Gastroparesis Treatment Market Size and Forecast 2025 to 2034

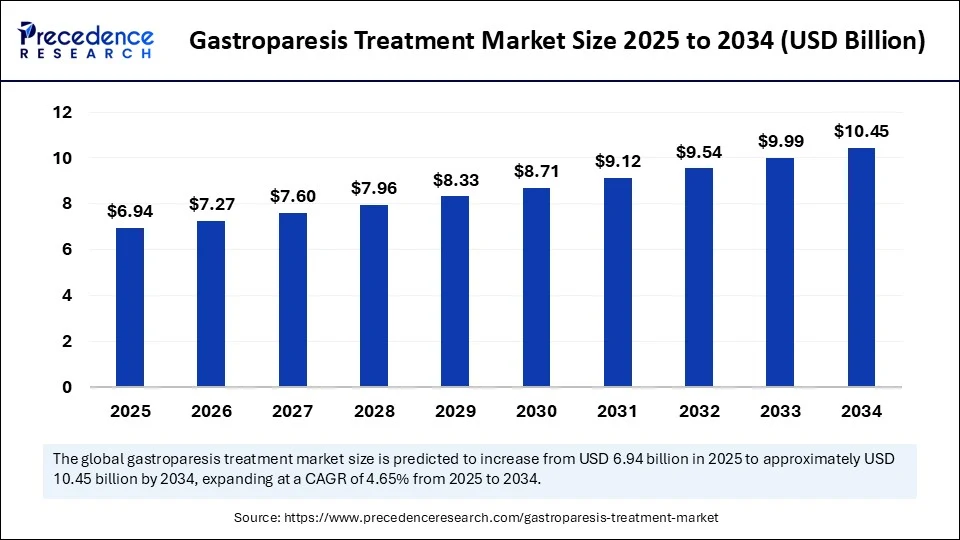

The global gastroparesis treatment market size accounted for USD 6.63 billion in 2024 and is predicted to increase from USD 6.94 billion in 2025 to approximately USD 10.45 billion by 2034, expanding at a CAGR of 4.65% from 2025 to 2034. The market is steadily growing, driven by the rising prevalence of diabetes-related gastric dysfunction, a growing need for minimally invasive devices and new prokinetics, and increased awareness, suggesting the market is on a path for a sustainable, upward trend.

Gastroparesis Treatment MarketKey Takeaways

- In terms of revenue, the global gastroparesis treatment market was valued at USD 6.63 billion in 2024.

- It is projected to reach USD 10.45 billion by 2034.

- The market is expected to grow at a CAGR of 4.65% from 2025 to 2034.

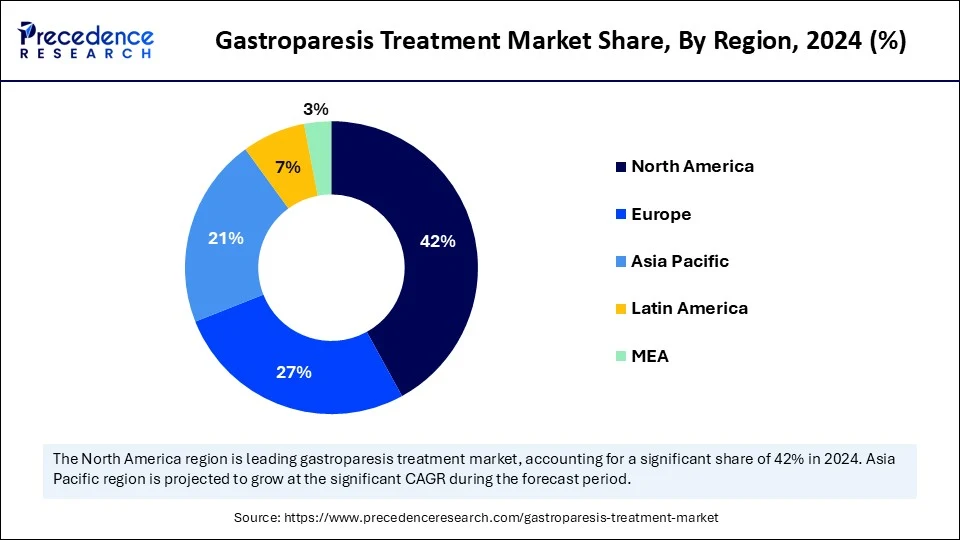

- North America led the gastroparesis treatment market with the highest revenue share of 42% in 2024.

- Asia Pacific is projected to expand the fastest CAGR between 2025 and 2034.

- By treatment type, the pharmacological therapy segment led the market share in 2024.

- By treatment type, the device-based therapy segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By disease type, the diabetic gastroparesis segment captured the biggest market share of 45% in 2024.

- By disease type, the idiopathic gastroparesis segment is expected to expand at a notable CAGR over the projected period.

- By end user, the hospitals segment held the highest market share of 50% in 2024.

- By end user, the specialty clinics and gastroenterology centers segment is expected to grow at a notable CAGR over the projected period.

- By distribution channel, the hospital pharmacies segment generated the major market share of 38% in 2024.

- By distribution channel, the online pharmacies segment will expand at a notable CAGR over the projected period.

AI Beacons New Horizons in Gastroparesis Management

Artificial intelligence is beginning to redefine the gastroparesis treatment market by enhancing diagnostics and individualizing care. An emerging machine-learning model predicts postoperative risk for gastroparesis before, during, and after surgery, allowing clinicians to adjust plans proactively. At the same time, advances in gastroenterology see AI's potential greater than ever, particularly in visual diagnostic aspects like endoscopy, even amidst regulatory and real-world validation challenges.

Additionally, new evidence distinguishes diagnosis as distinct from gastroparesis versus functional dyspepsia, which could offer an opportunity to explore a common disease spectrum or utilize AI to uncover helpful biomarkers and develop individualized treatments. Although still limited, these early innovations and data points illustrate the potential for AI to change the trajectory of diagnostics and care for gastroparesis.

U.S. Gastroparesis Treatment Market Size and Growth 2025 to 2034

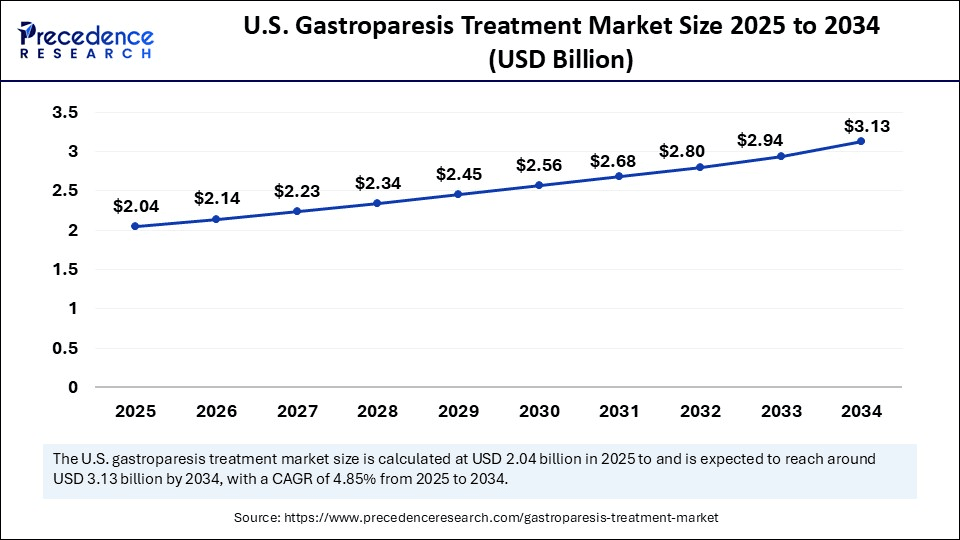

The U.S. gastroparesis treatment market size was exhibited at USD 1.95 billion in 2024 and is projected to be worth around USD 3.13 billion by 2034, growing at a CAGR of 4.85% from 2025 to 2034.

Why is North America the Most Important Region in the Gastroparesis Treatment Market?

North America's superiority is directly tied to high diagnostic penetration and awareness of gastroparesis by gastroenterologists and primary care physicians, which is markedly higher than in the rest of the world. North America's advanced healthcare systems are allowing for widespread use of gastric emptying scintigraphy, wireless motility capsules, and antroduodenal manometry, which leads to quicker case confirmation and quicker treatment. Clinical trial density for the approval of therapies related to gastroparesis is among the highest in the world. The ability to conduct research in multi-center research networks facilitates a quicker regulatory approval process, allowing innovation to adopt timelines into the patient care pathways to remain shorter than in other markets.

The U.S. represents a large proportion of North America's diagnosed patient volume (million), with the large diabetes population acting as a primary and substantial risk factor for developing gastroparesis. The majority of urban hospitals have access to advanced motility testing. Approaches are now expanding from tertiary care settings to regional hospitals for minimally invasive interventions such as G-POEM. The presence of multidisciplinary teams, including: gastrosurgeons, dieticians, and GI specialists, posits a higher rate of initiate of treatment than in comparison with global rates.

Asia Pacific Projected to Host the Fastest-Growing Market

Asia Pacific is experiencing rapid growth fueled by the increasing prevalence of diabetes and obesity, both of which are significant risk factors for gastroparesis, and the expansion of gastroenterology departments in secondary and tertiary hospitals. Diagnostic procedures, such as gastric emptying breath tests and scintigraphy, are becoming more accessible through government-funded healthcare modernization projects. Increased penetration of the pharmaceutical market, particularly for newer prokinetics and antiemetics, is expanding access to treatment options. Use of digital health platforms for tracking symptoms and follow-up with patients is also decreasing the region's overall diagnosis-to-treatment timelines.

China, with its large, ignored patient population and quickly evolving health care infrastructure, is helping drive the significant growth of the region. National health reforms have focused on expanding coverage for gastroparesis-related diagnostics and therapies, especially in urban metropolitan areas. Academic partnerships are producing clinical guidelines specific to the region's contemporary practice to aid in producing evidence-based care in everyday practice to minimize the traditional underdiagnosis.

Market Overview

The gastroparesis treatment market comprises products, procedures, and services aimed at managing delayed gastric emptying, a chronic motility disorder where the stomach muscles fail to function normally despite no physical blockage. The market covers pharmaceutical interventions, minimally invasive and surgical procedures, nutritional support therapies, and emerging device-based treatments designed to improve gastric motility, reduce symptoms (nausea, vomiting, bloating, abdominal pain), and enhance patient quality of life. It serves patients with diabetic gastroparesis, idiopathic gastroparesis, post-surgical gastroparesis, and other underlying causes, targeting both symptomatic relief and functional improvement.

Gastroparesis Treatment MarketGrowth Factors

- Escalating Diabetes Rates- Escalating diabetes rates (primarily chronic Type 1 and Type 2 diabetes) will impact the risk of gastroparesis, increasing the patient pool as well as driving the demand for effective therapeutic approaches.

- Aging and Surgical Complications- There is an increasing geriatric population experiencing impaired gastric motility, and the increase in gastric and bariatric surgical patients getting gastroparesis post-operatively. Together, these two scenarios are expanding the need for diagnostic and therapeutic solutions.

- Improved Awareness and Diagnosis- Increased awareness among patients and medical professionals about the symptomatology of gastroparesis is leading to educational campaigns and improved aspects of delivering specialized care, along with improved rates of diagnosis and initiation of therapy.

- Advanced Therapies and Devices - Newer agents that are prokinetic, novel non-invasive ways to administer agents, and neuromodulation devices (for example, gastric electrical stimulators) are expanding available treatment options and increasing market growth based on the patient complying and having a successful outcome.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.45 Billion |

| Market Size in 2025 | USD 6.94 Billion |

| Market Size in 2024 | USD 6.63 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Treatment Type, Disease Type, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is the Rise in Diabetes Epidemic Fostering Growth of the Gastroparesis Treatment Market?

The power behind the majority of growth in the gastroparesis treatment market is the steady rise in diabetes incidence globally, which is a leading risk factor of gastroparesis. According to the published research in the Cleveland Clinic Journal of Medicine, reported U.S. prevalence of 21.5 per 100,000 adults7 and 24.2 per 100,000 adults, and the incidence has been reported to be around 6.3 per 100,000 person-years in the United States. (Source: https://www.ccjm.org0

While there were multiple studies and awareness being published establishing the evidence on poor glycemic control and delayed gastric emptying in patients with diabetes, indicating that healthcare providers should screen patients with diabetes for delayed gastric emptying, there were significant advancements in diagnostic imaging and testing for gastric motility that will surely increase reporting and also bring about early detection.

Restraint

Is Restricted Treatment Efficacy Holding Back the Gastroparesis Treatment Market?

Limited efficacy as well as side effects for existing therapies are a major limiting factor for the gastroparesis treatment market. For example, over-the-counter medications for gastroparesis say which are "prokinetic agents," may only demonstrate partial effect and severe side effects, namely due to cardiac risk or neurological effects. Additionally, there is no potentially curable option, and end-stage therapy remains somewhat divided into symptomatically treating the symptoms vs intervening in some manner to the underlying condition.

Due to this gap in effective therapy, patients it leads them to treated symptomatically without satisfaction, which leads to medication discontinuation, and providers are unwilling to endorse medications on a medium-term or long-term basis. Without the opportunity to expand and sustain the reliance on effective medications prevents meaningful engagement with these patients is prevented as the prevalence of disease continues to increase.

Opportunity

Is the Domperidone Shortage Fostering Innovation in Gastroparesis Treatment?

One of the main driving forces pushing the gastroparesis treatment market forward is the recent shortage in the U.S. of domperidone, which has shifted demand toward alternative therapies, such as GIMOTI (metoclopramide nasal spray), which is FDA approved for use in diabetic gastroparesis. Meaningful real-world evidence suggests a 60% reduction in ER visits and a 68% reduction in hospitalizations following treatment with GIMOTI, indicating its clinical importance.(Source:https://investor.evokepharma.com)

This represents a significant market opportunity for innovative solutions, including treatments for gastroparesis not rely on pharmaceuticals or invasive procedures such as neuromodulatory devices. An exciting example of this is research underway at MIT that is targeting an endoscopic swallowable capsule (smart capsule) delivering gentle electrical pulses to promote gut activity. A result from animal trials shows considerable promise. The unmet need, combined with new approaches to addressing it, could revolutionize the delivery of care in this space.

Treatment Type Insights

Which Treatment Type Dominates the Gastroparesis Treatment Market in 2024?

The pharmacological therapy segment dominated the market in 2024, with the prokinetic agents sub-segment holding 40% revenue share. This is due to the continued use of prokinetic and antiemetic medications for symptom management purposes. These treatments had been and remained the mainstay for treatment as they are readily available and cheap, and clinicians were very comfortable prescribing these medications. Furthermore, the increase in diabetes-related gastroparesis and patient preference for non-invasive treatments reinforced the pharmacological therapy segment in 2024.

The device-based therapy segment is likely to expand quickly, particularly the gastric electrical stimulation (GES) systems sub-segment. This is due to the increase in gastric electrical stimulation and other minimally invasive treatments being used for patients with severe cases or non-responsive cases. These devices have been more consistently used in the management of severe gastroparesis and often can be considered for longer-lasting results than medications alone. Improved implantable technologies, as well as beneficial reimbursement in some areas, should help with the adoption of the devices in the market over the next several years.

Disease Type Insights

Why Diabetic Gastroparesis Dominates the Gastroparesis Treatment Market?

The diabetic gastroparesis segment dominated the gastroparesis treatment market in 2024. This is mainly due to the rising global burden of diabetes and complications related to diabetes. High blood glucose levels can damage the vagus nerve, which has a resulting effect on gastroparesis motility, ultimately increasing demand for treatments, particularly disease management-focused treatments. Given the increasing attention to early diagnosis and positive disease management strategies, diabetic gastroparesis can be expected to continue to remain dominant in type and volume.

The idiopathic gastroparesis segment is expected to grow at the fastest CAGR during the forecasted period, as the rising number of identified patients with an unknown etiology will potentially contribute to the growth. Drug companies may become more focused on personalized treatments for patients with complex cases that are not caused by diabetes.

End User Insights

Which End User Dominates the Gastroparesis Treatment Market in 2024?

The hospitals segment accounted for a large portion of the gastroparesis treatment market in 2024, due to the availability of state-of-the-art diagnostics, well-trained health care professionals, and comprehensive treatment options all under one roof. As sites of complex care (severe cases with surgical interventions), hospitals will always be the first option for patients who are not already treated by a specialist

The specialty clinics and gastroenterology centers segment is expected to grow the fastest during the forecasted period, due in part to their dedicated attention, shorter wait times, and patient responsibility for managing chronic gastrointestinal disorders (including gastroparesis) that is around the emergence and increasing popularity for contemporary healthcare is trending towards a more specialized and personalized type of care.

Distribution Channel Insights

Why Hospital Pharmacies are the Most Dominant Distribution Channel in the Gastroparesis Treatment Market?

The hospital pharmacies segment accounted for a larger share of the distribution channel in the gastroparesis treatment market in 2024, due to their direct access to medications that were prescribed, and essential coordination directly with the healthcare providers to ensure treatment was initiated timely manner. Hospital pharmacies ensured adherence to medications by providing dosing instructions and assistance with possible side effects.

The online pharmacies segment is expected to grow the fastest in the forecast period as digital adoption continues to rise and people increasingly utilize home delivery services for medications with added discounts, making it more convenient for patients seeking treatment, especially for patients with limited access to treatment due to remote location or physical mobility challenges.

Gastroparesis Treatment Market Companies

- Medtronic plc

- Allergan plc (now part of AbbVie Inc.)

- AbbVie Inc.

- Takeda Pharmaceutical Company Limited

- Evoke Pharma Inc.

- Neurogastrx, Inc.

- Theravance Biopharma, Inc.

- CinRx Pharma

- Axsome Therapeutics, Inc.

- RaQualia Pharma Inc.

- ANI Pharmaceuticals, Inc.

- Ironwood Pharmaceuticals, Inc.

- Daewoong Pharmaceutical Co., Ltd.

- Processa Pharmaceuticals, Inc.

- Neurogastrix Technologies Ltd.

- Evoke Pharma Inc.

- EndoStim, Inc.

- AbbMed Inc.

- Teva Pharmaceutical Industries Ltd.

- Cadila Healthcare Limited

Recent Developments

- In April 2025, Meitheal Pharmaceuticals, Inc., announced that it has received U.S. Food and Drug Administration (FDA) approval for and launched liraglutide injection (18mg/3mL), its generic equivalent for Victoza2 in the U.S. Liraglutide injection is a glucagon-like peptide-1 (GLP-1) receptor agonist used along with diet and exercise to improve glycemic control in adults and pediatric patients aged 10 years and older with type 2 diabetes mellitus.(Source: https://www.businesswire.com)

- In September 2024, Avenacy, a specialty pharmaceutical company, announced it had launched Metoclopramide Injection, USP in the United States as a therapeutic generic equivalent for Reglan as approved by the U.S. Food and Drug Administration. Metoclopramide Injection, USP is indicated for symptoms associated with diabetic gastroparesis, nausea, and vomiting associated with emetogenic cancer chemotherapy.(Source: https://www.businesswire.com)

Segments Covered in the Report

By Treatment Type

- Pharmacological Therapy

- Prokinetic Agents (Metoclopramide, Domperidone, Cisapride, Others)

- Antiemetic Agents (Ondansetron, Prochlorperazine, Promethazine, Others)

- Gastric Motility Modulators (Erythromycin, Ghrelin Agonists, Others)

- Others (Antidepressants, Analgesics for symptom management)

- Device-based Therapy

- Gastric Electrical Stimulation (GES) Systems

- Endoscopic Procedures (Per-oral Endoscopic Pyloromyotomy – POP, Botulinum Toxin Injections)

- Others (Magnetic bead-assisted techniques, emerging neurostimulation devices)

- Surgical Treatment

- Partial Gastrectomy

- Pyloroplasty

- Others (Jejunostomy feeding tubes, Combination approaches)

- Nutritional and Dietary Management

- Oral Nutrition Supplements

- Enteral Nutrition (Jejunal feeding)

- Parenteral Nutrition

- Others (Dietary counselling, liquid diets)

By Disease Type

- Diabetic Gastroparesis

- Idiopathic Gastroparesis

- Post-Surgical Gastroparesis

- Others (Drug-induced, Neurological disorders, Autoimmune-related)

By End User

- Hospitals

- Specialty Clinics and Gastroenterology Centers

- Ambulatory Surgical Centers (ASCs)

- Home Care Settings

- Others (Rehabilitation centers, Long-term care facilities)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others (Direct procurement, Specialty distributors)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting