Exosome Isolation Market Size and Forecast 2025 to 2034

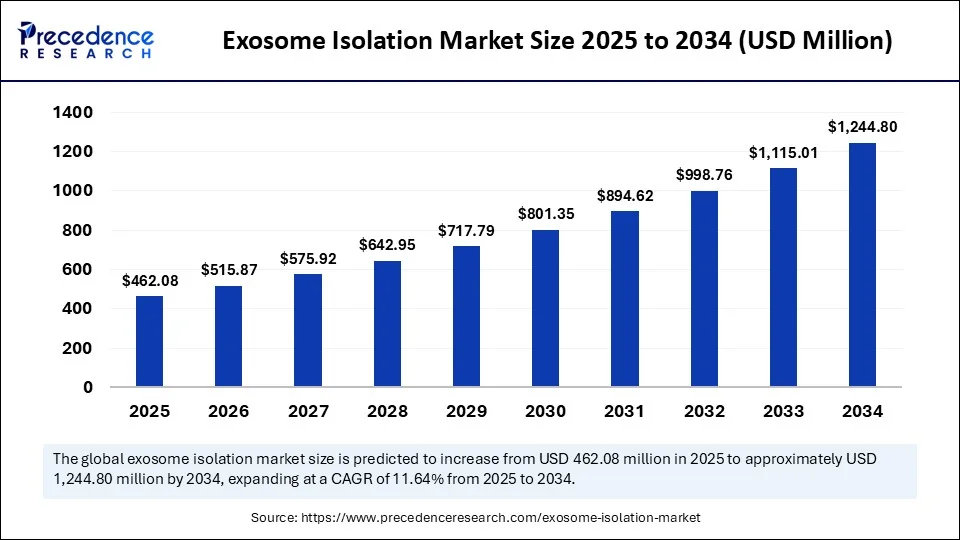

The global exosome isolation market size was estimated at USD 413.91 million in 2024 and is predicted to increase from USD 462.08 million in 2025 to approximately USD 1,244.80 million by 2034, expanding at a CAGR of 11.64% from 2025 to 2034. The exosome isolation market is experiencing rapid growth, driven by rising interest in exosome-based diagnostics and therapeutics. As biomedical research advances, the development of efficient, scalable, and precise isolation techniques also increases.

Exosome Isolation Market Key Takeaways

- In terms of revenue, the global exosome isolation market was valued at USD 413.91 million in 2024.

- It is projected to reach USD 1,244.80 million by 2034.

- The market is expected to grow at a CAGR of 11.64% from 2025 to 2034.

- North America dominated the exosome isolation market in 2024.

- By region, Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By product & service, the kits and reagents segment held the largest share of 47-58% in 2024.

- By product & service, the services and software segment is expected to grow at a remarkable CAGR of 40% between 2025 and 2034.

- By workflow stage, the isolation methods segment captured the biggest share of 55% in 2024.

- By workflow stage, the downstream analysis segment is expected to grow at a remarkable CAGR of 39% between 2025 and 2034.

- By application, the diagnostics/biomarker discovery segment led the market in 2024.

- By application, therapeutics / drug delivery / regenerative medicine segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By indication, the cancer segment contributed the highest market share in 2024.

- By indication, the neurodegenerative disorders segment is expected to grow at a significant CAGR between 2025 and 2034.

- By end-user, the pharmaceutical and biotechnology companies segment held the largest market share in 2024.

- By end-user, the academic and research institutes segment is expected to grow at a remarkable CAGR between 2025 and 2034.

Impact of AI on the Exosome Isolation

Artificial intelligence (AI) is revolutionizing the market by enhancing the speed, accuracy, and scalability of isolation techniques. AI-powered platforms are being used to optimize isolation protocols and automate sample processing, reducing manual errors. Machine learning algorithms enable the detection and classification of exosomes with unprecedented precision, facilitating early diagnostics. The integration of AI with microfluidic systems has enabled real-time analysis, streamlining workflows in clinical and research settings. AI is also aiding researchers to discover novel biomarkers. As AI continues to evolve, its role in driving innovation and efficiency in exposome isolation is set to expand.

Market Overview

The exosome isolation market refers to the segment of the broader exosome market focused on tools, kits, instruments, reagents, and services specifically for isolating and purifying exosomes (extracellular vesicles ~30–150 nm) from biological samples (e.g., blood, urine, cell culture). This includes technologies like ultracentrifugation, size-exclusion chromatography, immunoaffinity, microfluidics, electrokinetics, and more, enabling downstream diagnostic, therapeutic, and research applications.

The exosome isolation market is expanding due to increased interest in non-invasive diagnostics and regenerative medicine. Advancements in isolation technologies, such as ultracentrifugation and microfluidics, are improving yield and purity. Pharmaceutical and biotech companies are investing heavily in exosome research for drug delivery applications. Collaboration between academic institutions and industry players is driving innovation and product development. Government funding for cancer and neurodivergent research is further boosting the market. As precision medicine gains traction, exosome isolation is becoming a critical component of diagnostics and therapeutic strategies.

Market Trends

- The rapid shift toward microfluidics-based isolation techniques, which offer high throughput and sample purity, is boosting the market's growth.

- A surge in clinical trials focused on exosome-based biomarkers for oncology and neurology boosts market growth.

- The rising use of exosomes in drug delivery systems, particularly in targeted cancer therapies, drives market growth.

- Increasing collaborations and M&A activity between biotechs, universities, and diagnostics firms further support market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,244.80 Billion |

| Market Size in 2025 | USD 462.08 Billion |

| Market Size in 2024 | USD 413.91 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product & Service, Workflow Stage, Application / Use Case, Indication, EndUser, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Demand for Precise Diagnostics

The rising demand for precision diagnostics is a major factor driving the growth of the exosome isolation market. Exosomes provide critical insights into the molecular makeup of diseases such as cancer, Alzheimer's, and Parkinson's. Increased funding from the government and private sectors supports exosome research & development. Additionally, the ability of exosomes to cross biological barriers makes them ideal candidates for drug delivery. The rise in minimally invasive testing methods, such as liquid biopsies, is fueling the need for efficient exosome isolation. As the healthcare sector moves toward personalized treatment, the relevance of exosome technology continues to grow.

Restraint

High Costs and Lack of Standardization

Despite its promise, the exosome isolation market faces several challenges. High costs of isolation instruments and consumables limit accessibility in resource-constrained settings. Lack of standardized protocol across labs results in variability in outcomes and reproducibility. Technical limitations in isolating pure, intact exosomes continue to hinder downstream applications. Regulatory ambiguity regarding exosome classification adds uncertainty to commercial development. Scalability remains a challenge for translating research into clinical use. Addressing these bottlenecks is crucial for use. Addressing these bottlenecks is crucial for the market to achieve its full potential.

Opportunity

Market and Application Expansion

Emerging economies and untapped applications present major opportunities for market players. Innovations in point-of-care exosome isolation kits are expanding access beyond large laboratories. The rise of wearables could lead to the integration of exosome testing devices in the future. Strategic partnerships and licensing agreements are expected to open new product pipelines. Exosome isolation in veterinary medicine and plant biology also shows untapped promise. Companies investing in AI-enabled platforms and automation will be well-positioned to capture the next wave of demand.

Product & Service Insights

Why did the kits & reagents segment dominate the exosome isolation market in 2024?

The kits & reagents segment dominated the market with the largest share in 2024 due to their ease of use and compatibility with a wide range of biological samples. Their standardized protocols allow researchers to achieve reproducible and high-purity results across experiments. Increasing demand for ready-to-use solutions in both research and clinical diagnostics is fueling the adoption of kits & reagents. Companies are expanding their product portfolios with enhanced reagent formulations, driving competition and innovation. These kits reduce experiment time and are cost-effective compared to custom isolation methods. As automation increases in labs, the demand for reagent kits tailored to specific instruments is also growing.

Isolation kits, quantitation kits, and purification kits are becoming essential in routine testing and clinical research. Market players are offering both magnetic bead-based and precipitation-based kits, meeting different performance requirements. As precision medicine becomes mainstream, the importance of kits & reagents is expected to rise. With ongoing research into novel therapeutics, the demand for efficient, reproducible isolation kits is expected to maintain a stronghold in the product category.

The services & software segment is expected to grow at the fastest rate in the market during the forecast period. This is mainly due to the increasing demand for data analysis to accelerate research. Many institutions and startups lack the infrastructure or expertise to perform complex exosome isolation and characterization in-house. Outsourcing these tasks to specialized service providers ensures better accuracy and turnaround time. Cloud-based data analysis tools and AI-powered platforms are improving exosome data interpretation, driving demand for software-enabled services, with an advanced bioinformatics platform being a key market differentiator. As clinical applications rise, the need for validated, GMP-compliant exosome services is increasing rapidly.

The expansion of CROs offering exosome-related services is making it easier for biotech and pharma firms to integrate exosomes into R&D. These services range from isolation and characterization to exosome RNA/DNA profiling and functional analysis. Many companies now offer end-to-end exosome services from isolation to therapeutic development. Software tools facilitate the analysis of large databases, classification of exosome content, and identification of biomarkers efficiently. The rising demand for customized exosome solutions further supports segmental growth. The availability of comprehensive services reduces the time and resources required for in-house development, making exosome research more accessible.

Workflow Stage Insights

How does the isolation methods segment dominate the market in 2024?

The isolation methods segment dominated the exosome isolation market in 2024 due to their critical role in sample preparation. For diagnostic or therapeutic use, high-quality exosome isolation is the foundation of accurate downstream analysis. Techniques such as ultracentrifugation, size exclusion chromatography, and polymer-based precipitation are widely adopted. Newer microfluidics and magnetic bead technologies are improving purity, scalability, and throughput. The emphasis on standardized, reproducible isolation methods is vital for clinical and research consistency. As exosomes gain regulatory interest, robust.The choice of isolation method influences both the quantity and quality of exosomes recovered.

Research labs continue to favor a hybrid approach, using multiple methods for optimal results. Companies are now integrating isolation with real-time monitoring to track yield and purity. Isolation is also evolving with kits designed for specific sample types like blood, CSF, or plant tissue. The clinical potential of exosomes in diagnostics has led to rigorous scrutiny of isolation methods. Developers are innovating systems to meet the demands of large-scale operations.

As exosome applications expand across multiple disease areas, isolation methods are being fine-tuned to retain vesicle integrity and function. Real-time data analytics are also being added to isolation systems to guide workflows. Automation and miniaturization are helping labs process more samples with less labor. With the rise in exosome-based drug delivery systems, purity and scalability in isolation methods are paramount.

The downstream analysis segment is expected to grow at the highest CAGR in the upcoming period, driven by the increasing need for detailed characterization and analysis of exosomes. Analytical techniques, such as NGS, proteomics, flow cytometry, and nanoparticle tracking, are widely used. These techniques facilitate a comprehensive analysis of exosome contents, enabling the development of disease-specific biomarkers, therapeutic targets, and insights into functional properties. The growth of personalized medicine is increasing the need for precise molecular profiling. Investment in high-throughput analysis platforms is accelerating segmental growth.

Advanced software and imaging tools enable better visualization and quantification of exosome content. Characterization of RNA, proteins, and lipids within exosomes supports disease diagnosis and drug efficiency studies. Clinical labs are adopting multi-omics platforms to understand exosome heterogeneity and function. Vendors are offering bundled analysis services alongside isolation kits, creating integrated workflows. Downstream analysis is also key to validating exosome-based therapies, particularly in oncology and CNS diseases. As exosome applications diversify, the depth and accuracy of analysis become essential.

Application Insights

What made diagnostics / biomarker discovery the dominant segment in the Market in 2024?

The diagnostics/biomarker discovery segment dominated the exosome isolation market in 2024, driven by the increased need for exosome-based biomarkers for disease detection. Exosomes provide a wealth of molecular data, making them an ideal choice for liquid biopsies and early disease screening. Cancer diagnostics have benefited from exosome RNA and protein markers. The ability to obtain detailed molecular insights from blood or urine samples boosts patient compliance. Pharmaceutical companies are investing in exosome diagnostics for real-time monitoring of treatment. The rising burden of chronic diseases like cancer, neurodegenerative, and cardiovascular disorders further propels demand.

Exosome-based diagnostics are also gaining traction in parental testing, infectious disease, and neurological disorders. Several diagnostic companies are developing an exosome test that can detect disease at asymptomatic stages. Companion diagnostics based on exosomes are emerging alongside targeted therapies. The specificity and sensitivity of exosome tests are improving with AI-enabled interpretation. Clinical trials are underway across geographies to validate these applications. The diagnostic value of exosomes lies in their dynamic molecular signature, which reflects disease progression and treatment response.

Moreover, regulatory bodies are increasingly open to exosome-based tests, particularly in oncology. Companies are working to develop FDA-cleared exosome biomarkers for disease diagnostics. The reduced need for tissue biopsies enhances the appeal of patient care. With a growing focus on personalized medicine, exosomes are becoming a preferred tool for precision diagnostics. As healthcare systems seek early detection tools to reduce treatment costs, diagnostics will continue to dominate application areas.

The therapeutics / drug delivery / regenerative medicine segment is expected to grow at the fastest rate in the market during the forecast period. This is because of the ability of exosome isolation to transport genetic material and proteins across biological barriers, making them ideal candidates for drug delivery. They offer a natural, biocompatible vehicle for delivering RNA, siRNA, and small molecules to target tissues. Research is expanding into using exosomes derived from stem cells for tissue repair and immune modulation. Clinical trials in cancer, neurodegenerative disorders, and autoimmune diseases are exploring exosome-based therapies.

Exosomes are being engineered to carry therapeutic agents with higher specificity and reduced side effects. Their use in regenerative medicine is expanding into wound healing, cartilage repair, and cardiac regeneration. Stem cell derived exosomes show promise in reducing inflammation and promoting tissue recovery.

Indication Insights

Why did the cancer segment dominate the exosome isolation market in 2024?

The cancer segment dominated the market with the largest share in 2024 due to the increased use of exosome biomarkers for early detection and monitoring. Tumor-derived exosomes carry genetic and proteomic signatures that reflect tumor behavior. Liquid biopsies using exosomes provide non-invasive alternatives to tissue biopsies. Researchers are focusing on exosomal miRNAs, proteins, and DNA to detect cancer at early and pre-symptomatic stages. Exosomes are also used to monitor therapy resistance and recurrence. Their role in personalized oncology is gaining significant attention.

The neurodegenerative disorders segment is expected to expand at a significant CAGR in the market during the forecast period, due to the need for better diagnostic and therapeutic tools. Exosomes can cross the blood-brain barrier, making them ideal for CNS-targeted drug delivery and biomarker detection. Alzheimer's, Parkinson's, and ALS research is focusing on exosomal tau, amyloid, and neurofilament proteins, contributing to segmental growth.

The cardiovascular disorders segment is expected to grow at a steady rate in the upcoming years. In cardiology, exosomes show promise in ischemic heart disease and post-MI tissue repair. Their role in immune modulation is also being explored in autoimmune and inflammatory diseases. As these conditions rise globally, so does the interest in exosome-based solutions.

End User Insights

How does the pharmaceutical & biotechnology companies segment dominate the exome isolation market?

The pharmaceutical & biotechnology companies segment dominated the market in 2024, due to their involvement in therapeutic development and precision medicine. These companies rely on high-purity exosomes for drug discovery, biomarker validation, and the development of delivery platforms. Strategic investments are being made in in-house isolation capabilities and external partnerships. Exosomes are increasingly seen as potential carriers for RNA-based therapies and gene-editing tools. Biopharma firms are also acquiring exosome startups to expand their pipelines. Their dominance reflects both capability and strategic interest in this emerging field.

The academic & research institutes segment is likely to grow at a rapid pace during the projection period due to the increasing funding and interest in translational research. Universities and medical research centers are at the forefront of discovering novel exosome biomarkers and their functions. They serve as innovation hubs, often collaborating with industry for product validation. The focus on omics-based approaches and disease modeling is boosting exosome-related projects. Grant support for precision medicine and biomarker discovery has accelerated academic involvement.

Regional Insights

What made North America the dominant region in the market?

North America dominated the exosome isolation market with the largest revenue share in 2024. This is primarily due to its robust research infrastructure and robust funding ecosystem. Top universities and biotech firms in the region are engaged in cutting-edge exosome R&D, supported by NIH and other federal grants. A robust biopharmaceutical industry ensures rapid development of novel isolation techniques. Widespread awareness about personalized medicine and non-invasive diagnostics fuels demand. Strategic collaborations between academic centers and diagnostics companies are accelerating product commercialization. The region's focus on oncology and neurodegenerative disorders further drives exosome-related innovations.

The U.S. is a major contributor to the market. NIH funding for research programs focusing on exosome biomarkers and therapeutics is a significant factor driving the market's growth. Companies like Thermo Fisher Scientific and bio-techne are launching advanced kits and systems. The clinical uptake of exosome-based liquid biopsies is increasing, especially in cancer diagnostics. Regulatory clarity from the FDA in recent years is helping streamline clinical adoption. Venture capital funding into exosome startups reflects strong investor confidence in the U.S. market.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest rate in the upcoming period due to improved healthcare infrastructure and government funding in R&D. Countries like China, Japan, and South Korea are investing heavily in biotech innovation. Rising cancer incidence and an aging population drive the need for early diagnostics. Academic institutions are increasingly partnering with global companies to enhance research capabilities. Local manufacturers are also entering the market with cost-effective isolation solutions. As the region embraces personalized medicine, the demand for exosome technologies is surging.

India is emerging as a key player in the Asia Pacific, due to government-backed initiatives such as Make in India and Ayushman Bharat, which support healthcare R&D. Indian research institutions are exploring the use of exosomes in cancer and infectious diseases for the development of cost-effective isolation kits. The rising burden of chronic diseases is creating demand for liquid biopsy alternatives. With strategic partnerships and regulatory support, India is poised to become a significant player in the global exosome market.

Exosome Isolation Market Companies

- Thermo Fisher Scientific

- QIAGEN

- BioTechne

- Danaher (Beckman Coulter)

- Miltenyi Biotec

- Abcam

- Clara Biotech

- Lonza

- System Biosciences (SBI)

- NX Pharmagen

- Exopharm

- RoosterBio

- Creative Medical Technologies

- Diagenode (Hologic)

- Izon Science (qEV SEC platform)

- FUJIFILM (Hitachi Diagnostics)

- Everzom

- Ciloa

- Unchained Labs

- Aethlon Medical

Recent Development

- In January 2025, Bhubaneswar-based biotech startup Exsure has made headlines with the launch of India's first dual-functional exosome isolation reagent, suitable for both human serum and cell-culture medium. In a milestone moment on republic day, the company also introduced Plantexosure, the first plant-based exosome isolated reagent in the country. These additions join their expanding product range, including leucoSure and dr barriers. Supported by rupees 3 crore in speed funding from Unicorn India Ventures, ExSure is now fast-tracking development of exosome-powered drug delivery platforms and conducting preclinical studies.

(Source: https://www.indianweb2.com)

Segments Covered in the Report

By Product & Service

- Kits & Reagents

- Instruments

- Services & Software

By Workflow Stage

- Isolation methods

- Downstream analysis

By Application / Use Case

- Diagnostics / biomarker Discovery

- Therapeutics / drug delivery / regenerative medicine

By Indication

- Cancer (liquid biopsy, monitoring)

- Neurodegenerative Diseases

- Cardiovascular disorders

- Infectious Diseases

- Other indications (e.g. wound healing, aging)

By EndUser

- Pharmaceutical & biotechnology companies

- Academic & research institutes

- Hospitals & Clinical Diagnostics Labs

- Others (contract labs, CROs)

By Region

- North America

- Asia-Pacific (APAC)

- Europe

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting