What is the Electric Grippers Market Size?

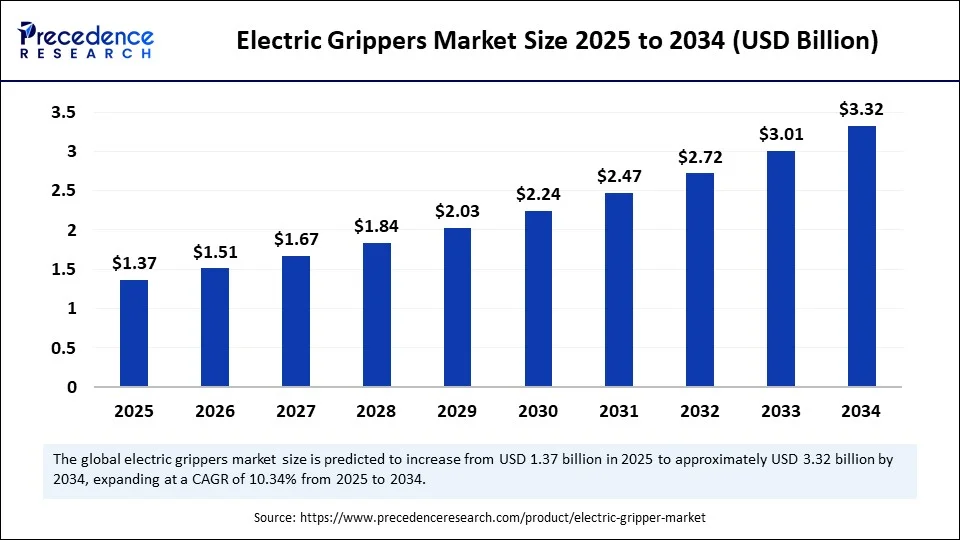

The global electric grippers market size was calculated at USD 1.24 billion in 2024 and is predicted to increase from USD 1.37 billion in 2025 to approximately USD 3.32 billion by 2034, expanding at a CAGR of 10.34% from 2025 to 2034. The market growth is attributed to rising automation adoption, expanding deployment of collaborative robots, and increasing demand for intelligent, energy-efficient gripping solutions in smart manufacturing environments.

Market Highlights

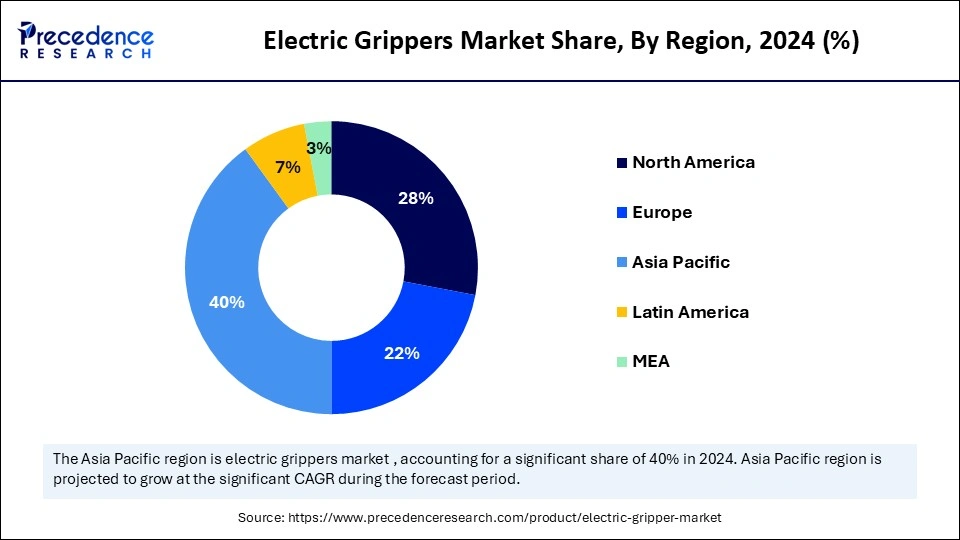

- Asia Pacific dominated the global electric grippers market with the largest share of 40% in 2024, and is expected to sustain the position in the coming years.

- By gripper mechanism, the parallel segment held the biggest market share of 35% in 2024.

- By gripper mechanism, the soft/adaptive segment is expected to grow at the fastest CAGR during the forecast period.

- By actuation technology, the servo segment accounted for a considerable share of 45% in 2024.

- By actuation technology, the direct-drive segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By payload capacity, the light-duty segment captured the highest market share of 42% in 2024.

- By payload capacity, the micro segment is set to experience the fastest CAGR from 2025 to 2034.

- By precision, the standard precision segment held the biggest market share of 55% in 2024.

- By precision, the high precision segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By communication interface, the IO-Link segment accounted for the significant market share of 35% in 2024.

- By communication interface, the industrial Ethernet segment is projected to expand rapidly in the electric grippers coming years.

- By end-use industry, the automotive segment maintained a leading position generated the major market share of 28% in 2024.

- By end-use industry, the electronics & semiconductor segment is predicted to witness significant growth over the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 1.24 Billion

- Market Size in 2025: USD 1.37 Billion

- Forecasted Market Size by 2034: USD 3.32 Billion

- CAGR (2025-2034): 10.34%

- Largest Market in 2024: Asia Pacific

Market Overview

The growing use of industrial automation is likely to speed up the growth of the electric grippers in production lines. According to the IFR 2023 report, manufacturers counted a global stock of operational robots at 4,281,585 industrial robots, which inspires the integration of advanced end-effectors to deal with various parts. Pneumatic fingers are replaced by electric grippers with compact electric motors, precise gear trains. Closed-loop force control, and multi-axis sensors and IO/IIoT telemetry are embedded in grippers to report cycles, energy consumption, and contact force in real time.

Gripper telemetry is connected to digital twins and PLCs or ROS-based controllers by factory teams to simulate pick-and-place sequences and reduce commissioning time. Products from the electric grippers market are used in the design of delicate assembly, machine tending, and e-commerce packaging due to the repeatability of the force profile. Furthermore, the higher robot density confirmed that digital-twin economics enhance adoption, and the dynamic limits the skyrocketing take-up of smart factories, expected to lead to further development of gripping technologies.(Source: https://www.therobotreport.com)

Impact of Artificial Intelligence on the Electric Grippers Market

Artificial intelligence (AI) is changing the electric grippers market by equipping the gadgets with more intelligence, flexibility, and the ability to handle more complicated industrial tasks. Companies implement the AI-based vision systems and machine learning models in the electric grippers. Additionally, the reliability is also enhanced by AI to analyze sensor data and predict maintenance requirements to reduce downtime and minimize operational expenses.

Electric Grippers Market Growth Factors

- Driving Demand for Precision Assembly: Growing complexity in electronics and semiconductor components is driving the adoption of electric grippers for highly accurate handling.

- Boosting Energy-Efficient Automation: Rising emphasis on reducing industrial energy consumption is boosting preference for electric over pneumatic gripping technologies.

- Fuelling Adoption in E-Commerce Logistics: Expanding global parcel volumes and automated fulfillment centers are fuelling investments in electric gripping solutions for high-speed sorting.

- Propelling Growth in Medical Robotics: Increasing reliance on robotic-assisted surgeries and laboratory automation is propelling demand for compact, hygienic electric grippers.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.24 Billion |

| Market Size in 2025 | USD 1.37 Billion |

| Market Size by 2034 | USD 3.32 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.34% |

| Dominating Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Gripper Mechanism, Actuation Technology, Payload Capacity, Precision, Communication Interface, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Growing Demand for Collaborative Robots Anticipated to Strengthen the Electric Grippers Market Outlook?

Increasing adoption of industrial automation is expected to accelerate the electric grippers market growth. The global average robot density in 2023 had reached 162 robots per 10,000 workers 2023 which makes suppliers to scale gripping solutions that can fit on high-volume production lines. The North American orders ended Q4 2024 with 8,277 robots with a value of approximately 506 million, according to the Association for Advancing Automation (A3), which means that there was a continuous procurement in the food and consumer-goods markets. Further, the electric grippers help to increase the throughput and decrease the scrap. (Source:https://ifr.org)

Large-scale automation vendors like ABB are prioritizing robotics and AI strategies for 2024. Large OEMs are aggressively defining electric end-effectors that include in-built sensing and programmable force control to support mixed-model production. Digital-twin simulations and real-time telemetry allow engineers to save time during commissioning and optimize finger geometry to particular part families, cutting down the number of trial runs on the shop floors. Furthermore, the growing demand for collaborative robots is anticipated to strengthen the market outlook for electric gripping solutions.(Source:https://www.automate.org)

Restraint

Limited Payload Capacity Restrains Adoption in Heavy-Duty Manufacturing

Limited payload capacity is anticipated to restrict applications in heavy-duty manufacturing sectors, further hindering the market. Electric grippers are good for precise handling and light to medium-sized payload work, but not for operations that involve large or dense objects. This drawback reduces the range of adoption of electric grippers, and it does not allow them to be applicable to every setting as compared to traditional gripping technology. Additionally, the high initial investment requirements are expected to challenge broader adoption across small and medium enterprises, thus hampering the market.

Opportunity

Why Is the Surging Adoption of Smart Factories Projected to Drive Innovation in the Electric Grippers Market?

Surging adoption of smart factories is projected to create immense opportunities for the electric grippers market. The rapid uptake of the use of smart factories has led to innovation in gripping technologies adapted to the realities of high-tech manufacturing ecosystems. Connected devices, machine learning, and IoT platforms help smart factories form a connection to production floors and make real-time decisions. Electric grippers are built into these settings without causing any disruption since they transmit the performance data, energy consumption, and the number of cycles to model predictive analytics. (Source: https://ifr.org)

Such information-driven capability will undoubtedly aid in proactive maintenance plans, reducing downtime and making the entire equipment more effective. In 2024, the International Federation of Robotics (IFR) documented that over 4 million industrial robots were active worldwide, with smart factory implementation becoming a major portion of the installations. The European Commission increased its Horizon Europe programs in 2024 to enhance Industry 4.0 implementations, which once again enhanced the need for smart gripping technologies. Furthermore, the growing demand for collaborative robots is anticipated to strengthen the market outlook for electric gripping solutions.(Source:https://www.researchgate.net)

Segments Insights

Gripper Mechanism Insights

Why Did Two-Finger Grippers Emerge as the Dominant Mechanism in the Electric Grippers Market?

Parallel segment dominated the electric grippers market in 2024, accounting for an estimated 35% market share, due to their repeatability, easy kinematics, and quick cycle time, which is preferred by manufacturers. Parallel versions are used by assemblers of automotive and electronics components in high-volume pick-and-place and machine-tending operations. This uniform end-component clamping and high responsiveness are required.

The large-scale robot installations, noted at 4,281,585 units in service around the world in 2023, support the requirements of these heavy-duty end-effectors. Integrators use parallel grippers to simplify integration on existing robotic arms and standard tooling plates to reduce the time of commissioning and enhance line uptime. Furthermore, the suppliers to the industry introduced larger and fully electric parallel models that support CNC-tending and heavy-part handling to expand the application range beyond light assembly and consolidate legacy adoption.(Source: https://ifr.org)

The soft/adaptive is expected to grow at the fastest rate in the coming years, owing to its automation to handle delicate, irregular, and mixed-SKU production. Research groups and institutes developed soft-grip technologies with enhanced material science and sensor fusion. Additionally, the trials in the industry focus on safety, less part damage, and fast changeover of short production runs, which spurs its use in SMEs and advanced manufacturing cells.

Actuation Technology Insights

What Factors Made Servo-Electric Actuation the Leading Technology in the Electric Grippers Market?

The servo segment held the largest revenue share in the electric grippers market in 2024, accounting for 45% of the market share, due to its high density of torque, tight position control, and established interface. With conventional robot controllers-attributes that reduced integration time on production lines.

The International Federation of Robotics estimated that 4,281,585 industrial robots were operating in 2023, and that demand remained high for proven servo modules. Suppliers improved servo electronics, adding faster commutation and closed-loop force control to make delicate assemblies easier to handle, and control latency on end-effectors. Moreover, the choice of servo grippers was driven by the goal of system integrators to fit the available fieldbus ecosystems and off-the-shelf drivers.

Direct-drive segment is expected to grow at the fastest CAGR in the coming years, owing to that designers have attained better backdrivability, improved-fidelity force control. This further reduces mechanical backlash by doing away with reduction gears-qualities that were critical to force-sensitive gripping and safe human-robot interaction. Furthermore, the engineering teams decreased the number of parts by using direct-drive designs and removed the periodic maintenance of the gearboxes, further creating high demand for electric grippers in the coming years.

Payload Capacity Insights

How Did the 5–20 kg Range Dominate Payload Capacity in the Electric Grippers Market?

The light-duty segment dominated the electric grippers market in 2024 that holding a market share of about 42%, due to their widespread application in consumer electronics, automotive parts, and logistics. They provide the best combination of gripping power, size, and energy savings of medium-weight components, including circuit boards, electronic gadgets, and light metal parts.

These models were popular with robotics integrators because they can be paired with collaborative robots that constituted over 10% of all industrial robot installations worldwide by 2024, according to the International Federation of Robotics (IFR). Moreover, the light-duty configurations spread in popularity in Asia and Europe as system integrators standardized assembly lines to reduce downtimes, thus driving the segment growth.(Source: https://ifr.org)

The micro segment is expected to grow at the fastest rate in the coming years, owing to its use in fine manufacturing, medical devices, and sophisticated laboratory automation. These grippers are best in dealing with delicate products like microchips, optical lenses, syringes, and biomedical samples, where tolerances are measured in microns. Furthermore, the worldwide wave of semiconductor demand is expected to drive the use of micro-grippers to large-scale applications in the transfer of wafers and the packing of chips.

Precision Insights

Why Did Standard Precision Hold the Largest Share in the Electric Grippers Market?

Standard precision segment held the largest revenue share in the electric grippers market in 2024, accounting for an estimated 55% market share, as industries were focused on cost-effective automation solutions that were sensitive and speedy in operations. These grippers were popular with manufacturers in the automotive, packaging, and general assembly operations.

They provide them with the required repeatability, often to the range of +-0.1 mm, which matches their production tolerances. The International Federation of Robotics (IFR) considers that as of 2023, there are over 590,000 installations of industrial robots around the world. The most common end-effectors utilized in industrial robotic applications are standard precision grippers because of apply to numerous tasks. Additionally, the compatibility with collaborative robots further supported the adoption of grippers to automate various tasks.(Source: https://ifr.org)

High precision segment is expected to grow at the fastest CAGR in the coming years, owing to the growing adoption in semiconductor, aerospace, and medical devices industries. A repeatability of less than 50 microns is offered by these grippers, and this is important in processes, including wafer transfer, assembly of surgical instruments, and optical lens alignment. Furthermore, the 2024 industrial automation project by the European Commission focused on precision robotics in microelectronics and medical technologies, which further promoted R&D and early adoption in the region.

Communication Interface Insights

What Drove IO-Link to Lead the Communication Interface Segment in the Electric Grippers Market?

The IO-Link segment dominated the electric grippers market in 2024, accounting for an estimated 35% market share, as manufacturers preferred its simplicity, affordability, and the ability to work with standard sensors and actuators.

The IO-Link-enabled grippers were used by automation engineers working in the packaging, electronics, and automotive industries to simplify machine integration and allow plug-and-play installation. Additionally, the Vendors of collaborative robots assisted this ecosystem by providing IO-Link masters as standard modules, which increases the use of small to medium-sized facilities.

The industrial Ethernet segment is expected to grow at the fastest rate in the coming years, owing to the need to have high-bandwidth and low-latency communications networks in sophisticated automation systems. Furthermore, the growing developments in electric grippers support their future as the interface of choice in the next generation smart factories and high-precision robotic tasks that are to be accomplished.

End-Use Industry Insights

How Did the Automotive Sector Secure the Largest Share in the Electric Grippers Market?

The automotive segment held the largest revenue share in the electric grippers market in 2024, accounting for 28% of the market share, due to the wide-scale adoption of automation in the assembly lines and handling of parts. These devices were popular among automakers in machine tending, welding preparation, and parts inspection due to their accuracy, repeatability, and efficiency compared to pneumatic ones. (Source: https://www.industrialautomationindia.in)

In 2024, the International Federation of Robots confirmed that approximately 23,000 new robots were installed in the auto industry in Europe, which strengthened the dependence on advanced gripping solutions. According to the U.S. automotive industry, a 10.7% growth in robot installations was reported in 2024, with about 13,700 units of installations reported and about 40% of installations directly related to automotive manufacturing. Moreover, the electrification, digitalized production, and high-precision component management are expected to keep the automotive industry leading in the uptake of automation-based gripping technologies. (Source: https://ifr.org)

The electronics & semiconductor segment is expected to grow at the fastest CAGR in the coming years, as the demand for elegant, high-precision handling in the chip production, circuit board assembly, and consumer electronics production grows tremendously. This space of fabrication is getting more and more manufacturers in need of adaptive grippers with ultra-thin wafers and micro-components without rejecting or polluting.

Wafer fab capacity installed was over 42 million wafers per quarter in Q4 2024, and foundry and logic increased approximately 2.3% quarter-to-quarter, with a dire need for cleanroom-compatible precision grippers in wafer handling and packaging. Furthermore, such a congruence of semiconductor growth with flexible production is expected to make the electronics and semiconductor sector the fastest-growing consumer of electric gripping technologies in the next few years.(Source: https://www.semi.org)

Regional Insights

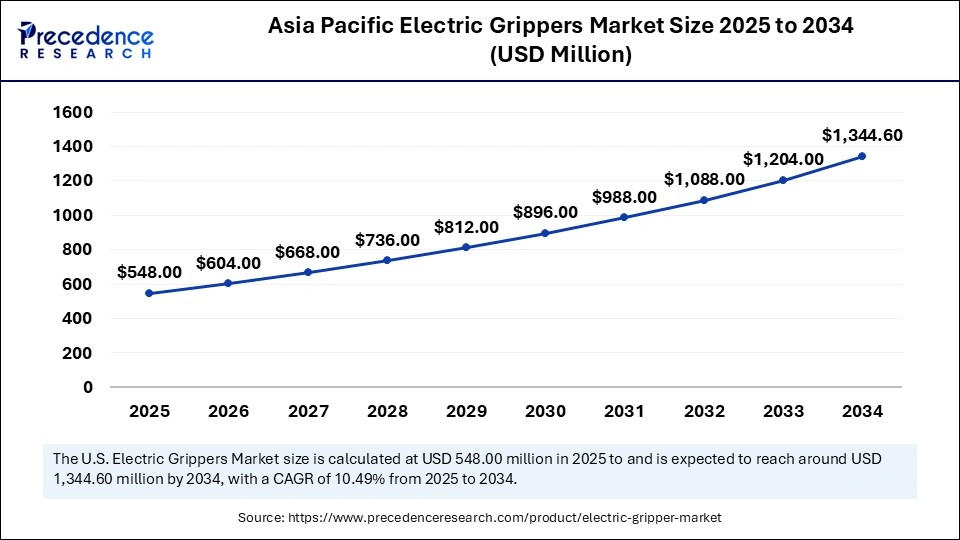

Asia Pacific Electric Grippers Market Size and Growth 2025 to 2034

The Asia Pacific electric grippers market size was exhibited at USD 496.00 million in 2024 and is projected to be worth around USD 1,344.60 million by 2034, growing at a CAGR of 10.49% from 2025 to 2034.

Why Did Asia-Pacific Dominate Regional Demand in the Electric Grippers Market?

Asia Pacific dominated the global market with the largest share in 2024, accounting for an estimated 40% market share, and is expected to sustain the position in the coming years, due to capital investments, workforce changes, and government-based initiatives. The 2024 World Fab Forecast published by SEMI pointed out that Asia has almost 80% of the world's fab capacity. The growth plans in Taiwan, South Korea, and China require a cleanroom quality gripper to handle the wafer. The exports of Japanese robotics have boomed with domestic plants specialized in precision assembly to serve the automotive and electronics markets.

By 2024, South Korea will remain the world leader in terms of robot density, with over 1,000 robots per 10,000 employees working in the manufacturing industry. A record that supports the high rate of robot integration into automotive and semiconductor manufacturing lines. The World Economic Forum (WEF) cited Asia-Pacific as the most prevalent center of smart factory implementation, and China and India as the top drivers of industrial IoT and automation-based productivity improvement. Furthermore, the region is preparing to be the strongest growth engine in gripping solutions in the globe by aligning government policy, industry investment, and academic research networks.(Source: https://ifr.org)

Electric Grippers Market Companies

- ABB Robotics

- ATI Industrial Automation

- Camozzi Automation

- Comau

- Destaco

- FANUC

- Festo

- Gimatic

- J. Schmalz GmbH

- Kawasaki Robotics

- OnRobot

- Parker Hannifin

- PIAB

- Robotiq

- SCHUNK

- SMC Corporation

- Soft Robotics Inc.

- Weiss Robotics

- Yaskawa Motoman

- Zimmer Group

Recent Developments

- In August 2025, J Schmalz GmbH, a recognized leader in vacuum automation and handling technology, introduced its latest innovation, the FQE-V modular area gripper, in August 2025. The system offers a freely scalable design that allows safe and efficient handling of workpieces in diverse shapes and sizes. Its modular construction shortens project planning cycles and enables rapid integration into robotics-driven workflows. By supporting precise gripping of irregularly shaped objects, the FQE-V targets industries such as logistics, packaging, and manufacturing, where flexibility and reliability are critical to automation performance. (Source: https://www.industrialautomationindia.in)

- In March 2025, Denmark-based OnRobot unveiled the VGP30, a powerful vacuum gripper designed for collaborative applications. Engineered to manage payloads up to 30 kg (66 lbs.), the device specializes in palletizing and handling irregularly shaped or porous items, including those made from thinner and more cost-efficient cardboard materials. The VGP30 ships fully equipped with hardware and software, ensuring compatibility with leading robot brands and enabling immediate deployment. Its robustness and adaptability position it as a valuable solution for industries seeking to improve throughput in packaging and logistics operations. (Source: https://www.businesswire.com)

- In July 2025, DESTACO announced the release of its eRDH Series Electric Parallel Gripper in July 2025, further strengthening its Robohand product line. The eRDH series delivers advanced levels of precision, flexibility, and usability, setting a new benchmark for high-performance gripping solutions. Designed to serve a broad range of automation environments, the electric gripper emphasizes energy efficiency while maintaining reliable operation for repetitive tasks. By offering improved accuracy and adaptability, the new series is expected to support applications across automotive, electronics, and industrial manufacturing sectors where precise component handling is essential.(Source: https://www.roboticstomorrow.com)

Segments Covered in the Report

By Gripper Mechanism

- Parallel

- Angular

- Rotary / Centric

- Multi-finger

- Soft / Adaptive

- Magnetic / Electromagnetic

- Vacuum-assisted

By Actuation Technology

- Servo (BLDC / Brushed DC integrated)

- Stepper motor

- Direct-drive (harmonic, linear)

- Piezoelectric / Micro-actuation

By Payload Capacity

- Micro: < 0.5 kg

- Light-duty: 0.5 – 5 kg

- Medium-duty: 5 – 50 kg

- Heavy-duty: > 50 kg

By Precision

- High precision (≤0.1 mm)

- Standard precision (>0.1 – 0.5 mm)

- Low precision (>0.5 mm)

By Communication Interface

- Industrial Ethernet (EtherCAT, PROFINET, EtherNet/IP)

- Fieldbus / Serial (CANopen, Modbus, RS-485)

- IO-Link

- Wireless (Wi-Fi/Bluetooth)

By End-Use Industry

- Automotive & Auto Components

- Electronics & Semiconductor

- Food & Beverage

- Pharmaceutical & Medical Devices

- Logistics & E-commerce

- Aerospace & Defense

- General Manufacturing & Metalworking

- Plastics & Rubber Processing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting