What is Fumed Silica Market Size?

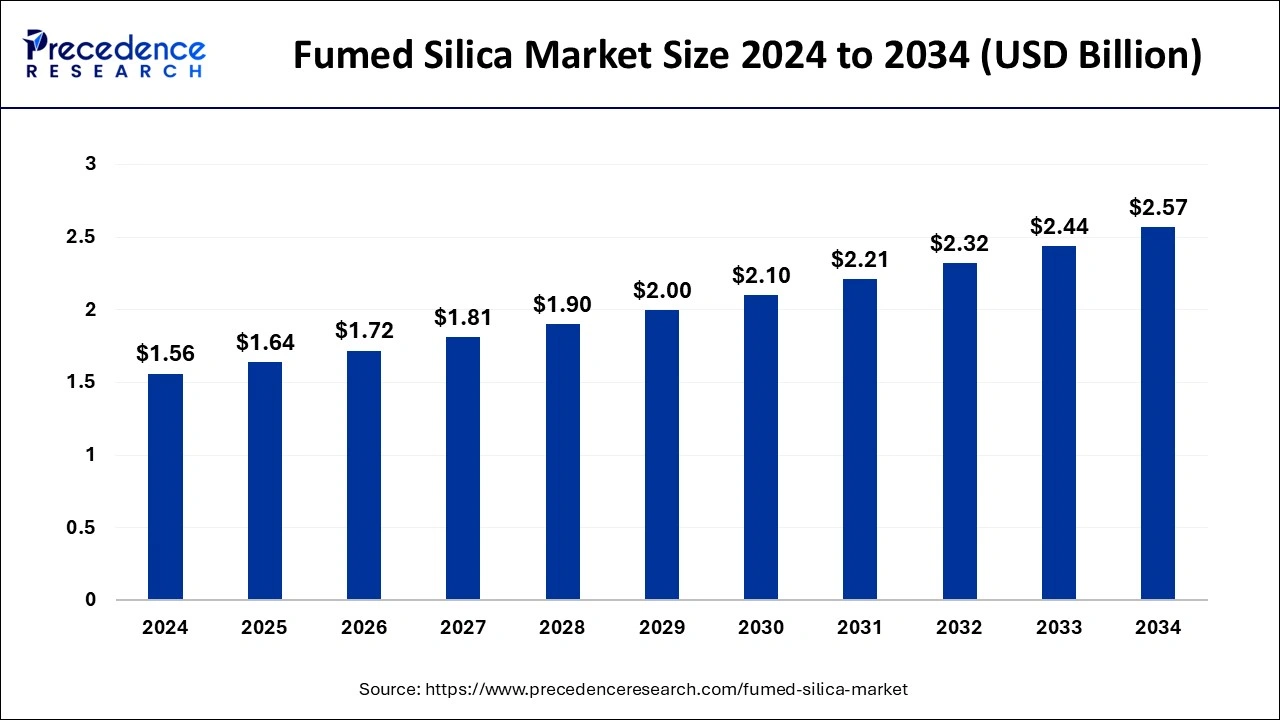

The global fumed silica market size is calculated at USD 1.64 billion in 2025 and is anticipated to reach around USD 2.57 billion by 2034, expanding at a CAGR of 5.13% from 2025 to 2034. The increasing demand for high-performance parts for the marine & transportation industry is the key factor driving the growth of the fumed silica market. Also, increasing adoption of fumed silica in coating applications coupled with technological advancements can fuel market growth further.

Market Highlights

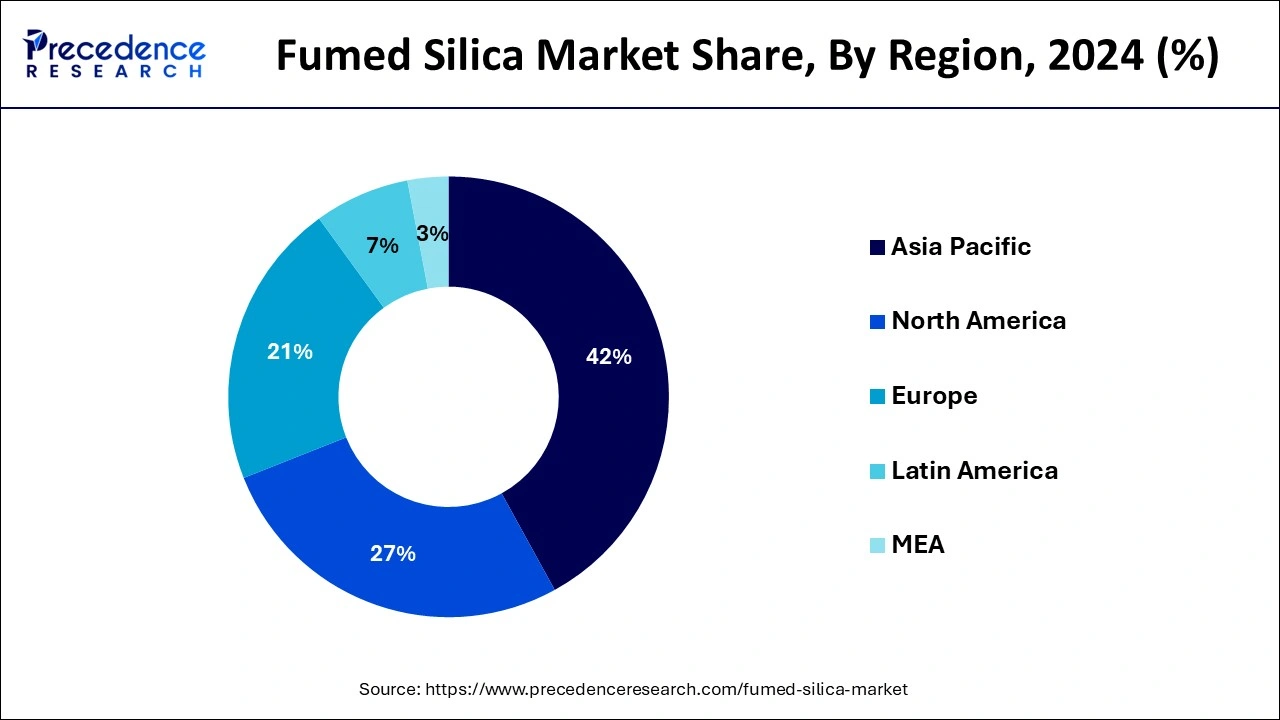

- Asia Pacific dominated the global market with the largest market share of 42% in 2024.

- North America is expected to show the fastest growth during the forecast period.

- By product, the hydrophobic segment contributed the highest market share in 2024.

- By product, the hydrophilic segment is expected to grow at the fastest CAR during the forecast period.

- By application, the pharmaceutical industry segment captured the biggest market share in 2024.

- By application, the silicone elastomers segment is anticipated to grow with the highest CAGR from 2025 to 2034.

What is fumed silica?

Fumed silica is produced through the reaction of silicon tetrachloride in the presence of hydrogen-oxygen flame. Its diverse features made it a key ingredient in many industrial applications, such as pharmaceuticals, food & beverages, etc. Hydrophilic fumed silica is popular for its affinity towards polar substances and water and is experiencing high demand. Industries such as paints, silicone, and rubber are increasingly using hydrophobic fumed silica because of their unique benefits.

How does AI-driven technology impact on fumed silica market?

Artificial intelligence is playing a transformative role in reshaping the fumed silica market and can be used to streamline production processes, improve product consistency, and enhance quality control in the production of these additives. Furthermore, AI-driven systems are optimizing operations and decreasing costs, leading to more effective manufacturing of fused silica-based food additives.

Fumed Silica Market Growth Factors

- The increasing adoption of renewable energy sources is expected to boost fumed silica market growth soon.

- The growing need for high-performance energy storage solutions and batteries can propel market growth soon.

- The increasing emphasis on green and sustainable technologies will likely contribute to the market expansion over the forecast period.

Market Outlook

- Industry Growth Overview: The fumed silica market is increasing, driven by growing requirements for high-performance materials in construction, electronics, and personal care products, along with developments in production technologies. The increasing pharmaceutical industry is growing demand for fumed silica as a glidant and thickening agent in tablet formulations.

- Global Expansion: The fumed silica market is increasing worldwide, driven by growing urbanization, an increase in electric vehicle production, and the growing use of fumed silica to improve the performance of products like adhesives, coatings, and silicones. Asia Pacific is dominated in the market as rapid industrialization, urbanization, and growth in the construction, electronics, and automotive sectors.

- Major investors: Major investors and producers in the fumed silica industry include large chemical organizations such as Evonik Industries AG, Cabot Corporation, and Wacker Chemie AG. Various main players are Tokuyama Corporation, OCI Company Ltd., and Heraeus Holding GmbH.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.64 Billion |

| Market Size in 2026 | USD 1.72 Billion |

| Market Size by 2034 | USD 2.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.13% |

| Leading Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand from the pharmaceutical sector

Fumed silica is increasingly being used in the pharmaceutical industry in the formation of tablets. Hence, the pharmaceutical industry and related companies are key drivers for the growth of the market. In addition, the key market players are searching for other applications on which the product can be deployed to fulfill the future demand from the fumed silica market.

- In October 2023, HPQ Silicon Inc., a technology company specializing in green engineering processes for silica and silicon material production, announced continued industry interest from third parties in evaluating the potential of HPQ-produced commercial-grade Fumed Silica material. This third NDA involves another participant in the Fumed Silica industry.

- In June 2023, Solvay announced the new names of the future independent publicly traded companies that will result from its planned separation into two industry leaders: SOLVAY and SYENSQO. The new names will be effective upon completion of the planned separation of Solvay, which is on track to be completed in December 2023, following the satisfaction of customary conditions.

Restraint

Substitute usage

A major fumed silica market constraint is the substitution of fumed silica with other types of additives. Biogenic silica and precipitated fumed silica are being produced rapidly as alternatives to fumed silica to mimic its certain functionalities for different uses. Moreover, the advent of alternatives creates a hurdle in the expansion of the market, as they offer end-users competitive benefits and functionalities.

Opportunity

R&D and innovations in the silica production

Manufacturers are creating new formulations for fumed silica by focusing on technological progress and product innovation and by stretching its usage in a variety of industries. Many industries in the fumed silica market are augmenting the functionalities of fumed silica to strengthen its applicability in a wide range of industries. Furthermore, fumed silicon is an extensive application in nanotechnology for producing nanowires and nanoparticles.

- In July 2022, Wacker Chemie AG established a new silicone production complex at its Charleston site in Tennessee, U.S. Wacker's fumed silica market position was enhanced by this increased production capacity for pyrogenic silica and other silicon intermediates used in construction applications.

Segment Insights

Product Insights

The hydrophobic segment dominated the fumed silica market in 2024. This dominance can be attributed to the increasing preference of various industries for this segment for its notable coating properties, such as anti-icing/wetting, anti-fouling, Anti-corrosion, and self-cleaning. Additionally, the products also reduce the risk of rust and corrosion related to paints and coatings.

- In May 2022, Tokuyama Corporation increased the output from its hydrophobic-grade fumed silica line located at its subsidiary Tokuyama Chemicals (Zhejiang) Co Ltd. Hydrophobic-grade fumed silica is mainly used as a thickener in resin-type adhesives and printing ink.

The hydrophilic segment is expected to grow at the fastest rate over the forecast period. The growth of the segment in the fumed silica market can be credited to the growing emphasis on eco-friendly and sustainable solutions. Also, hydrophilic silica is cheaper than hydrophobic silica. Moreover, hydrophilic fumed acts as a thickening agent, rheology modifier, and anti-settling agent, which are highly beneficial.

Application Insights

The pharmaceutical industry segment led the fumed silica market in 2024. The dominance of the segment can be linked to the increasing use of fumed silica in the pharmaceutical industry as a functional excipient. Also, it is utilized in controlled-release matrices, modified-release formulations, and disintegrating tablets. This trend is boosted by the desire to improve bioavailability and drug stability.

The silicone elastomers segment is expected to grow at the fastest rate in the fumed silica market over the projected period. The growth of the segment can be driven by the rising need for high-performance materials in different end-use industries such as electronics, automobile, and medical. Furthermore, fumed silica has superior mechanical properties that protect silicon elastomers from wear and tear.

Regional Insights

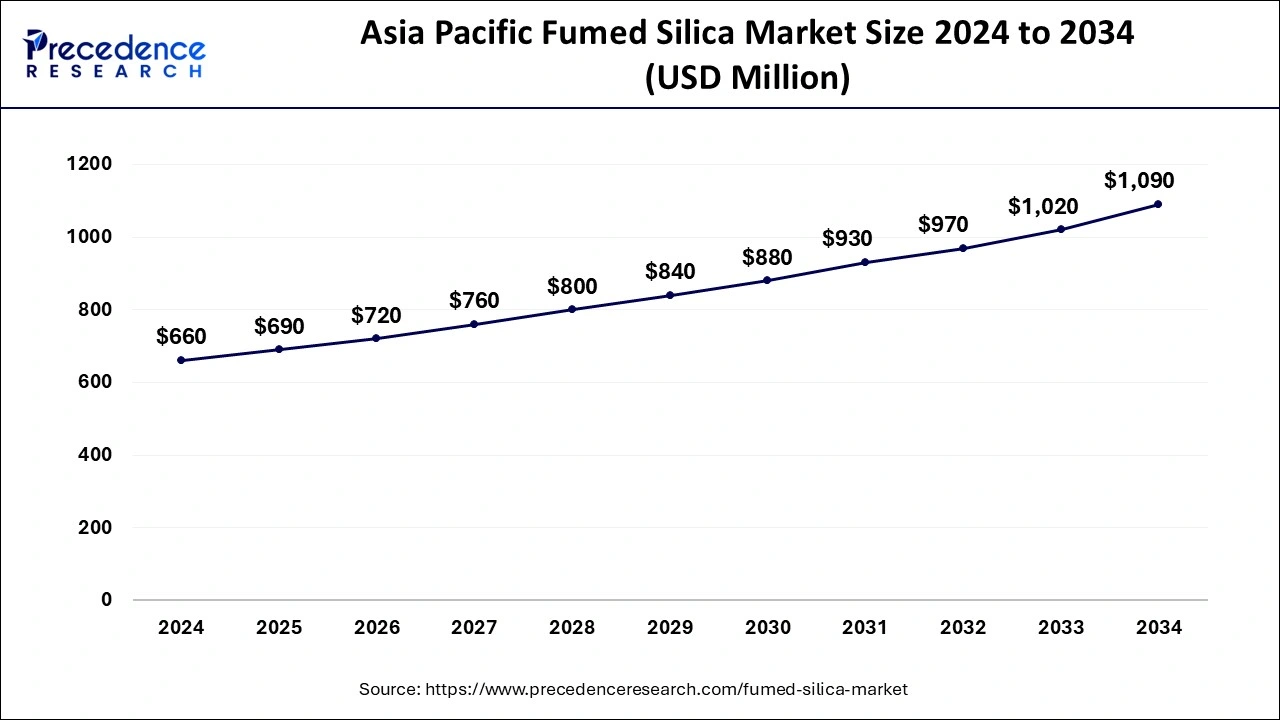

Asia Pacific Fumed Silica Market Size and Growth 2025 to 2034

The Asia Pacific fumed silica market size is exhibited at USD 690 million in 2025 and is projected to be worth around USD 1,090 million by 2034, growing at a CAGR of 5.14% from 2025 to 2034.

Asia Pacific: Increasing industrialization

Asia Pacific dominated the global fumed silica market in 2024. The dominance of the region can be attributed to the increasing use of fumed silica in numerous industries, such as adhesives, sealants, paints, and coatings, which fuels the overall industrial development in the region. Moreover, major market players are focusing on R&D and product innovation.

- In January 2023, Asian Paints approved an expenditure of USD 0.24 billion for setting up a waterborne paint manufacturing unit in Madhya Pradesh, India, having an annual capacity of 400,000 kilobits.

North America: Increasing innovation

North America is expected to show the fastest growth in the fumed silica market over the studied period. The growth of the region can be credited to the its increasing focus on technological progress, innovation, and stringent quality criteria. Furthermore, in North America, the U.S. led the market owing to the rising demand for fumed silica from various industries such as paints and coatings, adhesives and sealants, etc.

China: Increasing construction and infrastructure

China has a huge manufacturing infrastructure that enables it to produce fumed silica at a reduced cost, significantly in terms of pricing for raw materials and energy. Major international and domestic organizations have invested more in fumed silica production facilities in China, and the country's manufacturers are focused on technological development and quality control to remain competitive. Increasing urbanization and massive infrastructure projects have created a huge demand for fumed silica in construction materials.

Europe: Increasing government policies for energy saving

Europe's stringent regulations, such as those for low-VOC coatings and food safety, mandate the use of higher-quality fumed silica. This makes a strong market for products that meet these standards. European producers are best at developing carbon-driven and sustainable manufacturing processes. The push for groundbreaking products, combined with a commitment to sustainability, drives demand for fumed silica in novel applications.

U.S.: Established end-use industries

The U.S. has strong demand from significant sectors like pharmaceuticals, electronics, specifically in Silicon Valley, construction, and automotive. Fumed silica is a significant additive in products ranging from drug formulations and semiconductor encapsulation to high-performance adhesives, coatings, and sealants.

UK: Strong public health initiatives

In the UK, growing demand for fumed silica is fueled by its use in high-performance paints, coatings, adhesives, sealants, and food additives. It is applied in the electronics and pharmaceutical fields for insulation and drug formulation. The UK is a significant consumer of fumed silica in Europe, with demand driven by its large processed food, construction, and pharmaceutical sectors.

In the UK, growing demand for fumed silica is fueled by its use in high-performance paints, coatings, adhesives, sealants, and food additives. It is applied in the electronics and pharmaceutical fields for insulation and drug formulation. The UK is a significant consumer of fumed silica in Europe, with demand driven by its large processed food, construction, and pharmaceutical sectors.

Fumed Silica Market- Value Chain Analysis

- Raw Material Sourcing:

The significant raw materials for fumed silica are silicon tetrachloride or methyl trichlorosilane, which are vaporized and then burned in a high-temperature hydrogen and oxygen flame

Key Players: Kemitura A/S, and Dongyue Group - Package Design and Prototyping:

Prototyping includes testing different materials and design combinations to confirm the package handle's unique challenges, such as its extremely low bulk density and strong tendency to absorb moisture.

Key Players: Wacker Chemie AG - Recycling and Waste Management:

Fumed silica itself is an inert, non-toxic, and non-hazardous material in terms of chemical waste disposal, and it is highly recyclable, mostly as a valued byproduct in the construction industry.

Key Players: Evonik Industries and Cabot Corporation

Key Players in Fumed Silica Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Cabot Corporation |

U.S. |

Strong focus on sustainability |

In November 2025, Cabot Corporation announced that its LITX 95F conductive carbon, an advanced material engineered for use in lithium-ion batteries for energy storage systems (ESS) |

|

Evonik Industries AG |

Georgia |

Technological capabilities and innovation |

In January 2025, Evonik launched Smart Effects, a novel entity counting 3,500 employees global, born from the strategic merger of its Silica and Silanes business lines that will be part of "Advanced Technologies" within the novel company organization. |

|

Wacker Chemie AG |

Germany |

advanced integrated production technologies |

In May 2025, the Chemicals group WACKER commenced production of hybrid polymers at its Nünchritz site. |

|

Tokuyama Corporation |

Japan |

high-purity chemical manufacturing technologies |

Tokuyama to Exhibit high-quality silica at the in-cosmetics global 2025 |

|

OCI Company Ltd |

South Korea |

Focus on high-value advanced materials |

OCI envisions growing as a leading global core materials company and creating value for society by opening new frontiers in basic chemicals |

Latest Announcement by Market Leaders

- In December 2024, Cabot Corporation announced that its Board of Directors had been named 2025 "Public Company Board of the Year" by the National Association of Corporate Directors (NACD) New England Chapter. This award recognizes exceptional corporate leadership and governance of boards in New England.

- In June 2023, Tokuyama announced the OCI plan to build a 10,000 MT polysilicon factory in Malaysia. Tokuyama said the new factory should meet increasing demand for polysilicon. OCI already operates a polysilicon manufacturing facility in Malaysia. Tokuyama is looking to explore possible collaboration with OCI to build production and supply facilities.

Recent Developments

- In March 2024, PyroGenesis declared the expedited development of a fumed silica reactor endeavor after receiving all significant apparatus. This advancement represents a substantial milestone in the project, signifying progress towards the fumed silica reactor's finished product.

- In June 2024, AEROSIL commissioned a new system to produce AEROSIL Easy-to-Disperse (E2D) products, simplifying the use of silica as a rheology additive in paint and coating formulations. The technology, which has been successfully produced at the Rheinfelden site for decades, ensures quality and increases the global availability of AEROSIL E2D fumed silica products.

- In September 2023, Ecovyst Inc., a leading integrated and innovative provider of specialty catalysts and services, announced plans to expand silica catalyst production capability at its manufacturing facility in Kansas City, KS.

- In June 2023, Univar Solutions Inc., a leading global solutions provider to users of specialty ingredients and chemicals, announced that the Company has reached an agreement with W. R. Grace & Co.

Segments Covered in the Report

By Product

- Hydrophilic

- Hydrophobic

By Application

- Pharmaceutical

- Beauty and Personal Care

- Silicone Elastomers

- Paints

- Coatings and Inks

- UPR

- Adhesives and Sealants

- Food and Beverages

- Chemical Mechanical Polishing/Planarization (CMP)

- Polishing

- Printer Tone

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting