What is Fractional Flow Reserve Market Size?

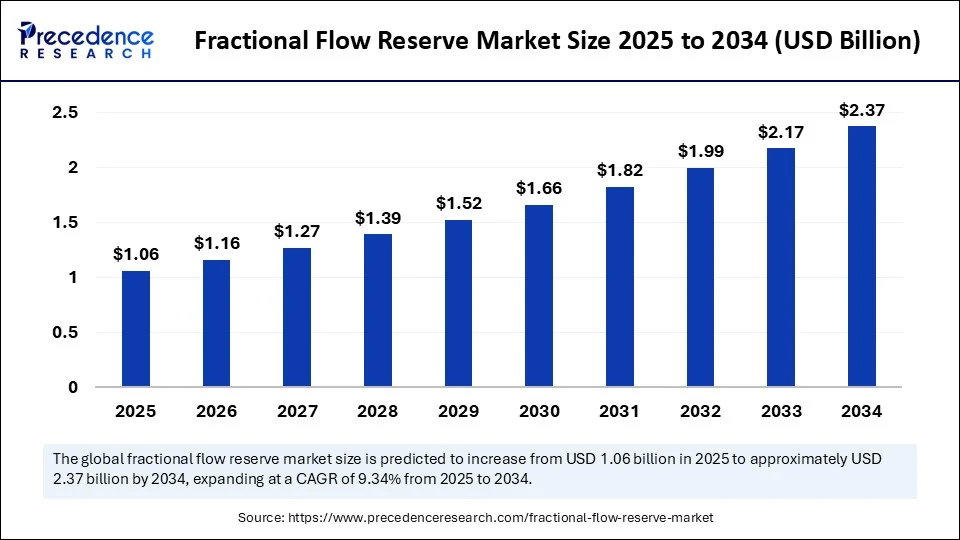

The global fractional flow reserve market size is calculated at USD 1.06 billion in 2025 and is predicted to increase from USD 1.16 billion in 2026 to approximately USD 2.37 billion by 2034, expanding at a CAGR of 9.34% from 2025 to 2034. The market growth is attributed to increased risk of cardiovascular diseases due to lifestyle and dietary factors, increasing demand for evidence-based diagnostics, and rapid adoption of AI-driven imaging technologies.

Market Highlights

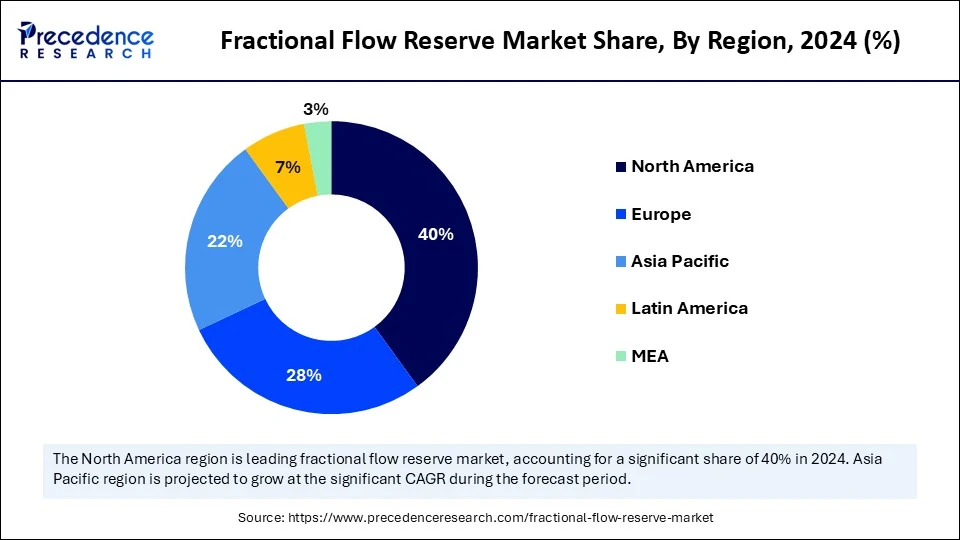

- North America dominated the global fractional flow reserve market with the largest share of 40% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By product/device, the pressure guidewires segment held the major market share of 55.5% in 2024.

- By product/device, the non-invasive FFR systems segment is projected to grow at a CAGR between 2025 and 2034.

- By technology, the invasive FFR segment contributed the biggest market share of 75% in 2024.

- By technology, the non-invasive FFR segment is expected to expand at a significant CAGR between 2025 and 2034.

- By application, the diagnosis of intermediate lesions segment captured the highest market share of 55% in 2024.

- By application, the post-PCI optimization segment is expected to grow at a significant CAGR over the projected period.

- By end-user, the hospitals segments generated the major market share of 70% in 2024.

- By end-user, the diagnostic imaging centers segment is expected to grow at a notable CAGR from 2025 to 2034.

- By component, the hardware segment accounted for the significant market share of 60% in 2024.

- By component, the software & analytics segment is expected to grow at a notable CAGR from 2024 to 2034.

- By distribution, the direct OEM sales segment held the major market share of 65% in 2024.

- By distribution, the cloud/SaaS subscription segment is projected to grow at a CAGR between 2025 and 2034.

- By pricing model, the one-time devices + disposable segment held the major market share of 60% in 2024.

- By pricing model, the subscription/SaaS segment is projected to grow at a CAGR between 2025 and 2034.

What Is the Impact of Artificial Intelligence on the Fractional Flow Reserve Market?

Artificial intelligence (AI) has significantly impacted the growth of the fractional flow reserve market and is a key factor in clinical adoption and product development. FFR was measured using wire-based techniques are being replaced by AI-enabled imaging systems through which physicians calculate a virtual fractional flow reserve value using measurements from angiographic or CT scans. Furthermore, the solutions also connect easily with digital health records and cloud-based networks, making care collaborations possible among care teams and enabling precision approaches to treatment.

- In August 2023, researchers from the Shahid Beheshti University of Medical Sciences and Mazandaran University of Medical Sciences found that various AI methods, including ML and DL, and hybrid methods for predicting the FFR, saw high significance in combining both anatomical and physiological parameters for diagnosing and treatment of the coronary disease in different stages of the disease.

Fractional Flow Reserve: The Gold Standard Revolutionizing Coronary Diagnosis

The fractional flow reserve market is driven by multiple factors, including the increasing popularity of evidence-based diagnosis. Integrated into the visualization workflow, fractional flow reserve provides physicians with a tool to quantify pressure variations across coronary stenoses. The goal is to reveal the functional importance of lesions, providing a more accurate guide to treatment than angiography alone. The technology operates through comparison of blood pressure before and after a constriction in the coronary artery, and values at/below 0.80 are clinically significant, indicating ischemia that is benefited by intervention.

In contrast to purely anatomical imaging, FFR not only reduces unnecessary stenting, thereby improving long-term patient outcomes, but also offers a physiologic thrust. Clinical validation has been growing, including the recently successful multicenter studies in 2024 that non-invasive CT-derived fractional flow reserve reduces invasive angiography referrals and optimally selects patients for revascularization. The growing risk of cardiovascular disease, leading to an increase in the worldwide population affected by it. The World Health Organization reported that cardiovascular disease claimed the lives of over 17.9 million people in 2023. The relevance of the availability of effective diagnostic methods, such as FFR. Furthermore, the endorsements of major societies of cardiology, such as the American College of Cardiology and the European Society of Cardiology, further underline the stature of fractional flow reserve as a treatment standard in assessing coronary artery disease.

Fractional Flow Reserve Market Growth Factors

- Driving Emphasis on Early Disease Detection: Growing preference for proactive cardiovascular risk assessment is fuelling the adoption of advanced FFR diagnostics in clinical practice.

- Rising Integration of AI-Powered Imaging: Increasing use of machine learning and AI algorithms is boosting precision and efficiency in non-invasive fractional flow reserve analysis.

- Boosting Clinical Validation from Global Trials: Expanding clinical studies and multicenter trials are propelling physician confidence in FFR-guided treatment strategies.

- Propelling Shift Toward Outpatient Cardiology Care: Rising demand for efficient and less resource-intensive diagnostic solutions is driving fractional flow reserve usage in ambulatory care settings.

- Fuelling Expansion of Reimbursement Support: Growing recognition of cost-effectiveness in reducing unnecessary stent placements is driving wider reimbursement approvals.

Market Outlook

- Industry Growth Offerings- Industry growth for fractional flow reserve is driven by rising cardiovascular disease cases, growing adoption of physiology-based diagnostics, and advancements in non-invasive FFR technologies. Increasing clinical validation and expanding catheterization lab infrastructure further boost market expansion.

- Global expansion- Global expansion of market is supported by rising adoption of FFR-CT, wider clinical guideline endorsement, and increased investment in advanced cardiac diagnostics. Growing healthcare infrastructure and demand for precise, patient-centric assessment further accelerate its worldwide uptake.

- Startup Ecosystem- The startup ecosystem for fractional flow reserve is growing with innovators developing AI-driven FFR-CT, wire-free platforms, and advanced imaging analytics. Emerging companies focus on improving accuracy, reducing invasiveness, and integrating cloud-based workflows to support faster, accessible cardiac diagnostics.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.06 Billion |

| Market Size in 2026 | USD 1.16 Billion |

| Market Size by 2034 | USD 2.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.34% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product / Device, Technology / Measurement Method, Application / Clinical Indication, End-User, Component / Offering, Distribution Channel, Pricing Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Growing Preference for Minimally Invasive Procedures Driving the Expansion of the Fractional Flow Reserve Market?

The increasing risk of cardiovascular disease due to high alcohol, tobacco, and nicotine use, along with increasingly sedentary lifestyles and increased consumption of processed foods worldwide, is driving the need for medical care and, in turn, driving the growth in the market for fractional flow reserves in the coming years. The burden of coronary artery disease is growing around the globe, imposing a serious burden on healthcare systems across the world. In the United States, as per a 2022 report by the American Heart Association stated that over 371,000 people died of coronary heart disease, and almost 5% of adults aged 20 and above had coronary heart disease. Further statistics released by the American College of Cardiology in 2024 pointed out that over 315 million people were living with coronary artery disease across the various parts of the world in 2022. This number is set to rise significantly with an aging population and high-risk life behaviors.

These figures demonstrate the importance of powerful diagnostic tools, including fractional flow reserve. This presents clinicians with the opportunity to measure ischemia related to the lesion to make optimum treatment plans. Hospitals and specialty clinics are investing in fractional flow reserve platforms to manage increased patient volumes efficiently. Furthermore, the growing preference for minimally invasive procedures is anticipated to boost adoption and market growth.

Restraint

High Procedural Costs and Infrastructure Gaps Challenge Growth

High procedural costs and sophisticated infrastructure requirements are hindering the widespread adoption of slightly advanced techniques such as fractional flow reserve. In emerging economies, small hospitals and clinics do not have the monetary capability to invest in high-end and expensive diagnostic tools. Such financial constraints are expected to inhibit growth prospects, especially in low and middle-income economies, even as the level of cardiovascular diseases is on the rise. Moreover, regulatory approval complexities and reimbursement challenges are projected to slow growth in the coming years.

Opportunity

Why Are Surging Technological Advancements in Imaging and AI Integration Set To Accelerate Growth in the Fractional Flow Reserve Market?

Surging technological advancements in imaging are projected to create significant opportunities for the key players competing in the fractional flow reserve market. Increased technological innovations in the fields of imaging and artificial intelligence applications are expected to boost growth. Such healthcare innovators as HeartFlow, CathWorks, Philips Healthcare, Siemens Healthineers, and GE HealthCare develop advanced platforms. That process routine imaging to generate virtual FFR measurements, requiring less time and making the functional diagnostics much more accessible. A 2024 National Institutes of Health report found that AI-fractional flow reserve performed with an 82% accuracy rate at the patient level and sensitivity up to 91% and specificity of 95% in the development of precise interventions.

Large-scale digitization and digitalization undertakings in the global healthcare industry are leading healthcare providers to switch to electronic health records and digital workflows, allowing for more seamless integration of advanced diagnostic solutions and allowing for wider use in centres that do not have specialists in both interventional and curative cardiology. In March 2024, the U.S. Food and Drug Administration externally pre-cleared 882 AI/ML-based medical devices, and by August 2024, that total increased to 950, a clear signal of regulatory preparedness for AI-integrated diagnostics. Furthermore, the spurring healthcare expenditure on cardiac care is likely to strengthen market penetration in the coming years.

Segment Insights

Product/Device Insights

Which Product/Device Category Had the Largest Share of the Fractional Flow Reserve Market in 2024?

The pressure guidewires segment had the largest share of the fractional flow reserve market in 2024, accounting for an estimated 55-65% market share, due to their established position in the catheterization laboratory and their well-understood role in payment card industry workflows. Wire-based FFR is anticipated to support high procedural volumes by providing lesion-dependent physiology at the point of care, critical to intervention teams. Furthermore, the growing advancement in this type of technology continues to see pressure guidewires retain leadership in the sphere of clinical adoption and procurement strategies in the coming years.

The non-invasive fractional flow reserve systems segment is expected to grow at the fastest rate in the coming years, owing to the AI-based image analysis that would help convert routine CCTA into meaningful physiology. The use of CT-FFR in health systems is to triage stable cases of chest pain upstream of cath labs, and this is predicted to decrease the number of invasive angiograms and provide early, timely care. On-premises and cloud workflows provide CT-fractional flow reserve output integration with PACS and EHR to facilitate review by multidisciplinary teams, and even assist insurance providers, which is expected to enhance care coordination and improve throughput.

The clinical programs focus on patient comfort and safety, as the pressure wires and hyperemic agents are avoided, a change that is likely to increase usage in outpatient and ambulatory diagnostic centers. In 2024, HeartFlow, one of the prominent companies in the field, celebrated 500,000 patient analyses globally, illustrating an increasing clinical acceptance of this technology. Furthermore, the currently emerging national initiatives focusing on CT-First approaches and pathway optimization are likely to stimulate further growth in CT-FFR within various countries.(Source: https://hlth.com)

Technology Insights

What Technology Segment Continues To Dominate the Fractional Flow Reserve Market Landscape?

The invasive fractional flow reserve segment continues to dominate the fractional flow reserve market in 2024, accounting for 70-80% of the market share, due to its high utilization on lesion-specific physiology during diagnostic angiography. Lead clinical recommendations note the importance of physiology-based evaluation of both acute coronary syndrome and stable disease, supporting the continued physician dependence on invasive techniques. Moreover, the reimbursement models are strong in major markets regarding wire-based FFR, and this is expected to maintain its market leadership in intervention strategy.

The non-invasive FFR segment is expected to grow at the fastest CAGR in the coming years, owing to the conversion of routine CCTA into a physiology-based decision tool, which yields no wires, hyperemic agents, and is expected to lead to fewer invasive angiographies. Health systems can incorporate CT-FFR into the early stages of evaluation pathways of chest pain patients, which will improve resource utilization and patient throughput. Additionally, the CT-fractional flow reserve has an important place in planning and optimising coronary procedures, further facilitating the segment growth in the coming years.

Application Insights

Which Application Area Holds the Leading Position in the Fractional Flow Reserve Market?

The diagnosis of intermediate lesions segment held the leading position in the fractional flow reserve market in 2024, accounting for an estimated 55% market share, as it is the most important in determining hemodynamically significant stenosis misclassified by angiography alone. FFR use continues to satisfy the high demand for procedures done on academic and community hospitals, as clinicians already use fractional flow reserve to inform their decisions when the lesion severity is visually ambiguous.

Clinical guidelines issued by the American College of Cardiology and European Society of Cardiology strongly suggest the use of physiology-based assessment to guide revascularization. That further drives the incorporation of physiology-based assessment into common cath lab processes. The recent updates regarding the ESC 2024 highlighted that the five-year survival is better with physiology-guided intervention than angiography-guided PCI, and thus reaffirms the clinical relevance of invasive FFR. Furthermore, the combination of fractional flow reserve consoles with IVUS and OCT imaging systems has the potential to extend diagnostic accuracy and further establish invasive physiology, thus further propelling the segment in the coming years.(Source: https://pmc.ncbi.nlm.nih.gov)

The post-PCI optimization segment is expected to grow at the fastest rate in the coming years, owing to the growing interest in enhancing long-term stent performance and potent reduction of residual ischemia. Interventionalists are using FFR after stenting to ensure functional success and identification of edge dissections or under-expansion, which is likely to reduce target lesion revascularization. Additionally, the new technology in the accuracy of pressure wire and pullback mapping capabilities is likely to increase procedural ease and workability on the post-PCI physiology and boost the segment growth.

End-User Insights

Which End-User Segment Accounted for the Highest Utilization in the Fractional Flow Reserve Market?

The hospital segment accounted for the highest utilization in the fractional flow reserve market in 2024, with an approximate 65-75% share due to the high volumes of heart disease operations utilizing fractional flow reserve technology.

The multidisciplinary heart researchers have established protocols favoring physiology-based decisions that are expected to support the procurement of pressure guidewires, consoles, and interface IVUS/OCT systems. Additionally, the familiarity with the process of reimbursement and well-established supply chains also makes it possible to schedule and manage predictable inventory, thus further fuelling the market in this sector.

- According to the NIH 2024 report, hospitalizations for cardiovascular diseases increased from 4,283,502 in 2016 to 4,635,246 in 2019, before declining to 3,865,399 in 2020.

The diagnostic imaging centers segment is expected to grow at the fastest CAGR in the forecast years, owing to the conversion to CT-derived FFR occurring upstream in the stable chest-pain pathways, which is expected to eliminate unnecessary downstream referrals to invasive angiography. Furthermore, the growing regulatory approvals are projected to make diagnostic imaging centers an essential point of access to non-invasive physiology, further facilitating the segment growth.

Component Insights

What Component Segment Is Dominating Adoption in the Fractional Flow Reserve Market?

The hardware segment dominated the fractional flow reserve market in 2024, accounting for an estimated 60% market share, due to the popularity of pressure guidewires, consoles, and hemodynamic monitoring systems in cardiac catheterization labs. These devices are important to interventional cardiologists and will likely continue to be used to accurately measure pressure gradient in real-time across a coronary lesion. Additionally, the ongoing training conducted by vendors and professional societies is estimated to maintain operator familiarity and consistent use of hardware in high-volume centers and regional hospitals.

The software & analytics segment is expected to grow at the fastest rate in the coming years, owing to the increasing adoption of artificial intelligence (AI) and highly advanced computational models aiding in the non-invasive fractional flow reserve evaluation using coronary CT angiography (CT-FFR). Vendors are set to invest in cloud-based applications that offer remote access to results, which can be used to increase adoption in outpatient and diagnostic imaging. Moreover, the Collaborations between imaging firms and AI developers are projected to have an even greater effect on this segment to integrate fractional flow reserve analytics into multimodality imaging workflows.

Distribution Insights

Which Distribution Channel Contributes the Most to the Fractional Flow Reserve Market Share?

The direct OEM sales segment held the largest revenue share in the fractional flow reserve market in 2024, which held a market share of about 55-70%, due to the adoption of quality assurance, warranty coverage, and training offered by the vendor, facilitating better levels of efficiency within the procedures. Additionally, the growing replacement demand associated with pressure wire technology and switch-offs to digital consoles is also expected to maintain a strong current level of sales by the OEM.

The cloud-based/SaaS subscription segment is expected to grow at the fastest CAGR in the coming years, as it offers greater speed in terms of scale-up, less investment in terms of initial infrastructure, and integration with the electronic health records and imaging networks. Furthermore, the hospitals and diagnostic centers are presumed to adopt the use of cloud-based solutions, as a result of their efficiency in promoting remote collaboration, second opinions, and the sharing of cases in real-time.

Pricing Model Insights

Which Pricing Model Represents the Largest Share in the Fractional Flow Reserve Market?

The one-time device + disposables segment represents the largest share in the fractional flow reserve market in 2024, accounting for an estimated 60% market share. Hospitals and cath labs prefer to make a single device investment and continue on the regular disposable sales model. This is likely that this pricing paradigm would be maintained, as it is a predictable inventory and procurement program that has been established. Additionally, the regulatory clearance processes and hospital reimbursement mechanisms largely favor device-plus-disposable models, which are projected to maintain their dominance in markets.

The subscription/SaaS segment is expected to grow at the fastest rate in the coming years, owing to the desire of hospitals and diagnostic centers to move capital expenditures to operational expenditures. This creates the potential to reduce the costs of adopting advanced analytics and CT-derived physiology. Furthermore, the increasing payer acceptance of software-based diagnostic pathways is estimated to drive subscription growth in the coming years.

Regional Insights

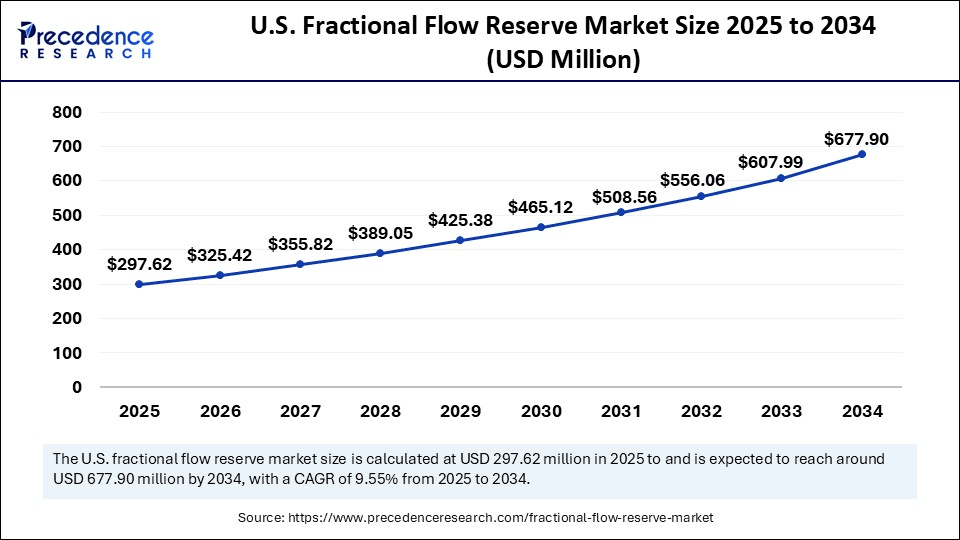

U.S. Fractional Flow Reserve Market Size and Growth 2025 to 2034

The U.S. fractional flow reserve market size is exhibited at USD 297.62 million in 2025 and is projected to be worth around USD 677.90 million by 2034, growing at a CAGR of 9.55% from 2025 to 2034.

Which Region Continues To Lead the Global Fractional Flow Reserve Market?

North America led the fractional flow reserve market, capturing the largest revenue share in 2024, due to well-developed healthcare facilities, a large number of procedures, and prominent support of major cardiology associations. The emphasis on physiology-guided PCI remained active in the 2024 release of the ACC, AHA, and SCAI guidelines, which is expected to strengthen the use of fractional flow reserve in common decision-making.

- According to the CDC 2024 report, one person dies every 34 seconds from cardiovascular disease in the United States, underscoring the urgent need for advanced diagnostic tools such as fractional flow reserve (FFR) technologies in the region.

The NCDR offers comprehensive benchmarking of interventional outcomes, which is likely to maintain procedural quality and appeal to further adoption of fractional flow reserve technology among U.S. hospitals and catheterization laboratories. Additionally, the CMS has had clear policies on coverage of FFR, which tend to provide impetus to both invasive and non-invasive approaches, thus driving the market in this region.(Source: https://www.cdc.gov)

Asia Pacific Steps into the Future of Cardiac Diagnostics with FFR

Asia Pacific is anticipated to grow at the fastest rate in the market for fractional flow reserve during the forecast period, owing to the increasing burden of coronary artery disease and the improved growth of interventional cardiology infrastructure. Epidemiological modeling has shown that the crude cardiovascular mortality in Asia will only increase by nearly two-fold by 2050, highlighting the enormity of the need for more advanced diagnostic tools like FFR.

- According to the Journal of the American College of Cardiology (JACC) 2024 report, the prevalence of rheumatic aortic stenosis (AS) has been reported at 4.54 per 1,000 people in India, 1.86 per 1,000 in China, and 1.3 per 1,000 in Bangladesh.

Tertiary care centers and catheterization laboratories are being increased in countries like China, India, and Japan, and such developments act as an opportunity to promote their guidelines that encourage physiology-based assessment of lesions. These efforts roll up procedure penetration and adoption in high-volume centers of the region. Furthermore, the trend towards the expansion of insurance coverage and the increase in patient awareness of coronary disease are propelling the market in the coming years.

Why the U.S. Fractional Flow Reserve Market is Expanding?

The U.S. market is growing due to rising cases of coronary artery disease and the increasing shift toward evidence-based, physiology-guided diagnosis. Clinicians are adopting FFR to reduce unnecessary stenting, improve patient outcomes, and enhance treatment accuracy compared to angiography alone. Strong support from clinical guidelines, expanding use of non-invasive CT-FFR, and continuous technological advancements further accelerate its adoption across hospitals and cardiac centers.

What's Fueling the Rise of Fractional Flow Reserve in China?

The China market is growing due to the rising burden of coronary artery disease and increasing demand for precise, evidence-based diagnostic methods. Hospitals are rapidly adopting FFR to improve treatment decisions, reduce unnecessary interventions, and enhance patient outcomes. Strong government investment in cardiovascular care, expanding use of advanced imaging technologies like CT-FFR, and growing clinical awareness among cardiologists further support the market's fast expansion.

Key Drivers Behind the Expansion of Europe's FFR Market

The Europe market is expanding due to the strong emphasis on evidence-based cardiology and the widespread adoption of physiology-guided diagnosis for coronary artery disease. Growing clinical trust in FFR, supported by guidelines from leading cardiology societies, is driving broader use across hospitals. Increasing prevalence of cardiovascular conditions, rising demand for minimally invasive diagnostics, and rapid adoption of non-invasive CT-FFR technologies further strengthen market growth across the region.

The UK's FFR Surge: A New Era in Cardiac Precision

The UK market is increasing as hospitals prioritize advanced diagnostic tools that enhance decision-making and streamline cardiac care pathways. Growing investments in modern catheterization labs and the push to shorten procedure times are encouraging clinicians to rely more on FFR for accurate lesion assessment. Additionally, expanding training programs for interventional cardiologists and rising adoption of AI-supported CT-FFR platforms are helping drive stronger market uptake across the country.

Value Chain Analysis

- R&D

Efforts are centered on developing non-invasive and AI-driven FFR technologies to simplify procedures and widen clinical use.

Innovations aim to speed up workflow, reduce reliance on pressure wires and drugs, and improve accessibility for routine cardiac assessment.

Key players: CathWorks, HeartFlow, GE HealthCare, Medtronic, and Opsens - Clinical Trials

Research evaluates how FFR improves decision-making in coronary artery disease compared to angiography alone.

Trials increasingly examine non-invasive approaches like CT-derived FFR (FFR-CT) and their impact on reducing unnecessary invasive procedures.

Studies focus on using FFR in challenging scenarios such as multi-vessel disease, left main lesions, and heart failure patients.

Key players: HeartFlow, CathWorks, Medtronic, GE HealthCare - Formulation and Final Dosage Preparation

FFR commonly relies on adenosine, a strong vasodilator that creates hyperemia to accurately assess coronary pressure differences.

The dosage and preparation change based on the delivery route, either IV infusion for steady hyperemia or intracoronary injection for rapid, localized effect.

Key players: Medtronic, Abbott, GE HealthCare, Opsens

Fractional Flow Reserve Market Companies

- Asahi Intecc Co.: A medical device company that manufactures high-performance coronary guidewires used in FFR procedures, known for superior flexibility and support.

- GE HealthCare: Offers integrated FFR measurement by embedding FFR algorithms into its Mac-Lab hemodynamic systems, streamlining the cath lab workflow.

- Opsens Inc.: Produces the OptoWire, a second-generation fiber-optic pressure guidewire for highly accurate, drift-free FFR and diastolic pressure ratio (dPR) measurements.

- Medtronic plc: Partners with CathWorks to co-promote the FFRangio system — a non-invasive, angiography-based FFR platform powered by AI.

- CathWorks Ltd.: Develops the FFRangio System, which computes FFR from routine angiograms using AI and computational modeling, eliminating the need for pressure wires.

Recent Developments

- In April 2025, Medis Medical Imaging announced U.S. FDA clearance for the latest version of its Medis QFR software. This AI- and Deep Learning-powered solution enables wire-free, angiography-derived coronary physiology assessment for patients with ischemic CAD. The upgraded version, Medis QFR 3.0, delivers greater automation and efficiency improvements while maintaining validated accuracy. Cardiologists attending the SCAI 2025 conference in Washington, D.C. will be able to experience its advanced features firsthand.(Source: https://medisimaging.com)

- In May 2025, HeartFlow released two-year results from the large-scale FISH&CHIPS study conducted by England's National Health Service (NHS). Published in Nature Medicine, findings demonstrated that combining CCTA with HeartFlow's FFRCT improved care efficiency and reduced unnecessary diagnostic procedures compared with CCTA alone. This real-world evidence reinforces the clinical and economic value of FFRCT in CAD care pathways.

(Source: https://www.heartflow.com) - In October 2024, Boston Scientific expanded its portfolio with the launch of the AVVIGO+ Multi-Modality Guidance System in India. Designed for use in PCI procedures, the system integrates intravascular ultrasound (IVUS) and fractional flow reserve (FFR) technologies to provide physicians with advanced vessel imaging and physiology data. The product launch aligns with the company's mission to transform cardiovascular care through innovation.

- December 18, 2024,Guadalupe Regional Medical Center (GRMC) in the U.S. announced the successful completion of 100 cases using the CathWorks FFRangio System. This non-invasive, computer-based platform reconstructs 3D coronary models from standard angiograms to precisely identify blockages. GRMC highlighted its position as the only hospital in the region offering this advanced diagnostic option, underscoring the growing adoption of non-invasive solutions. (Source: https://www.grmedcenter.com)

- In May 2025, at EuroPCR 2025 in Paris, Japan's Gifu Heart Center presented one-year results from the PROVISION1 Study. The physician-initiated trial demonstrated that FFRangio achieved non-inferiority against invasive fractional flow reserve while offering cost savings and resource efficiency. The findings support broader adoption of FFRangio technology in clinical practice.(Source: https://cath.works)

Latest Announcements by Industry Leaders

- In February 2025, Announcement: HeartFlow, Inc., a global pioneer in artificial intelligence solutions for coronary artery disease (CAD), announced the launch of its new brand identity that emphasizes clarity, precision, and confidence in cardiovascular care. The refreshed identity marks a significant milestone in the company's mission to empower clinicians with advanced insights for the prevention, diagnosis, and long-term management of CAD. Over the years, HeartFlow has supported physicians in treating more than 400,000 patients worldwide, becoming a trusted partner in the fight against one of the most prevalent health challenges globally.

- The company's commitment extends beyond diagnostics, aiming to transform CAD into a condition that patients can effectively manage throughout their lives. “Our vision is to reshape the way coronary artery disease is approached across the care continuum,” said John Farquhar, president and CEO of HeartFlow. “By leveraging AI-driven innovation, we are not only enhancing diagnostic accuracy but also enabling clinicians to create personalized treatment strategies that deliver better outcomes. This new brand identity reflects both our growth and our dedication to improving patient care at every stage.” Looking ahead, HeartFlow is focused on advancing early detection, refining treatment guidance, and equipping healthcare providers with actionable insights. The company's strategy positions it as a leader in supporting clinicians worldwide, while striving to improve the quality of life for millions of patients affected by cardiovascular disease each year. (Source: https://www.globenewswire.com)

Segments Covered in the Report

By Product / Device

- Pressure Guidewires (disposable & reusable; fiber-optic / piezoelectric)

- Monitoring Systems & Consoles

- Non-invasive FFR Systems (CT-FFR / FFR-CT)

- Instantaneous Wave-Free Ratio (iFR) / resting indices

- Accessories & Disposables

By Technology / Measurement Method

- Invasive FFR (hyperemic FFR)

- Non-invasive FFR (CT-FFR / computational FFR)

- Hybrid (invasive + computational)

- iFR / alternative hyperemia-free assessment

By Application / Clinical Indication

- Diagnosis of intermediate coronary lesions

- Pre-PCI lesion assessment

- Post-PCI optimization

- Multi-vessel disease assessment

- Other cardiovascular interventions

By End-User

- Hospitals (cath labs)

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Research & Academic Institutions

- Others (specialty clinics)

By Component / Offering

- Hardware (guidewires, consoles)

- Software & Analytics (FFR-CT SaaS, cloud platforms)

- Services (training, calibration, subscription-based analytics)

By Distribution Channel

- Direct OEM Sales

- Distributor / Dealer Network

- Cloud / SaaS Subscription

By Pricing Model

- One-time Device Purchase + Disposable Sales

- Subscription / SaaS (CT-FFR)

- Per-Test Billing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting