What is the Diabetes Care Devices Market Size?

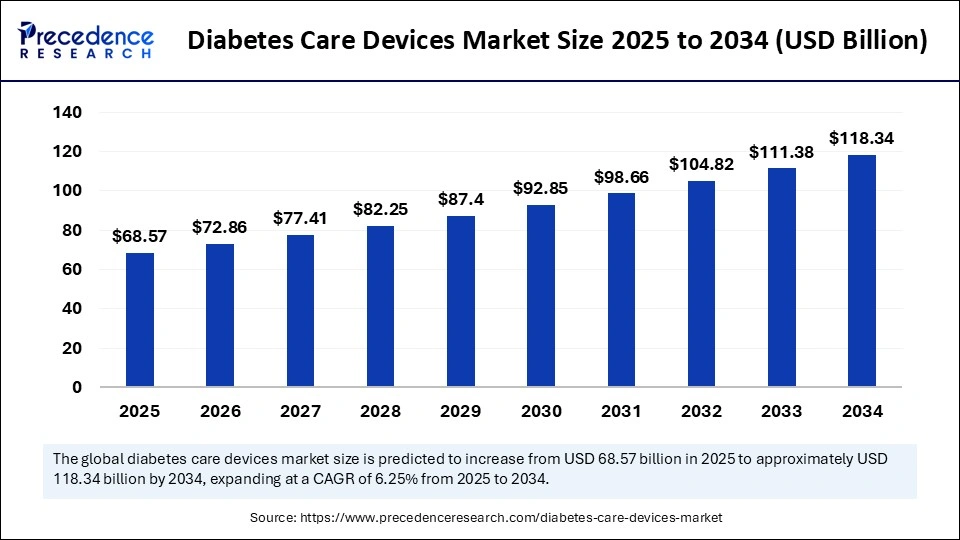

The global diabetes care devices market size is calculated at USD 68.57 billion in 2025 and is predicted to increase from USD 72.86 billion in 2026 to approximately USD 125.03 billion by 2035, expanding at a CAGR of 6.19% from 2026 to 2035.

Diabetes Care Devices Market Key Takeaways

- In terms of revenue, the global diabetes care devices market was valued at USD 68.57billion in 2025.

- It is projected to reach USD 125.03billion by 2035.

- The market is expected to grow at a CAGR of 6.19% from 2026 to 2035.

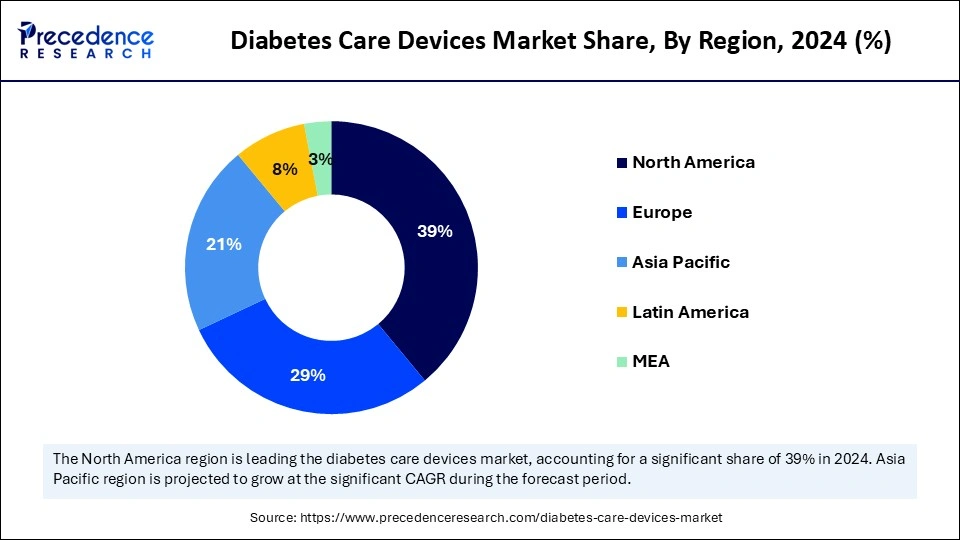

- North America dominated the diabetes care devices market with the largest share of 39% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR between 2026 and 2035.

- By product type, the blood glucose monitoring devices segment dominated the market in 2025 and is expected to sustain its growth trajectory in the coming years.

- By end-user, the homecare settings segment held the biggest market share of 35% in 2025.

- By end-user, the diabetes specialty centers segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By distribution channel, the institutional sales segment captured the highest market share of 40% in 2025.

- By distribution channel, online pharmacies segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By patient type, the type 2 diabetes segment contributed the major market share of 62% in 2025.

- By patient type, the gestational diabetes segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By usage type, the therapeutic use segment accounted for the significant market share of of 58% in 2025.

- By usage type, the remote patient monitoring segment is expected to grow at a remarkable CAGR between 2026 and 2035.

Market Overview

The diabetes care devices market includes medical equipment and systems used to monitor blood glucose levels, administer insulin, and manage diabetes efficiently. These devices are critical for managing Type 1, Type 2, and gestational diabetes, improving patient outcomes through precision monitoring, timely intervention, and advanced drug delivery technologies. The market encompasses both diagnostic and therapeutic devices designed for homecare, hospital, and ambulatory settings. The market is experiencing robust growth, driven by increasing awareness of diabetes and its management. The rising development of smart medical devices further supports market growth.

How is AI Impacting the Diabetes Care Devices Market?

Artificial intelligence (AI) is significantly revolutionizing the diabetes care devices market by enhancing the accuracy and efficiency of glucose monitoring systems. AI algorithms analyze data in real-time, allowing for more personalized treatment plans for patients. AI-powered devices can predict blood sugar spikes and suggest timely interventions, improving overall glucose management. Additionally, AI has fostered innovations in continuous glucose monitoring (CGM) systems, leading to more user-friendly and accurate monitoring devices. Through machine learning, these technologies continuously improve over time, adapting to individual patient needs. As a result, AI not only streamlines diabetes management but also empowers patients with better insights into their health.

Key Market Trends

- Rise of Smart Devices: The integration of smart technology in diabetes care devices is becoming increasingly prevalent. Devices equipped with IoT connectivity enable real-time data sharing with healthcare providers and caregivers, enhancing remote monitoring and personalized treatment approaches.

- Growth of Continuous Glucose Monitoring (CGM): Continuous glucose monitoring systems are gaining popularity, especially with advancements in accuracy and usability. These devices provide uninterrupted blood glucose data, allowing for better glycemic control and reducing the burden of frequent finger pricking.

- Increased Focus on Remote Patient Monitoring: The shift toward telehealth and remote patient monitoring is transforming diabetes management. Patients can manage their conditions from the comfort of their homes, driving demand for devices that facilitate remote monitoring and data analysis.

- Emphasis on AI and Machine Learning: The use of artificial intelligence and machine learning algorithms is expected to increase, enhancing predictive analytics for blood glucose levels. These technologies enable devices to provide personalized recommendations and timely alerts for potential hypoglycemic or hyperglycemic events.

- Expansion of Personalized Medicine: There is a growing trend toward individualized treatment plans that cater to the unique needs of patients. Diabetes care devices are beginning to incorporate features that allow for tailored doses of insulin and medication, leading to improved patient outcomes.

- Rising Demand for Cost-effective Solutions: There is an increasing demand for affordable diabetes care devices. Manufacturers are focusing on developing cost-effective solutions that maintain quality and efficacy while being accessible to a broader patient population, particularly in developing regions.

Market Outlook:

How Smart Devices for Diabetes Care are Changing the Management of Chronic Conditions?

- Industry Growth Overview: The industry is experiencing growth as a result of an increase in the number of people diagnosed with diabetes, an increase in the use of continuous glucose monitoring devices, and a growing focus on creating personalized solutions for managing chronic conditions.

- Sustainability Trends: Sustainability trends have led manufacturers to use more recyclable device components, have longer sensor life spans, and reduce the use of single-use plastics, thus making diabetes care product development consistent with global sustainable and environmentally friendly objectives.

- Global Expansion: As manufacturers create new manufacturing facilities and form partnerships in Asia, Latin America, and the Middle East, they will be able to produce their products at a lower cost, provide better access to their products, and make their products more product regulatory compliant with the healthcare systems of the regions they are entering.

- Startup Ecosystem: The startup ecosystem is helping to shake up the way we think about diabetes care, including advances in glucose analytics based on Artificial Intelligence, integrating wearable devices, and developing non-invasive methods of monitoring glucose.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 125.03 Billion |

| Market Size in 2025 | USD 68.57 Billion |

| Market Size in 2026 | USD 72.86 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.19% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, End User, Distribution Channel, Patient Type, Usage, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of Diabetes

The rising global prevalence of diabetes is a significant driver for the diabetes care devices market. As lifestyle changes and dietary habits lead to higher obesity rates, more individuals are being diagnosed with diabetes, particularly Type 2. This trend emphasizes the urgent need for effective management solutions, propelling the demand for diabetes care devices. Additionally, heightened awareness and education about diabetes have prompted patients to actively seek tools that assist in monitoring and controlling their condition. Governments and healthcare organizations are also implementing initiatives to promote routine diabetes screening, further boosting market growth. Consequently, the increasing number of diabetes patients is creating a robust market for innovative devices that enhance disease management.

Restraint

Regulatory and Reimbursement Issues

Despite the promising growth prospects, the diabetes care devices market faces several challenges, particularly concerning regulatory and reimbursement hurdles. Stringent regulatory approvals for medical devices can lead to delays in bringing innovative products to the market, which may hinder the pace of advancements. Additionally, the inconsistency of reimbursement policies across different regions further complicates the market landscape. Healthcare providers and patients often face uncertainty over coverage, which can dissuade the adoption of new technologies. Furthermore, companies must navigate complex regulatory frameworks to ensure compliance, which may divert resources away from research and innovation.

Opportunity

Technological Innovation

Ongoing technological innovations create immense opportunities in the diabetes care devices market. Innovations such as continuous glucose monitoring (CGM) systems and integrating artificial intelligence and smartphone connectivity are revolutionizing how diabetes is managed. These technologies allow for real-time monitoring of glucose levels, providing patients and healthcare providers with critical data to make informed decisions. Moreover, the rise of telemedicine and remote patient monitoring solutions offers significant avenues for companies to reach patients in their homes. The demand for personalized medicine is also surging, providing an opportunity for developers to create tailored solutions that cater to individual patient needs.

Segment Insights

Product Type Insights

How Does the Blood Glucose Monitoring Devices Segment Dominate the Market in 2025?

The blood glucose monitoring segment dominated the diabetes care devices market, under which the self-monitoring blood glucose (SMBG) devices sub-segment held the maximum share in 2025. This is mainly due to their affordability, ease of use, and wide availability have made them the most commonly used tool for routine glucose tracking. Patients, especially in homecare settings, prefer test strips for their convenience and rapid results. Pharmacies and online platforms ensure widespread accessibility, further boosting their adoption. Additionally, insurance coverage and bulk packaging options make test strips an economical choice for long-term diabetic management. Physicians also continue to prescribe them due to their compatibility with basic glucometers.

Despite technological advances, test strips retain their relevance in both low- and middle-income economies where CGMs may still be cost-prohibitive. Their role in supporting regular testing, particularly in regions with minimal digital infrastructure, cannot be underestimated. Moreover, advancements in strip accuracy and smaller blood sample requirements have improved the user experience. Some manufacturers are also offering eco-friendly and recyclable test strips to align with sustainability goals. The continued integration of test strip data with mobile apps enhances tracking and encourages adherence.

The continuous glucose monitoring (CGM) systems sub-segment is expected to grow at a rapid pace during the forecast period. These systems offer real-time data, trends, and alerts, empowering patients to take proactive control of their diabetes. Unlike traditional SMBG devices, CGMs provide round-the-clock glucose insights without constant finger pricking. The integration with smartphones and cloud-based platforms allows seamless data sharing with healthcare providers. This continuous feedback loop enhances decision-making around insulin, diet, and lifestyle.

As healthcare pivots toward predictive and personalized care, integrated CGM systems align perfectly with this transition. Their usage is expanding rapidly across hospitals and homecare, especially for patients with type 1 diabetes or high glycemic variability. The rising demand for closed-loop insulin delivery (artificial pancreas) is also accelerating CGM adoption. Additionally, wearable sensors are getting more compact, longer-lasting, and less invasive. Government subsidies and private insurance are beginning to cover CGMs in select markets, further pushing their uptake. This category is expected to redefine the standards of modern diabetes management.

The insulin delivery devices segment is expected to grow at the fastest CAGR during the forecast period. These devices are widely favored for their convenience, precision, and portability. These devices simplify insulin administration with pre-filled cartridges and adjustable dosing options. Their user-friendly design has helped reduce dosing errors and enhance patient compliance. Available in both disposable and reusable formats, insulin pens cater to diverse patient preferences and economic backgrounds. With growing awareness and education around self-management, pens are increasingly preferred over traditional syringes. Pharmaceutical companies continue to innovate with pens featuring dose memory and ergonomic improvements.

Insulin pens are widely accepted across hospitals, clinics, and home settings due to their reliability and minimal training requirements. They significantly reduce the stigma associated with insulin injections, encouraging better adherence among newly diagnosed patients. Their use has expanded not only in high-income nations but also in developing countries due to rising diabetic populations. Combined with affordability initiatives and access programs, insulin pens are penetrating rural markets as well. Advanced smart insulin pens that track dosage and sync with apps are gaining attention. As a result, insulin pens remain the cornerstone of effective and user-friendly insulin therapy.

The patch pumps segment is expected to grow due to their wearable, tubeless design and automation features. Unlike traditional insulin pumps, patch pumps are compact, discreet, and adhere directly to the skin, reducing inconvenience. These devices support basal and bolus delivery with programmable settings, offering more freedom and flexibility to users. The elimination of tubing not only simplifies daily use but also improves comfort and aesthetics. Their popularity is particularly rising among tech-savvy patients and pediatric diabetic populations. Additionally, patch pumps are increasingly paired with CGM systems, inching closer to closed-loop systems.

The growth of patch pumps is supported by growing consumer demand for mobility, precision, and convenience. Their usage is expanding in homecare, particularly among patients who seek more autonomy in managing their condition. Technological upgrades, such as smartphone-controlled dosing and improved skin adhesive technology, are further enhancing adoption. More countries are now recognizing patch pumps in reimbursement frameworks, lowering barriers to access. Companies are also launching entry-level models to tap into emerging markets. As innovation continues, patch pumps are set to become mainstream in insulin delivery, reshaping the diabetic therapy landscape.

End-User Insights

What Made Homecare settings the Dominant Segment in the Market in 2025?

The homecare settings segment dominated the diabetes care devices market in 2024, as these settings are suitable for patients requiring ongoing monitoring and management of chronic conditions, such as diabetes. These environments provide patients with greater independence while ensuring they receive the necessary care and attention. One of the primary advantages of homecare is the accuracy of monitoring devices, which allows for timely interventions. Patients can regularly check their blood glucose levels using devices like self-monitoring blood glucose (SMBG) meters and continuous glucose monitors (CGMs) from the comfort of their homes. This immediate access to data empowers patients to make informed decisions about their health, improving adherence to treatment plans.

In homecare settings, patients benefit from personalized care tailored to their specific needs. Healthcare providers can use integrated data monitoring systems to track patients' progress, adjust treatment protocols, and provide support through telehealth services. This approach enhances patient engagement and fosters a sense of ownership over their health journey.

The diabetes specialty centers segment is expected to grow at the fastest CAGR over the projection period. These dedicated centers offer holistic care tailored to the unique needs of diabetic patients, promoting better outcomes. With rising cases of both type 1 and type 2 diabetes, such centers are multiplying across urban and suburban areas. They provide a one-stop destination for diagnosis, education, medication, and monitoring. Advanced tools like integrated CGMs, smart insulin pens, and metabolic testing are frequently used in these setups. Physicians and diabetes educators work closely to personalize treatment plans based on device data.

These centers are gaining traction due to increased patient awareness and the desire for expert-led care beyond general hospitals. Many centers offer subscription-based digital services, including remote consultations, follow-ups, and mobile app syncing of device data. The strong doctor-patient relationship nurtured in these clinics supports long-term adherence. Furthermore, specialty clinics are quicker to adopt new technologies, making them an ideal ground for early product deployment. As chronic disease management becomes more patient-centric, these centers are bridging the gap between medical technology and day-to-day diabetes care. Their expanding footprint marks a significant shift in the care delivery model.

Distribution Channel Insights

Why Did the Institutional Sales Segment Dominate the Diabetes Care Devices Market in 2025?

The institutional sales segment led the market, holding a significant share in 2025. This leadership is largely due to the ongoing demand for advanced diabetes management solutions within healthcare facilities, where improving patient outcomes and care efficiency is essential. Hospitals consistently invest in innovative devices that enhance monitoring and treatment programs, ensuring patients receive optimal care for diabetes management. Furthermore, institutional sales benefit from established partnerships between manufacturers and healthcare providers, which facilitate bulk purchases and efficient distribution channels. As the prevalence of diabetes continues to rise, the importance of hospitals in delivering comprehensive care solutions becomes even more pronounced. With ongoing technological advancements, the reliance on institutional sales for high-quality diabetes care devices is expected to grow even stronger in the future.

The online pharmacies segment is expected to grow at the fastest CAGR in the upcoming period. With the increasing demand for convenient access to healthcare products, online pharmacies are witnessing a rapid increase in sales of diabetes care devices. They offer a wide range of diabetes care devices, including blood glucose monitors and insulin delivery systems, with the added benefits of home delivery and potentially lower prices. Patients can order their necessary diabetes care devices from home, avoiding the need to visit a physical store. Online pharmacies provide access to various products that might not be available in local pharmacies, especially specialized diabetes management tools. E-commerce platforms often offer competitive pricing and discounts compared to brick-and-mortar stores, making diabetes management more affordable. Many online pharmacies provide educational resources and support for diabetes management, helping patients make informed choices about their care.

The retail pharmacies segment held the largest share of 41.30% in the 2024 global diabetes care devices market. The retail pharmacies enable education, continue support, and provide access to global diabetes care devices. By providing training to the patients regarding data and devices, in the retail pharmacist has been preserved. The segment provides support and monitoring, alongside acting as a major available center of contact for sugar-related problems. It also includes the reference of skilled care providers to the patient with additional devices such as continuous glucose monitors (CGMs) in the patient care plans and counsels the patients on changing their health or eating habits.

Patient Type Insights

What Made Type 2 Diabetes the Dominant Segment in the Market in 2025?

The type 2 diabetes segment dominated the diabetes care devices market in 2025. Type 2 diabetes is a chronic condition that affects how the body metabolizes glucose, leading to elevated blood sugar levels. It typically develops in adults but is increasingly being diagnosed in children and adolescents due to rising obesity rates. Unlike type 1 diabetes, where the body fails to produce insulin, individuals with type 2 diabetes often have insulin resistance, meaning their cells do not respond effectively to insulin.

Risk factors for type 2 diabetes include obesity, sedentary lifestyle, and genetic predisposition. Effective management typically involves lifestyle modifications, such as a balanced diet and regular physical activity, alongside medications when necessary. Early intervention is crucial, as uncontrolled type 2 diabetes can lead to serious health complications, including cardiovascular disease, nerve damage, and kidney issues, boosting the demand for advanced diabetes diagnostics devices.

The gestational diabetes segment is expected to expand at the fastest rate in the coming years. This is mainly due to the growing concerns of GDM, particularly among pregnant women. Its prevalence has been on the rise due to various factors, including increasing rates of obesity and changes in lifestyle. Early detection and proper management are crucial for the health of both the mother and the baby. The rising demand for early detection of GDM is likely to support segmental growth.

Usage Insights

Why Did the Therapeutic Use Segment Dominate the Market in 2025?

The therapeutic use segment dominated the diabetes care devices market with the largest share in 2025. This is mainly due to the increased demand for effective treatment options. Devices designed for therapeutic purposes play a crucial role in managing diabetes through precise insulin delivery and continuous glucose monitoring. As more patients seek solutions that improve their day-to-day health, therapeutic devices are becoming integral to diabetes management plans. Advances in technology have enhanced the functionality and reliability of these devices, leading to improved patient outcomes. Additionally, healthcare providers are increasingly recommending therapeutic devices due to their effectiveness in ensuring optimal glucose control. This trend is expected to continue as the focus on personalized and effective diabetes care intensifies.

The remote patient monitoring segment is expected to experience the fastest growth during the forecast period. The growth of the segment is driven by the increasing adoption of telehealth solutions and the demand for at-home healthcare services. Remote monitoring devices allow patients to track their blood glucose levels and health metrics conveniently from home, facilitating continuous care without frequent hospital visits. As healthcare becomes more patient-centered, these devices provide valuable insights that enable timely interventions. Additionally, the integration of AI and data analytics in remote patient monitoring enhances accuracy and personalization, further boosting its appeal. As a result, healthcare systems are increasingly prioritizing investments in remote monitoring technologies to improve diabetes management outcomes.

Regional Insights

What is the U.S. Diabetes Care Devices Market Size?

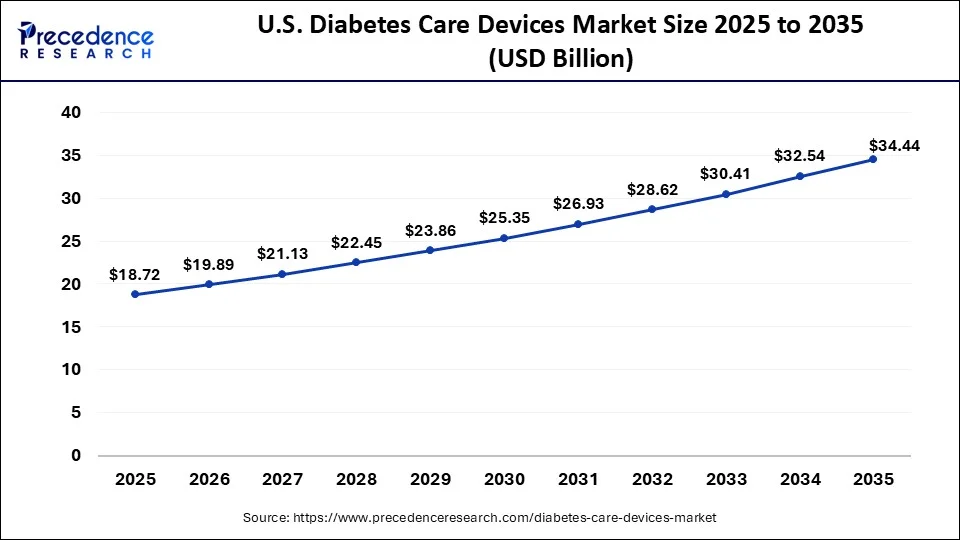

The U.S. diabetes care devices market size was evaluated at USD 18.72 billion in 2025 and is projected to be worth around USD 34.44 billion by 2035, growing at a CAGR of 6.29% from 2026 to 2035.

What Made North America the Dominant Region in the Diabetes Care Devices Market in 2025?

North America dominated the diabetes care devices market with the largest share in 2025, due to widespread awareness, high adoption of advanced glucose monitoring systems, and favorable reimbursement policies. Increasing investments in digital health and wearable technologies have further accelerated the uptake of continuous glucose monitors and insulin delivery systems. The strong presence of major industry players and research institutions has continued to drive innovation and product launches in the region. Moreover, supportive government initiatives and patient education programs have improved early diagnosis and disease management. Overall, North America's market leadership stems from a combination of clinical advancements and tech-driven healthcare evolution.

The U.S. is a major contributor to the market in North America, due to rising demand for minimally invasive and real-time monitoring devices. Growing consumer inclination towards personalized diabetes management solutions is fostering new opportunities for product expansion. The integration of AI-powered analytics with diabetes devices is enhancing treatment accuracy and patient engagement. Furthermore, strategic collaborations between medical device companies and digital health firms are reinforcing the ecosystem. Homecare settings are also witnessing increased demand for compact and user-friendly devices among the aging population.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest CAGR during the projection period. Countries like China, India, and Japan are witnessing an alarming rise in type 2 diabetes cases due to sedentary lifestyles and dietary changes. Governments across the region are actively promoting early screening and access to affordable diabetes care, accelerating market penetration. The increasing availability of low-cost glucose meters and test strips is improving diagnosis rates in rural and semi-urban areas. Moreover, local manufacturing and regional partnerships are helping reduce dependency on imported devices, making diabetes care more accessible. Public-private initiatives to expand healthcare coverage are also playing a critical role in supporting growth.

In the coming years, Asia Pacific is expected to witness exponential growth in wearable and app-connected diabetes management devices. Growing smartphone penetration and tech-savvy populations are enabling the adoption of mobile health solutions for real-time glucose tracking. Additionally, AI-based platforms integrated with diabetes care devices are being tested and deployed to improve outcomes. Health startups and innovators in the region are also contributing to the digital transformation of diabetes care. Demand for compact, portable, and affordable monitoring devices is rising rapidly, particularly in urban areas. With its blend of need, innovation, and government support, Asia Pacific is positioning itself as a pivotal growth engine in the global diabetes care devices landscape.

Europe: Digitally Mature Diabetes Management Landscape:

By far the most developed market in terms of diabetes care, Europe has the most extensive infrastructure for diabetes treatment and is supported by the public, placing a high priority on diabetes management, as evidenced by the EU and its member states. Due to its advancement in technology, Europe has the largest number of continuous glucose monitoring devices available in the marketplace today.

Germany Diabetes Care Devices Market Trends

Germany has been able to maintain its leadership position and also rapidly grow as the leading provider of connected diabetes monitoring devices as a result of its continued support for current technology and advanced development of digital health policies.

Latin America: Rising Access Through Healthcare Modernization:

The rapid growth of diabetes awareness, combined with a growing awareness of the availability of affordable and user-friendly devices, is creating significant opportunities for the development and growth of a successful diabetes care market in Latin America. As a result of rapid urbanization and the growth of the middle class in Brazil, the demand for diabetes care devices is expected to increase dramatically due to increased access to monitoring technologies.

Middle East and Africa: Emerging Demand Driven by Lifestyle Shifts:

Diabetes incidence is growing at an exponential rate in this region. For this reason, governments in this region are making considerable investments in early detection programs and the development of digital health solutions to reduce the burden of diabetes and improve long-term management of patients with diabetes.

Saudi Arabia is experiencing fast growth due to the national government's initiatives to digitize health care and to raise public awareness about diabetes prevention and the importance of early detection.

Value Chain Analysis of the Diabetes Care Devices Market

- Component and Sensor Manufacturing: This area of the value chain describes how biosensor production, as well as the creation of micro needles, test strips, insulin reservoirs, and the electronic components that give the accuracy and reliability to the devices being made.

Key Players: Abbott Laboratories; Dexcom, Inc.; Medtronic plc - Device Assembly/Technology Integration: The manufacturer will have taken hardware components and integrated them with embedded software, hardware driven through AI analytical intelligence, data is sent through Bluetooth, and they are compatible with Mobile Phone Applications (MSAs).

Key Players: Insulet Corp.; Tandem Diabetes Care; F. Hoffmann-La Roche Ltd. - Distribution/Care Access/Post-Sale Support: Networks through which devices reach patients include hospitals and retail pharmacies, e-commerce storefronts, and home health care providers. Post-sale support through device training, digital support through applications, and remote monitoring platforms will play an important role in engaging patients long-term and building strong brand loyalty.

Key Players: Becton, Dickinson and Company; Ascensia Diabetes Care; Ypsomed, etc.

Diabetes Care Devices Market Companies

- Abbott Laboratories

- Medtronic plc

- F. Hoffmann-La Roche Ltd

- Dexcom, Inc.

- Ascensia Diabetes Care (PHC Holdings)

- LifeScan, Inc.

- Insulet Corporation

- Tandem Diabetes Care, Inc.

- B. Braun Melsungen AG

- Ypsomed AG

- Terumo Corporation

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi S.A.

- Glooko, Inc.

- Senseonics Holdings, Inc.

- ARKRAY, Inc.

- Nipro Corporation

- Embecta Corp

- AgaMatrix, Inc.

Recent Developments

- In April 2025, Ambrosia launched India's first 24x7 real-time glucose and stress monitoring service, following its successful adoption in the U.S. and Europe. This groundbreaking service integrates advanced wearable sensor technology, AI-driven analytics, and remote monitoring to provide continuous health insights, empowering individuals to take control of their well-being.(Source: https://www.business-standard.com)

- In July 2024, Roche received the CE Mark for its Accu-Chek SmartGuide continuous glucose monitoring (CGM) solution. This significant milestone paves the way for the solution to be made available to people living with type 1 and type 2 diabetes over the age of 18 on flexible insulin therapy.

(Source: https://www.roche.com)

Segments Covered in the Report

By Product Type (Revenue and Volume)

- Blood Glucose Monitoring Devices (BGM)

- Self-Monitoring Blood Glucose (SMBG) Meters

- Standard Blood Glucose Meters

- Smart Blood Glucose Meters (with connectivity features)

- Test Strips/Test Papers

- Lancets/Lancing Devices

- Continuous Glucose Monitoring (CGM) Systems

- Sensors

- Transmitters

- Receivers/Displays (including smartphone apps)

- Flash Glucose Monitoring (FGM) Systems (a subset of CGM, typically requiring a scan)

- Self-Monitoring Blood Glucose (SMBG) Meters

- Insulin Delivery Devices

- Insulin Pens

- Reusable Insulin Pens

- Disposable/Pre-filled Insulin Pens

- Smart Insulin Pens (with connectivity for dosage tracking and data sharing)

- Insulin Pumps

- Traditional/Tethered Insulin Pumps

- Patch Pumps (tubeless)

- Implantable Insulin Pumps

- Automated Insulin Delivery (AID) Systems / Hybrid Closed-Loop Systems (integrating CGM with pumps)

- Insulin Syringes & Needles

- Jet Injectors

- Insulin Cartridges/Reservoirs

- Insulin Pens

- Other Diabetes Management Devices

- Diabetes Management Mobile Applications / Digital Health Platforms

- Diabetes Remote Monitoring Devices

- Ketone Monitoring Devices (e.g., ketone meters, test strips)

- Non-invasive Glucose Monitoring Devices (emerging technologies)

By Diabetes Type

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

- Other Specific Types of Diabetes

By End User

- Hospitals & Specialty Clinics

- Inpatient Settings

- Outpatient Departments

- Home-Care Settings / Self-Care

- Diagnostic Centers

- Ambulatory Surgical Centers (ASCs)

- Physician Offices

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies / E-commerce & Direct-to-Consumer (D-to-C)

- Diabetes Clinics/Centers

- Wholesalers & Distributors

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting