What is Energy Cloud Platform Market Size?

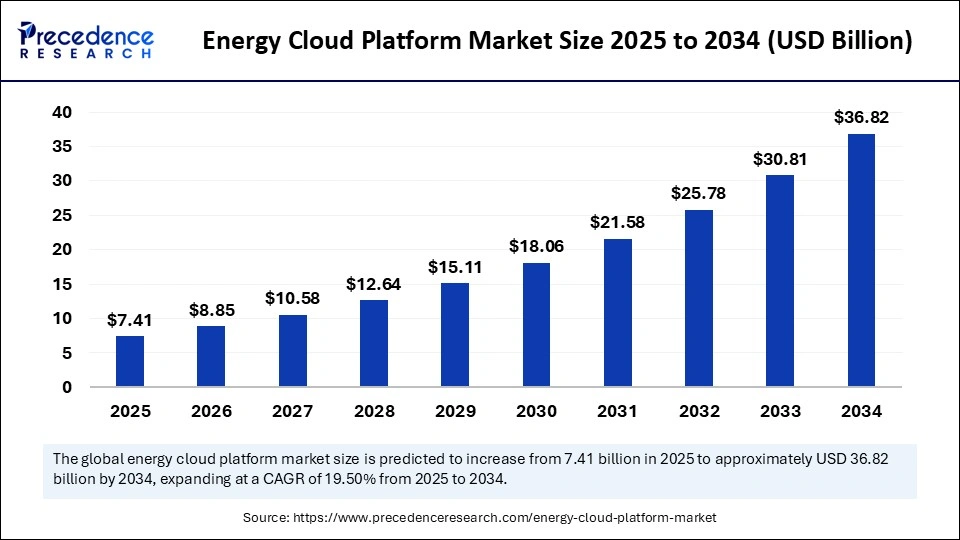

The global energy cloud platform market size was calculated at USD 7.41 billion in 2025 and is predicted to increase from USD 8.85 billion in 2026 to approximately USD 36.82 billion by 2034, expanding at a CAGR of 19.50% from 2025 to 2034. This market is growing due to the increasing adoption of digital technologies for optimizing energy management and integrating renewable energy sources.

Market Highlights

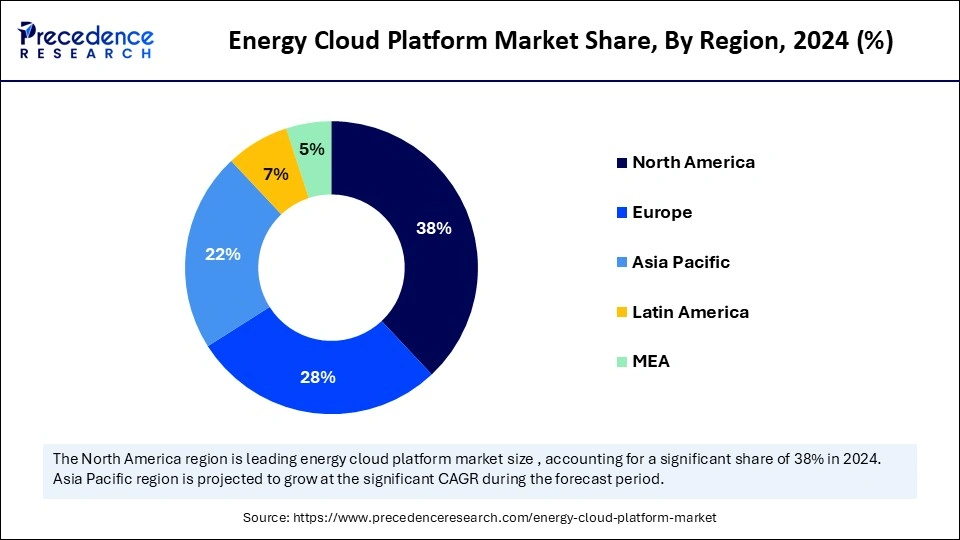

- By region, North America dominated the market, holding the largest market share of 50% in 2024.

- By region, Asia Pacific is expected to grow at a notable rate in market share.

- By application, the energy trading and optimization segment held the largest share of the energy cloud platform market at 35% in 2024.

- By application, the renewable energy integration segment is expected to grow at the fastest rate during the forecast period.

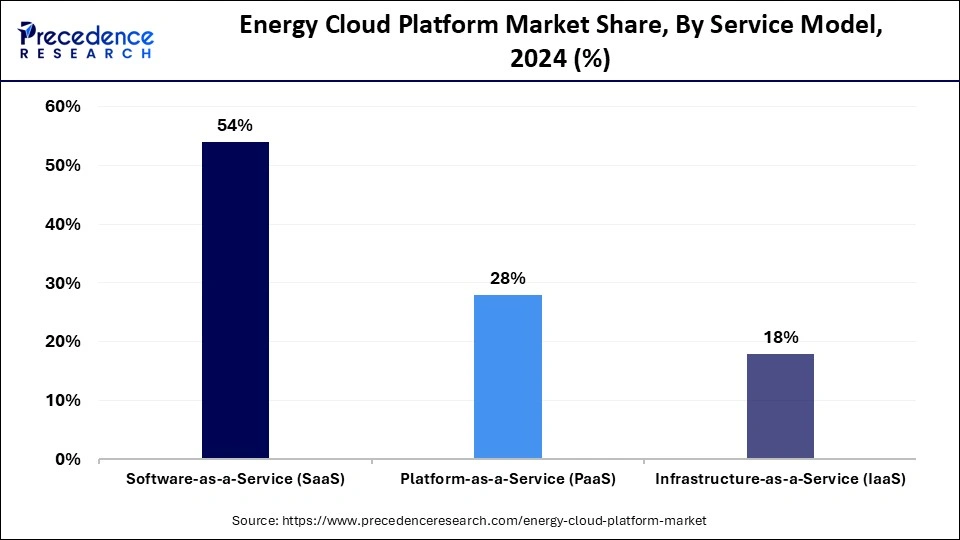

- By service model, the software-as-a-service (SaaS) segment held the largest share of 54% in the energy cloud platform market during 2024.

- By service model, the platform-as-a-service (PaaS) segment is expected to grow at the fastest rate during the forecast period.

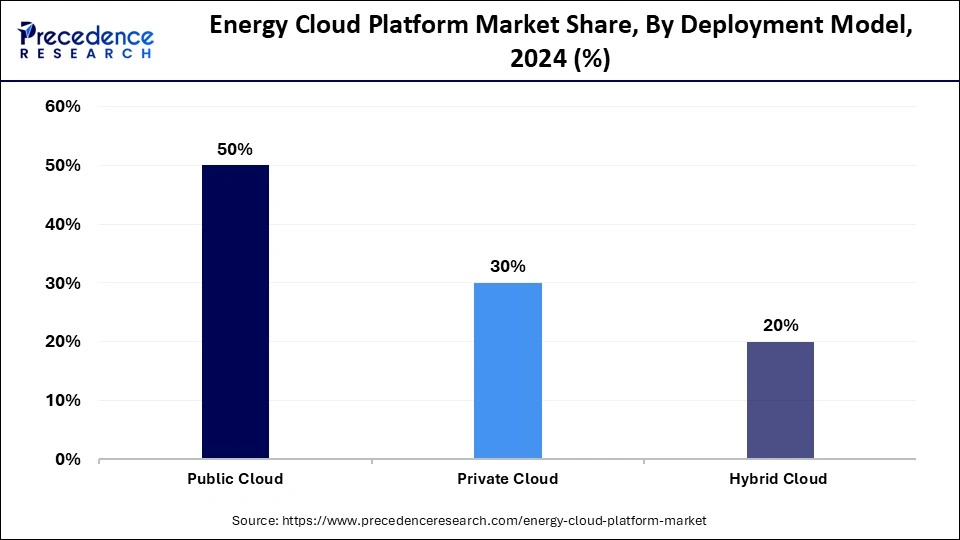

- By deployment model, the public cloud segment is expected to grow at the fastest rate of 50% in the energy cloud platform market.

- By deployment model, the hybrid cloud segment held the largest share in the market in 2024.

- By end-user industry, the utilities segment held the largest share at 45% in 2024.

- By end-user industry, the renewable energy segment is expected to grow at the fastest rate during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 7.41 Billion

- Market Size in 2026: USD 8.85 Billion

- Forecasted Market Size by 2034: USD 36.82 Billion

- CAGR (2025-2034): 19.50%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Key Technologies Shifts in the Energy Cloud Platform Market

Blockchain for Decentralized Energy Trading

Peer-to-peer energy transactions are becoming safe, transparent, and traceable thanks to blockchain technology. It promotes effective and reliable energy markets by facilitating decentralized energy trading, tracking carbon credits, and reducing reliance on middlemen.

- In May 2025, Ampli Energy introduced a blockchain-enabling renewable energy trading platform for secure power exchange. (Source: https://en.wikipedia.org)

Decentralized Identity Management for Consumer Data

As consumer data privacy becomes increasingly important, decentralized identity management systems are being implemented within energy cloud platforms. These systems empower consumers to control access to their personal energy usage data, enhancing trust and compliance with data protection regulations. Blockchain and distributed ledger technologies are often utilized to ensure secure and transparent data transactions.

Market Overview

What is the Energy Cloud Platform Market?

The energy cloud platform market is witnessing strong growth as operations at energy companies become more connected, digital, and data-driven. Demand is increasing due to the expanding use of cloud computing, IoT, and Artificial Intelligenceto manage dispersed renewable assets and enhance grid efficiency. Additionally, government initiatives that support the transition to clean energy and sustainability goals are speeding up market expansion globally.

- In October 2025, About: Energy launched the vothe voltt, a new cloud-based platform designed to speed up battery cell selection and performance analysis. (Source:https://www.renewableenergymagazine.com)

Market Outlook

- Industry Growth Overview: The market for energy cloud platforms is growing quickly because of the growing use of data analytics, cloud computing, and renewable energy integration. Support from regulations for the digital energy transformation and rising investments in smart grids are fueling steady growth.

- Sustainability Trends: The sector is concentrating on energy-efficient data centers, carbon reduction programs, and cloud operations driven by renewable and green technologies, bringing digital transformation and environmental responsibility into line. To improve long-term sustainability, businesses are also investing in water-positive and zero-emission solutions.

- Startup Ecosystem:The energy industry is becoming more efficient, sustainable, and modern thanks to startups ' innovative solutions for renewable integration, decentralized trading, and AI-powered energy management. IoT integration and blockchain are also being investigated by many of these startups to facilitate more intelligent and transparent energy operations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.41 Billion |

| Market Size in 2026 | USD 18.94 Billion |

| Market Size by 2034 | USD 36.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application,Service Model,End-user Industry,Deployment Model, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Restraint

Interoperability and Integration Challenges with Legacy Systems

Many energy companies continue to use outdated on-premises systems that are incompatible with modern cloud computing platforms, creating challenges in the energy cloud platform market. Communication between systems, data synchronization, and overall scalability are all hampered by this lack of interoperability. Often, it takes intricate and expensive customization work to get past these obstacles.

- In May 2025, Siemens Energy reported challenges integrating cloud analytics with legacy grid systems during its digital transformation phase.

Opportunity

Opp Integration of Artificial Intelligence and Advanced Analytics

AI and machine learning integration in energy cloud platforms is unlocking predictive analytics, grid automation, and asset optimization opportunities. Companies are leveraging AI-driven insights to forecast energy demand, detect anomalies, and reduce operational costs. This technological evolution is reshaping how energy is managed globally.

- In August 2025, FY Energy introduced its Encrypted Gree Cloud platform, combining secure data management with integrated AI-based analytics.(Source:https://finance.yahoo.com)

Segment Insights

Application Insights

Why Did the Energy Trading and Optimization Segment Dominate the Market in 2024?

In 2024, the energy trading and optimization segment dominates the energy cloud platform market with a 35% share due to the increasing demand for real-time grid management, price forecasting, and efficient energy distribution. Through AI-driven analytics, these platforms enable utilities and energy traders to better generate revenue by analyzing market dynamics. The most popular application among energy stakeholders is trading and optimization because it can combine sizable datasets from various sources.

The renewable integration segment is expected to be the tfastest-growinging segment in the market during the forecast period, as global efforts to achieve net-zero emissions have accelerated. Cloud-based platforms enable seamless integration of solar, wind, and other renewables into the grid forecasting capabilities, supporting utilities in managing intermittent renewable sources efficiently.

Service Model Insights

What Made the Software-as-a-Service (SaaS) Segment Dominate the Energy Cloud Platform Market in 2024?

The Software-as-a-Service (SaaS) segment dominates the energy cloud platform market with a 54% share in 2024 due to its ease of deployment, affordability, and scalability. SaaS based energy cloud platforms provide utilities and energy companies with tools for grid optimization, demand forecasting, and advanced analytics on a subscription basis. This ability to update and integrate with current systems is what makes it so popular in developed markets.

The Platform-as-a-Service (PaaS) segment is expected to be the fastest-growing segment in the market during the forecast period, driven by companies' growing desire for adaptable solutions to develop and oversee energy-specific applications. PaaS speeds up the creation of specialized tools for renewable forecasting, energy trading, and monitoring. The expansion of this market is being driven by the increasing demand for integration and interoperability across various energy systems.

Deployment Model Insights

What made the utilities segment dominate the Energy Cloud Platform Market in 2024?

The utilities segment dominated the market with a 45% share in 2024 due to grid optimization, load balancing, and energy trading solutions, since they are the main users of these technologies. These platforms aid in the management of distributed energy resources, demand forecasting, and operational efficiency improvements for utilities. The growing need for dependable data-driven grid systems reinforces this market's dominance.

The renewable energy developers segment is expected to be the fastest-growing in the market during the forecast period as they increasingly rely on cloud platforms for project monitoring and asset optimization. Cloud-based tools support predictive maintenance, performance analytics, and smart forecasting for wind and solar farms. The global push for cleaner energy solutions continues to boost adoption among developers.

End-user Industry Insights

What Made the Utilities Segment Dominate the Energy Cloud Platform Market in 2024?

The utilities segment dominated the market with a 45% share in 2024 due to grid optimization, load balancing, and energy trading solutions, since they are the main users of these technologies. These platforms aid in the management of distributed energy resources, demand forecasting, and operational efficiency improvements for utilities. The growing need for dependable data-driven grid systems reinforces this market's dominance.

The renewable energy developers segment is expected to be the fastest-growing in the market during the forecast period as they increasingly rely on cloud platforms for project monitoring and asset optimization. Cloud-based tools support predictive maintenance, performance analytics, and smart forecasting for wind and solar farms. The global push for cleaner energy solutions continues to boost adoption among developers.

Regional Insights

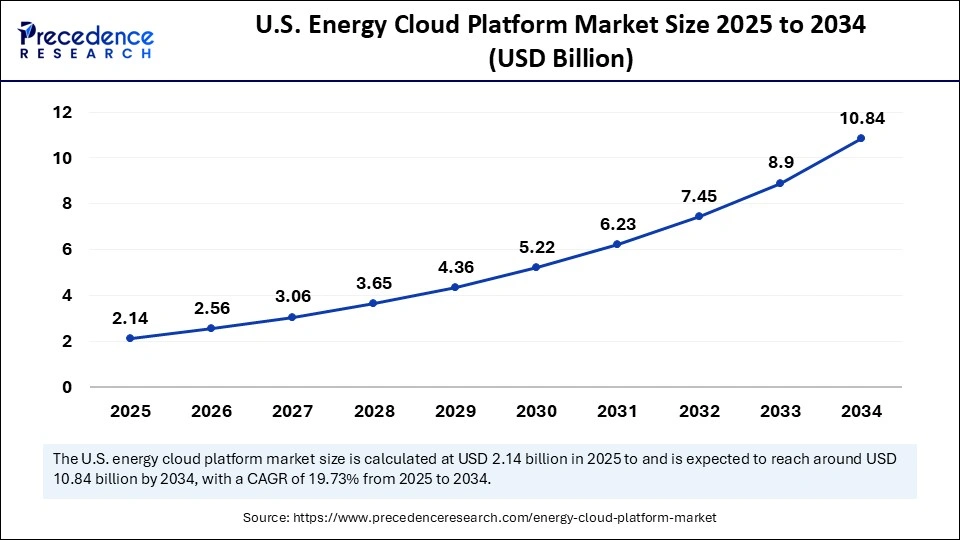

U.S. Energy Cloud Platform Market Size and Growth 2025 to 2034

The U.S. energy cloud platform market size was exhibited at USD 2.14 billion in 2025 and is projected to be worth around USD 10.84 billion by 2034, growing at a CAGR of 19.73% from 2025 to 2034.

What Made North America Dominate the Energy Cloud Platform Market?

North America dominated the market with approximately 38% share in 2024 because of strong digital infrastructure, early adoption of smart grid technologies, and favored government initiatives. The region's utilities and tech firms lead in integrating IoT and advanced analytics.

Asia Pacific is expected to be the fastest-growing market during the forecast period, driven by initiatives for smart cities, the growth of renewable energy, and fast industrialization. Governments throughout the region are encouraging the energy sector to undergo digital transformation to increase sustainability and grid efficiency. The market is accelerating due to rising investments in cloud-based energy solutions.

Country-Level Investments/Funding Trends for the Energy Cloud Platform Market

|

Country |

Investment/Funding Focus |

Key Drivers |

Noteworthy Trends & Funding |

|

United States |

Broad-based investment in energy security, grid modernization, and AI-driven cloud infrastructure. |

Federal funding (IRA), clean energy transition, and demand for data centers. |

Major funding in AI-focused cloud infrastructure (e.g., Crusoe). High VC funding for SaaS. North America dominates the market share. |

|

Germany |

Decarbonization and energy security; hyperscaler data center expansion for AI workloads. |

Emphasis on digital sovereignty and BSI C5 compliance. |

There is strong growth in hybrid cloud models, favored due to high electricity prices. Funding for energy management startups (e.g., 1Komma5°, epilot). |

|

India |

Meeting ambitious clean energy targets (500 GW by 2030) and infrastructure modernization. |

Rapidly growing energy demand, digitization, and government support for renewables. |

Massive infrastructure investment ($360B by 2030) and significant foreign direct investment (FDI). High private funding for solar and wind projects. |

|

UAE |

Attracting investment for AI-focused data centers, leveraging low-cost renewable power. |

"Cloud-first" mandates, 5G rollout, strategic partnerships with global cloud providers. |

Aggressive data center expansion and partnerships with tech giants. High CAGR (approx. 28.75%) in the cloud market. Funding tied to AI and national digitization. |

Top Energy Cloud Platform Market Companies

- Microsoft Azure: Provides Azure Energy Data Services, offering scalable cloud and AI solutions for grid optimization, renewable integration, and real-time energy analytics.

- Amazon Web Services (AWS): Delivers AWS Energy Competency solutions that enable IoT-driven energy monitoring, predictive maintenance, and decarbonization insights for utilities and oil & gas.

- Google Cloud Platform (GCP): Offers AI-powered data analytics and sustainability platforms for optimizing energy efficiency, carbon tracking, and renewable asset management.

- IBM Cloud: Integrates AI, IoT, and hybrid cloud technologies via IBM Maximo and Watson AI to drive predictive maintenance and energy infrastructure digitization.

- Oracle Cloud: Provides Oracle Utilities Cloud for advanced energy management, smart metering, and customer experience solutions within the energy transition ecosystem.

- Siemens MindSphere: A leading industrial IoT platform enabling energy asset monitoring, grid management, and predictive maintenance through real-time operational data analytics.

- GE Vernova (Predix): Offers Predix Platform, combining digital twins and AI analytics to enhance power plant performance, grid reliability, and emission reduction.

- Schneider Electric: Provides EcoStruxure™, a cloud-based platform integrating IoT, analytics, and AI for energy automation, smart grids, and sustainable power management.

- Siemens Energy: Delivers digital energy solutions leveraging cloud data analytics for asset optimization, renewable integration, and energy transition management.

- Honeywell Forge: A connected platform providing AI-enabled industrial energy management, focusing on efficiency, carbon reduction, and asset health optimization.

- SAP Leonardo: Integrates IoT, machine learning, and blockchain into energy management systems for real-time visibility, billing, and sustainability analytics.

- Accenture: Provides end-to-end digital energy transformation services, leveraging partnerships with major cloud providers to enable smart grid and ESG data integration.

- Country: Delivers cloud-based energy data and AI solutions for utilities and renewables, helping clients accelerate smart grid digitization and energy efficiency programs.

- Country: Focuses on AI-driven energy cloud platforms that support smart metering, asset optimization, and renewable forecasting for global energy providers.

- Tata Consultancy Services (TCS): Offers TCS Clever Energy™, a sustainability platform for energy performance optimization, carbon tracking, and predictive insights.

- Country: Provides cloud-based digital twin and IoT analytics solutions to support predictive energy management and decarbonization initiatives across enterprises.

- Wipro: Delivers AI, IoT, and blockchain-powered cloud platforms for smart grids, distributed energy resources, and energy efficiency management.

- Tech Mahindra: Focuses on smart energy and IoT cloud systems, offering predictive grid analytics, asset tracking, and renewable integration solutions.

- Country: Provides Energy Cloud and IoT consulting services, helping utilities implement data-driven optimization and sustainability reporting platforms.

- HCL Technologies: Offers cloud-hosted energy management solutions leveraging AI and data analytics to optimize asset performance and energy distribution.

Recent Developments

- In August 2025, Gravity introduced the Energy Management Marketplace, a connected cloud-based ecosystem for businesses, to monitor energy consumption and reduce emissions. The platform helps organizations access renewable energy projects, automate efficiency tracking, and meet sustainability goals. This move supports industries transitioning toward carbon neutrality through digital energy tools.(Source: https://www.prnewswire.com)

- In May 2025, Schneider Electric unveiled its One Digital Grid Platform, an AI-powered cloud-integrated solution aimed at modernizing energy distribution systems. The platform supports real-time analytics, predictive maintenance, and grid optimization to enhance energy efficiency. Schneider's innovation highlights its commitment to enabling digital transformation and sustainability in power networks worldwide.(Source: https://www.se.com)

- In October 2024, Adani Group & Google announced that Adani will supply clean energy from a solar-wind hybrid project (Kavda, Gujarat) to power Google's cloud operations in India. The project is expected to become commercially operational in Q3 2025.(Source: https://www.indiatoday.in)

- In June 2025, RWE & Amazon Web Services (AWS) formed a partnership. RWE will supply clean power from its solar/wind assets and receive cloud, AI, and data analytics services from AWS, supporting both companies' sustainability and digital transformation goals.(Source: https://www.reuters.com)

Segments Covered in the Report

By Application

- Energy Trading and Optimization

- Grid Management

- Renewable Energy Integration

- Demand Response and Load Balancing

- Energy Storage Management

- Asset Management

- Workforce Management

By Service Model

- Software-as-a-Service (SaaS)

- Platform-as-a-Service (PaaS)

- Infrastructure-as-a-Service (IaaS)

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By End-User Industry

- Utilities

- Renewable Energy Developers

- Energy Retailers

- Industrial and Commercial Energy Consumers

By Connectivity Technology

- Internet of Things (IoT)

- Smart Meters

- Distributed Energy Resources (DERs)

- Blockchain

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting