What is the DNA Data Storage Market Size?

The global DNA data storage market size is calculated at USD 150.63 million in 2025 and is predicted to increase from USD 283.21 million in 2026 to approximately USD 44,213.05 million by 2034, expanding at a CAGR of 88.01% from 2025 to 2034. The DNA data storage market is an emerging sector poised for significant growth as demand for efficient, high-density data storage solutions increases. With advancements in synthetic biology and biotechnology, DNA stands out as a viable medium for storing vast amounts of data.

Market Highlights

- North America dominated the market, accounting for 55% of the market share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By storage type, the synthetic DNA storage segment held the largest market share of 50% in 2024.

- By storage type, natural DNA-based storage is growing at a remarkable CAGR between 2025 and 2034.

- By technology type, the DNA synthesis phosphoramidite chemistry segment contributed the highest market share of 50% in 2024.

- By technology type, the enzymatic synthesis segment is expanding at a remarkable CAGR between 2025 and 2034.

- By application type, the archival storage corporate data centers segment recorded more than 45% of market share in 2024.

- By application type, cloud storage services are projected to grow at the highest CAGR between 2025 and 2034.

- By end user type, the IT & cloud service providers segment held the largest market share of 50% in 2024.

- By end user type, healthcare & life sciences are expected to grow at a remarkable CAGR between 2025 and 2034.

Defining the DNA Data Storage Market: From Biological Code to Digital Archive

The DNA Data Storage Market refers to technologies and solutions that encode digital information into synthetic or natural DNA molecules for long-term, high-density, and highly durable data storage. DNA can store vast amounts of data in an extremely small physical footprint and remain stable over thousands of years, making it an ideal medium for archival and ultra-secure applications.

The market is driven by the exponential growth of global data, limitations of conventional storage media, and advances in DNA synthesis, sequencing, and error-correction algorithms. Applications span healthcare, banking, defense, cloud service providers, and large-scale data centers. North America leads adoption due to early R&D and regulatory support, while Asia Pacific is the fastest-growing region, driven by rising cloud infrastructure and investment in next-generation storage solutions.

Market growth in DNA data storage is being propelled by an inexorable surge in global data generation and the urgent need for ultra-dense, long-term archival media. DNAs information density and stability are orders of magnitude superior to those of magnetic tape or silicon, rendering it an alluring substrate for the cold storage of archival data that must endure for decades or centuries. Advances in enzymatic synthesis, high-fidelity sequencing, and error-correcting encoding schemes have moved the concept from academic curiosity toward pragmatic pilot deployments.

Yet the pathway to commoditization is strewn with challenges: synthesis cost, random-access latency, and write-read throughput remain material constraints. Investors and national archives, however, are already intrigued by DNAs potential to compress exabytes into minuscule physical footprints. Consequently, the market evolves as a dialectic between the astonishing physical promise of the medium and the arduous engineering required to industrialize it.

Innovation Frontiers: DNA Synthesis, Sequencing, and Encoding Algorithms

The seminal technological shift is the transition from purely chemical oligonucleotide synthesis to enzymatic and multiplexed synthesis coupled with advanced error-correcting codes, enabling lower cost-per-base and higher effective reliability. Enzymatic methods promise gentler, faster assembly with reduced reagent consumption and potential for instrument miniaturization. Concurrently, the development of locality-aware encoding schemes and molecular indexes has improved random-access performance, mitigating one of DNAs principal latency disadvantages. On the read side, ultra-fast nanopore and parallel sequencing chemistries increase throughput and reduce per-read expense. Integrating these biochemical advances with cloud-native software stacks and metadata indexing transforms DNA from a laboratory medium into a managed archival tier. This confluence of wet-lab innovation and information theory marks the pivot toward practical, scalable deployments.

Shift Toward Energy-Efficient, Molecular-Scale Data Solutions

- Convergence of synthetic biology and data-storage engineering into hybrid supply chains.

- Emergence of pilot services for cold-archival workloads by cloud and archival institutions.

- Focus on enzymatic synthesis and multiplexed writing to drive down costs.

- Development of standardized DNA-encoding formats and metadata schemas.

- Creation of secure, climate-controlled vaulting services for long-term preservation.

DNA Data Storage Market Outlook

Industry expansion is anchored by improvements in DNA synthesis throughput, sequencing speed, and algorithmic encoding that reduce per-byte costs and improve reliability. A layering effect is occurring: component suppliers (synthesizers, sequencers), middleware providers (encoding and compression), and system integrators (cold-vault operators) are coalescing into an ecosystem. Large cloud providers and national labs are sponsoring pilots, creating demand signals that justify capital investments in scale-up tools. Parallel advances in biochemistry, enzymatic synthesis, and error-tolerant oligo assembly shorten iteration cycles for optimization. Nevertheless, the sectors growth is lumpy, advancing in fits as specific technical bottlenecks are unblocked. In sum, expansion is steady but contingent on continued cross-disciplinary engineering.

Sustainability narratives are central: DNA storages minuscule physical footprint and potential for negligible energy draw in deep cold storage positions it as an environmentally attractive archival medium. Compared with energy-hungry data centers and increasingly fragile tape libraries, DNA vaults promise long-term storage with minimal maintenance energy if retrieval frequency is low. Lifecycle assessments are emerging to quantify the carbon advantage, particularly when synthesis energy is sourced from renewables. Moreover, biodegradable carriers and greener reagent chemistries are topics of active research to reduce upstream environmental impact. Sustainable deployment models will emphasize infrequent access, renewable-powered synthesis, and modular vaults to minimize embodied carbon. Thus, environmental arguments strengthen the case for DNA storage in long-horizon archives.

Capital enters the field from venture capitalists specializing in deep-tech and synthetic biology, strategic corporate investors within cloud and archival ecosystems, and governmental research grants focused on national data sovereignty. Strategic investors often prioritize startups with differentiated IP in synthesis, encoding, or low-cost sequencing. Corporate R&D arms fund pilot integrations to test long-term viability at scale. Public-private partnerships occasionally underwrite foundational infrastructure for national archives. Overall, investor interest is pragmatic focused on companies that can demonstrably lower per-bit costs and integrate with enterprise workflows.

A vibrant startup economy surrounds DNA data storage, populated by specialists in enzymatic synthesis, oligonucleotide assembly, coding theory for DNA, and physical vaulting technologies. Many ventures are spinouts from academic laboratories and leverage specialized IP to target component cost reduction or throughput gains. The ecosystem is collaborative: partnerships with sequencing and synthesis firms, as well as alliances with cloud integrators, are common routes to market. Capital intensity is considerable, but successful pilots attract larger industrial partners for scaling. Startups that solve the last mile of random access and cost per gigabyte hold disproportionate strategic value. Thus, entrepreneurial energy is high and focused on practical bottlenecks.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 150.63 Million |

| Market Size in 2026 | USD 283.21 Million |

| Market Size by 2034 | USD 44,213.05 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 88.01% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Storage Type, Technology, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Densitys New Dominion

A dominant driver is the unique information density of DNA, which can theoretically store exabytes in a volume that fits within a shoebox, making it irresistibly attractive for institutions grappling with exponential archival growth. This physical compactness also translates into potential savings on real estate and long-term maintenance when data access is infrequent. Furthermore, DNAs longevity under benign conditions (centuries if properly preserved) offers a continuity advantage unmatched by magnetic media. The confluence of archival policy demands, data sovereignty concerns, and the geopolitical desire to decentralize cold storage further amplifies the impetus to pursue DNA-based solutions. Consequently, density combined with durability forms the most compelling commercial rationale for early adoption.

Restraint

Cost and Latency: The Twin Tyrants

A principal restraint remains the high cost of synthesizing and sequencing DNA at the scale necessary for competitive pricing, coupled with latency challenges for random access that limit use to cold archival tiers. Current per-byte economics still favor tape or cloud cold storage for many institutional budgets. Additionally, throughput constraints in writing workflows and the complexity of error correction impose engineering overheads that slow commercial rollouts. Regulatory and biosecurity concerns about storing information in a biological medium also require careful governance frameworks. Until synthesis costs fall markedly and random-access methods improve, DNA storage will remain a niche rather than ubiquitous. Thus, cost and access speed represent the most immediate brakes on market expansion.

Opportunity

Vaulting the Centuries: Archival Sovereignty

The most luminous opportunity is in high-value, long-horizon archival use cases: national archives, cultural heritage repositories, scientific data with enduring provenance (astronomy, particle physics), and enterprises requiring immutable, long-term backups. Institutions willing to pay a premium for longevity and density can deploy DNA vaults to reduce physical storage footprints and secure data across geopolitical contingencies. Opportunities also exist in specialized cold-storage services bundled with provenance, encryption, and SLAs for retrieval-on-demand. Additionally, vertical integration, combining synthesis, encoding middleware, and vaulting, can create defensible commercial platforms. For organizations facing existential data-preservation imperatives, DNA storage is not merely novel but transformational.

DNA Data Storage Market Segment Insights

Storage Type Insights

The synthetic DNA storage is dominating the DNA data storage market by holding a share of 55%, due to its precision, scalability, and the relative maturity of phosphonamidite-based synthesis methods. This modality allows data to be encoded into carefully designed oligonucleotides, offering exquisite control over sequence fidelity and information density. Its robustness under diverse environmental conditions renders it particularly suitable for long-term archival preservation, where durability is paramount. The adaptability of synthetic DNA to custom encoding algorithms and error-correcting architectures has positioned it as the benchmark for molecular data vaulting. Furthermore, its compatibility with extant sequencing technologies ensures interoperability and reliability during retrieval cycles.

The industrial ascendancy of synthetic DNA is also driven by its capacity for standardization and high-throughput manufacturing. Pilot projects across academic consortia and commercial data centers continue to validate its economic trajectory, progressively narrowing the gap between laboratory prototype and commercial feasibility. As automation, miniaturization, and parallelization advance, the scalability bottleneck is gradually eroding. Its synthetic nature also circumvents bioethical or sourcing dilemmas that occasionally afflict natural DNA systems. Investors perceive synthetic storage as both technically pragmatic and symbolically futuristic, a bridge between molecular biology and digital eternity. The dominance of synthetic DNA, thus, is as much philosophical as it is practical, humanity encoding memory into the molecules it has learned to design.

The natural DNA-based storage is the fastest-growing in the DNA data storage market, because natural DNA-based storage, though nascent, is witnessing a brisk upsurge, propelled by interest in leveraging biologically derived sequences and cellular frameworks for in vivo data encoding. The approach seeks to exploit the intrinsic stability and self-replicating properties of biological materials, offering tantalizing prospects for sustainable, regenerative data storage paradigms. Unlike synthetic constructs, natural systems promise integration with living hosts or biopolymer matrices, potentially enabling dynamic updating or distributed replication. The elegance of storing data within biological substrates captures both scientific imagination and ecological aspiration. Researchers envisage libraries written into bacterial genomes or bioengineered tissue matrices as living archives.

This growth is undergirded by interdisciplinary collaboration between synthetic biologists, bioinformaticians, and molecular archivists who aim to fuse biological resilience with informational permanence. Although cost, controllability, and biosecurity present formidable challenges, innovation in containment and retrieval mechanisms is accelerating. Natural DNA-based systems are gaining favor for experimental applications where sustainability and bio-integration eclipse sheer storage density. Their expansion signifies a deeper philosophical pivot from inert archives to living memory systems. As biotechnological sophistication matures, natural DNA may evolve from speculative curiosity into a legitimate complement to synthetic data preservation, redefining the ontology of storage itself.

Technology Insights

The DNA Synthesis phosphonamidite chemistry is dominating the DNA data storage market by holding a share of 50%, because its precision and reproducibility making it the industrys procedural lingua franca. This venerable method, refined through decades of oligonucleotide production, enables the meticulous assembly of sequences with predictable yields and high purity.

For archival applications, where sequence integrity is paramount, phosphonamidite synthesis offers unparalleled confidence in data fidelity. Its established infrastructure across sequencing facilities and research laboratories ensures robust supply chains and well-characterized performance metrics. Furthermore, its compatibility with automated synthesis platforms allows scaling to thousands of oligos per run, an essential attribute for data encoding at industrial volumes.

DNA synthesis using phosphoramidite chemistry is a widely adopted method for producing synthetic DNA strands. This technique enables the assembly of DNA sequences with high precision and efficiency, making it essential for a range of research and biotechnology applications. During the synthesis process, phosphoramidite nucleotides are sequentially added to a growing DNA chain, which provides a controlled way to construct complex DNA molecules.

One notable advantage of phosphoramidite chemistry is its ability to efficiently incorporate modifications, such as fluorescent tags or purification handles, into the DNA sequence. The method has revolutionized synthetic biology by enabling the creation of custom DNA sequences for gene editing, synthetic gene constructs, and molecular diagnostics. As advancements continue in this area, phosphonamidite chemistry remains at the forefront of DNA synthesis technologies, facilitating innovative research and applications.

Enzymatic synthesis is the fastest-growing segment of the DNA data storage market, as it represents the vanguard of technological evolution, heralding a paradigm shift toward gentler, faster, and more sustainable nucleotide assembly. Unlike the reagent-intensive phosphonamidite method, enzymatic synthesis employs biological catalysts to weave DNA strands with remarkable precision under ambient conditions. Its ecological appeal lies in reduced chemical waste and lower energy consumption; attributes aligned with global sustainability mandates. Moreover, the technique promises rapid parallelization, enabling the simultaneous synthesis of multiple sequences with minimal risk of cross-contamination.

The exponential interest in enzymatic platforms stems from their potential to slash production costs while maintaining high fidelity, an essential prerequisite for commercial scalability. Startups and research consortia are racing to develop proprietary enzymes that can elongate strands quickly and with high error tolerance, once deemed unattainable. The method inherent adaptability to microfluidic and chip-based systems augments its industrial relevance. Though still in its developmental ascent, enzymatic synthesis is poised to become the catalyst, quite literally for the next epoch of molecular data writing. Its future lies in marrying biological ingenuity with computational precision to make data inscription as natural as transcription itself.

Application Insights

The archival storage corporate data centers segment is dominating the DNA data storage market by holding a share of 45%, driven by their unrelenting need to preserve exabytes of regulatory, financial, and historical data over extended horizons. The impervatives of compliance, risk mitigation, and indispensable. DNA storage, with its extreme density and longevity, addresses these imperatives with elegant economy. Enterprise view it as a stratergic complement to magnetic tape libraries an insurance policy against data obsolescence and physical decay. The capacity to preserve corporate legacy in molecules resonates with the zeitgeist of technological permanence.

From an operational vantage, corporate adopters appreciate DNAs negligible energy demands for long-term storage and its resilience against electromagnetic degradation. Pilot programs are often initiated in collaboration with biotech partners to evaluate encoding workflows and retrieval protocols. Moreover, DNA archives align with the sustainability ethos now shaping corporate social responsibility narratives. As early implementations demonstrate reliability, large data custodians are increasingly exploring hybrid infrastructures where DNA vaults act as the immutable backbone of archival architecture. Thus, corporate data centers have become the proving grounds for the molecular renaissance of information storage.

The cloud storage services is fastest growing in the DNA data storage market, rapidly emerging as the most enthusiastic explorers of DNA-based data storage, viewing it as a strategic frontier in long-term, low-maintenance infrastructure. The cloud economy thrives on redundancy, resilience, and compactness virtues that DNA storage inherently offers. For hyperscale operators, the ability to vault petabytes of cold data in infinitesimal physical space translates to radical cost optimization. Beyond mere storage, DNA immutability confers cyber-resilience, an attribute increasingly prized amid escalating digital threats. The allure is not just efficiency, but durability on a planetary scale.

End User Insights

The IT & cloud service providers segment is dominating the DNA data storage market by holding a share of 50%, Their dominance is largely driven by the increasing demand for efficient data management solutions as businesses continue to generate massive volumes of data. Cloud service providers are particularly interested in the high-density, long-term storage capabilities of DNA, which offer superior reliability compared to traditional storage media. As more organizations move toward cloud-based infrastructures, the need for innovative storage solutions becomes critical. This sector is actively exploring DNA storage as an answer to the challenges posed by data growth and the limitations of current technologies. Consequently, the strong positioning of IT and cloud service providers is expected to lead the market as they invest in and advocate for DNA-based storage solutions.

In contrast, the healthcare and life sciences sector is emerging as the fastest-growing segment within the DNA data storage market. This rapid expansion is fueled by the increasing need for secure, long-term data preservation of sensitive medical records, genomic data, and research findings. As advancements in personalized medicine and gene therapy drive the generation of vast amounts of data, healthcare organizations are turning to DNA storage for its unparalleled density and durability. The ability to store enormous data volumes in a compact form makes DNA an attractive option for institutions looking to optimize their data management strategies. Furthermore, regulatory pressures and data compliance requirements within the healthcare sector are compelling organizations to seek innovative and reliable storage solutions. As a result, the healthcare and life sciences industry is positioned for remarkable growth as it increasingly adopts DNA data storage technologies.

DNA Data Storage Market Regional Insights

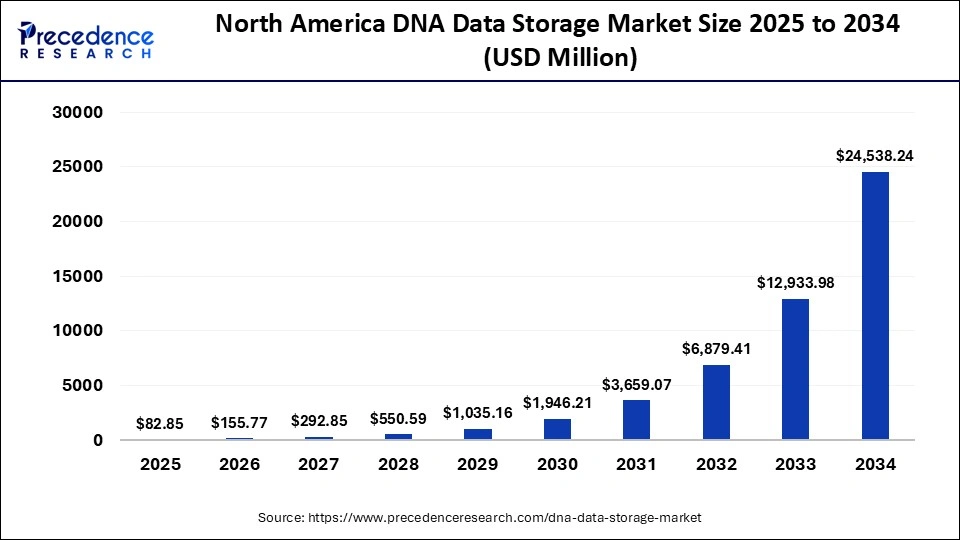

The North America DNA data storage market size is estimated at USD 82.85 million in 2025 and is projected to reach approximately USD 24,538.24 million by 2034, with a 88.31% CAGR from 2025 to 2034.

Will North America Anchor Humanitys Long-Term Memory in Synthetic Molecules?

North America dominates the DNA data storage landscape, buoyed by a confluence of world-class synthetic-biology research, deep-pocketed cloud providers, and an appetite for cutting-edge archival solutions. The regions academic institutions and national labs incubate core technologies synthesis, sequencing, and molecular computing, feeding a robust entrepreneurial ecosystem. Major hyperscalers and archival consortia provide pilot opportunities and potential offtake agreements that de-risk scale-up. Venture capital availability and permissive translational grant programs further accelerate commercial ventures from bench prototypes to demonstrators. This ecosystemic advantage consolidates North Americas leadership in both innovation and early customer deployments.

The U.S. DNA data storage market size is calculated at USD 59.65 million in 2025 and is expected to reach nearly USD 17,790.23 million in 2034, accelerating at a strong CAGR of 88.31% between 2025 and 2034.

U.S. Market Analysis

The United States remains the global leader in DNA data storage research and early commercialization efforts, driven by deep investment from major technology and life-science companies, intensive academic research, and strong private funding for automation of synthesis and sequencing workflows. U.S. efforts have focused on developing end-to-end automation, reducing costs through high-throughput synthesis, and robust encoding/decoding algorithms that make archival DNA storage technically and operationally feasible for cold data.

Large tech companies and university consortia have demonstrated fully automated prototype systems and pilot archives, and U.S. labs continue to publish advances in error-correcting codes and molecular handling that push the field toward practical use cases. Because of this R&D leadership, the U.S. is the most mature market for moving from lab demonstrations to early commercial services and specialized pilot customers who need ultra-long retention and extreme density.

Asia Pacific is the fastest-growing region for DNA data storage, propelled by expansive data generation, state-led investments in advanced biomanufacturing, and a strategic imperative to localize critical data infrastructure. Nations across the region are investing in synthetic-biology hubs and sequencing capacity, thereby reducing barriers to pilot deployments. Large cloud operators and research consortia are exploring DNA vault pilots to diversify archival strategies and to assert data sovereignty. Cost-sensitive manufacturing ecosystems in the region also promise scale advantages as synthesis industrializes. Consequently, Asia Pacifics rapid ascent reflects both demand-side scale and emerging supply-side capability.

China Market Analysis

China is an increasingly important market for DNA data storage research and innovation, with active university groups and national labs publishing novel encoding schemes and synthesis techniques, and industry academic collaborations advancing rapidly. Chinese researchers reported breakthroughs in encoding efficiency and palette design for DNA-based storage in recent years, and several institutions are exploring applications for medical data archiving and research data preservation.

At the same time, ethical and regulatory scrutiny around genetic materials, plus international concerns about export controls and data governance, add complexity for cross-border collaborations, but domestic priority on technological self-reliance has encouraged local development. Taken together, China is a leading innovator in the field alongside the U.S., with strengths in method development and scaling, and it is likely to remain a major contributor to both technical progress and regionally focused pilot deployments.

Latin America emerged as a notable region of growth in the DNA data storage market in 2024, supported by increasing interest in next-generation data storage technologies, expanding biotechnology research capacity, and the growing presence of international collaborations in synthetic biology and genomics. The region growing demand for secure, long-term, and sustainable data storage solutions has encouraged research institutions and innovation hubs in countries such as Brazil, Mexico, and Argentina to explore DNA-based storage as an alternative to conventional magnetic and optical systems. Over the past few years, academic and government research programs in genomics and molecular engineering have strengthened significantly, creating a foundation for the testing and potential integration of DNA as a medium for high-density data archiving.

Additionally, the rising importance of digital preservation in scientific, healthcare, and governmental sectors has encouraged partnerships between regional universities and global biotechnology companies. As Latin America data generation continues to rise, coupled with growing environmental awareness and the push for green data storage technologies, the region is expected to play an increasingly active role in early adoption and experimentation with DNA data storage technologies.

Brazil Market Analysis

In Brazil, the DNA data storage market is gaining attention as the country invests in advancing its biotechnology ecosystem and digital infrastructure. Brazil strong base of genomic research institutions, including those involved in molecular biology, bioinformatics, and data science, has provided fertile ground for pilot projects and academic initiatives focused on synthetic DNA for data storage. In recent years, Brazilian research universities and government-backed science programs have expanded collaborations with global tech and life science organizations to explore the potential of molecular-level data encoding and retrieval.

Furthermore, the country growing emphasis on data sovereignty and digital sustainability has encouraged exploration into decentralized, long-term storage technologies that align with environmental goals. While DNA data storage is still in its early stages of commercial adoption in Brazil, the nation research capacity, scientific talent, and increasing public and private funding for biotechnology innovation position it as the leading market in Latin America for future development and implementation of DNA-based storage solutions.

Quick Picks by Regional Insights DNA Data Storage Market

| Company | Country | Product | Uses |

| Microsoft Research | U.S. | Project Silica | Uses quartz glass and laser technology to encode data into DNA-like molecular structures for long-term archival storage. |

| Twist Bioscience | U.S. | DNA Synthesis Platform | Provides synthetic DNA strands used to encode and preserve digital information at molecular scale. |

| Catalog Technologies | U.S. | Shannon DNA Writer | Converts digital data into DNA sequences using high-throughput automation for large-scale data storage. |

| DNA Script | France | Enzymatic DNA Synthesis Platform | Enables rapid, on-demand production of DNA for data storage and bioinformatics applications. |

| Evonetix | U.K. | Silicon Chip DNA Writer | Develops thermally controlled chip-based DNA synthesis systems for scalable and precise data encoding. |

| Ginkgo Bioworks | U.S. | Foundry Platform | Employs synthetic biology tools for creating programmable DNA constructs that can encode and retrieve digital data. |

| Helixworks | Ireland | DNA Cloud Storage System |

Focuses on converting binary data into biological DNA sequences for secure, long-term digital archiving. |

DNA Data Storage Market Value Chain

Primary inputs include nucleotide phosphonamidites, enzymatic reagents, solid supports for synthesis, and protective matrices for DNA encapsulation, such as silica beads or polymeric carriers. Supply chains for high-purity reagents and stable storage matrices are therefore foundational to consistent manufacturing quality.

Core technologies encompass enzymatic and phosphonamidite-based oligo synthesis, high-throughput sequencing platforms, microfluidic assembly systems, and robust error-correcting coding schemes tailored to molecular media. Complementary innovations include molecular indexing, encapsulation chemistries for long-term stability, and automated retrieval robotics.

Investors typically back platform players that can demonstrably lower synthesis cost-per-bit, or service providers that integrate encoding software with vaulting logistics; strategic corporate investments by cloud providers are particularly sought after for pilot deployments. Venture capital also flows to niche firms improving random-access or sequencing throughput.

AI accelerates progress by optimizing coding strategies, predicting synthesis error profiles, and guiding quality control in oligo assembly; machine learning models also improve sequencing-error correction and expedite metadata mapping for rapid retrieval. Additionally, AI-driven process control can reduce reagent consumption and improve yield in enzymatic synthesis workflows.

DNA Data Storage Market Companies

- Headquarters: Redmond, Washington, United States

- Year Founded: 1975

- Ownership Type: Publicly Traded (NASDAQ: MSFT)

History and Background

Microsoft Corporation was founded in 1975 by Bill Gates and Paul Allen as a software company developing and licensing computer programs. Over the decades, Microsoft has grown into one of the world largest technology corporations, with a portfolio spanning software, cloud computing, artificial intelligence, and data infrastructure.

In recent years, Microsoft has become a pioneer in DNA data storage, an emerging technology that encodes digital data into synthetic DNA strands. Through its partnership with the University of Washington and collaborations with biotech firms such as Twist Bioscience, Microsoft is developing scalable, sustainable, and ultra-dense data storage systems to address the exponential growth of global data.

Key Milestones / Timeline

- 1975: Founded in Albuquerque, New Mexico

- 1986: Listed on NASDAQ (MSFT)

- 2017: Began collaboration with the University of Washington to develop DNA data storage prototypes

- 2019: Demonstrated the worlds first automated system for DNA data writing and retrieval

- 2021: Expanded partnership with Twist Bioscience for large-scale DNA synthesis for data encoding

- 2024: Announced progress toward commercializing DNA-based archival data storage solutions

Business Overview

Microsoft operates as a global technology leader in software, cloud infrastructure, and data management. Within the DNA data storage market, Microsofts research is focused on developing hybrid cloud architectures capable of integrating biological data storage systems into data center operations. The company envisions DNA as a next-generation storage medium offering massive data density, long-term stability, and sustainability compared to traditional silicon-based media.

Business Segments / Divisions

- Intelligent Cloud (Azure)

- More Personal Computing

- Productivity and Business Processes

- Microsoft Research (DNA Storage Initiative under Azure Research and Cloud Infrastructure)

Geographic Presence

Microsoft operates in more than 190 countries, with global R&D centers in the United States, Europe, and Asia-Pacific.

Key Offerings

- DNA data encoding and retrieval systems (prototype level)

- Hybrid cloud biological storage integration

- Long-term data archiving solutions using synthetic DNA

- Azure data infrastructure supporting next-generation storage research

Financial Overview

Microsoft reports annual revenues exceeding $240 billion USD, with a strong focus on cloud computing and AI-driven technologies. The companys investment in DNA data storage research is part of its broader long-term data infrastructure strategy under Microsoft Research and Azure Cloud.

Key Developments and Strategic Initiatives

- 2017: Initiated a partnership with the University of Washington for DNA storage automation

- 2019: Demonstrated end-to-end automated DNA data storage and retrieval prototype

- 2021: Entered partnership with Twist Bioscience for large-scale DNA synthesis services

- 2023: Published advancements in DNA-based random-access data storage

- 2025: Working toward hybrid DNA storage integration into Azure data centers

Partnerships & Collaborations

- Collaboration with the University of Washington Molecular Information Systems Lab (MISL)

- Strategic partnership with Twist Bioscience for DNA synthesis and encoding

- Alliances with global cloud and storage research organizations for long-term data archiving projects

Product Launches / Innovations

- Automated DNA writing and retrieval prototype (2019)

- Cloud-integrated DNA archival storage proof of concept (2021)

- Advancements in enzymatic DNA data writing technologies (2024)

Technological Capabilities / R&D Focus

- Core technologies: DNA synthesis, molecular encoding, automation, cloud storage, and AI-based error correction

- Research Infrastructure: Microsoft Research and the University of Washington Molecular Information Systems Lab

- Innovation focus: Scalable DNA data storage, hybrid computing systems, and sustainable data archiving

Competitive Positioning

- Strengths: Global R&D scale, advanced cloud infrastructure, and strong biotechnology partnerships

- Differentiators: Integration of DNA data storage with the Azure cloud ecosystem

SWOT Analysis

- Strengths: Extensive research resources, AI, and data infrastructure expertise

- Weaknesses: High cost and early-stage technology readiness

- Opportunities: Rising demand for ultra-dense, long-term data storage solutions

- Threats: Slow commercialization pace and competition from emerging bio-storage startups

Recent News and Updates

- March 2024: Microsoft and the University of Washington demonstrated improved DNA encoding speed using automation

- July 2024: Announced roadmap for integrating DNA data storage in Azures long-term archive systems

- January 2025: Published research on error correction and data retrieval improvements for large-scale DNA storage

- Headquarters: South San Francisco, California, United States

- Year Founded: 2013

- Ownership Type: Publicly Traded (NASDAQ: TWST)

History and Background

Twist Bioscience Corporation was founded in 2013 by Emily M. Leproust, Bill Banyai, and Bill Peck with a mission to revolutionize DNA synthesis through its proprietary silicon based DNA writing platform. The company produces high-quality synthetic DNA for applications across biotechnology, pharmaceuticals, industrial chemicals, and data storage.

In the DNA data storage market, Twist Bioscience is a key enabler and supplier, providing large-scale, precise DNA synthesis used by technology companies such as Microsoft to encode digital data into DNA strands. Twist platform allows for the mass production of DNA oligonucleotides, enabling scalable and cost-efficient molecular data storage.

Key Milestones / Timeline

- 2013: Founded in San Francisco, California

- 2016: Developed the first silicon-based DNA synthesis platform for high-throughput production

- 2018: Completed initial public offering (NASDAQ: TWST)

- 2019: Partnered with Microsoft and the University of Washington on DNA data storage initiatives

- 2021: Announced successful encoding of large datasets into synthetic DNA

- 2024: Expanded DNA synthesis production capacity to support commercial-scale data storage projects

Business Overview

Twist Bioscience operates as a biotechnology company specializing in synthetic DNA manufacturing. Its silicon-based platform enables precise DNA writing at an unprecedented scale. In the DNA data storage sector, Twist DNA is used as the physical medium for data encoding, providing the foundation for molecular-level data storage and retrieval systems.

Business Segments / Divisions

- Synthetic Biology

- Next-Generation Sequencing (NGS)

- Biopharma Solutions

- DNA Data Storage

Geographic Presence

Twist Bioscience serves customers globally, with offices and manufacturing facilities in the United States and Europe.

Key Offerings

- Custom synthetic DNA production

- High-throughput DNA synthesis for data storage and biotechnology

- DNA data encoding for long-term archival storage

- DNA libraries for research and commercial applications

Financial Overview

Twist Bioscience reports annual revenues of approximately $250 to 300 million USD, with growing contributions from partnerships in DNA data storage and synthetic biology. Continued investment in capacity expansion supports the scaling of DNA synthesis for emerging data storage applications.

Key Developments and Strategic Initiatives

- 2019: Partnered with Microsoft and the University of Washington for DNA-based data storage research

- 2021: Demonstrated storage and retrieval of complex data sets in synthetic DNA

- 2023: Expanded silicon-based synthesis platform for higher throughput and cost reduction

- 2025: Launched pilot-scale DNA synthesis program targeting commercial DNA data archiving

Partnerships & Collaborations

- Strategic partnership with Microsoft for large-scale DNA synthesis for data storage

- Collaboration with the University of Washington on molecular data storage systems

- Alliances with research institutions and biotechnology companies for DNA encoding optimization

Product Launches / Innovations

- High-throughput DNA synthesis platform expansion (2023)

- DNA data encoding batch production for archival storage (2024)

- Pilot-scale synthetic DNA storage solutions (2025)

Technological Capabilities / R&D Focus

- Core technologies: Silicon-based DNA synthesis, automation, miniaturization, and molecular encoding

- Research Infrastructure: Integrated manufacturing and R&D centers in South San Francisco

- Innovation focus: Scaling DNA synthesis for data storage, improving fidelity, and reducing cost per base

Competitive Positioning

- Strengths: Proprietary silicon DNA synthesis platform, strong R&D collaboration network, scalability

- Differentiators: Ability to produce large volumes of high-precision DNA for data storage applications

SWOT Analysis

- Strengths: Industry-leading DNA synthesis technology, partnerships with major tech firms

- Weaknesses: High operational costs and dependence on external commercialization partners

- Opportunities: Commercialization of DNA data storage and growth in synthetic biology

- Threats: Competition from alternative synthesis technologies and high cost of production

Recent News and Updates

- April 2024: Twist announced the expansion of its DNA production capacity to meet growing data storage demand

- July 2024: Reported successful collaboration with Microsoft on new data encoding techniques

- January 2025: Launched pilot project for commercial-scale DNA data storage synthesis in partnership with technology and cloud service providers

Other Companies in the DNA Data Storage Market

- Catalog Technologies: Catalog Technologies is developing a DNA-based computation and storage platform, utilizing a proprietary method of encoding data into synthetic DNA for high-density information storage. The companys approach enables mass parallel writing of data, significantly reducing the time and cost associated with DNA data storage. Catalogs research focuses on archival and exascale data management applications.

- IBM Corporation: IBM is exploring DNA and molecular storage as part of its long-term innovation strategy in nanotechnology and quantum data systems. The companys R&D efforts emphasize AI-driven algorithms for DNA encoding and decoding, aiming to enhance reliability and speed in molecular data retrieval. IBMs involvement positions it as a major technology contributor to scalable and automated DNA-based storage systems.

- DNA Script: DNA Script specializes in enzymatic DNA synthesis, a breakthrough technology that enables faster, more sustainable, and decentralized DNA writing. Its SYNTAX platform provides on-demand DNA synthesis capabilities, crucial for scalable DNA data storage applications. By replacing chemical synthesis with enzymatic methods, DNA Script enhances both environmental sustainability and production efficiency in the DNA storage workflow.

- Evonetix: Evonetix develops a silicon chip-based DNA synthesis platform enabling parallel, high-accuracy DNA writing. Its patented thermal control technology facilitates error correction and scalability, making it ideal for data storage applications requiring high precision and throughput.

- Ginkgo Bioworks: Ginkgo Bioworks leverages synthetic biology to optimize DNA design and assembly processes. Its advanced biofoundry infrastructure supports large-scale DNA synthesis and manipulation, enabling more efficient encoding of digital information into biological formats.

- Microsoft Research (Project Silica): Project Silica, a Microsoft Research initiative, explores long-term data storage using DNA and glass quartz-based molecular systems. The project aims to develop archival storage solutions that are highly durable, compact, and resistant to environmental degradation.

- Helixworks: Helixworks focuses on molecular data encoding systems, offering platforms like DATADNA, which translate digital information into biological DNA sequences. The companys innovations center on low-cost, scalable encoding and decoding of large data volumes.

- Nuclera Nucleics: Nuclera Nucleics develops digital microfluidic bioprinters for rapid DNA and protein synthesis. Its technology supports the creation of synthetic DNA strands for storage applications, promoting localized and efficient DNA writing.

- Synthetic Genomics, Inc.: Synthetic Genomics, now part of Viridos, is a pioneer in synthetic biology and large-scale DNA assembly. Its expertise in high-throughput DNA synthesis supports next-generation molecular storage research, integrating automation and bioinformatics.

- Inscripta, Inc.: Inscripta offers genome engineering platforms that enable precise DNA writing and editing. Its tools enhance error correction and data fidelity in DNA-based storage processes, advancing the scalability of molecular data technologies.

- Codex DNA: Codex DNA develops automated DNA synthesis and assembly platforms, including the BioXp system, which enables fast, accurate, and automated production of DNA constructs. Its technology plays a key role in making DNA data storage more efficient and cost-effective.

- Zymergen Inc.: Zymergen applies bioengineering and automation to create synthetic molecules, including DNA-based polymers. Its expertise contributes to the development of bio-integrated materials capable of storing digital data in molecular form.

- Molecular Assemblies: Molecular Assemblies pioneers enzymatic DNA synthesis for precision and sustainability. Its approach provides the foundation for writing long DNA strands with fewer errors, a critical step toward scalable DNA-based data storage.

- Ansa Biotechnologies: Ansa Biotechnologies develops a novel enzymatic DNA synthesis process that produces long, accurate DNA strands without the use of traditional chemical reagents. Its technology accelerates data encoding and minimizes synthesis errors in DNA data storage systems.

- FleksyBio: FleksyBio focuses on DNA synthesis and bioinformatics platforms for encoding, storing, and retrieving digital information at the molecular level. The company integrates automation and AI to enhance data density and security in DNA storage.

- Amaryllis Nucleics: Amaryllis Nucleics specializes in DNA synthesis and repair enzyme optimization, enabling more efficient and accurate long-read DNA writing for molecular data storage.

- Cambridge Epigenetix: Cambridge Epigenetix applies epigenetic and sequencing technologies to data encoding and information density enhancement. Its work on DNA modification could enable multi-layered data storage within a single DNA strand, exponentially expanding storage capacity.

- Twist Bioscience / Illumina (Joint Research Projects): Twist Bioscience and Illumina have collaborated on DNA-based data storage and sequencing initiatives that leverage Twist synthesis platform and Illumina next-generation sequencing (NGS) technologies. This partnership aims to accelerate read/write efficiency and standardization for commercial DNA storage applications.

Recent Developments

- In September 2025, our increasingly digital world faces a problem with data storage. Hard drives and other forms of storage are nearing their capacity, while data generation is outpacing our ability to store it. Thankfully, the solution can be found in nature, which offers a remarkable storage medium: DNA (deoxyribonucleic acid). This genetic material is being utilized by Xingyu Jiang and his team at the Southern University of Science and Technology in China to develop DNA storage cassettes.(source: https://techxplore.com)

DNA Data Storage MarketSegments Covered in the Report

By Storage Type

- Synthetic DNA Storage

- Natural DNA-Based Storage

By Technology

- DNA Synthesis

- Enzymatic Synthesis

- Phosphoramidite Chemistry

- DNA Sequencing/Reading

- Next-Generation Sequencing (NGS)

- Nanopore Sequencing

- Data Encoding & Decoding Algorithms

- Error-Correcting Codes

- Compression Techniques

By Application

- Archival Storage

- Government & Defense Data

- Corporate Data Centers

- Healthcare & Genomic Data

- Active Data Storage & Retrieval

- Cloud Storage Services

- Research & Academic Applications

- Others

By End User

- IT & Cloud Service Providers

- Government & Defense Agencies

- Healthcare & Life Sciences

- Enterprises & Corporates

- Research Institutes & Academia

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting