GI Stool Testing Market Size and Forecast 2025 to 2034

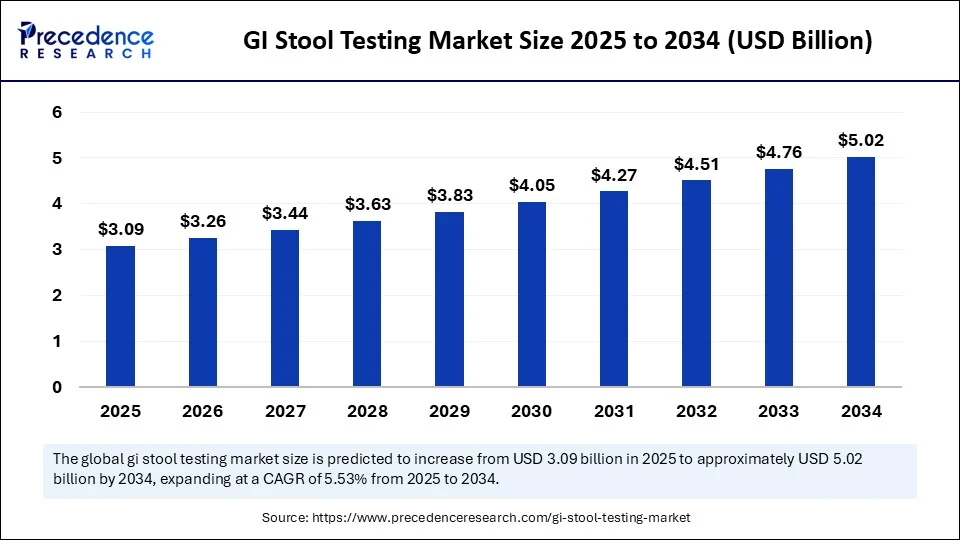

The global GI stool testing market size accounted for USD 2.93 billion in 2024 and is predicted to increase from USD 3.09 billion in 2025 to approximately USD 5.02 billion by 2034, expanding at a CAGR of 5.53% from 2025 to 2034. The GI stool testing market is growing rapidly, driven by the increasing prevalence of gastrointestinal disorders, greater awareness for preventive health, and advances in home-based, non-invasive tests such ass molecular, AI-enhanced, and including some advanced immunoassay tests.

GI Stool Testing Market Key Takeaways

- In terms of revenue, the global GI stool testing market was valued at USD 2.93 billion in 2024.

- It is projected to reach USD 5.02 billion by 2034.

- The market is expected to grow at a CAGR of 5.53% from 2025 to 2034.

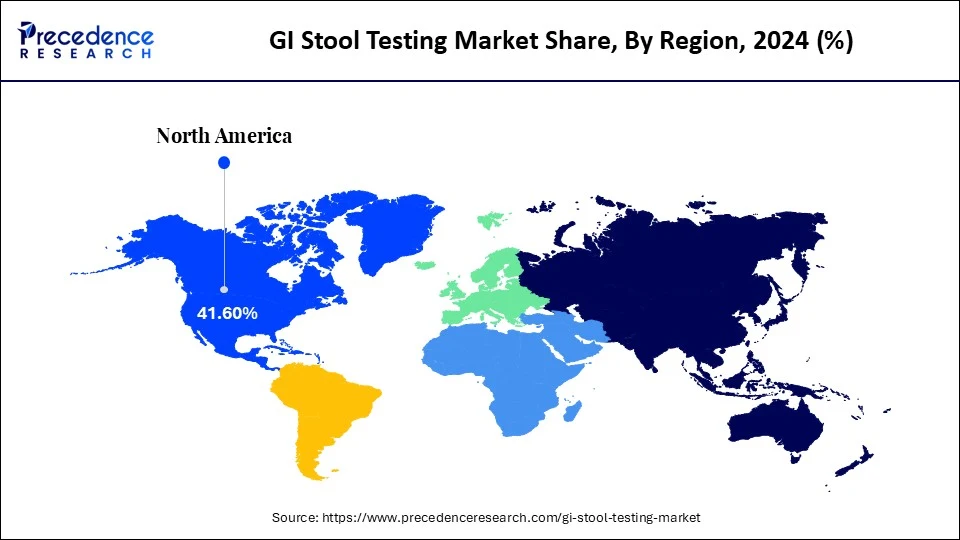

- North America dominated the GI stool testing market with the largest market share of 41.6% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By test type, the occult blood test (FOBT, FIT) dominated the market, under which the immunochemical-based FOBT (iFOBT or FIT) sub-segment held a 22.5%

- market share in 2024.

- By test type, the gut microbiome testing segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By technology, the immunoassay segment captured the biggest market share of 26.4% in 2024.

- By technology, the next generation sequencing (NGS) segment is expected to expand at a notable CAGR over the projected period.

- By application, the colorectal cancer screening segment held the highest market share of 33.2% in 2024.

- By application, the gut microbiome health assessment segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By sample collection, the hospital / lab collection segment captured the major market share of 57.8% in 2024.

- By sample collection, the at-home sample collection kits segment is expected to expand at a notable CAGR over the projected period.

- By end user, the hospitals & clinics segment generated the remarkable market share of 38.1% in 2024.

- By end user, the homecare / individual users segment is expected to expand at a notable CAGR over the projected period.

How is AI Improving Diagnostic Accuracy and Making GI Stool Testing More Accessible

Artificial Intelligence (AI) is changing gastrointestinal (GI) stool testing in an accurate, accessible, and non-invasive manner. AI algorithms analyze vast datasets of the test results and provide personalized health recommendations and early alerts to the person who submits the testing kit. This is transforming the GI diagnostic process into a data-driven process designed for more proactive exploration.

Recently, in Singapore, researchers worked to create a deep learning model that could detect blood in stool fromsmartphone images, and trained their model with Generative Adversarial Networks (GAN) to improve accuracy. The app called "Poolice" can help users identify potential early signs of gastrointestinal bleeding with an accuracy of 94% in their trials. Viome, a U.S.-based biotech company, has sent out over 500,000 AI-enhanced stool testing kits for at-home use that uses a stool testing approach using RNA and metatranscriptomes.(Source: https://www.businessinsider.com)

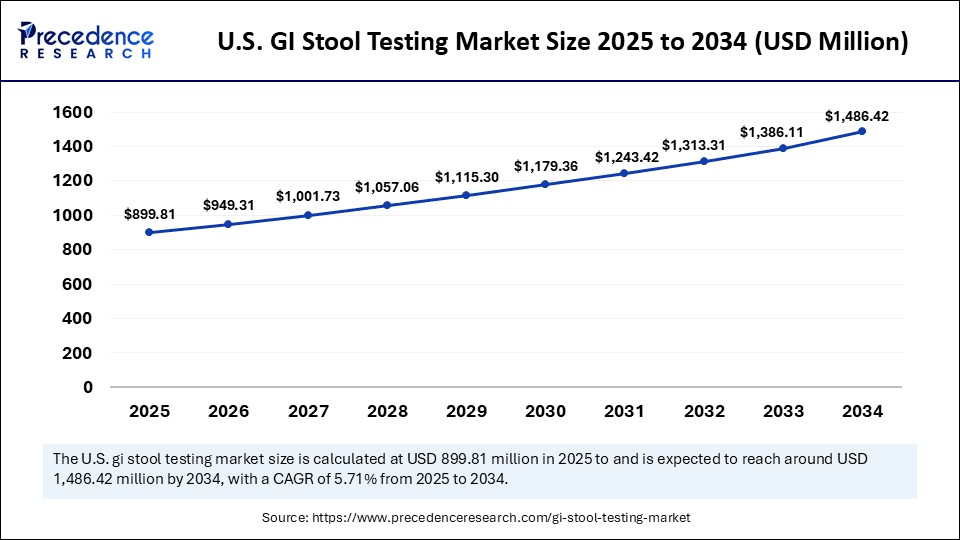

U.S. GI Stool Testing Market Size and Growth 2025 to 2034

The U.S. GI stool testing market size was exhibited at USD 853.22 million in 2024 and is projected to be worth around USD 1,486.42 million by 2034, growing at a CAGR of 5.71% from 2025 to 2034.

What Made North America the Dominant Region in the GI Stool Testing Market?

North America dominated the market with a major share in 2024, owing to its sophisticated diagnostic infrastructure, increasing incidence of gastrointestinal diseases, and high public health awareness. There have been improvements in screening for colorectal cancer, infections, and inflammatory bowel diseases across the region, supported by federal initiatives and insurance reimbursements. There has also been a great adoption of non-invasive diagnosis, in addition to the rapidly changing landscape of molecular diagnostics, which has further increased the demand for GI stool testing products. Most importantly, continued cooperative research partnerships between diagnostic companies and academic institutions have brought about many more stool-based tests that are faster and more accurate across the clinical spectrum.

The U.S. is a major contributor to the dominance of North America in the GI stool testing market. This is mainly due to its robust healthcare system and growing awareness of the importance of detecting diseases early. As stated by the CDC, colorectal cancer is among the leading causes of cancerous death, which has spurred federal backed screening initiatives across the country. 141,902 new cases of colorectal cancer were reported in 2021, and 52,967 people died of this cancer in 2022. In particular, the country has increased the acceptance of at-home stool tests and molecular diagnostics, supporting market growth.(Source: https://www.cdc.gov)

What Makes Asia Pacific the Fastest-Growing Region in the GI Stool Testing Market?

Asia Pacific is the fastest growing region for the GI stool testing market due to increasing rates of individuals being diagnosed with digestive disorders, increased access to healthcare disparately, and increasing understanding of the role preventive diagnostics play. Increased urbanization, changes in dietary habits, and the growing presence of cancer diagnoses are fuelling demand for GI testing. Increased adoption of non-invasive tests, mobile diagnostic services, and public-private partnerships is allowing wider access to testing, as well as the use of modern GI screening modalities.

India is emerging as a major player in the GI stool testing in Asia Pacific because of the increased burden of gastrointestinal diseases and stronger diagnostic infrastructure. Awareness of colorectal cancer in urban settings is also leading to earlier testing and diagnosis of GI disease. Increased attention to prevention in national health programs, as well as infection control, is leading to increased utilization of GI preventive diagnostics, in addition to affordable stool-based diagnostics provided by startups and private labs. A greater adoption of molecular and point-of-care GI testing in hospitals, as well as providing home-based sample collection models, aligns well with India's pathway to becoming a game-changer for stool-based testing accessibility and development globally.

Market Overview

The GI stool testing market encompasses diagnostic tests performed on fecal samples to detect gastrointestinal (GI) disorders, infections, inflammation, bleeding, cancer, and microbial imbalances. These tests are critical in diagnosing conditions such as colorectal cancer, Clostridium difficile infection, inflammatory bowel disease (IBD), irritable bowel syndrome (IBS), parasitic infections, and gut microbiome imbalances. They include traditional laboratory testing, point-of-care (PoC) diagnostics, and molecular-based stool testing kits. The market includes tests for occult blood, pathogens (bacterial, viral, parasitic), inflammatory markers (like calprotectin and lactoferrin), digestive enzymes, and microbiome profiling.

What are the key growth factors of the GI stool testing market?

- Increased Incidence of GI Disorders: The rise of gastrointestinal infections, inflammatory bowel disease, and colorectal cancer is a factor driving demand for accurate stool-based diagnostic tests to ensure potential issues are detected and treated promptly.

- Advances in Diagnostic Technology: The introduction of molecular and multiplex PCR-based stool testing allows for faster and more precise detection of pathogens, promoting greater reliability of diagnoses in both acute and chronic GI disorders.

- Increased Awareness of Preventive Healthcare: The public's focus on early-stage disease screening and prevention has increased the benefits of practicing stool tests to detect latent GI disorders and address them with little to no symptoms.

- Aging Population: As older adults are more prone to GI diseases that require monitoring, there is also an increased rate of use of non-invasive stool tests for ongoing management of GI diseases.

- Favorable Health Initiatives and Screening Policies: Government-led screening programs and insurance reimbursements of non-invasive stool tests are improving access and affordability of these tests and increasing compliance, especially for early detection of colorectal cancer.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.02 Billion |

| Market Size in 2025 | USD 3.09 Billion |

| Market Size in 2024 | USD 2.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test Type, Technology, Sample Collection Method, Application, Sample Collection Method, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Awareness of Gut Health Drives the Demand for GI Stool Testing

Increased awareness among the public and clinicians about gut health is driving the GI stool testing market. As people become more aware of the impact of gut microbiota on overall health, there is an increasing demand for noninvasive diagnostic modalities like stool tests. For example, increased interest in studying the microbiome and preventive care has led to a surge in at-home testing kits for tracking a person's digestive health. (Source: https://www.cancer.org)

Various important conditions are associated with gut dysfunction, such as IBS, IBD, colorectal cancer, and infections. In 2022, the number of new colorectal cancer cases globally was about 1,926,425 new cases of colorectal cancer, of the global population. And 147,931 new colorectal cancers were reported in the U.S. alone in 2022. With the heightened concern about health and the ongoing monitoring of their gut state, the demand for stool-based diagnostics is increasing.

(Source: https://www.cdc.gov)

Restraint

Patient Reluctance Over Stool Collection Impedes Uptake of GI Stool Testing

A major constraining factor for the overall GI stool testing market is the significant patient reluctance and stigma around stool sample collection, and while these tests are non-invasive and effective for the early detection of GI disorders, the uncomfortable nature of handling their stool makes people self-conscious and resistant to using these tests and complying with screening programs.

This reluctance means that conditions such as colorectal cancer and IBD are more likely to be detected late or never at all. In emerging markets, patient denial about the benefits of stool testing in terms of awareness is an added obstacle that further constrains adoption rates. Education and outreach, opening conversations about bowel concerns to de-stigmatize conversations around bowels and testing, and creating a better experience for at-home stool testing will lead to improved acceptance.

Opportunity

The Rise of At-Home RNA-Based Stool Tests

A major future opportunity for the GI stool testing market lies in the emergence of advanced, at-home RNA-based diagnostic tests that provide non-invasive, highly sensitive detection for gastrointestinal conditions, particularly colorectal cancer. In May 2024, the U.S. FDA approved ColoSense, the first multitarget stool RNA (mt-sRNA) test for adults over 45 for colorectal cancer screening. The test, developed by Geneoscopy, demonstrated 94.4% sensitivity in clinical study reports and is designed for at-home self-collection of stool samples with medical confirmation if positive.(Source: https://www.cancernetwork.com)

This initial approval represents a shift away from traditional diagnostics to patient-centered remote diagnostics and testing, particularly for the early diagnostic disease continuum. Governments and health insurers are increasingly supporting the use of mail-in sample kits to provide easier access for patients to increase screening rates and reduce reliance on hospital visits. With the rise in GI diseases and colorectal cancer worldwide, the incorporation of at-home RNA-based stool tests may provide new options for early intervention, development of a public health approach, and industry expansion, making them potentially one of the most attractive growth drivers in the industry.

Test Type Insights

Why Did the Occult Blood Test (FOBT, FIT) Segment Dominate the GI Stool Testing Market in 2024?

The occult blood test (FOBT, FIT) segment dominated the market, under which the immunochemical-based FOBT sub-segment held the largest share in 2024. These tests are preferred for colorectal cancer screening for a combination of reasons, including accuracy, non-invasiveness, and the ability to detect hidden blood (i.e., the reason to call it a fecal occult blood test) in stool, all while not requiring dietary restrictions beforehand. FIT tests have been clinically reliable for many reasons, but their inclusion in national screening programs has reinforced their standing in each region.

The gut microbiome testing segment is likely to grow at the fastest rate during the forecast period. The growth of the segment is attributed to the rising interest in gut health and the prevention of chronic disease. Moreover, technological advances in sequencing technology and personalized medicine delivery have driven the demand for gut microbiome profiling tests.

Technology Insights

How Does the Immunoassay Technology Segment Dominate the GI Stool Testing Market?

The immunoassay segment dominated the GI stool testing market in 2024. The dominance of the immunoassay stems from its cost-effectiveness and ease of use. Immunoassays are suitable for regular diagnostic screening at high throughput for testing, such as fecal occult blood tests and similar screenings. The widespread use of immunoassays in hospital laboratories and testing centers has given it a leading market position.

Meanwhile, the next-generation sequencing (NGS) segment is expected to grow at the fastest CAGR in the upcoming period. This is due to its ability to provide robust microbial profiling and high-resolution integrated insights into gut health, leading to increased research and clinical adoption of NGS, notably in microbiome-based research tests and personalized medicine.

Application Insights

Which Application Segment Dominate the Market in 2024?

The colorectal cancer screening segment dominated the GI stool testing market in 2024, driven by the increased prevalence of colorectal cancer, which is increasing around the world, and there is a greater emphasis on programs for early detection. Immunochemical-based fecal occult blood tests (FIT) enable non-invasive screening and are often implemented as part of an organized public health program or can be seen within a short stay at the hospital, where a true screening test is taken based on clinical protocol.

The gut microbiome health segment is likely to grow at a rapid pace, owing to increased consumer awareness of digestive health, chronic gastrointestinal conditions, and the impact of gut microbiota on immunity and metabolism. The convergence of sequencing and personalized nutrition strategies drove the emerging interest in microbiome testing.

Sample Collection Method Insights

What Made Hospital / Laboratory Collection the Dominant Segment in the GI Stool Testing Market?

The hospital/ laboratory collection segment dominated the market in 2024, mainly because this method is reliable, handled in a controlled environment, and collected accurately in a professional manner. For the most part, hospitals and diagnostic laboratories are likely to provide standardized protocols and timely sample diagnoses that may be critical for features, such as cancer screening and infectious disease diagnostics. It is also important to note that hospital-based and laboratory-based sample collections are more preferred over residential-based sample collections, because healthcare providers typically prefer to have samples processed in a centralized processing unit to assist in quality control.

The at-home sample collection kits segment is expected to expand at the fastest rate over the projection period due to a rapid shift to patient-centric healthcare models, convenience, and the rise in preventive health screening as notable drivers. At-home sample collection kits facilitate remote testing, are advancing access to underserved populations, and promote greater public engagement with gut health assessments.

End User Insights

Which End User Segment Dominate the Market in 2024?

The hospitals & clinics segment dominated the GI stool testing market in 2024. This is mainly due to their established diagnostic infrastructure, trained personnel, and association with programs for screening. Hospitals and clinics play an important role in the overall diagnostic workup of disease, especially when a follow-up procedure (e.g., colonoscopy) is warranted. In addition, hospitals and clinics are tightly integrated with their public health partnership for organized screening and test accessibility, solidifying their position in the GI stool testing market.

The homecare / individual users segment is expected to grow at the fastest CAGR in the coming years, fueled by increased demand for privacy, convenience, and proactive health. Additionally, the proliferation of digital health or health innovation platforms and easy-to-use at-home stool test kits allows consumers direct access to better manage their gut health outside of a healthcare context.

GI Stool Testing Market Companies

- Exact Sciences Corporation

- BioFire Diagnostics (bioMérieux)

- QuidelOrtho Corporation

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Becton, Dickinson and Company

- Roche Diagnostics

- Hologic, Inc.

- CerTest Biotec

- Alere Inc. (now part of Abbott)

- Genova Diagnostics

- Diagnostic Solutions Laboratory

- Promega Corporation

- Biomerica, Inc.

- Gastrointestinal Diagnostic Laboratory (GDX)

- Biomerieux SA

- Siemens Healthineers

- MyBioma

- DayTwo

- Seegene Inc.

Recent Development

- In August 2024, MP Biomedicals launched advanced gastrointestinal diseases diagnostic kits. This test kit includes Rapid H.pylori Antigen Test Card is an in-vitro qualitative immunochromatographic assay for the rapid detection of Helicobacter pylori antigens in human stool specimen.

(Source: https://www.news-medical.net) - In November 2024, EmeritusDX, announced the launch of GI Detect™, a laboratory diagnostic test designed to diagnose gastrointestinal disturbances. This test utilizes a single stool swab to identify 26 bacteria, viruses, and parasites known to disrupt the digestive system.(Source: https://www.prweb.com)

Segments Covered in the Report

By Test Type

- Occult Blood Test (FOBT, FIT)

- Guaiac-based FOBT (gFOBT)

- Immunochemical-based FOBT (iFOBT or FIT)

- Microbial Testing

- Bacterial Infections

- Viral Infections

- Parasitic Infections

- Calprotectin & Inflammatory Markers

- Calprotectin Test

- Lactoferrin Test

- M2-PK (M2 Pyruvate Kinase)

- Digestive Function Tests

- Pancreatic Elastase

- Fecal Fat Test

- Molecular Diagnostics

- PCR-based Panels

- NGS (Next Generation Sequencing)

- Gut Microbiome Testing

- Targeted Bacterial Testing

- Comprehensive Microbiota Profiling

- Others

- pH Testing

- Reducing Substances

- Alpha-1 Antitrypsin

By Technology

- Immunoassay

- Lateral Flow Assay (LFA)

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Polymerase Chain Reaction (PCR)

- Next Generation Sequencing (NGS)

- Mass Spectrometry

- Others

By Application

- Infectious Gastroenteritis

- Colorectal Cancer Screening

- Inflammatory Bowel Disease (IBD)

- Irritable Bowel Syndrome (IBS)

- Nutritional Malabsorption Disorders

- Gut Microbiome Health Assessment

- Others

By Sample Collection Method

- At-home Sample Collection Kits

- Hospital / Laboratory Collection

- Others

By End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Academic & Research Institutions

- Homecare / Individual Users

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting