What is the Extracellular Vesicles-Based Liquid Biopsy Market Size?

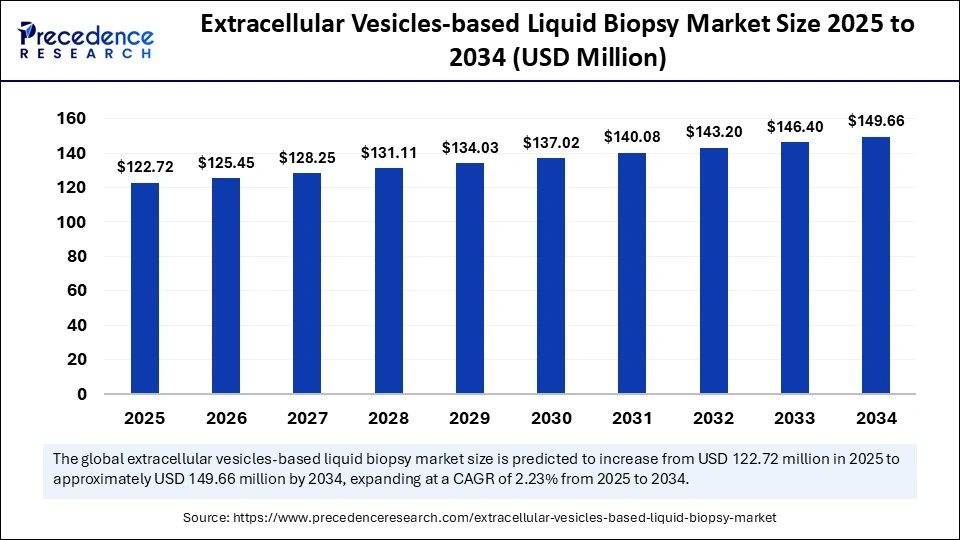

The global extracellular vesicles-based liquid biopsy market size is calculated at USD 122.72 million in 2025 and is predicted to increase from USD 125.45 million in 2026 to approximately USD 149.66 million by 2034, expanding at a CAGR of 2.23% from 2025 to 2034. This market is growing due to the increasing demand for minimally invasive diagnostic tools and the rising global prevalence of cancer.

Market Highlights

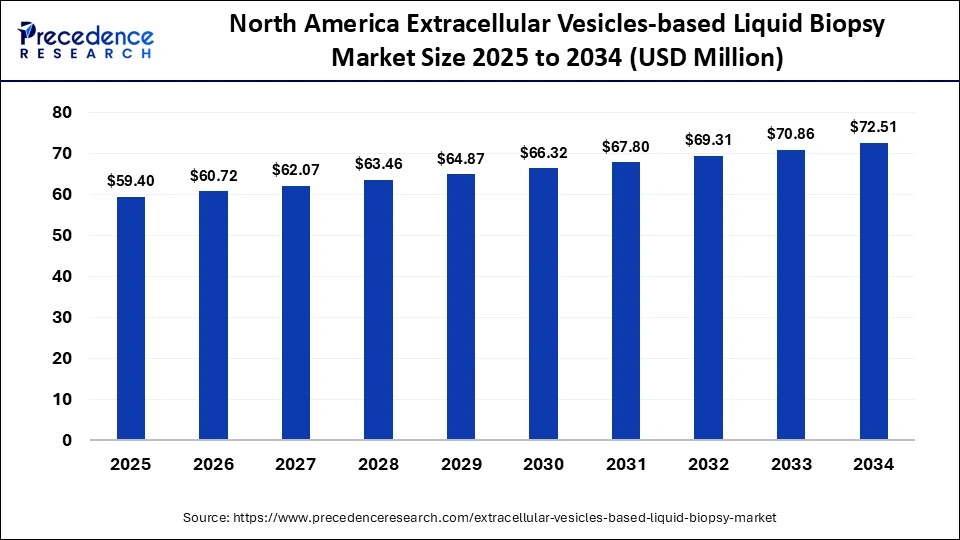

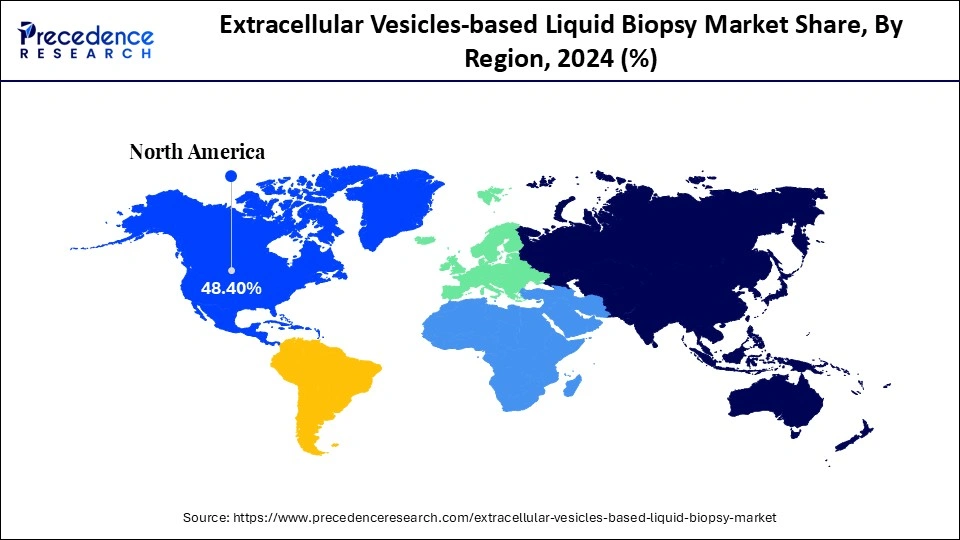

- North America dominated the market, holding the largest market share of 48.40% in 2024.

- The Asia Pacific is expected to expand at the fastest CAGR of 15.5% between 2025 and 2034.

- By type of vesicle, the exosomes segment held the major market share of 54.3% in 2024.

- By type of vesicle, the apoptotic bodies segment is expected to grow at a remarkable CAGR of 14.2% from 2025 to 2034.

- By component, the kits & reagents segment contributed the highest market share of 54.4% in 2024.

- By component, the services segment is growing at a remarkable CAGR of 14.4% from 2025 to 2034.

- By application, the oncology segment recorded the highest market share of 48.2% in 2024.

- By application, neurology is growing at a remarkable CAGR of 14.8% between 2025 and 2034.

- By biomarker type, the RNA biomarkers segment accounted for the highest market share of 51.8% in 2024.

- By biomarker type, the DNA biomarkers segment is expected to expand at a solid CAGR of 14.6% between 2025 and 2034.

- By end user, the academic & research institutes segment held the largest market share of 46.5% in 2024.

- By end user, the hospitals & diagnostic centers segment is set to grow at a significant rate of 14.7% CAGR between 2025 and 2034.

Market Overview

EV-Based Liquid Biopsy: Transforming Diagnostics for Precise, Early Detection

The extracellular vesicle-based liquid biopsy market is expanding rapidly as demand for precise, non-invasive diagnostic tools increases. For early disease detection, particularly in cancer, EVs offer rich biomarker data. Due to advanced R&D, North America dominates the market, while the Asia Pacific exhibits robust growth supported by healthcare investments. Wider adoption is still constrained by issues like standardization and high costs.

Case Study: In June 2024, Mursla Bio launched NEXOS, an advanced electro-optical extracellular vesicle (EV) detection system designed for ultra-sensitive diagnostics. The technology combines electrical and optical detection methods to quantify EV subtypes and protein markers in blood with unprecedented precision. This innovation supports non-invasive liquid biopsy applications, particularly in early cancer detection and precision medicine. NEXOS also underpins Murslas EvoLive program for liver cancer surveillance, which has received FDA Breakthrough Device Designation for its strong diagnostic performance.

Key Technological Shifts & Innovation in Extracellular Vesicles-Based Liquid Biopsy Market

| Innovative Areas | Technological Shifts | Market Impact |

| EV Isolation | Transition from ultracentrifugation to microfluidic & immunoaffinity-based methods | Faster, purer, and scalable EV extraction for diagnostics |

| AI & Data Analytics | AI-powered biomarker profiling and predictive modeling | Improves diagnostic accuracy and early disease detection |

| Detection Platforms | Shift to electro-optical, nano plasmonic & biosensor systems | Enables ultra-sensitive and real-time EV detection |

| Multi-Omics Integration | Combining EV proteomics, RNA & metabolomics | Delivers deeper molecular insights and personalized medicine |

| Lab-on-a-Chip Systems | Portable, high-throughput microfluidic devices | Speeds up analysis and supports point-of-care testing |

Extracellular Vesicles-Based Liquid Biopsy Market Outlook

The market for EV-based liquid biopsies is growing as demand for accurate non-invasive diagnostics increases. For early disease detection, particularly cancer, EVs provide rich biomarker data. Market momentum is being driven by expanding research to clinic transitions and improvements in EV isolation.

EV testing is becoming more standardized, scalable, and affordable. Microfluidics and artificial intelligence technologies are increasing accessibility and speed, and their uses are growing beyond cancer. Long-term sustainability requires clinical integration and stricter regulations.

The startup landscape is thriving, with innovators like Mursla Bio and Mercy BioAnalytics leading EV-based diagnostic advancements. Startups are securing funding, partnering with research institutes, and driving the commercialization of next-gen liquid biopsy solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 122.72 Million |

| Market Size in 2026 | USD 125.45 Million |

| Market Size by 2034 | USD 149.66 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.23% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Vesicle, Component, Application, Biomarker Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Extracellular Vesicles-Based Liquid Biopsy Market Segmental Insights

Type of Vesicle Insights

The exosomes segment dominates the extracellular vesicle-based liquid biopsy market, accounting for 54.3%, as these are favored as biomarkers for cancer and neurodegenerative diseases due to their widespread presence in biological fluids and their capacity to carry molecular signatures representative of parent cells. Their market dominance is further reinforced by their ease of isolation and compatibility with cutting-edge detection platforms.

Apoptotic bodies are the fastest-growing segment in the extracellular vesicles-based liquid biopsy market, with a 14.2% CAGR, driven by growing curiosity about the mechanisms underlying programmed cell death and the role of apoptotic bodies in immunological signaling and disease detection. Market expansion is supported by R&D ongoing use of these vesicles for the early detection of autoimmune and neurodegenerative diseases.

Microvesicles are emerging as versatile diagnostic tools as scientist learn more about their function, inflammatory reactions, and cellular signaling. They may serve as biomarkers for metabolic and chronic illnesses due to their molecular diversity and dynamic nature, opening up possibilities beyond oncology.

Component Insights

The kits & reagents segment dominates the extracellular vesicles-based liquid biopsy market, with a 54.4% share, due to their crucial role at each step of extracellular vesicle isolation, purification, and analysis. Their steady demand is driven by ongoing improvements in EV-specific reagent formulations and the expanding use of standardized isolation kits in clinical and research settings.

Services are the fastest growing in the extracellular vesicles-based liquid biopsy market, with a CAGR of 14.4% driven by growing EV analysis outsourcing to specialized labs, the need for custom assay development, and the rise of contract research firms providing biopharma clients with EV characterization, sequencing, and proteomics services, all contribute to growth.

In response to the increasing demand for diagnostic instruments, development is moving toward automation and miniaturization. High-efficiency clinical testing is enabled by advanced EV analyzers and lab-on-a-chip devices, which are increasing sample throughput and accuracy.

Application Insights

The oncology segment is dominating the extracellular vesicles-based liquid biopsy market, with a 48.2% share, driven by the strong potential of EV-based liquid biopsies for tracking recurrence, monitoring therapy, and early cancer detection. Exosomes and microvesicles are highly useful in precision oncology workflows because they provide non-invasive access to tumor-derived nucleic acids.

Neurology is the fastest-growing segment in the extracellular vesicles-based liquid biopsy market, with a CAGR of 14.8% driven by interest in EV-based brain biomarkers, which provide insights into diseases like Alzheimer and Parkinson via cerebrospinal fluid and blood analysis has increased due to the rising prevalence of neurodegenerative diseases and the challenge of obtaining neural tissue samples.

Cardiovascular and metabolic disorder applications are gradually emerging, as EV-based liquid biopsy shows promise for evaluating inflammation, lipid metabolism, and cardiac damage. Beyond oncology, this diversification expands the clinical application of EV diagnostics.

Biomarker Type Insights

The RNA biomarkers segment dominates the extracellular vesicles-based liquid biopsy market, with a 51.8% share, owing to their strong ability to mirror gene expression changes and disease progression. Exosomal RNAs, including miRNA and lncRNA, have become crucial indicators for tumor classification and therapeutic response prediction in liquid biopsy assays.

DNA biomarkers are the fastest-growing segment in the extracellular vesicles-based liquid biopsy market, with a 14.6% CAGR, particularly in oncology research and early-stage diagnostics. The identification of tumor-derived DNA fragments encapsulated within vesicles has increased their use in mutation detection and minimal residual disease monitoring.

Protein biomarkers continue to play a complementary role by validating EV function and improving assay accuracy. Their incorporation with RNA and DNA biomarkers improves clinical reliability across disease domains and increases overall diagnostic sensitivity. The synergistic use of these multiplexed biomarkers promises a new era of highly sensitive, non-invasive liquid biopsies for early disease detection and personalized medicine.

End User Insights

The academic & research institutes segment dominates the extracellular vesicles-based liquid biopsy market, with a 46.5% share. Government funding partnerships with biotech companies to validate new liquid biopsy applications and a wealth of basic and translational research on EV biology and biomarker discovery are the sources of their leadership.

Hospitals & diagnostic centers are the fastest-growing segment in the extracellular vesicles-based liquid biopsy market, with a CAGR of 14.7%. The rising integration of EV-based liquid biopsy tests into clinical workflows for cancer screening and therapeutic monitoring has driven adoption among healthcare facilities, improving early diagnosis and personalized treatment strategies.

Biotechnology and pharmaceutical companies are increasingly utilizing EV-based liquid biopsy data for drug discovery, biomarker validation, and patient stratification. By bridging the gap between therapeutics and diagnostics, this integration signals a change toward a more comprehensive healthcare system.

Extracellular Vesicles-Based Liquid Biopsy Market Regional Insights

The North America extracellular vesicle-based liquid biopsy market size is estimated at USD 59.40 million in 2025 and is projected to reach approximately USD 72.51 million by 2034, with a 2.24% CAGR from 2025 to 2034.

Why Did North America Lead the Extracellular Vesicles-Based Liquid Biopsy Market?

North America dominated the market in 2024, with a 48.4% share, backed by early regulatory approvals, significant R&D investments, and a robust biotech presence. U.S. leads in the clinical adoption of EV-based diagnostics due to its strong healthcare infrastructure and strategic partnerships with biopharmaceutical companies and academic institutions.

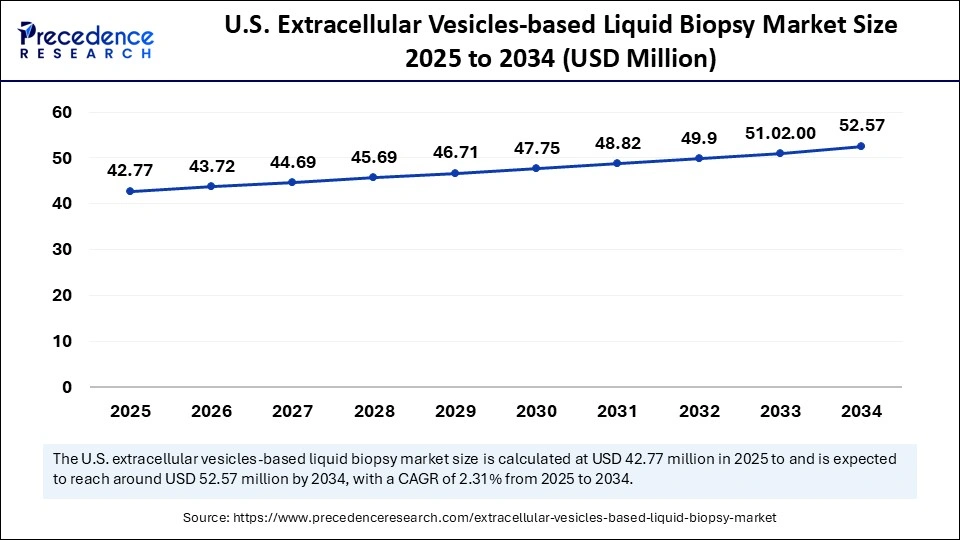

The U.S. extracellular vesicle-based liquid biopsy market size is calculated at USD 42.77 million in 2025 and is expected to reach nearly USD 52.57 million in 2034, accelerating at a strong CAGR of 2.31% between 2025 and 2034.

U.S. Extracellular Vesicles-Based Liquid Biopsy Market Trends

The U.S. extracellular vesicles-based liquid biopsy market is expanding, driven by robust R&D investments in precision medicine and the growing need for non-invasive cancer diagnostics. Innovation is fueled by the increasing use of AI-driven data analysis, collaborations between biotech companies and academic institutions, and developments in EV isolation technologies. Large-scale clinical adoption is still hampered by issues like reimbursement restrictions and a lack of assay standardization. The market is still concentrating on creating trustworthy EV-based assays for real-time disease monitoring and early detection.

Asia Pacific is the fastest-growing region in the extracellular vesicles-based liquid biopsy market, with a 15.5% CAGR, driven by government initiatives supporting cutting-edge healthcare technologies, rising awareness of non-invasive diagnostics, and the adoption of precision medicine. The regions market potential is further strengthened by its increasing investment in biotechnology and clinical research.

India Extracellular Vesicles-Based Liquid Biopsy Market Trends

The Indian extracellular vesicle-based liquid biopsy market is witnessing strong growth driven by the rising number of cancer cases, the need for non-invasive diagnostic tools, and advances in molecular biology. Adoption is also being fueled by greater awareness of early disease detection through government healthcare programs and research partnerships.

The Latin America extracellular vesicle-based liquid biopsy market is steadily growing, encouraged by the governments emphasis on healthcare innovation, the rising incidence of cancer, and increased funding for precision medicine. Growing partnerships between academic institutions and biotech companies are expanding the regions access to cutting-edge diagnostic tools. Research on EV-based biomarkers is being driven by the focus on early disease detection and non-invasive testing, making Latin America an emerging contributor to the global diagnostic landscape.

Brazil Extracellular Vesicles-Based Liquid Biopsy Market Trends

Within the region, Brazil leads the market with strong R&D capabilities and academic initiatives in exosome and biomarker research. Argentina is fortifying its molecular diagnostics industry through public-private partnerships, while Mexico is growing its diagnostic infrastructure through partnerships between domestic universities and foreign biotech firms. Prominent regional contributors include Bioensayos Laboratorios (Argentina), which specializes in biomarker testing and validation, and CellPraxis Biotech (Brazil), which is well-known for its exosome research in oncology. These companies are establishing Latin America as a potential center for the development and uptake of EV-based liquid biopsy technology.

Extracellular Vesicles (EV)-Based Liquid Biopsy Market Value Chain

Focuses on identifying EV-derived RNA, DNA, and protein biomarkers, and developing advanced isolation, enrichment, and characterization technologies using nanotechnology and AI.

Key Players: Codiak BioSciences, HansaBioMed Life Sciences, Evox Therapeutics, NanoSomix

Involves clinical validation of EV-based assays, regulatory compliance, and scalable production of diagnostic kits and instruments with reproducible results.

Key Players: Thermo Fisher Scientific, Qiagen, Bio-Techne, Agilent Technologies

Ensures reliable supply of EV-based kits and reagents through established distribution networks and partnerships with diagnostic centers worldwide.

Key Players: Thermo Fisher Scientific, Qiagen, Bio-Rad Laboratories, Merck KGaA

EV-based liquid biopsy technologies are used in clinical diagnostics, academic research, and pharmaceutical drug development for disease monitoring and personalized treatment.

Key Players: Mayo Clinic Laboratories, MD Anderson Cancer Center, Dana-Farber Cancer Institute, Johns Hopkins University

Extracellular Vesicles-Based Liquid Biopsy Market Companies

Corporate Information

- Headquarters: Waltham, Massachusetts, United States

- Year Founded: 2006 (through the merger of Thermo Electron Corporation and Fisher Scientific International)

- Ownership Type: Publicly Traded (NYSE: TMO)

History and Background

Thermo Fisher Scientific, Inc. was formed in 2006 through the merger of Thermo Electron and Fisher Scientific, creating one of the worlds largest providers of scientific instruments, analytical tools, reagents, and laboratory services. The company serves multiple industries, including healthcare, biotechnology, pharmaceuticals, and diagnostics.

In the Extracellular Vesicles (EV)-Based Liquid Biopsy Market, Thermo Fisher Scientific is a Tier-1 global leader, offering cutting-edge platforms for EV isolation, characterization, and nucleic acid analysis. Its integrated workflow solutions enable researchers and clinicians to use extracellular vesicles such as exosomes and microvesicles for early disease detection, oncology biomarker discovery, and therapeutic monitoring.

Key Milestones / Timeline

- 2006: Established through the merger of Thermo Electron and Fisher Scientific

- 2015: Introduced EV isolation and purification kits for research and diagnostic applications

- 2020: Expanded its EV research solutions through acquisitions of molecular and sequencing technology firms

- 2023: Launched the Invitrogen Exosome Isolation and Characterization platform

- 2024: Announced integration of EV workflows with next-generation sequencing (NGS) for precision liquid biopsy applications

Business Overview

Thermo Fisher provides comprehensive liquid biopsy solutions that combine its expertise in molecular biology, sequencing, and analytical instrumentation. In the extracellular vesicle-based segment, its products support the full workflow from sample preparation and EV isolation to RNA/DNA profiling and biomarker quantification.

Business Segments / Divisions

- Life Sciences Solutions

- Analytical Instruments

- Specialty Diagnostics

- Laboratory Products and Biopharma Services

Geographic Presence

Thermo Fisher operates in over 100 countries with major R&D, manufacturing, and service centers in the United States, Germany, the United Kingdom, and Singapore.

Key Offerings

- Invitrogen Total Exosome Isolation Kits for plasma, serum, and urine samples

- NanoDrop spectrophotometers and EV characterization instruments

- Ion Torrent Genexus Sequencer for integrated EV-based liquid biopsy workflows

- Applied Biosystems QuantStudio qPCR systems for EV RNA quantification

- EV-compatible sample preparation reagents and microfluidic chips

Financial Overview

Thermo Fisher Scientific reports annual revenues exceeding $42 billion USD, driven by continued growth in its diagnostics and life sciences businesses, including EV-based research tools.

Key Developments and Strategic Initiatives

- April 2023: Expanded EV characterization portfolio with high-sensitivity nanoparticle analysis instruments

- September 2023: Partnered with leading research institutions to develop standardized EV liquid biopsy workflows

- June 2024: Released integrated EV RNA extraction-to-NGS sequencing pipeline for oncology diagnostics

- January 2025: Announced AI-driven EV biomarker analysis software for early cancer detection

Partnerships & Collaborations

- Collaborations with cancer research consortia and academic hospitals for EV-based biomarker discovery

- Partnerships with biotech firms for the commercialization of EV liquid biopsy assays

- Alliances with diagnostic labs for workflow validation in clinical applications

Product Launches / Innovations

- Invitrogen Total Exosome Isolation Reagent (2023)

- Ion Torrent Genexus EV Workflow (2024)

- AI-integrated EV Analysis Suite (2025)

Technological Capabilities / R&D Focus

- Core technologies: Extracellular vesicle isolation, nucleic acid quantification, microfluidics, and next-generation sequencing

- Research Infrastructure: Global R&D facilities in Massachusetts, Germany, and Singapore

- Innovation focus: Standardized EV workflows for liquid biopsy, automation, and AI-driven analysis

Competitive Positioning

- Strengths: Comprehensive workflow integration, global reach, and strong innovation pipeline

- Differentiators: Complete EV-to-NGS liquid biopsy ecosystem and advanced analytical instrument integration

SWOT Analysis

- Strengths: Broad product range, established brand reputation, and R&D leadership

- Weaknesses: High instrument cost limits accessibility for smaller research facilities

- Opportunities: Growing adoption of EV-based liquid biopsies in oncology and rare disease diagnostics

- Threats: Rising competition from specialized EV start-ups offering low-cost kits

Recent News and Updates

- March 2024: Launched next-generation EV characterization instruments with enhanced sensitivity

- July 2024: Announced collaboration with the NIH on liquid biopsy biomarker standardization

- January 2025: Introduced a cloud-enabled EV data analysis platform for genomics researchers

Corporate Information

- Headquarters: Venlo, Netherlands

- Year Founded: 1984

- Ownership Type: Publicly Traded (NYSE: QGEN; Frankfurt Stock Exchange: QIA)

History and Background

QIAGEN N.V. was founded in 1984 and has become a global leader in sample preparation, molecular diagnostics, and assay technologies. The company specializes in developing solutions for nucleic acid extraction, molecular testing, and bioinformatics, enabling advances in life sciences, forensics, and clinical research.

In the Extracellular Vesicles (EV)-Based Liquid Biopsy Market, QIAGEN plays a Tier-1 role by offering a suite of sample and assay technologies that streamline EV isolation and nucleic acid extraction for liquid biopsy applications. Its kits and automated systems are widely used for detecting RNA, DNA, and protein biomarkers from EVs in blood, urine, and cerebrospinal fluid, supporting both translational research and clinical development.

Key Milestones / Timeline

- 1984: Founded in Germany with a focus on nucleic acid extraction

- 2004: Expanded into automated sample preparation technologies

- 2018: Introduced exoRNeasy Serum/Plasma Kits for EV RNA extraction

- 2022: Enhanced liquid biopsy portfolio through integration with QIAcuity digital PCR

- 2024: Developed next-generation QIAsymphony EV workflow for high-throughput diagnostics

Business Overview

QIAGEN provides molecular testing solutions across the research-to-diagnostics spectrum. Its role in the EV-based liquid biopsy market focuses on reliable and reproducible EV nucleic acid isolation and quantification, enabling improved sensitivity in cancer and infectious disease testing. The companys products are used by pharmaceutical companies, research labs, and diagnostic developers worldwide.

Business Segments / Divisions

- Life Sciences Research

- Molecular Diagnostics

- Bioinformatics Solutions

Geographic Presence

QIAGEN operates in more than 35 countries, with major facilities in Germany, the Netherlands, the United States, and China.

Key Offerings

- exoRNeasy and exoEasy Kits for EV RNA and protein purification

- QIAcuity Digital PCR System for EV-based mutation and expression analysis

- QIAamp Circulating Nucleic Acid Kits for EV biomarker detection

- QIAxcel and QIAsymphony automation platforms for high-throughput workflows

- Integrated bioinformatics tools for EV biomarker data interpretation

Financial Overview

QIAGEN N.V. reports annual revenues of approximately $2.0 billion USD, supported by steady growth in liquid biopsy and molecular diagnostics demand.

Key Developments and Strategic Initiatives

- March 2023: Introduced improved exoRNeasy Maxi Kit for enhanced EV RNA yield

- October 2023: Collaborated with biopharma partners for clinical-grade EV liquid biopsy validation

- May 2024: Released automated QIAcuity digital PCR-based EV biomarker quantification workflow

- January 2025: Expanded bioinformatics capabilities to integrate AI-based EV biomarker analysis

Partnerships & Collaborations

- Partnerships with leading cancer centers for EV-based biomarker discovery

- Collaborations with diagnostic companies for co-developed liquid biopsy assays

- Alliances with sequencing firms for EV nucleic acid analysis integration

Product Launches / Innovations

- exoRNeasy Serum/Plasma Kit (2023 update)

- QIAcuity Digital PCR EV Workflow (2024)

- AI-enabled QIAGEN CLC Genomics Software for EV biomarker analysis (2025)

Technological Capabilities / R&D Focus

- Core technologies: Nucleic acid extraction, microfluidic separation, PCR, and bioinformatics integration

- Research Infrastructure: R&D centers in Hilden (Germany), Venlo (Netherlands), and Maryland (U.S.)

- Innovation focus: Streamlined EV isolation, reproducible nucleic acid recovery, and clinical-grade assay development

Competitive Positioning

- Strengths: Global brand presence, proven molecular testing expertise, and reliable automation systems

- Differentiators: End-to-end workflow from EV isolation to biomarker quantification

SWOT Analysis

- Strengths: Broad product portfolio, automation capabilities, and bioinformatics integration

- Weaknesses: Higher pricing compared to small EV-focused suppliers

- Opportunities: Expansion into precision medicine and oncology diagnostics using EV-based assays

- Threats: Increasing competition from emerging molecular diagnostic startups

Recent News and Updates

- April 2024: QIAGEN launched expanded exoRNeasy kits for multi-sample EV analysis

- August 2024: Partnered with clinical labs to validate EV workflows for cancer detection

- January 2025: Announced integration of QIAcuity dPCR with AI-assisted data analytics for EV biomarker profiling

Other Players in the Extracellular Vesicles-Based Liquid Biopsy Market

- Bio-Techne Corporation: Bio-Techne develops and manufactures high-quality biological research materials, instruments, and diagnostic solutions. Through its subsidiary Exosome Diagnostics, the company offers advanced extracellular vesicle (EV) isolation and analysis platforms for liquid biopsy applications, enabling biomarker discovery and cancer diagnostics.

- Illumina, Inc.: Illumina is a global leader in DNA sequencing and genomic analysis technologies that play a critical role in EV-based liquid biopsy workflows. Its sequencing platforms are used for profiling exosomal RNA and DNA, facilitating precision oncology, early disease detection, and personalized medicine.

- NanoView Biosciences, Inc: NanoView Biosciences specializes in single-exosome characterization technology. Its ExoView platform provides high-resolution, label-free detection and quantification of individual extracellular vesicles, supporting biomarker discovery and clinical assay development in liquid biopsy research.

- Norgen Biotek Corp.: Norgen Biotek provides comprehensive sample preparation kits and nucleic acid purification systems optimized for exosome and EV isolation. The companys products enable efficient RNA, DNA, and protein extraction from biofluids, supporting both clinical diagnostics and research applications.

- System Biosciences, LLC: System Biosciences offers research tools and kits for exosome isolation, RNA analysis, and EV labeling. The companys proprietary ExoQuick platform is widely used for scalable exosome purification and downstream molecular profiling.

- Beckman Coulter, Inc. (Danaher Corporation): Beckman Coulter provides automated centrifugation and flow cytometry solutions essential for exosome isolation, quantification, and analysis. Its instruments support high-throughput workflows in EV-based diagnostics and research laboratories.

- Hitachi Chemical Diagnostics, Inc: Hitachi Chemical Diagnostics develops diagnostic solutions incorporating EV biomarkers for cancer and neurological disease detection. The company focuses on combining advanced chemical analysis with EV isolation for improved diagnostic sensitivity.

- Exosome Diagnostics (Bio-Techne subsidiary): Exosome Diagnostics, a subsidiary of Bio-Techne, offers liquid biopsy tests based on exosome-derived RNA and DNA analysis. Its proprietary ExoLution technology enables non-invasive detection of cancer biomarkers from biofluids such as blood and urine.

- HansaBioMed Life Sciences: HansaBioMed Life Sciences specializes in EV isolation products, antibodies, and analytical tools. The companys kits and standards are used globally in exosome research, offering solutions for quality control, size profiling, and molecular analysis.

- Evox Therapeutics Ltd.: Evox Therapeutics develops engineered exosome-based delivery platforms for targeted drug and RNA therapy. Its proprietary technology leverages natural EV pathways for precise molecular transport, contributing to innovations in EV-based diagnostics and therapeutics.

- Miltenyi Biotec: Miltenyi Biotec provides advanced EV isolation and analysis solutions, including magnetic separation and flow cytometry systems. Its MACS technology allows for high-purity exosome enrichment from complex biological fluids, supporting translational research and biomarker validation.

- Lonza Group AG: Lonza offers manufacturing and analytical services for extracellular vesicle-based products. The company supports EV purification, characterization, and scalable production for diagnostic developers and biopharmaceutical companies working on EV therapeutics.

- NanoSomix, Inc.: NanoSomix focuses on developing non-invasive liquid biopsy tests based on exosome and EV biomarkers for neurological and neurodegenerative diseases. Its diagnostic research targets Alzheimers and Parkinson disease, utilizing circulating vesicle signatures for early detection.

Recent Developments

- In June 2025, Mursla Bio launched its AI Precision Medicine Platform, built on organ-specific EV isolation from blood.(Source: https://www.businesswire.com)

- In February 2025, INOVIQ Ltd established a new Medical and Scientific Advisory Board to guide advanced diagnostics development, including exosome/extracellular vesicle technologies for cancer.

Extracellular Vesicles-Based Liquid Biopsy MarketSegments Covered in the Report

By Type of Vesicle

- Exosomes

- Microvesicles

- Apoptotic Bodies

By Component

- Kits & Reagents

- Instruments

- Services

By Application

- Oncology

- Neurology

- Cardiovascular Diseases

- Infectious Diseases

- Others (Metabolic, Autoimmune)

By Biomarker Type

- RNA Biomarkers

- Protein Biomarkers

- DNA Biomarkers

- Lipid Biomarkers

By End User

- Academic & Research Institutes

- Hospitals & Diagnostic Centers

- Biotechnology & Pharmaceutical Companies

- CROs & Laboratories

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting