What is the Enterprise Search Market Size?

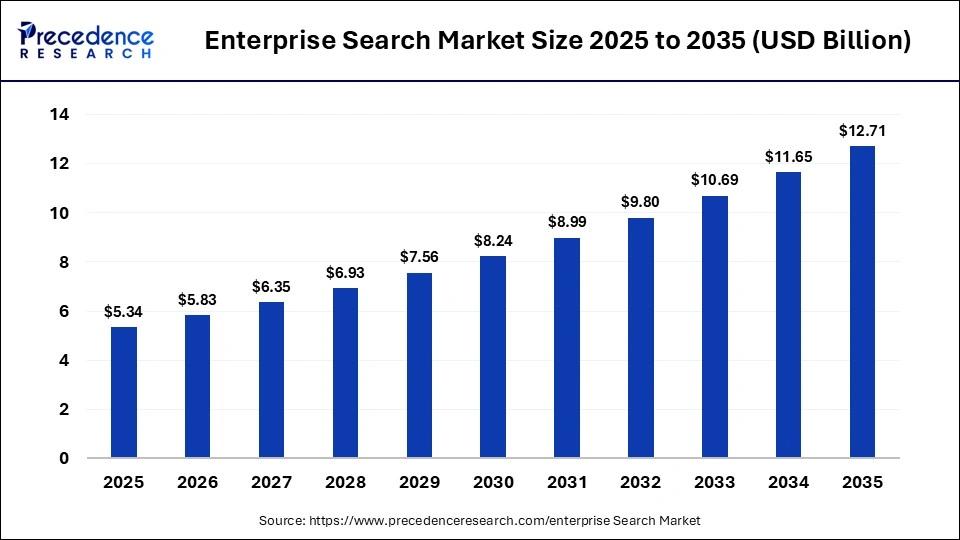

The global enterprise search market size was calculated at USD 5.34 billion in 2025 and is predicted to increase from USD 5.83 billion in 2026 to approximately USD 12.71 billion by 2035, expanding at a CAGR of 9.05% from 2026 to 2035. The enterprise search market is driven by data explosion and demand for fast, accurate information access. Integration of AI and other AI-based tools has created advancements in enterprise search systems.

Market Highlights

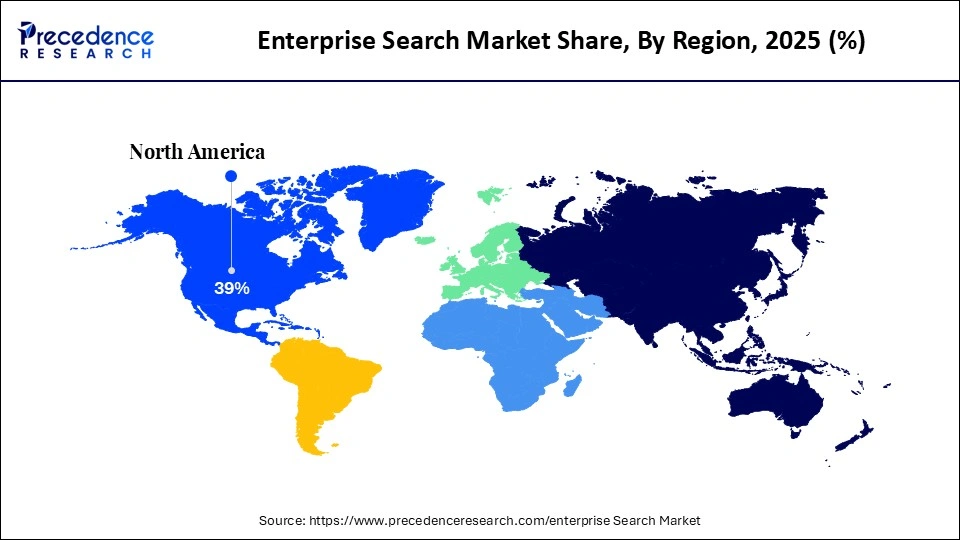

- North America dominated the enterprise search market, holding the largest market share of approximately 39% in 2025.

- The Asia Pacific is expected to expand at the fastest CAGR between 2026 and 2035.

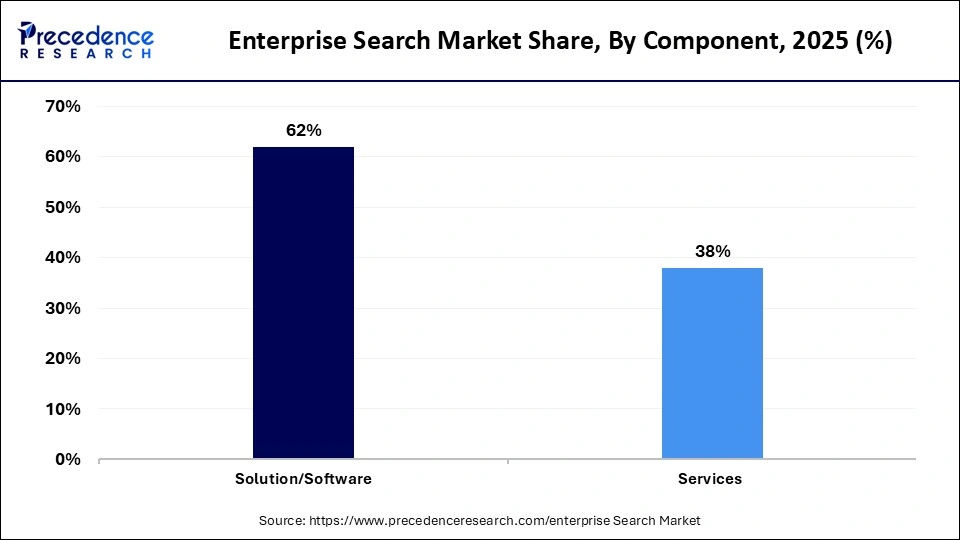

- By component, the solution/software segment held the largest market share of approximately 62% in 2025.

- By component, the services segment is expected to grow at a remarkable CAGR of 9.0% between 2026 and 2035.

- By search type/technology, the keyword-based search segment held the largest market share of approximately 42% in 2025.

- By search type/technology, the conversational/NLP search segment is expected to grow at a remarkable CAGR of 8.7% %between 2026 and 2035.

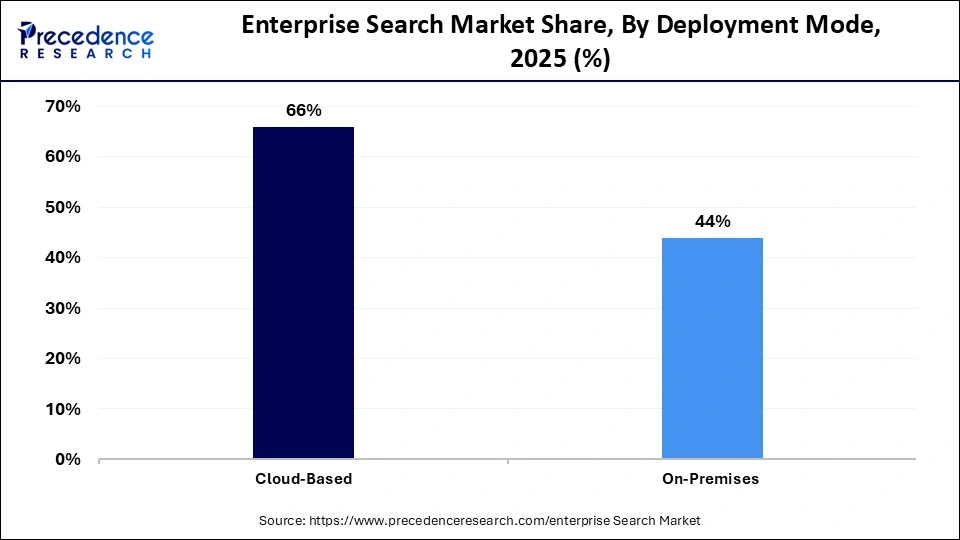

- By deployment mode, the cloud-based segment held the largest market share of approximately 66% in 2025 and is expected to grow at the fastest CAGR of 9.1% during the forecast period.

- By deployment mode, the on-premises segment held a notable share of 30-34% between 2026 and 2035.

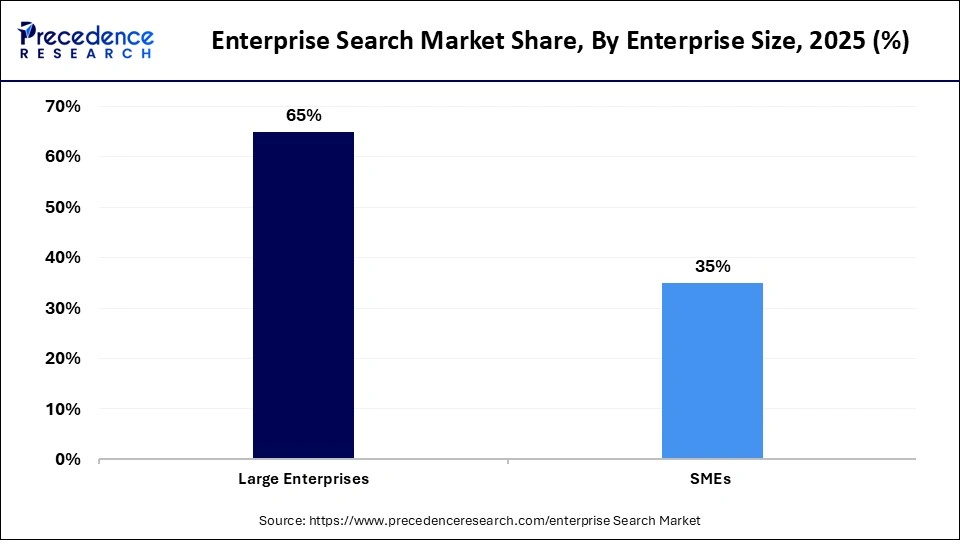

- By enterprise size, the large enterprises segment held the largest share of approximately 65% in the enterprise search market in 2025.

- By enterprise size, the SMEs are set to grow at the fastest CAGR of 9.4% between 2026 and 2035.

- By industry vertical, the BFSI segment held the largest market share of approximately 20% in 2025.

- By industry vertical, the healthcare & life sciences segment is expected to expand at the fastest growth rate of 8.9% CAGR between 2026 and 2035.

Transforming Data Access: Innovation and Growth in the Enterprise Search Market Enterprise

The enterprise search market consists of software and services that enable organizations to effectively find, retrieve, and analyze information in various and distributed data sources. These solutions make use of indexing, artificial intelligence, natural language processing, and analytics technologies to provide highly relevant search results based on both structured and unstructured data to make decisions, improve productivity, and general knowledge management.

The fast growth of data permeating enterprises, the requirement to get actionable insights more quickly, is compelling uptake in major industries such as BFSI, healthcare, government, and retail. The implementation of enterprise search systems has also been increased by the initiatives of digital transformation, the transition to the cloud, and the transition to a remote and hybrid work model.

Key AI Integration in the Enterprise Search Market

Artificial intelligence is proving to be an irreplaceable component of contemporary enterprise search systems, which would greatly help in the way companies seek, manage, and use information. Machine vision and optical character recognition (OCR) are technologies that can be used by enterprises to make the text in scanned documents, images, invoices, contracts, and handwritten records, revealing large volumes of previously inaccessible unstructured data.

Useful AI is used to automatically classify the material, generate metadata, and detect entities, making the life of organizing information in emails, databases, and cloud applications, as well as inside repositories, easier. The productivity of employees can be improved through ongoing user behaviors and feedback that can result in increasingly accurate AI-led enterprise search solutions.

Enterprise Search Market Trends

- Rising use of enterprise search systems in cloud applications, collaboration systems, and content management systems to promote single access to distributed organizational information.

- Making semantic search and knowledge graph more frequently used to improve the understanding of data relationships, making it more relevant, and faster decision-making in business processes.

- Voice and virtual assistant search, such as voice-activated search and hands-free information search, will be extended to enable a remote and mobile work environment to be more useful and productive.

- High data protection, access control, and conformity capacity to sensitive enterprise information, and meet regulatory requirements in industries.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.34 Billion |

| Market Size in 2026 | USD 5.83 Billion |

| Market Size by 2035 | USD 12.71 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.05% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Search Type/Technology, Deployment Mode, Enterprise Size, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

Why Did the Solution/Software Segment Hold a 62-69% Share in 2025?

In 2025, the solution/software segment commanded approximately 62% market share in the enterprise search market, since there is growing uptake of the core search platform in big and mid-sized organizations. The businesses and governments needed scalable AI-powered software to index, analyze, and access structured and unstructured data in an efficient way. The features, such as natural language processing, machine learning, semantic search, and workflow integration, made productivity and decision-making processes more effective, which drove the demand for software solutions.

The services segment is expected to grow at the fastest CAGR of 9.0% in the enterprise search market during the forecast period. Organizations require professional consulting, system integration, customization, maintenance, and cloud migration services to simplify performance and ensure compliance. The fast development of AI, NLP, and analytics required continuous service, which was a need in managed services. The SMEs and the large enterprises utilized the services of third parties to implement, upgrade, and support more complex search solutions without straining the internal IT department. They also offered training for employees, data indexing, and security audits, and this helped organizations to maximize the ROI of search platforms.

Search Type/Technology Insights

Why Did the Keyword-Based Search Segment Hold a 42% Share in 2025?

In 2025, the keyword-based search segment had approximately 42% of the enterprise search market share since it has been widely used as a highly reliable and comfortable method of information retrieval. Keywords used to index the structured databases, document archives, and internal knowledge systems were the choice of the organizations in traditional industries. It has allowed identifying specific information with ease upon searching using the specific words or Boolean operators, and has been suitable when the necessary information was necessary in accordance with financial and human resource questions.

The conversational/NLP search segment is expected to grow at the highest rate of 8.7% in the enterprise search market during the forecast period. The use of natural language processing was also common in organizations where the workers could interact with search systems through the human language to improve productivity and ease of access. Such systems could determine intent, synonyms, and semantics between unstructured and structured data sources and deliver more relevant and accurate results. The conversational search was useful in enhancing the workflow, chatbots, virtual assistants, and voice-based search, particularly in BFSI, healthcare, and retail industries.

Deployment Mode Insights

Why Did Cloud-Based Lead the Enterprise Search Market in 2025?

The cloud-based segment dominated the market, occupying approximately 66% in 2025 and is estimated to achieve the fastest CAGR of 9.1% during 2026-2035. Cloud solutions enabled the organizations to implement enterprise search solutions without investing a lot of upfront infrastructure, and could also implement the solution across various locations quickly. They advocated elastic computing in order to address the changing search requests, massive data, and AI-based analytics effectively. The adoption of clouds also enabled a smooth update, integration with the SaaS applications, and accessibility even in the remote or hybrid work environment.

The on-premises segment will increase substantially as a result of organizations with high data privacy, regulatory, as well and security demands. Companies in the BFSI, healthcare, and government sectors like to store sensitive information in internal IT infrastructure as it facilitates compliance with laws and control. This model is also preferred by companies that are highly customization-based so that they can customize search capabilities to particular workflows.

Enterprise Size Insights

Why Did the Large Enterprises Segment Lead the Market in 2025?

The large enterprises segment took up approximately 65% of the enterprise search market in 2025 because they have large volumes of structured and unstructured data, which require a sophisticated exit tool. Multinational corporations and conglomerates deployed AI-based search systems to enhance the decision-making process, streamline workflow, and knowledge management. The budgets on IT were high enough to invest in cloud as well as on-premise deployment with advanced analytics, natural language processing, and semantic search features. Enterprise search was also used by large businesses in compliance, customer insights, and operational effectiveness.

The SMEs segment is expected to expand at a high rate of 9.4% during the predicted timeframe as digitalization, adoption of technology, and accessibility of low-cost, cloud-based enterprise search are increasing. SMEs are also demanding affordable solutions that will simplify their operations, increase productivity, and access important business-related information without the use of extensive upfront infrastructure. The connection with the existing business, collaboration, and customer management tools further increases the level of access and efficiency in workflow.

Industry Vertical Insights

Why Did the BFSI Segment Lead the Enterprise Search Market in 2025?

The BFSI segment was the market leader with approximately 20% share in 2025. Enterprise search systems facilitate access to valuable information by banks, insurance companies, and investment firms in a rapid way so as to meet and manage risks, report, and make business decisions. Enterprise resource planning (ERP), customer relationship management (CRM), and compliance systems have been incorporated to ensure the right access to information and meet the utmost regulatory requirements. The search tools useful to the industry also help in the detection of fraud, real-time analytics, and predictive insight, making the operations of the industry work better and reducing the risk posed by the finances.

The healthcare & life sciences segment will be described as rapidly growing with a CAGR of 8.9% in the enterprise search market due to the increasing number of people who need effective knowledge management, access to clinical data, and the possibility of research findings. Hospitals, pharmaceutical companies, and research institutions generate high volumes of structured and unstructured data in the form of patient records, laboratory reports, clinical trial data, and scientific publications. Enterprise search solutions enable such organizations to search and extract important information. The integration of the EHRs, research databases, and compliance systems is carried out to provide an auditable and secure access to sensitive information.

Region Insights

How Big is the North America Enterprise Search Market Size?

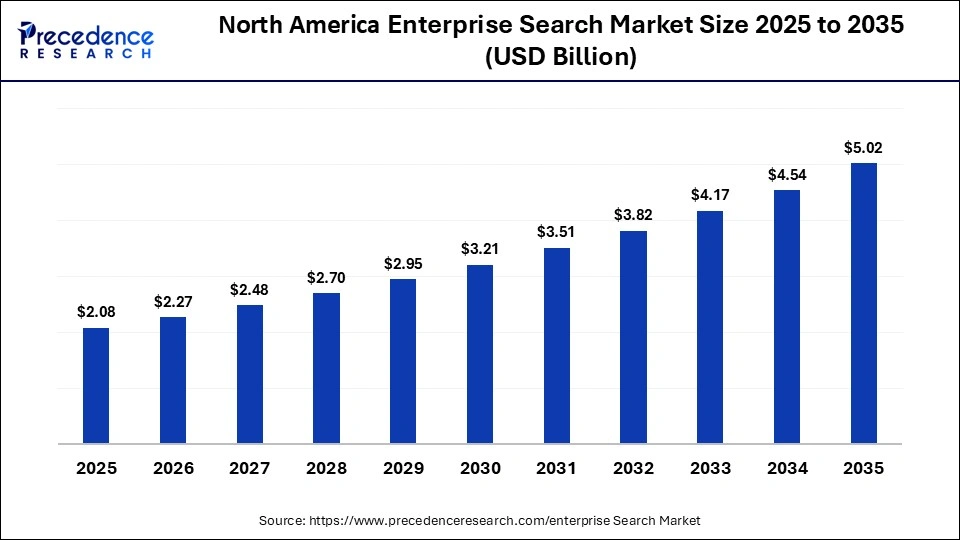

The North America enterprise search market size is estimated at USD 2.08 billion in 2025 and is projected to reach approximately USD 5.02 billion by 2035, with a 9.21% CAGR from 2026 to 2035.

Why Did North America Lead the Global Enterprise Search Market in 2025?

In 2025, North America was the largest market with approximately 39% share of the enterprise search market because of several technology providers and software innovators that have their headquarters in the region. North America has led in enterprise search innovation, with these companies leading technological innovations such as AI-powered search, natural language processing, and machine learning integrations. The area enjoys the presence of a high adoption of cloud computing, digital transformation intervention, and advanced IT infrastructure in the industries of BFSI, healthcare, retail, and government. There are also strong investments in research and development, venture capital, and quality human resources.

What is the Size of the U.S. Enterprise Search Market?

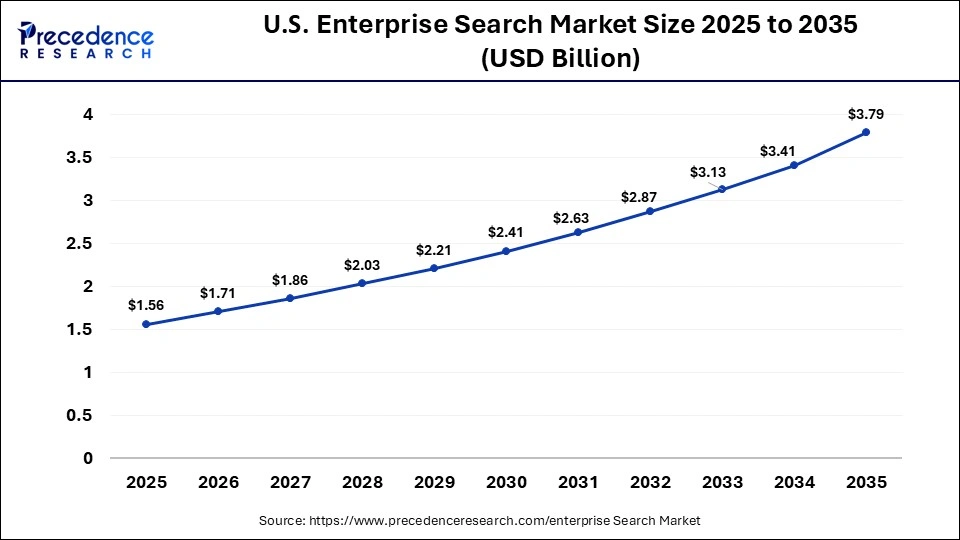

The U.S. enterprise search market size is calculated at USD 1.56 billion in 2025 and is expected to reach nearly USD 3.79 billion in 2035, accelerating at a strong CAGR of 9.28% between 2026 and 2035.

U.S. Enterprise Search Market Analysis

The market in the U.S. is growing due to the increasing need for organizations to efficiently access and analyze vast amounts of structured and unstructured data across multiple sources. The rapid adoption of cloud computing, AI-powered search, and analytics platforms is enhancing data accessibility, productivity, and decision-making capabilities. Additionally, rising demand for personalized user experiences, knowledge management, and regulatory compliance is driving businesses to invest heavily in advanced enterprise search solutions.

Why is Asia Pacific undergoing the Fastest Growth in the Enterprise Search Market?

The Asia Pacific region is experiencing the most rapid growth of 10.3% in the world enterprise search market, which has 10.3% market share, due to the high growth of the IT sector in China, India, Japan, South Korea, and the Philippines. More efforts in digitalization and the adoption of AI, cloud computing, and data analytics by businesses have intensified the demand for intelligent search solutions.

The growth of small and large software companies, as well as the active support of the government for the projects of smart cities, fintech innovations, and digital transformation, provided great opportunities in the market. High rates of smartphone and internet connections, and the growing use of the cloud, have allowed companies to use scalable AI-driven search engines that enhance productivity, collaboration, and decision-making.

Why Is the European Enterprise Search Market Experiencing Notable Growth?

The European enterprise search market has grown significantly because of the stringent data privacy measures like GDPR that are stimulating the usage of hybrid and localized enterprise search solutions. Germany has a robust industrial uptake with enterprise search being incorporated within the production and manufacturing cycles, increasing operational effectiveness.

The United Kingdom is the leader in the financial and regulatory industries and has integrated semantic search into the compliance and risk management activities. Companies in the retail, healthcare, and BFSI industries are increasingly using improved search engines to handle vast amounts of both structured and unstructured information, promote teamwork, and make decisions that help drive continuous expansion in the local market.

Recent Developments in the Enterprise Search Market

- In June 2025, Glean had raised USD 150 million in Series F funding by Wellington, which gave the company a USD 7.2 billion valuation. The investment will hasten the process of developing AI-based enterprise search solutions and expanding initiatives in the country by the company.(Source: https://www.glean.com)

- In May 2025, Microsoft released NLWeb, an open protocol that is intended to add search features powered by AI directly to websites. The innovation allows companies to integrate the features of conversational search and chatbots on the web platforms effectively.(Source: https://techcrunch.com)

- In April 2025, HubSpot also bought Dashworks to allow go-to-market teams to search their business-wide. The acquisition will deliver AI-aided search and productivity solutions, enhancing access to information and efficiency in operations in sales and marketing operations.(Source: https://www.cmswire.com)

Who are the Major Players in the Global Enterprise Search Market?

The major players in the enterprise search market include Microsoft Corporation, IBM Corporation, Google LLC, Oracle Corporation, SAP SE, Coveo Solutions Inc., Lucidworks, Elastic NV (Elasticsearch), Sinequa, Attivio / TIBCO (if under Attivio brand), MarkLogic Inc., X1 Technologies, Expert System (Expert System Inc.), Algolia, and OpenText Corporation.

Segments Covered in the Report

By Component

- Solution/Software

- Services

By Search Type/Technology

- Keyword-Based Search

- Conversational/NLP Search

- Multimedia/Multilingual, Others

By Deployment Mode

- Cloud-Based

- On-Premises

By Enterprise Size

- Large Enterprises

- SMEs

By Industry Vertical

- BFSI

- Healthcare & Life Sciences

- Government & Defense

- IT & Telecom

- Retail & E-Commerce

- Manufacturing & Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting