Containers as a Service Market Size and Forecast 2025 to 2034

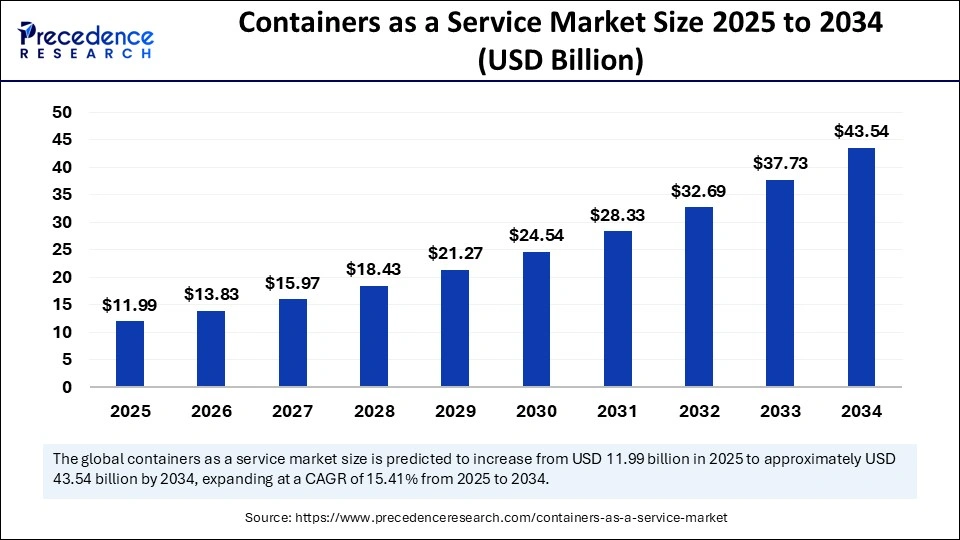

The global containers as a service market size accounted for USD 10.39 billion in 2024 and is predicted to increase from USD 11.99 billion in 2025 to approximately USD 43.54 billion by 2034, expanding at a CAGR of 15.41% from 2025 to 2034. The market growth is driven by the government push toward digital transformation and the increasing adoption of cloud computing.

Containers as a Service Market Key Takeaways

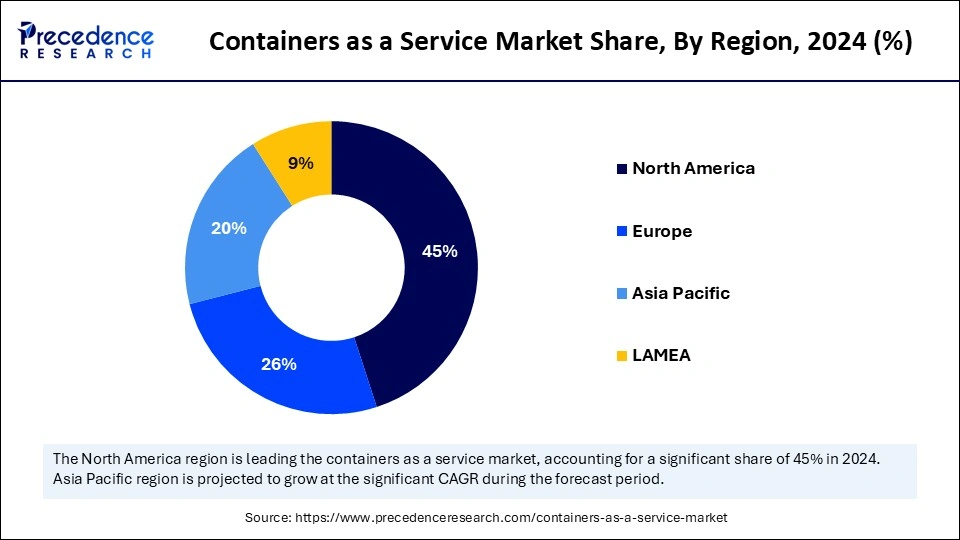

- North America dominated the containers as a service market by holding 45% of the market share in 2024.

- Asia Pacific is expected to witness the fastest growth between 2025 and 2034.

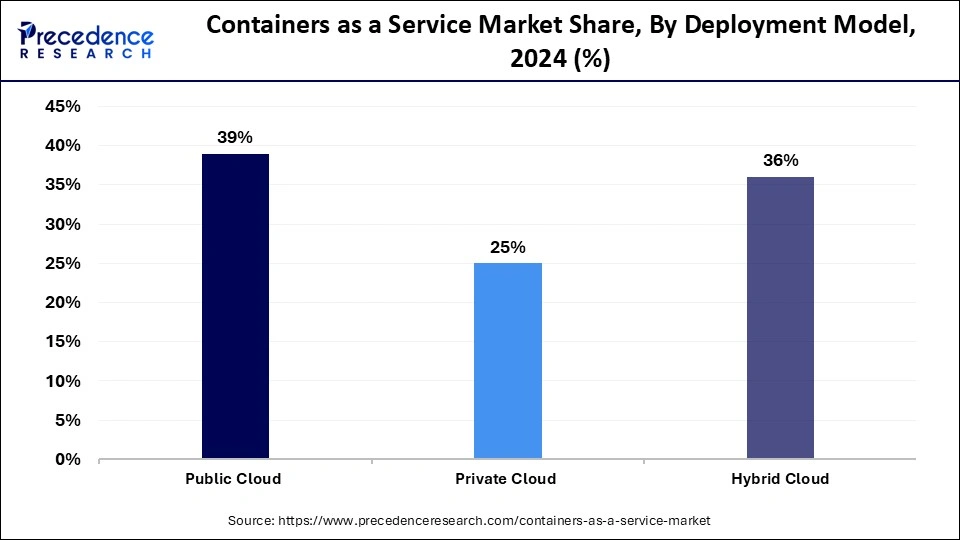

- By deployment model, the public cloud segment held a considerable share of 39%in 2024.

- By service type, the container orchestration segment dominated the market in 2024.

- By service type, the container monitoring segment is projected to grow at a notable rate in the coming years.

- By end-user, the large enterprises segment led the market in 2024.

- By end-user, the small and medium enterprises segment is anticipated to expand at the fastest rate during the projection period.

- By vertical, the information technology segment dominated the market in 2024.

- By vertical, the healthcare segment is likely to grow at a significant rate in the upcoming period.

AI Integration in Containers as a Service Market

The integration of Artificial Intelligence (AI) algorithms in Containers as a Service (CaaS) drive innovations and efficiency in various ways. Integrating AI into container orchestration platforms such as Kubernetes holds the promise to address risks related to security and optimize resource allocation. AI can automate container orchestration, optimizing performance and reducing the need for manual intervention. AI-based containers provide several advantages, including enhanced scalability, portability, and dependability. AI also analyzes patterns and anomalies in containerized environments, preventing security threats. AI ensures the optimal performance of containers.

U.S. Containers as a Service Market Size and Growth 2025 to 2034

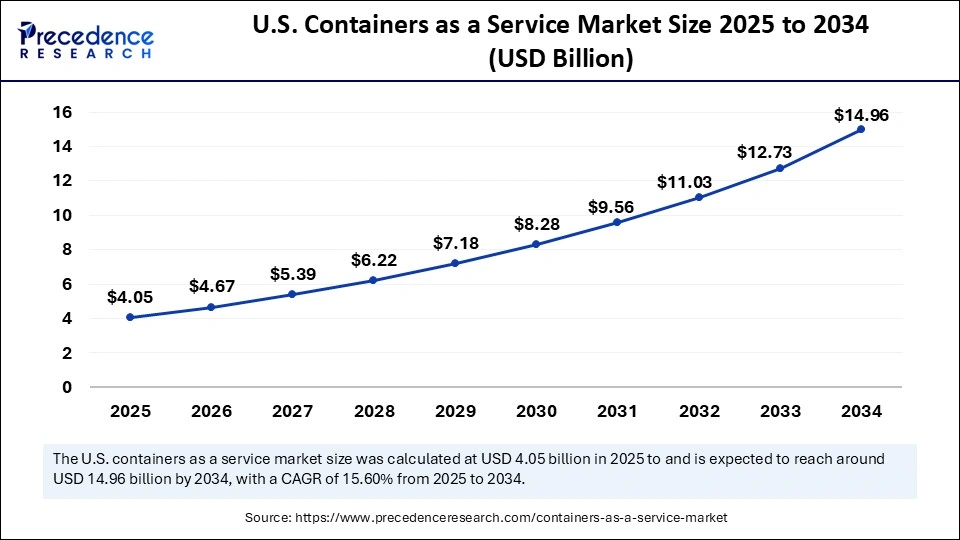

The U.S. containers as a service market size was exhibited at USD 3.51 billion in 2024 and is projected to be worth around USD 14.96 billion by 2034, growing at a CAGR of 15.60% from 2025 to 2034.

North America dominated the containers as a service market with the largest share in 2024. This is mainly due to the increased adoption of cloud-based technologies. North America has become a hub for tech services. The region boasts some of the leading tech companies. The region is expected to sustain its position in the market throughout the forecast period. With increasing government support for technological innovation, tech ventures are continuously launching innovative technologies, including cloud-based solutions.

The U.S. is a major contributor to the North American containers as a service market. There is a rising acceptance of DevOps in the U.S. However, CaaS solutions seamlessly integrate with DevOps practices, allowing businesses to revolutionize quicker. In addition, the rising IT spending contributes to market growth.

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The growth of the market in the region can be attributed to the rapid digitization across various industries. Businesses in the region are rapidly shifting toward cloud solutions. Moreover, the rising penetration of online business and government initiatives to digitize economies support regional market growth. Governments of various Asian countries are promoting digital transformation and encouraging the adoption of cloud solutions. The increasing adoption of cloud solutions is likely to drive the growth of the market in the region.

For instance, cloud infrastructure spending in China increased by 13% in 2024 compared to the previous year and is projected to grow by 15% in 2025, reaching USD 46 billion. This indicates ongoing growth driven by the adoption of cloud technologies.

Europe is considered to be a significantly growing area. The growth of the containers as a service market in Europe can be attributed to the increasing adoption of cloud computing, the demand for scalable services, and the rising popularity of microservices architecture. The presence of several major IT & Telecommunications companies further contributes to market growth. Companies in the region are prioritizing digital transformation, boosting the demand for cloud-based solutions, including CaaS. Incorporating digital technologies in the major areas of a business allows various organizations to enhance their services, which increases the need for containers as a service in European countries.

Market Overview

The containers as a service market is witnessing significant growth due to the rapid expansion of the IT infrastructure. CaaS service is utilized to manage and develop containers in the IT infrastructure, working in a multi-cloud or hybrid environment. CaaS is a cloud solution that helps deploy, scale, and manage containerized applications. Within cloud computing, the container refers to a standard unit, including codes, libraries, frameworks, tools, configuration files, and settings to form complete software packages. These containers function as a virtual operating system environment that runs on a private data center, a physical machine, or a public cloud. Some of the major CaaS providers, including AWS Fargate, Azure Container Instances (ACI), Google Cloud Run, and Oracle Application Container Cloud Service, are focusing on expanding their operations worldwide, which further propels the growth of the market.

Containers as a Service Market Growth Factors

- The rising need for flexible and scalable platforms is boosting the growth of the market. CaaS platforms enhanced flexibility and scalability, allowing organizations to scale up or down their applications as per requirements.

- The growing concerns about data safety further boost the growth of the market. CaaS platforms increase data safety and support businesses to comply with regulations. CaaS protects sensitive data and reduces the challenges of data breaches. CaaS provides in-built security features and disaster recovery solutions, ensuring that businesses can sustain operations even in the event of an outage.

- Businesses are increasingly seeking cost-saving options, which contributes to the growth of the market. CaaS solutions offer pay-as-you-go pricing models, helping businesses to optimize costs by paying only for resources they use.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 43.54 Billion |

| Market Size in 2025 | USD 11.99 Billion |

| Market Size in 2024 | USD 10.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.41% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Model, Service Type, End-User, Vertical and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Adoption of Microservices

The rising adoption of microservices architecture is a major factor driving the growth of the containers as a service market. This software development approach allows development teams to build, test, and deploy services independently, leading to faster iteration cycles and reducing the risk of system-wide failure. This architecture allows the use of diverse technologies tailored to the specific needs of personal services, resulting in more efficient and optimized implementation. Additionally, microservices are scaled individually based on real-time demand, ensuring better resource utilization and enhanced application responsiveness. However, microservices rely on containers for efficient deployment and management as they provide the ideal environment.

Restraint

Complexity of Management

The growth of the containers as a service market is restrained because IT workplaces are becoming more heterogeneous, creating barriers to the widespread acceptance of containers. Organizations have no visibility into where their business information resides, leaving them vulnerable to loss of information. It becomes more complex as companies run extra containers in various environments and systems. Managing all containerized applications across multiple environments can be complex, requiring specialized skills and knowledge. This limits the adoption of containers as a service.

Opportunity

Integration with the Existing Infrastructure

Integrating containers and containers as a service platforms in existing infrastructure presents a significant opportunity for organizations aiming to streamline their software delivery processes. By bridging the gap between development and operation teams, CaaS provides a unified, scalable, and efficient environment for deploying and managing applications. This enhanced collaboration supports agile development and enables rapid adaptation to evolving market demands and technological shifts. Furthermore, CaaS enables resource optimization by reducing reliance on traditional physical servers and virtual machines, allowing businesses to scale resources on demand. This flexibility reduces overprovisioning expenses and operational waste, making CaaS an attractive solution for enterprises seeking cost-efficiency and competitive agility.

Deployment Model Insights

The public cloud segment held a considerable share of the containers as a service market in 2024. This is mainly due to the increased demand for scalable and cost-saving solutions. Public cloud platforms offer on-demand scalability, enabling businesses to adjust resources and containerized workloads as per requirements. These platforms further eliminate the need for upfront investments by providing pay-as-you-go- pricing models.

Service Type Insights

The container orchestration segment dominated the containers as a service market in 2024. Container orchestration platforms automate container deployment, freeing up developers to focus on application development. These platforms allow businesses to track container health and security vulnerabilities, as they provide robust security features and monitoring capabilities. Container orchestration platforms enable scaling and management of containerized applications, optimizing resource utilization. Container orchestration increases the productivity of developers, helping to lower repetitive tasks and eliminate the load of maintaining, managing, and installing containers.

The container monitoring segment is projected to grow at a notable rate in the coming years due to the rising need for performance optimization. Container monitoring provides real-time visibility into the health and performance of containers. It prevents downtime by tracking key metrics and detecting anomalies. It also provides developers with the ability to troubleshoot issues faster and boost productivity.

End-User Insights

The large enterprises segment led the containers as a service market with a significant share in 2024. This is mainly due to the increased demand for scalable solutions to enhance performance and efficiency across multiple applications. CaaS platforms allow large organizations to deploy new services and applications faster without investing in IT infrastructure. These platforms expand the application configurations, ensuring consistent operation in different computing environments. Containers, with a lightweight nature, permit high-density deployment, improving resource utilization and potentially lowering infrastructure expenses for large enterprises.

The small and medium enterprises segment is anticipated to expand at the fastest rate during the projection period. CaaS platforms enable SMEs to optimize their IT infrastructure by investing in hardware. These platforms provide SMEs with the flexibility to adapt to changing business needs. CaaS platforms permit developers to run additional containers. Furthermore, they also require less computing energy to operate since there is no supplementary requirement to operate various operating systems in the container, which is beneficial for SMEs.

Vertical Insights

The information technology segment dominated the containers as a service market in 2024. This is mainly due to the rapid expansion of the IT infrastructure. CaaS platforms automate infrastructure management tasks, freeing up IT teams to focus on other core tasks. Containers reduce the need for virtualized operating systems and hypervisors, making them beneficial for IT operations. Moreover, CaaS provides scalability and flexibility required to handle fluctuating IT workloads.

The healthcare segment is likely to grow at a significant rate in the upcoming period. CaaS platforms enable healthcare providers to deploy and manage applications that enhance patient care. CaaS platforms facilitate the use of data analytics, enabling healthcare providers to analyze healthcare records. Moreover, they enhance the safety of sensitive patient data. CaaS helps the quick adoption of telemedicine solutions and electronic health records, permitting patients to obtain care more easily.

The telecommunications segment is expected to grow at a notable rate over the studied period. CaaS is a cloud-based solution that permits telecommunication companies to upload, run, organize, scale, and manage containers. CaaS platforms enable telecom businesses to easily deploy 5G and next-generation telecom networks. They also help in optimizing telecom infrastructure.

Recent Developments in the Market

- In March 2025, Triton International Limited announced that it had agreed to acquire Global Container International LLC. The transaction is subject to customary closing conditions, including regulatory approval. The transaction is projected to close in the first half of 2025. This acquisition enables Triton to expand its container fleet.

- In February 2025, Akamai Technologies launched a Managed Container Service. This service will enable organizations to deploy cloud-native applications across a global network made up of more than 4,300 points of presence (PoPs).

- In October 2024, Moro Hub entered into a collaboration with Red Hat to deliver Containers as a Service on Red Hat OpenShift. This platform is designed to satisfy the increasing demand for environmentally conscious digital solutions while empowering organizations to adopt cloud-native applications and helping to reduce their environmental impact.

Containers as a Service Market Companies

- Cisco Systems, Inc.

- Hewlett-Packard Enterprise Company

- IBM Corporation

- Oracle

- Huawei Technologies Co., Ltd.

- Amazon Web Services

- Microsoft

- VMWare

- Docker

- SUSE

- Red Hat

- Tata Communications

- Alibaba Cloud

- DXC Technology

Segments Covered in the Report

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Service Type

- Container Orchestration

- Container Management

- Container Monitoring

By End-User

- Small and Medium Enterprises

- Large Enterprises

- Startups

By Vertical

- Information Technology

- Healthcare

- Retail

- Telecommunications

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting