High Purity Citric Acid Market Size and Forecast 2025 to 2034

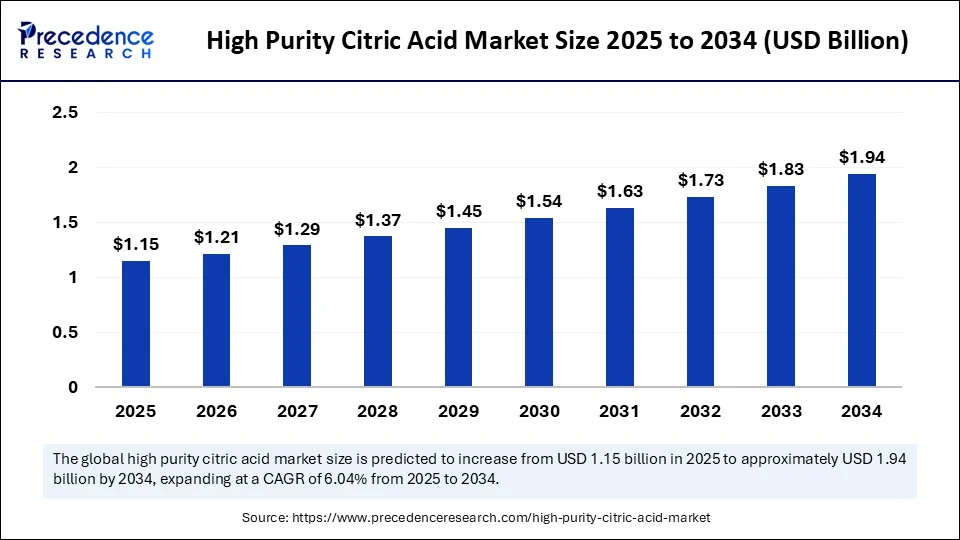

The global high purity citric acid market size was estimated at USD 1.08 billion in 2024 and is predicted to increase from USD 1.15 billion in 2025 to approximately USD 1.94 billion by 2034, expanding at a CAGR of 6.04% from 2025 to 2034. The market is experiencing significant growth due to its extensive applications in various sectors such as pharmaceutical, personal care, and food & beverages. The increasing shift toward clean-label and naturally derived ingredients further contributes to market growth.

High Purity Citric Acid Market Key Takeaways

- In terms of revenue, the global disposable urine bags market was valued at USD 1.08 billion in 2024.

- It is projected to reach USD 1.94 billion by 2034.

- The market is expected to grow at a CAGR of 6.04% from 2025 to 2034.

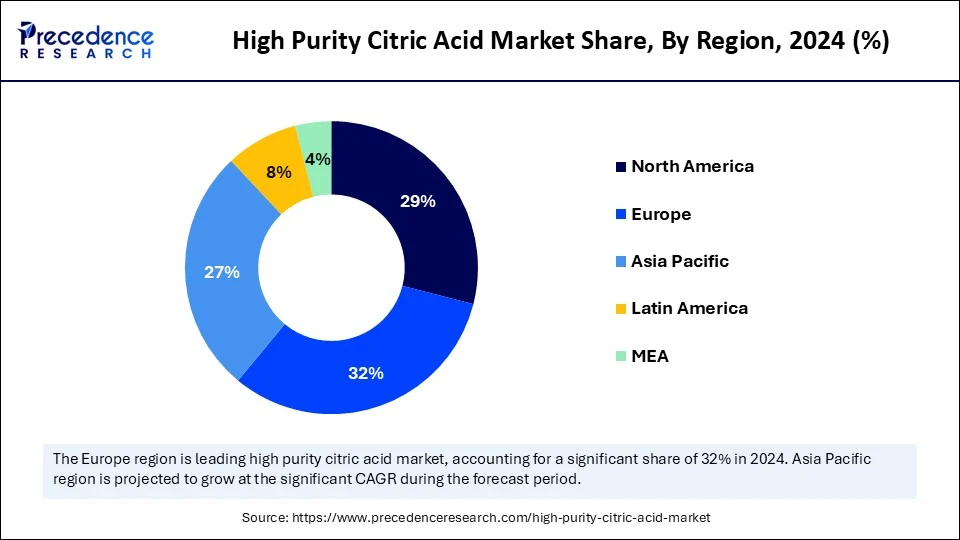

- Europe held the largest market share of 32% in 2024.

- The Asia Pacific is expected to witness the fastest growth during the foreseeable period of 2025-2034.

- By form, the anhydrous citric acid segment held the largest market share of 56% in 2024.

- By form, the liquid citric acid segment is expected to grow at the fastest CAGR during the forecast period of 2025-2034.

- By purity grade, the ≥99.5% pharmaceutical grade segment held the largest market share of 61% in 2024.

- By purity grade, the ≥99.8% laboratory/reagent grade segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By application, the pharmaceuticals segment held the largest market share of 38% in 2024.

- By application, the biotechnology & laboratory use segment is expected to witness the fastest growth during the foreseeable period.

- By end use, the food & beverage manufacturing segment held the largest market share of 41% in 2024.

- By end use, the nutraceuticals & functional food segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034.

- By distribution channel, the direct (industrial supply contracts segment) dominated the market in 2024.

How is AI transforming the high purity citric acid Market?

Artificial intelligence significantly impacts the high purity citric acid market by optimizing production and market analysis. AI enhances manufacturing through machine learning, improving process control, reducing waste, and boosting quality. It predicts optimal fermentation conditions, increasing yield. AI also revolutionizes extraction of high-purity citric acid using advanced technologies like artificial neural networks and response surface methodology. These technologies significantly enhance the extraction process, enabling the production of high-purity citric acid from various sources while maximizing yield and product quality.

AI algorithms effectively analyze extensive datasets generated from diverse experiments, simulating numerous iterations and potential outcomes under varying conditions. These conditions encompass crucial factors such as pH levels, solvent ratios, temperature, and extraction time. By meticulously optimizing these parameters, AI models facilitate the extraction of maximum high-purity citric acid. In market analysis, AI accurately forecasts demand by processing sales data and consumer trends, aiding in production and pricing decisions.

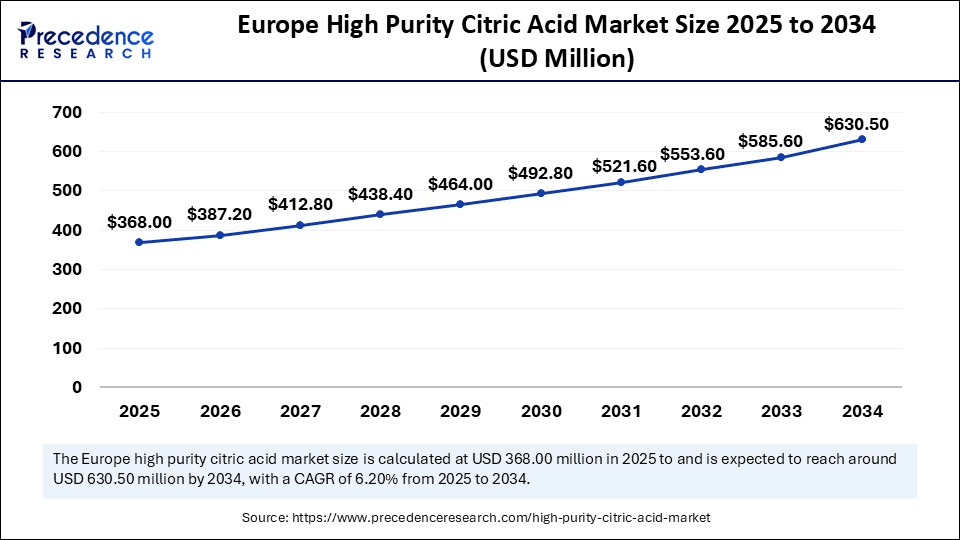

Europe High Purity Citric Acid Market Size and Growth 2025 to 2034

The Europe high purity citric acid market size is evaluated at USD 368.00 million in 2025 and is projected to be worth around USD 630.50 million by 2034, growing at a CAGR of 6.20% from 2025 to 2034.

What factors contribute to the dominance of Europe in the high purity citric acid market?

Europe dominated the high purity citric acid market, holding the largest market share of 32% in 2024. This is mainly due a well-established production base and a large consumer base that favors products with citric acid. Additionally, the European region emphasizes sustainable products and eco-friendly practices. European manufacturers are at the forefront of developing advanced fermentation technologies, aligning with stringent food and safety regulations set by authorities. These regulations, particularly under Annex II of Regulation (EC) No 1333/2008, which permits the use of citric acid in various foods, play a key role in expanding the European high-purity citric acid market.

Additionally, leading European companies like Cargill and Tate & Lyle are employing strategies such as launching innovative products and forming collaborations with emerging companies. For instance, Cargill's 2023 collaboration with organic food brands increased bio-based citric acid revenue in France by up to 25%.

What makes Asia Pacific the fastest-growing market for high purity citric acid.

Asia Pacific is expected to experience the fastest growth in the coming years, driven by the rapid expansion of industries like food and beverages, pharmaceuticals, and cosmetics, which increases the demand for high-purity citric acid. The growth of the market is further fueled by a shift toward clean-label products with organic ingredients, alongside economic expansion in countries like India, China, and Japan, which boosts the demand for citric acid as a preservative and buffering agent. Ongoing research and development in fermentation technologies and strategic collaborations among key players in the region are contributing to market expansion. In addition, the increasing consumption of processed foods, beverages, and confectionery products fuels the demand for high-purity citric acid.

Market Overview

The high purity citric acid market focuses on citric acid with purity levels typically ≥99.0%, used in high-spec industries such as pharmaceuticals, biotechnology, cosmetics, and food processing. Derived mainly through microbial fermentation, this form of citric acid serves as a chelating agent, buffer, and acidulant with strict compliance to standards such as USP, EP, FCC, and EFSA. Market growth is fuelled by the increasing need for clean-label, biocompatible, and biodegradable ingredients, particularly in regulated and research-intensive sectors.

What are the key trends in the high purity citric acid market?

- Bio-based extraction process for high-purity citric acid:A key trend in the market is the adoption of sustainable, bio-based extraction methods. This approach utilizes microorganisms, such as Aspergillus niger, for enhanced efficiency, involving fermentation, filtration, precipitation, and purification steps. Sugars derived from sources like molasses and corn serve as carbon sources in the fermentation process. Alternative bio-based methods include solvent extraction using organic solvents like acetone, as well as ion exchange and electrodialysis techniques for citric acid recovery.

- Growing usage of citric acid into emerging sector:The market is also seeing a rise in the application of high-purity citric acid in functional foods, where it boosts nutritional value as a natural preservative. Additionally, it is utilized in eco-friendly cleaning products and non-food applications, such as specialized cleaning agents.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1.94 Billion |

| Market Size in 2025 | USD 1.15 Billion |

| Market Size in 2024 | USD 1.08 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.04% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Purity Grade, Application, End-Use Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand from the food & beverages industry

A major factor driving the growth of the high purity citric acid market is the rising demand from the food & beverage industry. It serves as a high-quality preservative, flavor enhancer, and acidulant. Citric acid reduces the acidity in foods and beverages, preserving their taste and unique flavors. Consequently, high-purity citric acid is widely used in beverages like juices and soft drinks, powdered beverages, and food items such as dairy products, jams, jellies, and processed foods.

Additionally, stringent food safety regulations and increasing consumer awareness of food quality and safety encourage the use of high-purity citric acid in food processing to ensure product stability and shelf life. Citric acid's safety as a food and beverage additive is well-established, confirmed by regulatory bodies like the EMA and FDA. This acceptance enhances its credibility and reliability as a safer additive, significantly driving market growth.

Restraint

Availability of alternatives and regulatory hurdles

One of the major restraining factors for the high purity citric acid market is the rising competition from alternative acidulants and preservatives like acetic acid, lactic acid, and malic acid. These substitutes are often easier and cheaper to produce, appealing to budget-conscious markets. Moreover, the citric acid industry is subject to strict regulations regarding food safety, pharmaceutical standards, and environmental protection. Compliance with these regulations increases production costs and can limit market expansion.

Opportunity

Increasing demand for eco-friendly and clean personal care products

A significant opportunity for the high purity citric acid market lies in its growing application in the personal care industry as a clean and natural agent. High-purity citric acid, known for its excellent exfoliating and anti-aging properties, aligns with current consumer priorities. It functions as a pH adjuster, antioxidant, and chelating agent. It is utilized in AHA (alpha hydroxy acid) formulations for skincare products, providing mild exfoliation and a high concentration of antioxidants to remove dead cells, revealing a fresh skin layer. Furthermore, citric acid is included in various shampoo formulations to shield the initial layer of hair from free radicals and pollutants that can damage the hair shaft.

Form Insights

Why did the anhydrous citric acid segment dominate the market in 2024?

The anhydrous citric acid segment dominated the high purity citric acid market while holding the largest share of 56% in 2024. The dominance of anhydrous citric acid stems from its inherent characteristics, including higher stability and an extended shelf life, supported by a well-established infrastructure for extracting the anhydrous form. Due to its substantial production, it's extensively utilized in various sectors like food and beverages, pharmaceuticals, and industrial applications, thereby fueling the segment's growth. Moreover, anhydrous citric acid's crystalline and consistent structure makes it an ideal component for applications within the pharmaceutical and food industries.

The liquid citric acid segment is expected to grow at the fastest CAGR in the foreseeable period. The growth of the segment is driven by its superior mixing capabilities and homogeneous nature, which ensure the consistent nature of the required formulations, unlike the powder form. The liquid form offers convenience for direct blending into beverages and liquid products, providing easy dispensing, which is particularly beneficial in applications demanding precise measurements, such as cosmetic formulations and pharmaceutical products.

Purity Grade Insights

What made ≥99.5% pharmaceutical grade the dominant segment in the high purity citric acid market?

The ≥99.5% pharmaceutical grade segment dominated the market with the largest share of 61% in 2024. The segment's dominance stems from its critical role in ensuring product safety and efficacy in pharmaceutical applications. Some sensitive areas, like nephrology and extended-release drugs, are subject to stringent safety and purity regulations to avoid unwanted impurities. Citric acid also functions as a buffering agent in pharmaceutical formulations, which is crucial for maintaining drug pH levels and enhancing stability and purity.

The ≥99.8% laboratory/reagent grade segment is expected to witness the fastest growth in the upcoming period. Stringent regulations in the cosmetics, personal care, and pharmaceutical industries necessitate high-purity citric acid to ensure product safety and efficacy. Furthermore, the increasing consumer preference for natural and clean-label products drives demand for high-purity ingredients. These trends, coupled with environmental protection laws, are collectively boosting the segment's growth.

Application Insights

How does the pharmaceuticals segment lead the market in 2024?

The pharmaceuticals segment led the high purity citric acid market with the largest market share of 38% in 2024. This dominance stems from citric acid's crucial role in numerous medications, acting as a buffering agent to balance pH levels and enhance the solubility of active pharmaceutical ingredients. Drug delivery systems, such as topical applications and effervescent tablets, extensively utilize citric acid as a preservative and buffering agent, further driving the segment's global growth.

The biotechnology & laboratory use segment is expected to expand at the highest CAGR during the projection period. This growth is driven by the use of high-purity citric acid as a key element in cell culture media, where it maintains optimal pH levels to support cell growth and viability, which is critical for successful production of therapeutic and gene-modified cells. The increasing investment in biotechnology research and the expansion of laboratory infrastructure globally are driving the demand for high-purity citric acid. Furthermore, the growing need for accurate and reliable experimental results necessitates the use of high-purity reagents, further fueling the segment's growth.

End Use Insights

Why did the food & beverage manufacturing segment dominated the market in 2024?

The food & beverage manufacturing segment dominated the high purity citric acid market, holding the largest market share of 41% in 2024. This is mainly due to stringent regulations regarding food safety. Citric acid is recognized as a safe additive for food and beverage products by regulatory bodies like the FDA. Its widespread use in bakery goods, dairy products, soft drinks, and confectionery products, along with its preservation properties, further boosts market growth. Additionally, citric acid enhances the taste and color profile of food items and offers clean labels, contributing to its market expansion.

The nutraceuticals & functional foods segment is expected to witness the fastest growth during the foreseeable period of 2025-2034. Citric acid is used in these products as a flavoring agent, preservative, and pH regulator. The growth of the segment is driven by the increasing demand for eco-friendly and clean-label products and the enhanced bioavailability of specific nutrients, making it an ideal supplement and functional food ingredient. Additionally, citric acid's role as an acidulant in various nutraceutical products, such as dietary supplements, further propels the segment's growth.

Distribution Channel Insights

How does the direct (industrial supply contracts) segment dominate the market in 2024?

The direct segment dominated the high purity citric acid market in 2024. The direct (industrial supply contracts) segment dominated the market in 2024 due to its strategic advantages. This segment benefits from long-term agreements, ensuring a stable supply chain and predictable revenue streams for manufacturers. These contracts allow for tailored solutions and competitive pricing, making it a preferred choice for large-scale industrial consumers of high-purity citric acid.

The online B2B/e-commerce platforms segment is expected to grow at a significant CAGR in the upcoming period. The growth of the segment is driven by the increasing adoption of digital platforms for procurement and the convenience they offer to businesses. Online platforms provide wider access to suppliers, competitive pricing, and streamlined ordering processes, making them an attractive option for sourcing high-purity citric acid.

High Purity Citric Acid Market Companies

- Jungbunzlauer Suisse AG

- Cargill, Inc.

- Tate & Lyle PLC

- Gadot Biochemical Industries

- Weifang Ensign Industry Co., Ltd.

- COFCO Biochemical (AnHui) Co., Ltd.

- RZBC Group Co., Ltd.

- Citrique Belge NV

- TTCA Co., Ltd.

- Bartek Ingredients Inc.

- Lemon Biochemical Co., Ltd.

- Sigma-Aldrich (Merck)

- Thermo Fisher Scientific

- MP Biomedicals

Recent Developments

- In January 2025, a partnership between Brenntag Pharma and Citrabel has been extended further for the distribution of citric acids and citrates pharma excipients.(Source: https://www.pharmaindustrial-india.com)

- In November 2024, a leading producer of sustainable ingredients from natural sources, Jungbunzlauer has collaborated with the technical university of Vienna aimed to support innovative research for citric acid production with the help of refining fungal strains using newly introduced Christian Doppler Laboratory.

(Source: https://www.jungbunzlauer.com)

Segments Covered in the Report

By Form

- Anhydrous Citric Acid

- Monohydrate Citric Acid

- Liquid Citric Acid

By Purity Grade

- ≥99.5% Pharmaceutical Grade

- ≥99.8% Laboratory/Reagent Grade

99.0% – 99.5% Food/Feed Grade with High Purity Certifications

By Application

- Pharmaceuticals

- Food & Beverages

- Cosmetics & Personal Care

- Biotechnology & Laboratory Use

- Medical Nutrition & Nutraceuticals

- Industrial & Specialty Chemicals

By End-Use Industry

- Pharmaceutical & Healthcare

- Food & Beverage Manufacturing

- Cosmetics & Personal Care

- Biotechnology & Research Institutions

- Chemical & Industrial Processing

- Nutraceuticals & Functional Foods

By Distribution Channel

- Direct (Industrial Supply Contracts)

- Distributors & Ingredient Suppliers

- Online B2B/E-Commerce Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting