What is the E-fuse Market Size?

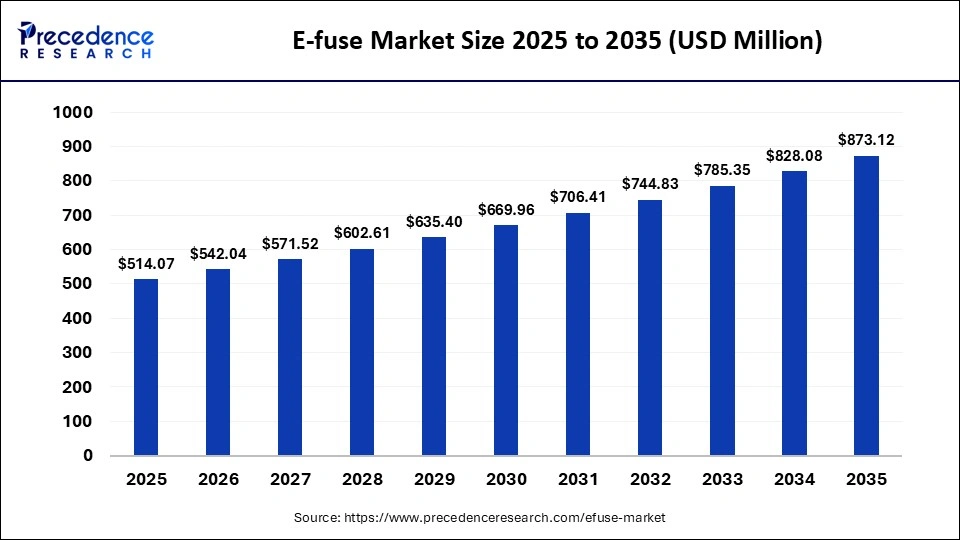

The global e-fuse market size accounted for USD 514.07 million in 2025 and is predicted to increase from USD 542.04 million in 2026 to approximately USD 873.12 million by 2035, expanding at a CAGR of 5.44% from 2026 to 2035. This market is growing due to rising demand for advanced circuit-protection solutions in increasingly compact, high-power electronic devices.

Market Highlights

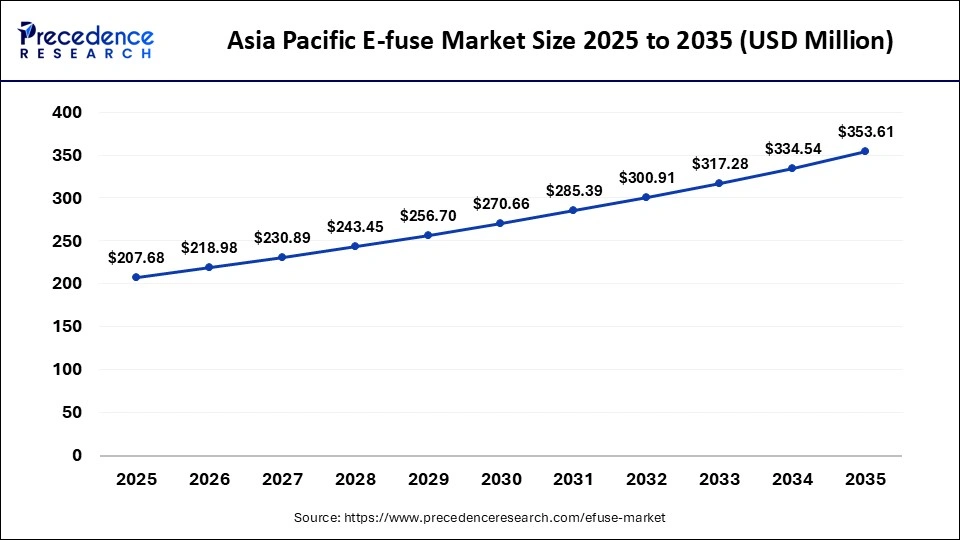

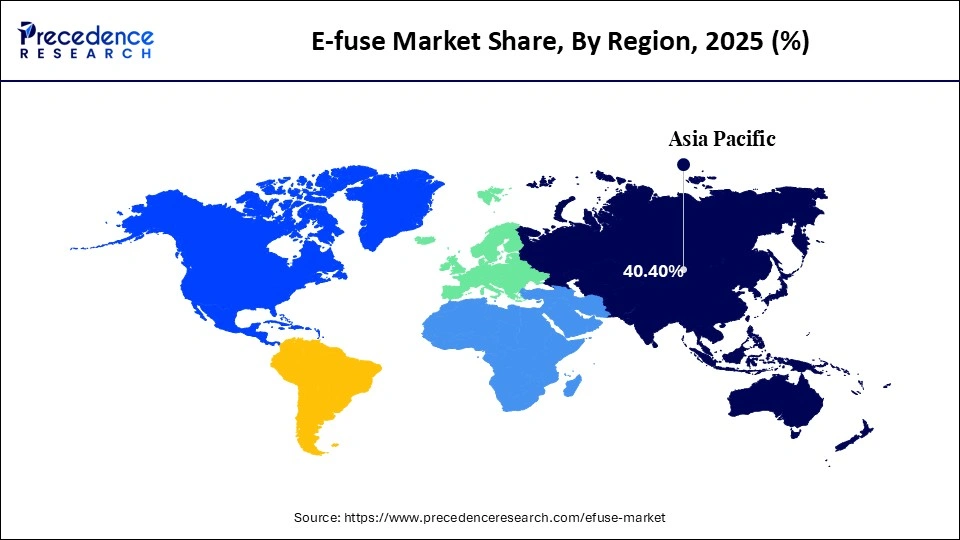

- The Asia Pacific accounted for the largest market share of 40.4% in 2025 and is set to grow at the fastest CAGR of 6.5% from 2026 to 2035.

- North America is expected to rise at a notable CAGR between 2026 and 2035.

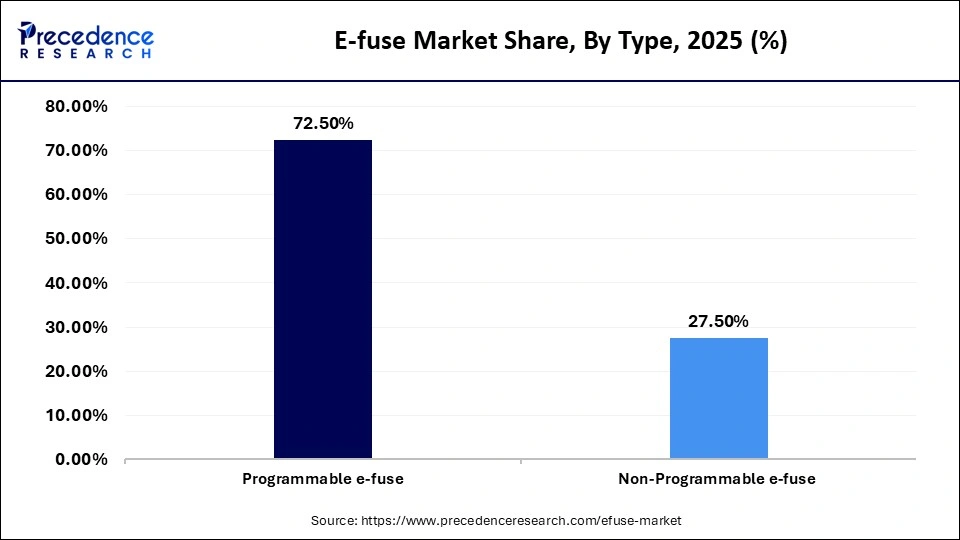

- By type, the programmable e-fuse segment has contributed the largest market share of 72.5% in 2025.

- By type, the non-programmable e-fuse segment is growing at a CAGR of 5.8% between 2026 and 2035.

- By voltage rating, the 5V-20V segment held the largest market share of 43.5% in 2025.

- By voltage rating, the above 40V segment is poised to grow at a CAGR of 5.7% between 2026 and 2035.

- By application, the consumer electronics segment captured the highest market share of 32.5% in 2025.

- By application, the automotive electronics segment is growing at a CAGR of 5.5% between 2026 and 2035.

- By distribution channel, the direct sales segment accounted for the biggest market share of 56.8% in 2025.

- By distribution channel, the online sales segment is expanding at a strong CAGR of 5.6% between 2026 and 2035.

Market Overview

Is the E-fuse Market Powering the Next Wave of Electronics?

The e-fuse market is growing rapidly as manufacturers increasingly shift toward intelligent, secure, and dependable electronic protection technologies. Electronically controlled fuses are becoming essential as compact, high-density electronics are deployed across consumer devices, automotive electronics, and industrial control systems. Traditional mechanical fuses are limited in response speed and diagnostics, while e-fuses enable programmable current limiting, fault detection, and real-time monitoring.

Growing investments in advanced power management integrated circuits and the industry-wide push toward smaller, more efficient circuit designs further support market expansion. These trends are particularly visible in applications where board space is limited, and protection accuracy directly affects system reliability.

Will E-fuse Become the Backbone of Next-Gen Electronics?

Future demand for e-fuse solutions is expected to surge as high-density circuit devices require protection that is faster, smarter, and more precise. Modern electronic systems operate with tighter voltage margins and higher power density, which increases the risk of short circuits, inrush current damage, and thermal stress. This compels manufacturers to develop programmable and miniaturized e-fuses that can dynamically adjust protection thresholds based on load behavior.

The accelerating electrification of mobility, rising adoption of IoT-enabled devices, and expansion of data- and power-intensive infrastructure are reinforcing this demand. The shift toward self-healing, resettable, and energy-efficient protection architectures across industries further strengthens long-term market prospects.

Key Technological Shifts

- Transition from traditional thermal fuses to intelligent electronic fuses with real-time monitoring and auto-reset capabilities.

- Integration of advanced MOSFET and current sensing technologies to improve precision, response time, and safety.

- Rise in programmable protection features enabling adjustable current limits, soft start, and load diagnostics.

- Growing adoption of miniaturized, high-power e-fuse modules to support compact consumer electronics and EV architectures.

E-fuse Market Outlook

- Industry Growth Overview: The e-fuse industry is growing steadily as demand rises for smarter protection in compact, high-power electronics. Expanding use in EVs, data centers, and consumer devices is driving the adoption of programmable and reliable fuse solutions.

- Sustainability Trends: The market is shifting toward resettable, long-life e-fuses that help reduce electronic waste. Energy-efficient designs and eco-friendly manufacturing practices are becoming key priorities for companies.

- Global Expansion: Global reach is widening as manufacturers strengthen their presence in the Asia Pacific, North America, and Europe. Rapid electrification in emerging markets and new regional partnerships are accelerating adoption worldwide.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 514.07 Million |

| Market Size in 2026 | USD 542.04 Million |

| Market Size by 2035 | USD 873.12 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.44% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Voltage Rating, Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Type Insights

Why Did the Programmable E-fuse Segment Dominate the Market?

Programmable E-fuse: This segment dominates the market with a 72.5% share because of its versatility, cutting-edge security features, and extensive use in contemporary small electronics. They are crucial for next-generation devices because they provide real-time monitoring, automatic reset, and adjustable current limits. Programmable variations are becoming more popular in industries such as consumer electronics, telecom, and industrial automation to improve circuit safety and reliability.

Non-Programmable E-fuse: This segment is experiencing the fastest growth at 5.8% because they are easy to use, reasonably priced, and suitable for applications requiring basic protection. In low- to medium-power devices where cost and portability are important considerations, these fuses are quickly adopted. They are perfect for new electronics in developing markets due to their dependability and simplicity of integration.

Voltage Rating Insights

Why Did the 5V-20V Voltage Segment Dominate the E-fuse Market in 2025?

5V-20V: This category dominates with 43.5% market share, as it is compatible with the widest range of common electronic devices. This range is favored for wearables, computing peripherals, smartphones, and portable devices, all of which account for enormous global manufacturing volumes. The increasing integration of power-efficient components has further bolstered demand in this voltage.

Above 40V: The segment is growing fastest, at 5.7%, as high-voltage systems are used more frequently in sectors such as renewable energy, automotive, and industrial automation. Advanced e-fuses are essential for these applications because they provide robust protection against electrical faults and high-current spikes. The expansion of solar inverters and electric vehicles is accelerating uptake in this category.

Application Insights

What Made the Consumer Electronics Segment Dominate the Market?

Consumer Electronics: The segment dominates the application landscape, with a 32.5% share, driven by the large scale production of smartphones, laptops, wearables, and smart home devices. These products require compact, reliable, and programmable e-fuses to support modern miniaturized circuit designs. The continuous launch of high-performance gadgets keeps this segment at the forefront of demand.

Automotive Electronics: This segment is the fastest-growing segment at 5.5% propelled by digital cockpit technologies, advanced driver assistance systems, and growing EV adoption. More sensitive high power electronic modules are used in vehicles today, necessitating accurate and quick protection. The market for automotive-grade e-fuses is growing due to the electrification trend.

Distribution Channel Insights

Why Did the Direct Sales Segment Dominate the Market?

Direct Sales: The segment led the e-fuse market by accounting for a 56.8% market share. This dominance is driven by the technical complexity of e-fuse integration and the need for close coordination between manufacturers and end users during product selection and deployment. Large OEMs in automotive electronics, industrial automation, power management, and consumer electronics often require customized e-fuse specifications related to current thresholds, thermal limits, fault response timing, and programmability.

Direct sales channels enable suppliers to provide engineering support, design-in assistance, qualification samples, and long-term supply agreements, which are critical for high-volume and safety-sensitive applications. This channel is also preferred for projects that require compliance validation, reliability testing, and integration with broader power-management architectures, reinforcing its leadership position in the market.

Online Sales: The segment is expanding at the fastest rate, with growth of 5.6%, supported by the increasing digitization of component procurement and the rising number of small and mid-sized buyers sourcing electronic components through digital platforms. Online distribution channels allow startups, system integrators, contract manufacturers, and design engineers to access a wide range of e-fuse variants without lengthy procurement cycles.

These platforms provide immediate access to datasheets, reference designs, simulation tools, and real-time availability, which accelerates prototyping and early-stage product development. Growth is further supported by the expansion of e-commerce portals operated by authorized distributors and manufacturers, offering reliable logistics, transparent pricing, and global reach. As electronics design cycles shorten and decentralized innovation increases, online sales continue to gain traction as a flexible and efficient procurement channel for e-fuse solutions.

Regional Insights

What is the Asia Pacific E-fuse Market Size?

The Asia Pacific e-fuse market size is expected to be worth USD 353.61 million by 2035, increasing from USD 207.68 million by 2025, growing at a CAGR of 5.47% from 2026 to 2035.

What Made Asia Pacific Dominate the E-fuse Market in 2025?

Asia Pacific dominates the e-fuse market due to its extensive electronics manufacturing ecosystem and sustained demand for advanced circuit protection technologies. The region hosts large-scale production of smartphones, consumer appliances, automotive electronics, and industrial automation equipment, all of which require compact and reliable protection components.

Rapid technological advancement, expanding semiconductor fabrication capacity, and continuous miniaturization of electronic products are driving strong adoption of programmable e-fuses. Increasing investment in power management components and local semiconductor supply chains further reinforces the region's leading position.

India E-fuse Market Trends

India is emerging as a significant growth market as demand for smart, energy-efficient devices increases and domestic electronics manufacturing continues to expand. Initiatives such as Production Linked Incentive schemes support local assembly of consumer electronics, automotive components, and power electronics, which directly increases demand for reliable circuit protection.

Rising electric vehicle adoption and the integration of power electronics into charging infrastructure further accelerate e-fuse usage. The rapid expansion of consumer electronics, automotive electronics, and industrial equipment manufacturing plays a central role in driving market growth within the country.

Why Is North America Growing Rapidly in the E-fuse Market?

North America is growing rapidly, with notable market share, backed by widespread use of high-reliability circuit protection across industries such as digital devices, data infrastructure, and next-generation mobility. The demand for programmable e-fuses is increased by the region's high safety standards, quick technological advancements, and rising investment in sophisticated power systems. It's a quick technological advancement and a rising investment in sophisticated power systems. Its quick expansion is fueled by ongoing modernization in energy and industrial applications.

U.S. E-fuse Market Trends

The United States is driving regional expansion as intelligent power management solutions integrate across both consumer and industrial applications. Growing reliance on cloud systems. EV technologies and advanced electronics are driving the need for precise, programmable circuit protection. Strong innovation capabilities and continuous modernization efforts support sustained demand.

Why Is Europe Showing Steady Growth in the E-fuse Market?

Europe shows steady growth driven by increasing modernization across key electronic applications and a strong emphasis on dependable, energy-efficient power systems. Regulatory focus on safety compliance and product reliability encourages manufacturers to adopt advanced protection technologies that offer diagnostics and controlled fault response. The integration of smart e-fuse solutions is supported by the region's adoption of next-generation device architectures in automotive electronics, industrial automation, and renewable energy systems. Growing investment in digital infrastructure and electrified transport continues to support market expansion.

Germany E-fuse Market Trends

Germany is advancing in the market as industries adopt sophisticated electronic protection solutions to support high-performance systems. Strong demand for precision engineering and advanced automation is pushing the use of programmable e-fuses. Continuous upgrades in manufacturing and energy systems contribute to consistent growth.

Why Is Latin America Having a Moment in the E-fuse Market?

Latin America is experiencing growth as the industrial and electronics sectors modernize their protection frameworks to meet higher safety and efficiency standards. Manufacturers across the region are increasingly adopting advanced e-fuse solutions to protect modern power electronics and connected devices. Rising interest in energy-efficient systems, smart appliances, and automation is encouraging wider use of programmable protection components. Initiatives aimed at strengthening local electronics production capacity further support market development.

Brazil E-fuse Market Trends

Brazil is seeing increased uptake of e-fuse technologies as demand grows for dependable protection in consumer electronics, industrial machinery, and power distribution equipment. Expansion of smart electronics usage, combined with improvements in regional manufacturing capabilities, is driving adoption. Investments in industrial automation and digital transformation across manufacturing, energy, and infrastructure sectors also contribute to stronger demand for intelligent circuit protection solutions.

What Is the MEA E-fuse Market Status?

The Middle East and Africa region is expanding steadily due to rising demand for robust electronic protection in industries undergoing modernization. Growth in digital devices, renewable energy installations, power infrastructure upgrades, and industrial automation is supporting broader adoption of e-fuse solutions. Increasing focus on operational safety, system reliability, and high-performance power components further strengthens this trend across the region.

UAE E-fuse Market Trends

The UAE is advancing rapidly in the e-fuse market as the country deploys advanced electronic systems across consumer applications, industrial processes, and national infrastructure projects. Significant investment in digital transformation, smart infrastructure, and modern power systems is accelerating the use of programmable e-fuses. Adoption is particularly strong in applications requiring precise current control, remote diagnostics, and high reliability. The national push toward smart technologies and energy-efficient systems continues to intensify demand for advanced electronic protection solutions.

Top Companies in the E-fuse Industry

- Littelfuse, Inc.

- Toshiba Electronic Devices & Storage Corporation

- Semiconductor Components Industries, LLC

- Texas Instruments Incorporated

- Alpha and Omega Semiconductor

- Analog Devices, Inc.

- Diodes Incorporated

- Bel Fuse Inc.

- SCHURTER AG

- Eaton Corporation plc

- Siemens AG

- ABB Ltd

- Mersen S.A

- Schneider Electric SE

- Fuji Electric Co., Ltd

- Conquer Electronics Co., Ltd

- General Electric

- RBC Bearings

- SIBA Fuses

- Fujikura Ltd

- Hager Group

- Hubei Longxin Electric Co., Ltd

Recent Developments

- In December 2025, Toshiba Electronic Devices & Storage Corporation announced the launch of its new 40V TCKE 6 series eFuse ICs, designed for enhanced overcurrent and overvoltage protection in compact designs. The solution targets industrial, consumer, and battery-powered devices needing fast, precise circuit protection.(Source:https://toshiba.semicon-storage.com)

- In August 2025, Alpha and Omega Semiconductor launched the AOZ17517 QI 60A eFuse, which built the high-reliability 12V power rails used in cloud servers, AI processors, and telecom systems. It offers programmable protection, faster fault isolation, and improved thermal performance.(Source: https://investor.aosmd.com)

- In July 2025, Fortune advanced technology introduced its 63V high voltage reusable eFuse FA7660, featuring reverse current protection for safer and more stable power supply design. This product supports industrial equipment, power modules, and communication devices.(Source: https://www.fortuneadvanced.com)

Segments Covered in the Report

By Type

- Programmable e-fuse

- Non-Programmable e-fuse

By Voltage Rating

- Below 5V

- 5V-20V

- 20V-40V

- Above 40V

By Application

- Consumer Electronics

- Battery Management Systems

- SSDs & Storage Devices

- Automotive Electronics

- Telecom & Networking

- Industrial Equipment

- Data Centers & Servers

By Distribution Channel

- Direct Sales (OEM)

- Distributors/Wholesalers

- Online Sales

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting