Drone Battery Market Size and Forecast 2025 to 2034

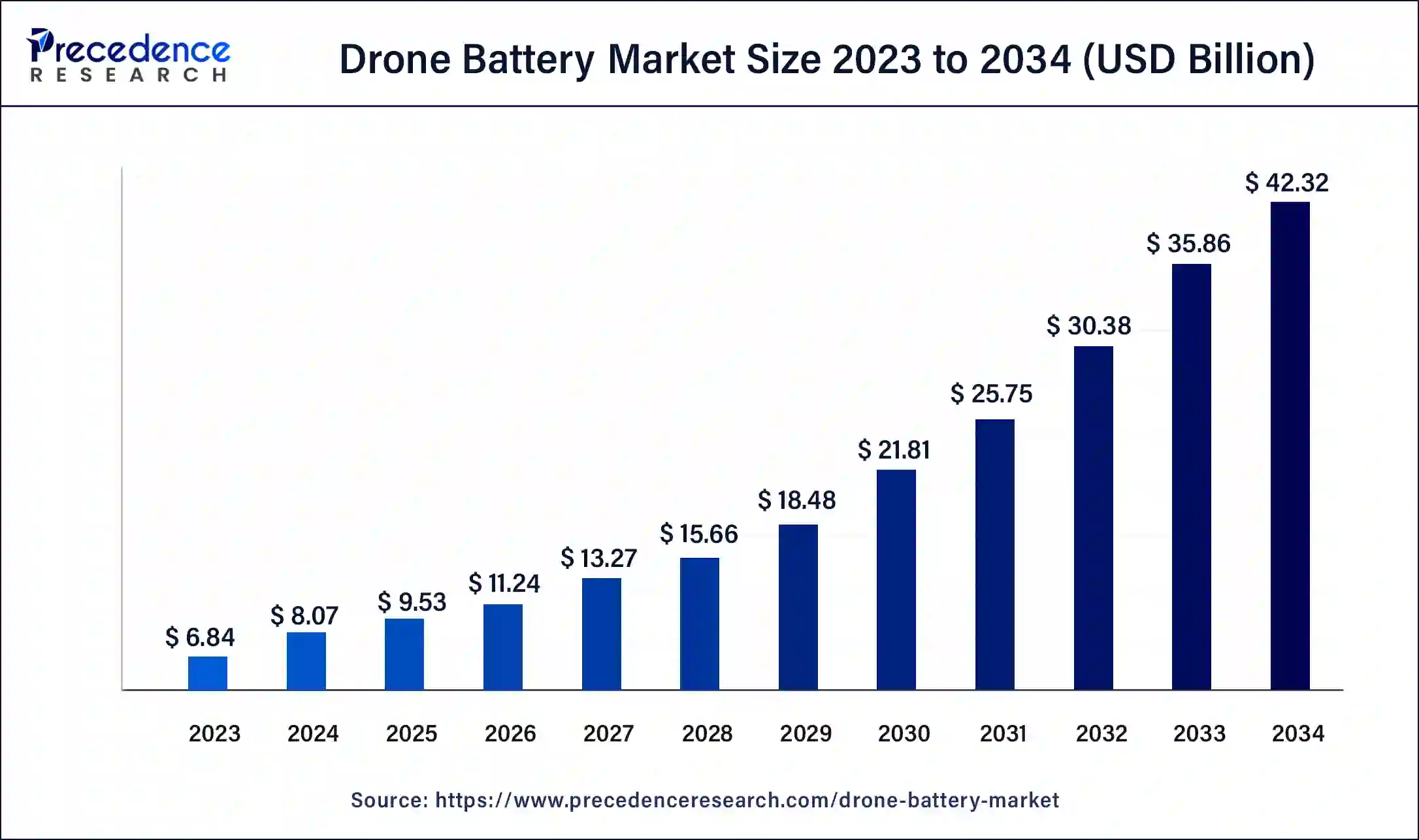

The global drone battery market size was calculated at USD 8.07 billion in 2024 and is anticipated to reach around USD 42.32 billion by 2034, growing at a solid CAGR of 18.02% over the forecast period 2025 to 2034. The North America drone battery market size reached USD 2.74 billion in 2024. Drones service providers and manufacturers needs to provide various type of drone batteries as per requirement fuelling the production of drone battery and thus, propelling the drone battery market world widely on a larger scale.

Drone Battery Market Key Takeaways

- The global drone battery market was valued at USD 8.07 billion in 2024.

- It is projected to reach USD 42.32 billion by 2034.

- The drone battery market is expected to grow at a CAGR of 18.02% from 2025 to 2034.

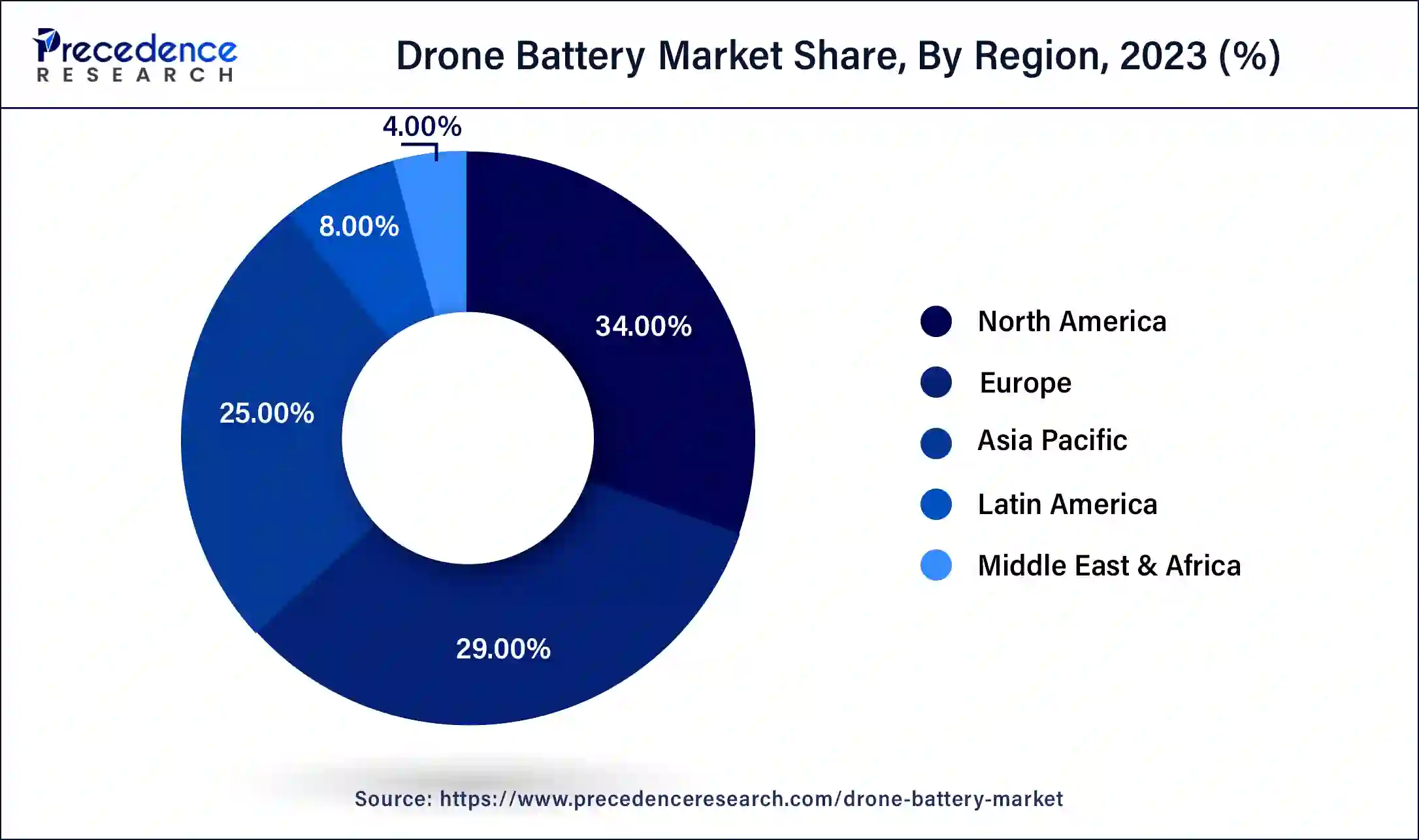

- North America accounted for the largest market share of 34% in 2024.

- Asia Pacific is expected to witness the fastest growth in the market during the forecasted years.

- By technology, the lithium-based segment accounted for the largest share of the market in 2024.

- By technology, the fuel cell segment is anticipated to witness the fastest growth in the market in the upcoming period.

- By component, the battery management system segment accounted for the largest share of the market in 2024.

- By drone type, the fixed-wing segment holds a significant share of the global market.

- By platform, the military segment dominated the global market in 2024.

- By function, the passenger drone segment led the market in 2024.

- By point of sale, in 2024, the aftermarket segment accounted for the largest share of the market.

AI Impact on the Drone Battery Market

AI implementation with drone systems is undoubtedly an innovative and transforming integration that has led the world's economy on a larger scale due to its tremendous applications. AI-based drones are designed to work independently of human interference and offer a range of use cases that were not possible previously. AI is a conscious but mechanical brain-like system that enables machines to work with the help of huge amounts of data provided to them by various inputs and algorithms.

The integration of AI into the drone battery market makes them more intelligent and allows them to work from their radar, sensors, and cameras with different angles and zooming capacities for better mapping and surveillance. With the help of AI, drones can automatically change their direction if they seem to collide with obstacles while flying in a determined way.

Actionable steps in AI-based drones for business operations

- At first identify use cases related to business— By researching and analyzing how AI-based systems can be leveraged for specific companies to increase productivity and reduce cost.

- Right choice of drone—Selecting a drone specifically designed for business needs is crucial. It's necessary to look for a drone that is reliable and easy to handle.

- AI software—The third and most crucial step is to choose exact, compact AI software for drones that fulfills business targets within a minimum of an hour and can be easily integrated with the drones' systems.

- To train AI—Training AI software plays an important role in ensuring that drones can work autonomously.

- Establish standard protocol—After training AI, establishing a standard protocol, such as maintenance rules, safety rules, and emergency response outlines, for the precise use of AI software is important in terms of safety for data collection.

- Monitoring—Conduct regular check-ups on the performance of AI-based drones to identify flaws and improve operations.

U.S. Drone Battery Market Size and Growth 2025 to 2034

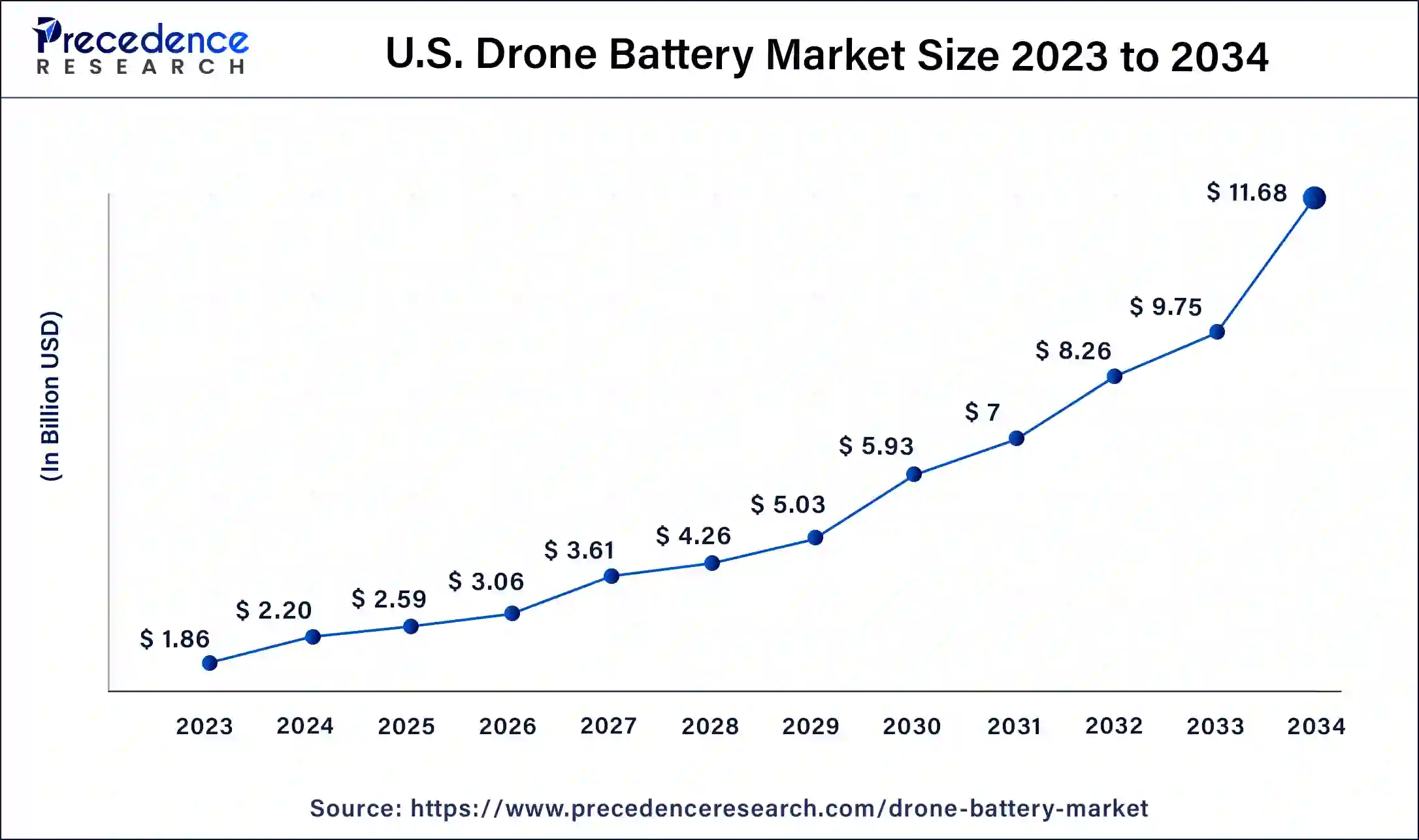

The U.S. drone battery market size was exhibited at USD 2.20 billion in 2024 and is projected to be worth around USD 11.68 billion by 2034, poised to grow at a CAGR of 18.17% from 2025 to 2034.

North America dominated the drone battery market with the largest market share of 34% in 2024. The growth of this region is attributed to the rising adoption of drones in defense and commercial sectors in North America. Drone batteries are developed for better performance, higher range, energy density, and efficiency, are more lightweight, and are able to carry the maximum amount of goods or payloads over longer ranges. Such drones are ideal for daily use delivery of products like medicine, food, postal delivery, and other day-to-day goods. Major key players' development of drone batteries is another significant factor fuelling the region's dominance in the market. Moreover, due to the federal administration's aviation, the number of drones in the defense sector for various applications has increased.

Asia Pacific is expected to witness the fastest growth rate during the forecasted years in the global drone battery market. The growth of the region is due to the rising technological advancement and manufacturing process of lithium-ion batteries in the major areas and evolving countries like China and India. An increased production rate for various types of drone batteries in diverse sectors is the key driver for Asia Pacific. Countries like China and India are focusing more on strengthening the security and defense systems of nations to avoid external invasion, propelling the use of UAVs for a number of crucial tasks for safer purposes. Drones used in the sectors have different capacities and ranges, creating various types of battery production.

- In September 2024, the Indian drone industry is set to showcase the capabilities of its drone solutions for the Indian Army in high-altitude areas in an event slated to be held in Ladakh.

Market Overview

The drone battery market is expanding due to the increasing usage of drones in commercial and defense sectors across the globe due to the convenience of transportation a UAV provides, strengthening their roots worldwide in terms of various applications in diverse sectors. Drone systems are more convenient for delivering goods within the city or within less distance; hence, emerging key players in the drone manufacturing area are focusing more on drone production along with their endurance and long flight ability.

Since drones are of various types, the production of drone batteries is a crucial part of making them available for use as per demand. Hence, the rising E-commerce sector is also leveraging drone delivery methods to expand its roots in the market; this is also a major key factor driving the drone battery market. Region-wise, North America is leading, while Asia Pacific is registered as the fastest-growing region during the forecasted years.

Drone Battery Market Growth Factors

- Rising applications of drones in various fields like surveillance and mapping, defense, e-commerce, cinematography, etc, fuelling the drone battery market's growth.

- Drone service manufacturers need to provide extra batteries.

- Usage of drones in the military sector globally for better surveillance and safety.

- Automated drones need no intervention from humans, creating a greater convenience.

- Increasing deployment of drones for medicinal delivery in the healthcare sector propelling the market growth.

- Ongoing technological advancements and innovations in drone systems.

- Integration of the latest technologies like AI and ML with drone systems is further increasing the usage of drones with more efficiency.

- With the increasing adoption of UAVs across various fields due to their high-performing ability and greater convenience, drone manufacturers are focusing on the production side precisely.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 42.32 Billion |

| Market Size in 2025 | USD 9.53 Billion |

| Market Size in 2024 | USD 8.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.02% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Component, Drone Type, Platform, Function, Point of Sale, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increased use of security and surveillance applications

A significant driving factor for the drone battery market is an expansion of mapping and surveillance applications across various sectors. Drones are set up with technically advanced equipment like cameras and sensors and are increasingly used for public safety and border mapping along with monitoring of infrastructure, which is critical to saving. Such trends are observed in the defense sector more, fuelling the demand for powerful and highly efficient batteries and causing the proliferation of the drone battery market on a global level. Moreover, end users in various industries are looking for drones with extended endurance for flight, which helps in operational efficiency, fuelling the demand for longer flights and, in turn, increasing the demand for efficient batteries. By recognizing this need, major key players in the market are investing heavily in drone batteries.

Restraint

Limited energy and charging infrastructure concerns

One of the challenges faced by the battery drone market is limited energy density and concern over charging infrastructure. The lack of robust and widespread charging infrastructure is restraining the market growth. Drones generally have limited energy since they are battery-operated flying machines and need to be charged frequently for a longer run. Drones mostly operate or travel in remote areas where infrastructure limitation is concerned to charge them at regular intervals. Hence, it becomes crucial to develop reliable infrastructure that can charge various types of battery-operated drones. Drones require lightweight and highly charged batteries for extended flying.

Opportunity

Emergence of solid-state batteries

A significant opportunity that the market holds is the rise of solid-state batteries and hybrid, multifunctional batteries, and marketers' growing interest in developing these innovative changes in the manufacturing of drone batteries, creating a lucrative opportunity that is fuelling the drone battery market further. As compared to conventional lithium-ion batteries, solid-state batteries provide longer flight endurance, high energy density, and increased safety, making them more appealing in the market. As the technology evolves, the integration of drones with solid-state batteries is anticipated to redefine the global industry on a notable scale.

Technology Insights

The lithium-based segment accounted for the largest share of the drone battery market in 2024. The market is further segmented into nickel-based and fuel-based batteries. The growth of the lithium-based segment is due to the ongoing advancements in the area of lithium-sulfur and lithium metal technology, which aids in market growth further. The increasing demand for optional transportation with the help of technology is propelling the demand for the urban air mobility concept.

The fuel cell segment is anticipated to witness the fastest growth in the drone battery market in the upcoming period. The growth of this segment is related to its longer flight time, high energy, and environmental benefits. The fuel cells can be used as the best alternative to traditional lithium-based batteries as they are lightweight and more efficient.

Component Insights

The battery management system segment accounted for the largest share of the drone battery market in 2024. Further segmentation includes cells, enclosures, and connectors. The BMS segment is proliferating owing to the increasing focus on registering critical functional parameters of the system, such as voltage, current, state of charge, condition, and temperature. These parameters play a crucial role in the drone system's functioning.

Drone Type Insights

The fixed-wing segment holds a significant share of the global drone battery market. The market is again segmented into the rotary wing and fixed-wing VTOL. The fixed-wing segment has features like high endurance, higher stability, and longer run, which are critical factors in commercial as well as civil operations. Fixed-wing drones are battery-powered and use lithium polymer batteries to work efficiently due to the high voltage capacity and long-range endurance for flight.

Platform Insights

The military segment dominated the global drone battery market in 2024. The market is further segmented into consumer, commercial, government, and law enforcement. The growth of military segments is due to the increasing investment of defense in strengthening security and, for that, developing an unmanned aerial vehicle on a larger scale. Drone batteries are used in UAVs and have various sizes and capacities.

Function Insights

The passenger drone segment led the drone battery market in 2024. The market is further divided into purpose, inspection, monitoring, surveying, and mapping drones. Passenger drones are expanding due to the surge in the application of drones in urban areas for fast reach with the help of drone taxis, air shuttles, drone ambulances, etc. Generally, hydrogen-based fuel cells are used in passenger modes of transportation.

Point of Sale Insights

The aftermarket segment accounted for the largest share of the drone battery market in 2024. The market is bifurcated into original equipment manufacturers along with aftermarkets. Rising demand for upgradation and technological modification in drone systems, especially in the commercial and civil sectors, is fuelling the aftermarket segment's growth. Each drone has an additional two batteries at the time of purchase, though it's advisable to purchase more batteries for longer flight time.

Drone Battery Market Companies

- Amperex Technology Limited

- Autel Robotics

- DJI

- LG Chem

- MaxAmps

- Panasonic

- Parrot

- Samsung SDI

- Tadiran Batteries

- Tattu (Shenzhen Grepow Battery Co., Ltd)

Recent Developments

- In June 2024, MaxAmps announced a new LiPo battery pack, the 9000XL 4S 14.8v, which is designed to provide enhanced performance and longer flight times for various UAV applications.

- In March 2024, Atomik RC launched new high-capacity LiPo batteries for hobby drones with enhanced performance and flight time. This is expected to enhance the product portfolio of Atomik RC and expand its global footprint.

Segments Covered in the Report

By Technology

- Lithium-based

- Nickel-based

- Others

By Component

- Cell

- Enclosures

- Connectors

- BMS

By Drone Type

- Fixed-wing Drone

- Rotary Wing

- Hybrid Wing

By Platform

- Military

- Consumer

- Commercial

- government

- law Enforcement

By Function

- Passenger

- Purpose

- Inspection

- Monitoring

- Surveying and Mapping

By Point of Sale

- Original Equipment Manufacturers

- Aftermarket

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content