Dunaliella Salina Extract Market Size and Forecast 2025 to 2034

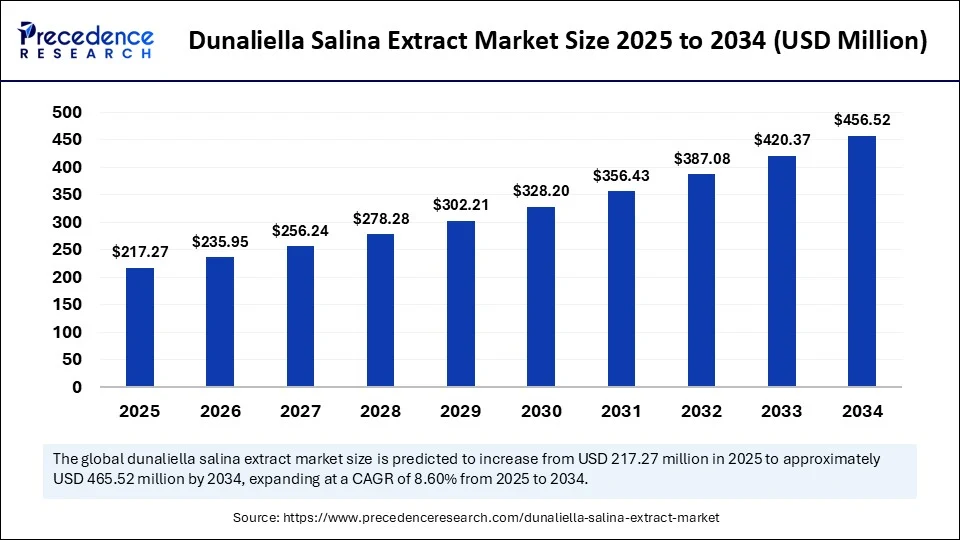

The global dunaliella salina extract market size accounted for USD 200.06 million in 2024 and is predicted to increase from USD 217.27 million in 2025 to approximately USD 456.52 million by 2034, expanding at a CAGR of 8.60% from 2025 to 2034. The market is experiencing significant growth due to the rising demand for natural antioxidants and carotenoids in nutraceuticals and cosmetics. This demand is supported by the high beta-carotene content of the extract and its associated health benefits in skincare and dietary supplements. Additionally, the increasing use of personal food products and anti-aging treatments is expected to further boost market expansion.

Dunaliella Salina Extract Market Key Takeaways

- In terms of revenue, the global dunaliella salina extract market was valued at USD 200.06 million in 2024.

- It is projected to reach USD 456.52 million by 2034.

- The market is expected to grow at a CAGR of 8.60% from 2025 to 2034.

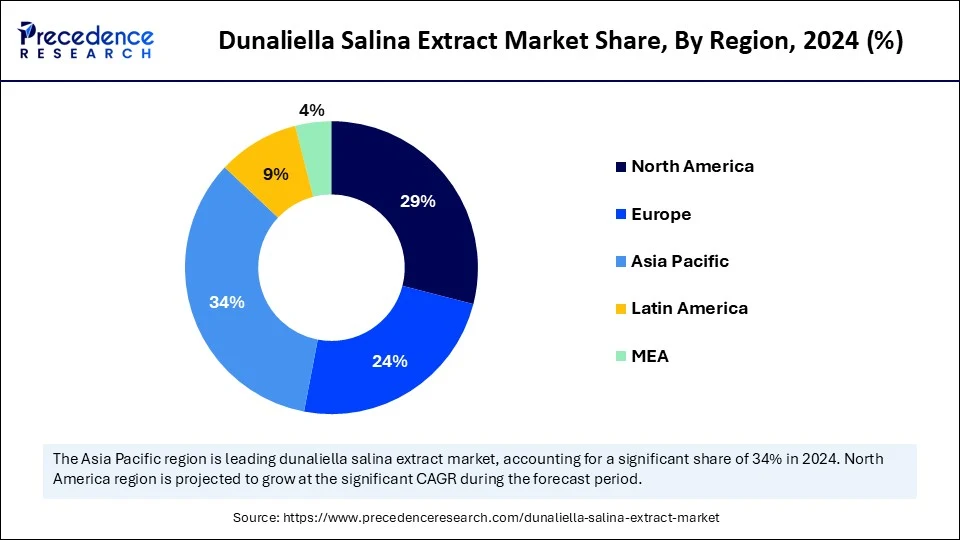

- Asia Pacific dominated the global dunaliella salina extract market with the largest market share of 34% in 2024.

- Europe is expected to witness the fastest CAGR during the foreseeable period.

- By product type, the beta-carotene-standardized extract segment held the biggest market share of 38% in 2024.

- By product type, the oil-based extract segment is expected to witness the fastest CAGR during the foreseeable period.

- By formulation/finished format, the bulk powder segment captured the highest market share of 36% in 2024.

- By formulation/finished format, the microencapsulated powder segment is expected to witness the fastest CAGR during the foreseeable period.

- By extraction and processing technology, the solvent extraction (food-grade solvents) segment contributed the major market share of 40% in 2024.

- By extraction and processing technology, the supercritical CO2 extraction segment is expected to witness the fastest CAGR during the foreseeable period.

- By application/end-use industry, the dietary supplements segment generated the major market share of 32% 2024.

- By application/end-use industry, the cosmetics and personal care segment is expected to witness the fastest CAGR during the foreseeable period.

- By distribution channel, the ingredient distributors/brokers segment accounted for the significant market share of 33% in 2024.

- By distribution channel, the direct sales (B2B) segment is expected to witness the fastest CAGR during the foreseeable period.

- By pricing tier/value, the mid-tier standardized ingredient segment held the largest market share of 38% in 2024.

- By pricing tier/value, the premium high-purity/certified grade segment is expected to witness the fastest CAGR during the foreseeable period.

- By packaging type and size, the bulk drums (100–200 kg) segment generated the maximum market share of 45% in 2024.

- By packaging type and size, the cold chain segment is expected to witness the fastest CAGR during the foreseeable period

- By customization and service offering, the standard formulations segment held the major market share of 50% in 2024.

- By customization and service offering, the co-development and R&D partnerships segment is expected to witness the fastest CAGR during the foreseeable period.

How Can AI Impact the Dunaliella Salina Extract Market?

Artificial intelligence (AI) is revolutionizing Dunaliella salina cultivation and extraction by improving efficiency and quality. AI helps analyze large genetic datasets to develop more productive strains. It can also analyze spectroscopic data to ensure consistent quality and optimize resource use (water, nutrients, energy), reducing waste and environmental impact. Additionally, AI aids in strain development, optimizing growth conditions, enhancing cell harvesting and extraction, and minimizing downtime.

Asia Pacific Dunaliella Salina Extract Market Size and Growth 2025 to 2034

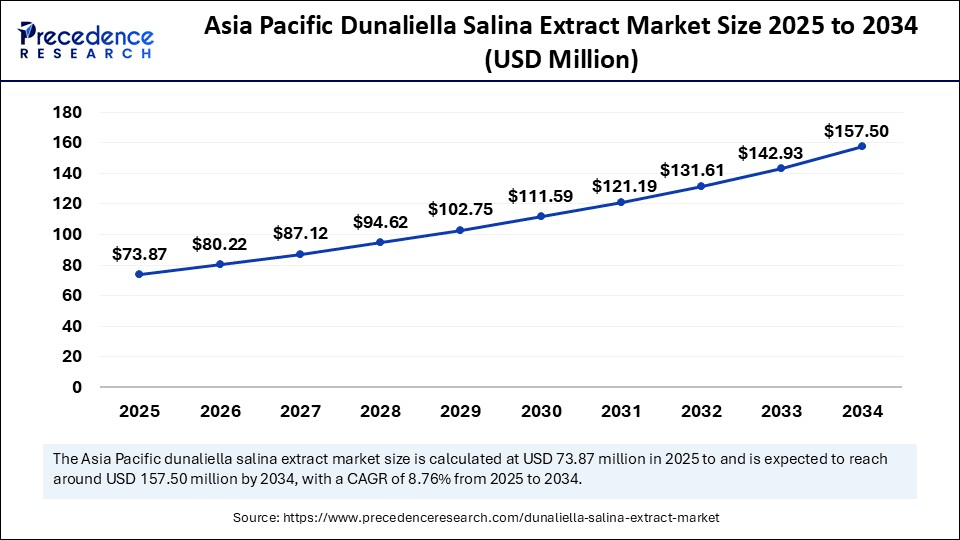

The Asia Pacific dunaliella salina extract market size was exhibited at USD 68.02 million in 2024 and is projected to be worth around USD 157.50 million by 2034, growing at a CAGR of 8.76% from 2025 to 2034.

How Did Asia Pacific Dominate the Dunaliella Salina Extract Market in 2024?

Asia Pacific dominated the global market in 2024, primarily due to its large population, a growing middle class, increasing awareness of natural ingredients, and supportive government initiatives. Several governments in the region are actively promoting the use of algae and algal ingredients in various industries, including food, pharmaceuticals, and cosmetics. The presence of numerous local and regional companies like Seagrass Tech Private Limited, Hangzhou OuQi Food Co., Ltd., Shaanxi Rebecca Bio-Tech Co., Ltd., Nutragreenlife Biotechnology Co., Ltd., and Fuqing King Dnarmsa Spirulina Co., Ltd, involved in the production and processing of Dunaliella salina extract, contributes to the market's growth.

How Will Europe be considered a Notable Region in the Dunaliella Salina Extract Market in 2024?

Europe is experiencing rapid growth in the Dunaliella Salina extract market. This is primarily due to a combination of factors, including a high demand for natural ingredients in cosmetics and nutraceuticals, government support for sustainable and green initiatives, and advancements in extraction technologies. Specifically, the UK is projected to have the highest growth, driven by the increasing demand for natural-source beta carotene and the rising use of Dunaliella Salina in the cosmetics industry. European governments are actively promoting sustainable practices and green biotechnology ventures through incentives and policies, reducing carbon footprints, and conserving biodiversity.

How Will North America Surge in the Dunaliella Salina Extract Market in 2024?

North America is expected to grow significantly in the foreseeable future. This is primarily due to increasing consumer demand for natural and sustainable ingredients, a thriving health and wellness industry, and advancements in aquaculture and animal feed sectors. The aquaculture and animal feed industries are also contributing to the growth of the Dunaliella salina extract market. Dunaliella salina, known for its high beta-carotene content and antioxidant properties, aligns perfectly with this trend, making it a sought-after ingredient in nutraceuticals and cosmetics. The extract is used as a natural pigment and nutritional supplement in aquaculture and as a feed additive in animal agriculture, boosting its demand.

How Will Latin America make an Impact on the Dunaliella Salina Extract Market in 2024?

Latin America is experiencing significant growth in the global market. This is due to rising demand for natural ingredients, particularly in cosmetics and nutraceuticals, and the region's favorable conditions for algae cultivation. Improved extraction methods, including those using ultra-high pressure and supercritical fluid extraction, are enhancing the efficiency and quality of Dunaliella Salina extract production, making it more attractive to manufacturers. General government support for green biotechnology and sustainable practices creates a favorable environment for the growth of this market.

How Will the Middle East and Africa Power the Dunaliella Salina Extract Market in 2024?

The Middle East and Africa are expected to experience significant growth in the market. This is due to increasing consumer preference for natural ingredients, particularly in cosmetics and nutraceuticals, coupled with rising awareness of the extract's health benefits. This growth is further fueled by government initiatives promoting local herbal agriculture and sustainable sourcing, alongside the expanding e-commerce channels and the penetration of international brands in the region. The increasing penetration of e-commerce in the MEA region is making Dunaliella salina products more accessible to consumers, further boosting market growth.

Market Overview

The Dunaliella salina extract market is seeing strong growth because of the rising demand for natural, health-boosting ingredients across many industries. This market mainly focuses on extracting beta-carotene and other beneficial compounds from the microalga Dunaliella salina, especially for use in cosmetics, pharmaceuticals, food and beverages, and industrial sectors. Key growth drivers include the growing consumer preference for natural and plant-based products, improvements in extraction technologies, and expanding uses in functional foods and dietary supplements.

What Are the Key Trends in the Dunaliella Salina Extract Market?

- Rising Awareness of Health Benefits: Consumers are becoming more aware of the health benefits linked to beta-carotene, including immune support, improved eye health, and antioxidant protection. This awareness is driving the demand for Dunaliella Salina extracts.

- Expanding Applications in Cosmetics: The application of Dunaliella Salina extract in cosmetics is growing due to its antioxidant and anti-aging properties, making it a sought-after ingredient in skincare products.

- Advancements in Extraction Technologies: As consumers seek natural and sustainable alternatives to synthetic ingredients, advancements in extraction technology are making it more efficient and cost-effective to produce high-quality Dunaliella Salina extracts. This trend is further fueling demand for the product.

- Government Initiatives and Support: Governments around the world are introducing incentives to support green biotechnology initiatives, including those focused on algae cultivation. This support indirectly contributes to the growth of the Dunaliella Salina extract market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 456.52 Million |

| Market Size in 2025 | USD 217.27 Million |

| Market Size in 2024 | USD 200.06 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.60% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Formulation/Finished Product Format, Extraction and Processing Technology, Application/End-use Industry, Distribution Channel , Packaging Type and Size, ricing Tier/Value Segment, Customization and Service Offering, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Clean-Label Movement

The main driver fueling the market is the clean-label movement, which reflects a rising consumer desire for products with simple, natural, and transparent ingredients. Consumers are scrutinizing product labels more closely, looking for recognizable and understandable ingredients. They worry about potential health risks from artificial additives, preservatives, and GMOs. Since it is a natural, plant-derived ingredient, it aligns well with this trend. Clean labels build trust between consumers and brands by emphasizing transparency about ingredients, sourcing, and manufacturing.

Restraint

Higher Production Cost

A major restraint in the market is the higher production cost compared to synthetic options. This cost barrier hampers market penetration and limits widespread use, especially in budget-sensitive sectors like food and beverages. Growing Dunaliella salina, especially for large-scale commercial production, requires specific environmental conditions (high salinity, sunlight, temperature), which can be costly to maintain. Additionally, extraction and purification processes add to overall expenses. Competition from synthetic beta-carotene, which is often cheaper and more available, also influences market preferences.

Opportunity

Increasing Role in Nutraceuticals and Functional Foods

Looking ahead, a significant opportunity exists in the expanding use of Dunaliella salina in nutraceuticals and functional foods. This is driven by increasing demand for natural ingredients like beta-carotene and other beneficial compounds, along with the growth of clean-label products. The extracts are being incorporated into functional foods such as energy bars, smoothies, and health drinks, providing health benefits beyond basic nutrition. Its rich beta-carotene content makes it a popular ingredient in dietary supplements.

Product Type Insights

What Made the Beta-Carotene-Standardized Extract Segment Lead the Market in 2024?

The beta-carotene-standardized extract segment led the market in 2024, due to high demand for natural beta-carotene as a health supplement and natural food coloring, along with advances in extraction technology. Beta-carotene, a precursor to Vitamin A with antioxidant properties, is popular in health and wellness products. Growing awareness of its health benefits, like supporting eye health and skin care, further boosts this segment. Improved extraction methods and broader applications across industries help maintain its leading position.

The oil-based extract segment is growing fastest, due to its improved stability, bioavailability, and ease of use compared to other forms. These forms offer better protection against oxidation and light degradation of active compounds like beta-carotene, enhancing bioavailability, meaning more active ingredients are absorbed and utilized. They also simplify formulations and improve sensory qualities, making products more appealing.

Formulation/Finished Format Insights

How Did the Bulk Powder Segment Dominate the Dunaliella Salina Extract Market?

The bulk powder segment holds a dominant market share because of its versatility, cost-effectiveness, and suitability for use in functional foods, dietary supplements, and animal feed. Its popularity stems from easy incorporation into various formulations, its stability, and long shelf life. Bulk powder is more manageable to handle, transport, and store, which contributes to its widespread adoption.

The microencapsulated powder segment is expected to grow the fastest, mainly because of its improved stability, bioavailability, and versatility. It protects sensitive carotenoids and other bioactives from degradation, facilitates absorption, and allows for sustained-release and targeted delivery. It also improves solubility in liquids, making it easier to include in beverages, supplements, and cosmetic products.

Extraction and Processing Technology Insights

How Will Solvent Extraction Using Food-Grade Solvents Segment Dominate the Dunaliella Salina Extract Market in 2024?

The solvent extraction (food-grade solvents) segment was dominant in 2024 because of its ability to efficiently extract high-value compounds like beta-carotene and glycerol safely for food and cosmetics. This technique delivers high purity levels, which are crucial for product safety and quality. Using food-grade solvents ensures the extracts are safe for consumption and contact, meeting strict regulations and consumer expectations. It is favored for its effectiveness and compatibility with consumer products.

The supercritical CO2 extraction segment is growing rapidly due to its environmentally friendly approach and efficiency. The extraction of high-value compounds like carotenoids from algae can be done effectively without harmful solvents, which helps to preserve the integrity of the extracted compounds and offers higher yields compared to traditional methods. As a result, the extracts obtained through this method are often of higher purity and quality than those derived from conventional solvent-based techniques. This has led to a growing demand for this extraction, as it is a green and sustainable option.

Application/End-Use Industry Insights

How Did the Dietary Supplements Segment Lead the Dunaliella Salina Extract Market in 2024?

The dietary supplements segment led the market in 2024. This is due to increasing consumer demand for natural health supplements and a growing awareness of beta-carotene's health benefits. Dunaliella salina extract, which is rich in beta-carotene and antioxidants, is a popular ingredient in supplements that aim to boost immunity, improve eye health, and provide antioxidant protection. Consumers are increasingly looking for natural supplements to enhance their overall health, and Dunaliella salina extract offers significant benefits, including immune support and protection against cellular damage caused by free radicals.

The cosmetics and personal care segment is the fastest-growing area of the market, driven by rising consumer demand for natural ingredients, especially those with antioxidant and anti-aging properties. Consumers are actively seeking products with clean labels and natural components, aligning with Dunaliella salina, high beta-carotene content. Technological advancements in extraction methods have made obtaining extracts more efficient and cost-effective, contributing to their increased use in the cosmetics industry. These advancements, along with the growing wellness trend, further encourage the adoption of these extracts.

Distribution Channel Insights

Why Did the Ingredient Distributors/Brokers Segment Dominate the Dunaliella Salina Extract Market in 2024?

The ingredient distributors/brokers segment dominated the market in 2024, primarily due to their established networks and expertise in reaching diverse consumer bases, particularly in the nutraceutical and cosmetic industries. These intermediaries facilitate connections between producers and a wide range of buyers, enhancing market access and product visibility. They possess in-depth knowledge of market trends, consumer preferences, and regulatory landscapes, crucial for effectively positioning and promoting to the target segments, streamlining the supply chain, and ensuring timely product availability.

The direct sales (B2B) segment is expected to experience rapid growth during the forecast period. This growth is attributed to its cost-effective approach for accessing niche markets and streamlining supply chains for smaller businesses. By bypassing traditional and potentially costly distribution channels, smaller companies can more easily source and utilize the extract. The rising demand for natural ingredients, particularly in cosmetics and dietary supplements, further fuels this growth. Online platforms enable targeted marketing campaigns that reach specific customer segments interested in Dunaliella salina and its applications, resulting in faster order processing and reduced lead times.

Pricing Tier/Value Insights

How Did the Mid-Tier Standardized Ingredient Segment Lead the Market in 2024?

The mid-tier standardized ingredient segment has maintained a dominant position in the market due to its balance of quality and cost-effectiveness, appealing to a wider range of consumers and industries compared to higher-priced premium options or lower-cost, lower-quality alternatives. This segment caters to various industries, including food and beverage, cosmetics, and dietary supplements, offering a standardized level of quality and purity that meets many application needs while remaining more affordable than top-tier extracts. Improved cultivation and extraction techniques have led to more efficient production.

The premium high-purity/certified grade segment is the fastest-growing in the market, driven by an increasing consumer preference for natural, high-quality ingredients, especially in cosmetics and nutraceuticals. This segment benefits from stringent quality standards that align with the rising demand for clean-label products and the desire for scientifically validated health benefits. The growing focus on sustainable cultivation practices also appeals to environmentally conscious consumers, further boosting demand for certified grades.

Packaging Type and Size Insights

Why Did the Bulk Drums (100–200 Kg) Segment Dominate the Dunaliella Salina Extract Market in 2024?

The bulk drums (100–200 kg) segment dominated the market in 2024. This dominance is primarily due to the industrial scale of production and end-use applications, along with considerations for cost-effectiveness and product stability. Purchasing and transporting xtract in bulk formats is significantly more cost-effective than using smaller packaging units. This approach reduces manufacturing and logistics expenses. Industries that require large volumes of the extract as raw material find bulk packaging to be the most suitable and efficient option for transportation and storage, preserving product quality and stability over longer durations compared to smaller, frequently opened containers.

The cold chain packaging is expected to be the fastest-growing segment of the market. This growth is mainly driven by increasing consumer demand for natural ingredients, health and wellness trends, and advancements in packaging technology. Cold chain packaging maintains optimal temperatures throughout the supply chain, ensuring product stability and preventing degradation. Additionally, it reinforces the perception of premium, high-quality products, aligning with consumer expectations for purity and safety. Innovations in sustainable and eco-friendly packaging materials address consumer concerns about environmental impact.

Customization and Service Offering Insights

What Made the Standard Formulations Segment Lead the Dunaliella Salina Extract Market in 2024?

The standard formulations segment is characterized by customization and service insights, driven by the growing demand for tailored solutions in various industries like cosmetics, nutraceuticals, and food. Companies are leveraging their expertise in beta-carotene extraction and formulation to offer customized solutions that meet the specific needs of their clients, leading to a competitive edge and market dominance. Different industries require specific formulations with varying concentrations and purities of beta-carotene, and customization allows companies to cater to these unique needs. The market is increasingly competitive, with companies differentiating themselves through specialized offerings and superior customer service.

The co-development and R&D partnerships segment is rapidly growing in the market due to the increasing demand for personalized solutions and the unique properties of the extract, making it ideal for various applications. Both consumers and businesses are seeking customized products and solutions tailored to their specific needs, which drives demand for this segment. This growth is further fueled by advancements in cultivation and extraction techniques, as well as rising awareness of its health benefits, making it more accessible for various applications.

Value Chain Analysis

- Research and Development (R&D)

R&D efforts in the market primarily concentrate on improving extraction methods, developing new product formulations, and exploring the full potential of bioactive compounds.

Key Players: Algalimento SL, DIC Corporation, Cyanotech Corporation, Seagrass Tech Private Limited

- Clinical Trials and Regulatory Approvals

Clinical trials are conducted to validate the efficacy and safety of the extract for specific applications, while regulatory approvals from organizations like the FDA and EFSA ensure its safety for human consumption, thereby enhancing market growth and consumer confidence.

Key Players: Plankton Australia Pty Ltd, Hangzhou OuQi Food Co., Ltd., Nutragreenlife Biotechnology Co., Ltd.

- Formulation and Final Dosage Preparation

Dunaliella Salina extract is formulated (e.g., lipid-soluble, carotenoid-rich, or whole biomass) to meet specific needs. It is available in various forms, such as powders, capsules, and oils, suitable for applications in food, nutraceuticals, cosmetics, and more.

Key Players: Algalimento SL, Seagrass Tech Private Limited, Hangzhou OuQi Food Co., Ltd., Nutragreenlife Biotechnology Co., Ltd.

- Packaging and Serialization

Packaging protects product quality through airtight, light-protective containers and barrier materials for powders and capsules. Serialization employs unique identifiers, such as 2D data matrix codes or RFID tags, for traceability and authentication, thereby enhancing quality and integrity.

Key Players: Alpha Packaging, Gerresheimer AG, Berry Global Group, Inc., OPTEL Group, Amcor plc

- Distribution to Hospitals and Pharmacies

Dunaliella Salina extracts are primarily sold in pharmacies as health supplements for eye health and antioxidant support. Their use in hospitals is mainly limited to research on potential therapeutic applications, such as wound healing, liver protection, and myocardial ischemia/reperfusion injury.

Key Players: Algalimento SL, Amway, BlueBio Tech Group, Plankton Australia Pty Ltd

- Patient Support and Services

Patient support in the market emphasizes consumer education about the benefits of Dunaliella Salina extracts, particularly as a natural source of beta-carotene. The focus is also on ensuring product quality and safety through certifications such as organic, ISO, Kosher, Halal, and GMP.

Key Players: Algalimento SL, Seagrass Tech Private Limited, Plankton Australia Pty Ltd

Dunaliella Salina Extract Market Companies

- Algalif

- Algatechnologies

- AlgaEnergy

- Cyanotech Corporation

- Fermentalg

- DIC Corporation (DIC)

- DSM-Firmenich (DSM Nutritional Products)

- Kemin Industries

- Corbion

- GNT Group

- DDW The Color House (DDW)

- Algomega

- Valensa International

- TMO Group

- Acadian Seaplants (Acadian)

- Azantis

- AlgaeCytes/AlgaeCyte Biotech

- AlgaPrime

- Uniquium/UniCarotenoids (specialty carotenoid manufacturers)

Leaders' Announcements

- In March 2023, Nutragreenlife Biotechnology Co., Ltd. established Lushi County Shanyangde Biotechnology Co., Ltd. to enhance product research, expand production capabilities, and strengthen its new product R&D and production layout, and further accelerate its factory-direct sales strategy with provides customers with more timely, efficient, and convenient services and support. (Source: https://www.nutragreen-extracts.com)

Recent Developments:

- In December 2023, Sun Chemical announced the expansion of its SunPURO Naturals product line, introducing SunPURO Natural Carotene O N70-2317, a cultured beta carotene from Dunaliella salina, and SunPURO Natural Carotene BTO N70-2527, a natural orange-red colorant produced via biofermentation. These additions respond to the beauty industry's demand for responsibly sourced natural colorants, emphasizing sustainability and lower environmental impact.(Source: https://www.echemi.com)

- In February 2025, A4F Algafuel joined the European CoPilot project through the Pilot4Algae subproject, aiming to develop the Pilots4U digital platform for promoting bioeconomy pilot infrastructures and positioning the Lisbon Experimental Unit in a European database for entrepreneurs, allowing them to access to scale up their innovative processes. (Source: https://a4f.pt)

Segments Covered in the Report

By Product Type

- Crude biomass (dried)

- Powdered extract (standardized)

- Liquid extract/concentrate

- Oil-based extract (carrier oils)

- Beta-carotene-standardized extract (various % w/w)

- Mixed-carotenoid extract

- Colorant grade (food color)

- Pharmaceutical grade isolate (high-purity carotenoids)

- Feed grade formulation

- Cosmetic grade formulation

By Formulation/Finished Product Format

- Bulk powder

- Microencapsulated powder

- Syrup/liquid concentrate

- Oil suspension

- Emulsion (for cosmetics/foods)

- Capsule/tablet (finished supplement)

- Serum/cream (cosmetic finished)

- Extruded premix (feed additive)

- Sachet/single-serve

By Extraction and Processing Technology

- Solvent extraction (food-grade solvents)

- Supercritical CO2 extraction

- Aqueous/water-based extraction

- Enzymatic-assisted extraction

- Ultrasonic/sonication-assisted extraction

- Mechanical cold-press/expeller processing

- Downstream purification (chromatography/crystallization)

- Microencapsulation technologies (spray-drying, complex coacervation)

By Application/End-use Industry

- Dietary supplements (capsules, softgels, tablets)

- Functional foods and beverages (fortified foods, drinks)

- Natural food coloring (bakery, confectionery, dairy)

- Cosmetics and personal care (anti-ageing, sunscreens, colorants)

- Pharmaceuticals and nutraceutical therapeutics (provitamin A, antioxidant therapies)

- Animal feed and aquaculture (pigmenting agents for salmon/shrimp/poultry)

- Agricultural biostimulants/foliar sprays

- Research and laboratory reagents (standards, assay kits)

- Industrial applications (natural dyes, textiles, specialty chemicals)

By Distribution Channel

- Direct sales (B2B)

- Ingredient distributors/brokers

- Online ingredient marketplaces

- Contract manufacturing/private label

- ODM/OEM partnerships

- Specialty chemical suppliers

- Feed ingredient suppliers

By Packaging Type and Size

- Bulk drums (100–200 kg)

- Intermediate bulk containers (IBCs)

- Retail jars/bottles

- Sachets/single-serve

- Tubs/pails

- Aseptic liquid totes

- Cold chain packaging (for temperature-sensitive grades)

By Pricing Tier/Value Segment

- Commodity/low-cost grade

- Mid-tier standardized ingredient

- Premium high-purity/certified grade

- Custom R&D/specialty formulations (high-margin)

By Customization and Service Offering

- White-label finished products

- Custom concentration and formulation services

- Co-development and R&D partnerships

- Toll extraction and contract processing

- Blending and premix services

- Standard formulations

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting