What is the Grid Automation and Protection System Market Size in 2026?

The global grid automation and protection system market size was calculated at USD 109.70 billion in 2025 and is predicted to increase from USD 118.48 billion in 2026 to approximately USD 236.83 billion by 2035, expanding at a CAGR of 8.00% from 2026 to 2035.The grid automation and protection system market is experiencing unprecedented growth, driven by rapid infrastructure development, increasing focus on enhancing efficiency and reliability, and the rising integration of Artificial Intelligence (AI), IoT, and machine learning (ML) for improved reliability.

Key Takeaways

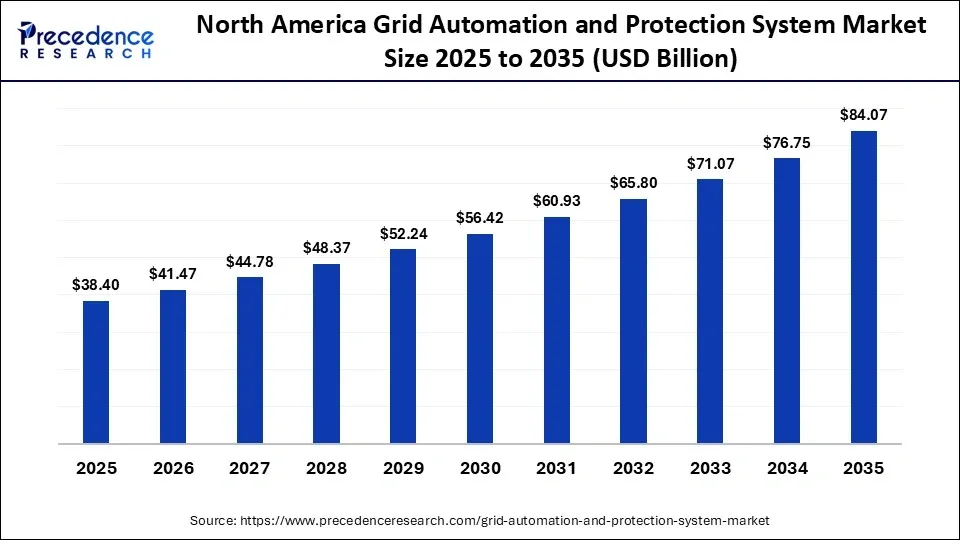

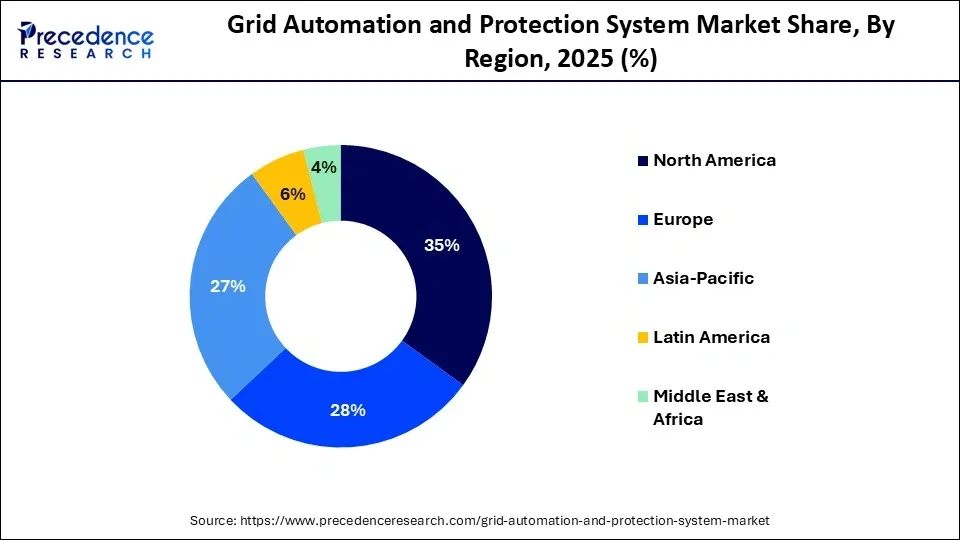

- North America held the largest market share of approximately 35% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of approximately 12.5% in the grid automation and protection system market.

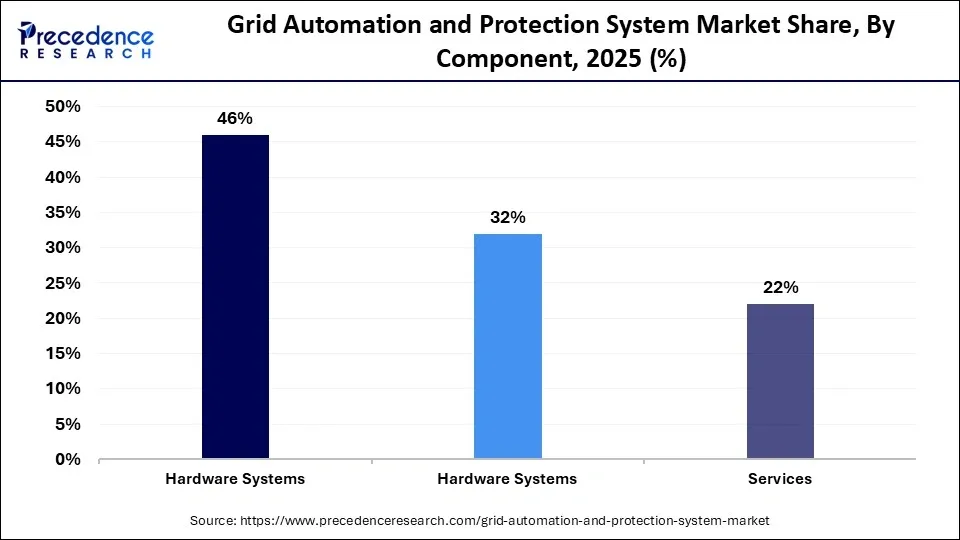

- By component, the hardware systems segment held the largest market share of approximately 46% in 2025.

- By component, the software and platforms segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By automation type, the distribution automation segment held a dominant share of approximately 38% in 2025.

- By automation type, the customer/DER integration segment is expected to grow at the highest CAGR from 2026 to 2035.

- By protection system, the overcurrent protection segment contributed the biggest revenue share of approximately 34% in the market in 2025.

- By protection system, the arc fault and insulation protection segment is expected to expand at the fastest growth rate between 2026 and 2035.

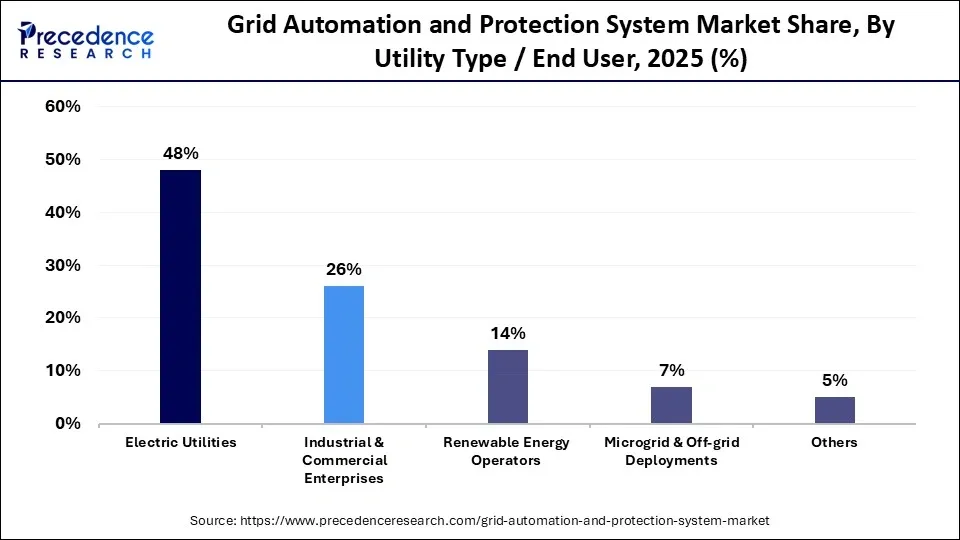

- By end-user, the electric utilities segment registered its dominance with the revenue share of nearly 48% during 2025.

- By end-user, the renewable energy operators segment is expected to grow at the highest CAGR during the forecast period.

Market Overview

The global grid automation and protection system market includes hardware, software, and services used to automate electrical grid operations, enhance monitoring and control, improve fault detection and response, and protect critical grid infrastructure. Grid automation encompasses SCADA, distribution automation, feeder automation, substation automation, protective relays, fault recorders, and associated analytics for utilities, industrial facilities, renewable integration, and smart grid platforms.

How are AI-driven innovations reshaping the Market?

As the technology continues to evolve, the integration of Artificial Intelligence (AI) is significantly accelerating the growth of the grid automation and protection system market by enabling predictive maintenance, real-time monitoring, and edge computing for faster decision-making. AI algorithms analyze data from IoT sensors, smart meters, and SCADA systems for real-time monitoring of equipment like transformers and circuit breakers. Artificial Intelligence (AI) technologies have the potential to optimize grid operations, manage peak demand, and enhance cybersecurity. Several utility companies are increasingly implementing AI tools across energy grids. Machine learning systems can efficiently analyse real-time demand data, weather conditions, and generation forecasts to adjust energy distribution instantly. This significantly reduces strain during peak loads and improves integration of intermittent renewables such as wind and solar.

What are the emerging trends in the market?

- The increasing investment in grid modernization and aging infrastructure is expected to drive the market's growth in the coming years.

- The market is experiencing an increasing need to upgrade aging electrical infrastructure with intelligent electronic devices (IEDs). Digital systems enable faster fault detection, isolation, and service restoration (FLISR).

- The rising emphasis on securing smart grid infrastructure against malicious attacks is spurring the demand for automated protection systems to ensure continuous operation, bolstering the market's growth during the forecast period.

- The rapid adoption of digital substations is anticipated to fuel the expansion of the market. The transition from analog to digital systems reduces footprint, improves reliability, and enhances safety. Digital substations improve worker safety through remote monitoring and protect critical infrastructure.

- The integration of renewable energy is expected to contribute to the overall growth of the grid automation and protection system market.

- The rising adoption of solar and wind requires advanced protection systems like sensors and relays to manage intermittent power flows.

- The supportive government policies and regulations are expected to accelerate the growth of the market during the forecast period.

- Government mandates and incentives are increasingly promoting the smart grid development, energy efficiency, and carbon reduction.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 109.70 Billion |

| Market Size in 2026 | USD 118.48 Billion |

| Market Size by 2035 | USD 236.83 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Automation Type, Protection System , End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Component Insights

What caused the Hardware Systems segment to dominate the Market?

The hardware systems segment held the largest grid automation and protection system market share of approximately 46% in 2025. The segment's growth is driven by the rising need to upgrade aging infrastructure and the widespread adoption of IEDs & and digital relays, and the rapid deployment of smart sensors for real-time monitoring. Hardware components like intelligent electronic devices (IEDs), digital relays, and sensors & actuators plays critical role in collecting data, monitoring grid conditions, and executing control actions.

The software and platform segment is expected to grow at a remarkable CAGR between 2026 and 2035. The segment's fastest growth is driven by the increasing need to manage the complex, large, and real-time data generated by decentralized and renewable-heavy power grids. Software enables automated fault detection, predictive maintenance, and optimizing power distribution. Software and analytical platforms assist in transforming unstructured data into actionable, real-time insights for enhancing grid performance, managing distributed energy resources (DERs), and significantly reducing outages.

Automation Type Insights

Which Automation Type Dominated the Market in 2025?

The distribution automation segment dominated the grid automation and protection system market with approximately 38% market share in 2025. Distribution automation improves the reliability and availability of power distribution grids, with capabilities ranging from real-time monitoring to fully automated and self-healing applications. Distribution Automation (DA) uses intelligent electronic devices (IEDs), sensors & actuators, and advanced communication to control, monitor, and optimize power distribution networks in real-time. The major functions include Volt/VAR control, Fault Location, Isolation, and Service Restoration (FLISR), and remote monitoring. In addition, the strong government regulations encourage investments in the smart grid across various countries, which further accelerates the deployment of these systems.

The customer/DER integration segment is expected to witness the fastest growth in the market with a remarkable CAGR over the forecast period, owing to the rising global transition from centralized toward decentralized and cleaner energy and the increasing need to manage the intermittency of renewable energy sources. The significant rise in Distributed Energy Resource (DER) adoption, including solar PV, electric vehicles (EVs), and battery storage, creates complexity that necessitates advanced automation to maintain grid stability, security, and reliability. DER integration involves efficiently managing decentralized, intermittent, and inverter-based resources to maintain grid reliability.

Protection System Insights

What has led the Overcurrent Protection segment to dominate the Market?

The overcurrent protection segment accounted for the majority of the grid automation and protection system market share of approximately 34% in 2025. Overcurrent protection is the primary line that safeguards against overloads and short circuits. As grids modernize, the use of overcurrent protection assists in preventing damage and reducing the risk of electrical fires and other safety incidents, providing safe and reliable operation of electrical systems and equipment. Moreover, the stringent safety regulations, such as NFPA, OSHA, and others, compel industrial and utility operators to upgrade to active protection systems that detect fault conditions.

The arc fault and insulation protection segment is expected to expand at a remarkable growth rate from 2026 to 2035. The segment with the fastest growth is attributed to the stringent safety and regulatory standards, the growing need to protect sensitive electronic equipment, and the rising risks of electrical fires in aging infrastructure. As the complexity of the grid increases with the integration of renewable energy sources, these devices play a crucial role in preventing catastrophic failures, minimizing downtime, and ensuring compliance with regulatory standards. Several governments worldwide are enforcing strict standards that necessitate the installation of Arc Fault Detection Devices (AFDDs) and Insulation Monitoring Devices (IMDs) in industrial and utility settings.

End-user Insights

What factors are contributing to the dominance of the Electric Utilities segment in the Market?

The electric utilities segment dominated the grid automation and protection system market with the largest share of nearly 48%. This dominance is primarily supported by the increasing investment of electric utility companies in modernizing aging infrastructure, integrating renewable energy sources, expanding transmission and distribution networks, and complying with regulatory standards. Electric utilities are upgrading outdated infrastructure with intelligent electronic devices (IEDs) to improve grid resilience. They are rapidly deploying automated control systems and AI/IoT to improve reliability, enable real-time monitoring, and enhance operational efficiency.

The renewable energy operators segment is expected to grow with the highest CAGR in the automation and protection system market during the studied year, owing to the rising need for managing intermittent power generation, stringent safety regulations, and the increasing need to ensure grid stability. The rising move toward smart grids requires protection to handle bidirectional power flows for managing the decentralized nature of renewable energy sources. Automated systems, including intelligent electronic devices (IEDs) and numerical relays, manage the fluctuations of renewable sources such as wind and solar and prevent grid instability.

Regional Insights

How Big is the North America Grid Automation and Protection System Market Size?

The North America grid automation and protection system market size is estimated at USD 38.40 billion in 2025 and is projected to reach approximately USD 84.07 billion by 2035, with a 8.15% CAGR from 2026 to 2035.

North America's Grid automation and protection system market Analysis

North America dominated the market, holding the largest market share of nearly 35% in 2025. North America leads in technological innovation and strongly focuses on developing advanced grid automation and protection systems. The region maintains its leadership position, owing to the increasing investment in smart grid projects and renewable energy infrastructure. Several utility companies in the region are increasingly deploying these systems to optimize grid operations, improve energy efficiency, and enhance safety. Such a combination of factors is anticipated to bolster the growth of the market in the region.

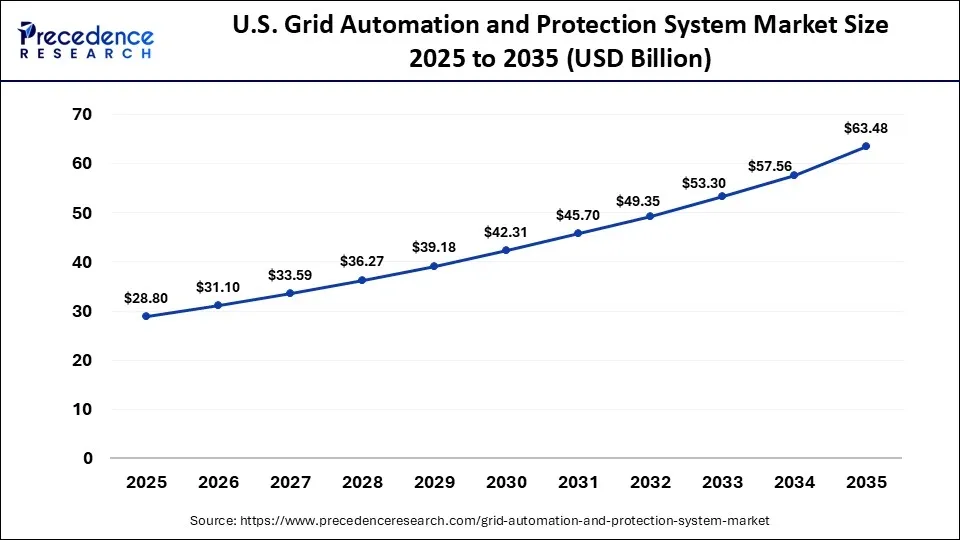

What is the Size of the U.S. Grid Automation and Protection System Market?

The U.S. grid automation and protection system market size is calculated at USD 28.80 billion in 2025 and is expected to reach nearly USD 63.48 billion in 2035, accelerating at a strong CAGR of 8.22% between 2026 and 2035.

The U.S. Grid automation and protection system market Analysis

The U.S. holds a substantial share of the market. The country is home to the leading market players such as GE Vernova, Eaton Corporation, Honeywell International Inc., Itron Inc., Rockwell Automation, Hubbell Incorporated, Cisco Systems, Inc., and others. The country has ambitious smart grid initiatives aimed at modernizing the electricity infrastructure. The country's rapid growth is also largely driven by the rising need for renewable energy integration, improved operational efficiency, and enhanced cybersecurity in utility infrastructure. Moreover, the rapid adoption of digital substations and rising government incentives to promote smart grid development are anticipated to drive the country's growth during the forecast period.

Asia Pacific Grid automation and protection system market Analysis

The Asia Pacific region is the fastest-growing region with a CAGR of approximately 12.5% in the market during the forecast period. The growth of the Asia Pacific region is mainly driven by the rapid urbanization, increasing focus on modernization of aging infrastructure, rising integration of renewable energy sources such as wind and solar, surging investment in smart grid technologies, and rapid technological advancements like IoT and AI integration. Countries like China, Japan, India, and South Korea are leading the market, owing to their heavy investment in smart grids, substation automation, and protective relays to manage increasing electricity demand and improve grid reliability.

China's Grid Automation and Protection System Market Analysis

China's market holds a notable revenue share. The country is experiencing widespread deployment of intelligent electronic devices (IEDs), numerical relays, and IoT-enabled monitoring systems. The growth of the country is also largely driven by rapid urbanization, increasing grid in grid modernization initiatives, increasing electricity demand, rising threats to critical infrastructure, growing need for enhanced grid reliability, and significant investment in increasing renewable energy projects.

Grid Automation and Protection System Market Companies

- Hitachi Energy

- Eaton

- Honeywell

- Cisco Systems

- Mitsubishi Electric

- Rockwell Automation

- Emerson Electric

- Itron

- Siemens

- ABB

- Schneider Electric

- GE Grid Solutions (GE Vernova)

Recent Developments

- In February 2026, GE Vernova Inc. announced the launch of a new solution designed to simplify grid operations and protection as electricity networks expand globally and become more complex. GridBeats APS (Automation and Protection System) is a new product within GE Vernova's GridBeats portfolio of software-defined grid automation solutions. It is designed to help utilities modernize electrical substations, reduce device footprints, and keep power flowing reliably as power grid requirements evolve.(Source: https://www.gevernova.com)

- In December 2025, ABB announced that it had signed an agreement to acquire Netcontrol, a provider of electrical grid automation solutions for power utilities and critical infrastructure operators. The acquisition enhances ABB's grid automation offerings for utilities facing the rising need to digitalise the electrical power grid. ABB's electrification portfolio, combined with Netcontrol's advanced grid automation solutions, helps customers on their journey to digitalise the power grid.(Source: https://new.abb.com)

Segment covered in the report

By Component

- Hardware Systems

- Protection relays

- Sensors & actuators

- Communication interfaces

- Software & Platforms

- Grid automation software

- Analytics & management suites

- Services (Installation, Integration, Support)

- Consulting

- Commissioning & maintenance

By Automation Type

- Distribution Automation

- Feeder automation

- Fault isolation & service restoration

- Substation Automation

- Transmission Automation

- Customer / DER (Distributed Energy Resource) Integration

By Protection System

- Overcurrent Protection

- Distance & Differential Protection

- Transformer & Generator Protection

- Arc Fault & Insulation Protection

- Other Specialized Protection

By End User

- Electric Utilities

- Industrial & Commercial Enterprises

- Renewable Energy Operators

- Microgrid & Off-grid Deployments

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting