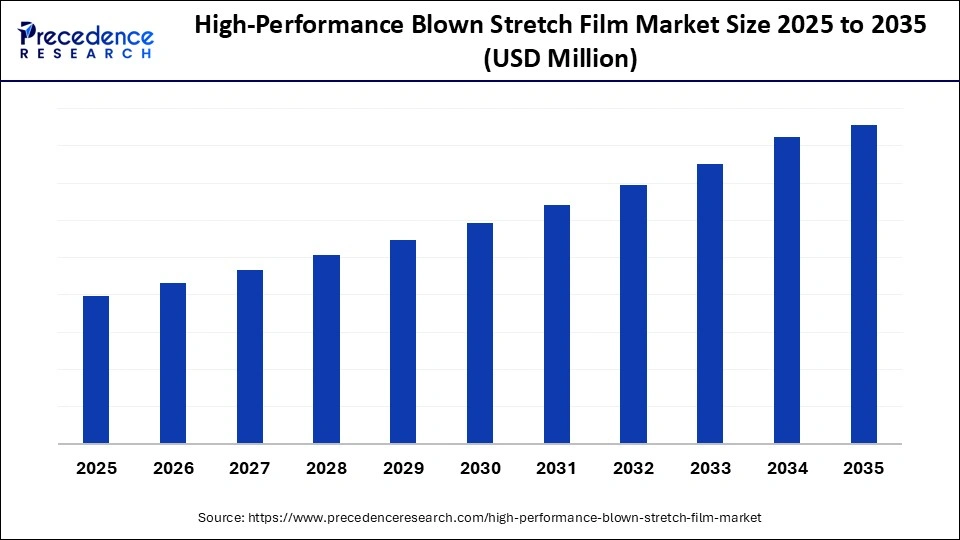

What is the High-Performance Blown Stretch Film Market Size?

High-Performance Blown Stretch Film Market growth is fueled by expanding logistics and warehousing, AI-driven production optimization, cold-chain demand, and sustainable packaging regulations. The market growth is attributed to rising demand for durable, high-clarity, and puncture-resistant films across logistics, e-commerce, and industrial packaging sectors.

High-Performance Blown Stretch Film Market Key Takeaways

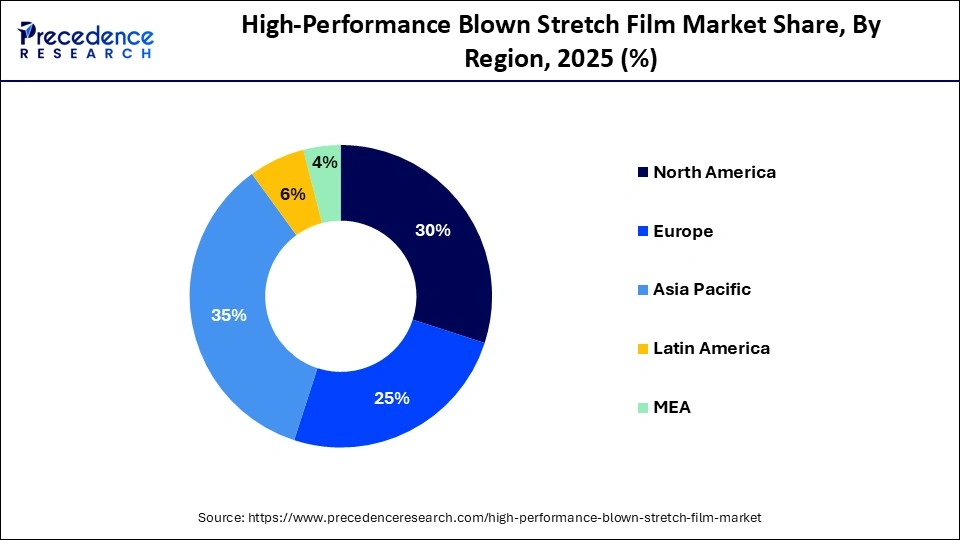

- North America dominated the market with 30% of the market share in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 6.0% between 2026 and 2035.

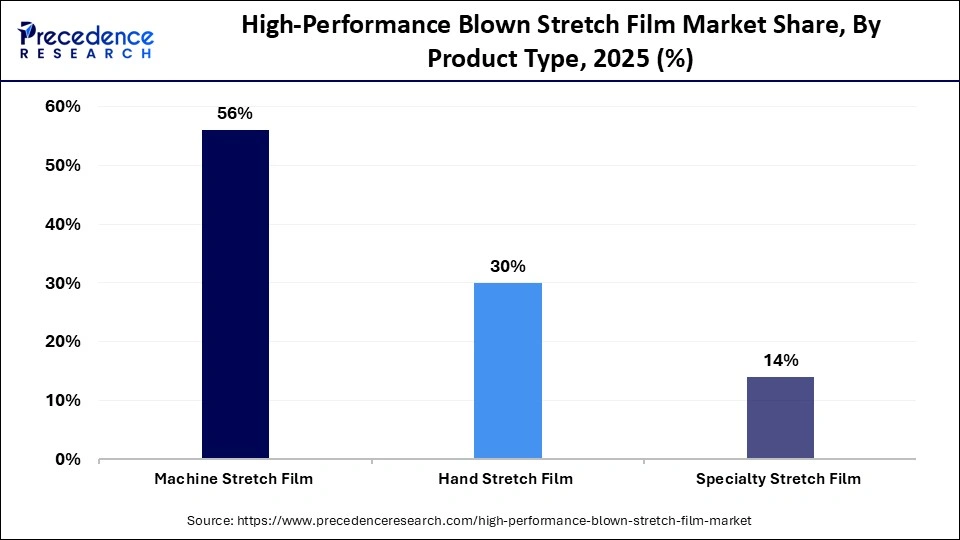

- By product type, the machine stretch film segment contributed the highest share of 56% in 2025.

- By product type, the specialty stretch film segment is growing at a strong CAGR of 5.2% between 2026 and 2035.

- By material type, the LLDPE (linear low-density polyethylene) segment held a major market share of 52% in 2025.

- By material type, the polypropylene (PP) segment is growing at a CAGR of 5% from 2026 to 2035.

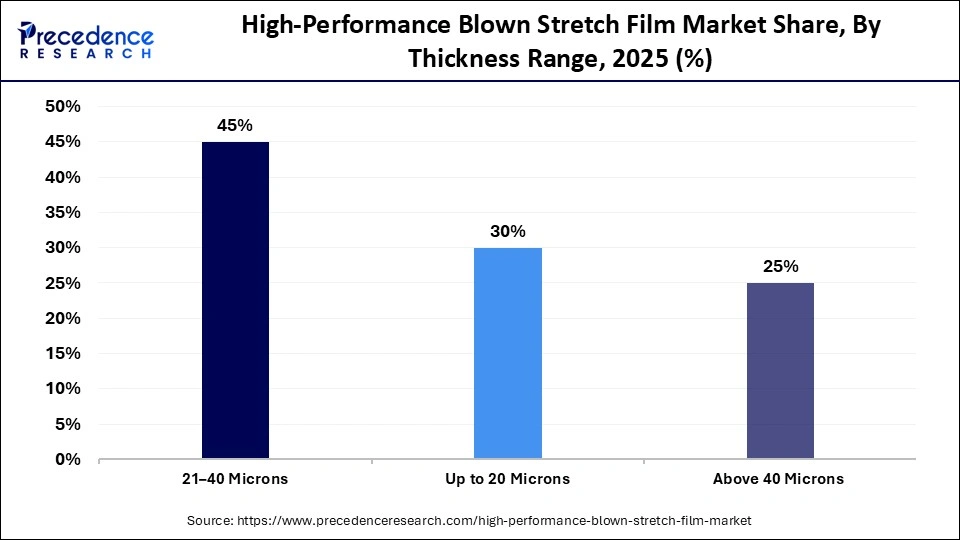

- By thickness range, the 21–40 microns segment captured the highest market share of 45% in 2025.

- By thickness range, the Up to 20 microns segment is poised to grow at a healthy CAGR of 5.1% between 2026 and 2035.

- By end-use/industry, the food and beverage packaging segment generated the biggest market share of 38% in 2025.

- By end-use/industry, the pharmaceuticals segment is expanding at the fastest CAGR of 5.2% between 2026 and 2035.

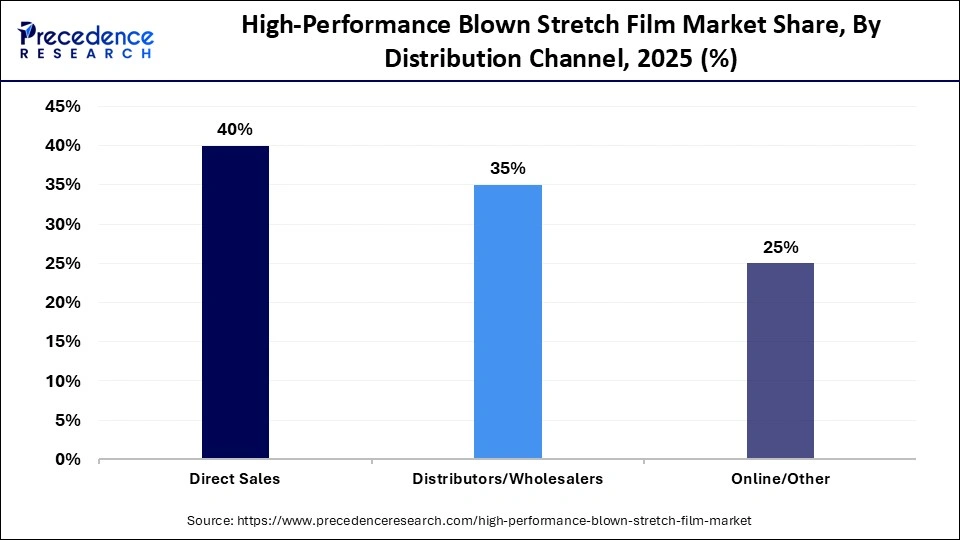

- By distribution channel, the direct sales segment accounted for the largest share of 40% in 2025.

- By distribution channel, the online/other segment is projected to grow at a solid CAGR of 5.3% between 2026 and 2035.

High-Performance Blown Stretch Film Market Overview

High-performance blown stretch film is a multi-layer polyethylene packaging material engineered to provide high elasticity, puncture resistance, and load stability for palletized goods during storage and transportation. The market is driven by rising demand for secure secondary packaging across logistics, warehousing, manufacturing, and retail distribution environments where load containment and product protection are critical. Blown stretch films are increasingly preferred over conventional cast films for heavy, irregular, or sharp-edged loads due to their superior tear resistance and sustained holding force.

Growth in organized warehousing, third-party logistics operations, and cross-border supply chains is reinforcing demand for films that reduce product damage, minimize film usage through downgauging, and maintain stability during long-distance handling. In parallel, manufacturers are advancing resin formulations and multilayer extrusion technologies to improve performance consistency, recyclability, and compatibility with automated wrapping systems.

(Source: census.gov)

Impact of Artificial Intelligence on the High-Performance Blown Stretch Film Market

The high-performance blown stretch film market has been more influenced by the application of AI. They improve production efficiency, product quality, and supply chain management. Through predictive maintenance systems based on AI, manufacturers continuously monitor blown film extrusion lines and avoid the expensive downtime to facilitate smooth operations. Furthermore, AI-assisted automation in pallet wrapping and packaging will provide homogenous load containment, less reliance on labor, and enhanced safety in operation.

AI-driven process control systems are also being used to optimize extrusion parameters such as temperature, air ring settings, and draw ratios to achieve consistent film thickness, strength, and stretch performance. Machine learning algorithms are supporting quality inspection by detecting defects like gels, weak spots, or gauge variations in real time, reducing material waste and rework rates. In addition, AI-enabled demand forecasting and inventory optimization are improving raw material planning and distribution efficiency across complex logistics and warehousing networks.

High-Performance Blown Stretch Film Market Growth Factors

- Boosting Cold-Chain Logistics Efficiency: Increasing global trade in perishable goods is propelling demand for films with puncture resistance and temperature stability.

- Growing Emphasis on Sustainable Packaging: Rising regulatory focus on recyclability and circular economy initiatives is driving innovation in eco-friendly stretch films.

- Propelling Adoption of Multi-Layer Film Technology:Advances in co-extrusion and high-clarity layering are boosting applications requiring stronger load containment.

High-Performance Blown Stretch Film Market Trends

- Increasing Regulatory Tide on Recyclable Packaging: Growing regulatory action by governments and initiatives like the U.S. Plastics Pact and EU Packaging Regulation are driving demand for blown films compatible with recycling systems. This gives producers room to improve design to recycle stretch films that comply with the requirements of sustainability in the supply chain.

- Growth of Extended Producer Responsibility (EPR) Schemes:Several regions, such as North America, the EU, and India, are increasing the financial incentive to manufacturers to use circular materials and reintroduce programs. Stretch film producers' positioning solutions that support EPR obligations unlock new partnerships with brand owners and logistics providers.

- Standardization of Recycled Content Metrics:Specifications of recycled content polymers are being developed by specifications bodies like the ISO Technical Committee on Plastics (ISO TC61) and ASTM International. Stretch film suppliers adopting these standards early gain an advantage in markets where purchasers require verified recycled content and chain of custody transparency.

Market Scope

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Material Type, Thickness Range, End-Use/Industry and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

High-Performance Blown Stretch Film Market Dynamics: From Logistics Titans to E-Commerce Surges

- Between June 2024 and May 2025, the world recorded approximately 46,542 stretch film export shipments, involving 4,299 exporting companies and 6,544 buyers globally, marking a 36 % year-on-year growth in total shipments

- Antalis launched a blown hand stretch film range with 30% recycled content and enhanced puncture resistance, which is Plastic Packaging Tax exempt in some regions, reflecting performance and regulatory alignment. This product demonstrates how high-performance blown films are evolving with sustainability, regulatory compliance, and performance characteristics.

- Reifenhäuser produced the world's first blown MDO PE film at just 18µm thickness, reducing material use by ~25% compared to conventional 25µm blown films. This demonstrates a clear downgauging milestone in high-performance blown film production using advanced EVO Ultra Stretch MDO technology.

- Global online retail sales reached approximately USD6.4–6.8trillion in 2025, accounting for ~20–21% of all retail sales worldwide; continued expansion of online shopping drives higher parcel volumes and logistics throughput. Larger parcel volumes from online orders directly increase the use of stretch film for pallet wrapping and load stabilization in supply chains.

(Source: volza.com) (Source: ingsol.in) (Source: reifenhauser.com) (Source: packagingeurope.com) (Source: reifenhauser.com) (Source: ecommercegermany.com)

Segment Insights

Product Type Insights

Why Does Machine Stretch Film Dominate the Global High-Performance Blown Stretch Film Market?

The machine stretch film segment dominated the high-performance blown stretch film market in 2025, accounting for an estimated 56% market share due to its ability to have better load containment, even tension of the film, and high pre-stretch options. They are increasingly being adopted in automated pallet wrapping systems across logistics, warehousing, and manufacturing sectors. The increasing levels of e-commerce in North America, Europe, and Asia-Pacific were heavily dependent on high levels of performance films regularly in terms of bulk handling of goods.

The specialty stretch film segment is expected to grow at the fastest rate in the coming years, accounting for 5.2% of CAGR, owing to its usability on high-performance, niche applications. Chemical, pharmaceutical, and sensitive electronic industries are expected to be the driving forces since specialty films have better puncture resistance, load stability, and customized properties of barriers. Additionally, the segment's growth is likely to accelerate for its customizable properties, such as anti-static, anti-slip, and UV-stabilized coatings, in the coming years.

Material Type Insights

Why Does LLDPE Dominate the High-Performance Blown Stretch Film Market?

The LLDPE (linear low-density polyethylene) segment held the largest revenue share in the high-performance blown stretch film market in 2025, holding a market share of about 52%, due to the excellent tensile strength, superior elongation, and high puncture resistance. This allows films to secure heavier and irregular pallet loads in logistics and industrial applications. Additionally, the increase in warehouse automation and the growth of e-commerce and industrial supply chains are expected to facilitate the segment's growth.

The polypropylene (PP) segment is expected to grow at the fastest growth rate in the coming years, accounting for 5% CAGR. The PP films are less dense than LLDPE, and they are also stiffer and more transparent. This is beneficial in packaging high-value or delicate products. Moreover, the growth of polypropylene is anticipated to accelerate as manufacturers innovate multi-layer PP blends with improved barrier performance, tear resistance, and anti-slip properties.

Thickness Range Insights

Why Do 21-40 Micron Films Dominate High-Performance Blown Stretch Film Usage?

The 21-40 microns segment dominated the high-performance blown stretch film market in 2025, accounting for an estimated 45% share, due to their optimal balance between strength and flexibility, which allows efficient pallet wrapping without overusing material. This thickness is popular with automated wrapping systems, which need to maintain the same tension and have a higher throughput rate in large distribution centers. Furthermore, the companies increasingly rely on this thickness to reduce wastage, improve load security, and meet sustainability standards, thus boosting the segment growth.

The up to 20 micron segment are expected to grow at the fastest rate in the coming years, accounting for 5.1% of CAGR, owing to their lightweight, price-sensitive, and economy applications. Such thin films are estimated to save the use of raw materials without compromising on the ability to hold an adequate load when shipping lighter products. This makes them suitable for FMCG, retail, and small package e-commerce. Additionally, the growth of up to 20 micron films is likely to accelerate due to rising e-commerce volumes and shorter delivery cycles.

End-Use/Industry Insights

Why Does Food & Beverage Packaging Dominate High-Performance Blown Stretch Film Demand?

The food & beverage packaging segment held the largest revenue share in the high-performance blown stretch film market in 2025, holding a share of about 38%. Due to the need for secure pallet loads, product freshness, and hygiene compliance during storage and transportation. Additionally, this market is also expected to maintain its leadership till the year 2026 based on the increasing e-commerce food delivery and supermarket distribution.

The pharmaceuticals segment is expected to grow at the fastest CAGR in the coming years, accounting for a 5.2% CAGR, owing to the high level of regulatory compliance and secure and tamper-evident packaging. Specialty films offer greater puncture strength, loading, and contamination resistance. They are essential in the transportation of medicines, vaccines, and other products that require temperature regulation. The high-technology blown film equipment assists in maintaining high pharmaceutical handling requirements. Additionally, the Growth in global healthcare distribution networks and cold-chain logistics has significantly increased demand for high-performance films in this sector.

Distribution Channel Insights

Why Do Direct Sales Dominate High-Performance Blown Stretch Film Distribution in 2025?

Direct sales segment dominated the high-performance blown stretch film market in 2025 accounting for an estimated 40% market share, as it ensures tailored product specifications, bulk pricing, and long-term supply commitments that are critical for high-volume operations. Direct sales teams are in tight technical contact with customers. This allows problem-solving in real time, customized formulation support, and continuity of supply in high logistics cycles. Moreover, the emphasis on direct large accounts is likely to deepen as global supply chains become more complex and service expectations rise, further facilitating this segment's dominant position.

The online/other segment is expected to grow at the fastest rate in the coming years, accounting for a 5.3% CAGR. The digital marketplaces and industrial e-commerce websites provide convenient ordering, clear, detailed pricing, and fast delivery. This is particularly attractive to small and mid-sized converters, 3PLs, and regional distributors interested in the flexibility in purchasing. Furthermore, the online distribution helps to serve smaller quantity orders, regional delivery centers, and drop ship capabilities, thus further propelling the segment in the coming years.

Regional Insights

Why Does North America Dominate the Blown Stretch Films?

North America led the high-performance blown stretch film market, capturing the largest revenue share in 2025. Due to a good logistical system, the great consumption of packaged goods per capita, and the close combination of the packaging technologies in industries. North America is projected to contribute a commendable share of packaging film demand globally in the year 2025. The U.S. alone is consuming a commanding share owing to the big retail, manufacturing, and distribution market. Additionally, the film demand in North America also increases due to strict quality and safety requirements, which stimulates consistent load containment and long-distance performance.

U.S. High-Performance Blown Stretch Film Market

The U.S. represents the largest high-performance blown stretch film market in North America, supported by a dense warehousing network, high palletized freight volumes, and widespread use of automated load-wrapping systems across national distribution centers. Demand is strongly anchored in food and beverage logistics, consumer packaged goods, and industrial manufacturing, where blown stretch films are preferred for their superior puncture resistance, load retention, and performance under long-distance transportation stress. Growth is further reinforced by the expansion of e-commerce fulfillment centers that require consistent load containment for mixed and irregular pallet loads moving through high-speed material handling environments. In parallel, sustainability-driven material optimization, including downgauging and incorporation of recycled polyethylene content, is shaping product development as U.S. converters and end users work to reduce material usage while maintaining mechanical performance standards.

Why Is Asia Pacific Emerging as the Growing Region for High-Performance Blown Stretch Films?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the robust industrial adoption and explosive e-commerce growth, accounting for a leading regional share in 2025. The manufacturing centers of the region, China and India, sustain high production of packaged products. This facilitates the use of blown films to stabilize the supply chains of logistics and pallet stabilization. Moreover, the Asia Pacific's manufacturing acceleration further fuels demand for blown stretch films used in securing industrial goods, electronics, and FMCG products. (Source:ibef.org)

India High-Performance Blown Stretch Film Market

India's high-performance blown stretch film market is expanding due to rising domestic manufacturing activity, rapid growth of organized retail, and sustained expansion of e-commerce logistics networks that rely on palletized freight movement. Increasing investment in modern warehousing, third-party logistics providers, and fulfillment centers is driving demand for stretch films that offer high load stability, puncture resistance, and performance consistency under varied handling conditions. Industry collaboration and knowledge exchange platforms, including large-scale flexible packaging and specialty films forums hosted in India, are strengthening technology transfer, process optimization, and adoption of advanced multilayer blown film solutions. The fast-growing e-commerce sector is further increasing demand for high-performance blown stretch films that can secure mixed and irregular pallet loads during long-distance transportation and last-mile distribution. In parallel, domestic film converters are focusing on downgauging and material efficiency to balance cost sensitivity with mechanical performance requirements in logistics and industrial packaging applications. (Source:lfam.i)

High Performance Blown Stretch Film Market - Value Chain Analysis

- Raw Material Sourcing: Sourcing key resins like LLDPE, LDPE, and performance additives forms the base of blown stretch film production.

Key Players: Dow Inc., Borealis AG, ExxonMobil Chemical, LyondellBasell, SABIC. - Film Extrusion & Blown Film Manufacturing:Compounded resins are processed into multilayer blown films using advanced extrusion lines for high mechanical performance.

Key Players: Reifenhauser Group, Windmoller & Holscher, Hosokawa Alpine, SAMA Engineering. - Film Conversion & Finishing:Blown films are slit, rolled, and packaged into hand wrap, machine wrap, or specialty films for end-user requirements.

Key Players: Berry Global Group, Amcor plc, Sealed Air Corporation, Sigma Plastics Group. - Distribution & Logistics Services:Finished films are delivered globally through distributors and logistics partners to warehouses, e-commerce, and industrial clients.

Key Players: Univar Solutions, Brenntag, Kuehne + Nagel, DHL Supply Chain.

Recent Developments

- In December 2025, U.S.-based Cortec introduced a new packaging film for the electronics sector: EcoSonic VpCI-125 HP permanent electrostatic discharge (ESD) stretch film. The product is engineered to provide both ESD protection and corrosion inhibition. Its formulation ensures permanent static dissipative properties throughout its lifespan, addressing the shelf-life and stability challenges commonly seen with traditional "pink poly" stretch films used in electronics packaging.

- In February 2025, Berry Global's flexible films division announced the latest expansion of its Bontite Sustane Stretch Film portfolio at Packaging Innovations in Birmingham on 12-13 February, now incorporating 30% certified post-consumer recycled (PCR) content. Bontite is a technically advanced range of blown stretch films providing exceptional holding force to secure palletized goods during transit. Offering strength, puncture resistance, and load stability, these films serve diverse sectors, including logistics, food and beverage, construction, retail, manufacturing, pharmaceuticals, and e-commerce.

- In January 2025, Trioworld, a global leader in stretch film innovation, unveiled its newest 67-layer stretch film line from SML in North America. Featuring advanced SmartCast technology, the line is slated to become operational in Spring 2025, marking a major milestone in Trioworld's continuous drive for innovation and industry leadership.

(Source:packaging-gateway.com)

(Source: constructionworld.in)

(Source: packagingsolutions.amcor.com)

(Source: trioworld.ca)

Segments Covered in the Report

By Product Type

- Machine Stretch Film

- Hand Stretch Film

- Specialty Stretch Film

By Material Type

- LLDPE (Linear Low-Density Polyethylene)

- LDPE (Low-Density Polyethylene)

- HDPE (High-Density Polyethylene)

- Polypropylene (PP)

- Others

By Thickness Range

- 21–40 microns

- Up to 20 microns

- Above 40 microns

By End-Use/Industry

- Food & Beverage Packaging

- Industrial & Logistics

- Consumer Goods

- Pharmaceuticals

- Others

By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Online/Other

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting