What is Glucose Tolerance Test Market Size?

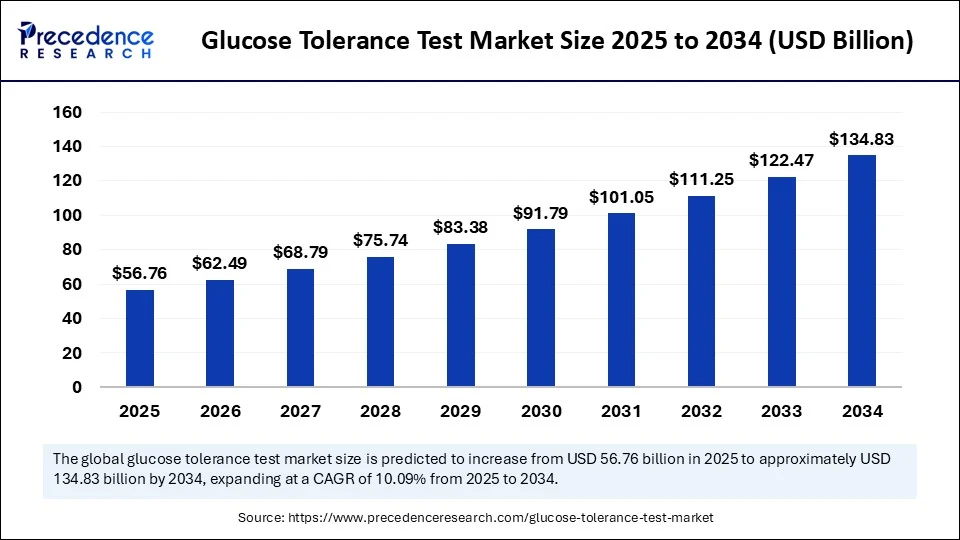

The global glucose tolerance test market size accounted for USD 56.76 billion in 2025 and is predicted to increase from USD 62.49 billion in 2026 to approximately USD 134.83 billion by 2034, expanding at a CAGR of 10.09% from 2025 to 2034. The market is experiencing significant growth due to the rising prevalence of diabetes and prediabetes. The growing awareness of health and routine screening practices further supports market growth. Additionally, technological advancements in diagnostic devices are expected to contribute to market expansion in the coming years.

Market Highlights

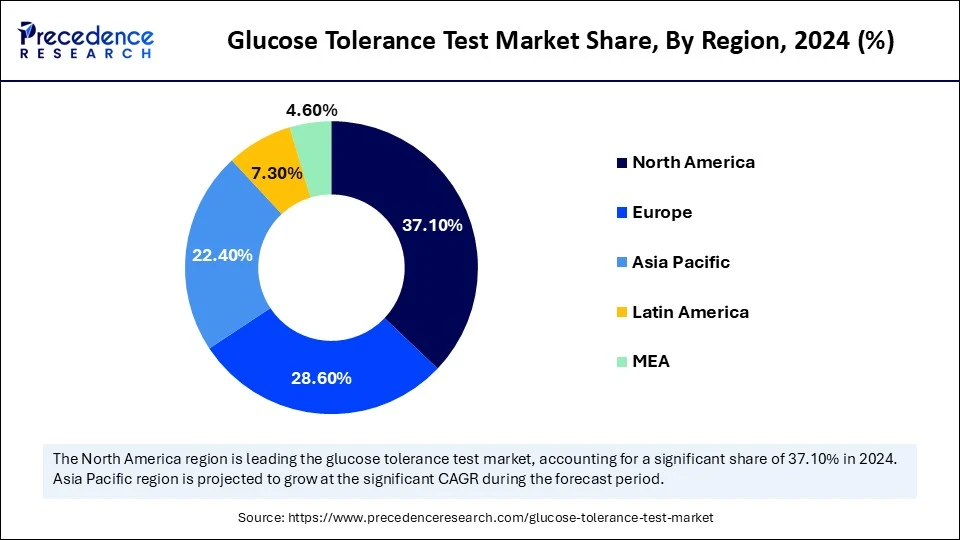

- North America dominated the glucose tolerance test market with the largest share of 37.1% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By product type, the oral glucose tolerance test (OGTT) kits segment captured the biggest market share of 42.5% in 2024.

- By product type, the reagents & consumables segment is expected to grow at a significant CAGR over the projected period.

- By mode of testing, the laboratory-based testing segment contributed the largest market share of 71.8% in 2024.

- By mode of testing, the point-of-care testing segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By application, the gestational diabetes screening segment held the highest market share of 39.6% in 2024.

- By application, the insulin resistance diagnosis segment is expected to expand at a significant CAGR from 2025 to 2034.

- By end user, the hospitals segment generated the major market share of 46.7% in 2024.

- By end user, the homecare settings segment is projected to grow at the fastest CAGR between 2025 and 2034.

Market Overview

The glucose tolerance test market encompasses products, services, and technologies used to perform glucose tolerance testing, a diagnostic procedure employed to assess how efficiently the body metabolizes glucose. Primarily used in the diagnosis of diabetes, gestational diabetes, and insulin resistance, the GTT evaluates blood glucose levels after fasting and following the ingestion of glucose over a specific time period. The market includes test kits, analyzers, reagents, and lab services, catering to various end users such as hospitals, diagnostic labs, and home care settings.

Glucose tolerance tests are crucial for diagnosing and managing diabetes and other conditions that affect glucose metabolism. This market is growing due to the rising prevalence of diabetes and other metabolic disorders, which require accurate diagnostic tools. The glucose tolerance test (GTT) assesses how effectively the body processes glucose, helping to diagnose conditions such as diabetes mellitus and gestational diabetes. The increase in diabetes cases, driven by lifestyle changes, along with advancements in testing methods and equipment, fuels the growth of this market.

Artificial Intelligence Transforms Glucose Monitoring and Personalized Diabetes Care

Artificial intelligence (AI) is transforming the glucose tolerance test market by enhancing diagnosis, treatment, and management of diabetes. AI-driven tools can analyze data from Continuous Glucose Monitors (CGMs) and other sources to predict glucose levels, personalize treatment strategies, and support patient self-management. AI can also analyze GTT data to classify diabetes types more accurately, potentially assisting primary healthcare providers who lack access to specialized tests. Moreover, AI can forecast glucose fluctuations and tailor treatment plans, including insulin dosage recommendations. Tools powered by AI, such as smartphone apps and wearable devices, give real-time feedback, analysis, and advice to patients, empowering them to manage their condition more effectively.

What are the key Trends in the Glucose Tolerance Test Market?

- Increased Awareness and Screening: There is a growing awareness of the importance of early diabetes detection and the use of Glucose Tolerance Tests (GTTs) for timely intervention, particularly in high-risk populations. This awareness is contributing to market growth.

- Gestational Diabetes Screening:The demand for reliable screening methods for gestational diabetes during pregnancy is another significant factor driving growth. Early detection and management can prevent complications for both mother and child.

- Improved Healthcare Infrastructure:Advancements in healthcare infrastructure and increased access to diagnostic services in many regions are also facilitating the growth of the GTT market.

- Growing Geriatric Population:Older adults are more susceptible to diabetes and other metabolic disorders, resulting in a higher demand for GTTs in this demographic.

- Technological Advancements:Innovations in testing procedures, such as the development of more accurate and user-friendly glucose meters and the integration of Internet of Things (IoT) capabilities for real-time monitoring, are enhancing the efficiency and accessibility of GTTs, further boosting market growth.

Market Outlook

- Industry Growth Offerings- The market is growing thanks to innovations like at home testing kits, AI enabled analytics for glucose patterns, and more affordable smart sensors pushing wider accessibility.

- Global Expansion- The global glucose tolerance test market is expanding across regions, bolstered by an increasing diabetes burden, rising screening initiatives, and wider accessibility through emerging markets.

- Startup Ecosystem- The startup ecosystem for glucose tolerance testing is vibrant, featuring innovative companies developing at home OGTT platforms and non invasive glucose assays supported by strong venture funding.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 134.83 Billion |

| Market Size in 2026 | USD 56.76 Billion |

| Market Size in 2034 | USD 51.56 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.09% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Mode of Testing, End User, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Global Prevalence of Diabetes

The main driver of the glucose tolerance test market is the growing global prevalence of diabetes. The diabetes burden is further driven by lifestyle changes and an aging population. Worldwide, healthcare systems are expanding screening programs and incorporating GTTs into routine diagnostic programs. The rising awareness of gestational diabetes further drives the market growth. Screening for gestational diabetes during pregnancy is now standard practice, boosting the demand for GTTs. As a result, there is a higher demand for diagnostic tools like GTTs for early detection and management of diabetes. Additionally, increased government funding for diabetes research and diagnostics has contributed to market growth.

Restraint

Limited Access to Healthcare Services

The primary obstacle in this market is limited access to healthcare services, especially in underdeveloped and rural areas. The high cost of advanced testing devices also presents a barrier, particularly in low- and middle-income countries where affordable diagnostics are crucial. Overall, insufficiently trained personnel, poor infrastructure, and low awareness about diabetes screening in certain regions restrict the availability and use of GTTs. These issues hinder the widespread adoption of GTTs for diabetes diagnosis and management, impacting market growth.

Opportunity

Integration of Digital Health Solutions and the Development of Non-Invasive Monitoring Methods

A key future opportunity in the glucose tolerance test market lies in the integration of digital health solutions and the development of non-invasive monitoring methods. This includes using mobile apps, cloud-based platforms, and other digital tools to track, store, and analyze glucose readings from GTTs, enabling personalized diabetes management and early intervention. These tools enable patients to easily monitor their glucose levels, share data with healthcare providers, and receive personalized feedback and recommendations. Digital health solutions can also customize GTT protocols and treatment plans to meet individual patient needs based on their unique data and responses, thereby reducing errors and enhancing patient confidence in the results.

Segment Insights

Product Type Insights

What Made Oral Glucose Tolerance Test (OGTT) Kits the Dominant Segment in the Glucose Tolerance Test Market in 2024?

The oral glucose tolerance test (OGTT) kits segment dominated the market with the largest share in 2024. This is mainly due to their diagnostic accuracy and ability to detect different stages of glucose intolerance, including gestational diabetes. OGTT kits provide a more comprehensive assessment of glucose metabolism than simpler tests like fasting blood glucose tests, making them essential for identifying those at risk of developing type 2 diabetes or with gestational diabetes. By identifying individuals with impaired glucose tolerance early, OGTT kits facilitate intervention strategies such as lifestyle changes and medication to prevent or delay progression to type 2 diabetes.

The reagents & consumables segment is expected to experience the fastest growth in the upcoming period, as they are essential in performing the necessary analysis. The growth of the segment is also driven by the increasing prevalence of diabetes, innovations in testing procedures, and the need for frequent testing. Growing awareness about early diagnosis and management of diabetes, along with public health campaigns, is increasing demand for GTTs and related products. Moreover, the need for regular glucose monitoring, especially among individuals with diabetes or prediabetes, drives the use of reagents and consumables. The development of more accurate and accessible glucose monitoring solutions further supports segmental growth.

Mode of Testing Insights

How Does the Laboratory-Based Testing Segment Dominate the Glucose Tolerance Test Market in 2024?

The laboratory-based testing segment held the largest market share in 2024. This is mainly because of its higher accuracy and reliability compared to point-of-care testing, as well as its ability to perform a broader range of tests and provide detailed analysis. Laboratory tests, especially those using enzymatic methods like glucose oxidase (GOx), offer high precision in measuring glucose levels. These enzymatic reactions are well-understood, and their results are less affected by other substances. Labs can also analyze additional biochemical markers, such as lipids and electrolytes, which are important for evaluating overall metabolic health and identifying potential diabetes-related complications.

The point-of-care testing segment is likely to grow at the fastest rate during the forecast period due to its convenience, rapid results, and increasing focus on a patient-centric care approach. Point-of-care testing devices deliver quick results, allowing timely adjustments to diet, exercise, or medication. The rapid shift toward home care setting further supports segmental growth. POCT enables individuals to monitor their glucose levels conveniently without visiting a clinic or hospital. Rising awareness about diabetes management and the availability of user-friendly devices are boosting adoption. There is a growing trend toward decentralized healthcare and patient empowerment, with individuals actively participating in their health management.

Application Insights

Why Did the Gestational Diabetes Screening Segment Dominate the Glucose Tolerance Test Market in 2024?

The gestational diabetes screening segment maintained dominance in the market in 2024. The dominance of the segment stems from the increased incidence of gestational diabetes mellitus (GDM) and the need for early detection and treatment to prevent adverse pregnancy outcomes. GDM can cause complications like macrosomia, neonatal hypoglycemia, and a higher likelihood of cesarean delivery, underscoring the importance of early diagnosis and treatment. Advances in diagnostic methods, such as the 1-step 75-g 2-hour OGTT, and strategies like using HbA1c as a screening tool, further support this dominance.

The insulin resistance diagnosis segment is expected to grow at the highest CAGR in the coming years. This is primarily due to the rising prevalence of diabetes and prediabetes, along with advancements in diagnostic tools and a better understanding of the condition. Insulin resistance, a key factor in developing type 2 diabetes, is now recognized as a significant health concern, which has increased the demand for accurate and accessible diagnostic methods. This has led to a stronger focus on addressing it as part of overall metabolic health management. Improvements in glucose monitoring devices, minimally invasive testing techniques, and the integration of real-time data monitoring are boosting the accuracy and accessibility of insulin resistance diagnosis.

End User Insights

How Does the Hospitals Segment Lead the Glucose Tolerance Test Market in 2024?

The hospitals segment led the market in 2024. This is because of the high volume of tests conducted for diabetes diagnosis and management in hospitals, combined with the global rise in diabetes cases. Hospitals are the main setting for diagnosing, treating, and caring for diabetes, which creates a high demand for GTTs. They are where most people with diabetes get their initial diagnosis, ongoing care, and treatment plans, making them a central hub for GTTs. Hospitals handle many patients needing screening, diagnosis, and management of diabetes, which directly increases the demand for GTTs. They are equipped with the latest technology and skilled professionals to perform GTTs accurately and efficiently.

The homecare settings segment is expected to grow at the fastest CAGR over the projection period. The growth of the segment is driven by patients' increasing preference for testing at home, the rising prevalence of diabetes and prediabetes, and advancements in point-of-care technology. The rapid shift toward a homecare approach boosts the demand for POCT for managing chronic conditions like diabetes. More patients prefer managing their health from home, which leads to higher adoption of home-based glucose monitoring devices. The integration of glucose monitoring with remote patient monitoring systems enables continuous tracking and timely intervention by healthcare providers, offering a more cost-effective alternative to frequent clinic visits for glucose testing.

Regional insights

U.S. Glucose Tolerance Test Market Size and Growth 2025 to 2034

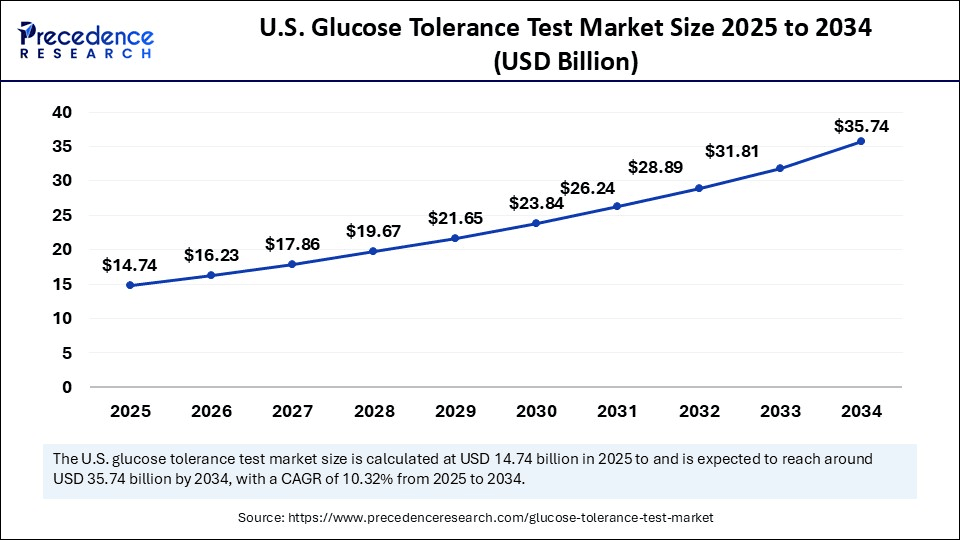

The U.S. glucose tolerance test market size is exhibited at USD 14.74 billion in 2025 and is projected to be worth around USD 35.74 billion by 2034, growing at a CAGR of 10.32% from 2025 to 2034.

The U.S. held the maximum share of the market in 2024, mainly driven by its high rates of diabetes and prediabetes, which create strong demand for advanced glucose monitoring and diagnostic tools. This leadership is supported by the country's sophisticated healthcare infrastructure, quick adoption of innovative point-of-care technologies, and a comprehensive reimbursement system covering these tests. Additionally, the presence of major international manufacturers, along with public awareness campaigns and prevention initiatives, significantly contributes to the country's leadership in the market.

In June 2024, Abbott introduced Libre Rio, its first over-the-counter continuous glucose monitoring (CGM) system in the U.S., designed for adults with Type 2 diabetes who do not use insulin. This system is aimed at individuals managing their diabetes through lifestyle changes like diet and exercise. The technology powering this device is now available for U.S. consumers with and without diabetes through two FDA-cleared over-the-counter CGM systems.

What Makes Asia Pacific the Fastest-Growing Region in the Glucose Tolerance Test Market?

Asia Pacific is expected to experience the fastest growth in the market during the projection period. This growth is mainly driven by the high prevalence of diabetes, increasing awareness about the early detection and prevention, and government initiatives promoting early diagnosis and management. Further growth is fueled by technological advancements, especially in non-invasive testing methods, and a shift toward preventive healthcare. The development of non-invasive glucose testing technologies, smart monitoring systems, and wearable devices is expanding market options by offering convenient and user-friendly solutions. Governments of several Asian countries are working to improve healthcare infrastructure, promote digital health monitoring, and support the development of innovative glucose monitoring technologies, which drive market growth.

How is India Addressing Diabetes Through Increased GTT Adoption?

India plays a major role in the market. This is mainly because of the country's alarming rise in diabetes and prediabetes prevalence. This surge has led to increased awareness about the importance of early diagnosis and management, consequently boosting the demand for GTTs. The Indian government is actively addressing this through initiatives like the National Programme for Prevention and Control of Non-Communicable Diseases (NP-NCD), which focuses on screening, early diagnosis, and promoting healthy lifestyles, ultimately contributing to improved diabetes care in India.

Why is Europe Considered a Notable Region in the Glucose Tolerance Test Market?

Europe is expected to experience notable growth in the market. This is due to the increasing prevalence of diabetes, advancements in technology, and higher healthcare spending. Europe is at the forefront of adopting new technologies in diabetes management, including continuous glucose monitoring (CGM) systems and Bluetooth-enabled meters. Rising healthcare expenditure, coupled with a focus on early diagnosis and preventative care, drives the growth of the GTT market. The region holds a significant market share, second only to the Americas, and is witnessing increased adoption of advanced medical devices and technologies.

What Opportunities Exist in the Glucose Tolerance Test Market in Latin America?

Latin America plays a distinctive role in the market. This is primarily due to the increasing prevalence of diabetes, especially type 2, and greater awareness of the importance of early detection and management. Growing awareness about the risks associated with diabetes and the benefits of early diagnosis prompts more individuals to undergo glucose tolerance tests. This growth is further supported by government initiatives focused on diabetes prevention and treatment, as well as advancements in diagnostic technologies and collaborations within the healthcare sector.

What Factors Contribute to the Middle East & Africa Glucose Tolerance Test Market?

The market in the Middle East & Africa is expected to grow at a steady rate in the upcoming period, driven by rising diabetes prevalence, increased awareness, and government initiatives promoting early detection and management of the disease. Public health campaigns, partnerships with diabetes foundations, and government focus on chronic disease management are raising awareness about diabetes and the necessity of early diagnosis and monitoring, including GTTs. This growth is further fueled by technological advancements, particularly in non-invasive and continuous glucose monitoring solutions, and strategic partnerships focused on diabetes care.

Rising Diabetes Prevalence Fuels UK Glucose Tolerance Test Adoption

The UK market is increasing due to the growing prevalence of diabetes and gestational diabetes, particularly among high-risk populations. Rising awareness of early detection, adoption of advanced diagnostic technologies, and government initiatives supporting preventive healthcare are key drivers. Additionally, expanding hospital and clinic infrastructure, coupled with increasing demand for accurate and timely glucose monitoring, is fueling growth in the UK GTT market.

How are Advanced diagnostics Boosting Brazil's Glucose Tolerance Test Adoption?

The Brazil market is expanding due to the increasing prevalence of diabetes and obesity, which are major public health concerns. Growing awareness of early diagnosis, supportive government initiatives for preventive healthcare, and rising investments in diagnostic infrastructure are driving market growth. Additionally, the adoption of advanced point-of-care and laboratory-based glucose monitoring technologies, along with increasing patient demand for accurate and timely testing, is fueling Brazil's GTT market expansion.

Why is Early Diagnosis Fueling Growth in Egypt's Market?

The Egypt market is growing due to the rising prevalence of diabetes and obesity, particularly in urban populations. Increased awareness of early diagnosis, government initiatives promoting preventive healthcare, and expansion of healthcare infrastructure are key growth drivers. Additionally, the adoption of advanced diagnostic technologies, such as point-of-care testing and laboratory-based glucose monitoring, along with rising patient demand for accurate and timely assessments, is fueling Egypt's GTT market expansion.

How are Advanced diagnostics Boosting Brazil's Glucose Tolerance Test Adoption?

The Brazil market is expanding due to the increasing prevalence of diabetes and obesity, which are major public health concerns. Growing awareness of early diagnosis, supportive government initiatives for preventive healthcare, and rising investments in diagnostic infrastructure are driving market growth. Additionally, the adoption of advanced point-of-care and laboratory-based glucose monitoring technologies, along with increasing patient demand for accurate and timely testing, is fueling Brazil's GTT market expansion.

Why is Early Diagnosis Fueling Growth in Egypt's Market?

The Egypt market is growing due to the rising prevalence of diabetes and obesity, particularly in urban populations. Increased awareness of early diagnosis, government initiatives promoting preventive healthcare, and expansion of healthcare infrastructure are key growth drivers. Additionally, the adoption of advanced diagnostic technologies, such as point-of-care testing and laboratory-based glucose monitoring, along with rising patient demand for accurate and timely assessments, is fueling Egypt's GTT market expansion.

Value Chain Analysis

R&D

- Improving the accuracy and reliability of glucose tolerance tests (GTT)

- Reducing invasiveness to make testing more patient-friendly

- Enhancing convenience and usability for both patients and healthcare providers

- Key players: Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Dexcom, Medtronic

Clinical Trials

- Conducting trials to enhance the accuracy and efficiency of glucose tolerance tests (GTT)

- Evaluating new treatments for impaired glucose tolerance

- Studying links between GTT results and conditions like diabetes, gestational diabetes, and cystic fibrosis-related diabetes

- Key players: Abbott Laboratories, Roche Diagnostics, Medtronic, Dexcom, Siemens Healthineers

Patient Support and Services

- Providing patient education on test procedures and preparation

- Ensuring comfort and support during the glucose tolerance test (GTT)

- Offering post-test guidance and interpretation of results

- Adapting support based on the condition tested: prediabetes, type 2 diabetes, or gestational diabetes

- Key players: Abbott Laboratories, Roche Diagnostics, Medtronic

Key Players in Glucose Tolerance Test Market and their Offerings

Arkray, Inc.: Provides self monitoring blood glucose meters (e.g., Glucocard G+), lancing devices and diagnostics systems for hospitals, clinics and home use.

Novo Biomedical: Manufactures in vitro diagnostic instruments including glucose analyzers, meters and test strips for self testing and clinical settings.

Medtronic plc: Offers the MiniMed 780G system and Guardian Connect CGM for continuous glucose monitoring and insulin delivery in diabetes care.

Bayer AG: Develops diabetes monitoring solutions and point of care glucose test systems as part of its diagnostics portfolio.

Recent Developments

- In April 2025, DexCom, Inc. announced that the FDA had approved the Dexcom G7 15-Day Continuous Glucose Monitoring System for people over 18 with diabetes in the U.S. This product builds on Dexcom's performance, offering the longest-lasting wearable and most accurate CGM, helping users better control their diabetes with advanced technology, lower A1C, and reduced hyper- and hypoglycemia.(Source: https://investors.dexcom.com)

- In November 2024, Beurer India Pvt. Ltd. launched the GL 22 Blood Glucose Monitor. This launch demonstrates Beurer's commitment to providing innovative and user-friendly health monitoring solutions tailored for the Indian market, aligning with its plans for expansion across the country. The device offers comprehensive monitoring features, including average readings for 7, 14, 30, and 90 days, providing key insights into blood glucose trends.

(Source: https://www.financialexpress.com) - In August 2024, Medical Technology and Devices (MTD) announced a strategic acquisition of Ypsomed's Pen Needles and Blood Glucose Monitoring Systems (BGM) businesses. This move not only strengthens their leadership in diabetes care but also emphasizes their commitment to delivering innovative solutions for both self-care and professional use as they expand MTD's market position.(Source: https://mtdglobal.com)

- In January 2024, Trinity Biotech plc announced the acquisition of the biosensor and Continuous Glucose Monitoring assets of privately held Waveform Technologies, Inc. for USD 12.5 million. This acquisition aims to establish a global leadership position in accessible wearable biosensor technology and related data-driven wellness analytics under a revised strategy. The initial focus is on CGM, intending to provide access to high-quality diagnostics worldwide, according to CEO John Gillard.(Source: https://finance.yahoo.com)

Segment Covered in the Report

By Product Type

- Oral Glucose Tolerance Test (OGTT) Kits

- 1-Step OGTT Kits

- 2-Step OGTT Kits

- Others

- Intravenous Glucose Tolerance Test (IVGTT) Kits

- Standard IVGTT

- Modified IVGTT

- Reagents and Consumables

- Glucose Solutions

- Blood Collection Tubes

- Others

- Analyzers and Instruments

- Glucometers

- Autoanalyzers

- Others

- Others

- Monitoring Accessories

- Sample Handling Devices

By Mode of Testing

- Laboratory-Based Testing

- Point-of-Care Testing

- Hospital Bedside

- Home Care Settings

- Ambulatory Settings

By Application

- Type 2 Diabetes Diagnosis

- Gestational Diabetes Screening

- Insulin Resistance Diagnosis

- Type 1 Diabetes Evaluation

- Others

- Polycystic Ovary Syndrome (PCOS)

- Pre-diabetes Risk Detection

By End User

- Hospitals

- Diagnostic Laboratories

- Homecare Settings

- Specialty Clinics

- Others

- Nursing Homes

- Ambulatory Surgical Centers (ASCs)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting