Educational Technology Market Size and Forecast 2025 to 2034

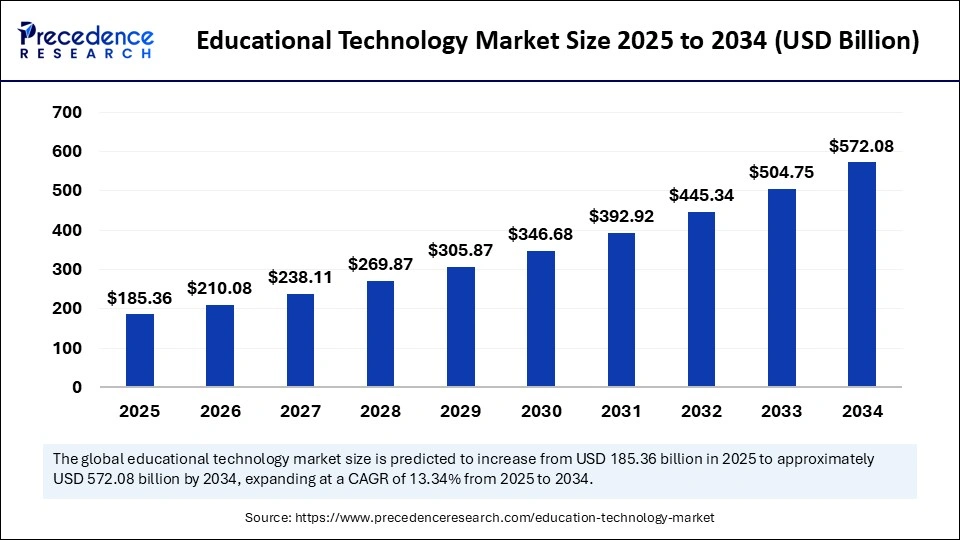

The global educational technology market size was calculated at USD 163.54 billion in 2024 and is predicted to increase from USD 185.36 billion in 2025 to approximately USD 572.08 billion by 2034, expanding at a CAGR of 13.34% from 2025 to 2034. The growing need for accessible and flexible learning solutions is driving demand for advanced technologies in the education industry, leading to global market growth. The market is also experiencing growth with supportive government initiatives and investments in digital education.

Educational Technology Market Key Takeaways

- In terms of revenue, the global educational technology market was valued at USD 163.54 billion in 2024.

- It is projected to reach USD 572.08 billion by 2034.

- The market is expected to grow at a CAGR of 13.34% from 2025 to 2034.

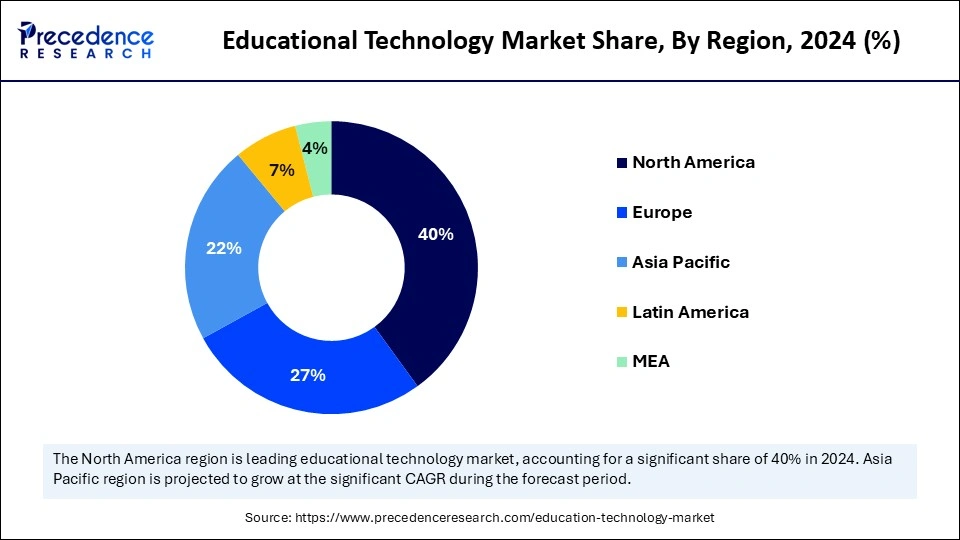

- North America dominated the global educational technology market with the largest share of 40% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 20245 to 2034.

- By product type, the software segment contributed the biggest market share of 45% in 2024.

- By product type, the hardware segment is expected to grow at a notable CAGR between 2025 and 2034.

- By end-user, the K-12 schools segment captured the highest market share of 50% in 2024.

- By end-user, the corporate/professional learning segment will grow at a significant CAGR between 2025 and 2034.

- By technology, the artificial intelligence (AI) in education segment held the maximum market share of 30% in 2024.

- By technology, the blockchain in education segment will grow rapidly between 2025 and 2034.

- By delivery mode, the online learning platforms segment generated the major market share of 60% in 2024.

- By delivery mode, the mobile learning (m-learning) segment is expected to grow at a notable CAGR between 2025 and 2034.

Market Overview

Educational technology (EdTech) refers to the integration of technology into education to facilitate learning and improve academic outcomes. It encompasses digital tools, platforms, hardware, and software designed to enhance teaching and learning processes across various educational levels. The global education technology market is experiencing spectacular growth with several factors like the need for online and hybrid learning tools, rising innate userbase, government investments in digital education initiatives, government support for digital transformation, need for affordable online education, and the acceptance of cutting-edge technologies in academic firms.

Major Key players like Google and Microsoft are providing speculative AI tools like Century Tech, big, and ed tech to enhance personalized learning while harvesting a broad amount of data and turning education into monetizable widgets and digital badges.

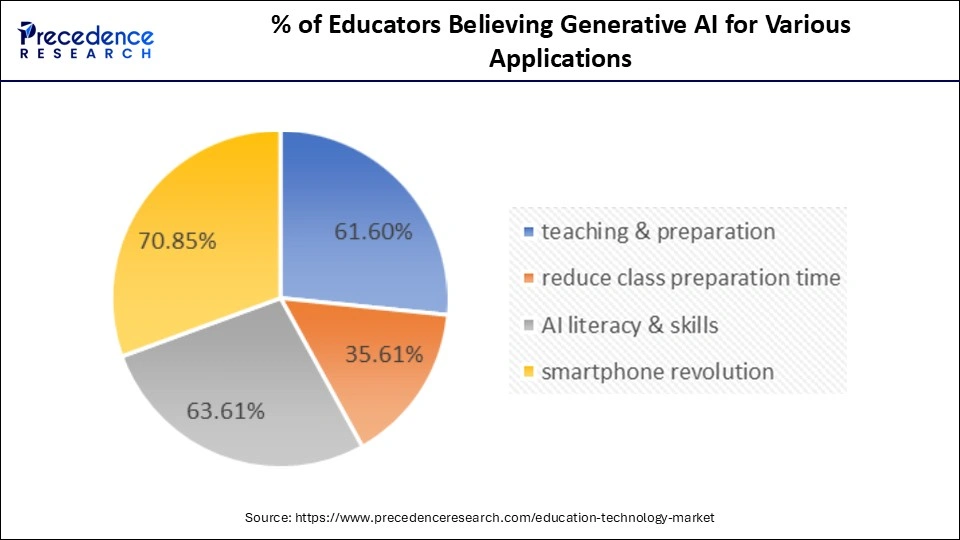

Generative AI and Its Ongoing Influence on Educational Professionals

(Source: https://www.teamleaseedtech.com)

- The TeamLease EdTech survey reported that 61.60% educators have started using Generative AI tools for teaching and preparation, with advantages of adoption and perceived in education delivery and engagements.

- The educators using Generative AI tools for reducing class preparation time are 35.61%.

- Educators highlight the use of Generative AI to emphasize that the growing requirement of AI literacy and skills is 63.61%.

- 70.85% educators are aligning with Generative AI influence on the smartphone revolution.

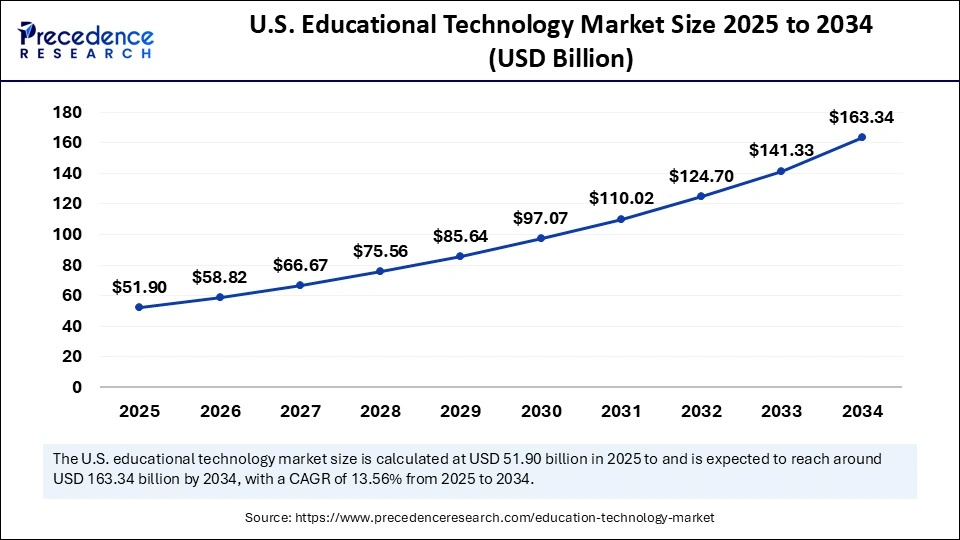

U.S. Educational Technology Market Size and Growth 2025 to 2034

The U.S. educational technology market size was evaluated at USD 45.79 billion in 2024 and is projected to be worth around USD 163.34 billion by 2034, growing at a CAGR of 13.56% from 2025 to 2034.

North America Educational Technology Market

North America dominates the global educational technology market, driven by the region's well-established education sector and widespread accessibility of novel technologies. North America has experienced significant growth adoption of AI, VR, and AR with a strong focus on personalized and flexible learning. Regional strong digital infrastructure enabling the adoption of cutting-edge technologies in the education industry. Rapid innovations in immersive technologies and a surge of skill-based learning and accessible designs are transforming the market.

The U.S. is a major player in the regional market, growth driven by the rapid adoption of hybrid learning models and immersive technologies like AR and VR. The strong focus on innovations and the adoption of AI and automation is fueling the educational technology industry in the country. The ongoing innovations in data-driven insights, micro-credentialing, and personalized learning platforms are contributing to market expansion.

Asia Pacific Educational Technology Market

Asia Pacific is the fastest-growing region in the global market, driven by regional broad educational sector and adaptability of cutting-edge technologies. The increased adoption of digital technologies, enhanced internet access, and government initiatives and supporting digital literacy. The large use of mobile devices in countries like China and India is fueling the growth of EdTech. Additionally, the growing preference for personalized learning solutions is catering to individual students to get access to advanced learning with affordability.

China's Market Trends

China is a major player in the regional market, contributing to growth due to the country's government initiatives for EdTech, increasing internet and smartphone penetration, and robust focus on the adoption of AI. The government of China is investing heavily in digital infrastructure. China's large population and focus on innovative technologies are fostering market growth.

India's Government Initiatives to Lead the Market

India is the second-largest country, leading the regional market, due to the country's vast digitalization and focus on internet and smartphone penetration. The large student population and vast educational system are the key factors leveraging the adoption of digital technologies in education firms. Additionally, the government support and policies like the DIKSHA platform and PM e-VIDYA initiatives are promoting the use of digital education technologies.

Several initiatives like Make AI for India and Make AI Work for India are leveraging to achieve the Indian goals of becoming an AI industry leader. The establishment of three artificial intelligence centers of excellence (CoE) worth a budget allocation of INR 255 Cr as per the Interim Budget of 2024-25, contributing to enhancing the adoption of AI educational tools in India.

- According to the TeamLease EdTech survey published in January 2024, AI has been allocated by 64.87% of 6,000 educators for enhancing learning experiences. A survey has reported that more than 6,000 Indian educators have recognized the potential of Generative AI in education transformation. (Source: https://www.teamleaseedtech.com)

What are the Key Trends in the Global Educational Technology Market?

- Growth in Internet Userbase: The use of the internet in daily life has increased, offering significant growth opportunities for education technology (EdTech) stakeholders for online tutoring and preparation of competitive exams.

- Demand for personalized and Adaptive Learning: The growing need for personalized learning has boosted the adoption of AI for analyzing students' learning style, preferences, progress, and interests to create customized learning ways.

- Gamification and Immersive Technologies: The adoption of immersive technologies like virtual reality (VR) and augmented reality (AR) has increased for better learning experiences. The growing surge in online learning, engagement, and fun is transforming educational technology platforms.

- Workflow Developments and Corporate Training: Various corporate organizations are focusing on the adoption of digital technologies for corporate training and workflow developments for better educational experiences and skill enhancements.

- Demand for Affordable Online Education: The growing cost of traditional education is leading to a shift toward affordable online education with better quality, education accessibility to students from various income categories.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 572.08 Billion |

| Market Size in 2025 | USD 185.36 Billion |

| Market Size in 2024 | USD 163.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.34% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End-User, Technology, Delivery Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Internet and Smartphone Penetration

The increased internet accessibility and smartphone penetration are the major drivers for the adoption of cutting-edge technologies in the educational industry. Digital leading platforms are gaining significant accessibility that enabling studies to acquire novel skills, knowledge in remote and hybrid modes. Advancements in smartphone technologies are allowing access to educational content, courses, and apps for students, helping to make learning more flexible, convenient, and diverse. The digitalization efforts are emerging adoption of education firms on the internet and smartphone technologies. Additionally, the government and institutions' initiatives in promoting digital literacy are harnessing the growth of EdTech solutions across the globe.

Restraint

High Cost

The cutting-edge technological adoption in education requires high initial investments for installation and integration with smart classroom hardware. The classroom hardware, like tablets, projectors, and whiteboards, is very expensive, making them less accessible for many institutions. The public and low-income schools face high challenges in the adoption of these technologies. Additionally, the cost associated with software updates, maintenance, and technical support can further hinder their adoption across small or budget-conscious institutions.

Opportunity

Government Initiatives

The technological adoption and infrastructure developments of educational firms are driven by strong government initiatives, support, and policies promoting digital education. Several polices like the National Education Policy (NEP) 2020, digital infrastructure for knowledge sharing (DIKSHA), national digital education architecture (NDEAR), PM eVIDYA, artificial intelligence centers of excellence (CoE), national education alliance for technology (NEAT), and many more are contributing to expanding digital education portfolios. Government support has boosted the accessibility of quality education for students in the low-income category, disadvantaged students, and rural areas. Government policies are enabling studies to gain access to personalized experiences and online courses to enhance their skills, knowledge, and capabilities.

Product Type Insights

What Made the Software Lead the Educational Technology Market in 2024?

The software segment led the market in 2024, due to a rapid shift towards online and hybrid models for educational acceleration. Software offers scalable, accessible, and sophisticated platforms to manage courses, facilitates personal and remote learning, and processes tracking. The growing emphasis on the interaction of AI, interactive content, analytics, and mobile accessibility to enhance user experiences, engagements, and offer valuable data is contributing to the segment's growth. Top players, including Oracle, Microsoft, SAP, Google, and PowerSchool Group LLC, are offering comprehensive software for educational learning.

The hardware segment is expected to grow fastest over the forecast period, due to increased adoption of interactive learning tools and devices. Hardware like interactive displays, laptops, and tablets, for required and tangible infrastructure for digital learning, is highly adopted across the global educational industry. Rowing investments from instates for developing a strong digital learning ecosystem and amplification by government support in the digital divide have boosted demand for hardware learning tools. Both hybrid and remote learning settings are highly standardized by these tools.

End-User Insights

Which End-User Dominates the Educational Technology Market?

The K-12 schools segment dominated the market in 2024, due to increased adoption of digital learning tools and developments of online undergraduate programs. The adoption of solutions like assessment tools, learning management systems (LMS), and interactive platforms is high in K-12 schools. These solutions help to improve student engagement, facilitate personalized, remote, and hybrid learning, and streamline operations. The supportive higher participation rates in upcoming economies and significant investments in digital infrastructure by governments are fostering this segment across the globe.

The corporate/professional learning segment is the second-largest segment, leading the market due to increased focus of corporations/professionals on workflow development and corporate training. The growing need for lifelong learning and constant skill development in the corporate sector is driving a surge towards digital educational platforms. Several organizations are investing heavily in digital platforms for upskilling and reskilling their employees. The need for flexible, cost-effective, on-demand training and AI-integrated tools for personalized learning pathways and tracking processes is contributing to the segment's growth.

Technology Insights

Which Technology Dominates the Educational Technology Market?

In 2024, the artificial intelligence (AI) in education segment dominated the market, due to increased adoption of AI in educational settings. AI is an innovative and cutting-edge technology that offers personalized learning experiences by automating administrative tasks and adaptive platforms for enhancing learning efficiency. AI enables intelligent tutoring systems to help students more and enhance performance. The increased demand for individualized instruction across higher education, K-12 schools, and corporate training is driving the adoption of scalable cloud-based AI solutions. Ai-power tools are versatile and highly sought-after technology that contribute to efforts in achieving educational outcomes.

- According to the data from AIPRM, the global market of AI in education was estimated to be worth $2.5 billion in 2022 and was expected to rise by more than double by 2025. (Source: https://www.aiprm.com)

The blockchain in education segment is expected to lead the market over the forecast period, driven by rapid use of digital certifications, micro-credentials, and tamper-proof student records. Blockchain plays a crucial role in offering a secure, transparent, and decentralized system. This system helps educational settings by managing academic records, protecting digital content, verifying credentials, and enabling lifelong learning. The ability of blockchain solutions to protect from fraud and administrative burdens makes them suitable in education. Blockchain is enabling innovation and effectiveness in the EdTech space.

Delivery Mode Insights

How Online Learning Platforms Dominated the Educational Technology Market in 2024?

In 2024, the online learning platforms segment dominated the market due to its widespread accessibility and flexibility. The growing need for flexible and scalable learning platforms, especially in rural, remote, and hybrid areas, is transforming the adoption of online learning platforms. This platform helps to engage learning solutions across academic, professional, and corporate sectors. The affordability of these platforms is making them ideal for students with a limited budget. Use of online learning platforms has increased for student training and employee upskilling.

The mobile learning (m-learning) segment is the second-largest segment, leading the market due to widespread smartphone adoption. The growing internet and smartphone penetration are the major reasons behind the increased adoption of mobile learning (m-learning). The ability of this platform to offer accessible, flexible, and engaging learning experiences on mobile devices makes it convenient for people with limited hardware access. Advancements in AI-driven personalized and large-scale shift toward digital and remote education, with cost-effectiveness, fuel segment expansion.

Value Chain Analysis

- Assessment and Integration

Assessment and integration are systematic processes that help to gather and interpret data on student skills, abilities, and knowledge for measuring learning and progress. Integration of digital tools and digital platforms is improving teaching and learning experiences.

Key Players: upGrad, BYJU'S, Extramarks, Watermark.

- Support and Feedback

For enabling and enhancing the learning process, support and feedback play an interconnected role. Explore Blue is one of the enhanced automated technologies that enables real-time feedback.

Key Players: MyLearningHub, Panorama Education, Explorance Blue, and Blackboard.

- Regulatory Compliance

Regulatory compliance associated with data privacy, like FERPA & GDPR, and accessibility standards like ADA, are setting standards for educational quality and intellectual property protection. Some services EdTech provides, like Cornerstone OnDemand, Docebo, and Coursera, to achieve standards like SOC 2 compliance.

Key Players: VComply and Class.com

Educational Technology Market Companies

- Pearson

- Blackboard

- Microsoft

- Google for Education

- Apple

- Coursera

- Khan Academy

- Adobe

- Moodle

- Instructure

- Samsung Electronics

- SMART Technologies

- Udemy

- Dell Technologies

- Cisco Systems

- Intel Corporation

- Lenovo

- Epic Systems

- Descartes Systems

- Seesaw Learning

Recent Developments

- In May 2025, Kaspersky and the Manipal Institute of Technology (MIT), Bengaluru, MAHE partnered for the launch of HackSky, with the hackathon taking place in July 2025. This partnership was announced by a press release and an MoU signed in October 2024 for promoting cybersecurity education. (Source:https://digitalterminal.in)

- In February 2025, the Director-General of UNESCO, Audrey Azoulay, dedicated International Education Day 2025 to the opportunities and challenges of artificial intelligence (AI). She has encouraged member states of UNESCO to invest in the training of both teachers and students about the responsibility of utilizing AI technology within the education field. (Source: https://www.unesco.org)

Segment Covered in the Report

By Product Type

- Hardware

- Interactive Whiteboards

- Tablets

- Laptops

- Virtual Reality (VR) and Augmented Reality (AR) Devices

- Classroom Response Systems

- Software

- Learning Management Systems (LMS)

- Virtual Classrooms

- Collaboration Tools

- Course Authoring Tools

- Analytics Software

- Services

- Cloud-based Solutions

- IT Support and Consulting

- Professional Development and Training

By End-User

- K-12 Schools

- Higher Education

- Corporate/Professional Learning

- Vocational Training

- Tutoring Services

By Technology

- Artificial Intelligence (AI) in Education

- Blockchain in Education

- Virtual Reality (VR) / Augmented Reality (AR)

- Internet of Things (IoT) in Education

- Learning Analytics

By Delivery Mode

- Online Learning Platforms

- Mobile Learning (M-Learning)

- In-classroom Learning Tools

- Hybrid Learning Solutions

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content