India Healthcare Cloud Computing Market Size and Forecast 2025 to 2034

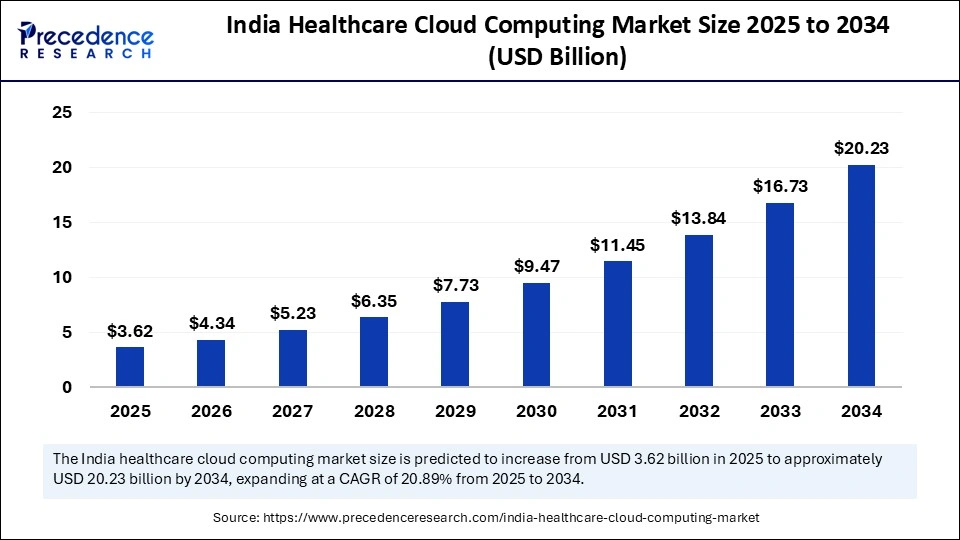

The India healthcare cloud computing market size accounted for USD 3.03 billion in 2024 and is predicted to increase from USD 3.62 billion in 2025 to approximately USD 20.23 billion by 2034, expanding at a CAGR of 20.89% from 2025 to 2034. The growth of the market is attributed to the rising need for efficient data management and increasing use of telehealth and wearable technology.

India Healthcare Cloud Computing MarketKey Takeaways

- In terms of revenue, the india healthcare cloud computing market is valued at $3.62 billion in 2025.

- It is projected to reach $20.23 billion by 2034.

- The market is expected to grow at a CAGR of 20.89% from 2025 to 2034.

- By product, the healthcare provider solutions segment held the major revenue share of the market in 2024.

- By product, the healthcare payer solutions segment is expected to grow at a notable CAGR between 2025 to 2034.

- By deployment, the private segment contributed the biggest market revenue share in 2024.

- By deployment, the public segment is expected to grow at a significant CAGR from 2025 to 2034.

- By application, the non-clinical information system segment dominated the market in 2024.

- By application, the clinical information system segment is expected to expand at the fastest CAGR between 2025 and 2034.

- By service, the Software as a Service (SaaS) segment held the biggest market share in 2024.

- By service, the Platform as a Service (PaaS) segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By end-user, the healthcare providers segment held the largest market share in 2024.

- By end-user, the healthcare payers segment is expected to grow at the highest CAGR from 2025 to 2034.

Cloud Computing and AI Convergence: Transforming the Healthcare Industry

The convergence of artificial intelligence (AI) and cloud computing is transforming healthcare delivery by improving diagnosis, treatment, and patient care. AI enables personalized medicine, early disease detection, and remote patient monitoring, making healthcare more accessible and efficient. Advancements such as AI-powered virtual assistants streamline administrative tasks, AI-driven diagnostics enhance accuracy, and AI-powered remote patient monitoring systems improve early warning and proactive care. However, cloud computing provides reliable infrastructure and scalable computing power to train AI models. This enables healthcare organizations to develop and deploy AI solutions without substantial investment in hardware.

Market Overview

The India healthcare cloud computing market is expanding rapidly due to government initiatives supporting digitization, growing adoption of cloud solutions, and the demand for digital solutions improving interoperability, analytics, and data management. Healthcare cloud computing encompasses the internet to store, manage, process, and share healthcare data and applications, leveraging remote servers and networks. It also enables healthcare organizations on-demand access to resources, driving efficiency, collaboration, and scalability. It offers numerous advantages for healthcare providers and patients, including cost savings, improved efficiency, enhanced accessibility, and better patient outcomes. It allows for scalable, secure, and interoperable solutions that provide data sharing, collaboration, and advanced analytics, ultimately driving innovation and improving the quality of care.

What are the Key Trends in the India Healthcare Cloud Computing Market?

- Demand for Digital Solutions: The requirement for digital solutions to enhance interoperability, analytics, and data management, which provides cost-effective solutions for the storage and processing of healthcare data, making it a viable option for market growth.

- Increased Healthcare Awareness: Increasing understanding of the benefits of cloud computing, such as affordability, scalability, and data accessibility, is hastening healthcare providers to adopt effective cloud solutions.

- Government Backing: Different government initiatives, including policies and programs promoting digital health and digitization, are contributing to the adoption of cloud-based solutions.

- Technological Advancements: Advancements in cloud technology, such as the development of specialized healthcare cloud solutions, are making it easier to integrate cloud computing into healthcare operations due to higher demands for analyzing large datasets and data accessibility.

- Shift Toward EHRs and Telehealth: The increasing adoption of electronic health records (EHRs), telemedicine, and other healthcare IT solutions is spurring the necessity for secure and scalable cloud-based platforms.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 20.23Billion |

| Market Size in 2025 | USD 3.62 Billion |

| Market Size in 2024 | USD 3.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.89% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Authentication, Component,Deployment, Application, and Region |

Market Dynamics

Drivers

Increasing Demand for Remote Patient Monitoring and Data Access & Sharing

The primary driver of the India healthcare cloud computing market is the increasing demand for remote patient monitoring solutions to improve healthcare delivery and patient outcomes. This significantly boosts the adoption of telehealth services, which rely on cloud computing for data storage and real-time communication. Moreover, there is a high need for remote access to patient data and data sharing, which is enabled by cloud technology. Cloud computing allows healthcare providers to access patient data from different locations, improving care coordination and remote work. By offering a cost-effective solution to reduce the demands for on-site hardware and maintenance, cloud computing enhances scalability and flexibility to fulfill the changing demands.

Restraint

Data Privacy and Security Concerns

The primary restraint in the India healthcare cloud computing market is data privacy and security concerns. This is further attributed to the sensitive nature of patient information and the fear of data breaches and cyberattacks. While the market is growing, these concerns are causing organizations to move cautiously with cloud adoption. Therefore, the Indian government is increasingly focusing on data protection and privacy through initiatives like the Digital Personal Data Protection Act (DPDPA), ensuring healthcare data protection and stringent security standards for cloud service providers.

Opportunity

Rising Adoption of Advanced Technologies and Need for Efficient Data Management

The main key future opportunity in the India healthcare cloud computing market lies in the rising use of advanced technologies. Healthcare organizations are increasingly adopting advanced technologies, such as IoT devices, wearables, and big data analytics, to improve healthcare delivery. This, in turn, boosts the need for This creates the need for efficient data management solutions to handle vast volumes of data generated by these technologies. Cloud computing has become essential for healthcare organizations to store and manage data generated from various health delivery solutions.

Product Insights

How does the healthcare provider solutions segment dominate the India healthcare cloud computing market?

The healthcare provider solutions segment dominated the market with the largest revenue share in 2024. This dominance is attributed to the increased incorporation of healthcare provider solutions in both clinical and non-clinical information systems, which focus on enhancing patient care, streamlining operations, and leveraging technology for improved patient outcomes. Increased adoption of cloud-based solutions for electronic health records (EHRs), telemedicine, and other IT applications, driven by the pandemic, regulatory compliance demands, and the shift to value-based care, further bolstered the segmental growth.

The healthcare payer solutions segment is expected to grow at a notable CAGR during the forecast period. The growth of the segment is attributed to the increasing need to enhance patient care. Healthcare payers are increasingly using cloud solutions for optimizing operational efficiency, reducing care costs, and enhancing customer satisfaction. Cloud computing enables healthcare payers to access patient data from anywhere, facilitating better coordination. The segment growth is further driven by the rising need to manage complex claims, fraud, and other administrative tasks effectively.

Deployment Insights

Which deployment segment dominated the India healthcare cloud computing market in 2024?

The private cloud segment dominated the market with the most revenue share in 2024. This is mainly due to the high security, data control, and regulatory compliance needs of healthcare providers. Private clouds typically offer better data control, compliance with regulations, and more flexibility than public clouds, making them the preferred choice for handling sensitive medical data through shared infrastructure and broader access. Furthermore, private cloud platforms can be seamlessly integrated with existing healthcare IT systems, ensuring adherence to data privacy regulations and minimizing the risk of data breaches.

The public segment is expected to grow at a significant CAGR during the predicted timeframe. With the growing acceptance of telemedicine and remote healthcare services, the need for private cloud is rising. Private cloud is preferred for its cost-effectiveness, scalability, and flexibility. Healthcare providers can opt for subscription-based services, reducing upfront investments and enabling quick adjustments to resources based on demand. Additionally, cloud-based analytics tools allow healthcare providers to analyze large datasets, identify trends, and make informed decisions.

Application Insights

Why did the non-clinical information system segment dominate the market?

The non-clinical information system segment dominated the India healthcare cloud computing market with the largest share in 2024. This is mainly due to the increased need to manage non-clinical data, such as administrative records, patient demographics, and financial data. Cloud solutions streamline administrative tasks like billing and revenue cycle management, reducing the burden on healthcare staff and improving operational efficiency. This significantly reduces operational costs. Moreover, the increased need to secure administrative and patient data bolstered the growth of the segment.

The clinical information system segment is expected to expand at the fastest CAGR during the projection period. This is mainly due to the ability of cloud computing to streamline operations and enhance patient care by providing access to electronic health records and lab results. Cloud-based CIS solutions provide cost-effectiveness and flexibility while facilitating easy data sharing among healthcare professionals, resulting in better collaboration and patient outcomes. Moreover, it also minimizes administrative burdens by offering secure and scalable storage for patient data, supporting informed decision-making.

Service Insights

What made service as a service (SaaS) the dominant segment in the India healthcare cloud computing market?

The Software as a Service (SaaS) segment dominated the market by capturing the largest share in 2024. This is mainly due to its flexible, subscription-based access to healthcare applications, which eliminates the need for expensive hardware and software installations. It further manages updates and maintenance, freeing up IT staff for other tasks while ensuring access to the latest features and security patches. This model offers cost savings, scalability, and ease of adoption, making it very attractive to healthcare providers.

The Platform as a Service (PaaS) segment is expected to grow at the fastest rate during the forecast period due to its advantages in accelerating app development, reducing infrastructure management, and providing scalability and cost efficiency. Moreover, PaaS allows developers to focus on application development without the overhead of managing infrastructure, leading to faster time-to-market and lower costs. The Indian healthcare sector is increasingly adopting cloud solutions for features like data analytics, telehealth, and e-prescribing facilitated by PaaS.

End-User Insights

Why did the healthcare providers segment dominate the India healthcare cloud computing market in 2024?

The healthcare providers segment dominated the market with the highest revenue share in 2024. This is mainly due to the increased integration of healthcare IT solutions, greater acceptance of technological innovations, and the shift toward value-based care. Healthcare providers are particularly leveraging cloud solutions to support telemedicine, mobile health applications, and integrated care models, all considered crucial for enhancing patient outcomes and operational efficiency. The increased need for efficient management of patient data among healthcare providers further boosted the adoption of cloud computing.

The healthcare payers segment is expected to grow at the highest CAGR in the upcoming period. The growth of the segment is attributed to the increasing adoption of cloud-based solutions among healthcare payers for claims management, fraud detection, and data analytics, ensuring secure data storage. Cloud computing enables healthcare payers to analyze vast amounts of data to detect fraud and improve risk management. It also allows them to reduce operational costs by streamlining administrative tasks like claims processing.

Country Level Analysis

How Government Initiatives and Innovations Lead the Growth of the India Healthcare Cloud Computing Market?

Government digital healthcare initiatives, focusing on e-hospital and Ayushman Bharat, along with the rising awareness of cloud benefits and the active promotion of cloud technology adoption in healthcare, contribute to market growth. Additionally, a rapidly expanding healthcare industry, public-private collaborations, and the increasing necessity for efficient and accessible healthcare solutions are driving the development of secure and scalable cloud-based solutions for data storage, management, and sharing. The Indian government is launching various initiatives to facilitate rapid digitization in the healthcare industry. This significantly creates the need for cloud computing.

The GI Cloud initiative by the Indian government, MeghRaj, is a significant effort to implement cloud computing in various sectors, including healthcare. This initiative aims to deliver ICT services via cloud to all government departments at both the central and state levels by fostering a nationwide cloud ecosystem, ensuring optimal utilization of IT infrastructure, and accelerating the development and deployment of e-Government applications like digital payments, identity verification, and consent-based data sharing.

(Source: https://www.pib.gov.in)

CharakDT is an open-source web platform that leverages cloud services and a SaaS- based marketplace to improve health and life expectancy. It serves as a one-stop technology innovation that revolutionizes healthcare by creating a cohesive digital ecosystem, facilitating data exchange, enabling accurate predictions, and ensuring the right treatment at the right time, ultimately enhancing patient care and collaboration among healthcare stakeholders.

(Source: https://drishticps.iiti.ac.in)

Apollo Hospitals in India have developed a Cardiovascular Disease Risk tool using a cloud-based platform. This platform employs artificial intelligence to assist doctors in predicting at-risk individuals based on data from over 400,000 individuals.

(Source: https://d1.awsstatic.com)

India Healthcare Cloud Computing Market Companies

- Wipro Healthcare

- Cerner Healthcare Solutions India

- Greenway Health

- Tech Mahindra

- HCL Technologies

- 3i Infotech

- CitiusTech

Recent Developments

- In October 2024, Amazon Web Services India Private Limited announced that the National Health Authority, Government e-Marketplace, and Public Sector Bank Alliance are adopting AWS technology to create innovative, scalable, and secure solutions for India's digital transformation journey. This initiative aims to develop an integrated digital health infrastructure in India for 1.4 billion citizens and provide health coverage to more than 550 million citizens through flagship schemes of the Government of India.

(Source: https://www.aboutamazon.in) - In January 2024, Apollo 24|7, the largest multi-channel digital healthcare platform in India, partnered with Google Cloud to build systems, including a Clinical Knowledge Graph, a clinical entity extractor, and a timestamp relationship extractor. This system aims to design an expert clinical assistant with a deep understanding of Apollo's clinical knowledge base to enhance clinician experiences on the CIE platform, leading to improved clinical decision-making.

(Source: https://cloud.google.com) - In July 2023, Amazon Web Services (AWS) announced that Dr. Reddy's Laboratories chose it as its preferred cloud provider to help offer affordable and innovative medications. By centralizing the platform on the world's leading cloud, Dr. Reddy's will speed up the development of new healthcare applications, helping the organization serve more patients and allowing healthcare providers to better track patient progress.

(Source: https://www.business-standard.com)

Segments Covered in the Report

By Product

- Healthcare Provider Solutions

- Clinical Information Systems

- EHR/EMR

- Telehealth Solutions

- PACS/VNA

- PHM Solutions

- LIS

- PIS

- RIS

- Non-clinical Information Systems

- RCM Solutions

- HIE Solutions

- Financial Management Solutions

- SCM Solutions

- Billings and Account Management Solutions

- Clinical Information Systems

- Healthcare Payer Solutions

- Claims Management Solutions

- Payment Management Solutions

- Provider Network Management Solutions

- Fraud Management Solutions

- CMR Solutions

By Deployment

- Public

- Private

- Hybrid

By Application

- Clinical Information System

- Telehealth Solutions

- Computerized Physician Order Entry

- Population Health Management (PHM) Solutions

- Electronic Medical Records

- Pharmacy Information System

- Radiology Information System

- Others

- Non-clinical Information System

- Revenue Cycle Management (RCM)

- Billing & Accounts Management Solutions

- Claims Management

- Others

By Service

- Platform as a Service (PaaS)

- Infrastructure as a Service (IaaS)

- Software as a Service (SaaS)

By End User

- Healthcare Providers

- Healthcare Payers

Get a Sample

Get a Sample

Table Of Content

Table Of Content