What is the Indian Solar Cells Market Size?

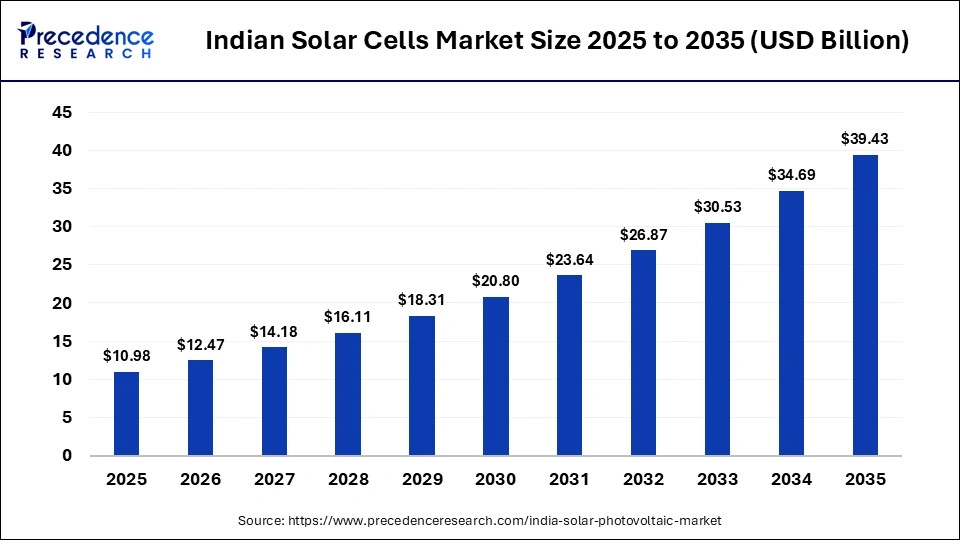

The Indian solar cells market size was calculated at USD 10.98 billion in 2025 and is predicted to increase from USD 12.47 billion in 2026 to approximately USD 39.43 billion by 2035, expanding at a CAGR of 13.67% from 2026 to 2035.The indian solar cells market is experiencing robust growth, driven by the country's goal to reach 500 GW of renewable energy by 2030. The growing awareness of natural energy sources, high electricity use, and the shifting trend towards reduced fossil fuel consumption.

Market Highlights

- By material, the crystalline segment dominated the market in 2025.

- By material, the thin film segment is expected to be the fastest-growing segment during the forecast period.

- By product, the BSF segment led the market in 2025.

- By product, the HJT segment is expected to grow at the fastest CAGR in the coming years.

- By technology, the monocrystalline segment held the largest Indian solar cells market share in 2025.

- By technology, the CDTE segment is expected to witness the fastest growth over the studied years.

- By installation type, the utility segment contributed the biggest revenue share of the market in 2025.

- By installation type, the residential segment is expected to account for the highest growth in the forthcoming years.

What are Indian Solar Cells?

The Indian solar cells market refers to the development and large-scale manufacturing of solar cells to fulfill local needs. India has become one of the fastest-growing renewable energy sectors globally, due to the nation's aggressive climate goals and dedication to sustainable development. It has enormous solar potential because of its geographical position, which receives sufficient sunlight throughout the year, making it an ideal location for large-scale solar deployment.

Solar energy adoption has been further driven by government programs like the National Solar Mission, production-linked incentives (PLI) for solar manufacturing, and favorable regulations. It is becoming increasingly appealing to residential, commercial, and industrial users due to the falling rates of solar panels and inverters, as well as the rising cost of conventional electricity. Various states, including Rajasthan, Gujarat, Tamil Nadu, and Karnataka, are leading in solar cell development, and their dependability is being further increased through the integration of cutting-edge technologies like energy storage systems and smart inverters.

What is the Role of AI in the Indian Solar Cells Market?

Artificial Intelligence (AI) is becoming a transformative force in the development and commercialization of solar cells. Testing various materials, developing manufacturing techniques, and predicting long-term performance would particularly take months or years, but the emergence of AI tools has since accelerated the process. In the research domain, machine learning (ML) tools analyze huge amounts of datasets, pinpointing the best performance results. In the manufacturing domain, integrating AI with computer vision systems enables real-time monitoring of processes and detects minor defects that can potentially compromise the whole batch.

Indian Solar Cells Market Trends

- Solar Farms: India's focus on the development of solar farms comes from the immense potential of solar energy and the nation's urgent requirement for sustainable energy solutions. Solar farms can reduce dependency on fossil fuels while improving energy security. They enable localized power generation, which benefits Indian rural communities by increasing energy availability and quality of life.

- Perovskite Solar Cells: Perovskite solar cells are expected to revolutionize the market in India. This is due to high-efficiency potential, low production cost, and diverse applications. Indian scientists have developed lead-free and low-cost carbon-based perovskite solar cells with higher efficacy. The government is also striving to integrate perovskite cells into building materials and construction domains.

- Government Initiatives and Policies: Various government initiatives, such as the Jawaharlal Nehru National Solar Mission (JNNSM) and various other state-level policies, offer subsidies, tax benefits, and incentives to promote solar energy adoption. India aims to promote solar energy adoption through initiatives such as pre-registration of solar power projects with a capacity ranging from 100 KW to 2 MW under the mission, facilitated by the Haryana Renewable Energy Development Agency (HAREDA) as the Competent Authority.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.98 Billion |

| Market Size in 2026 | USD 12.47 Billion |

| Market Size by 2035 | USD 39.43 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.67% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material, Product,Technology, and Installation Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics in the Indian Solar Cells Market

- Drivers: The growing use of renewable energy sources and rising power demand is predicted to drive market expansion. Demand is expected to increase as a result of technological developments aimed at lowering manufacturing costs and enhancing performance effectiveness. In addition, strong government backing through various national and state-level initiatives has greatly boosted the market. With specific goals and legislative frameworks, the National Solar Mission established the groundwork for widespread solar adoption. The Production Linked Incentive (PLI) program also encourages self-sufficiency and lessens reliance on imports by promoting domestic solar production.

- Restraint : The expansion of solar energy business in India does have its fair share of challenges. One of them is financing, especially for small and medium-sized developers. Solar projects often require a large upfront financial commitment, which can be challenging for small-scale companies. Large companies may be able to raise investment, while smaller developers may frequently face difficulties due to complex loan procedures, high interest rates, and a lack of collateral. Potential investors are also discouraged by perceived risks such as regulatory uncertainty, distribution firms' payment delays, and tariff volatility.

- Opportunity: Electricity demand has increased significantly across all sectors of India due to the country's rapidly expanding industrial base, urbanization, and population. This growing demand cannot be met sustainably by traditional power sources alone, as it would negatively impact the environment. Clean, dependable, and scalable energy solutions are now on the rise. With its enormous potential and falling costs, solar power has become a significant player in sustainability. It provides an environmentally safe solution to close the energy gap and reduce the reliance on fossil fuels.

Segmental Insights

Material Insights

Which Material Segment Dominated the Indian Solar Cells Market?

The crystalline segment dominated the market in 2025, due to higher efficiency levels, durability, and better performance in India's diverse climate conditions, especially in high temperatures and dust exposure. Various government-backed projects also favor crystalline technology due to its mature supply chain and cost-effective nature. Monocrystalline cells are further favored for high-utility scale solar parks and large rooftop projects. The PLI has also prioritized its production, thus creating a strong domestic manufacturing base.

The thin film segment is expected to be the fastest-growing segment in the coming years, due to their lightweight structure, flexibility, and comparatively lower material costs, making them a popular choice for new-age applications such as building-integrated photovoltaics, portable power, and small-scale residential installation processes. Their advantage lies in their ability to perform better in diffuse light and high-temperature conditions.

Product Insights

Why Did the BSF Segment Dominate the Indian Solar Cells Market?

The BSF segment contributed the biggest revenue share of the market in 2025, due to their low production costs, simplistic manufacturing processes, and a well-established supply chain. Several Indian companies continue to produce BSF cells in bulk, mainly because they are economical and suitable for large-scale and cost-sensitive utility projects. These types of cells are also popular in government-backed rural projects.

The HJT segment is expected to account for the highest growth in the forthcoming years, due to its ability to deliver higher efficiency, bifacial capability, and high performance in hot climates, making it attractive for premium as well as export-oriented projects. This segment continues to gain traction due to a growing interest in manufacturers and increasing research and development efforts.

Technology Insights

How the Monocrystalline Segment Dominated the Indian Solar Cells Market?

The monocrystalline segment held a dominant revenue share of the market in 2025, as monocrystalline cells are produced using a single-crystal growing process, which lowers the entire unit cost and makes them more economical compared to other options. They offer high efficiency, durability, embedded energy, and lower operational costs, making them a popular option. Monocrystalline cells have a longer life span and provide space-saving benefits, further optimizing their efficiency.

The CDTE segment is expected to grow at the fastest CAGR in the coming years. This type of technology is better suited for India's hot and humid temperatures, as these panels perform better than any other material. Additionally, it requires less material for production, which is a critical point as India aims to reduce its reliance on imported materials.

Installation Type Insights

Which Installation Type Segment Led the Indian Solar Cells Market?

The utility segment led the market in 2025, due to the country's aggressive push towards large-scale solar parks under national programs and schemes. Utility projects often benefit from economies of scale, lower costs per watt, and easier land acquisition in rural belts, thus making them attractive for both public and private investments. Various states, such as Rajasthan and Gujarat, have already become hubs for solar farms, boosting up utility scale installations.

The residential segment is expected to witness the fastest growth over the studied years. This growth is driven by decreased rooftop solar prices, supportive subsidies, net metering policies, and the rising cost of electricity in households. Increasing urbanization and the government's push towards 40+ GW of rooftop capacity are further accelerating this segment's growth. There are also EMI-based systems and leasing models that further increase awareness, making it accessible to middle-class households.

Indian Solar Cells Market Value Chain Analysis

- Raw material procurement

The Indian solar cells value chain begins with the sourcing of critical raw materials such as polysilicon, wafers, glass sheets, EVA encapsulates and silver paste. Currently, India remains heavily dependent on imports, especially from China, due to limited domestic production. However, new government schemes are aiming to build a fully integrated local production ecosystem, reducing reliance on global suppliers.

Key players: Adani Solar, Waaree Energies, Tata Power Solar

- Cell Manufacturing

This stage involves converting wafers and raw materials into photovoltaic cells through processes such as diffusion, doping, metallization, and coating application. The government has recently approved 50+ GW of new integrated manufacturing capacity, which is expected to begin in full force from 2026, boosting local cell production.

Key players: Adani Solar, Vikram Solar, Premier Energies

- Module Assembly

The next stage involves assembling modules by interconnecting solar cells and encapsulating them with EVA, then sealing them with glass and a back sheet. This is India's strongest segment with more than 40+ GW of installed capacity. Indian manufacturers are increasingly investing in advanced systems and fully integrated assembly lines to improve quality and reduce costs.

Key players:RenewSys India, Waaree Energies, Adani Solar

Who are the Major Players in the Indian Solar Cells Market?

The major players in the indian solar cells market include Adani Solar, Emmvee Solar, Mahindra Susten Pvt. Ltd., Sterling and Wilson Pvt. Ltd., Tata Power Solar Systems Ltd., Vikram Solar Limited, ReNew Power Pvt. Ltd., NTPC Ltd., Azure Power Global Ltd., Websol Energy System Limited (WESL), RenewSys India Pvt. Ltd, Premier Solar Systems Pvt Ltd

Recent Developments in the Market

- In July 2025, the Ministry of New and Renewable Energy (MNRE) asked power PSUs, such as NTPC, SJVN, NHPC, and Solar Energy Corporation of India (SECI), to modify their tenders to include the mandate of Indian made solar cells in their renewable energy bids. These PSUs are also acting as renewable energy implementing agencies (REIAs) in India's goal to achieve 500 GW of non-fossil power capacity by 2030.(Source: https://www.moneycontrol.com)

- In April 2025, India's solar module manufacturing capacity has nearly doubled from 38GW to 74GW between March 2024 and March 2025. Furthermore, the country also commissioned its first 2GW of ingot and wafer manufacturing capacity. These figures are encouraging developments for India's push towards greater domestic clean energy manufacturing.(Source:https://www.pv-tech.org)

Segments Covered in the Report

By Material

- Crystalline

- N Material

- P Material

- Thin Film

By Product

- BSF

- PERC/PERL/PERT/TOPCON

- HJT

- IBC & MWT

- Others

By Technology

- Monocrystalline

- Polycrystalline

- Cadmium Telluride (CDTE)

- Amorphous Silicon (A-Si)

- Copper Indium Gallium Diselenide

By Installation Type

- Residential

- Commercial

- Utility

Get a Sample

Get a Sample

Table Of Content

Table Of Content