older people use one or two supplements monthly. These goods include vitamin D, multivitamins, and omega 3 fatty acids. The area's well-established healthcare system facilitates the creation, production, and distribution of health-related products.

- For instance, in August 2023, French pharmaceutical producer Sanofi will acquire the U.S. CoQ10 trademark Qunol in a deal expected to be valued at least $1 billion. The parent business, Quten Research, controls the brand, which is situated in New Jersey, and the company has agreed to buy it. It also cites the deal's purpose about its turmeric supplements. The consumer healthcare division of Sanofi will house the recently acquired business.

Asia-Pacific is expected to grow at a CAGR of 17% in the coenzyme Q10 market during the forecast period. An aging population in many Asia-Pacific nations and growing health and wellness consciousness have resulted in a surge in demand for supplements and nutraceuticals, which frequently contain coenzyme Q10. The prevalence of chronic illnesses like cardiovascular diseases is on the rise, which has raised interest in preventative healthcare. Because of its antioxidant qualities, the cosmetic and skincare industries also employ it. There is a growing demand for CoQ10-containing goods due to the region's burgeoning beauty and personal care industry.

- For instance, Boryung Consumer Healthcare, a division of Boryung, has introduced a new nutritious functional food called Boryung Coenzyme Q10 Max. The maximum daily dose of coenzyme Q10, antioxidants, and folic acid, critical for blood and cell production as well as zinc and vitamin E, critical for cell health are all present in Boryung Coenzyme Q10 Max.

Market Overview

The body has a material called CoQ10, which has antioxidant and energy-producing properties. Age, some drugs, genetic abnormalities, malnutrition, and certain medical conditions can all be linked to low levels of CoQ10. The production of adenosine triphosphate (ATP), the primary energy source for cells, depends on CoQ10.

It is well-known for its cardiovascular advantages, supporting the effective operation of the cardiovascular system and assisting in maintaining a healthy heart. Researchers are looking into the possible benefits of CoQ10 for neurological health, including Parkinson's and Alzheimer's disease. According to some research, CoQ10 may help people with diabetes by enhancing their glycemic control and insulin sensitivity.

According to specific research, coQ10 supplementation can lessen migraine frequency and intensity. As an antioxidant, CoQ10 lessens the effects of free radicals and shields cells from oxidative damage. CoQ10 is believed to support skin health and provide anti-aging benefits due to its antioxidant characteristics. Supplementing with CoQ10 has been studied for its ability to improve energy metabolism, which may enhance exercise performance.

- The Ministry of Food and Drug Safety (MFDS) of South Korea is seeking public input on modifications to the heavy metal limitations, daily intake, and consumption warnings for healthy functional meals that comprise nine different types of functional raw materials, such as coenzyme Q10 and oat fiber.

Coenzyme Q10 Market Data and Statistics

- More health food files than coenzyme Q10 and fish oil were submitted for goods utilizing Lingzhi cracked spore powder as a single raw material, according to the latest information from China's State Administration of Market Regulation (SAMR).

- According to a study conducted by researchers at the University of Granada (UGR), taking supplements containing Coenzyme Q10 (CoQ10). This molecule is necessary for life and is produced in our organs and tissues and obtained through diet; it may be a useful adjunctive therapeutic option for treating Crohn's, thyroid, colon, and other mitochondrial diseases.

- The FDA controls dietary components as well as completed dietary supplement products. The laws governing "conventional" foods and drug items differ from those that the FDA applies to dietary supplements.

- Research indicates that about ninety-five percent of Americans need more B vitamins, C, E, and A as recommended daily. People can close the nutritional gap and put their health first by using dietary supplements.

Coenzyme Q10 Market Growth Factors

- Consumers are paying more attention to prevention and health.

- Probiotics, fatty acids (fish oil), and protein supplements are the key drivers of the growing demand for supplements.

- Rising health care expenses and the hunt for substitute solutions for specific issues.

- Herbal and botanical supplements are becoming popular supplemental and alternative therapy or additions to contemporary treatment.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.68% |

| Market Size in 2025 | USD 802.00 Million |

| Market Size by 2034 | USD 1,847.29 Million |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing demand for cosmetic product

CoQ10 is prized for its anti-aging qualities in cosmetic formulas since it helps tighten the skin, prevents oxidative damage, and lessens the appearance of fine lines and wrinkles. The growing demand for skincare and anti-aging product formulations, including CoQ10, results from consumers' growing awareness of these goods. With CoQ10's potential benefits, cosmetic businesses are putting it into various skin care products, including serums, lotions, and creams. CoQ10 is a prominent ingredient in the cosmetic industry because of its antioxidant qualities, which make it an appealing ingredient for preventing the effects of environmental stresses on the skin.

Rising of pharmaceutical industry

Coenzyme Q10, or CoQ10, has been linked to potential health benefits and is essential for synthesizing cellular energy. Coenzyme Q10 has drawn interest for its antioxidant qualities and therapeutic applications as pharmaceutical companies concentrate more on creating medications and supplements that support general health and treat various medical disorders. Pharmaceutical companies are investigating Coenzyme Q10 for formulations for cardiovascular diseases, neurological disorders, and other health-related problems. Coenzyme Q10 is in high demand due to continuous research that shows how important it is for cellular function and how it may be able to help with specific health issues.

- For instance, in July 2023, with great pleasure, Fortifeye Vitamins, a pioneer in the field of eye health, announces the release of Fortifeye Next Gen Zinc-Free Macular Defense Formula, a ground-breaking product. This innovative supplement meets the unique requirements of those sensitive to zinc and is a significant breakthrough in the fight against macular degeneration caused by age (AMD).

Restraint

Limited insurance coverage

Natural antioxidants such as coenzyme Q10 are abundant in the body and frequently taken as dietary supplements to help with various illnesses. Nevertheless, insurance coverage for these supplements is usually restricted, and many policies do not cover over-the-counter or non-prescription items.

Because of this, people who want to take coenzyme Q10 supplements could have to pay for them entirely out of pocket, limiting their accessibility. Thus, a lack of insurance coverage may hinder coenzyme Q10's price and general uptake, limiting market expansion. This cost barrier would deter prospective customers from adding the supplement to their daily regimens for health purposes, which would lower overall market demand and impede the growth of the coenzyme Q10 market.

Opportunity

Focus on specific health conditions

Interest in using CoQ10 supplements to treat various medical disorders has grown due to its possible advantages. Companies in the CoQ10 market can profit from the increasing need for personalized solutions by focusing their marketing efforts and product development on addressing specific health concerns.

- For instance, CoQ10 has been linked to cardiovascular health because it promotes heart health and may be helpful in the treatment of diseases like hypertension and heart failure. Furthermore, CoQ10 has demonstrated potential in treating neurological diseases, enhancing skin health, and lessening the adverse effects of several drugs. Businesses can set themselves apart, draw in a niche customer base, and increase their market share by highlighting these health benefits.

Application Insights

The dietary supplements segment held the largest market share of 61% in 2024. Many health-conscious adults and children in the US regularly consume vitamins and other dietary supplements, joining a large community of individuals prioritizing their health. These supplements, which include minerals, amino acids, digestive enzymes, herbs, and other botanicals, come in various forms, such as drinks, energy bars, candies, tablets, and powders. Common supplements are vitamins D and B12, minerals like iron and calcium, products such as probiotics, fish oils, and glucosamine, and plants like echinacea and garlic.

As the world's focus shifts increasingly towards health and wellness, the importance of nutritional supplements has become more apparent. Among these, CoQ10 stands out, captivating health-conscious individuals with its unique ability to enhance cardiovascular health. This distinctive quality has sparked interest, making it a popular choice for those seeking comprehensive preventive healthcare solutions.

Unlike other supplements, CoQ10 is recognized for its potential benefits to the cardiovascular system, especially its role in maintaining heart health. As cardiovascular diseases remain a significant global health issue, people are progressively incorporating CoQ10 supplements into their daily routines to support heart health.

The cosmetics segment is expected to grow at a CAGR of 10.8% during the forecast period. Free radicals are known to cause skin aging, but the antioxidant capabilities of Coenzyme Q10 can help neutralize them. This has led to the popularity of coenzyme Q10-infused cosmetics, especially in the anti-aging skincare market. The demand for products containing coenzyme Q10 has grown, thanks to the increasing consumer awareness of the benefits of antioxidants and anti-aging compounds in skincare products.

Customers often seek products that offer benefits for their skin health, beyond just cosmetics. To meet this demand, cosmetic companies are constantly innovating and developing products with unique ingredients. One such unique ingredient is Coenzyme Q10, a scientifically backed ingredient with antioxidant benefits and aids in cellular energy production, making it a standout in the skincare and cosmetic industry.

Recent Developments

- In September 2023, Cardiosmile is a liquid sachet supplement that uses water-dispersible phytosterols and was recently introduced by Nutrartis.

- In June 2023, Prominent worldwide eye health firm Bausch + Lomb Corporation launched the release of PreserVision AREDS 2 Formulated soft gels with coenzyme Q10 (CoQ10) in the United States.

- In April 2023, NIVEA Q10 is the brand's top face care line; a product is held at Beiersdorf every second. More than 60 nations currently offer the well-liked Q10 series. Coenzyme Q10 is the basis of this success story, having been the first active ingredient in mass-market cosmetics 25 years ago. This year marks the anniversary of Beiersdorf, which introduced the first skin care products with this active ingredient under the NIVEA brand. Even now, Q10 is still one of the most essential active components for anti-aging products and keeps producing important discoveries that benefit the global scientific community.

Coenzyme Q10 Market Companies

- KANEKA CORPORATION

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Gnosis

- PharmaEssentia Corporation

- ZMC-USA LLC

- Nisshin Seifun Group Inc.

- Hwail Pharmaceutical CO., LTD.

- KYOWA HAKKO U.S.A., INC.

- DSM Nutritional Products AG

Segments Covered in the Report

By Application

- Dietary Supplements

- Pharmaceuticals

- Cosmetics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting