What is Gas Insulated Substation Market Size?

The global gas insulated substation market size is calculated at USD 33.88 billion in 2025 and is predicted to increase from USD 39.43 billion in 2026 to approximately USD 132.80 billion by 2034, expanding at a CAGR of 16.39% from 2025 to 2034. The gas insulated substation market is surging because of its safety, low maintenance, and high efficiency in urban and industrial areas, where space is limited and conditions are harsh, gas insulated substation technology is becoming a preferred choice worldwide.

Market Highlights

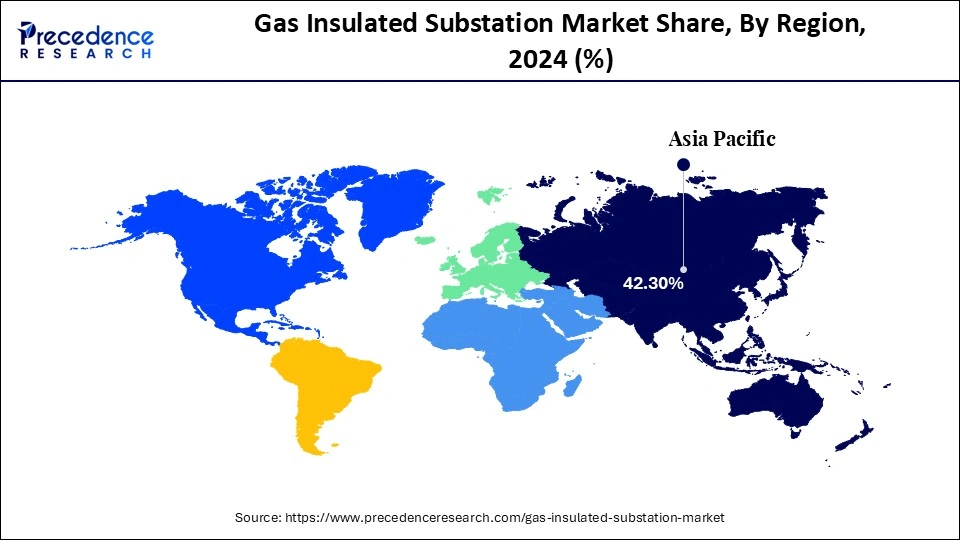

- The Asia Pacific is dominated the market by holding more than 42.3% of market share in 2024.

- By voltage ratings, the medium voltage segment contributed the largest market share of 52.4% in 2024.

- By voltage ratings, high voltage segments is expected to grow at a remarkable CAGR of 9.4% between 2025 and 2034.

- By type, the hybrid GIS segment held the major market share of 61.4% in 2024.

- By type, compact GIS segment is expected to grow at a solid CAGR of 9.4% from 2025 to 2034.

- By installation type, the indoor segment generated the highest market share of 71.2% in 2024.

- By installation type, the outdoor segment is set to grow at a remarkable share of 9.6% CAGR between 2025 and 2034.

- By application, the power transmission segment contributed the major market share of 49.5% in 2024.

- By application, the renewable integration segment growing at a strong CAGR of 9.7% CAGR between 2025 and 2034.

- By end-user industry, the power utilities segment recorded the highest market share of 38.4% in 2024.

- By end-user industry, the industrial segment expanding at a CAGR of 9.8% between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 33.88 Billion

- Market Size in 2026: USD 39.43 Billion

- Forecasted Market Size by 2034: USD 132.80 Billion

- CAGR (2025-2034): 16.39%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What is the Gas Insulated Substation Market?

The Gas Insulated Substation (GIS) Market involves advanced electrical substations that use sulphur hexafluoride (SF₆) or alternative gases for insulation instead of air, providing compact, safe, and reliable power transmission solutions. GIS technology is widely adopted in urban areas, industrial zones, and renewable energy projects due to its space efficiency, low maintenance, and high safety. Market growth is driven by increasing electricity demand, urban infrastructure development, grid modernization, and the rising integration of renewable energy sources globally.

The market has seen a steady growth in recent years, driven by rising electricity demand, rapid urbanization, and the expansion of renewable energy networks. Compared of traditional air-insulated substations, gas insulated substation offers higher reliability, a smaller footprint, and smaller footprint, and longer service life. Many developing countries are adopting this system to modernize their grid infrastructure and improve power efficiency. The market is also benefiting from government initiatives toward smart grid and underground power transmission systems.

Market Outlook

- Industry overview: The growth trajectory of the gas insulated substation market closely reflects global urbanization patterns and increasing space limitations. As cities continue to expand, available land in densely populated areas is becoming both scarce and expensive. This has encouraged utilities and developers to adopt compact, efficient power infrastructure solutions like GIS. Moreover, the industry is under growing regulatory pressures to reduce greenhouse gas emissions, especially concerning the gas, which has a high global warming potential.

- Sustainability trend: Sustainability has become a defining pillar of the gas insulated substation market's evolution. Manufacturers are focusing on developing eco-efficient substations that use low-emission or SF-free insulation systems. The shift toward digital and automated substation is also contributing to reduced energy losses and improved system efficiency. Many companies are integrating life-cycle assessments into their production to minimize environmental footprints, ensuring that both manufacturing and operations align with global climate goals.

- Major Investments: Major investments in the gas insulated substation industry are concerned with the government initiatives aimed at modernizing urban power networks and accommodating infrastructure in limited spaces. Public and private sector collaborations are funding projects that integrate compact substitutions into metro systems, industrial zones, and renewable energy grids. Several governments are also offering financial incentives and policy support for utilities transitioning towards low-emission, space-saving electrical systems.

- Sustainable ecosystem and startups: A new wave of start-ups is emerging within the GIS ecosystem, focusing on green insulation technologies, digital monitoring, and predictive maintenance platforms. These young companies are playing a vital role in promoting sustainability through innovation, from developing alternatives to creating IoT-enabled systems that enhance grid transparency and energy efficiency.

Key Technological Shift in the Gas Insulated Substation Market

The GIS market is witnessing major technological advancements such as the development of free insulation systems, digital monitoring, and automated control systems, digital monitoring, and automated control solutions. Hybrid substations combining GIS and air-insulated components are becoming popular due to their flexibility and cost efficiency. The use of IoT sensors and AI-driven diagnostics is improving predictive maintenance and reducing downtime, marking a significant step toward smart substations.

Market Key Trends in the Gas Insulated Substation Market

- A key trend shaping the GIS market is the growing focus on eco-efficient solutions. Companies are developing insulating with gases with lower global warming potential.

- Green gas for grid and vacuum-based insulation systems. There's also a shift toward modular and prefabricated GIS designs.

- Moreover, digital substations with remote monitoring are becoming standard, offering enhanced safety and real-time performance analysis.

Gas Insulated Substation Market Value Chain Analysis

- Raw Material Sourcing: The foundation of GIS manufacturing begins with sourcing key raw materials such as aluminum, copper, stainless steel, and insulating gases, traditionally SF₆, and increasingly eco-friendly alternatives. Aluminum and copper are primarily used for conductors and busbars due to their excellent electrical conductivity. Stainless steel forms the enclosure for gas compartments, ensuring durability and resistance to corrosion. The insulating gas serves as the medium that prevents electrical breakdown.

- Technology Used:GIS technology integrates several advanced components such as high-voltage switchgear, circuit breakers, disconnectors, current and voltage transformers, and control systems, all housed within a compact gas insulated enclosure.

- Investments by Investors: Investors are playing a crucial role in shaping the GIS market through funding for R&D, infrastructure modernization, and sustainability-driven innovations. Many investments are directed toward developing green substation technologies and digital automation platforms that align with global energy transition goals.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 33.88 Billion |

| Market Size in 2026 | USD 39.43 Billion |

| Market Size by 2034 | USD 132.80 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.39% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Voltage Rating,Installation Type, Type, Application, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Hitachi Energy vs. Siemens Energy - Gas Insulation Substation

|

Company |

Country |

Product |

Aim |

|

Hitachi Energy |

China |

Sulphur hexafluoride (SF₆)-free 550 kV GIS |

To reduce carbon emissions in the country. |

|

Siemens Energy |

U.S. |

LIFE Blue 420 kV GIS |

For improved climate friendliness. |

Segment Insights

Voltage Rating Insights

Why Medium Voltage Is Dominating the Gas Insulated Substation Market?

The medium voltage is dominating the gas insulated substation market, holding the share of 52.4%, due to its suitability for urban power distribution and commercial applications. Its reliability and compact design make it the preferred option for metro networks, data centers, and industrial facilities. Medium voltage GIS systems are also cost-effective and easier to install in congested city spaces. Their low maintenance needs further add to their appeal in developing smart urban grids. Additionally, the adoption of medium voltage GIS is supported by government programs focused on modernizing aging distribution infrastructure. Overall, this segment will remain strong as urbanization and electrification continue to expand globally.

The high voltage is the fastest-growing segment of the gas insulated substation market, with a CAGR of 9.4%, fueled by rising electricity demand and the expansion of long-distance transmission networks. High-voltage gas insulated substation market systems play a crucial role in connecting renewable power plants to main grids efficiently. The growing shift toward cross-border power trade and high-capacity corridors is also stimulating demand. Their superior reliability and minimal power losses make them essential for future smart grid frameworks. Continuous advancements in insulation materials and SF₆ alternatives are further boosting adoption. As nations move toward decarbonization, high high-voltage gas insulated substation market will play a key role in supporting large-scale renewable integration.

Type Insights

How Is Hybrid Dominating the Gas Insulated Substation Market?

The hybrid segment is dominating the gas insulated substation market by holding a share of 61.7%, as it combines the strengths of air and gas insulation technologies, offering high reliability with flexibility in design. It is particularly favored in upgrade and retrofit projects where space and cost are critical factors. Hybrid systems reduce the need for full gas insulated substation setups while still delivering excellent safety and insulation performance. They are widely deployed across transmission substations, renewable energy plants, and industrial parks. The ability to customize configurations according to project needs makes the hybrid gas insulated substation market a preferred choice among utilities. As the power sector continues to transition toward efficient and compact infrastructure, the hybrid gas insulated substation market will maintain its dominance.

The compact GIS is fastest growing the gas insulated substation market at a growth rate of 9.4%, due to the growing demand for space-efficient power infrastructure. These systems are modular, lightweight, and easy to install, making them ideal for smart cities and underground substations. Compact GIS units also reduce installation time and enhance safety with sealed enclosures. Their environmental adaptability allows deployment in extreme climates and seismic zones. Manufacturers are focusing on improving the performance of compact systems while reducing their carbon footprint. With increasing emphasis on clean and efficient design, compact GIS is set to become a mainstream choice in future grid development.

Installation Type Insights

Why is the Indoor Segment Dominating the Gas Insulated Substation Market?

The indoor installation segment, accounting for 71.2% of the gas insulated substation market, leads due to its suitability for dense urban areas and industrial applications. Indoor GIS setups protect electrical components from environmental factors like humidity, pollution, and corrosion. They are widely used in metro networks, commercial complexes, and high-rise buildings where space is limited. Their enclosed structure enhances operational safety and reduces noise levels, making them ideal for populated zones. Additionally, indoor systems allow for easy monitoring and automation integration. With urban infrastructure projects expanding globally, the demand for indoor GIS will remain strong.

On the other hand, outdoor GIS installations are witnessing rapid growth in the gas insulated substation market, by holding a share of 9.6% CAGR. These systems are being increasingly deployed for renewable energy plants, transmission corridors, and substations in remote locations. Outdoor GIS offers durability and resistance to extreme weather conditions, ensuring long-term performance. The trend toward rural electrification and off-grid renewable setups is further fueling demand. Modular outdoor GIS units are now being designed for faster deployment and reduced maintenance needs. As global power infrastructure expands beyond cities, outdoor GIS will play a vital role in bridging the energy access gap.

Application Insights

Why Power Transmission is dominating the Gas Insulated Substation Market?

The power transmission is dominating the gas insulated substation market, holding the share of 49.5%, due to its critical role in maintaining stable and efficient electricity flow. GIS systems ensure minimal energy loss and high reliability in long-distance power transfer. They are preferred for high-capacity transmission lines, interconnectors, and grid substations. The increasing need to replace aging infrastructure in developed regions is boosting installations. Additionally, grid modernization projects in developing economies are driving strong demand for advanced GIS systems. As global energy consumption grows, the transmission segment will remain the backbone of the GIS market.

The renewable integration is the fastest-growing in the gas insulated substation market, by holding a CAGR of 9.7%, supported by the global transition to clean energy. Wind and solar farms rely on GIS for efficient grid connections in space-constrained or harsh environments. Compact and modular designs allow easy setup in renewable project sites. These substations help stabilize grid fluctuations caused by variable renewable output. Governments and energy developers are prioritizing GIS in hybrid renewable microgrids for reliability and safety. As renewables become a key pillar of energy policy, GIS will be central to ensuring smooth power integration and grid stability.

End-User Insights

Why Power Utilities are Dominating the Gas Insulated Substation Market?

The power utilities are dominating the gas insulated substation market by holding the share of 33.8%, reflecting the central role of utilities in energy transmission and distribution. These entities continuously invest in grid expansion and modernization projects to meet rising energy demand. GIS installations help utilities minimize maintenance costs, improve reliability, and optimize space usage. The growing push for smart grids and urban substations is further driving adoption. Additionally, government-backed programs for grid resilience and carbon reduction are increasing utility investments in GIS technology. As power utilities embrace digitalization and sustainability, their reliance on GIS will continue to strengthen.

The industrial segment is dominating the gas insulated substation market by holding and share of 9.8%, driven by rising electrification and industrial automation. Industries such as oil & gas, mining, manufacturing, and data centers are adopting GIS to ensure an uninterrupted, safe, and high-quality power supply. The need for compact and environment-friendly substations in industrial zones is fuelling growth. Industries are also investing in GIS solutions to reduce operational risks and improve energy efficiency. As industrial operations become more digital and power-intensive, GIS systems provide the reliability and compactness required. The segment will continue to thrive as industries modernize and integrate sustainability goals into their power infrastructure

Regional Insights

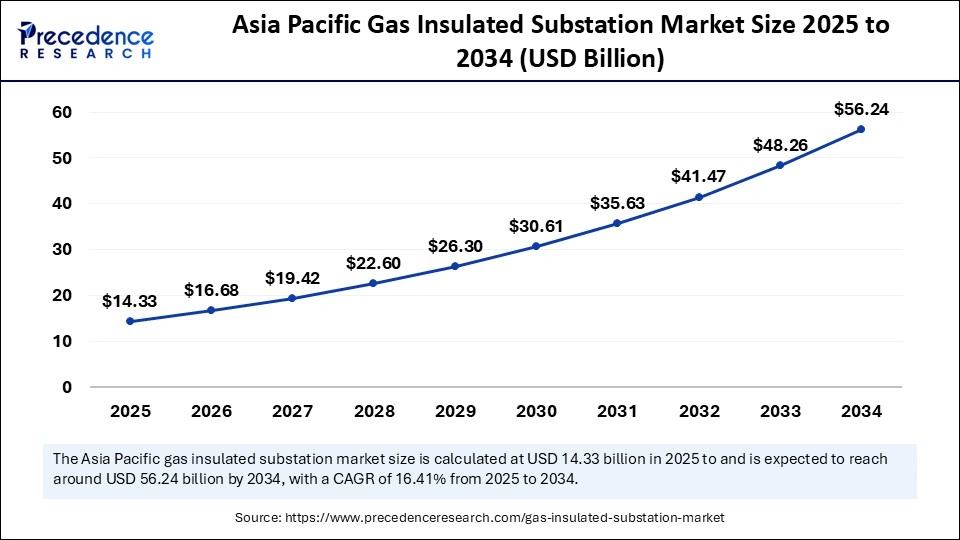

Asia Pacific Gas Insulated Substation Market Size and Growth 2025 to 2034

The Asia Pacific gas insulated substation market size is exhibited at USD 14.33 billion in 2025 and is projected to be worth around USD 56.24 billion by 2034, growing at a CAGR of 16.41% from 2025 to 2034.

Why Is Asia Pacific the Rising Star and Dominating the Market?

Asia Pacific is dominating the market by holding a share of 42.3% and fastest-growing by holding a CAGR of 10.2% in the gas insulated substation market, it is led by countries like China, Japan, India, and South Korea. The region's rapid industrial growth, urban expansion, and renewable energy projects have significantly increased the demand for compact and reliable power systems. Governments are investing heavily in upgrading transmission networks and building smart grids. China countries to lead with large-scale GIS installations for high voltage applications, while India is adopting gas insulated substations for metro projects and renewable power integration. Overall, the Asia Pacific will remain the fastest-growing region in the coming years due to strong infrastructure development and energy transition initiatives.

India is dominating in the Asia Pacific, driven by infrastructure maturity, energy demand, and investment priorities. Developed countries such as Japan, India, and Korea are focusing on upgrading aging power grids with compact and meet emission standards. Emerging economies like India, China, and others are witnessing rapid adoption due to urban expansion, industrialization, and renewable energy integration. Meanwhile, Middle Eastern nations are investing in this industry to support large-scale industrial zones and renewable energy integration. Meanwhile, Middle Eastern nations are investing in these industry zones and smart city projects, while African countries are gradually adopting GIS technology for reliable power access in developing urban regions.

Why Is North America Showing Promise in the Gas Insulated Substation Market?

North America is showing strong promise in the gas insulated substation (GIS) market, driven by the growing need to modernize aging power infrastructure and meet rising electricity demand across industrial, commercial, and residential sectors. The region's utilities are increasingly investing in compact and efficient substation technologies to enhance grid reliability, reduce transmission losses, and support the integration of renewable energy sources such as wind and solar. Gas insulated substations are particularly well-suited for North America's urban and densely populated areas, where limited land availability and stringent safety regulations make traditional air-insulated systems less practical.

The United States and Canada are leading this trend through large-scale grid modernization programs and smart grid deployments. Federal and state-level funding initiatives aimed at improving energy resilience and reducing carbon emissions are further supporting GIS adoption. Moreover, advancements in digital monitoring, automation, and predictive maintenance are helping utilities maximize asset performance and minimize downtime.

Manufacturers are also developing eco-efficient GIS systems that use alternative gases with lower global warming potential, aligning with regional sustainability goals. With robust technological innovation, supportive regulatory frameworks, and growing renewable integration, North America is poised to remain one of the most dynamic and promising regions for gas insulated substation development in the coming years.

Why Is Europe a Notable Region of Growth in the Gas Insulated Substation Market?

Europe is emerging as a notable region of growth in the gas insulated substation (GIS) market due to its strong emphasis on energy efficiency, grid modernization, and sustainability. The region's transition toward renewable energy sources, such as wind and solar, is driving the demand for compact, reliable, and high-capacity substations that can operate efficiently within urban and space-constrained environments. Gas insulated substations offer significant advantages in this context, including reduced footprint, enhanced safety, and superior insulation performance compared to conventional air-insulated systems.

Furthermore, the European Union's decarbonization targets and infrastructure investment programs, such as the European Green Deal and the Trans-European Networks for Energy (TEN-E) initiative, are supporting large-scale grid upgrades and cross-border electricity transmission projects. Countries like Germany, France, and the United Kingdom are at the forefront, integrating GIS technology into smart grid frameworks to enhance stability and accommodate fluctuating renewable inputs.

Additionally, the region's strong regulatory framework emphasizing environmental compliance and advanced technology adoption is accelerating innovation in eco-efficient GIS solutions, including the replacement of SF₆ gas with sustainable alternatives. As a result, Europe's focus on reliability, sustainability, and advanced grid management continues to solidify its position as a leading growth hub in the global gas insulated substation market.

Recent Developments

- In October 2025, Hitachi Energy was selected to deliver 1100 KV gas insulated switchgear for the 1000 KV Nanchang ultra-high-voltage substation in Jiangxi province, China. This project supports the expansion of the Nanchang site as a part of the country's border UHV grid development initiative. Commissioned at the end of 2021, the Nanchang substation stands as the first 1000 kV UHV facility in Jiangxi and a vital link within central China's double-looped grid network. It plays a crucial role in enhancing the power interconnection between Hunan and Jiangxi provinces, boosting cross-regional transfer capacity, and enabling more efficient integration of renewable energy sources

Top Gas Insulated Substation Market Companies

- ABB Ltd. (Hitachi Energy): ABB, now operating its power grid business as Hitachi Energy, is a global leader in gas insulated substations (GIS) known for their compact design, safety, and reliability. The company's advanced GIS solutions are used in high-voltage applications to ensure efficient power transmission with minimal environmental impact. ABB continues to innovate with eco-efficient switchgear technologies that reduce SF₆ gas usage and support sustainable grid modernization.

- Siemens Energy AG: Siemens Energy offers a comprehensive range of gas insulated substations with a focus on digitalization, compact design, and eco-friendly alternatives to SF₆ gas. Its blue GIS technology uses clean air insulation, minimizing greenhouse gas emissions while maintaining high operational reliability. Siemens Energy's strong presence in renewable integration and smart grid projects enhances its leadership in the global GIS market.

- General Electric Company (GE Grid Solutions): GE Grid Solutions, a subsidiary of General Electric, provides advanced GIS systems engineered for efficiency, safety, and environmental performance. Its g� (Green Gas for Grid) technology replaces SF₆ with an environmentally sustainable gas mixture, significantly reducing emissions. GE's GIS products are widely deployed in utilities, industrial plants, and renewable energy substations worldwide.

- Mitsubishi Electric Corporation: Mitsubishi Electric manufactures high-performance GIS systems known for their durability, low maintenance, and compact footprint. The company's focus on smart grid technologies and digital monitoring systems enhances operational efficiency. Mitsubishi Electric's eco-friendly designs and global service network make it a key player in power infrastructure development.

- Schneider Electric SE: Schneider Electric offers medium- and high-voltage gas insulated substations that emphasize sustainability, modularity, and safety. Its digital switchgear solutions integrate monitoring and automation features for improved reliability and asset management. Schneider's investment in green energy and digital substations supports its mission toward decarbonized energy systems.

- Toshiba Energy Systems & Solutions Corporation: Toshiba provides reliable GIS solutions for high-voltage transmission networks, featuring compact layouts and low environmental impact. Its products are widely used in urban substations and renewable integration projects.

- Hyundai Electric & Energy Systems Co., Ltd.: Hyundai Electric delivers robust GIS technology designed for high-voltage networks, combining compact designwith superior insulation performance. The company's GIS units are used globally in utility, industrial, and renewable energy sectors.

- Larsen & Toubro Limited (L&T): L&T manufactures GIS systems tailored for transmission and distribution networks, offering high safety standards and long service life. The company supports India's growing grid infrastructure through advanced substation automation technologies.

- Fuji Electric Co., Ltd.: Fuji Electric specializes in compact, high-reliability GIS solutions for medium- and high-voltage applications. Its energy-efficient designs reduce space requirements and operational costs while enhancing performance.

- CG Power and Industrial Solutions Ltd.: CG Power produces GIS systems for high-voltage substations with a focus on reliability, compactness, and cost efficiency. The company's products support infrastructure expansion in emerging markets.

- Hyosung Heavy Industries Corporation: Hyosung develops high-voltage GIS systems known for their precision engineering, compact size, and high safety standards. Its solutions are widely deployed in smart grid and renewable integration projects.

- Meidensha Corporation: Meidensha provides advanced GIS technology offering compact installation and high dielectric strength. The company's systems are used in power plants, transmission lines, and industrial facilities.

- Alstom Grid (part of GE): Now integrated into GE Grid Solutions, Alstom Grid historically contributed to GIS innovation with its advanced insulation technologies and robust system designs, forming the foundation for GE's modern grid solutions.

- Nissin Electric Co., Ltd.: Nissin Electric manufactures GIS and high-voltage equipment focusing on reliability, safety, and energy efficiency. Its products cater to both domestic and international power utilities.

- Powell Industries, Inc.: Powell Industries designs and manufactures GIS and switchgear systems for industrial and utility applications. Its focus on modular designs and advanced protection systems enhances power system reliability and safety

Segments Covered in the Report

By Voltage Rating

- Medium Voltage

- High Voltage

- Extra High Voltage

By Type

- Hybrid GIS

- Compact GIS

- Integrated Three-Phase GIS

- Mobile GIS

By Installation Type

- Indoor

- Outdoor

By Application

- Power Transmission

- Power Distribution

- Renewable Integration

- Infrastructure

By End-User Industry

- Power Utilities

- Industrial

- Commercial

- Transportation (Railways, Airports, etc.)

- Renewable Energy

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting