What is the Cybersecurity Services Market Size?

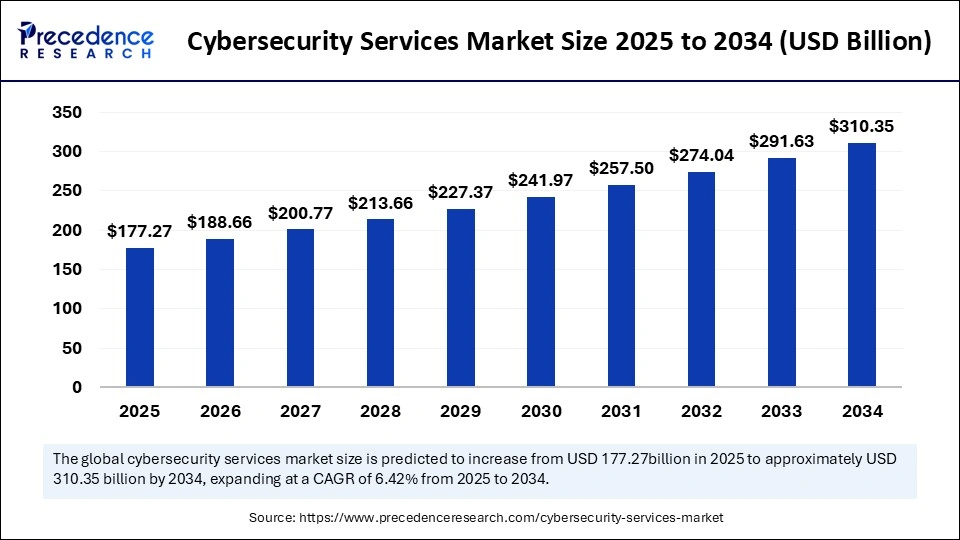

The global cybersecurity services market size is accounted at USD 177.27 billion in 2025 and predicted to increase from USD 188.66 billion in 2026 to approximately USD 310.35 billion by 2034, expanding at a CAGR of 6.42% from 2025 to 2034. The growth of the cybersecurity services market is driven by rising cyber threats, regulatory compliance demands, and increased digital transformation across industries.

Cybersecurity Services Market Key Takeaways

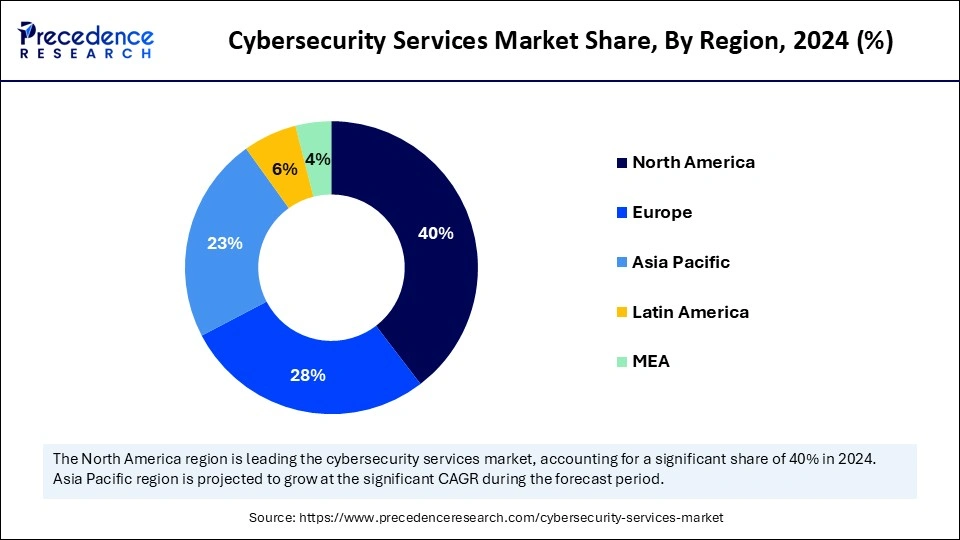

- North America dominated the global market with the largest market share of 40% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By service, the professional services segment captured the biggest market share in 2024.

- By service, the managed services segment is expected to grow at the highest CAGR in the coming years.

- By industry vertical, the defense and government segment contributed the highest market share in 2024.

- By industry vertical, the healthcare segment is expected to register the fastest CAGR in the upcoming period.

How is AI Transforming the Cybersecurity Services Market?

The use of artificial intelligence is helping cyber security companies address new security risks. Artificial intelligence (AI) allows quick analysis of a lot of data so that anomalies can be noticed shortly after they occur. Thanks to predictions, the organization can act fast and prevent damage or loss. The growing number and difficulty of cyber threats encourage businesses to rely more on AI to avoid data breaches and stay in line with stringent regulations.

- In April 2025, TCS launched two India-first, AI-powered platforms in cloud services and cybersecurity systems to transform public and defense sector systems. The platforms are designed with robust AI capabilities integrated into the cloud services for a modernized version of the public sector/defense system.(Source: https://www.fortuneindia.com)

Why Are Cybersecurity Services Suddenly Everyone's Top Priority?

Cybersecurity includes safeguarding systems, networks, programs, and data from cyber threats. Cybersecurity practices involve securing cloud services, devices for mobile use, internet-connected gadgets (IoT), and database systems in business. The government and private sectors are spending large amounts on cybersecurity systems to prevent cyber risks. Cybersecurity services secure confidential data from BFSI, healthcare, manufacturing, and government sectors. Instances of cyber threats are rising continuously, raising concerns among businesses. As cyber threats are becoming more sophisticated, businesses are actively choosing well-developed security systems. Because more people are using the Internet for banking, healthcare, and shopping, the incidences of cyberattacks keep rising.

What are the Major Factors Boosting the Growth of the Cybersecurity Services Market?

- Generative AI (GenAI) Integration: Using Generative AI in cybersecurity permits easier and more accurate recognition of security threats. Analyzing extensive data allows it to find repeated risks, which means organizations can address problems early on.

- Increased Regulatory Scrutiny: Since governments are paying more attention, the compliance rules have been sharpened. Stringent updated data protection rules require companies to increase their cybersecurity spending to avoid penalties.

- Focus on IoT (Internet of Things) and OT (Operational Technology) Security: Security should focus on IoT and OT, as these are now working closely, so the risks are greater. Companies are adopting newer cybersecurity products to address risks due to smart devices and control systems.

Market outlook

- Industry outlook: The cybersecurity services market is poised for rapid growth from 2025 to 2034, driven by drivers like cloud & hybrid transformation as organizations migrate workloads to public clouds and adopt hybrid architectures, demand for cloud-native security services, CSPM, CWPP, cloud identity governance grows; service providers that embed security into cloud operations reduce misconfiguration risks and accelerate secure innovation.

- Major investment: secure capital partners provide growth capital to MSSPs and cloud-security platform companies, enabling scale-up of global SOC capabilities and acquisition of niche analytics teams. Tech defend Ventures funds innovative threat-intelligence and automation startups, accelerating the integration of AI/ML into managed security services and reducing time-to-detect for customers.

- Sustainability trend: Sustainability in cybersecurity focuses on responsible consumption of compute resources, optimizing SIEM and analytics workloads to reduce energy use and on long-lived, maintainable platforms that avoid frequent, costly rip-and-replace cycles. Managed service providers are adopting green-hosting options, efficient data-retention policies, and edge analytics to minimize cloud egress and storage energy footprints.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 310.35 Billion |

| Market Size in 2025 | USD 177.27 Billion |

| Market Size in 2026 | USD 188.66 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.42% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Advanced Cybersecurity Solutions

The hackers usually target companies, organizations, or networks in certain industries and try to steal important documents or disrupt business operations. So, companies are paying more attention to improving their security measures. Using cloud computing, IoT, and AI more often makes companies more vulnerable to cyber threats. New digital assets on the market make it easier for cybercriminals to find a way to attack. As a result, companies may lose earnings, see their reputation hit, and have to stop working until the cyber-attack is handled. This, in turn, is boosting the demand for advanced cybersecurity solutions. Industries are also investing more in cybersecurity solutions so that they can instantly catch threats, take action, and keep risks in check.

Surging Mobile Banking Adoption

The rising use of mobile banking and digital payment is one of the major factors driving the growth of the cybersecurity services market. Because more people have smartphones and faster mobile Internet, people now do their transactions online and with mobile apps. Because of this increased connection, Paytm, Google Pay, Apple Pay, and PayPal have become popular choices for paying online. There is increased digitization in the banking sector, making banking institutes target of cybercriminals. Because many people handle their finances using their phones, hackers have exploited the weak security on those devices. When a data breach occurs via phishing, malware, or account takeover, cybercriminals use the data to carry out financial fraud. Thus, banks and fintech firms are now putting more effort into protecting their customers from digital risks. Companies are putting more money into modern cybersecurity to find vulnerabilities, add multi-factor authentication, and respond immediately to any attack. Such activs help protect client data and ensure the company adheres to regulations and is trusted by people. Since banking is moving online, strong cybersecurity is now needed to maintain smooth workflows.

Restraint

Lack of Experts and Budget Constraints

Although business optimization needs to adopt highly effective cybersecurity, small and medium-sized enterprises (SMEs) struggle to implement these solutions. An important issue is that there aren't enough qualified cybersecurity professionals for managing, setting up, and updating cybersecurity systems. Rising cyberattacks means more people with specialized skills are required. Small businesses are often unable to afford to buy, build, or maintain the large cybersecurity systems of bigger organizations. Many SMEs still rely on outdated or rudimentary systems, which elevates the risk of getting hit by a cyberattack.

Opportunity

Adoption of Cloud-Based Cybersecurity Solutions

More companies are turning toward cloud-based cybersecurity solutions, creating significant growth opportunities for cybersecurity firms. Cyber threats are gradually increasing in number and complexity, and SMEs are more interested in finding affordable, flexible, and quick-to-use security tools. Cloud-based cybersecurity solutions deliver strong security without needing to hire full cybersecurity teams or handle complicated systems. Cybersecurity companies can focus on making solutions tailored to the specific challenges and budgets of SMEs. As a result of providing cloud-based security solutions that are simple to use and can grow with a business, providers can serve a growing market.

Service Insights

Why did the Professional Services Segment Dominate the Market in 2024?

The professional services segment dominated the cybersecurity services market with the biggest market share in 2024. Because of the rapid use of cloud computing, IoT, and AI by different companies, organizations are dealing with more security problems. Consequently, companies are in greater demand for services that search for vulnerabilities, perform hacking tests, carry out security assessments, check compliance, and provide risk management consulting. Service providers are expanding their portfolio by offering plans and offers to help businesses deal with complex security challenges. As the adoption of cybersecurity solutions rises, so does the need for integration, support, and maintenance services.

The managed services segment is expected to grow at the highest CAGR in the coming years. The complexity of cyberattacks is rising, and there is a shortage of skilled workers in many businesses, especially small and mid-sized businesses, which is boosting the demand for managed services. Businesses are now turning to service providers that provide managed services. These services allow businesses to handle security and focus on other company priorities without having to spend much on their resources. More organizations are adopting cloud solutions and letting staff work from anywhere, which is boosting the need for managed services that are able to provide instant security and support. These services create adaptable, personalized security options that can adapt to changing business needs.

Industry Verticals Insights

How does the Defense and Government Segment Dominate the Cybersecurity Services Market?

The defense and government segment dominated the market with the most revenue share in 2024. This is mainly due to the increased demand for robust security measures among government and defense agencies, as they need to protect sensitive national security details, defense strategies, reports from intelligence agencies, and critical assets. These agencies are more vulnerable to cyberattacks. Government operations have shifted to digital networks. This raised concerns about data security.

Moreover, governments across the globe are spending much on strong cybersecurity solutions that can detect threats early and fast to maintain the safety of data and keep their systems operating. The defense sector is also investing in modern security solutions to deal with new cyber threats and secure important national resources. These factors ensure the long-term growth of the segment.

The healthcare segment is expected to register the fastest CAGR in the upcoming period. With electronic health records (EHRs) in use, more medical devices connected to the internet (IoMT), expansion of telemedicine platforms and patient management systems, new risks have emerged for cybercriminals. Healthcare data is private and of high value since it includes personal health information (PHI) that could be used by attackers in ransomware attacks, breaches, and identity theft. If healthcare institutions are victims of cyberattacks, they fail to deliver care services to patients and may suffer great financial and image damage. Thus, healthcare organizations are taking action to stop these risks by using threat intelligence, managing vulnerabilities, safeguarding vulnerable devices, and building cloud security systems.

Regional Insights

U.S. Cybersecurity Services Market Size and Growth 2025 to 2034

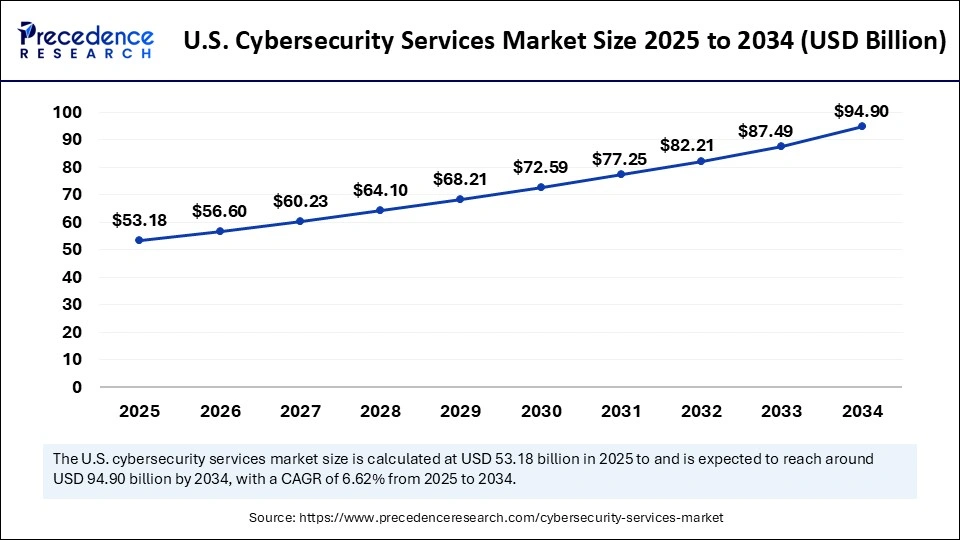

The U.S. cybersecurity services market size is evaluated at USD 53.18 billion in 2025 and is projected to be worth around USD 94.90 billion by 2034, growing at a CAGR of 6.62% from 2025 to 2034.

Why Does North America Dominate the Cybersecurity Services Market?

North America registered dominance in the market by holding a major revenue share in 2024. This is mainly due to the availability of advanced cybersecurity technologies and increased instances of cybercrimes. Stringent regulations regarding data security encouraged various industries to invest in cybersecurity services. Governments in North America are setting security and compliance standards to secure important data and keep their operations running strong. Businesses around the region have shifted to cloud environments, making them vulnerable to cyber threats. This significantly created the need for threat intelligence, incident response, and managed security services.

The U.S. is a major player in the North American cybersecurity services market due to its large digital economy, boosting the need for robust cybersecurity measures to reduce the risks of potential threats. With more use of online platforms in e-commerce, finance, healthcare, and government, people need more cloud application security and solutions. Due to the frequent cyberattacks, mainly ransomware, data breaches, and problems in the supply chain, U.S. businesses are setting up advanced security frameworks. With more people shopping online and digital changes happening in various industries, the demand for security measures is rising.

Why is the Cybersecurity Services Market Growing Rapidly in the Asia Pacific?

The market in Asia Pacific is expected to expand at the fastest CAGR in the coming years. This growth is supported by funding from local and international groups seeking to ensure that digital security standards are improved across the Asia Pacific. The need to secure consumer data has become essential because of increased digitization and increases in e-commerce activities. In the last few years, the governments of South Korea, Singapore, Japan, and Australia experienced substantial cyberattack, which encouraged them to impose strong cybersecurity measures and spend more on such services. Besides, the growing concerns among businesses about cyber threats are boosting the growth of the market in the region.

- In April 2025, the government of India launched the first Digital Threat Report 2024 to support cybersecurity in the Banking, Financial Services, and Insurance (BFSI) sector. At the launch of Digital Threat Report 2024, MeitY Secretary S. Krishnan emphasized the need for a unified cybersecurity framework to protect India's financial backbone. (Source: https://www.pib.gov.in)

What Opportunities Exist in the European Cybersecurity Services Market?

Europe is expected to grow at a notable rate during the forecast period because more European businesses are investing in security solutions. Stringent security regulations in countries such as the U.K., Germany, France, Spain, and Italy are influencing market growth. Many businesses in these countries are placing a strong emphasis on protecting their sensitive information. Manufacturing, finance, and IT businesses are imposing security measures in order to ensure data security. The rising frequency of cyberattacks and the growing concerns about data privacy are driving the growth of the market.

Is Europe Building a Privacy-First Cybersecurity Services Model?

Europe's market is characterized by strong regulatory pressure, data-protection norms and an emphasis on privacy-preserving security designs that respect user rights while enabling robust defences. European buyers often prefer auditable, transparent services that map to GDPR, critical-infrastructure requirements, and sectoral standards pushing vendors to offer explainable telemetry and compliant data-handling models. Public-private collaboration, regional threat-sharing initiatives, and certification schemes create a fertile environment for trusted MSSPs and boutique specialist firms. As a result, Europe tends to lead on privacy-aware managed services and compliance-integrated incident response offerings.

Germany Cybersecurity Services Market Trends

Germany emphasizes industrial cybersecurity (OT/ICS) and highly certified services for manufacturing and critical utilities, with buyers demanding deterministic SLAs and rigorous auditability. Nordic countries combine high digital uptake with strong privacy norms, fostering advanced identity, encryption and secure-by-design consulting practices. UK markets show robust demand for managed detection, threat intelligence, and financial-sector security services focused on fraud and payments protection. Collectively, these markets favour vendors who can demonstrate privacy compliance, resilience metrics and long-term service assurance.

Is Middle East Africa Fast-Tracking Cyber Resilience with Strategic Investment?

Middle East & Africa markets display rapid government and enterprise investment in cyber capabilities driven by smart-city projects, energy sector digitization and a need to protect strategic infrastructure. Wealthier Gulf states are deploying large-scale security operations, sovereign CERTs, and advanced managed services, while many African markets adopt MSSP models to overcome local talent gaps. The region's heterogeneous maturity encourages partnership models where global vendors enable local integrators through training, technology transfer and joint SOC operations. Connectivity constraints and fragmented regulation remain challenges, but demand for cloud security and identity services is rising swiftly.

The UAE Cybersecurity Services Market Trends

In the UAE, strategic initiatives and digital-transformation programmes are boosting demand for enterprise SOCs, cloud security, and secure digital identities for citizens and businesses. South Africa shows strong private-sector demand especially in finance and telecommunications for managed detection, incident response and endpoint protection services. Across MEA, public-private initiatives and regional cybersecurity hubs are catalyzing skilled workforce development and vendor ecosystems.

Can Latin America Close the Cybersecurity Gap Through Services?

Latin America is experiencing growing demand for outsourced security as organizations confront rising ransomware, fraud and supply-chain threats while coping with skills shortages. Managed services, remote incident response, and cloud-native security offerings are attractive because they lower entry barriers for mid-market firms that lack in-house capability. Payment platforms, retail and government digitization projects are primary consumption drivers, prompting regional vendors to offer Spanish-/Portuguese-friendly platforms and localized support. Economic volatility and budget constraints slow procurement cycles, but practical, outcomes-focused service bundles gain traction.

Brazil Cybersecurity Services Market Trends

Brazil is the most active market with robust demand across financial services, e-commerce and public sectors for MDR, threat intel and compliance services. Mexico shows accelerating interest from corporates and critical supply-chain operators seeking managed detection and resilience solutions. Across LATAM, partnerships with global MSSPs and local integrators are key to delivering scalable, culturally attuned services.

Top Companies in the Cybersecurity Services Market & Their Offerings:

- Accenture: A global professional services giant, Accenture is critical in helping organizations worldwide with strategy, consulting, technology, and operations, leveraging cutting-edge solutions in AI, cloud, and cybersecurity to drive large-scale transformation and growth.

- AT&T Inc.: As a major U.S. telecommunications company, AT&T provides essential connectivity through its vast wireless network and growing fiber-optic internet services, which are foundational for modern communication, entertainment, and business operations, including supporting the vital FirstNet public safety network.

- Atos SE: Atos is a key global player in digital transformation, specializing in business consulting, cloud services, cybersecurity, and high-performance computing (HPC). It helps clients across various industries, including the public sector and major sporting events like the Olympics, to manage and secure their digital environments.

- Capgemini: A global leader in consulting, technology services, and digital transformation, Capgemini helps clients address opportunities in cloud, digital, and platforms. Its expertise spans from strategy and transformation to applications development and operations, with a strong focus on innovation and leveraging AI and data.

- Cisco Systems, Inc.: Cisco is a global leader in networking hardware, software, and telecommunications equipment. It is vital for building and powering the internet and data centers, providing the infrastructure that allows networks to connect, communicate, and operate securely and efficiently.

- CrowdStrike Holdings, Inc.: CrowdStrike is a significant force in cybersecurity, known for its cloud-native platform that delivers endpoint security, threat intelligence, and cyberattack response services. It plays a crucial role in protecting businesses and governments from sophisticated cyber threats.

- Deloitte Global: As one of the "Big Four" accounting firms and a major global professional services network, Deloitte provides audit, consulting, financial advisory, risk advisory, and tax services. It is important for helping the world's largest organizations navigate complex business challenges and regulatory environments.

- DXC Technology Company: DXC provides end-to-end IT services, focusing on modernizing and managing clients' mission-critical systems and integrating new digital solutions to produce better business outcomes. It serves a wide range of industries globally.

- IBM: A historic leader in technology and innovation, IBM focuses on enterprise computing, IT services, and software, particularly in areas like artificial intelligence (AI) with its Watson platform, cloud computing, and blockchain. It has a long history of pioneering R&D and technological advancements.

- Rapid7: This company is important in the cybersecurity market, offering a leading platform for vulnerability management, security operations, and incident detection and response. Its solutions help organizations rapidly identify and remediate security risks.

Cybersecurity Services Market Companies

- Accenture

- AT&T INC.

- Atos SE

- Capgemini

- Cisco Systems, Inc

- CrowdStrike Holdings, Inc

Deloitte Global - DXC Technology Company

- IBM

- Rapid7

Recent Developments

- In April 2025, Stellar Cyber unveiled its Open Cybersecurity Alliance based on its award-winning Open XDR platform. This groundbreaking initiative streamlines security operations, improves interoperability, and enhances threat detection and response for enterprises and MSSPs. (Soure: https://www.businesswire.com)

- In November 2024, CrowdStrike teamed up with Ignition Technology to launch the Falcon cybersecurity platform in Ireland. By adding Ignition's experience as well as CrowdStrike's advanced applications, the partnership is designed to help stop breaches and make cybersecurity both safer and simpler in Europe. (Source: https://www.businesswire.com)

- In November 2024, Cisco and LTIMindtree strengthened their collaboration to provide better cybersecurity for remote and hybrid teams. The goal of this collaboration is to make IT tasks simpler, improve what users see and do, and implement better zero-trust security measures for offices. LTIMindtree now offers next-generation SSE to its global clients via Cisco Secure Access.(Source: https://investor.cisco.com)

Segments Covered in the Report

By Service

- Professional Services

- Integration

- Support and Maintenance

- Training, Consulting, and Advisory

- Penetration Testing

- Bug Bounty

- Others

- Managed Services

- Managed Detection Response (MDR)

- Managed Security Incident and Event Management (SIEM)

- Compliance and Vulnerability Management

- Others

By Industry Vertical

- IT & Telecom

- Retail

- BFSI

- Healthcare

- Defense and Government

- Energy

- Manufacturing

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting