What is the Federated Cloud Storage Market Size?

The global federated cloud storage market is witnessing strong growth as organizations adopt decentralized storage models to enhance data security, accessibility, and compliance.The rapid expansion of sources like social media, IoT devices, and analytical platforms has fueled the demand for secure and scalable cloud range solutions, contributing to the growth of the market.

Federated Cloud Storage Market Key Takeaways

- North America dominated the global federated cloud storage market with the largest share of approximately 35% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By deployment model, the public cloud segment led the market while holding the largest share of approximately 40% in 2024.

- By deployment mode, the hybrid cloud segment is expected to grow at the highest CAGR between 2025 and 2034.

- By service model, the infrastructure-as-a-service (IaaS) segment led the market while holding approximately 50% share in 2024.

- By service model, the software-as-a-service (SaaS) segment is projected to grow at the fastest CAGR between 2025 and 2034.

- By storage type, the object storage segment contributed the largest market share of approximately 45% in 2024.

- By storage type, the file storage segment is expected to grow at a notable rate between 2025 and 2034.

- By end-user industry, the BFSI (banking, financial services, and insurance) segment led the market while holding the largest share of approximately 30% in 2024.

- By end-user industry, the healthcare and life sciences segment is expected to grow at the fastest rate between 2025 and 2034.

What is Federated Cloud Storage?

The federated cloud storage market is a rapidly expanding segment of cloud computing, driven by increasing demands for flexibility, cost-efficiency, and robust data security. The market refers to the global industry that provides cloud storage solutions, integrating multiple, distributed storage resources across various providers. This model enables seamless data access and management across different cloud environments, ensuring data availability, security, and compliance. The increasing need for scalable storage solutions, data sovereignty concerns, and the growing adoption of hybrid and multi-cloud architectures drives the market.

The growing popularity of remote working and virtual collaborations is fueling the adoption of cloud storage services. The growing accessibility and transformation of data are making cloud storage solutions increasingly essential in various industries. Rapid digitalization is driving the need for scalability and flexibility, leading to innovations and developments in federated cloud storage solutions that offer highly efficient data management and cost-effectiveness.

Key Technological Shifts in the Federal Cloud Storage Market

Federal cloud storage solutions are undergoing a significant technological shift, driven by the increasing adoption of hybrid and multi-cloud strategies and models by various agencies. The growing trend of cloud-native applications, which utilize cloud computing features to enhance scalability and performance, is transforming the federal cloud storage industry. Additionally, the adoption of edge computing, particularly in the intelligence sector and defense, is transforming industrial growth. With a strong focus on federated cloud storage solutions that integrate AI and ML, it enables enhanced security, accessibility, and management capabilities.

Microsoft and Google are key companies that enable hybrid and multi-cloud solutions. The strong investments in infrastructure and software by companies like Dell Technologies, VMware, and Nutanix are enabling the development of blocks for diversity management in cloud environments. These companies are also developing specialized software and services for data management and interoperability across various clouds, including Yotta.

Federated Cloud Storage Market Outlook

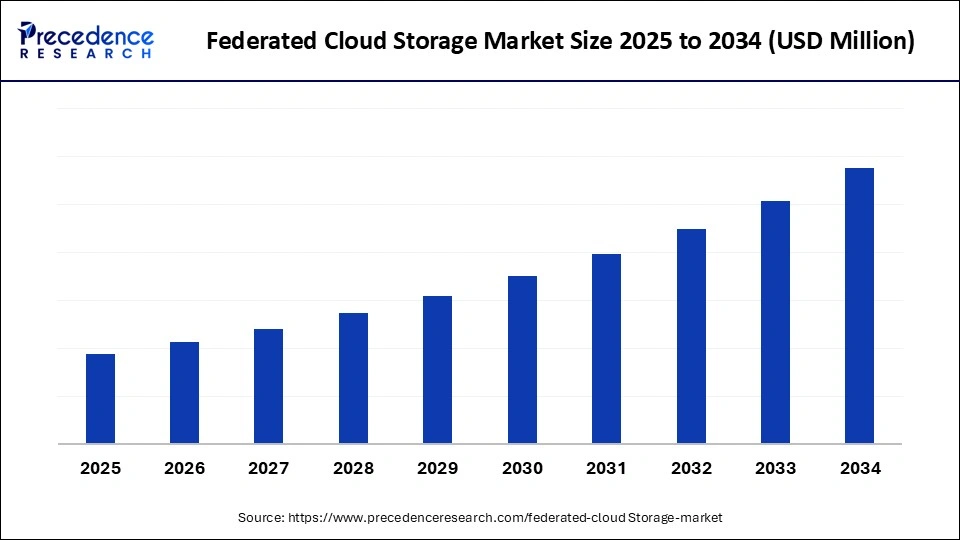

- Market Growth Overview: The federated cloud storage industry is projected to experience significant growth between 2025 and 2030, driven by increasing demand from consumers for flexible, scalable, and secure data storage solutions. With exponential data growth and digital transformation, the demand for federated cloud storage solutions is expected to rise significantly over the forecast period, particularly in North America and the Asia Pacific, which have a robust IT infrastructure base.

- Global Expansion: The adoption of hybrid and multi-cloud strategies, edge computing, and an emphasis on integrating AI and ML are expanding the reach of the federated cloud storage industry worldwide. Asia Pacific is expected to lead the market over the forecast period, driven by the increased adoption of cloud services and government initiatives promoting digitalization.

- Major Investors: The federated cloud storage industry is experiencing sustainable investments from Scale Venture Partners, DFJ, Andreessen Horowitz (a16z), Bessemer Venture Partners, and First Mark Capital. Microsoft, Google, and IBM are the key companies investing heavily in the core industry. Cribl and Yotta Data Services are offering sophisticated federated cloud services.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Model, Service Model, Storage Type, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Demand for Cloud-Native Storage Technologies

The rising demand for cloud-native storage technologies is driving the growth of the federated cloud storage market by enabling seamless, scalable, and flexible data management across multiple cloud environments. There is a high demand for comprehensive cloud-native storage technologies across various industries, driven by the increasing volume of data and the growing adoption of cloud computing. The increased demand for cloud-based applications is driving the need for cloud-native storage technologies. Industries like BFSI, healthcare, IT, and government are the major adopters of these technologies. The ability of cloud-native storage technologies to offer scalable, flexible, and high-performance solutions makes it essential in a rapidly growing cloud environment.

Restraint

Data Security and Privacy Concerns

Rising concerns over data security and privacy are a restraint for the federated cloud storage market. Organizations are focusing on ensuring data security and privacy across the various cloud ecosystems, which are creating challenges for the adoption of federated cloud storage solutions. The risk of data breaches, data loss, and unauthorized access hinders its adoption. The cloud storage manufacturers are required to establish comprehensive features for data security and privacy with federated cloud storage solutions.

Opportunity

Rising Demand for Edge Computing

The increasing demand for edge computing, combined with federated cloud storage, creates significant opportunities by enabling real-time data access and processing closer to the source. This synergy allows organizations to handle massive data volumes generated at the edge while maintaining centralized control and security through federated storage networks. By distributing storage and compute resources across multiple locations, businesses can reduce latency, enhance performance, and support time-sensitive applications such as IoT and autonomous systems. Additionally, federated cloud storage ensures data sovereignty and compliance while seamlessly integrating with edge infrastructure. This growing need for efficient, secure, and low-latency data solutions is fueling the expansion of the federated cloud storage market.

Segment Inisights

Deployment Mode Insights

What Made Public Cloud the Dominant Segment in the Federated Cloud Storage Market?

The public cloud segment dominated the market while holding approximately 40% share in 2024. This is mainly due to increased public demand for scalable, accessible, and cost-effective cloud solutions. The growing availability, affordability, and scalability of public clouds are making them ideal in the industry. The adoption of public cloud storage solutions has increased due to the high adoption of hybrid and multi-cloud strategies. The rising need for secure data and disaster recovery capabilities is fueling the shift toward public cloud deployments.

The hybrid cloud segment is expected to grow at the fastest CAGR over the forecast period, driven by its ability to enhance security and compliance. The hybrid cloud deployment offers flexible and scalable solutions that combine the advantages of public and private clouds. This deployment enables integration with various cloud ecosystems and businesses that employ diverse strategies for managing workloads and data. Business organizations can maintain sensitive data on-premises while also integrating the cloud for increased scalability.

Service Model Insights

Which Service Model Dominates the Federated Cloud Storage Market?

The infrastructure-as-a-service (IaaS) segment dominated the market, accounting for a 50% share in 2024, due to its affordability, scalability, and flexibility. The growing emphasis on on-demand infrastructure is fueling the adoption of the infrastructure-as-a-service (IaaS) model in various organizations. This model facilitates the seamless integration of resources from multiple cloud ecosystems, supporting complex federated storage with enhanced flexibility, agility, and speed. Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform (GCP) are the major players conducting significant innovations and developments of a sophisticated infrastructure-as-a-service (IaaS) model.

The software-as-a-service (SaaS) segment is expected to expand at the fastest rate over the projection period, driven by increasing demand for scalable storage solutions. The need for complex data integration and cloud-agnostic storage strategies has increased. This model enables the provision of software applications over the internet, reducing reliance on local installation and maintenance. Companies with a high need for affordable, flexible, and scalable solutions are focusing on enhancing operational efficiency and reducing costs, which is fueling the adoption of software-as-a-service (SaaS).

Storage Type Insights

What Made Object Storage the Leading Segment in the Federated Cloud Storage Market?

The object storage segment led the market, accounting for approximately 45% share in 2024. This is primarily due to its high scalability, cost-effectiveness, and flexibility. The object storage type plays a vital role in data lakes, content delivery networks, and big data analytics. The growing adoption of cloud-based services and the requirement for scalable and affordable storage solutions across various industries are driving the adoption of object storage. This type enables organizations to integrate the strengths of different cloud providers and other storage types.

The file storage segment is expected to grow at the highest CAGR in the upcoming period due to increased data volumes and demand for reliable and scalable solutions. The data volume has increased from various businesses and IoT devices, enabling remote workforce collaboration and driving the need for advanced resource management and security, which in turn is fueling the adoption of file storage types. The growth in remote work and digital collaboration tools is driving the adoption of cloud-based file storage types for seamless file sharing and collaboration. This type ensures data accessibility and enables seamless data exchange with high scalability and security.

End-User Industry Insights

How Does the BFSI Segment Dominate the Federated Cloud Storage Market in 2024?

The BFSI (banking, financial services, and insurance) segment dominated the market with approximately 30% share in 2024. This is primarily due to the increased need for improved security in the industry and the requirement to comply with regulations. The BFSI industry handles sensitive and vast datasets, as well as critical transactions. The increasing volume of data and the need for secure data storage drive the adoption of federated cloud storage solutions in this industry. The high demands for security, high performance, and compliance in handling sensitive data and facilitating seamless transactions are solidifying the position of federated cloud storage services in the BFSI industry.

The healthcare and life sciences segment is expected to expand at a significant rate in the coming years, driven by the increasing volume of data in this industry. The healthcare and life sciences industry handles sensitive patient data, adheres to strict privacy protocols, and utilizes decentralized data management solutions. The federated learning and storage solutions help maintain patient data security and enable advanced analytics for applications such as drug discovery and personalized medicine. The healthcare and life sciences industry has experienced sustainable growth in demand for affordability, scalability, and collaboration, driving acceptance of federated cloud storage solutions for robust, secure, and compliant data handling.

Regional Insights

What Made North America the Dominant Region in the Federated Cloud Storage Market?

North America dominated the global federated cloud storage market by capturing a 35% share in 2024. This is mainly due to the region's well-established technological infrastructure and high adoption of cloud technologies. North America is investing heavily in digital infrastructure, driving the need for federated cloud storage solutions. North America is an early adopter of cloud technologies, with demand for scalable storage solutions, and government initiatives and regulatory frameworks supporting, solidifying the market growth. The presence of major industry players and their investments in advanced technologies and collaboration strategies are fueling this growth.

U.S. Market Trends

The U.S. is a major contributor to the North America federated cloud storage market, driven by high adoption of remote work and cloud services across variousindustries. The U.S. has a well-established IT infrastructure that drives the need for secure and flexible storage solutions, including federated cloud storage solutions. Moreover, the U.S. federal government's Federal Risk and Authorization Management Program (FedRAMP) offers standardized acceleration of security assessment, authorization, and continuous monitoring for cloud products and services, supporting market growth. Rising government spending on cloud services is likely to ensure the long-term growth of the market.

The U.S. federal spending on cloud services is expected to increase to over $13 billion annually by 2025, according to research. The Federal departments have secured $90 billion annually for information technology expenses. The federal government's launch of Cloud Smart initiatives in 2018 has been fueling the shift of federal agencies to adopt cloud more intelligently (Source: https://www.bacancytechnology.com)

What Makes Asia Pacific the Fastest-Growing Area?

Asia Pacific is expected to experience the fastest growth in the coming years, driven by the region's increased internet penetration and digitalization. The government of Asia is investing heavily in promoting digital transformation initiatives. The high consumer base and proliferation of mobile devices are driving the need for sophisticated federated cloud storage solutions. The expanding e-commerce platforms and increasing data volume from various industries are driving the need for highly secure, performance, and scalable storage solutions. The rapid adoption of cloud services in the region is fueling the need for federated cloud storage solutions.

China is a major player in the regional market, contributing to growth due to the country's robust digital economy and large population, resulting in high data volumes. China is investing heavily in public cloud services, enabling access to highly scalable and affordable storage solutions, including federated cloud storage solutions. Additionally, the strong presence of key local market players, such as Alibaba Cloud and Huawei, and their investments in technological advancements, are fueling market accessibility and availability.

Country-Level Investments and Funding for Federated Cloud Storage Industry

- U.S.: A leading provider of hybrid cloud storage solutions, Cloudian, Inc., closed its $24 million financing round with novel investors INCJ and Fidelity Growth Partners and existing Cloudian shareholders like Intel Capital in July 2014. (Source: https://cloudian.com)

- India: The Indian cloud service environment is gaining significant support from digital transformation. The Enhancement of National Information Center (NIC) National Cloud Services project, launched in 2022, aims to upgrade the national cloud infrastructure. Cloud services are being implemented in more than 300 government departments, fueling the sustainable growth of Indian digital public infrastructure. (Source: https://www.pib.gov.in)

- China: In August 2024, China invested more than 43.5 billion in nationwide projects for building computing data centers in 2023.(Source: https://www.reuters.com)

- Japan: Amazon plans to expand its $15 billion cloud computing business in Japan with investments in its cloud computing infrastructure. These investments by Amazon are followed by the $10 billion investments in cloud computing in Japan between FY 2011 and 2022.

(Source: https://www.investmentmonitor.ai) - Germany: Oracle has announced a $2 billion investment over the next four years to meet the demands for AI and cloud infrastructure in Germany. This announcement was made in July 2025 to expand Oracle Cloud Infrastructure's (OCI) footprint in Germany.

Top Companies in the Federated Cloud Storage Market & Their Offering

- Amazon Web Services (AWS): The core offering of AWS is Amazon S3, a simple storage service that provides block storage and file storage services.

- Microsoft Azure: It offers services such as Azure File Sync, Azure Data Lake Storage, and Azure Storage Mover, enabling hybrid file access, developing a unified data platform across the ecosystem, and moving data between locations, respectively.

- Google Cloud Platform: The company provides Google Cloud Storage for various object storage needs, storage transfer services, and partner connect integration that brings data into cloud storage from multiple platforms.

- IBM Cloud: The IBM Cloud Storage for FedRAMP demonstrates security and compliance storage solutions for government and sensitive data. IBM is offering its comprehensive hybrid cloud capabilities

- Oracle Cloud Infrastructure: It provides scalable and strong object storage, block storage services, and file storage, with more cost-effective and high-performance infrastructure, enabling the creation of sophisticated data fabrics.

Federated Cloud Storage Market Companies

- Alibaba Cloud

- Dell Technologies

- NetApp

- Hewlett Packard Enterprise (HPE)

- Hitachi Vantara

- VMware

- Huawei Cloud

- Rackspace Technology

- DigitalOcean

- Wasabi Technologies

Recent Developments

- In August 2025, At VMworld, EMC2 Federation previewed updates to its Enterprise Hybrid Cloud Solution and launched a new End-User Computing solution. Combining hardware, software, and services from EMC II, VMware, and VCE, the solution integrates private and public clouds to enhance business agility through self-service, policy-driven resource provisioning. Customers benefit from improved IT efficiency, with projected savings exceeding $50 million over five years.(Source: https://www.prnewswire.com)

- In June 2025, Nectcloud launched the Nextcloud Workspace office suite, slated for the third quarter of 2025, in collaboration with IONOS. This launch is expected to offer a digitally sovereign alternative to Microsoft 365. This suite is fully featured and ready to be integrated with privacy-first and secure collaboration tools, including video conferencing, ethical AI productivity tools, email, calendaring & chat, and file sharing & document editing.

(Source: https://www.linkedin.com) - In April 2025, DDN, the global leader in AI and data intelligence solutions, and Google Cloud collaborated to advance AI initiatives with Google Cloud Management Luster and Infinia at Google Cloud Next 2025. This collaboration aims to transform AI-driven infrastructure with Google Cloud Management Luster, based on DDN's EXAScaler. (Source: https://www.ddn.com)

Segment Covered in the Report

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Multi-Cloud

By Service Model

- Infrastructure-as-a-Service (IaaS)

- Platform-as-a-Service (PaaS)

- Software-as-a-Service (SaaS)

By Storage Type

- Object Storage

- Block Storage

File Storage

By End-User Industry

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare and Life Sciences

- IT and Telecommunications

- Retail and E-commerce

- Government and Public Sector

- Manufacturing

- Media and Entertainment

- Education

- Energy and Utilities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting