What is the Enterprise Firewall Market Size?

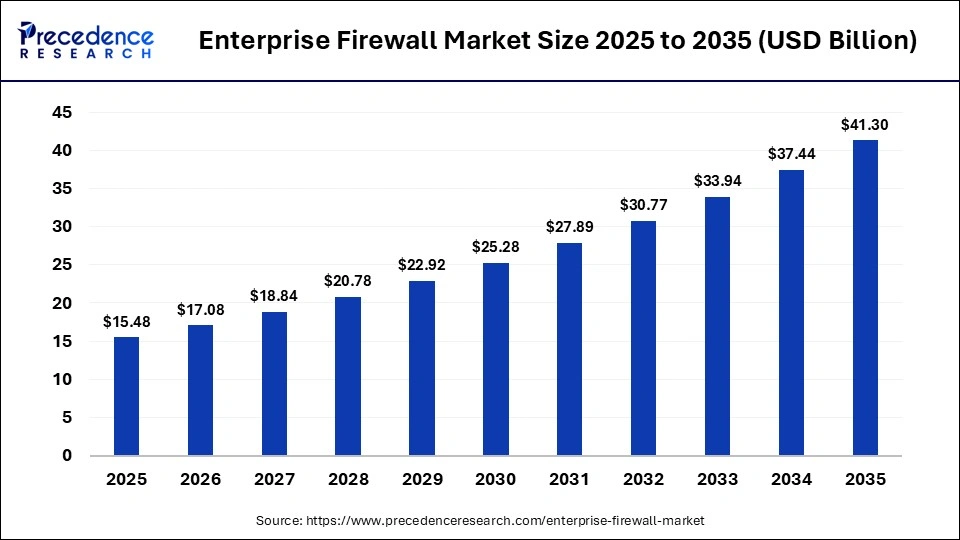

The global enterprise firewall market size was calculated at USD 15.48 billion in 2025 and is predicted to increase from USD 17.08 billion in 2026 to approximately USD 41.30 billion by 2035, expanding at a CAGR of 10.31% from 2026 to 2035. The market is driven by the increasing sophistication of cyberthreats, the expansion of connected IT infrastructures through IoT, AI/ML integration, and 5G deployment. Additionally, the rising adoption of next-generation firewall solutions by enterprises to meet stringent data security and compliance requirements is further accelerating market expansion.

Market Highlights

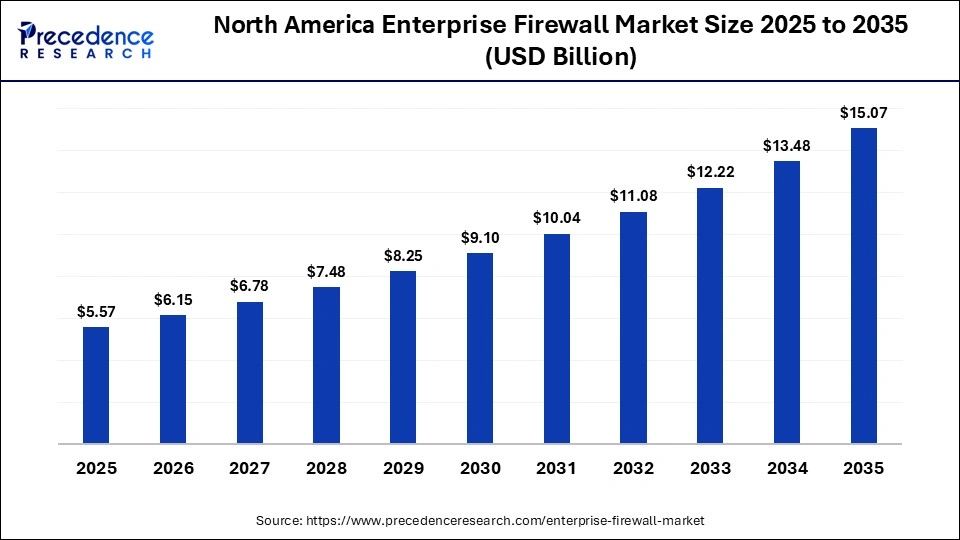

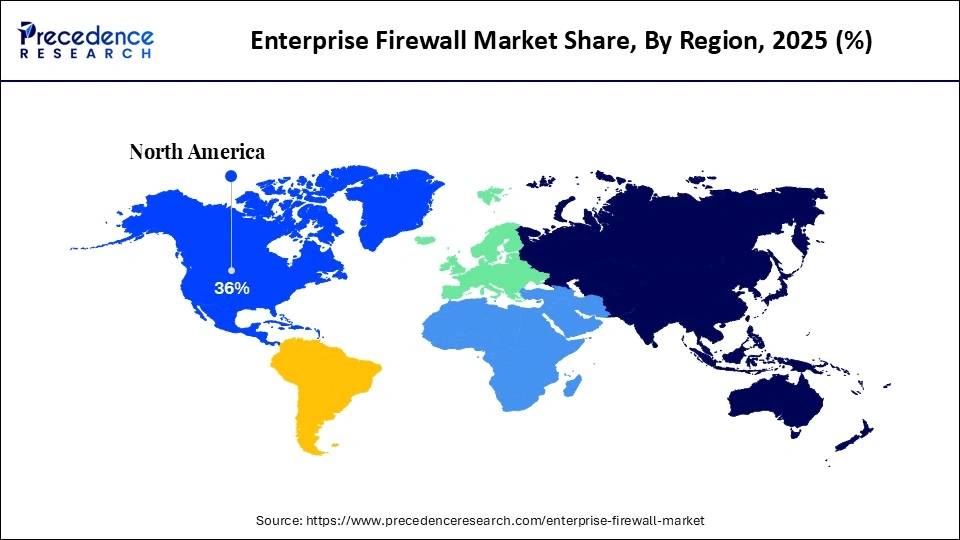

- North America held the largest share of 36% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the foreseeable period.

- By deployment type, the on-premises segment held the largest market share in 2025.

- By deployment type, the cloud-native firewall-as-a-service segment is expected to grow at the fastest CAGR during the foreseeable period.

- By component, the hardware segment held the largest market share in 2025.

- By component, the managed & professional services segment is expected to grow at the fastest CAGR during the foreseeable period.

- By enterprise size, the large organizations segment held the largest market share in 2025.

- By enterprise size, the small & micro enterprises segment is expected to grow at the fastest CAGR during the foreseeable period.

- By end user, the BFSI segment held the largest market share in 2025.

By end user, the retail & e-commerce segment is expected to grow at the fastest CAGR during the foreseeable period.

What is an Enterprise Firewall?

The enterprise firewall is a sophisticated network security solution designed to protect large and complex IT infrastructures from cyberthreats. It achieves this by inspecting, filtering, and controlling data traffic between the internet and internal company systems. Modern enterprise firewalls have evolved from traditional defenses into cloud-driven, multi-layered next-generation firewalls and firewall-as-a-service (FWaaS) solutions. These advanced systems support hybrid work models and multi-cloud environments, meeting the growing market demand for secure, flexible, and location-independent digital operations amid rapid digitalization.

Key Technological Shifts in the Enterprise Firewall Market

The market is undergoing significant shifts with the rapid integration of artificial intelligence into enterprise firewall-as-a-service (FWaaS) solutions. AI-driven firewalls provide proactive and predictive defense by analyzing vast real-time data streams to detect malicious attacks, automate routine security tasks, and enable hybrid and cloud infrastructure protection. These intelligent systems go beyond conventional data security, safeguarding AI applications against cyber threats such as model extraction, malicious prompt injections, and sensitive data breaches, while supporting strategic adoption by leading market players.

Enterprise Firewall Market Trends

- Organizations are increasingly moving from centralized hardware firewalls to cloud-native solutions and distributed security models, driving global expansion.

- Rising demand for advanced features such as encrypted traffic inspection, AI-powered threat detection, and intrusion prevention is fueling growth amid increasing cyberattacks.

- Firewalls are increasingly being integrated with frameworks like zero-trust security, particularly in critical public and private infrastructure sectors.

- Many companies are adopting subscription-based firewall-as-a-service (FWaaS) models to reduce hardware costs while maintaining advanced security capabilities, further strengthening market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.48Billion |

| Market Size in 2026 | USD 17.08 Billion |

| Market Size by 2035 | USD 41.30 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.31% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, Subscription Model, Delivery Mode, Market place, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Deployment Type Insights

Why Did the On-Premises Segment Dominate the Enterprise Firewall Market?

The on-premises segment dominated the market by holding the largest share in 2025, owing to the need for maximum data control, improved data security, and regulatory compliance. Many enterprises are maintaining the physical ownership of the hardware that ensures data sovereignty and restricts data leakage across borders, assisting in compliance with stringent data regulations like GDPR. On-premises firewalls provide granular segmentation of internal networks and prevent lateral movements of cyber threats. Enterprises prefer on-premises solutions for critical environments that require low latency, compliance with strict data regulations, and protection of sensitive information.

The cloud-native firewall-as-a-service segment is expected to grow at the fastest CAGR during the foreseeable period, as it offers highly scalable and centralized security, which is highly critical for modern and cloud-first infrastructure as compared to conventional hardware-based appliances. FWaaS provides a single-pane-of-glass view to managing security policies across several distributed regions that reduces the extra burden on IT administration. Cloud-native FWaaS also enables real-time threat detection, automated updates, and seamless integration with AI-driven security tools, making it ideal for protecting distributed networks and remote users while supporting digital transformation initiatives.

Component Insights

What Made Hardware Appliances the Leading Segment in the Enterprise Firewall Market?

The hardware appliances segment led the market by capturing the largest share in 2025 due to its critical role as a physical gatekeeper between the internet and internal enterprise networks. These appliances deliver high performance through dedicated, purpose-built components and advanced capabilities that allow network segmentation into isolated zones. By isolating different network areas, hardware firewalls prevent attackers from moving laterally and help contain the impact of potential data breaches, ensuring robust enterprise security.

The managed & professional services segment is expected to grow at the fastest CAGR during the foreseeable period, driven by the increasing complexity of modern network security solutions. These services address the shortage of in-house cybersecurity talent and help organizations manage constant, evolving cyber threats. Primarily offered by Managed Security Service Providers (MSSPs), they provide proactive 24/7 monitoring, support cloud-native security, and scale with business expansion across new locations and remote work environments, making them highly valuable for enterprises.

Enterprise Size Insights

How Does the Large Organizations Contribute the Largest Market Share?

The large organizations segment held the largest share of the market in 2025 as large enterprises heavily invested in the advanced, high-throughput next-gen firewalls to secure complex, hybrid cloud and distributed infrastructure to combat evolving ways of data breaches. These enterprises are early adopters of AI-powered threat intelligence and virtual firewall deployments to support innovation and business growth. Additionally, their significant budgets enable the procurement and implementation of comprehensive, multi-layered security architectures, further fueling market expansion.

The small & micro enterprises segment is expected to grow at the fastest CAGR during the foreseeable period due to the increasing need for cost-effective and scalable cybersecurity solutions that can protect smaller and more budget-conscious organizations. As cyber threats continue to evolve, even small businesses are becoming prime targets for data breaches and attacks, prompting them to adopt firewalls for data protection. Additionally, the growing adoption of digital tools, cloud services, and remote work practices among small businesses is further driving the demand for robust security solutions.

End User Insights

Why Did the BFSI Segment Dominate the Enterprise Firewall Market?

The BFSI segment dominated the market with the largest share in 2025. This is because the BFSI sector is highly sensitive in terms of data breaches, as they handle sensitive information in a huge volume and faces sophisticated cyber threats frequently. The BFSI sector's shift to online services is a major reason why this sector is adopting advanced security services like next-gen firewall services. Also, the sector follows strict data security regulations to protect consumers' assets and private data and to maintain trust and reliable data transactions.

The retail & e-commerce segment is expected to grow at the fastest CAGR during the foreseeable period. This is due to the sector's increasing reliance on digital platforms, online transactions, and cloud-based services, which expose sensitive customer and payment data to cyber threats. Rising instances of data breaches, ransomware attacks, and phishing targeting retailers have heightened the need for advanced firewall solutions to secure networks, point-of-sale systems, and e-commerce applications.

Moreover, the adoption of AI-driven firewalls and zero-trust security frameworks allows retailers to monitor traffic, detect threats in real time, and ensure compliance with data protection regulations, further driving market growth. The expansion of omnichannel retail strategies and mobile commerce also fuels demand for scalable and flexible firewall solutions in this sector.

Regional Insights

How Big is the North America Enterprise Firewall Market Size?

The North America Enterprise firewall market size is estimated at USD 5.57 billion in 2025 and is projected to reach approximately USD 15.07 billion by 2035, with a 10.47% CAGR from 2026 to 2035.

What Made North America the Leader in the Enterprise Firewall Market?

North America led the market by capturing the largest share in 2025, driven by its highly advanced IT infrastructure and the presence of leading cybersecurity vendors such as Palo Alto Networks and Fortinet. Strong regulatory mandates like GDPR and CCPA have further fueled the adoption of robust firewall solutions. Additionally, the concentration of industry giants in the region promotes high-quality innovation in firewall-as-a-service offerings, accelerating the deployment of advanced next-generation firewall technologies across enterprises.

The evolving landscape of cyberthreats has prompted organizations across North America to invest heavily in scalable, AI-powered firewall solutions to safeguard their cybersecurity frameworks and ensure compliance with stringent data protection regulations. The rapid adoption of advanced technologies such as IoT, 5G, and big data analytics is further driving the demand for robust security solutions, significantly fueling the growth of the enterprise firewall market in the region.

What is the Size of the U.S. Enterprise FirewallMarket?

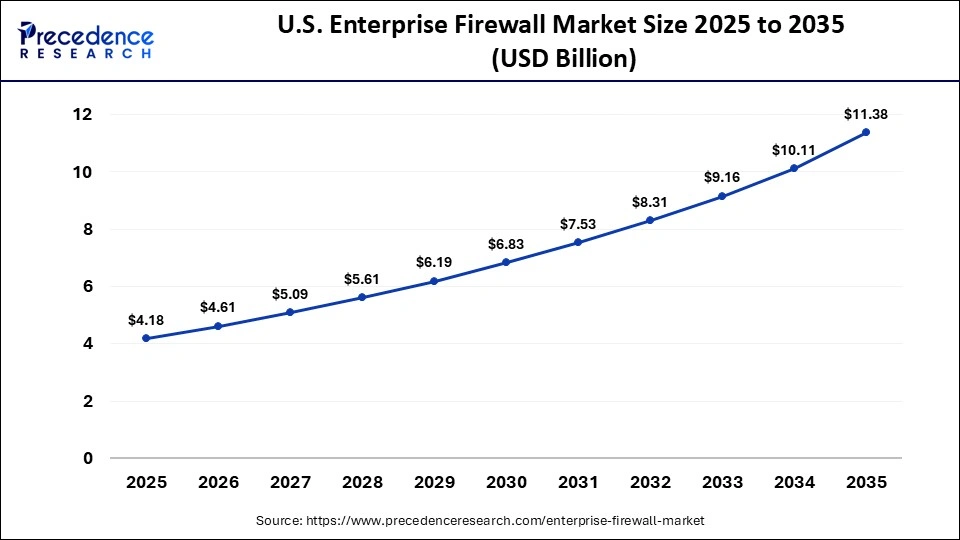

The U.S. Enterprise firewall market size is calculated at USD 4.18 billion in 2025 and is expected to reach nearly USD 11.38 billion in 2035, accelerating at a strong CAGR of 10.53% between 2026 and 2035.

U.S Enterprise Firewall Market Analysis

The U.S. is a leading contributor to the North American market, driven by the strong presence of highly regulated industries such as finance and insurance, which rely on robust cybersecurity to protect sensitive data. The rapid adoption of cloud computing and remote work models is creating demand for flexible and scalable firewall solutions capable of addressing increasingly sophisticated cyber threats. Additionally, the expansion of IoT devices and connected infrastructure is compelling U.S. enterprises to adopt next-generation firewall technologies, further accelerating market growth.

Why is Asia Pacific Considered the Fastest-Growing Region in the Enterprise Firewall Market?

Asia Pacific is expected to grow at the fastest CAGR during the foreseeable period, driven by the rapid digital transformation, evolving cyberthreats, and strict data regulations. Many economies across Asia Pacific are adopting cloud-based solutions, remote working models, 5G rollouts, and IoT expansion, which leads to the vulnerability of cyberthreats to the enterprises, as cyberattacks have become highly sophisticated and are targeting industries with sensitive information. Therefore, to effectively protect remote workforces, large private and government firms are turning to firewall solutions that can integrate with VPN, secure access service edge, and FWaaS models to maintain encrypted and secure connections, boosting the market growth further.

China Enterprise Firewall Market Trends

The market in China is experiencing notable growth, driven by rapid digitalization across multiple industries and the integration of advanced security engines by leading vendors. Companies are increasingly deploying AI-driven threat detection algorithms to improve real-time monitoring and prevention of cyberattacks; for instance, Huawei's network firewalls leverage AI-powered detection to achieve up to a 95% success rate in identifying malicious activities and potential data breaches. Additionally, the market is seeing heightened merger and acquisition activity as key players strengthen R&D capabilities and expand their firewall product portfolios to remain competitive.

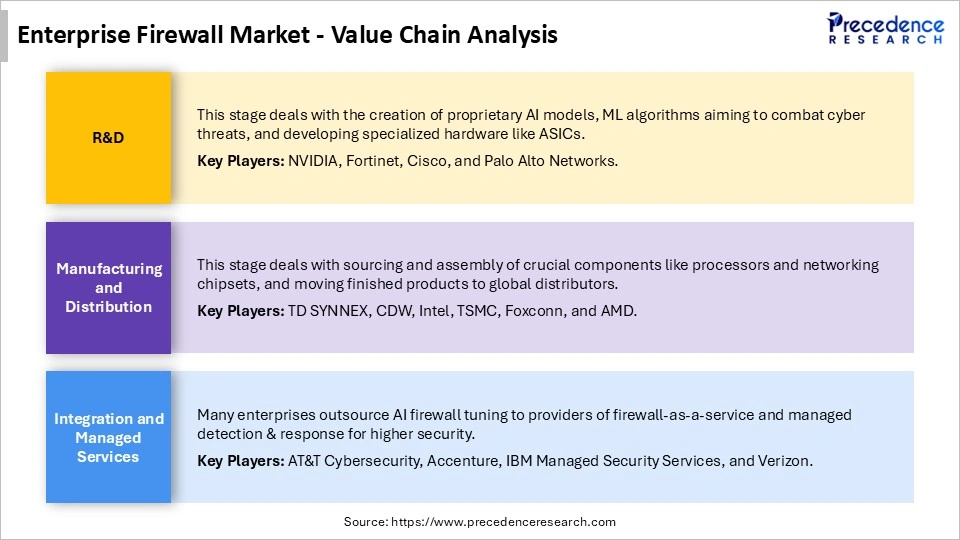

Enterprise Firewall Market Value Chain Analysis

Who are the Major Players in the Global Wellness Management Apps Market?

The major players in the wellness management apps market include Palo Alto Networks, Fortinet, Cisco, Juniper Networks, Sophos, WatchGuard Technologies

Recent Developments

- In June 2025, the global cybersecurity leader, Fortinet, announced its expansion of FortiMail with the launch of the FortiMail workspace security suite, combined with new features like an AI-driven approach and next-gen DLP.

- In January 2026, Cisco released patches and disclosed CVE-2026-20045 for a crucial remote code execution vulnerability under its unified communications products that are actively exploited by unknown intruders/attackers.

Segments Covered in the Report

By Deployment Type

- On-Premises

- Cloud-Native Firewall-as-a-Service (FWaaS)

- Hybrid/Virtual

By Component

- Hardware Appliance

- Virtual Appliance/Software

- Managed and Professional Services

By Enterprise Size

- Small and Micro Enterprises (<100 employees)

- Mid-sized Enterprises (100-999)

- Large Enterprises (≥1,000)

By End-user Industry

- BFSI

- Healthcare and Life Sciences

- Manufacturing and Industrial

- Government and Defense

- Retail and E-commerce

- Telecom and Media

- Education and Research

- Energy and Utilities

- Other End-user Industries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content