What is the Exosome Therapeutics Market Size?

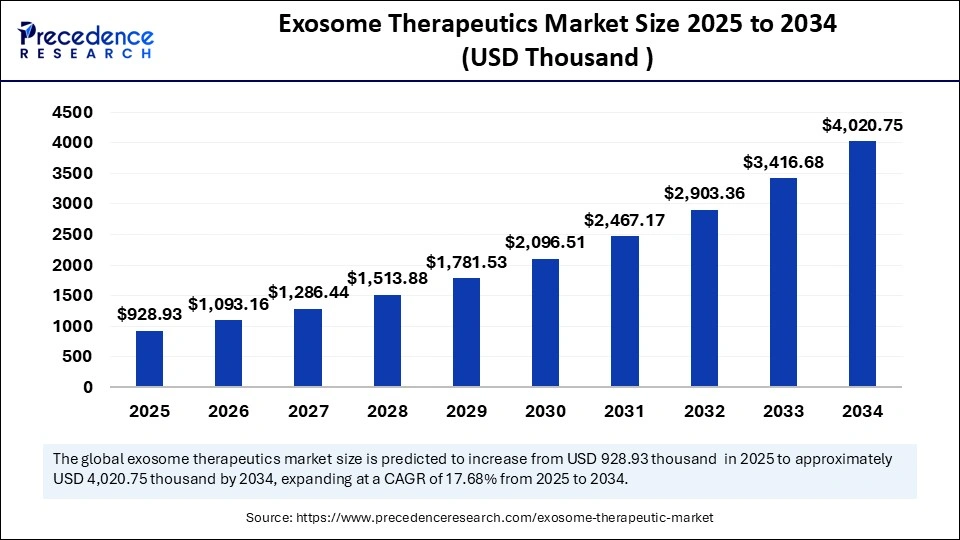

The global exosome therapeutics market size is calculated at USD 928.93 thousand in 2025 and is predicted to increase from USD 1093.16 thousand in 2026 to approximately USD 4,020.75 thousand by 2034, expanding at a CAGR of 17.68% from 2025 to 2034. The global exosome therapeutics market is witnessing robust growth driven by the increasing prevalence of chronic, infectious, autoimmune, and neurodegenerative diseases, rapid advancements in exosome isolation, and rising investments in healthcare infrastructure. This report covers market trends, production volumes, technological developments, and competitive dynamics across North America, Europe, and APAC between 2025 and 2034.

Market Highlights

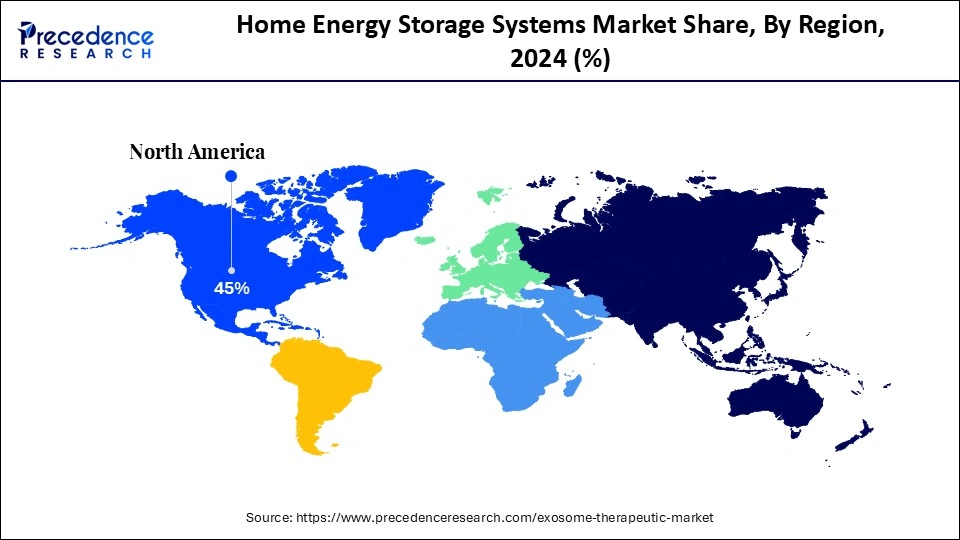

- North America held the largest share of 45% in the exosome therapeutics market in 2024.

- Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By source, the mesenchymal stem cells (MSCs) segment accounted for the dominating share of 45% in 2024.

- By source, the dendritic cells segment is expected to witness a significant share during the forecast period.

- By therapeutic application, the oncology segment held the major market share of 40% in 2024.

- By therapeutic application, the neurology segment is projected to grow at a CAGR between 2025 and 2034.

- By delivery mechanism, the intravenous (IV) segment held a dominant presence in the market in 2024 with a 55% share.

- By delivery mechanism, the intranasal segment accounted for considerable growth in the global exosome therapeutics market over the forecast period.

- By technology, the isolation & purification technologies - ultracentrifugation segment registered its dominance over the global exosome therapeutics market in 2024 with 35% share.

- By technology, the isolation & purification technologies - engineering technologies segment is expected to grow significantly during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 928.93 Thousand

- Market Size in 2026: USD 1093.16 Thousand

- Forecasted Market Size by 2034: USD 4,020.75 Thousand

- CAGR (2025-2034): 17.68%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What Encompasses the Exosome Therapeutics Market?

The increasing demand from oncology, neurology, cardiovascular diseases, and regenerative medicine is anticipated to boost the expansion of the exosome therapeutics market during the forecast period. Exosomes are being engineered as natural drug delivery systems due to their ability to cross biological barriers, low immunogenicity, and potential for targeted therapy. The exosome therapeutics market refers to the development and commercialization of therapies that utilize exosomes—nano-sized extracellular vesicles secreted by cells, to deliver biomolecules such as proteins, RNA, and lipids for disease treatment.

AI Shifts in the Exosome Therapeutics Market

In the rapidly evolving technological landscape, Artificial intelligence emerges as a game-changer and holds potential for growth and innovation in the exosome therapeutics market by optimizing drug discovery, enhancing the personalization of treatments, and accelerating the analysis of exosome data. The integration of AI has the potential to create more precise, data-driven exosome therapies. AI algorithms can efficiently and accurately analyze large datasets to identify potential therapeutic targets and design more effective exosome-based therapies. AI models analyze multi-omics and exosome biomarker data to predict a patient's ability to respond to specific therapies. AI assists in tailoring exosome therapies based on individual patient profiles by accurately analyzing their unique data, which leads to more personalized treatment strategies for better outcomes.

Exosome Therapeutics Market Outlook

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to see accelerated growth, owing to the advances in exosome isolation, characterization, and engineering technologies, coupled with increasing clinical trials for cancer immunotherapy, neurodegenerative diseases, and wound healing. North America leads due to strong biotech research and funding, while the Asia Pacific is the fastest-growing region due to expanding regenerative medicine adoption.

- Global Expansion: Leading players are expanding their geographical presence. For instance, in September 2022, Evox Therapeutics Ltd, a leading exosome therapeutics company, announced that the Company had been granted four new patents covering a broad range of exosome manufacturing methods and processes. Evox has been granted US Patent US11,298,319, European patents EP3700566 and EP3569254, and Japanese Patent JP6999601. In May 2023, Evox Therapeutics Ltd announced that the Company had been granted another US patent, adding to its growing manufacturing IP portfolio. Evox has been granted a US Patent US11,640,272. The claims of this patent cover a method of purifying engineered exosomes via a downstream process utilizing ultrafiltration and size-based separation steps.

- Major Investors: Private equity and strategic investors are actively engaged in the market. For instance, in April 2024, EXO Biologics, a clinical-stage biotech and a pioneer in developing exosome-based therapies, secured a total of up to EUR 16 million in Series A funding for exosome therapeutic development and clinical trials.(Source: https://www.exobio.be)

Major Trends in the Exosome Therapeutics Market

In March 2024, VivaZome Therapeutics Pty Ltd and La Trobe University announced their collaboration to explore the therapeutic potential of VivaZome's extracellular vesicles (EVs) in models of stroke in the laboratory of Professor Chris Sobey. This collaborative effort brings together VivaZome's expertise in EV manufacturing and La Trobe's stroke research capabilities, led by Professor Sobey. The study entitled “Anti-inflammatory exosomes for stroke: a proof-of-concept (PoC) pilot study” is supported by a $300k grant from the La Trobe Proof-of-Concept (PoC) Fund. (Source: https://vivazome.com)

In December 2024, EXO Biologics and its CDMO subsidiary, ExoXpert, leading innovators in exosome-based therapeutics and drug delivery solutions, announced that ExoXpert is the first European CDMO specializing in exosomes to receive Good Manufacturing Practice (GMP) certification for its state-of-the-art manufacturing plant. In addition, EXO Biologics has managed to achieve the loading of GMP-grade exosomes with mRNA and DNA payloads, a major milestone for the development of exosome-based therapies.(Source: https://www.exobio.be)

In May 2025, RoosterBio, Inc., a leading supplier of adult human mesenchymal stem/stromal cells (hMSCs), highly engineered media, and bioprocess development services, announced a new collaboration with Thermo Fisher Scientific, the world leader in serving science. This collaboration aims to accelerate the availability of new, potentially life-saving cell and exosome therapies that have the potential to revolutionize the treatment of degenerative disease.

(Source: https://www.prweb.com)

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 928.93 Thousand |

| Market Size in 2026 | USD 1093.16 Thousand |

| Market Size by 2034 | USD 4,020.75 Thousand |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.68% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Therapeutic Application, Delivery Mechanism, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Breakthroughs of Clinical Trials

| Key player | Date | Breakthroughs |

| Coya Therapeutics, Inc | In August 2025 | Coya Therapeutics, Inc., a clinical-stage biotechnology company focused on developing biologics, announced that the U.S. Food and Drug Administration had accepted its Investigational New Drug (IND) application for COYA 302. This proprietary immunomodulatory biologic combination therapy is being developed for the treatment of patients with amyotrophic lateral sclerosis (ALS). (Source: https://ir.coyatherapeutics.com) |

| Aegle Therapeutics Corp. | In August 2024 | Aegle Therapeutics Corp., a clinical-stage biopharmaceutical company developing novel extracellular vesicle (EV) therapies to address immune and inflammatory-based dermatological disorders, announced that the first patient has been dosed in a Phase 1/2a clinical study evaluating AGLE-102 for the treatment of the rare pediatric skin blistering disease DEB. (Source: https://www.prnewswire.com) |

| Capricor Therapeutics | In August 2025 | In August 2025, Capricor Therapeutics, a biotechnology company developing transformative cell and exosome-based therapeutics for rare diseases, announced that the first subjects had been dosed in a Phase 1 clinical trial evaluating its StealthX exosome-based vaccine. The study, funded by the National Institutes of Health's National Institute of Allergy and Infectious Diseases (NIAID) under the U.S. Department of Health and Human Services' Project NextGen, follows review and clearance of the Investigational New Drug (IND) application by the U.S. Food and Drug Administration (FDA). The trial is being conducted by an NIAID-funded network of clinical trial sites. (Source: https://www.globenewswire.com) |

| EXO Biologics | In June 2024 | EXO Biologics, a clinical-stage biotech and a pioneer in developing exosome-based therapies, today announces it has completed dosing of the first cohort of patients in EVENEW. This EVENEW study is the first European Medicines Agency (EMA) authorized clinical trial involving mesenchymal stromal cell (MSC)-based exosomes. |

| RION | In September 2025 | RION, a clinical-stage regenerative medicine company and global leader in exosome-based therapeutics, announced the formation of INTENT Biologics, a new independent biotechnology company focused exclusively on developing first-in-class exosome therapies for Inflammation & Immunology (I&I). INTENT Biologics launches with exclusive, perpetual worldwide rights to RION's Purified Exosome Product (PEP) biologic platform in I&I and will advance PEP Biologic into Phase 3 clinical development for advanced tissue regeneration and immune-mediated dermatologic indications. |

Segmental Insights

Source Insights

Which Segment Is Dominating the Market by Source in the Exosome Therapeutics Market?

The mesenchymal stem cells (MSCs) segment dominated the global exosome therapeutics market with a 45% share in 2024. Several studies are increasingly focused on the therapeutic potential of MSC-derived exosomes as a cell-free therapeutic for various health conditions, such as neurological disorders, autoimmune diseases, cardiovascular diseases, cancer, and tissue repair.

On the other hand, the dendritic cells segment is expected to witness remarkable growth during the forecast period. Dendritic cell-derived exosomes (Dex) are highly valued for their use in cancer vaccines and anti-infective therapies, owing to their potent antigen-presenting capabilities. Dex is promising for developing cancer vaccines and therapies against infectious diseases, along with the rapid advancements in 3D cell culture, which significantly increases Dex yield, driving the segment's growth in the coming years.

Delivery Mechanism Insights

What causes the intravenous (IV) segment to dominate the exosome therapeutics market?

The intravenous (IV) segment held a dominant presence in the exosome therapeutics market with a 55% share in 2024. Intravenous (IV) administration is the most widely used method for delivering exosome-based therapies, which allows for systemic circulation to reach target tissues.

On the other hand, the intranasal segment is expected to grow at a notable rate. Intranasal delivery of exosomes shows significant promise owing to their ability to cross the blood-brain barrier, leading to potential treatments for various chronic diseases. This delivery route has the potential to treat neurological disorders and inflammatory conditions by providing targeted therapeutic effects.

Therapeutic Application Insights

How Did the Oncology Segment Dominate the Exosome Therapeutics Market in 2024?

The oncology segment held the majority share of the exosome therapeutics market with a 40% share in 2024. The growth of the segment is driven by the rising global burden of cancer, particularly solid tumors and hematological malignancies. Exosomes act as drug transporters, offering innovative strategies for targeted drug delivery in cancer therapy. Exosomes can deliver therapeutic payloads specifically to cancer cells, enhancing efficacy and reducing side effects. The rapid advancements in exosome isolation and drug delivery technologies, and rising R&D efforts, are expected to propel the segment's growth during the forecast period.

On the other hand, the neurology segment is projected to grow at a CAGR between 2025 and 2034. The growth of the segment is driven by the increasing prevalence of Alzheimer's disease, Parkinson's disease, and stroke globally. Significant investment from pharmaceutical companies, a surge in the number of clinical trials, including Phase I/II and early Phase III, and expanding academic-industry collaborations, are accelerating the development and commercialization of exosome-based therapies for various conditions in neurology.

Technology Insights

How Will Isolation & Purification Technologies Segment Dominate the Market for Exosome Therapeutics in 2024?

The isolation & purification technologies segment held the dominant share of 35% in the exosome therapeutics market. Isolation and purification techniques enable the extraction of higher-purity and consistent exosomes for various therapeutic applications, including cancer vaccines, tissue regeneration, immunotherapy, and others. Key isolation methods include ultracentrifugation, size-exclusion chromatography (SEC), immunoaffinity capture, and microfluidics-based techniques.

On the other hand, the engineering technologies segment is anticipated to grow notably during the forecast period. Engineering technologies include surface modification and cargo loading. Engineered exosomes showing significant potential in treating autoimmune, cancer, neurodegenerative, and cardiovascular diseases by delivering treatments more effectively and safely.

Regional Insights

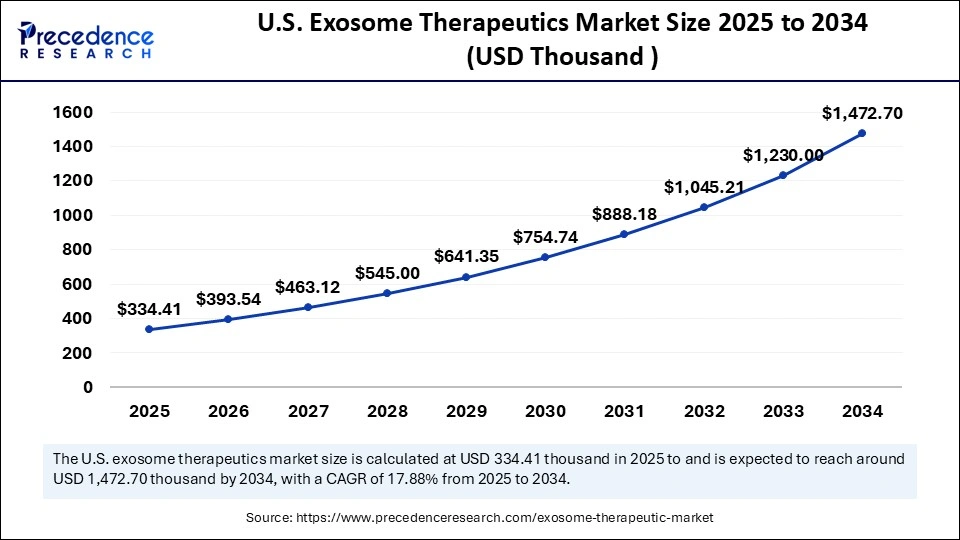

U.S. Exosome Therapeutics Market Size and Growth 2025 to 2034

The U.S. exosome therapeutics market size is evaluated at USD 334.41 thousand in 2025 and is projected to be worth around USD 1,472.70 thousand by 2034, growing at a CAGR of 17.88% from 2025 to 2034.

What Made North America Dominate the Market for Exosome Therapeutics in 2024?

In 2024, North America held a dominant presence in the market. This region holds a strong position in exosome therapeutics, with the presence of thriving biotechnology companies, accelerating emphasis on healthcare spending, surging R&D investments by key players, and increasing clinical trials for cancer immunotherapy, neurodegenerative diseases, and wound healing. The increasing prevalence of cancer, autoimmune diseases, infectious diseases, and neurodegenerative diseases like Alzheimer's Disease, Parkinson's Disease, and others, along with the rapid advancement in exosome collection technologies. Innovative methods, like immunoaffinity capture, microfluidic devices, and continuous-flow systems, enable more efficient exosome isolation and purification from complex samples, which is expected to accelerate the market's revenue during the forecast period.

The United States is a major contributor to the growth of the exosome therapeutics market. The presence of modern research institutions and biotechnology companies in the country, like Aegle Therapeutics, Capricor Therapeutics, StemXO Therapeutics, Codiak BioSciences, Coya Therapeutics, EV Therapeutics, and Direct Biologics. The country has a well-established healthcare infrastructure, a surge in clinical trials, increasing investment in advanced therapies, rising cases of chronic diseases, growing demand for personalized medicine, high per capita healthcare expenditure, expanding applications of exosome therapeutics, and increasing regulatory approvals.

What Makes Asia Pacific the Fastest-Growing Market for Exosome Therapeutics?

The Asia Pacific region is expected to experience the fastest growth during the forecast period. The market in the Asia Pacific is expanding steadily, driven by developing healthcare infrastructure, rising government funding for exosome-based therapies, increasing advancements in biotechnology, reimbursement policies, and a surge in regulatory approvals. Moreover, the greater R&D spending by major players and the increasing number of clinical studies are likely to boost the expansion of the exosome therapeutics market in the region.

The increasing burden of chronic diseases and growing focus on precision medicine in the region create significant medical needs and offer substantial market growth opportunities for innovative therapies. Several key players in the market are strategically adopting initiatives such as mergers & acquisitions to strengthen their market presence. The market is witnessing rapid advancements in exosome technologies are anticipated to propel the growth of the exosome therapeutics market in the region by improving exosome isolation and purification, expanding their potential in regenerative medicine, and enhancing their use as targeted drug delivery vehicles. Such factors are paving the way for more effective and targeted treatments and broadening possibilities of exosome therapeutics in the region.

How is Europe Contributing to the Exosome Therapeutics Market?

Europe is expected to grow at a significant rate during the projection period, driven by a strong emphasis on advanced therapies, research and development, personalized medicine, and a well-established academic and industrial research infrastructure. The market is characterized by strict regulatory environments established by the European Medicines Agency (EMA), which encourages the development of safe and effective exosome-based diagnostics such as liquid biopsies and therapeutics. The region holds a substantial share of the global exosome therapeutic pipeline candidates and hosts major companies, making it a hub for commercialization efforts and outsourcing manufacturing activities.

Germany is a major player in the European market, with a strong presence of global life sciences companies like QIAGEN and Miltenyi Biotec, which contribute significantly to its market share. The country emphasizes rigorous research and development, particularly in using exosomes as biomarkers for cancer and neurodegenerative diseases and as potential drug delivery vehicles. The market benefits from a robust research infrastructure and a skilled workforce, focusing on technical advancements in exosome isolation and characterization to support both academic research and commercial development.

How is the Opportunistic Rise of the Latin American Exosome Therapeutics Market?

The exosome therapeutics market in Latin America is an emerging market with significant growth potential, driven by rising research activity in countries such as Brazil and Argentina, particularly within academic and research institutions. Although the region currently makes up a small part of the global market, it is increasingly focusing on using exosomes for applications in diagnostics, especially for cancer and metabolic disorders, as well as for regenerative medicine. The market mainly depends on kits and reagents for research, with growth in the therapeutics segment relying on standardized isolation and purification protocols.

Brazil plays a major role in Latin America's exosome therapeutics market. The country is seeing increased investment in biotechnology and is focusing more on cancer immunotherapy, neurodegenerative disorders, and gene therapy using exosomes. Partnerships between local biotech companies and international pharmaceutical firms are speeding up research and development, while regulatory agencies like ANVISA are working on clearer guidelines for clinical trials and commercialization to promote innovation.

What Potentiates the Growth of the Middle East and Africa Exosome Therapeutics Market?

The market in the Middle East and Africa is driven by increasing investments in healthcare infrastructure, the rise of chronic diseases, and a growing interest in advanced biotechnological solutions. Challenges such as a lack of awareness, skilled personnel, and standardized protocols remain, but strategic partnerships and government support for R&D are creating opportunities for market growth.

Saudi Arabia is a contributor to the MEA market, acting as a major catalyst for investment in advanced biotechnology and regenerative medicine. The country is focused on using exosomes for cancer immunotherapy, regenerative medicine, including heart and nerve regeneration, and developing diagnostic tools for early disease detection. Strategic partnerships with global firms and increased government funding are positioning Saudi Arabia as a regional leader in the development and commercialization of exosome-based therapies.

Value Chain Analysis

- Research and Development & Innovation

This stage focuses on understanding exosome biology and developing new therapeutic/diagnostic applications.

Key Players: Evox, Capricor, Bio-Techne, and Thermo Fisher. - Clinical Trials and Regulatory Approval

New products undergo rigorous testing for safety and efficacy to secure regulatory approval.

Key Players: Direct Biologics with ExoFlo, Capricor with CAP-1002, Aegle Therapeutics with AGLE-102, IQVIA, and Labcorp. - Manufacturing and Production

This stage involves the scalable, GMP-compliant production of clinical-grade exosomes.

Key Players: Lonza, AGC Biologics, Thermo Fisher Scientific, Miltenyi Biotec, NanoFCM Inc., and Malvern Panalytical. - Distribution and Supply Chain Management

This stage ensures efficient and controlled delivery of sensitive biological products to labs and clinics.

Key Players: Cardinal Health, McKesson, AMSBIO, and System Biosciences. - Service Delivery and Clinical Application

This represents the point of care where physicians utilize exosome products for diagnostics or administer them as therapeutics.

Key Players: Hospitals, clinics, and diagnostic centers using tests such as Bio-Techne's ExoDx.

Country-Level Investments & Trends in Exosome Therapeutics Market

- In January 2025, Scientists at the Eli and Edythe Broad Center of Regenerative Medicine and Stem Cell Research at UCLA received USD 21.8 million in grants from the California Institute for Regenerative Medicine, the state's stem cell agency, to develop and advance new stem cell-based treatments for neuropsychiatric disorders, a blood disorder, and a neurodevelopmental condition.(Source: https://stemcell.ucla.edu)

- In April 2025, Department of New Biology Professor Yea Kyungmoo and his research team developed a next-generation exosome-based drug-delivery technology to effectively treat metabolic dysfunction-associated steatohepatitis (MASH), an incurable metabolic disease, in collaboration with Professor Baek Moon-chang of Kyungpook National University School of Medicine.(Source: https://www.asiaresearchnews.com)

- In March 2025, Exogenus Therapeutics, a biotech company based in Portugal, announced that it had contracted the contract development and manufacturing organization, Lonza, to develop a good manufacturing practice (GMP)-compliant process for Exogenus' exosome-based lead candidate, Exo-101. Lonza will use its expertise in exosome development and analytical services at its Sienna, Italy site to define a process to produce Exo-101 for clinical supply.

(Source: https://www.biopharminternational.com) - In August 2023, Evox Therapeutics Ltd, a leading exosome therapeutics company, announced a research collaboration and option agreement with the Icahn School of Medicine at Mount Sinai in New York, NY. The collaboration will work on developing exosome-encapsulated AAV (exoAAV) vectors as a novel gene delivery technology aimed at improving treatments for heart disease.(Source: https://www.evoxtherapeutics.com)

Global Regulatory Landscape for Exosome Therapeutics

|

Country |

Regulatory Body |

Classification/Framework |

Key Regulatory Approach |

|

U.S. |

FDA |

Drugs/Biologics |

IND required for trials; no approved products exist; warning letters issued to non-compliant clinics. |

|

EU |

EMA |

ATMPs/Biologicals |

Evaluated as biological products or Advanced Therapy Medicinal Products, human-derived exosomes are prohibited in cosmetics. |

|

China |

NMPA |

Cell Therapy/Biologics |

Follows GMP standards; proactive stance on EV therapies; explicitly prohibits cosmetic use of exosomes. |

|

Japan |

PMDA & MHLW |

Regenerative Medicine |

Classified as biologics or regenerative medicine products, a framework is designed to potentially expedite availability. |

Top Key Players in the Exosome Therapeutics Market & Their Offerings:

- Capricor Therapeutics: Capricor Therapeutics is a biotechnology company offering a new approach to drug development in Duchenne muscular dystrophy and beyond. Capricor's science is focused on cell and exosome-based biology, offering multiple modalities allowing us to create a new class of therapeutic medicines for patients.

- Aegle Therapeutics: Aegle Therapeutics is a pioneer in regenerative medicine, developing extracellular vesicle (EV) therapy to meaningfully improve the lives of those suffering from debilitating rare diseases, including dystrophic epidermolysis bullosa (DEB) and other severe dermatological disorders. Aegle's platform technology has the potential to treat a wide range of other therapeutic indications.

- Innovex Therapeutics: Innovex Therapeutics S.L. is a biotechnology company that uses Extracellular Vesicles as Vaccines against infectious diseases with the goal of global health equity. Their mission is focused on the development of Exosomes and Extracellular Vesicles as new platforms for vaccines and diagnostic tools.

- Coya Therapeutics: Coya Therapeutics is a clinical-stage biotechnology company focused on developing proprietary new therapies to enhance the function of regulatory T cells. We are currently developing our multi-modality Treg therapies for neurodegenerative, autoimmune, and metabolic diseases.

- Evox Therapeutics: Evox is a pre-clinical biotech company utilising exosomes as a novel drug delivery technology platform. Evox Therapeutics is redefining the treatment of rare neurological and neurodegenerative diseases by harnessing the power of next-generation genome editing technologies. Evox is advancing an innovative, proprietary pipeline targeting severe neurodegenerative conditions such as ALS and SCA2. They are dedicated to transforming patient outcomes through cutting-edge science and unparalleled therapeutic innovation.

Other Major Key Players

- EV Therapeutics

- StemXO Therapeutics

- Codiak BioSciences

- ExoCoBio

- ILIAS Biologics

- Regeneus

- Innovex Therapeutics

- Brexogen

- Organicell Regenerative Medicine

- Direct Biologics

- Exostemtech

- OmniSpirant

- ShiftBio Inc.

- Aruna Bio

- Kimera Labs

Recent Developments

- In September 2025, RION, a commercial and clinical-stage regenerative medicine company, announced a collaboration with Lonza, one of the world's largest contract development and manufacturing organizations (CDMOs), to provide cGMP manufacturing and technical support for commercial-scale production of its Purified Exosome Product (PEP) drug substance for late-phase clinical supply and beyond.

(Source: https://www.lonza.com) - In September 2025, Coya Therapeutics, Inc., a clinical-stage biotechnology company focused on developing biologics that enhance regulatory T cell (Treg) function in patients with neurodegenerative disorders, announced the launch of the ALSTARS Trial, a Phase 2, randomized, multi-center, double-blind, placebo-controlled study to evaluate the efficacy and safety of COYA 302 for the treatment of ALS.

(Source: https://ir.coyatherapeutics.com)

Segments Covered in the Report

By Source

- Mesenchymal Stem Cells (MSCs)

- Immune Cells

- Dendritic Cells

- Platelets

- Tumor Cells

- Others

By Therapeutic Application

- Oncology

- Solid Tumors

- Hematological Malignancies

- Neurology

- Alzheimer's Disease

- Parkinson's Disease

- Stroke

- Cardiovascular Diseases

- Infectious Diseases

- Regenerative Medicine

- Wound Healing

- Orthopedic Applications

- Others

By Delivery Mechanism

- Intravenous (IV)

- Intratumoral

- Intranasal

- Local/Topical Administration

- Others

By Technology

- Isolation & Purification Technologies

- Ultracentrifugation

- Size-Exclusion Chromatography (SEC)

- Immunoaffinity Capture

- Microfluidics-Based Techniques

- Engineering Technologies

- Surface Modification

- Cargo Loading

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting