Data Center Lithium-Ion Battery Market Size and Forecast 2025 to 2034

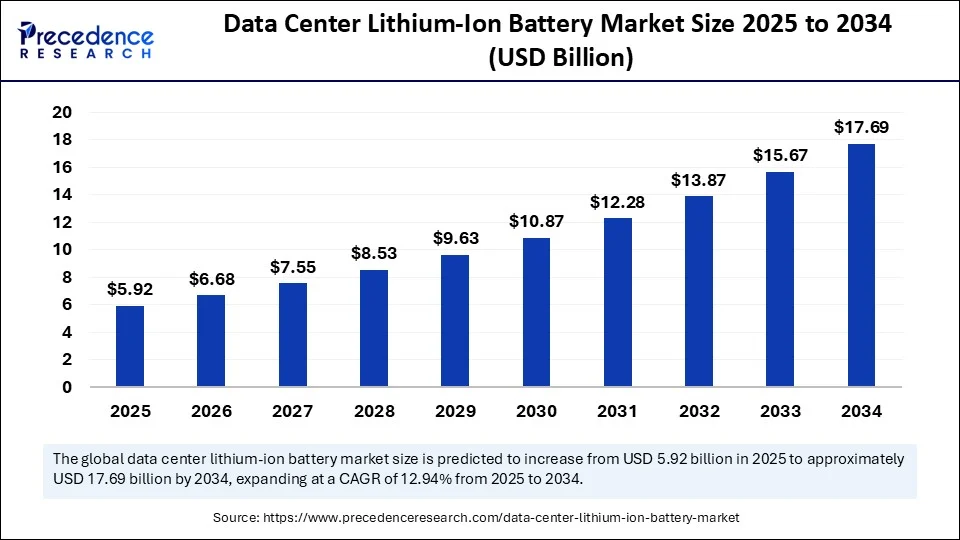

The global data center lithium-ion battery market size accounted for USD 5.24 billion in 2024 and is predicted to increase from USD 5.92 billion in 2025 to approximately USD 17.69 billion by 2034, expanding at a CAGR of 12.94% from 2025 to 2034.The market is significantly growing due to the unprecedented offerings of lithium-ion batteries, like high scalability and low thermal runaway, which is crucial for data centers to avoid accidents. Ongoing advancements in battery chemicals and their applications are boosting higher efficiency, aligning with cutting-edge technologies.

Data Center Lithium-Ion Battery MarketKey Takeaways

- In terms of revenue, the global data center lithium-ion battery market was valued at USD 5.24 billion in 2024.

- It is projected to reach USD 17.69 billion by 2034.

- The market is expected to grow at a CAGR of 12.94% from 2025 to 2034.

- North America dominated the data center lithium-ion battery market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth during the foreseeable period.

- By battery chemistry, the lithium-iron phosphate segment led the global market in 2024.

- By battery chemistry, the lithium nickel manganese cobalt (NMC) segment is expected to grow at the fastest CAGR during the forecast period.

- By data center type, the hyperscale data centers segment captured the biggest market share in 2024.

- By data center type, the edge/micro data centers segment is expected to expand at the fastest CAGR during the projection period.

- By application, the uninterruptible power supply segment contributed the largest market share in 2024.

- By application, the energy storage system segment is expected to showcase the fastest growth during the forecasted years.

- By component, the battery racks/modules segment held the highest market share in 2024.

- By component, the battery management systems segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By end user, the cloud service providers segment generated the major market share in 2024.

- By end user, the telecom operators segment is expected to grow at the fastest CAGR during the forecast period.

How is AI Transforming the Data Center Lithium-Ion Battery Market?

The integration of artificial intelligence with lithium-ion batteries is evident in the battery management system (BMS) of such batteries. As the BMS is a crucial part of any battery and its lifecycle, it is essential to reduce deterioration and avoid potential explosions due to mismanagement. AI has emerged as a transformative tool, providing innovative solutions to increase efficiency, forecast failures, and extend the working life of lithium-ion batteries.

AI algorithms can be incorporated to check battery parameters such as voltage, current, temperature, and its state of charge, ensuring the battery operates in a healthy state. These algorithms process collected data from the BMS system, offering insights to evaluate and restore it if any imbalances are found, which further reduces downtime and prevents massive failures. Moreover, AI algorithms can optimize energy consumption in data centers by dynamically adjusting battery usage based on real-time demand, grid conditions, and renewable energy availability. This helps to reduce energy costs and improve the overall efficiency of the data center. Some of the AI techniques are listed below that can be useful for Li-ion batteries.

- Evolutionary Computing

- Expert Systems

- Support Vector Machines

- Hybrid Intelligence Systems

- Neuro-fuzzy Systems

- Artificial Neural Network

Market Overview

The data center lithium-ion battery market refers to the global industry focused on supplying lithium-ion (Li-ion) battery systems for backup power and energy storage in data centers. These batteries are increasingly replacing traditional valve-regulated lead-acid (VRLA) batteries due to advantages such as longer lifespan, smaller footprint, faster charging, better temperature tolerance, and lower total cost of ownership. Li-ion systems are critical for uninterruptible power supply (UPS) units and provide power during grid outages or system transfers, especially in edge, colocation, hyperscale, and enterprise data centers.

What are the key trends in the data center lithium-ion battery market?

- Next-gen solid-state batteries: One of the key trends for market expansion is the development of next-generation solid-state lithium-ion batteries, focusing on enhanced safety, wider operating temperature ranges, and higher energy density. These batteries are prioritized for their quick recharge capabilities, minimizing downtime and providing an uninterrupted power supply with an extended lifespan.

- Automation system for power infrastructure:Another key trend in the market is the development of an automated control framework, utilizing smart grids and renewable energy sources to enhance operational efficiency.

- Trial of different battery chemistries:To enhance battery lifespan and safety, focusing on core chemicals crucial for battery operation is essential. Many researchers are developing various chemical blends suitable for lithium-ion batteries, potentially leading to breakthroughs in battery chemical compositions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 17.69 Billion |

| Market Size in 2025 | USD 5.92 Billion |

| Market Size in 2024 | USD 5.24 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.94% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Battery Chemistry, Data Center Type, Component, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing rate of rack density due to complex technologies

The escalating rack density within data centers, fueled by the rapid adoption of complex technologies, is a primary driver for the growth of the data center lithium-ion battery market. As more powerful servers and equipment are packed into each rack, the demand for robust and reliable power backup solutions intensifies. This increased density translates to a higher concentration of critical IT infrastructure, making the need for an uninterrupted power supply even more crucial.

Lithium-ion batteries, with their ability to offer instant recharge capabilities and a smaller footprint, are ideally suited to meet these demands. Furthermore, the superior cycle life and overall efficiency of lithium-ion systems make them a preferred choice for data centers aiming to optimize their operations and ensure high availability in the face of growing rack densities. This shift is also supported by the industry's move towards sustainable solutions, making lithium-ion batteries an ideal choice.

Restraint

Safety concerns and high costs

Although the adoption of Li-ion batteries in data centers is rising, they pose a greater fire risk compared to alternatives like valve-regulated lead-acid batteries. Heat buildup in lithium-ion batteries, often exceeding the rate of heat dissipation, raises significant safety concerns. Furthermore, the extraction of lithium through deep mining processes has a detrimental impact on overall environmental safety. Improper disposal of these batteries further exacerbates safety concerns. Moreover, the initial investment in lithium-ion battery systems is higher than that of lead-acid batteries, which creates challenges for some data centers, particularly smaller ones.

Opportunity

Integration of microgrids and renewable energy sources with Li-ion UPS system

A significant opportunity for the data center lithium-ion battery market lies in integrating renewable energy sources and microgrids into lithium-ion UPS systems. Data center operators are increasingly adopting hybrid power setups that combine Li-ion UPS arrays with solar, wind, or hydrogen-powered backups to maintain efficiency and avoid downtime. This integration reduces reliance on the main power grid and lowers overall operating costs. This approach aligns with carbon neutrality goals. As data center operators aim to minimize the total cost of ownership and comply with environmental regulations, the contribution of Li-ion batteries to market expansion is further reinforced.

Battery Chemistry Insights

Why did the lithium-iron phosphate (LFP) segment dominate the market in 2024?

The lithium-iron phosphate (LFP) segment dominated the data center lithium-ion battery market in 2024, driven by the increased demand for LFP-based batteries in EVs, given their cost-effectiveness compared to nickel or cobalt. LFP battery chemistry is exceptionally safe, less reactive to heat and air. It demonstrates thermal stability, which minimizes overheating risks, a critical advantage for data centers in preventing fire-related damage or explosions. These batteries also withstand numerous charge-discharge cycles, reducing replacement frequency and costs. Government support for green data centers and reduced carbon emissions through various policies further fuels this segment's expansion.

The lithium nickel manganese cobalt segment is expected to expand at the fastest CAGR during the forecast period of 2025-2034. This segment is expanding due to several factors, including the rising demand for high-energy storage, scalability, and cost-effectiveness offered by nickel-manganese-cobalt-based batteries. These batteries are widely used in EVs for their energy density and high performance.

Data Center Type Insights

What made hyperscale data centers the dominant segment in the data center lithium-ion battery market?

The hyperscale data centers segment dominated the market with the largest share in 2024. Specific and unique characteristics of lithium-ion batteries are highly suitable for the uninterrupted operation of hyperscale data centers, which require zero downtime and a reliable energy supply. A single instance of downtime can lead to significant financial and operational repercussions. Furthermore, many hyperscale data centers are adopting green energy initiatives by integrating renewable energy sources and lithium-ion batteries, which is expanding the segment's growth globally.

The edge/micro data centers segment is expected to grow at the fastest rate over the projection period. This segment is expanding due to the adoption of technologies like IoT, 5G, and AI/ML models, which require real-time processing with enhanced safety measures to prevent unauthorized access. This shift necessitates low-latency and high-bandwidth data processing to improve network efficiency and reliability through edge/micro data centers.

Application Insights

How does the uninterruptible power supply (UPS) segment lead the data center lithium-ion battery market in 2024?

The uninterruptible power supply (PUS) segment led the global market in 2024. This is mainly due to the shift from traditional lead-acid batteries to lithium-ion-based batteries. This change is driven by the superior offerings of lithium-ion batteries, including a longer lifespan, high energy density, and faster recharge times, which contribute to minimizing the total cost of ownership for data center operators.

The energy storage systems (ESS) segment is expected to expand at the highest CAGR in the upcoming period. The growth of the segment is attributed to the push for renewable energy integration into data centers and the need for high-density, reliable power sources to ensure continuous operation, along with backup power when renewable energy sources are unavailable.

Component Insights

Why did the battery racks/modules segment dominate the market in 2024?

The battery racks/modules segment dominated the data center lithium-ion battery market in 2024. The segment is dominating due to their durability, stability, and ability to accommodate different battery types within a steel rack/module, along with their high scalability. With the substantial expansion of data centers, operators are seeking robust solutions to safeguard batteries from physical harm, potential explosions, and other dangerous conditions. Consequently, racks and modules are vital components, significantly supporting market growth.

The battery management systems segment is expected to expand at the fastest CAGR during the forecast period of 2025-2034. The battery management system (BMS) is crucial for monitoring and controlling battery parameters, including current and voltage, preventing overheating and physical damage, and ensuring optimal battery performance. Moreover, BMS enables integration with smart grid technologies, which minimizes energy costs and enhances battery lifespan.

End User Insights

How does the cloud service providers segment dominate the data center lithium-ion battery market?

The cloud service providers segment dominated the market in 2024, driven by the increasing adoption of cloud services, the expansion of big data technologies, and the rise of IoT. Cloud providers require a reliable, uninterrupted power supply, which lithium-ion batteries offer to ensure data availability. Lithium batteries' extended charge and discharge cycle rates enhance their efficiency for modern, high-energy-consumption data centers.

The telecom operators segment is expected to expand at the fastest CAGR in the coming years, driven by the expansion of 5G networks, the rise in mobile usage, and increased internet availability, especially in rural areas, all of which are bandwidth-intensive applications. Lithium-ion batteries are essential for energy storage to support these high-demand applications. Additionally, government policies supporting green energy, along with incentives for telecom companies, further drive this segment's growth.

Data Center Lithium-Ion Battery Market Companies

- Vertiv Group Corp.

- Eaton Corporation

- Schneider Electric SE

- Legrand SA

- Delta Electronics Inc.

- Huawei Technologies Co., Ltd.

- Samsung SDI Co., Ltd.

- LG Energy Solution

- Contemporary Amperex Technology Co. Ltd. (CATL)

- BYD Company Limited

- Toshiba Corporation

- Tesla, Inc.

- Panasonic Holdings Corporation

- Narada Power Source Co., Ltd.

- Lithium Energy Storage

- Saft Groupe S.A. (TotalEnergies)

- ZincFive Inc.

- Exide Technologies

- Hitachi Energy Ltd.

- Riello UPS (RPS S.p.A.)

Recent Developments

- In March 2025, Google revealed that it has deployed more than 100 million Lithium-ion (Li-ion) cells across its global fleet of data centers since 2015.

(Source: https://www.datacenterdynamics.com) - In June 2024, Delta launched a transforming series of lithium-ion battery systems, named UZR Gen3 series for the power management of data centers.

(Source: https://www.delta-emea.com)

Segments Covered in the Report

By Battery Chemistry

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Titanate (LTO)

- Lithium Cobalt Oxide (LCO)

- Others (e.g., NCA)

By Data Center Type

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- Edge/Micro Data Centers

By Application

- Uninterruptible Power Supply (UPS)

- Energy Storage Systems (ESS)

- Load Management / Peak Shaving

- Others

By Component

- Battery Racks / Modules

- Battery Management Systems (BMS)

- Inverters / Converters

- Monitoring & Cooling Systems

- Others

By End User

- Cloud Service Providers

- Telecom Operators

- Banking, Financial Services & Insurance (BFSI)

- Government & Defense

- Healthcare

- IT & Tech Enterprises

- Others (Retail, Education, Media)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting